Identify an Impact of the US-China Trade War on Agriculture: A Comprehensive 2025 Perspective

Table of Contents

- Introduction

- Background: The US-China Trade War and Agricultural Tariffs

- Direct Impacts on U.S. Agriculture

- Impacts on Chinese Agriculture and Food Security

- Global Agricultural Trade and Market Dynamics

- Comparative Impact Table: US Agricultural Exports to China

- Long-Term Structural Changes & Strategic Lessons

- Farmonaut’s Role: Resilience & Innovation in a Shifting Agricultural Landscape

- Outlook for U.S.-China Agricultural Trade Post Trade War

- Frequently Asked Questions (FAQ)

- Conclusion

“U.S. soybean exports to China dropped by over 50% in 2018 due to trade war tariffs.”

Introduction: The Lasting Ripples of a Trade Conflict

The trade war between the United States and China—officially kicked off in 2018—has dramatically reshaped the agricultural landscape worldwide. As we reflect in 2025, it’s clear that this economic conflict’s direct and indirect impacts on agriculture, markets, tariffs, exports, and strategic alliances will persist for years to come. Our comprehensive analysis not only identifies key impacts of the trade war between the United States and China on agriculture but also explores market shifts, supply chain changes, global innovation, and the rise of technological resilience in response to mounting geopolitical uncertainty.

In this extensive, data-driven review, we’ll chart how American and Chinese farmers—and their governments—responded to tariffs, how global commodity flows reshaped, and what 2025 and beyond holds for world agriculture and food security. Along the way, we’ll highlight the role of agtech innovation—including visionary solutions from Farmonaut (a leading provider of carbon footprinting, traceability, and advanced farm analytics)—in making food systems more resilient in the face of shocks and uncertainty.

Background: The US-China Trade War and Agricultural Tariffs

To identify an impact of the trade war between the United States and China on agriculture, we must start with the background and sequence of events that initiated this global conflict. In mid-2018, the US government imposed tariffs on a wide array of Chinese goods, citing unfair trade practices and intellectual property concerns. In retaliation, China, the world’s largest agricultural importer, swiftly imposed stiff tariffs on American agricultural products.

The main products targeted included soybeans, pork, corn, wheat, dairy, and cotton. Tariff rates ranged from 15% up to 25% or more, effectively reducing the competitiveness of US exports in the Chinese market and triggering a domino effect through global supply chains. The immediate impact was felt through declining exports, price volatility, supply chain disruptions, and a sharp fall in farmer incomes (especially for soy and pork producers).

However, the conflict also spurred market diversification, policy innovation, and a realignment of international trade agreements that continue to shape agricultural and economic strategies in 2025.

Direct Impacts on U.S. Agriculture—Exports, Revenues & Market Shifts

1. Decline in Exports, Revenues & Competitiveness

One way to identify the impact of the trade war between the United States and China on agriculture is through an evaluation of export trends. The loss of China as a top buyer forced a dramatic shift in the U.S. ag export market, especially for soybeans:

- Soybeans: Before the trade war, China accounted for over 60% of U.S. soybean exports. After tariffs, U.S. exports of soybeans to China fell by over 75% (from roughly 30 million metric tons to less than 10 million metric tons annually at their lowest point).

- Pork & Meat: U.S. pork exports to China initially grew as African Swine Fever decimated Chinese herds, only for retaliation and additional tariffs to curtail this opportunity.

- Corn, Wheat, Dairy: Similar tariff pressures hit other American crops and dairy, with lower prices and increased domestic surpluses.

The combined revenue impact: Farm incomes across key US states (notably Illinois, Iowa, Nebraska, and Minnesota) fell by as much as 30% in the immediate aftermath.

2. Market Diversification Efforts and Domestic Shifts

To compensate for lost market access, U.S. farmers and exporters sought alternatives:

- Redirection to Other Regions: The European Union, Mexico, Japan, and Southeast Asian markets saw increases in U.S. agricultural imports, but could not fully replace the volume and price levels of the Chinese market.

