Assmang Manganese, Manganese Miners ASX: 2026 Trends – A 2025 Perspective

“Global manganese demand is forecasted to rise by 19% by 2026, driving innovation among ASX-listed miners.”

Table of Contents

- Introduction: Manganese’s Strategic Role in Modern Industry

- Assmang Manganese: Industry Titan and Global Benchmark

- ASX-Listed Manganese Mining Companies: The Australian Leaders

- 2025–2026 Manganese Mining Trends and Global Demand Drivers

- Sustainability, Technology & Innovation in Manganese Mining

- Economic and Strategic Importance of Manganese For Australia

- Comparative Trends Table: ASX Manganese Miners & Assmang

- Farmonaut’s Satellite Technology Solutions for Mining & Beyond

- 2026 and Beyond: The Future of Manganese Mining in Australia

- Frequently Asked Questions

Introduction: Manganese’s Strategic Role in Modern Industry

The manganese sector stands at a transformative crossroads as we approach 2026. A critical mineral, manganese is essential for numerous industrial processes, particularly steel production, battery technologies, and infrastructure development. Its importance is amplified in the age of green energy and technological change, with demand for manganese mining companies asx products growing steadily worldwide.

With countries pushing toward electrification, cleaner energy, and massive infrastructure projects, the global demand for high-quality manganese is at an all-time high. Australia, leveraging its favorable geological landscape and world-class mining expertise, has emerged as a central player in this evolving industry. The influence of global leaders like Assmang manganese, combined with innovation from highly regarded ASX-listed miners such as South32 and Element 25, is setting the stage for unprecedented growth and transformation in the Australian manganese sector.

“Australia’s manganese production is expected to contribute over 22% of global supply by 2025, strengthening market influence.”

Assmang Manganese: Industry Titan and Global Benchmark

Understanding the future trajectory of manganese mining companies asx requires a close look at Assmang Limited. Assmang manganese is a joint venture between African Rainbow Minerals and Assore Limited. While its core operations are rooted in South Africa, Assmang’s impact travels far beyond, serving as a benchmark for efficient, sustainable, and technologically advanced mining practices.

- Deep Roots: Assmang’s expertise stretches back decades, with a business model that emphasizes innovation, safety, and profitability. Its South African mining landscape is world-renowned for both resource quality and operational sophistication.

- Global Influence: Although primarily based in South Africa, Assmang’s techniques and practices are imitated by leading Australian manganese miners asx, who are aiming to achieve similar efficiency, sustainability, and growth.

- Efficient Model: Assmang demonstrates the business advantages of automation, advanced ore processing, environmental management, and stable supply chains—lessons increasingly applied by ASX listed entities.

As Australia positions itself to become a leading supplier of this essential mineral in 2025 and beyond, the inspiration provided by Assmang’s operations will be invaluable in setting new standards for sustainability and technological integration in mining.

ASX-Listed Manganese Mining Companies: The Australian Leaders

The Australian Securities Exchange (ASX) is home to multiple manganese mining companies asx that are driving technological advancement and increased output. Australia’s Pilbara region in Western Australia and the Northern Territory are globally significant for their vast, high-quality manganese resources.

Key Manganese Miners on the ASX

- South32 (ASX: S32): South32 operates the Groote Eylandt mine, recognized as one of the world’s leading high-grade manganese sources. Their production not only sustains domestic steel manufacturing but also serves surging international markets like China and Europe, contributing significantly to Australia’s export revenue.

- Element 25 (ASX: E25): An emerging powerhouse, Element 25 leverages innovative extraction and ore processing methods at its Butcherbird project. Their focus on supplying manganese for battery technologies essential to EVs and renewable energy storage characterizes Australia’s next wave of mining progress.

- OM Holdings Limited (ASX: OMH): As a vertically integrated manganese company, OM Holdings manages operations across mining, processing, and alloy production, giving it flexibility to adapt to evolving technology trends and demand.

These ASX-listed manganese miners are not only increasing manganese output but also differentiating through the adoption of new technologies, strong sustainability initiatives, and expanding their footprint in global supply chains. Their ability to scale and innovate is likely to accelerate as demand for manganese expands in 2025 and 2026.

