Agricultural Equipment Leasing: 7 Key Farmer Benefits

“Leasing can reduce upfront equipment costs for farmers by up to 60%, improving cash flow and financial flexibility.”

Introduction: Why Agricultural Equipment Leasing Matters

Agricultural equipment leasing has rapidly emerged as a smart, financial strategy for farmers and forestry professionals aiming to maximize operational efficiency and streamline costs. Facing challenges such as volatile commodity prices, swiftly advancing technology, and unpredictable market conditions, modern agriculture demands flexibility—and this is precisely what equipment leasing offers. Instead of making substantial upfront investment on new machinery, leasing empowers farmers and operators to access state-of-the-art equipment, preserve working capital, and strategically manage cash flow across each season.

Given the ever-shifting landscape of farming and forestry, understanding the benefits of leasing farm equipment is crucial. From financial advantages of equipment leasing and risk mitigation, to flexible agreements and rapid access to the latest machinery, the shift from ownership to leasing is transforming agribusinesses everywhere. In this comprehensive guide, we’ll explore all aspects of the equipment lease agreements ecosystem—including types, market trends, strategic considerations, and how modern agri-solutions like Farmonaut integrate with your operational goals.

Understanding Agricultural Equipment Leasing

Agricultural equipment leasing refers to a contractual agreement where the lessee (farmer or forestry operator) pays a lessor (leasing company) for the use of agricultural equipment and machinery for a specified period. At the end of the lease term, operators typically can choose to purchase the equipment at a previously agreed price, renew the lease agreement, or return the equipment to the lessor.

- Preserves Capital: Leasing requires less upfront investment, so your working capital can be allocated to other operational needs, from seeds to data-driven technology platforms like Farmonaut.

- Adaptability: Leasing enables operators to rapidly adapt to evolving technological advancements without the burden of owning potentially outdated equipment.

Unlike buying outright, leasing focuses on operational flexibility—a critical factor as new farm equipment technologies and data management solutions become available.

7 Key Farmer Benefits of Equipment Leasing

Let’s dive deep into the seven core benefits of leasing farm equipment and understand how they supercharge financial and operational performance for farmers and forestry professionals.

-

1. Conservation of Capital and Improved Cash Flow

One of the most touted benefits of agricultural equipment leasing is its ability to preserve capital. Instead of allocating vast resources for an outright purchase, leasing requires a much smaller upfront investment. This strategy is especially beneficial given the cash flow cycles inherent in agriculture—characterized by seasonal income and volatile market conditions.

- Allows you to redirect working capital into high-return areas, such as crop inputs or cutting-edge farm management solutions like Farmonaut.

- Reduces financial risk by minimizing long-term, fixed-asset exposure during periods of uncertainty.

-

2. Access to Latest Technology in Farm Equipment Leasing

The agriculture sector is advancing rapidly, with smart sensors, telematics, and data-driven machinery becoming standard. Leasing enables farmers to utilize the most current equipment models—boosting productivity, reliability, and efficiency without the financial strain of regular purchasing.

- Encourages faster adoption of advanced technologies that may be unaffordable through direct purchase.

- Keeps operations competitive and resilient by mitigating obsolescence.

-

3. Flexible Payment Plans for Equipment Leasing

Leasing companies often offer customizable payment plans tailored to your agricultural cash flow cycles. This flexibility ensures payments sync with seasonal revenue, easing pressure on operational budgets.

- Eases management of expenses throughout the lease period instead of lump-sum disbursements.

- Can be negotiated to match planting or harvest cycles, supporting both smallholders and large-scale operators.

-

4. Tax Benefits of Agricultural Equipment Leasing

Lease payments are typically treated as business expenses and may be deducted from taxable income, reducing your overall tax burden. The specifics depend on lease type, local tax law, and the agreement’s structure—making it essential to consult a dedicated advisor.

- True (Operating) leases generally provide higher expense deductions.

- Capital (Conditional Sale) leases may allow for depreciation claims as well.

