Table of Contents

- Summary: The Dynamics of Alluvial Diamonds Price in 2025–2026

- Introduction: Understanding Alluvial Diamonds and Their Unique Market Position

- The Significance of the Lulo Alluvial Diamond Mine in Angola

- Critical Factors Shaping Alluvial Diamonds Price in 2025

- Alluvial Diamonds Price Trends and Market Outlook (2024–2026)

- How Lulo Alluvial Diamond Mine Influences Global Supply and Pricing

- Ethical Mining Practices and Market Considerations

- Satellite Technology, Mining Efficiency, and the Future of Diamond Valuation

- Alluvial Diamond Price and Market Factors Table (2024–2026)

- Frequently Asked Questions (FAQ)

- Conclusion: Strategic Insights for Stakeholders in 2026 and Beyond

“Lulo mine’s alluvial diamonds accounted for nearly 2% of global rough diamond sales by value in 2023.”

Alluvial Diamonds Price: Lulo Mine & Mine It Trends 2026

Summary: The Dynamics of Alluvial Diamonds Price in 2025–2026

The alluvial diamond sector remains a pivotal component of the global gemstone landscape in 2025, with the Lulo alluvial diamond mine in Angola standing out as a significant, premium contributor. In this comprehensive exploration, we examine alluvial diamonds price trends for 2025, analyze the quality and rarity factors, decode Lulo’s market dynamics and global supply impact, and scrutinize the rise of ethical, sustainable mining practices.

In addition, we provide a focused analysis on price drivers, demand fluctuations, and operational realities presently shaping market outcomes, especially heading into 2026. Whether you’re a gemstone investor, diamond industry professional, miner, or stakeholder in Africa or the global market, or seek value-rich data for the year ahead, this in-depth guide offers critical insights into market pricing, ethical considerations, and supply trends—centered around the famed Lulo mine and the broader alluvial sector.

Introduction: Understanding Alluvial Diamonds and Their Unique Market Position

The alluvial diamonds price sits at the intersection of tradition and innovation—a reflection of both the geological processes that shape Earth’s most coveted gemstones and the market forces governing their global journey from Angola’s Lunda Norte province to luxury collections worldwide. But what distinguishes alluvial diamonds from their mined peers, and why do they command a unique position in today’s gemstone marketplace?

Let’s begin by defining alluvial diamonds. These precious gemstones are naturally occurring, having weathered free from primary kimberlite or lamproite sources—the deep, volcanic pipes where most diamonds are formed. Over centuries, water and erosion transported these stones into riverbeds, floodplains, and sometimes offshore marine sediments. Unlike their deep-mined counterparts, alluvial diamonds accumulate in sedimentary deposits that can be closer to the surface—making them accessible through specialized surface mining techniques, such as sediment washing and screening.

- Distinctive Provenance: Alluvial diamonds often boast remarkable clarity, size, and color due to their natural wash. Their journey shapes their crystalline structure, resulting in highly-prized stones that frequently emerge as some of the most valuable rough diamonds discovered.

- Premium Pricing: The allure of striking clarity, large carat weights, and exceptional rarity allows alluvial diamonds, especially those from renowned mines like Lulo, to often command premium prices compared to certain harder-mined types.

In 2025–2026, these unique attributes remain central in influencing both consumer demand and broader market pricing dynamics across the gemstone sector.

The Significance of the Lulo Alluvial Diamond Mine in Angola

The Lulo alluvial diamond mine, operating within the Lunda Norte province of Angola, has emerged as a flagship project shaping both the national and global alluvial diamond industry. Discovered relatively recently in the mid-2010s and operated by Rosas & Petalas, the Lulo mine’s geological setting enables it to consistently yield large, high-quality stones, including rare colored diamonds that are highly sought after in luxury jewelry markets.

Let’s break down what makes Lulo’s output so significant for alluvial diamond price and market movements:

- Exceptional Rarity: Regular discoveries of large-carat diamonds and rare hues—including light pinks and fancy colors—set Lulo apart from other mines in Angola and worldwide.

- Premium Market Impact: Stones sourced from Lulo often fetch premium prices in global auctions, influencing overall alluvial diamonds price benchmarks.

- Main Supply Contributor: In 2023, for example, Lulo’s sales accounted for nearly 2% of global rough diamond value—an impressive figure given the vast array of suppliers worldwide.

