Mastering Farm Cash Flow: 10 Proven Strategies for Financial Success and Sustainable Growth

In today’s dynamic agricultural landscape, mastering farm cash flow is essential for long-term success and sustainability. As farmers, we understand the unique challenges that come with managing finances in an industry subject to unpredictable weather patterns, market fluctuations, and evolving consumer demands. That’s why we’ve compiled this comprehensive guide on farm cash flow management and agricultural financial planning to help you navigate these complexities and achieve financial stability.

“Effective farm cash flow management can increase agricultural profitability by up to 25% through optimized expense tracking and budgeting.”

In this article, we’ll explore ten proven strategies for financial success and sustainable growth in farming. From implementing robust cash flow budgeting techniques to leveraging cutting-edge technologies for farm expense tracking, we’ll cover everything you need to know to optimize your agribusiness cash flow and boost your farm’s profitability.

1. Develop a Comprehensive Cash Flow Budget

The foundation of effective farm cash flow management lies in creating a detailed and accurate cash flow budget. This financial roadmap helps you anticipate income and expenses throughout the year, allowing you to make informed decisions about resource allocation and investment opportunities.

- Start by listing all expected sources of income, including crop sales, livestock revenue, and any off-farm income.

- Detail all anticipated expenses, such as seed costs, fertilizer, equipment maintenance, and labor.

- Break down the budget into monthly or quarterly periods to account for seasonal variations in cash flow.

- Regularly review and update your budget to reflect changing market conditions and farm operations.

By developing a comprehensive cash flow budget, you’ll gain a clearer picture of your farm’s financial health and be better equipped to navigate potential cash flow challenges.

2. Implement Robust Farm Expense Tracking Systems

Accurate and timely expense tracking is crucial for maintaining a healthy cash flow. By implementing robust farm expense tracking systems, you can identify areas where costs can be reduced and make more informed financial decisions.

- Utilize farm management software or apps to record expenses in real-time.

- Categorize expenses to easily identify major cost centers and trends.

- Regularly reconcile expenses with bank statements to ensure accuracy.