- Crop Portfolio Shifts: Some farmers began growing crops with less export dependency, shifting to large-scale farm management initiatives that prioritize internal processing, or those with better domestic demand.

- Domestic Processing: A portion of the surplus was redirected to biofuel producers and the animal feed industry.

Ultimately, these shifts reduced dependence on a single market, laying the foundation for more resilient U.S. agriculture in 2025 and beyond.

3. Government Assistance & Policy Innovation

Both the Trump and Biden administrations rolled out a series of government support measures:

- Market Facilitation Programs: These multi-billion dollar aid programs provided direct payments to farmers affected by the trade war.

- Calls for Diversification: Policymakers have since advocated for diversification in export markets and expanded the range of supported crops.

- Investment in Innovation: Enhanced focus on carbon footprinting, supply chain traceability, and agricultural innovation has been prioritized.

Impacts on Chinese Agriculture and Food Security

1. Import Substitution and Domestic Agricultural Expansion

For China, to identify the impact of the trade war between the United States and China on agriculture from the Chinese perspective, we observe major policy shifts:

- Boosted Domestic Production: China increased its focus on domestic soybean and pork production through strategic subsidies, technology adoption, and rural investment.

- Diversification of Imports: New trade agreements with Brazil, Argentina, Russia, Australia, and other agricultural exporters shifted global supply chains. Brazil, in particular, became the number one exporter of soybeans to China.

- Strategic Sourcing: China established new logistics, storage, and transportation hubs to facilitate diversified agricultural imports.

2. China’s Policy Emphasis on Food Security

The trade war exposed vulnerabilities in China’s food supply chain, catalyzing policies to increase food security:

- Food Security Plans: Emphasis on self-sufficiency in key crops—especially soy—and emergence of policies to reduce risk from global supply shocks.

- Storage and Supply Chain Management: Investment in cold storage, logistics, and fleet management allowed China to respond to intermittent shortages more effectively.

- Inflation and Consumption Patterns: While food prices rose initially, expanded local production and global sourcing stabilized prices by the early 2020s.

3. Rural Development and Technological Upgrades

The supply chain shocks of the trade war prompted large-scale investments in rural Chinese infrastructure, agri-technology, and sustainability to reduce reliance on volatile import markets.

- Expansion of precision agriculture and modernization of farms.

- Acceleration of AI-driven agricultural advisory systems and blockchain-enabled traceability for food safety and export compliance.

“China imposed tariffs on $34 billion worth of U.S. agricultural products during the 2018 trade conflict.”

Global Agricultural Trade and Market Dynamics Amidst the War

Realignment of Global Supply Chains

The US-China conflict drove a global realignment of supply chains:

- Brazilian Soy Boom: Brazil grew its soybean exports to China by over 60% from pre-trade war levels. This shift led to new environmental concerns in South America, such as deforestation in the Amazon as farmers rushed to increase acreage.

- Increased Competition: U.S. agricultural exporters were pushed into intense competition with South America, Eastern Europe, and others in previously secondary markets.

Increased Price Volatility & Uncertainty

Markets worldwide experienced pronounced price swings for key commodities (notably soy, pork, and cotton). Volatility was further aggravated by:

- Weather events and climate-induced shocks, such as severe Midwest US floods or South American droughts.

- Supply chain bottlenecks from logistics disruptions and port delays.

- Uncertainty over ongoing or renewed tariffs and retaliatory trade policies.

Shifts in Trade Alliances, Agreements, and Innovation

- New Regional Trade Agreements: To reduce dependency on the US or China, countries joined alliances like the Regional Comprehensive Economic Partnership (RCEP) for strategic access and economic security.

- Adoption of New Technologies: Countries accelerated the adoption of precision agriculture, transparent supply chains (with blockchain), and data-driven resource management to hedge against ongoing shocks. Farmonaut, with its traceability and fleet management services, is an example of how such tools support resilience and market confidence.