- Influence on Trends: The mine’s reputation for ethical sourcing, sustainable practices, and community investment has only increased international demand, especially with market sensitivity to provenance at an all-time high.

- Innovation in Extraction: Lulo’s surface-based approach exemplifies modern alluvial mining—involving sophisticated sediment screening, water management, and environmentally mindful extraction techniques.

As Angola pushes forward with mining regulations and international best practices, Lulo continues to set a benchmark for sustainable diamond extraction and market leadership in 2025 and beyond.

Critical Factors Shaping Alluvial Diamonds Price in 2025

Navigating the alluvial diamonds price landscape requires a detailed examination of the geological, economic, and operational factors that uniquely shape this segment of the gemstone industry. Let’s break down the primary dynamics influencing diamond value today:

1. Quality and Rarity of Alluvial Diamonds

- Size and Carat Weight: Alluvial stones from Lulo are often notably large, with numerous discoveries exceeding 50 carats—some surpassing 100 carats—impacting price averages for premium rough diamonds.

- Clarity and Color: The natural wash creates gemstone-quality pieces with exceptional luster, clarity, and often rare colorations, such as pink or Type IIa diamonds, prized in high jewelry.

- Rarity: With supply limited and demand for larger, higher-grade stones surging, the value and desirability of alluvial diamonds continues to rise.

2. Sustainable and Ethical Sourcing Practices

- Ethical Impact: Modern consumers are increasingly sensitive to mining practices. Stones certified from responsible, environmentally sound operations—such as Lulo—often command a price premium.

- Traceability: Buyers demand clear provenance reporting for high-value stones, favoring supply chains with blockchain-backed traceability and stringent environmental safeguards. (Explore traceability solutions for supply chain trust)

- ESG Focus: Environmental, Social, and Governance (ESG) factors permeate diamond valuation for 2025–2026, affecting both demand and public perception of leading mines.

3. Global Demand Fluctuations and Market Sensitivity

- Jewelry Demand: As global economies recover and luxury retail rebounds post-pandemic, demand for gem-quality diamonds—especially alluvial stones—has shown robust growth.

- Consumer Preferences: The evolving debate around lab-grown diamonds vs. natural stones introduces nuanced pressures and price fluctuations in premium sectors. However, many collectors remain loyal to the unique provenance of named mines like Lulo.

- Export and Regulatory Factors: Political conditions and trade regulations—including new rules governing conflict minerals—affect export logistics, pricing, and competitiveness in international markets.

4. Mining and Operational Cost Dynamics

- Extraction Techniques: Alluvial mining, though less infrastructure-heavy than kimberlite operations, is labor intensive and often subject to variable sediment yields. This operational model impacts the overall mine it diamond price.

- Resource Management: Costs associated with fuel, labor, water, and environmental management fluctuate alongside global resource markets.

- Technology Adoption: Mines adopting advanced operational tools—like satellite-driven monitoring—may reduce inefficiencies, optimizing extraction and supporting sustainable production. (See how Farmonaut empowers mining technology for cost-effective extraction)

5. Supply Chain and Export Considerations

- Lulo’s Output: Lulo’s significant alluvial diamond production continues to exert influence on global supply chains, meaning its trends help set broader market prices.

- Share in Global Market: As Lulo’s share of global rough supply increases and its stones consistently achieve premium auction results, its downstream impact on market valuations is amplified heading into 2026.

Optimize Mining Operations with Advanced Satellite Data

Real-time mining site monitoring, resource optimization, and environmental compliance are increasingly critical for sustainable, profitable diamond extraction. Explore our Fleet Management platform—designed for mining logistics, equipment optimization, and operational efficiency leveraging satellite-driven insights.

“Forecasts suggest alluvial diamond prices may rise over 8% by 2026, led by ethical sourcing trends from key mines.”

Alluvial Diamonds Price Trends and Market Outlook (2024–2026)

The market for alluvial diamonds in 2025 and beyond remains dynamic and complex, shaped by both cyclical trends and structural shifts. Let’s focus on the most influential trends:

Price Growth, Scarcity, and Premiums

- Alluvial diamonds, especially from Lulo, have consistently seen above-average price growth—estimates put the 2025/26 premium at 6–8% over comparable stones from hard rock sources. This premium is attributed to their notable rarity, renowned provenance, and the quality assurance pedigree associated with sites like the Lulo alluvial diamond mine.

