Table of Contents

- Introduction: Empowering Sustainable Agriculture through Loan Programs

- Key Trivia: Sustainable Impact in Nigeria

- The Global Significance of Agricultural Loan Programs in 2025

- Agriculture Loan Programs Oklahoma: Local Focus with National Impact

- Agricultural Extension Programs in Nigeria: Bridging Knowledge and Finance

- Sustainable Agricultural Loan Programs: Innovations & Value Guarantee Models

- Agriculture Land Loan Schemes: Unlocking Arable Potential

- Comparison Table: Sustainable Agricultural Loan Programs in Nigeria (2025)

- Farmonaut: Advanced Tech for Productivity & Sustainable Finance

- Farmonaut App, API, and Key Solutions (Links)

- Video Resources

- Farmonaut Subscription Plans

- Frequently Asked Questions (FAQ)

- Conclusion

Agricultural Loan Programs: Best Agriculture Land Loans 2025

Agriculture remains the backbone of many economies worldwide, providing food security, employment, and raw materials. However, one persistent challenge farmers face is access to affordable and suitable financial resources to invest in modern practices, equipment, and land. Agricultural loan programs play a pivotal role in addressing these challenges by offering targeted financial support to farmers and agribusinesses.

In 2025 and beyond, agricultural loan programs have evolved to be more inclusive, technology-driven, and tailored to regional needs, ensuring that farmers can maximize productivity while maintaining sustainability.

