“Mongolia’s mining sector is projected to contribute over 25% to the nation’s GDP by 2025.”

Mongolia Mining Sector 2025: Powering Growth & Global Impact

Summary: Mongolia’s Mining Sector: Driving National Growth and Future Prospects in 2025

The mongolia mining sector in 2025 stands as a transformative force within both the national economy and the global mining industry. Representing nearly a quarter of the country’s entire GDP and powering over 80% of its foreign export earnings, Mongolia’s mining industry remains both a pivotal growth engine and a leader in supplying strategic resources to the world. With its vast and rich reserves of coal, copper, gold, and rare earth elements, the sector has evolved dramatically over recent decades. From grassroots artisanal operations to giant multinational industrial projects like Oyu Tolgoi, mining continues to shape Mongolia’s economic landscape, society, and environmental policies. This comprehensive analysis explores the trends, economic impact, market outlook, challenges, and sustainable growth opportunities defining the industry as we move beyond 2025.

Economic Significance of the Mongolia Mining Industry in 2025

The mongolia mining sector in 2025 remains the cornerstone of the nation’s economy, with mining activities accounting for nearly 25% of GDP and over 80% of its total exports. This underlines an important fact: the sector is not just a contributor to revenue but is vital for foreign exchange, infrastructural development, and economic growth.

- Revenue Engine: Mining directly boosts national revenue through taxes, royalties, and fees.

- Exports Dominance: Top mineral products such as coking coal, copper concentrates, and gold form the backbone of Mongolia’s export portfolio.

- Strategic Positioning: Key markets are China (the largest neighbor and trading partner), Russia, Japan, and the European Union, but exports are expanding into other global destinations as mineral demand continues to rise.

- Diversification Driver: The government continues to prioritize mining as a pathway for diversification and national modernization.

With a unique location between major economies and vast deposits of globally significant mineral resources, Mongolia’s mining sector is positioned as a strategic conduit between East and West for the supply of critical minerals.

Key Mineral Resources and Major Mining Projects in Mongolia (2025)

Mongolia is exceptionally rich in mineral resources: coal, copper, gold, and rare earth elements. These vast reserves represent the heart of the nation’s industrial operations and its growing global significance.

Coal: Mongolia’s Dominant Export Commodity

Coal remains central in 2025, especially coking and thermal coal, still critical in global steel manufacturing and regional energy supply, despite mounting environmental challenges. The giant basins of Tavan Tolgoi and Shivee Ovoo comprise world-class reserves:

- Tavan Tolgoi: Among the largest untapped coking coal deposits globally. Exports mainly flow to China and are strategized for value-added processing.

- Shivee Ovoo: Focuses on coal for domestic power generation and targeted regional exports.

Copper: Mongolia’s Critical Green Metal

Copper demand is surging, increasingly vital for clean energy technologies, electrification, and global supply chains. As of 2025, Mongolia is expected to exceed 1.5 million metric tons in annual copper output, solidifying its position among the world’s major copper suppliers.

- Oyu Tolgoi: The flagship project, operated by a joint venture with multinational corporations. After major expansion and underground development, its output is set to become even more influential in the global market.

- Erdenet Mine: Longstanding operation, also an important copper concentrate supplier. Key for both domestic markets and export.

Gold: Mongolia’s Lustrous Prize

Gold mining remains one of the top products of Mongolia, supporting both export growth and national reserves. Artisanal and major industrial operations alike contribute.

- Key Mines: Oyu Tolgoi (joint copper-gold output), Altan Tsagaan Ovoo, and various artisanal gold mining operations in Selenge and Bayankhongor.

- Export Destinations: Primarily China, but also Japan, Russia, and the EU as export controls and traceability improve.

Rare Earth Elements: Mongolia’s Future as a Critical Supplier

The future of the mongolia mining sector lies increasingly in diversification. Recent discoveries of rare earth elements hold huge potential for supplying renewable energy, clean technologies, and high-tech manufacturing sectors globally.