Comparative Impact Table: US Agricultural Exports to China

| Crop/Product | Estimated Pre-Trade War Export Volume (metric tons) | Estimated Post-Trade War Export Volume (metric tons) | Tariff Rate (Estimated, %) | Estimated Export Value Change (%) |

|---|---|---|---|---|

| Soybeans | 30,000,000 | ~8,000,000 | 25 | -60% |

| Pork | 600,000 | 350,000 | 25 | -40% |

| Cotton | 800,000 | 550,000 | 20 | -20% |

| Corn | 1,400,000 | 950,000 | 20 | -30% |

| Wheat | 600,000 | 350,000 | 15 | -35% |

| Dairy | 270,000 | 150,000 | 20 | -45% |

All values are estimated and based on aggregated shipment data from 2017 (pre-trade war) and 2019-2021 (post-trade war) — reflecting the significant structural impact of tariffs on US exports to China.

Long-Term Structural Changes & Strategic Lessons (2025 Perspective)

Resilience, Diversification, and Risk Management

The deep disruption caused by the trade war between the United States and China led policymakers, analysts, and innovators to emphasize:

- Resilience via Market Diversification: The dependency on a single buyer (i.e., China as the main US soybean importer) became an example of structural risk. Most major exporters have adopted new diversified trade strategies and hedging tools.

- Investment in Technology: Record investments in AI, satellite-based crop monitoring, and blockchain for supply chain traceability are now at the heart of modern agricultural systems. Solutions like the Farmonaut carbon footprinting suite allow producers to track and improve sustainability performance globally.

- Policy Frameworks: The US, China, and others have institutionalized support systems (e.g., emergency funds, insurance, loan facilities for farmers) to help cushion future market shocks.

Sustainability & Environmental Considerations

While trade shocks prompted market innovation, they also intensified environmental, social, and governance (ESG) concerns:

- Deforestation in South America: Expanding soybean acreage to feed Chinese demand led to Amazon forest loss and growing calls for more sustainable practices.

- Emphasis on Carbon Footprinting: Traceability and emission-tracking are now paramount. Farmonaut’s Carbon Footprinting platform empowers agribusinesses to measure, report, and mitigate their environmental footprints.

- Supply Chain Transparency: Blockchain-based solutions (e.g., Farmonaut Traceability) are increasingly vital for compliance with new global standards and consumer demand for sustainable, traceable food.

Technological Advances & The Digital Transformation

As a direct response to heightened uncertainty, the agtech revolution gained rapid momentum:

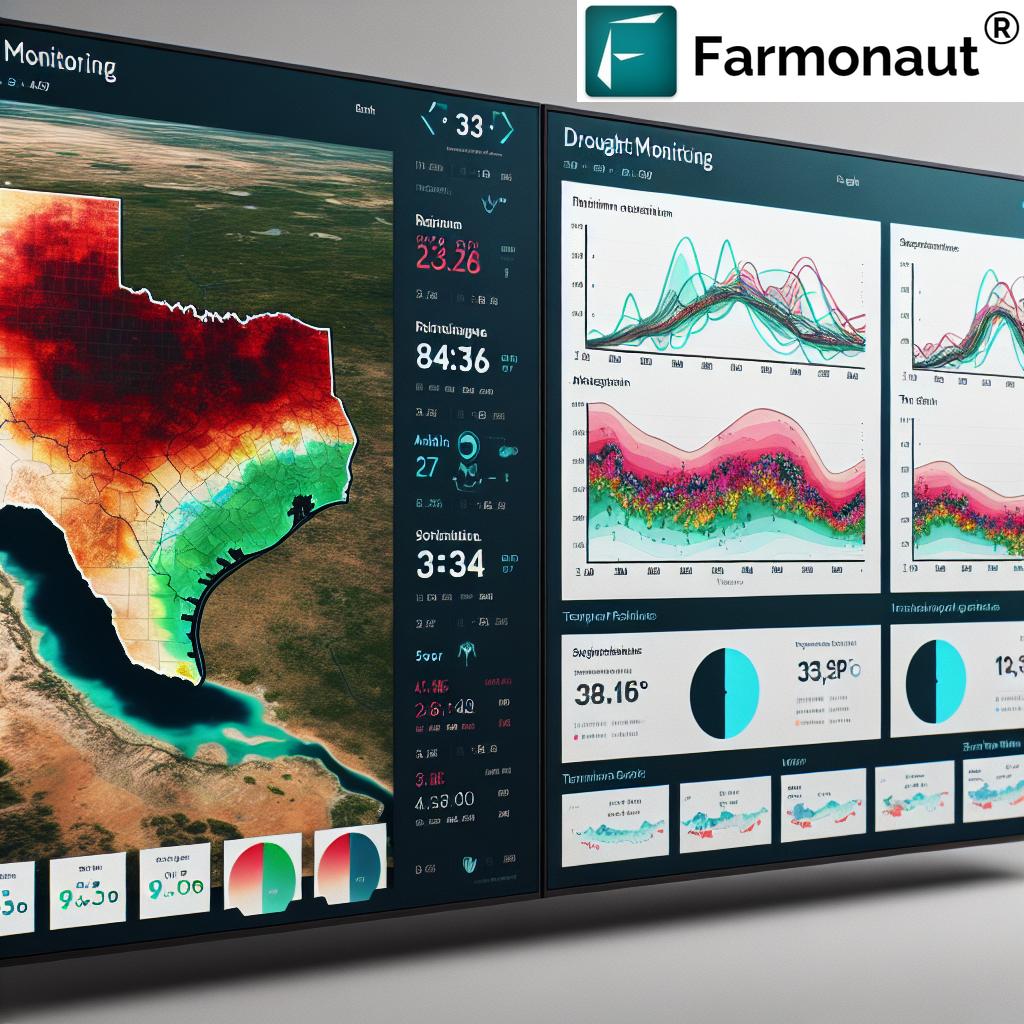

- Satellite-Based Crop Health: Companies like Farmonaut provide real-time NDVI, soil moisture, and diagnostics to farmers worldwide, using advanced satellite and AI technologies. See our farm management solutions for details.

- AI Advisory Systems: Intelligent systems guide farmers through changing weather, market prices, and pest/disease risks—essential in today’s volatile environment.

- Blockchain Traceability: Ensures transparency from farm to consumer, vital for food safety and global competitiveness.

Farmonaut Agricultural Innovation & Affordability

Looking to future-proof your farming operations? Farmonaut’s subscription plans make precision agriculture, fleet monitoring, carbon tracking, and traceability affordable and scalable for every type of user—from smallholders to governments and large agribusinesses.

Farmonaut’s Role: Resilience & Innovation in a Shifting Agricultural Landscape

As stakeholders across the world seek to identify an impact of the trade war between the United States and China on agriculture, Farmonaut’s solutions play a pivotal supporting role in reshaping global farming for 2025 and beyond.

- Crop Health Monitoring: Farmonaut’s satellite-based app and API tools give farmers and agribusinesses real-time, actionable insights for irrigation, fertilization, and disease management.

- AI Advisory & Decision Support: From weather forecasts to yield-boosting recommendations, Jeevn AI makes advanced farming accessible and effective under uncertainty.

- Supply Chain Transparency with Blockchain: Suppliers, governments, and food companies rely on Farmonaut Traceability to meet global compliance and achieve consumer trust.

- Resource & Fleet Management: Through our fleet management solutions, operational costs are reduced and supply chain reliability enhanced.

- Carbon Monitoring: Farmonaut Carbon Footprinting empowers producers to measure, benchmark, and improve environmental performance for sustainable market access.

- API, Integration, and Scalability: Developers and businesses can access Farmonaut satellite and weather data via our API or review our developer docs for seamless integration into digital agriculture ecosystems.