- Supply scarcity: Lulo’s alluvial diamond output comprises a relatively small share (2% by value in 2023) of global supply but exerts outsized pricing influence due to both gemstone quality and auction visibility.

- Ethical source premium: As transparent supply become central, stones with verifiable, sustainable production generate added value for both miners and end buyers.

Estimated Market Dynamics: 2025–2026

- Average Price per Carat: Forecasts for 2026 indicate sustained upward momentum, with estimates for premium alluvial stones exceeding $1,500–$2,200 per carat, depending on size and clarity.

- Quality Benchmarks: Buyers, particularly in Asian and North American markets, increasingly prioritize exceptional clarity and color—driving premium pricing for large, rare, and fancy-colored diamonds.

- Global Demand Index: Recovery from the economic impacts of previous years and new market entrants (e.g., via online auctions, blockchain platforms) boost demand visibility for alluvial stones.

- Operational Shifts: Adoption of sustainable practices and digital traceability standards by flagship mines—especially in Angola—ensure continued international trust and higher price realization.

- Challenges: Periodic regulatory or geopolitical disruptions, changes in consumer taste (potentially toward alternative gemstones or lab-created diamonds), and environmental pressures may inject volatility into both supply and price realization.

How Lulo Alluvial Diamond Mine Influences Global Supply and Pricing

Few mines command the international attention and market impact of the Lulo alluvial diamond mine:

- Premium Auction Results: Lulo’s large and rare stones regularly set price records at major auctions, establishing new benchmarks for alluvial diamonds price and influencing investor and collector sentiment worldwide.

- Sustained Output: Output remains steady and, in certain years, produces some of the largest stones found globally. This consistency, paired with Angola’s supportive mining policies, underpins market confidence.

- Increasing Share in High-Value Segments: As Lulo delivers a higher proportion of large and fancy-colored stones compared to global averages, its influence on price indices and downstream supply chain (from rough diamond trading to high jewelry) continues to grow.

- Ethical and Reputation Leverage: Stones with Lulo provenance, certified for responsible mining and community reinvestment, command higher prices and are featured in luxury brands prioritizing ESG (Environmental, Social, Governance) marketing.

In summary: Lulo’s impact is both quantitative (supply/value share) and qualitative (market and price leadership in premium segments).

Ethical Mining Practices and Market Considerations

As we move into 2026, it’s clear that ethical and sustainable mining practices are no longer optional—they’re fundamental to market access, price realization, and brand reputation in the alluvial diamond sector.

- Transparency Demands: International buyers increasingly require blockchain-based certification, third-party verification, and real-time environmental monitoring for their diamond purchases.

- Regulation Compliance: Export from Angola and similar producing nations is now tightly linked with demonstrating sustainable extraction and active community involvement, or else facing premium reductions.

- Resource Management: Water usage, tailings control, and minimization of surface disruption are monitored by both governments and buyers—driving adoption of satellite-based monitoring and digital reporting tools. (Discover solutions for carbon footprinting and emissions monitoring)

- Innovative Solutions: From blockchain-backed traceability to satellite imaging (see satellite technology impact below), leading mines aim to satisfy both legal requirements and evolving customer expectations.