Tip: Review your specific situation with a tax professional to maximize this financial advantage.

-

5. Risk Mitigation in Equipment Leasing

Leasing helps mitigate the risks linked to equipment ownership: market value deterioration, sudden repair or maintenance expenses, and obsolescence. By leasing, you can return or upgrade outdated equipment as advances arise, maintaining business agility and reducing potential losses.

- Protects against substantial losses from rapidly depreciating machinery.

- Avoids costly repairs often carried by the lessor within the agreement structure.

-

6. Reduced Maintenance Responsibilities and Associated Costs

Many farm machinery leasing options transfer maintenance responsibility to the lessor or bundle it into the lease. This can minimize operational disruptions due to mechanical breakdowns and help control expenses.

- Frequent upgrades and maintenance may be included depending on lease agreements.

- Reduces downtime and maintains efficiency throughout crop cycles.

-

7. Enhanced Flexibility in Farm Operations

Leasing allows for greater adaptability when scaling your farm operations up or down depending on climatic, market, or business conditions. Instead of being locked into long-term asset ownership, you can adapt to new technologies and adjust your equipment inventory efficiently.

- Return, renew, or purchase equipment as your operational needs change.

- Try out new models before committing to a full purchase—helping mitigate risks associated with larger capital commitments.

“Over 70% of farmers using equipment leasing report faster access to the latest agricultural technology and machinery.”

Types of Equipment Lease Agreements

Understanding equipment lease agreements is crucial for selecting the right structure for your business model. The two most common types are:

-

True Lease (Operating Lease):

- The lessor retains equipment ownership.

- Lease payments are often fully deductible as operating expenses.

- At term’s end, you may return the machinery, extend the lease period, or purchase it at a preset price.

- Helps shift the burden of obsolescence and maintenance back to the company.

-

Conditional Sale Lease (Capital Lease):

- Treated similarly to a loan for accounting and tax purposes—gives the lessee the right to depreciate the equipment.

- Often provides an option to purchase at term’s end for a nominal sum, such as $1.

- Suitable for those seeking eventual ownership with the initial cash flow flexibility of leasing.

Comparative Benefits of Equipment Leasing vs. Buying for Farmers

| Benefit | Leasing | Buying | Additional Notes |

|---|---|---|---|

| Lower Initial Investment | ~60% lower upfront cost | Full purchase price upfront | Leasing preserves capital for other operational needs. |

| Access to Latest Technology | Easier, upgrades possible every cycle | Requires repurchasing/upgrading | Leasing enables frequent access to updated equipment. |

| Flexible Agreements | Return/renew/purchase options | Asset fixed until resale or trade-in | More adaptable to changing business needs. |

| Tax Benefits | Lease payments may be fully deductible | Depreciation only, limited expense deduction | Leasing can improve tax outcomes and cash flow. |

| Maintenance Costs | Lower, often included in lease | Borne solely by owner | Less downtime, predictable costs in leasing. |

| Upgrade Flexibility | Upgrade at lease end | Must sell and repurchase | Leasing keeps operations technologically current. |

| Risk Mitigation | Obsolescence/market risks reduced | Owner fully bears devaluation risk | Leasing is ideal for managing financial uncertainty. |

Essential Considerations When Leasing Agricultural Equipment

While the advantages are significant, it’s vital to weigh potential challenges before entering equipment lease agreements:

- Long-Term Costs: Over a prolonged period, leasing may become more expensive than purchasing. Assess projected payments versus outright costs.

- Lack of Ownership: The lessee does not own the equipment, which can limit control over resale, customization, and financial leverage.

- Usage Restrictions: Some lease agreements restrict machine modifications or enforce return conditions—which may impact operational flexibility.

- Obsolescence: There is a chance that even leased equipment may become outdated before the lease term ends—study upgrade terms carefully.

- Contractual Details: Ensure all contractual agreements are crystal clear regarding expenses, maintenance, return conditions, and penalties to avoid surprises.

For maximum benefit, compare leasing vs buying agricultural equipment by factoring in your operational size, crop cycle, technology needs, and capital forecast.