- Supporting Access to Financing: With satellite-based crop loan and insurance verification, farmers and lenders reduce the likelihood of fraud and improve access to credit—enabling productive, sustainable farming even during periods of global market disruption.

Outlook for U.S.–China Agricultural Trade Post Trade War (2025 and Beyond)

As tariffs have moderated with new agreements and cautious negotiations, 2025 ushers in an era of both opportunity and uncertainty:

- Renewed Market Access: Partial lifting of tariffs has reopened select sectors (notably pork, beef, and specialty crops) for U.S. exporters.

- Strategic Partnerships: Even as political tensions remain, both sides recognize the mutual benefits of collaboration in food safety, sustainability, and agricultural innovation.

- Continued Innovation: The lessons of the trade war have made resilience, innovation, and diversified trade partnerships priorities for every player in the food system.

In summary, to identify an impact of the trade war between the United States and China on agriculture is to witness the profound, ongoing transformation of global food production, security, and sustainability.

Frequently Asked Questions (FAQ)

-

Q1: What was the most significant impact of the US-China trade war on agriculture?

The most significant impact was the dramatic reduction in American agricultural exports to China, particularly soybeans, causing price collapses, supply gluts, and loss of revenue for U.S. farmers. This forced a wave of market diversification, innovation, and government support measures across the U.S. agriculture sector. -

Q2: How did the trade war change global agricultural supply chains?

The trade war between the United States and China led to a realignment of commodity flows, with Brazil and other countries increasing exports to China, while U.S. products sought alternative markets. This resulted in increased price volatility, new trade alliances, and extra emphasis on supply chain resilience globally. -

Q3: What policy and technology responses emerged as a result?

Key responses included the roll-out of government aid (e.g., Market Facilitation Programs), increased focus on export market diversification, and rapid adoption of agtech innovations—such as satellite monitoring, AI advisories, and blockchain traceability. -

Q4: How are agricultural companies preparing for future trade disruptions?

Companies are investing in supply chain monitoring, diversified sourcing, environmental sustainability (e.g., carbon tracking), and digital tools that enable real-time, data-driven farming. Farmonaut’s robust API and farm management platform offer actionable insights for future-proofing agricultural operations. -

Q5: How do Farmonaut’s solutions address modern farming challenges in this context?

Farmonaut offers an integrated suite of satellite-based crop health, resource management, AI-driven advisories, blockchain traceability, and carbon footprinting. These tools together help farmers and agribusinesses improve productivity, reduce risk, and achieve sustainable growth in a complex, interconnected global food system.

Conclusion: Lessons, Resilience, and the Future of Global Agriculture

The trade war between the United States and China stands as a defining event for global agriculture—underscoring the dangers of over-reliance on individual export markets, and the critical need for diversification, transparency, and tech-driven innovation.

- For American Farmers: The aftermath brought lower prices, lost revenues, and supply chain headaches—but also set the stage for strategic market diversification, policy support, and the rapid embrace of digital farming solutions.

- For Chinese Agriculture: The focus shifted to domestic production, diversified global sourcing, and upgrading rural infrastructure to withstand future shocks and ensure food security.

- For the World: We observe a permanent shift towards supply chain resilience, sustainability (as seen in carbon tracing and traceability), and multi-lateral partnerships to manage economic, environmental, and geopolitical uncertainty.

As we move further into 2025, the imperative is clear: agricultural systems must become resilient to geopolitical, environmental, and market shocks. Innovation—particularly from companies like Farmonaut—will be essential to achieving this.

Key Takeaways:

- Trade conflict impacts last for years, affecting exports, prices, and livelihoods.

- Diversification, innovation, and sustainability are the foundation of agricultural resilience in 2025 and beyond.

- Technology and data-driven decision-making, as enabled through tools like Farmonaut, will increasingly define competitive, future-proof agriculture worldwide.

For more on how Farmonaut’s tools can build a sustainable, resilient farming operation in today’s complex world, visit our platform, try our apps, or integrate via our open API.