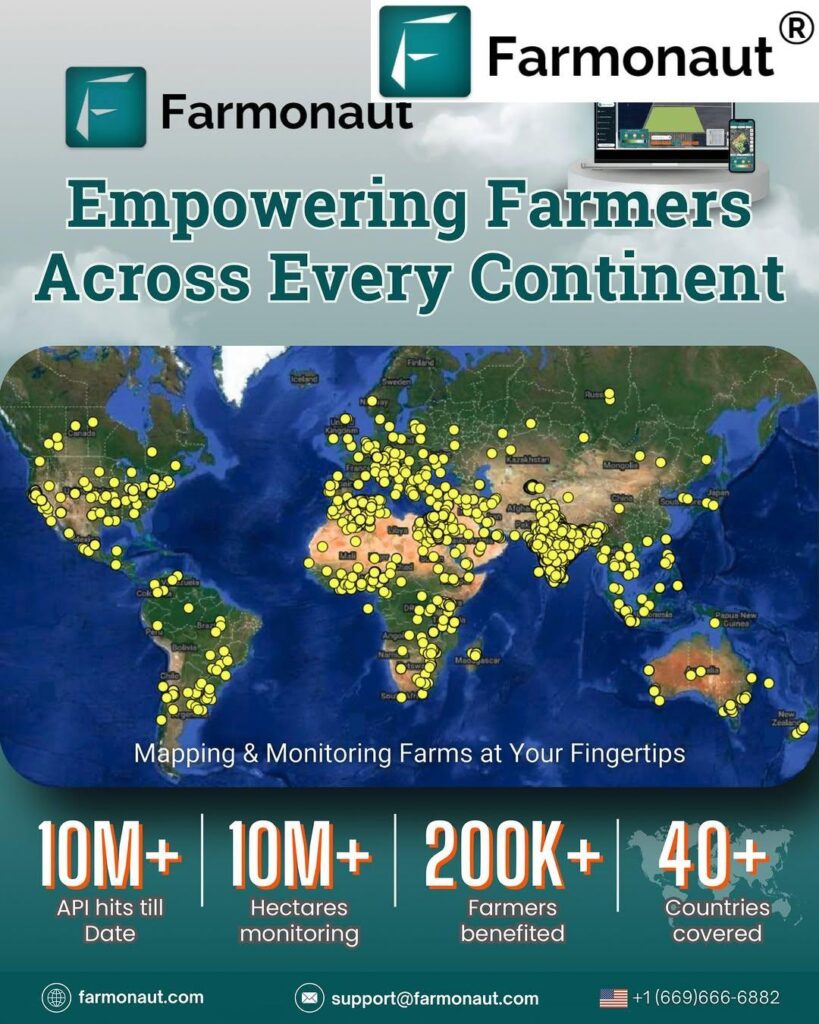

- Consider using digital tools like Farmonaut’s farm management platform to streamline expense tracking and gain valuable insights into your farm’s financial performance.

Effective expense tracking not only helps with cash flow management but also simplifies tax preparation and financial reporting.

3. Optimize Crop Profitability Strategies

Maximizing the profitability of your crops is essential for maintaining a healthy cash flow. This involves careful planning, market analysis, and strategic decision-making throughout the growing season.

- Conduct thorough market research to identify high-demand, high-value crops suitable for your region.

- Implement crop rotation and diversification strategies to mitigate risk and optimize soil health.

- Utilize precision agriculture techniques to improve yields and reduce input costs.

- Consider value-added processing or direct-to-consumer sales to increase profit margins.

By focusing on crop profitability strategies, you can enhance your farm’s income potential and strengthen your overall financial position.

4. Leverage Farm Operating Loans Strategically

Farm operating loans can be a valuable tool for managing cash flow, particularly during periods of low income or unexpected expenses. However, it’s crucial to approach borrowing strategically to avoid overextending your farm’s financial resources.

- Assess your farm’s credit needs carefully and only borrow what is necessary.

- Shop around for the best interest rates and terms from various lenders.

- Consider using operating loans to take advantage of bulk purchasing discounts on inputs.

- Develop a clear repayment plan and factor loan payments into your cash flow budget.

By using farm operating loans judiciously, you can smooth out cash flow fluctuations and invest in growth opportunities while maintaining financial stability.

5. Implement Effective Agricultural Income Forecasting

Accurate income forecasting is essential for proactive cash flow management. By developing reliable projections of your farm’s future income, you can better plan for expenses, investments, and potential financial challenges.

- Analyze historical sales data and market trends to inform your income projections.

- Consider factors such as weather patterns, market volatility, and policy changes that may impact future income.

- Use scenario planning to prepare for best-case, worst-case, and most likely income scenarios.

- Regularly update your income forecasts as new information becomes available.

Effective agricultural income forecasting allows you to make more informed decisions about resource allocation and helps you maintain a positive cash flow throughout the year.

6. Utilize Farm Financial Health Indicators

Monitoring key financial health indicators is crucial for assessing your farm’s overall financial performance and identifying potential cash flow issues before they become critical.

- Track liquidity ratios such as the current ratio and working capital to gauge your ability to meet short-term obligations.

- Monitor solvency ratios like the debt-to-asset ratio to assess your farm’s long-term financial stability.

- Calculate profitability metrics such as return on assets (ROA) and operating profit margin to evaluate your farm’s financial efficiency.

- Use financial management tools or consult with an agricultural financial advisor to interpret these indicators and develop improvement strategies.

By regularly assessing these financial health indicators, you can make data-driven decisions to optimize your farm’s cash flow and overall financial performance.

“Farmers who implement comprehensive cash flow strategies are 40% more likely to secure favorable farm operating loans.”