The Global Significance of Agricultural Loan Programs in 2025

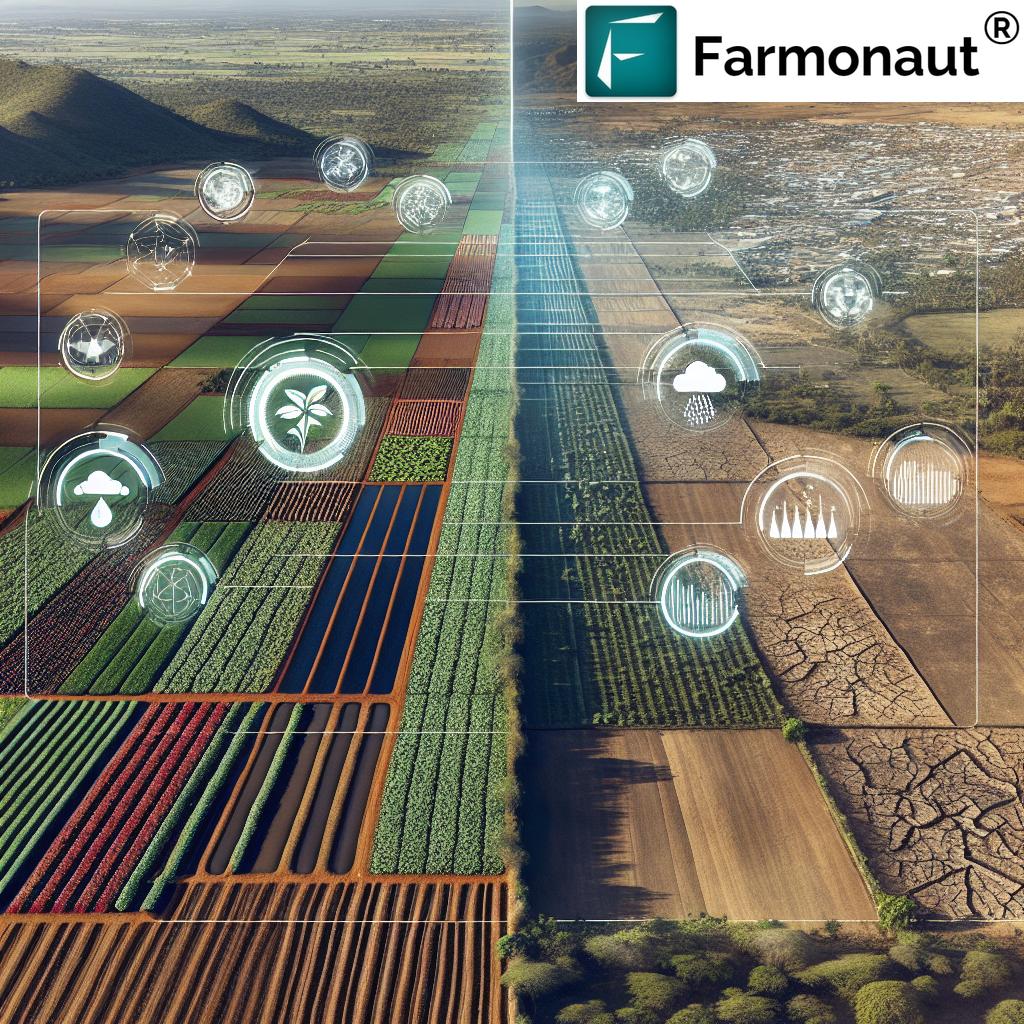

Agricultural loan programs are not just financial products—they are integral to empowering farmers, fostering economic growth, and ensuring food security. With the growing need for sustainable farming and climate resilience in 2025, these programs are designed to address regional and environmental challenges while providing a vital link to credit, technology, and knowledge.

- Sustainability stands at the forefront—with policies encouraging eco-friendly practices and conservation of soil, water, and arable land.

- Technological advancements (like satellite monitoring and AI-driven advisory) integrated into loan processes maximize productivity and minimize risks.

- Inclusive programs now support youth, women, and previously underserved farmers, fostering diversified agricultural communities.

Worldwide, financial institutions, government agencies, and innovative dealers are uniting around a shared goal: empowering farmers for sustainable growth.

Agriculture Loan Programs Oklahoma: Local Focus with National Impact

In the United States, states like Oklahoma exemplify the power of regionally tailored agricultural loan programs. Agriculture loan programs oklahoma are often supported by the USDA, state authorities, and local agencies. These initiatives help both small and large-scale farmers acquire land, machinery, and essential inputs such as seeds and fertilizers. The terms are generally favorable to accommodate the seasonal nature of farming.

Key Benefits of Agriculture Loan Programs Oklahoma

- Low-interest rates and extended repayment periods make finance accessible and reduce pressure on farmers.

- Youth and beginning farmer loan programs promote new entrants to farming, addressing succession and long-term sustainability.

- Diversification of crops and sustainable methods are incentivized, reflecting broader environmental objectives.

- Integrated technical support ensures effective utilization of funds and capacity-building for farmers.

Agriculture loan programs oklahoma are evolving to offer more inclusive and technology-driven solutions for farmers—mirroring trends seen across the United States and globally.

Agricultural Extension Programs in Nigeria: Bridging Knowledge and Finance

Agricultural extension programs in Nigeria have gained prominence as a vital complement to loan schemes. These programs focus on educating farmers about modern techniques, pest control, soil management, and climate-smart agriculture. Integrating extension services with agricultural loan programs ensures that farmers not only receive capital but also practical know-how to utilize funds effectively.

Core Features of Nigerian Extension-Linked Loan Schemes

- Collaborative projects between government agencies and program operators lead to extension-linked loan schemes.

- Loan disbursement is tied to crop-specific benchmarks or adoption of sustainable methods, enhancing accountability and reducing defaults.

- Farmers benefit from on-the-ground training, technical support, and access to high-yielding seeds and inputs.

- Extension services provide ongoing monitoring for soil health, pest management, and conservation practices.

The result? Notable increases in yield and improved overall productivity in staple crops like cassava, maize, and rice—vital for food security in Nigeria.

Sustainable Agricultural Loan Programs: Innovations & ‘Best Value’ Guarantee Models

A major development in agricultural loan programs is the emergence of innovative financial products catering to farmers’ dynamic needs, especially in high-growth regions. One standout is the best value agricultural dealers with yield guarantee programs—offerings that combine input provision and equipment sales on credit, with a yield guarantee model.

How the ‘Best Value’ Yield Guarantee Model Works

- Dealers provide critical equipment or quality inputs like seeds and fertilizers to farmers via a credit facility.

