Revolutionizing Agricultural Risk Management: How Farmonaut’s Solutions Boost Financial Resilience for Farmers

“A major property and casualty insurance provider reported significant growth in gross written premiums despite catastrophe losses.”

In the ever-evolving landscape of agriculture and insurance, recent industry developments highlight significant shifts in financial risk management strategies. As we navigate through these changes, it’s crucial to understand how innovative solutions, such as those offered by Farmonaut, are reshaping the agricultural sector’s approach to risk and financial resilience.

The Changing Face of Agricultural Insurance

The agricultural sector has long been at the mercy of unpredictable factors such as weather patterns, pest infestations, and market fluctuations. Traditional insurance models have struggled to keep pace with these challenges, often leaving farmers vulnerable to significant financial losses. However, the emergence of technology-driven solutions is transforming the landscape of agricultural risk management.

A recent industry report showcases impressive growth in gross written premiums and a strong adjusted combined ratio for a major player in property and casualty insurance solutions, despite the impact of catastrophe losses. This development underscores the resilience and adaptability of the insurance sector in the face of evolving risks.

Farmonaut: Pioneering Advanced Farm Management Solutions

At the forefront of this agricultural revolution is Farmonaut, a company dedicated to making precision agriculture affordable and accessible to farmers worldwide. By integrating innovative technology and data-driven insights into traditional farming practices, Farmonaut is reshaping how farmers approach risk management and financial planning.

Key Technologies Offered by Farmonaut:

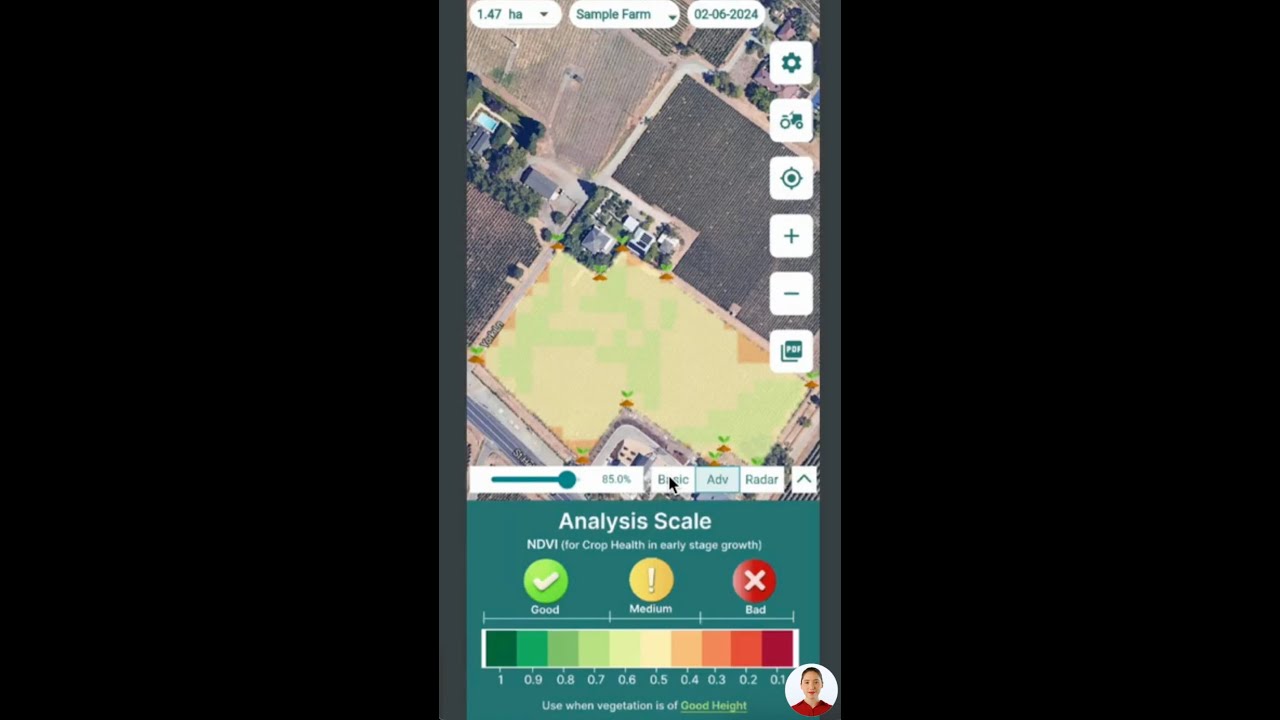

- Satellite-Based Crop Health Monitoring

- Jeevn AI Advisory System

- Blockchain-Based Product Traceability

- Fleet and Resource Management

- Carbon Footprinting

These advanced tools provide farmers with real-time insights, enabling them to make informed decisions that can significantly reduce their exposure to financial risks.