7. Implement Sustainable Farm Financing Practices

Adopting sustainable farm financing practices is essential for long-term financial stability and growth. These practices help you balance short-term cash flow needs with long-term financial goals.

- Develop a mix of financing options, including equity, debt, and leasing arrangements, to optimize your capital structure.

- Consider alternative financing sources such as crowdfunding or community-supported agriculture (CSA) models.

- Implement risk management strategies, including crop insurance and forward contracts, to protect against financial volatility.

- Invest in sustainable farming practices that can lead to long-term cost savings and improved profitability.

By implementing sustainable farm financing practices, you can build a more resilient financial foundation for your agricultural business.

8. Optimize Agribusiness Cash Flow Through Smart Marketing

Strategic marketing can significantly impact your farm’s cash flow by ensuring steady income streams and maximizing the value of your agricultural products.

- Develop a diversified marketing plan that includes both traditional and direct-to-consumer sales channels.

- Consider value-added products or services to increase profit margins and attract new customers.

- Utilize social media and digital marketing strategies to reach a broader audience and build brand loyalty.

- Explore contract farming or long-term supply agreements to secure more predictable income streams.

By optimizing your marketing strategies, you can enhance your farm’s cash flow and build a stronger, more sustainable agribusiness.

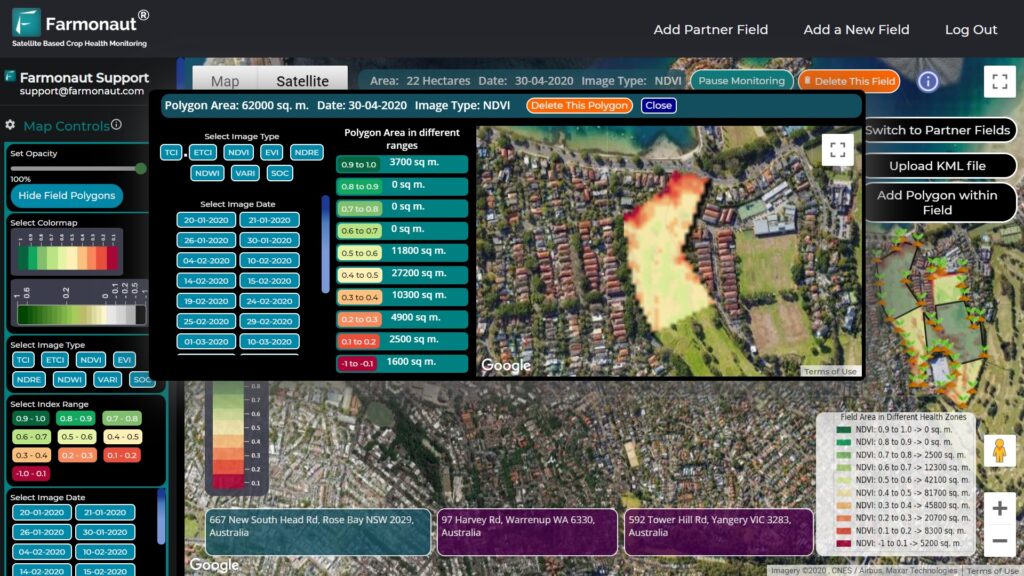

9. Leverage Technology for Improved Farm Budget Analysis

In today’s digital age, leveraging technology can significantly enhance your farm budget analysis and cash flow management capabilities.

- Utilize farm management software to automate data collection and analysis.

- Implement precision agriculture technologies to optimize resource allocation and reduce costs.

- Use data analytics tools to identify trends and opportunities for improving cash flow.

- Consider integrating satellite-based monitoring solutions like Farmonaut to gain valuable insights into crop health and potential yield, which can inform your financial planning.

By embracing technology, you can gain deeper insights into your farm’s financial performance and make more informed decisions to optimize cash flow.

10. Implement Regular Farm Financial Reviews

Conducting regular financial reviews is crucial for maintaining a healthy cash flow and ensuring your farm’s long-term financial success.