- Farmers’ repayment terms are linked to achieved yield thresholds—if the expected yield isn’t met, compensation or repayment flexibility applies.

- Ongoing support means dealers are incentivized to ensure farmers use best practices and optimal soil management.

- Risk mitigation: This model reduces the financial burden on farmers, especially during volatile seasons or market shocks.

Such development programs are best suited to empowering farmers who are innovating or scaling, as the added guarantee offers a safety net supporting the adoption of new methods. Importantly, these schemes also align the interests of both best value dealers and farmers for consistent, improved productivity.

Globally, institutions are now working side-by-side with dealers and environmental agencies to create innovative agricultural loan programs that encourage sustainable development—from resource-efficient processing facilities to climate-adaptive input packages.

Agriculture Land Loan Schemes: Unlocking the Potential of Arable Land

Agriculture land loan programs are vital for unlocking the potential of arable land worldwide. Access to suitable plots remains a critical barrier for many farmers and agribusinesses, particularly in rapidly developing regions or among youth and new entrants.

Key Features of Modern Agriculture Land Loan Programs (2025)

- Targeted finance: Farmers and agribusinesses can access capital specifically earmarked to acquire or lease land with clear terms and favorable rates.

- Sustainability link: Most agriculture land loan programs now integrate conditions on sustainable land management, promoting soil conservation, reforestation, and climate resilience.

- Environmental assessments: Financial institutions are collaborating with environmental agencies to conduct land quality checks before approving loans, aligning expansion with conservation goals.

- Maximized productivity: By unlocking underutilized land, these programs drive increased crop output and profitability, especially for strategic food security crops.

Access to agriculture land loan schemes, when coupled with extension support, enables farmers to invest in land rehabilitation and sustainable intensification. This is especially important in Nigeria, where land under-use and degradation has previously limited farm productivity.

Comparison Table: Sustainable Agricultural Loan Programs in Nigeria (2025)

Below is a structured comparison of major agricultural loan programs in Nigeria, accentuating their features and implications for sustainability and yield growth in 2025.

| Loan Program Name | Main Features | Eligibility Criteria | Sustainable Practices Supported | Est. Interest Rate (%) | Extension Services Offered | Yield Impact (% Increase) | Environmental Benefits |

|---|---|---|---|---|---|---|---|

| Nigerian Agricultural Credit Guarantee Scheme | Loans up to ₦10 million, flexible repayment up to 5 years | Registered farmers & cooperatives, land title preferred | Integrated pest management, crop rotation, soil conservation | 9%–12% | Yes—training and monitoring | 10%–16% | Promotes biodiversity, improves soil health |

| GreenAgro Initiative | Green input finance, mechanization support | Youth/first-time farmers, eco-certified farmers | Organic inputs, rainwater harvesting, afforestation | 7%–10% | Yes—demo farms, ongoing analytics | 14%–18% | Reduces chemical runoff, supports water conservation |

| Eco-Farmers Extension Fund | Input loans, rapid response funds, digital support | Smallholders, gender-inclusive groups | Climate-smart irrigation, reforestation, integrated farming | 8%–11% | Comprehensive—field visits, advisory, digital | 15%–21% | Mitigates land degradation, lowers emissions |

Farmonaut: Advanced Tech for Productivity & Sustainable Finance

At Farmonaut, we believe that advanced technology is a core enabler of agricultural loan programs success in 2025. Our satellite-based solutions are designed to empower farmers, financial institutions, and agencies with actionable insights:

-

Satellite-based monitoring: We offer real-time, multispectral crop monitoring for enhanced decision-making and risk assessment—vital for agricultural loan verification and supporting insurance processes.

Learn more about our crop loan and insurance support solutions - Jeevn AI Advisory System: Our AI-driven tool delivers personalized strategies for farmers, offering guidance on soil management, weather, and best practices that fit loan program requirements.

-

Blockchain-based traceability: We help build trust in agricultural supply chains and minimize fraud for lenders.

Read about Farmonaut’s blockchain traceability solutions -

Fleet and resource management: Optimize agricultural logistics for efficient movement of machinery and inputs—saving costs and maximizing loan value.