- Rare earths are critical for electric vehicles, wind turbines, and advanced electronics.

- Mongolia’s deposits near Bayan Obo rival some of the leading global mines, though development and extraction faces unique environmental stewardship challenges.

- Government and industry projects are underway to position Mongolia as a strategic supplier, reducing reliance on limited global sources.

Mongolia Mining Sector 2025: Key Resources & Economic Impact Overview

| Resource | Estimated 2025 Production Volume (tons/ounces) | Estimated Export Value (USD) | Share in Mongolia’s Total Mining Exports (%) | Global Market Share (%) | Major Importing Countries |

|---|---|---|---|---|---|

| Coal | 45–50 million tons | $4.2–$4.7 billion | ~50% | 7–8% | China, Russia, Japan, S. Korea |

| Copper | 1.5–1.7 million tons | $4.5–$5.2 billion | ~40% | 6–7% | China, Japan, European Union |

| Gold | 21–24 tons (675,000–770,000 oz) | $1.3–$1.7 billion | 7–8% | 1.5–2% | China, Singapore, European Union |

| Rare Earth Elements | 20,000–25,000 tons (est.) | $500m–$750m | 2–3% | 0.8–1.2% | China, South Korea, USA, EU |

“Copper output in Mongolia is expected to surpass 1.5 million metric tons annually by 2025.”

Infrastructure and Investment Landscape: Building Mongolia’s Mining Future

Robust infrastructure remains the linchpin for Mongolia’s ambitions as a global mineral supplier. Its development, modernization, and investment have been central to reducing logistical costs, enhancing competitiveness, and broadening market access.

- Transportation Networks: Expansion of the Trans-Mongolian Railway and construction of new roads and rail links are connecting remote mining regions like Tavan Tolgoi directly to Chinese and Russian borders. This facilitates faster, larger-volume exports, and supports diversification to reach new international markets.

- Logistics Upgrades: Investment in rail spurs, dry bulk terminals, and digital management systems makes bulk mineral exports more efficient and cost-effective.

- Energy Infrastructure: In the face of growing power demand from industrial mining projects, Mongolia is increasingly focused on hybrid energy grids—integrating coal-based and renewable sources for sustainability.

- Government Support: Incentives, regulatory reforms, and public–private partnerships are unlocking more investment in infrastructure, mining, and processing.

Improved infrastructure and investment ensure that Mongolia’s mongolia mining sector can operate at global scales. It simultaneously boosts domestic employment opportunities, skill development, and local wealth creation in mining-affected regions.

Satellite-Driven Resource Management & Carbon Footprinting for Mining

Unlocking operational excellence in the mongolia mining sector goes beyond physical infrastructure. With cutting-edge tools like satellite-based monitoring and carbon footprinting platforms, mining operators and policymakers can minimize waste, reduce emissions, and drive sustainable practices throughout the value chain.