2025–2026 Manganese Mining Trends and Global Demand Drivers

The future of manganese mining in Australia is determined by expanding global demand and the evolving role of manganese in industrial processes:

Major Trends

- Battery Technology Revolution: The global push towards electric vehicles (EVs) and renewable energy storage is boosting demand for manganese-rich batteries, particularly in lithium-ion cathodes that use manganese for stability and performance.

- Infrastructure Expansion: Intensifying infrastructure projects in emerging and developed economies alike require significant quantities of high-grade steel, for which manganese is indispensable.

- Supply Chain Regionalization: As countries seek to reduce reliance on single-source suppliers like South Africa and Gabon, Australia’s stable operating and regulatory environment makes it an attractive, secure source of supply.

- Sustainable Practices: The demand for environmentally responsible production is rising, compelling miners to invest in new technologies and ESG (Environmental, Social, Governance) initiatives to meet global standards.

For investors, analysts, and policymakers, these trends underscore why the Australian manganese sector represents a lucrative opportunity—balancing economic growth with technological and environmental progress as we move toward 2026 and beyond.

Sustainability, Technology & Innovation in Manganese Mining

As manganese miners asx and their international peers pivot towards long-term resilience, sustainability and innovation take center stage.

Key Sustainability & Innovation Initiatives

- Green Energy Integration: Utilization of renewable energy sources at mine sites to reduce carbon emissions and energy costs.

- Efficient Water and Waste Management: Advanced water recycling, tailings reduction, and circular economy principles are being adopted to minimize environmental impact.

- Real-Time Environmental Monitoring: Leveraging tools like Farmonaut Carbon Footprinting services, mines can track and manage carbon output, helping ensure compliance with regulatory frameworks and facilitating greener operations.

- AI and Automation: Remote monitoring, predictive maintenance, and autonomous equipment improve safety, lower costs, and boost operational efficiency.

- Blockchain for Traceability: Solutions like Farmonaut Traceability bring secure, transparent mineral tracking from pit to port, strengthening trust with buyers and regulators.

As these sustainable technologies gain momentum, Australian manganese mining companies asx set clear examples of ESG leadership and environmental management, helping ensure that the industry remains future-proof, competitive, and responsible.

“Global manganese demand is forecasted to rise by 19% by 2026, driving innovation among ASX-listed miners.”

Economic and Strategic Importance of Manganese For Australia

The continued development of Australia’s manganese mining sector brings considerable economic and geopolitical advantages.

- Job Creation: Manganese projects drive jobs in remote communities (especially in the Northern Territory and Pilbara region), supporting local economies and regional development.

- Export Revenues: With Australia projected to supply over 22% of global manganese by 2025, the sector’s contribution to national export earnings is expected to remain significant and growing.

- Strategic Autonomy: By building domestic capacity and reliability, Australia helps reduce the world’s dependence on single-source markets, ensuring essential supply chain stability for steel, battery, and infrastructure components.

- Infrastructure Underpinning: Manganese remains the backbone of high-strength steels and alloys used in construction, defense, and transportation infrastructure across Australia and its trading partners.

Comparative Trends Table: ASX Manganese Miners & Assmang

The table below compares leading ASX manganese miners and Assmang manganese, using estimated quantitative data for 2025–2026. This helps visualize sector dynamics and upcoming shifts.

| Company Name | 2025 Est. Production (MT) | Est. Market Share (%) | Innovation/Tech Adoption | Projected Revenue Growth (%) | ESG/Sustainability Initiatives |

|---|---|---|---|---|---|

| Assmang Limited | 3,200,000 | 11.5 | Advanced automated mining, optimized ore processing, environmental monitoring | 5.3 | Comprehensive waste/water management, community investment, renewable energy pilot projects |

| South32 (ASX: S32) | 2,750,000 | 9.7 | Renewable energy, AI-driven mine planning, real-time fleet management | 6.0 | Carbon reduction programs, biodiversity protection, enhanced safety protocols |

| Element 25 (ASX: E25) | 1,400,000 | 4.8 | Low-emission ore processing, battery-grade manganese, digital traceability | 9.0 | Battery supply chain ESG, local workforce training, community ESG reporting |

| OM Holdings Limited (ASX: OMH) | 1,050,000 | 3.7 | Flexible alloy processing, vertical integration, automation in mining | 4.1 | Water recycling, energy efficiency, safety certifications |

This comparative overview underlines how manganese miners asx and Assmang are innovating not only for production growth, but also embracing environmental and social responsibility—critical factors in 2026’s mining value chain.