Market Trends in Agricultural Equipment Leasing

The agricultural equipment leasing landscape is evolving rapidly, with several transformative trends:

-

Digital Leasing Platforms:

- Online platforms are revolutionizing how leases are organized, allowing easier access to a wider range of equipment, rapid comparison of terms, and quick approvals.

-

Flexible and Short-Term Leasing Options:

- An emerging market for seasonal or multi-year agreements matches equipment supply to annual or even monthly demand, reducing idle assets.

-

Integration of Advanced Technologies:

- New leased equipment often provides cross-platform features like remote diagnostics, predictive maintenance, and IoT connectivity, improving efficiency and reducing unplanned downtime.

-

Adoption of Sustainable Equipment:

- With growing interest in carbon footprinting and sustainable machinery, leasing offers a route to trial energy-efficient, eco-friendly technologies without major upfront investments.

Farmers now benefit from a broader selection, faster deployment, and heightened operational support thanks to digital-first leasing models. When combined with data-driven farm management tools and technology integration, the operational impact is multiplied.

Optimize Efficiency and Sustainability with Farmonaut Solutions

-

Fleet Management

– Manage your agricultural machinery, vehicles, and resources efficiently across your farm operation. Minimize idle time, optimize routes, and reduce fuel and maintenance expenses with Farmonaut’s digital tools. -

Large-Scale Farm Management

– Ideal for agribusinesses and large growers, this platform centralizes all farm data, enables real-time coordination, and streamlines operations for plantation and multi-hectare cropping systems. -

Blockchain-Based Product Traceability

– Unlock supply chain transparency by leveraging blockchain technology for traceability. Trace agricultural produce from field to market and build consumer trust. -

Carbon Footprinting

– Track and minimize your farm’s carbon emissions, supporting regulatory compliance and sustainable brand positioning. -

Crop Loan & Insurance Verification

– Streamline crop loan approvals and insurance claims using satellite-based verification, reducing fraud and improving access to agri-financing.