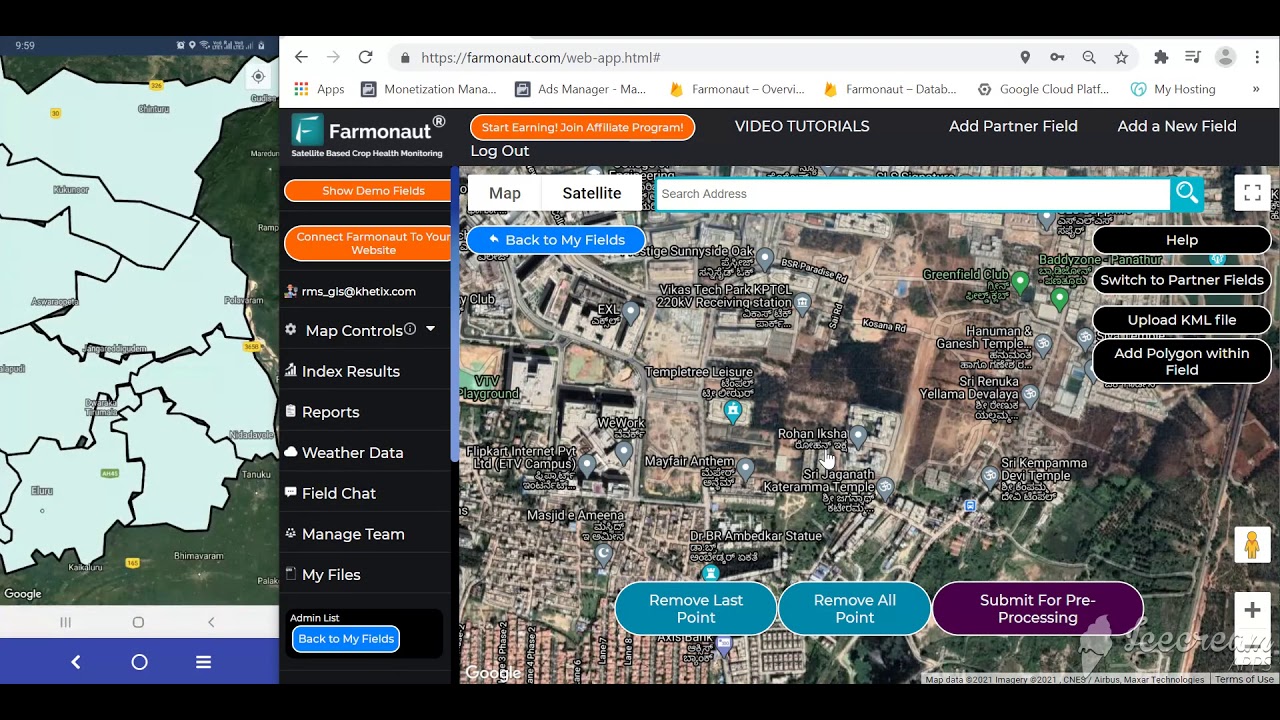

By using advanced climate and environmental monitoring solutions, like those offered by Farmonaut, organizations actively measure, track, and report their carbon emissions at every stage—from site clearance to mineral extraction and transportation.

Related Mining Sector Videos

Environmental and Social Challenges & Opportunities for Sustainable Growth

As the mongolia mining industry expands, its environmental and social impacts come under ever greater scrutiny. Addressing these challenges is central for ensuring long-term, sustainable growth and maintaining Mongolia’s positive global positioning.

Key Environmental Challenges

- Land Degradation: Large-scale mining, especially open-pit methods common at sites like Oyu Tolgoi and Tavan Tolgoi, can cause soil erosion, desertification, and a reduction in biodiversity.

- Water Scarcity: Central Asia’s arid climate, and Mongolia’s own sensitivity to water balance, makes water usage by mining a critical local concern.

- Pollution: Improperly managed tailings, chemical leaching, and dust emissions create risks to both ecosystems and human health.

- Climate Change Impacts: Mongolia is already experiencing hotter, drier seasons and more pronounced desertification—extractive activities must factor resilience and adaptation planning into site selection and operations.

Social and Community Concerns

- Community Displacement: Mining expansion sometimes conflicts with traditional nomadic herding, requiring respectful compensation, land agreements, and community input into extraction and reclamation projects.

- Indigenous Rights: Maintaining access to grazing lands and water resources is vital, and inclusive engagement must be a priority.

- Economic Inclusion: Providing jobs—both skilled and unskilled—training, and infrastructure benefits for local populations to ensure mining-led growth is inclusive and not extractive in the negative sense.

- Corporate Social Responsibility (CSR): Companies and multinationals are required by both Mongolian law and international best practice to operate ethically, reclaim mined lands, and contribute to sustainable development in surrounding communities.

Regulatory & Policy Evolution

The Mongolian government is increasingly enacting reforms and enforcing mining regulations focused on environmental protection, sustainable land management, and greater transparency in resource extraction.