Explore our fleet management platform -

Environmental impact tracking: Track your farm’s carbon emissions and ecological impact—necessary for many sustainable finance programs.

Access Farmonaut’s carbon footprint analysis -

Large scale farm management: Use our platform for comprehensive field mapping, real-time progress reporting, and resource guidance.

See how large farms benefit

By supporting financial institutions and governments with advanced tech, we make sustainable agricultural loan programs transparent, accessible, and risk-mitigated in 2025—and far into the future.

Farmonaut App, API, and Key Solutions

-

Farmonaut API for Satellite Crop and Weather Data:

Integrate our satellite-based insights for streamlined loan monitoring, crop mapping, and digital agricultural records. -

Developer Docs for Farmonaut API:

Detailed guides for creating custom agri-tech and fin-tech solutions on Farmonaut’s ecosystem. -

Admin Tools for Large-Scale Farm Management:

Optimize resources, generate lending reports, and meet modern loan scheme traceability requirements.

Video Resources

Farmonaut Subscription Plans

To help farmers, agribusinesses, and institutions leverage the latest satellite technologies for sustainable loan programs and productivity maximization, we provide flexible pricing and subscription options:

Frequently Asked Questions (FAQ) – Agricultural Loan Programs 2025

What are the main types of agricultural loan programs in 2025?

The main types include input loans (for seeds, fertilizers), equipment financing (tractors, irrigation), agriculture land loans (purchase/lease of land), and comprehensive credit plus extension packages. Many include sustainability and environmental criteria.

How do agriculture loan programs in Oklahoma differ from other states?

Oklahoma’s programs are tailored to its unique crop, livestock, and climate profile. They offer longer repayment periods, special youth/beginning farmer programs, and actively promote sustainable diversification and modern techniques.

How do extension programs in Nigeria benefit agricultural loan recipients?

Agricultural extension programs in Nigeria bridge finance and knowledge. They train farmers on climate-smart techniques, pest control, soil management, and help integrate these into loan requirements, ensuring effective use of resources.

What is a “yield guarantee” program?

Best value agricultural dealers with yield guarantee programs provide inputs/equipment on credit. If yield targets aren’t met due to specified risks, terms allow for compensation or repayment flexibility, reducing financial risk for farmers.

Why are sustainability conditions attached to modern agriculture land loans?

Sustainability criteria ensure that expansion does not come at the cost of soil, water, or ecosystem health. Loan conditions may require farmers to use conservation agriculture, afforestation, or soil health preservation methods.

Can technology such as Farmonaut help with agricultural loan programs?

Yes, Farmonaut’s satellite-based monitoring, AI advisory, and resource management tools streamline verification, reporting, and impact tracking for both financial institutions and farmers—improving transparency, sustainability, and access to finance.

How can I get started with Farmonaut solutions?

Visit our app via this link or download our Android/iOS apps to explore real-time monitoring, advisory, and sustainability support for your farming and finance needs.

Conclusion: Agricultural Loan Programs – A Foundation for Resilient, Sustainable Growth

Agricultural loan programs in 2025 are more than mere sources of credit. They serve as integrated support systems merging finance, technology, education, and sustainability principles, empowering farmers to overcome challenges, maximize yields, and adopt modern, eco-friendly methods.

Whether through agriculture loan programs oklahoma in the United States, agricultural extension programs in Nigeria, or globally via the rise of best value agricultural dealers with yield guarantee programs, the future of agriculture land loan finance is sustainable, inclusive, and deeply intertwined with technological innovation.

As farmers face the realities of climate change, resource constraints, and market uncertainties, a well-structured agricultural loan program remains a lifeline—one that requires collaboration among governments, financial institutions, agencies, and technology providers. At Farmonaut, we are committed to supporting this transformative journey—driving efficiency, transparency, and sustainability for farming communities worldwide.

Ready to supercharge your farm’s productivity or streamline your loan program?

Visit our app, explore our APIs, and discover satellite-driven solutions for a sustainable agricultural future.

Agricultural Loan Programs: Empowering Farmers for Sustainable Growth in 2025 and Beyond.