Satellite Technology, Mining Efficiency, and the Future of Diamond Valuation

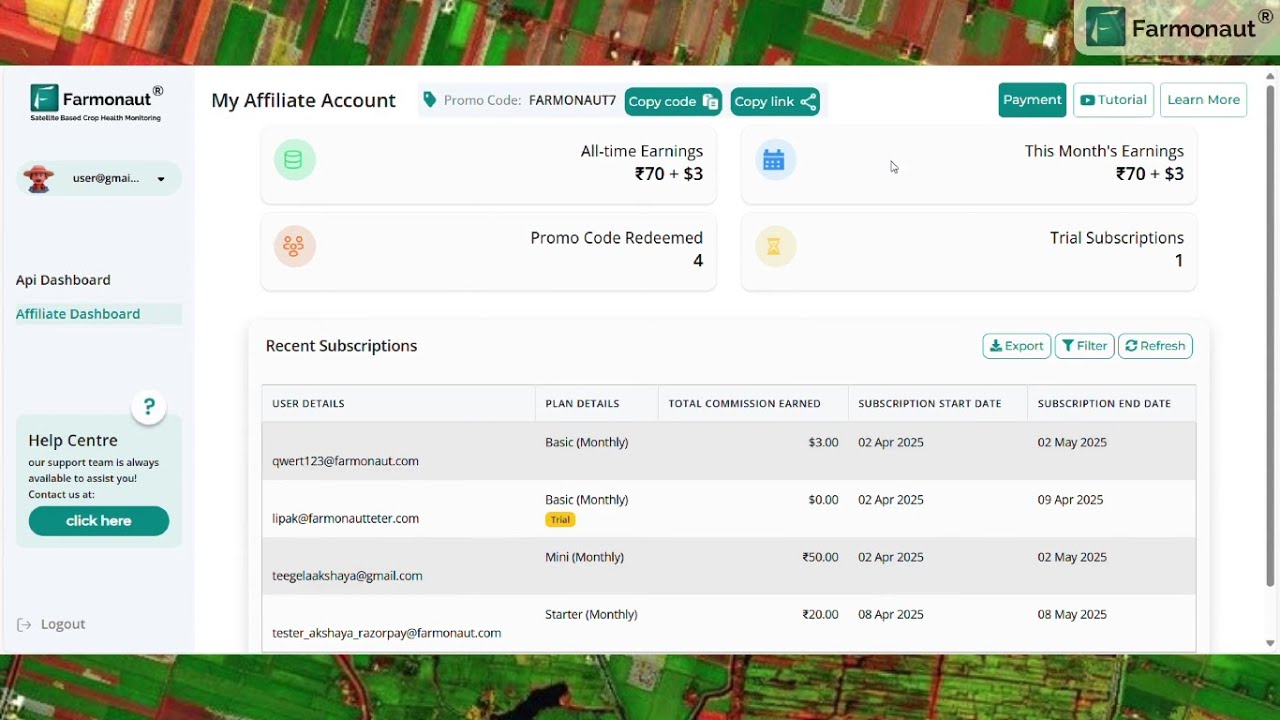

Operational excellence, cost control, ethical compliance, and premium valuation unite around access to high-quality, real-time data. As a satellite technology company, we at Farmonaut understand the significance of advanced digital tools in revolutionizing the diamond mining sector, including alluvial mining at sites like Lulo.

- Remote Sensing for Exploration and Extraction Efficiency: Leveraging multispectral satellite imagery allows mining firms to accurately identify promising sedimentary deposits, monitor the efficiency of ongoing extraction, minimize wastage, and ensure resource allocation remains optimized from initial sampling to large-scale washing and screening.

- AI-Driven Operational Insights: Our Jeevn AI system supports mining operations by analyzing field conditions, predicting weather risks, and advising on optimal extraction timing, further reducing lost output and operational costs.

- Blockchain-Based Traceability: By integrating blockchain, producers prove gemstone provenance from mine to market—addressing consumer sensitivity to ethical, tamper-proof chains of custody. (Learn how digital traceability protects mining value chains)

- Environmental Tracking and Compliance: Real-time monitoring with satellite-derived data empowers mining operators to track carbon footprint, manage impact, and address evolving regulations quickly and accurately. (Explore our carbon monitoring solutions)

- Loan and Insurance Verification: Satellite-based site verification reduces risk for financial providers supporting the mining sector, speeding up loan/insurance decisions and supporting both small and large-scale operators. (See how verification accelerates mining finance)

As technologies advance and new digital standards emerge, those involved in the alluvial diamond industry—from mine operators to government regulators—stand to benefit from integrated, affordable, and scalable solutions for resource management, traceability, and regulatory reporting.

Developers: Take advantage of our Farmonaut API and extensive API developer documentation to easily integrate satellite-powered monitoring, resource analytics, and traceability into your mining operations.

- Scalability: Our platform adapts to small-scale mines and major industry leaders without the complexity or capital cost of traditional remote sensing hardware.

- Security & Trust: Blockchain authentication supports transparency for buyers and regulators, increasing the price realization for ethically sourced diamonds.

- Regulatory-readiness: Instant compliance reporting—from environmental impact to full gemstone supply chain—prepares you for the future of regulated diamond exports.