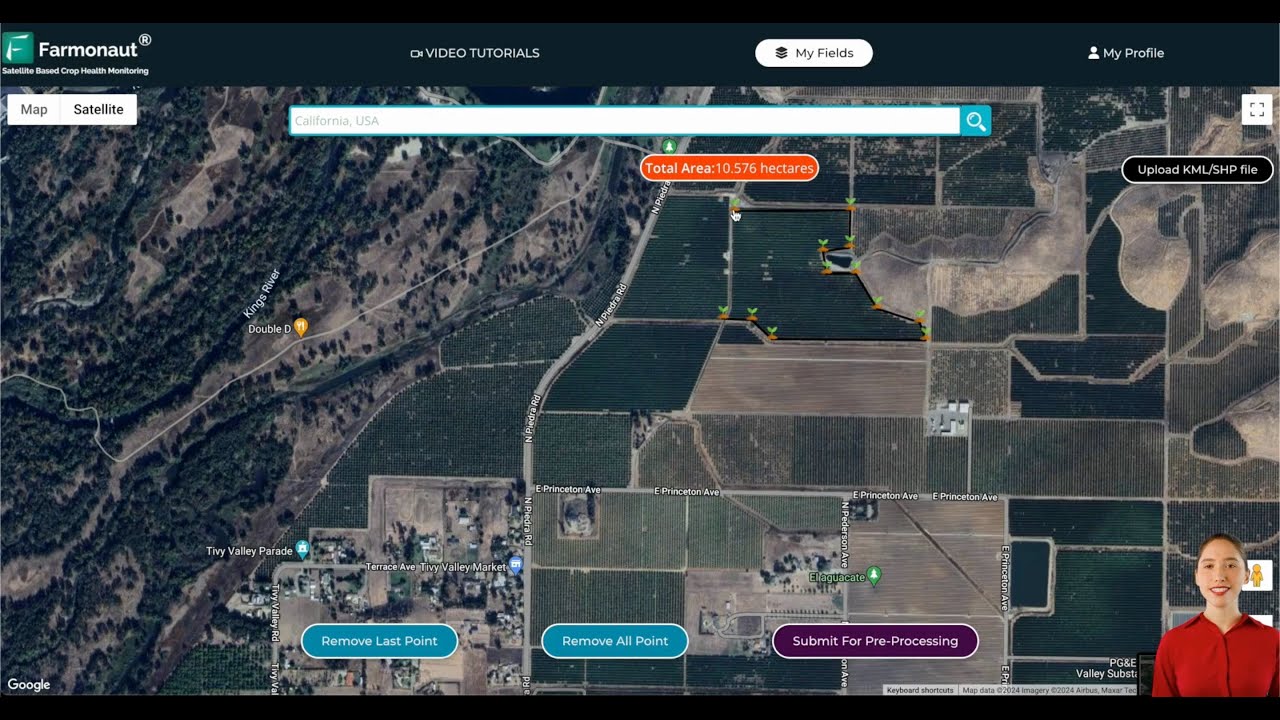

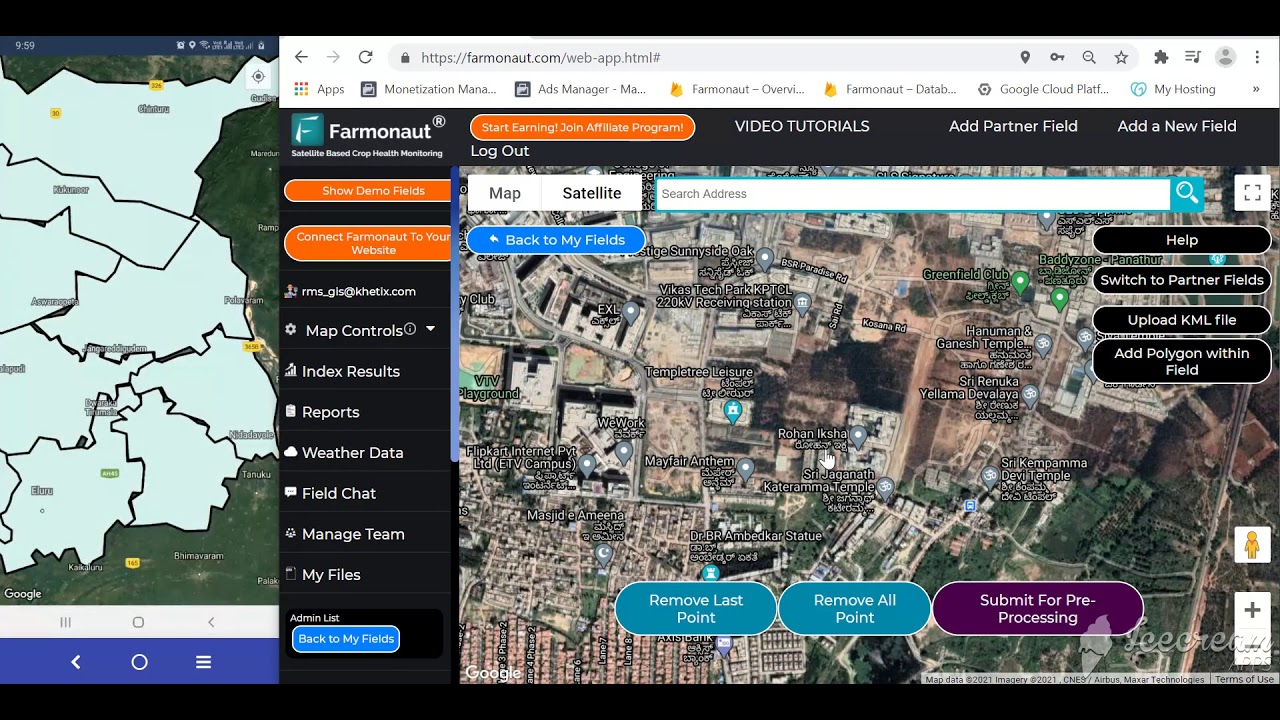

Farmonaut Platform Access

Developers and businesses: Integrate satellite data, weather insights, and more directly into your in-house systems through Farmonaut’s flexible API (API Developer Docs).