The Impact of Innovative Underwriting Practices

The insurance industry’s market dynamics are reflected in strategic moves such as the commutation of insurance loss portfolio transfers. These actions aim to mitigate future credit risks and strengthen the overall financial position of insurance providers. With a focus on reinsurance in agriculture and innovative underwriting practices, the sector anticipates continued growth and profitability.

“Strategic reinsurance in agriculture and innovative underwriting practices are driving continued growth and profitability in the insurance sector.”

Farmonaut’s solutions play a crucial role in this new paradigm. By providing accurate, real-time data on crop health, soil conditions, and weather patterns, Farmonaut enables insurance companies to develop more precise and fair underwriting models. This leads to better risk assessment and potentially lower premiums for farmers who adopt these technologies.

Financial Resilience Through Technology

The integration of Farmonaut’s technologies into agricultural practices offers a pathway to enhanced financial resilience for farmers. Here’s how:

- Improved Crop Yield Predictions: Accurate forecasting allows for better financial planning and risk management.

- Efficient Resource Allocation: Real-time data helps optimize the use of water, fertilizers, and pesticides, reducing unnecessary expenses.

- Early Warning Systems: Detection of potential issues before they escalate can save crops and prevent financial losses.

- Data-Driven Decision Making: Access to comprehensive analytics empowers farmers to make informed financial decisions.

By leveraging these technologies, farmers can significantly reduce their vulnerability to financial shocks and improve their overall economic stability.

Comparing Traditional and Innovative Risk Management Approaches

| Financial Metric | Traditional Approach | Farmonaut’s Solution |

|---|---|---|

| Gross Written Premiums | Moderate growth | Potential for higher growth due to precise risk assessment |

| Adjusted Combined Ratio | Higher due to less precise risk assessment | Potentially lower, benefiting from data-driven insights |

| Catastrophe Loss Impact | Higher vulnerability (e.g., 5-7% impact) | Reduced impact (e.g., 2-3% impact) through early warning systems |

| Future Credit Risk Mitigation | Limited by traditional assessment methods | Enhanced through real-time monitoring and predictive analytics |

This comparison illustrates the potential benefits of adopting Farmonaut’s innovative solutions in agricultural risk management. The data-driven approach offered by Farmonaut can lead to more accurate risk assessments, potentially resulting in lower premiums for farmers and reduced loss ratios for insurers.

The Role of Non-GAAP Financial Measures

In understanding the financial landscape of agricultural insurance, it’s important to consider non-GAAP financial measures. These metrics, such as adjusted operating income and adjusted combined ratios, provide valuable insights into a company’s performance by excluding certain one-time or non-recurring items.

For farmers and agricultural businesses, understanding these measures can help in making more informed decisions about insurance coverage and financial planning. Farmonaut’s data analytics capabilities can assist in interpreting these complex financial metrics, enabling farmers to better understand their risk profile and make more informed insurance decisions.

Global Agricultural Insurance Trends

The agricultural insurance market is experiencing significant changes on a global scale. Key trends include:

- Increased adoption of index-based insurance products

- Growing interest in parametric insurance solutions

- Rising demand for crop insurance in developing countries

- Integration of climate risk models into insurance products

Farmonaut’s technologies are well-positioned to support these trends. For instance, the company’s satellite-based crop health monitoring can provide valuable data for index-based insurance products, while its AI-driven advisory system can help farmers adapt to changing climate conditions, potentially reducing their risk profile.

Balancing Risk and Reward in Agriculture

The agricultural sector has always been a delicate balance between risk and reward. Farmers face numerous challenges, from unpredictable weather patterns to fluctuating market prices. However, with the advent of technologies like those offered by Farmonaut, the scales are tipping in favor of farmers.