Alluvial Diamond Price and Market Factors Table (2024–2026)

To make sense of shifting trends and support strategic decisions, study this multi-year, data-driven table comparing key indicators for the alluvial diamonds price market, with an emphasis on the Lulo alluvial diamond mine:

SEO Insight: This table ties together alluvial diamonds price, quality dynamics, Lulo mine output, and ethical trends—responding to frequent industry and research queries.

Frequently Asked Questions (FAQ)

Q1. What distinguishes alluvial diamonds from kimberlite (hard rock) diamonds?

Alluvial diamonds are naturally occurring stones found in sedimentary environments (riverbeds, floodplains, marine sediments), deposited after erosion and transportation from primary kimberlite/lamproite sources. They are recovered using specialized surface mining techniques, and often exhibit clarity and size superior to typical hard rock-mined diamonds.

Q2. Why is the Lulo alluvial diamond mine so important for diamond prices?

The Lulo mine is globally significant due to its consistent output of large, high-quality diamonds with rare colors. Its stones often set market standards for alluvial diamonds price thanks to their provenance, ethical credentials, and frequent premium auction results.

Q3. How do ethical mining practices affect alluvial diamond pricing?

Ethical sourcing, sustainable extraction, and traceability are prerequisites for access to premium diamond markets. Transparent and responsible operations, such as those demonstrated by Lulo, unlock price premiums and market trust, especially as buyer preferences are increasingly sensitive to environmental and community considerations.

Q4. Can technology improve diamond mining efficiency and value?

Yes. Advancements in satellite imagery, AI advisory, blockchain traceability, and environmental monitoring—as offered by Farmonaut—enable operators to optimize extraction, reduce losses, manage compliance, and secure higher valuations in both rough and finished diamond markets.

Q5. How is demand for alluvial diamonds projected to change by 2026?

Forecasts indicate continued strength and moderate growth for premium alluvial diamonds, especially for stones with certified ethical provenance and outstanding quality. The shift towards sustainable sourcing is expected to drive further price appreciation through at least 2026.

Q6. Where can I learn more about technological solutions for mining operations?

For those managing diamond mining, resource monitoring, or supply chain compliance, Farmonaut’s web and mobile apps offer industry-focused satellite data, reporting tools, and blockchain-based traceability for optimized, transparent operations.

Conclusion: Strategic Insights for Stakeholders in 2026 and Beyond

The alluvial diamond sector—particularly as represented by the Lulo alluvial diamond mine in Angola—is set to maintain its premium, influential position within the global gemstone and jewelry landscape into 2026 and well beyond. Several trends are unmistakable:

- Premium Pricing Endures: Quality, rarity, and provenance together sustain robust alluvial diamonds price growth, especially for stones sourced from respected projects like Lulo.

- Ethical and Sustainable Practices: Market access and pricing increasingly depend on demonstrable environmental, social, and governance (ESG) compliance—meeting evolving demands of buyers, regulators, and communities.

- Technology Drives Competitive Advantage: Adoption of satellite data, real-time monitoring, and blockchain traceability can reduce operational costs, support regulatory readiness, and secure premium valuations.

- Lulo’s Influence Expands: With its strong output, unique geological profile, and ethically led operations, Lulo’s share of market leadership—and impact on global diamond pricing—will likely grow further.

- Stakeholder Readiness: Whether as mine operators, investors, jewelry brands, or regulators, leveraging digital tools, complying with sustainability trends, and nurturing community value remain keys to long-term success.

Explore Cost-Effective Mining and Resource Monitoring Subscriptions

Transform your mining operations with affordable, scalable satellite-driven intelligence.

For tailored advice or a demo of how satellite monitoring, AI-driven advisory, and blockchain-backed traceability can improve your diamond mining, valuation, or resource management, explore the Farmonaut App or API integrations here.

As we step further into the 2026 diamond market, it’s clear that innovation, transparency, and strategic sustainability separate industry leaders from mere participants. The Lulo alluvial diamond mine’s trajectory offers a blueprint for premium value creation, informed by geological riches and a commitment to best practices. The exciting future of alluvial diamonds price—and the sector as a whole—continues to be written by the mines, technologies, and people who drive ethical progress and operational excellence.