How Farmonaut Supports Modern Farmers

As a pioneering agricultural technology company, Farmonaut is dedicated to making precision agriculture accessible and affordable to farmers, forestry professionals, agribusinesses, and governments worldwide. Our mission is clear: empower users with actionable insights and integrated platforms, leveraging the latest satellite imagery, AI, blockchain, and cloud solutions.

By using Farmonaut, you gain:

- Real-time crop health monitoring: Tap into multispectral satellite data to detect crop issues, drought, and nutrient deficiencies instantly—allowing you to act promptly and efficiently.

- AI-based advisory systems: Our “Jeevn” AI provides tailored management advice for varied crop cycles, utilizing real-time field and weather data.

- Blockchain-based traceability: Ensure product authenticity and transparency—from farm to consumer—building long-term market trust.

- Fleet and resource management: Streamline your agricultural machinery and resources for maximum productivity and lower costs.

- Carbon footprinting tools: Monitor and reduce emissions, supporting both regulatory compliance and sustainability goals.

- Access to agri-financing: Facilitate crop loan and insurance processes with robust, satellite-based farm verification, minimizing fraud and improving loan accessibility for all.

Our flexible, subscription-based model ensures that innovative farm technologies are within reach for operators of any scale—whether you’re a smallholder or part of a large agribusiness. Try the Farmonaut App on web, Android, or iOS today.

Frequently Asked Questions (FAQs) on Agricultural Equipment Leasing

1. What is agricultural equipment leasing and who benefits most?

Agricultural equipment leasing is the process of renting farm machinery and tech from a leasing company for a set period, instead of purchasing it outright. It primarily benefits farmers, forestry professionals, and operators seeking flexibility, lower upfront costs, and rapid tech adoption.

2. How does equipment leasing support farm efficiency?

Leasing ensures that farmers always have access to the latest technology in farm equipment, supports flexible scaling of operations, and reduces downtime and capital tied up in depreciating assets.

3. Are there any tax benefits?

Yes. Lease payments are often fully deductible as business expenses, which can reduce overall tax liability and free up working capital for other investments. However, exact tax benefits of agricultural equipment leasing depend on your agreement structure and local tax laws—consult an advisor for personalized guidance.

4. What are the risks of leasing versus buying?

While leasing reduces risk of obsolescence and lowers maintenance duties, it may result in higher total expenses over long periods. Lease agreements may also carry usage restrictions and offer less flexibility for equipment modification.

5. Is leasing right for smallholder farmers or only for large agribusinesses?

Leasing is a scalable solution. Smallholders can benefit from low capital requirements and short-term agreements. Large agribusinesses can leverage flexible contracts, efficient equipment deployment, and advanced technology without heavy upfront expenditure.

6. Can I integrate leased equipment into modern digital farm management platforms?

Absolutely. Leased equipment with digital capabilities can seamlessly integrate with platforms like Farmonaut, which enhances resource allocation, crop health tracking, and supply chain management, maximizing the value of every asset—owned or leased.

Conclusion

Agricultural equipment leasing is more than a funding option—it’s a dynamic financial strategy that enables farmers, forestry professionals, and operators to navigate market volatility, harness the latest technology, and maintain operational agility. The right lease agreement unlocks capital, enhances productivity, and helps mitigate risks across your business cycle.

When evaluating leasing vs buying agricultural equipment, consider your operating timeline, upgrade requirements, tax profile, and appetite for risk and technological change. Consult with experienced advisors to tailor solutions to your needs, structure leases effectively, and make the most of evolving market trends.

At Farmonaut, we are committed to facilitating this transformation—empowering agricultural professionals with affordable, technology-driven platforms for next-generation farm management. Join us on the journey towards smarter, more profitable, and sustainable agriculture.