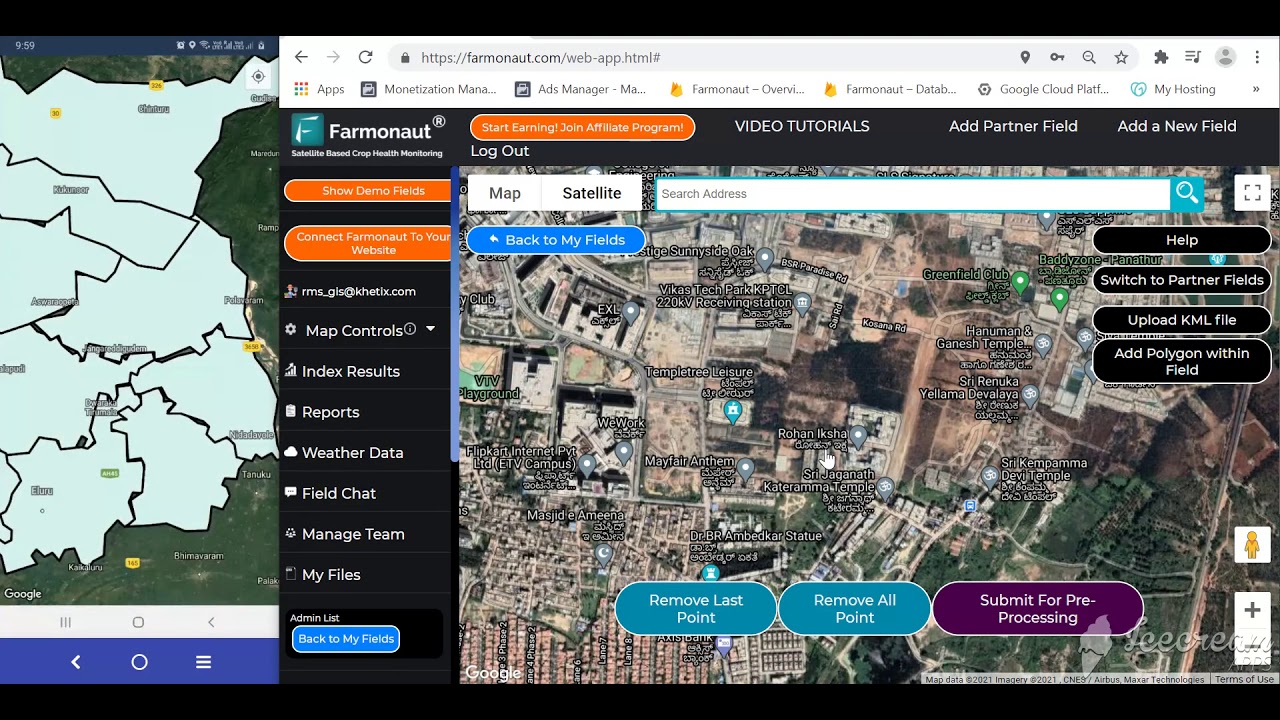

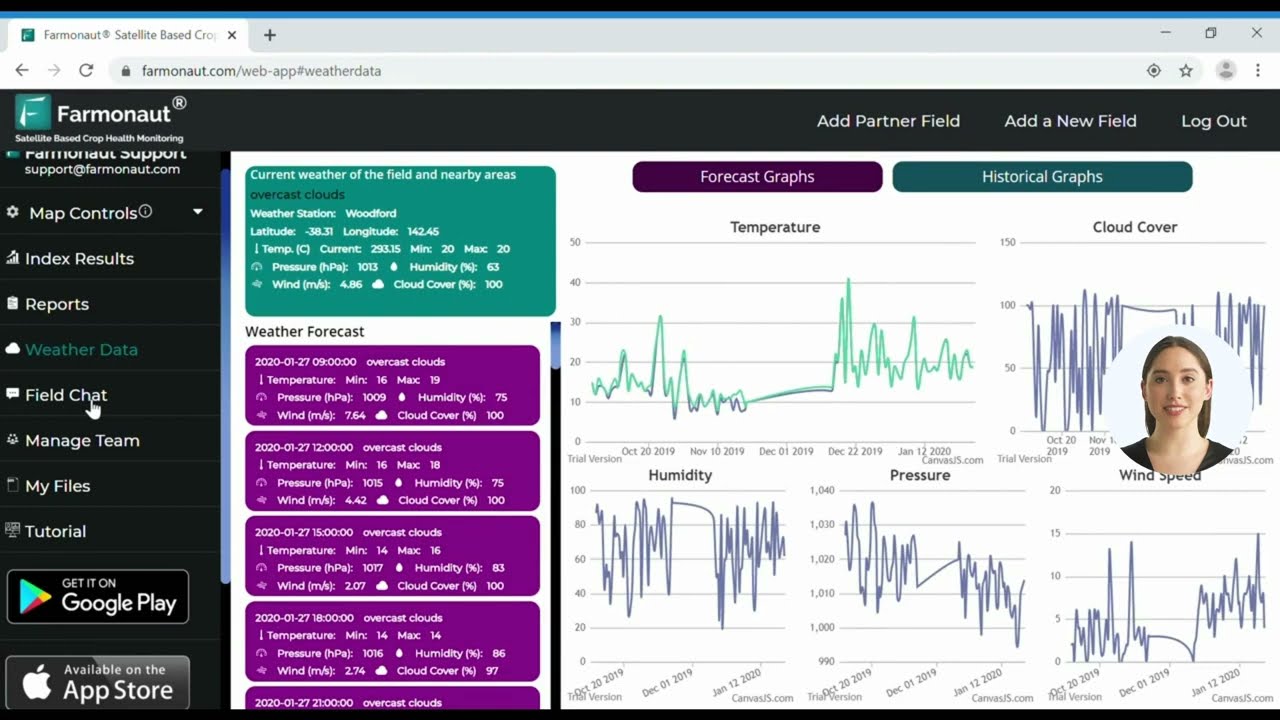

Farmonaut’s Satellite Technology Solutions for Mining & Beyond

We at Farmonaut are advancing the future of mining, agriculture, and infrastructure management through powerful satellite technology, AI-driven analytics, and blockchain-based traceability. Here’s how our platform serves the evolving needs of manganese mining and related sectors:

-

Satellite-Based Resource Monitoring:

Our web and app platforms allow for real-time monitoring of mining, agriculture, and infrastructure resources, supporting informed decisions for operational efficiency, compliance, and planning. -

AI-Driven Decision Tools:

The Jeevn AI Advisory System analyzes satellite data, providing custom insights for crop health, mining site integrity, or infrastructure risk—empowering businesses to boost productivity and prevent losses. -

Environmental Impact & Carbon Tracking:

Farmonaut’s carbon footprinting tool gives mining operators clear, actionable data on emissions, contributing to regulatory compliance and ESG goals. -

Traceability with Blockchain:

Our blockchain-based traceability solutions deliver end-to-end transparency for minerals and agricultural commodities—crucial for global supply chain authentication. -

Fleet & Resource Management:

With satellite-based fleet management tools, mining and infrastructure businesses can optimize vehicle and equipment usage, lower costs, and improve safety at scale. -

APIs for Integration:

Developers and enterprises can leverage Farmonaut APIs and explore our API developer docs to embed satellite and environmental insights directly into their own systems and dashboards. -

Large-Scale Project Oversight:

For expansive operations, our large-scale monitoring solutions integrate all data points (site health, vehicle status, resources) into unified, user-friendly dashboards—boosting operational oversight for mining, agriculture, and infrastructure managers alike. -

Banking & Insurance Support:

With satellite-based verification for crop loans and insurance, we help financial institutions reduce fraud, streamline claims, and support both the agriculture and mining sectors’ access to reliable financing.