- Adoption of International Best Practices: Requiring environmental impact assessments, regular monitoring, and operational transparency for all industrial projects.

- Digital and Satellite Monitoring Tools: Use of blockchain-based traceability and remote sensing supports effective oversight, compliance with licensing, and improves supply chain accountability.

- Stakeholder Engagement: Mandating ongoing dialogue between mining companies, local government, NGOs, and communities.

Farmonaut’s Role: Real-Time Monitoring & ESG Compliance

To meet stricter environmental policies and promote sustainable practices, real-time satellite-based monitoring systems are instrumental. At Farmonaut, we offer tools that track changes in land cover, monitor emissions, and verify natural resource restoration efforts for mining, which supports compliance and boosts both domestic and foreign investor confidence.

- Environmental Impact Monitoring: Gain transparency into a mine’s resource use and ecological footprint.

- Traceability & Reporting: Blockchain verified reporting solutions make ESG audits easier, increasing trust with regulators, international buyers, and supply chain partners.

For operators seeking specific APIs and developer tools for digital mining management, explore our Farmonaut API offerings and developer documentation.

Optimized Logistics: Satellite-Backed Fleet Management

Coordinating machinery, transport, and personnel across Mongolia’s remote mining regions requires robust planning and real-time visibility. Satellite-driven fleet management systems empower businesses to optimize vehicle scheduling, reduce fuel wastage, and ensure on-site safety and logistical efficiency.

Satellite & Digital Innovation: Farmonaut’s Role in Mining Modernization

The 2025 mongolia mining sector reflects a broader global trend: rapid adoption of digital tools and automated, data-driven resource management. At Farmonaut, we leverage satellite imagery, AI, blockchain, and scalable software to deliver:

- Remote Sensing for Real-Time Mining Oversight: Protect fragile ecosystems, reduce illegal resource extraction, and monitor operational efficiency using multispectral satellite images for vegetation, water, and land-use change.

- AI-Based Advisory Systems: Farmonaut’s Jeevn AI platform analyzes geospatial and climate data, delivering custom operational strategies directly to mining managers.

- Blockchain in Mineral Traceability: Our technology underpins secure, tamper-proof mineral auditing and supports ESG compliance.

- Environmental Impact Tracking: Track carbon, water, and habitat impacts from pit to port, and drive sustainable reporting for both the government and multinational mining companies.

- Fleet, Equipment, and Logistics Optimization: Enhance productivity on both large-scale and artisanal operations, ensure timely supply deliveries, increase safety, and lower operating cost.

These digital innovations do not just minimize environmental risk—they unlock new growth areas and global competitiveness for Mongolia’s critical minerals sector, aligning mining industry practices with 21st-century sustainability standards.

Are you a mining operator or government administrator seeking to deepen your strategic mining project monitoring? Explore Farmonaut’s large scale resource management platform, designed to support overlays of satellite data, operational analytics, and historic site records across even Mongolia’s largest concessions.

Future Prospects and Modernization of Mongolia’s Mining Sector

As global demand intensifies for both traditional and strategic mineral resources, the future of the mongolia mining sector promises continued expansion and modernization. However, it faces significant market and policy headwinds—including global energy transitions, regulatory pressures, and geopolitical tensions.

Technological Adoption & Sustainable Practices

- Automation and Robotics: Minimizing human risk and increasing productivity with autonomous equipment, drones, and real-time digital mapping.

- Remote Analytics: Farmonaut’s accessible blockchain traceability and AI-driven decision support for both small-scale and industrial mines.

- Cleaner Extraction Techniques: Hydro and bio-leaching, dry tailings management, and newer beneficiation methods are being implemented to reduce water and chemical use.

Value Addition & Downstream Industry Creation

Rather than exporting raw ores and concentrates, Mongolia’s government and industry vision centers on:

- In-Country Processing Facilities: Building smelters and refineries generates increased export value, reduces dependency on foreign processors, and increases job creation.