By providing real-time data and predictive analytics, Farmonaut empowers farmers to make more informed decisions about planting, harvesting, and resource allocation. This not only helps mitigate risks but also maximizes potential rewards by optimizing crop yields and reducing waste.

The Future of Agricultural Risk Management

As we look to the future, it’s clear that technology will play an increasingly important role in agricultural risk management. Farmonaut’s innovative solutions are at the forefront of this revolution, offering farmers the tools they need to navigate an uncertain future with confidence.

Key areas of development include:

- Artificial Intelligence and Machine Learning: Enhanced predictive capabilities for crop yields and pest outbreaks.

- Blockchain Technology: Improved traceability and transparency in agricultural supply chains.

- Internet of Things (IoT): Real-time monitoring of soil conditions, weather, and crop health.

- Big Data Analytics: More accurate risk assessments and personalized insurance products.

Farmonaut is continually evolving its offerings to stay ahead of these trends, ensuring that farmers have access to the most advanced risk management tools available.

Implications for Agricultural Businesses

The industry-wide changes in agricultural risk management have significant implications for businesses across the agricultural value chain. From small family farms to large agribusinesses, the adoption of innovative technologies and risk management strategies is becoming increasingly crucial for long-term success.

Farmonaut’s solutions offer benefits to various stakeholders in the agricultural sector:

- Individual Farmers: Access to precision farming techniques, improved decision-making, and potentially lower insurance premiums.

- Agribusinesses: Enhanced fleet management, resource optimization, and supply chain transparency.

- Financial Institutions: More accurate risk assessments for agricultural loans and insurance products.

- Government Agencies: Improved monitoring of agricultural productivity and more effective policy implementation.

By leveraging Farmonaut’s technologies, businesses can improve their operational efficiency, reduce risks, and potentially increase profitability.

Accessing Farmonaut’s Solutions

Farmonaut offers multiple ways for farmers and agricultural businesses to access its innovative solutions:

For developers and businesses looking to integrate Farmonaut’s data into their own systems, the company offers a comprehensive API. Detailed documentation for the API can be found in the API Developer Docs.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn more about the Affiliate Program

Farmonaut Subscriptions

Conclusion

The agricultural sector is undergoing a significant transformation in how it approaches risk management and financial planning. Innovative solutions like those offered by Farmonaut are at the forefront of this change, providing farmers and agricultural businesses with the tools they need to navigate an increasingly complex and unpredictable landscape.

By leveraging advanced technologies such as satellite imaging, AI, and blockchain, Farmonaut is helping to create a more resilient and financially stable agricultural sector. As we move forward, the integration of these technologies into traditional farming practices will be crucial for ensuring food security, improving farmer livelihoods, and creating a more sustainable agricultural industry.

The future of agricultural risk management is here, and it’s digital, data-driven, and more precise than ever before. With companies like Farmonaut leading the way, farmers and agricultural businesses have never been better equipped to face the challenges of tomorrow while maximizing their potential for success today.

FAQ Section

- How does Farmonaut’s technology improve agricultural risk management?

Farmonaut uses satellite imagery, AI, and data analytics to provide real-time insights on crop health, weather patterns, and soil conditions. This information helps farmers make informed decisions, reducing risks associated with crop failure and resource mismanagement. - Can Farmonaut’s solutions help reduce insurance premiums for farmers?

While Farmonaut doesn’t directly set insurance premiums, the data and insights provided by its technology can potentially lead to more accurate risk assessments. This could result in lower premiums for farmers who demonstrate effective risk management practices. - How does blockchain technology contribute to agricultural risk management?

Farmonaut’s blockchain-based traceability solution enhances transparency in the agricultural supply chain. This can help mitigate risks associated with fraud, contamination, and supply chain disruptions. - Is Farmonaut’s technology accessible to small-scale farmers?

Yes, Farmonaut aims to make precision agriculture affordable and accessible to farmers of all scales. Their solutions are designed to be user-friendly and can be accessed through mobile apps and web interfaces. - How does Farmonaut’s carbon footprinting feature benefit farmers?

The carbon footprinting feature helps farmers monitor and reduce their environmental impact. This can lead to more sustainable farming practices and potentially open up new revenue streams through carbon credit programs.