- Schedule monthly or quarterly financial review sessions to assess your farm’s performance against budgeted expectations.

- Analyze variances between actual and projected cash flows to identify areas for improvement.

- Review and update your financial goals and strategies based on changing market conditions and farm performance.

- Consider working with an agricultural financial advisor to gain expert insights and recommendations.

By implementing regular financial reviews, you can stay proactive in managing your farm’s cash flow and make timely adjustments to your financial strategies.

| Strategy Name | Implementation Difficulty | Short-term Impact | Long-term Impact | Initial Investment Required ($) | Estimated Annual Savings/Profit Increase (%) | Best Suited For |

|---|---|---|---|---|---|---|

| Comprehensive Cash Flow Budget | Moderate | Medium | High | 500-1,000 | 10-15% | All farm sizes |

| Robust Expense Tracking Systems | Easy | High | High | 200-500 | 5-10% | Small to medium farms |

| Crop Profitability Strategies | Difficult | Low | High | 1,000-5,000 | 15-20% | Medium to large farms |

| Strategic Use of Operating Loans | Moderate | High | Medium | Varies | 5-10% | All farm sizes |

| Agricultural Income Forecasting | Moderate | Medium | High | 500-2,000 | 8-12% | Medium to large farms |

| Farm Financial Health Indicators | Easy | Medium | High | 100-500 | 3-7% | All farm sizes |

| Sustainable Farm Financing | Difficult | Low | High | 1,000-10,000 | 10-20% | Medium to large farms |

| Smart Marketing for Cash Flow | Moderate | Medium | High | 1,000-5,000 | 10-15% | All farm sizes |

| Technology for Budget Analysis | Moderate | Medium | High | 1,000-5,000 | 8-12% | Medium to large farms |

| Regular Financial Reviews | Easy | Medium | High | 200-1,000 | 5-10% | All farm sizes |

Conclusion

Mastering farm cash flow is a critical component of achieving financial success and sustainable growth in agriculture. By implementing these ten proven strategies, you can enhance your farm’s financial resilience, optimize resource allocation, and make more informed decisions about your agricultural operations.

Remember that effective cash flow management is an ongoing process that requires regular attention and adaptation. Stay informed about market trends, leverage technology to gain valuable insights, and don’t hesitate to seek expert advice when needed. With dedication and the right strategies in place, you can navigate the financial challenges of farming and build a thriving, sustainable agricultural business.

To further enhance your farm management capabilities, consider exploring advanced technologies like Farmonaut’s satellite-based monitoring solutions. These tools can provide valuable data on crop health and potential yields, helping you make more accurate financial projections and optimize your farm’s performance.

FAQs

- What is the difference between a cash flow budget and a cash flow statement?

A cash flow budget is a forward-looking projection of expected cash inflows and outflows, while a cash flow statement records actual cash movements that have already occurred. - How often should I review my farm’s cash flow?

It’s recommended to review your cash flow at least monthly, with more frequent reviews during critical periods such as planting or harvesting seasons. - What are some common cash flow challenges faced by farmers?

Common challenges include seasonal income fluctuations, unexpected expenses, delayed payments from buyers, and market price volatility. - How can technology help improve farm cash flow management?

Technology can automate data collection, provide real-time insights, streamline expense tracking, and offer advanced analytics for better decision-making. - What role does crop insurance play in cash flow management?

Crop insurance helps mitigate financial risks associated with crop losses due to weather or other factors, providing a safety net for your farm’s cash flow.

By implementing these strategies and staying informed about the latest developments in agricultural finance, you can build a strong foundation for your farm’s financial success. Remember, effective cash flow management is key to navigating the challenges and opportunities in modern agriculture.

Explore Farmonaut’s farm management solutions to take your agricultural financial planning to the next level:

For developers interested in integrating agricultural data into their own applications, check out Farmonaut’s API and API Developer Docs.