- Manufacturing Linkages: Promoting domestic production of copper cables, gold jewelry, rare earth magnets, and battery components for both local and export markets.

International Investment and Geopolitical Realignment

Strong investment in Mongolia’s mining sector remains attractive for multinational corporations and sovereign wealth funds, given Mongolia’s stability and vast, untapped reserves. However, the landscape is dynamic, with:

- Resource Nationalism: Calls for increased government ownership and value retention from resource extraction versus completely open foreign investment.

- ESG Standards: Heightened scrutiny from Western banks, investors, and buyers means that compliance with carbon, ethics, and social justice standards is essential for future competitiveness.

- Diversification of Partnerships: Mongolia looks to balance economic dependencies by engaging not only with China and Russia, but also markets in Japan, the EU, South Korea, and the Americas.

Sustainable Growth: Emphasizing Environmental Stewardship

At the heart of Mongolia’s vision is a shift toward sustainable development—balancing the desire for growth with responsible, future-facing environmental and social practices. Essential steps include:

- Integrating real-time environmental, water, and land-use monitoring throughout the project lifecycle.

- Restoring mined lands, investing in biodiversity conservation, and developing renewable energy supplies for both the national grid and on-site mining use.

- Ensuring that mining-led wealth creation benefits local communities, supports education, and helps reduce inequalities.

For those in mining operations, regulatory agencies, or environmental compliance, leveraging Farmonaut’s carbon footprinting solutions ensures reporting, benchmarking, and real progress on reducing emissions and environmental impact.

Frequently Asked Questions (FAQ) – Mongolia Mining Sector 2025

What are the main mineral resources that drive Mongolia’s mining industry in 2025?

The primary resources are coal, copper, gold, and rare earth elements. These minerals account for the majority of production volume and export value, powering both the national economy and Mongolia’s global market share.

How important is mining for Mongolia’s economy today?

Mining accounts for nearly 25% of Mongolia’s GDP and over 80% of export earnings. It remains Mongolia’s key source of revenue, employment, and infrastructure development in 2025.

What are the environmental challenges facing Mongolia’s mining sector?

Key challenges include land degradation, water scarcity, pollution, and the effect of climate change on fragile steppe and desert ecosystems. The government is implementing stricter regulations, while technology adoption supports better monitoring and mitigation.

Can Mongolia become a major global supplier of rare earth elements?

Yes. New discoveries and investments in extraction and processing are positioning Mongolia for a greater role in supplying the global demand for rare earth elements critical to renewable energy and technology industries.

How does Farmonaut contribute to Mongolia’s mining sector modernization?

We provide satellite-based monitoring, AI-powered advisory tools, blockchain traceability, fleet/resource management, and environmental impact tracking solutions to enhance productivity, compliance, and sustainability across both large-scale and small-scale mining operations.

What are the prospects for mining sector modernization beyond 2025?

The future is bright, with ongoing investments in automation, digitization, value-added processing, and environmental stewardship driving long-term competitiveness in the mongolia mining sector.

Conclusion: Mongolia Mining Sector 2025—A Pillar of Sustainable National Growth and Global Supply

The mongolia mining sector in 2025 epitomizes dynamic transformation, global relevance, and strategic importance. With critical contributions to the nation’s GDP, foreign exchange, and industrialization, mining is the cornerstone for Mongolia’s future. Yet, the industry faces a delicate balance: harnessing vast mineral resources for economic growth while safeguarding environmental and social values.

As we move further into the decade, meeting sustainability benchmarks, digitization, modernization, and responsible leadership will separate enduring industry players from the rest. Unlocking Mongolia’s full mining potential demands an alliance of technology, community, policy, and responsible investment—delivering value for Mongolia, its people, and global supply chains.

At Farmonaut, we stand ready to support all stakeholders in Mongolia’s mining journey with cutting-edge, cost-effective digital solutions adapted for a new era of growth in the mongolia mining sector.