Our subscription-based model ensures scalable access for individual miners, large enterprises, and government agencies. Explore Farmonaut’s unique blend of cost-effectiveness, advanced analytics, and ESG enablement to deepen your impact in the 2026 minerals marketplace.

2026 and Beyond: The Future of Manganese Mining in Australia

The next decade for Australian manganese miners asx is defined by bold opportunity, steered by the ongoing example set by Assmang manganese’s global leadership. Here’s what we foresee:

-

Compelling Growth Trajectory:

Intensifying global demand and technological breakthroughs put Australia at the forefront of new supply chains for batteries, steel, and infrastructure projects. -

ESG and Innovation-led Value:

2026 will see sustainability, efficiency, and traceability as core differentiators for successful manganese mining companies asx, firmly aligned with investor and policy priorities. -

Technology Integration:

Digitalization, satellite-based monitoring, AI-powered maintenance, and real-time environmental tracking will become industry norms—the backbone for responsible growth. -

Australia’s Global Leadership:

As manganese production expands and environmental credentials strengthen, Australia will be a pivotal, reliable supplier underpinning the global transition toward green economies and advanced manufacturing.

Whether you’re an investor, operator, policymaker, or sustainability professional, the Australian manganese sector—anchored by lessons from Assmang manganese, and driven by technological and environmental ambition—is set to define essential value chains for 2026 and beyond.

“Australia’s manganese production is expected to contribute over 22% of global supply by 2025, strengthening market influence.”

Frequently Asked Questions

What are the leading manganese mining companies asx in Australia?

The most prominent ASX-listed manganese miners are South32 (ASX: S32), Element 25 (ASX: E25), and OM Holdings Limited (ASX: OMH). These companies are recognized for their robust production, technological innovation, and sustainable mining practices. Additionally, operational models and practices from Assmang manganese set global benchmarks that influence Australian companies.

How do Assmang manganese’s operations impact Australian manganese miners?

While Assmang operates primarily in South Africa, their advanced business practices—such as efficient production, technological adoption, and sustainability measures—serve as a benchmark for ASX miners. Australian miners adopt similar models to remain competitive and responsible as global demand increases.

What are the primary uses of manganese mined by Australian companies?

Manganese mined by ASX-listed companies is critical for steel production, battery technology (including lithium-ion batteries), chemical processes, and strengthening alloys used in infrastructure projects. With the transition to EVs and renewable energy, the demand for high-purity manganese is expanding rapidly.

What sustainability practices are being implemented by manganese mining companies asx?

Key sustainability efforts include the use of renewable energy, comprehensive carbon and water management, community engagement, and the adoption of digital monitoring technologies. Blockchain-based traceability solutions—such as those provided by Farmonaut Traceability—are becoming standard to secure ethical and environmentally responsible supply chains.

How is technology revolutionizing the manganese mining sector?

Advances in satellite technology, AI, automation, and blockchain are revolutionizing mine management, resource optimization, environmental compliance, and supply chain trust. Tools like Farmonaut’s apps provide powerful analytics and real-time monitoring for mineral and agricultural operations.

What is the outlook for the Australian manganese sector in 2026 and beyond?

With global demand set to increase by at least 19% and Australia’s market share expected to exceed 22% by 2025, the outlook is robust. The sector’s future will be shaped by technological innovation, ESG leadership, and strategic autonomy—placing Australia in a powerful position in global manganese supply for industries ranging from steel to battery storage and beyond.

How can mining companies benefit from Farmonaut’s solutions?

Mining operations can leverage Farmonaut’s satellite-based monitoring, AI-driven analytics, traceability, and carbon footprinting tools to improve resource efficiency, comply with ESG standards, secure financing, and maintain competitive advantage. Our platform supports both operational and strategic needs for both small operators and large-scale mining enterprises.