Lentil Market 2024: Shocking Trends & Top Producers!

Overview: Lentil Market in 2024

As we dive into 2024, the global lentil market stands at an inflection point, experiencing dynamic change driven by shifts in production trends, trade dynamics, evolving consumer preferences, and a rising emphasis on sustainable agriculture. Lentils, Lens culinaris, are small, lens-shaped legumes rich in protein, fiber, and nutrients—streamlining their journey from ancient diets to the modern-day plant-based protein market.

In this comprehensive guide, we uncover the latest data, analyze key trends, and explore how innovations are shaping the trajectory of lentil production, consumption, and trade. We also illuminate critical challenges and the increasingly vital role of technology—such as Farmonaut’s satellite-driven solutions—in building a more resilient and sustainable future for lentil agriculture.

Let us take you on this journey through the lentil market 2024: from the heartlands of India’s Madhya Pradesh and Canada’s prairies to emerging markets of Asia and Africa, we unlock the secrets behind shocking trends and highlight the world’s top producers!

The Global Lentil Market: An In-Depth Overview

The global lentil market has witnessed remarkable growth over the last decade, with total production reaching approximately 6.7 million tonnes in 2022. Lentils—one of the oldest staple foods known to human civilization—continue to underpin nutrition and food security for millions, while driving socioeconomic development in crucial producer and importing countries.

- Canada consistently ranks as the world’s largest producer and exporter of lentils.

- India is not just a key producer, but by far the largest consumer of lentils, with deep-rooted consumption patterns and traditional culinary uses.

- Australia, Russia, Turkey, USA, and Bangladesh are increasingly shaping the supply and demand balance on a global scale.

Driving market dynamism in 2024 are factors such as plant-based protein trends, shifting dietary behaviors, climate influences, technological innovations, and evolving trade relationships.

Lentil Production Trends: Leading Producers & Output

It is crucial to grasp the latest lentil production trends when analyzing the future outlook of the lentil market. In 2022, Canada led the pack with an estimated 2.2 million tonnes of lentils—a staggering 34% of the world market (source).

India followed closely, with major contributions from the states of Madhya Pradesh and Uttar Pradesh. Together, they account for roughly 70% of India’s national lentil output. This concentrated production underpins food security for millions and reinforces India’s pivotal role in driving both consumption and global market stability.

Other significant players:

- Australia: Rapidly growing as a major exporter and innovator in sustainable farming.

- Russia: Emerging strongly with boosted exports in 2024, especially toward South Asian markets.

- Turkey, USA, and Kazakhstan: Steady or increasing contributions with year-on-year changes influenced by local climate & market demands.

Why Do These Producers Stand Out?

- Agro-climatic suitability: Countries and states with favorable temperature, rainfall, and soil conditions naturally achieve higher yields and quality.

- Technological adoption: Use of satellite monitoring, AI-based advisory, and sustainable practices like those supported by Farmonaut drive output and resource efficiency.

- Export infrastructure: Canada and Australia’s strong logistics and trade agreements enable them to be reliable exporters even when conditions fluctuate.

Production Volume and Growth (2024 Highlights)

The emphasis on modern irrigation, pest and disease management, along with improved seed varieties, is steadily increasing yields and driving year-on-year growth in several countries.

Lentil Consumption Patterns: India, Asia & Beyond

Lentil consumption patterns are globally diverse, but one region stands head and shoulders above the rest: India. In 2024, India accounted for around 35% of total global lentil consumption, ingesting approximately 2.6 million tonnes (Indexbox).

- India: Lentils remain not only a staple in everyday meals but an essential source of protein and nutrients, especially for vegetarian and vegan populations. States like Madhya Pradesh and Uttar Pradesh are leaders in national output and consumption.

- Bangladesh: Consumed over 637,000 tonnes in 2024, driven by rapid population growth and dietary preferences.

- Australia: Consumed 476,000 tonnes, with a portion channeled into foodservice and health-conscious markets, as global demand for plant-based proteins rises.

Other significant consumers include countries in the Middle East, South Asia, and Africa.

- Turkey: Despite being a producer, imports have fluctuated as local production meets only part of domestic demand.

- Emerging Regions: Regions across Asia and Africa are experiencing rapid growth in lentil consumption due to rising incomes and awareness about nutrition.

This steady increase in vegetarianism and plant-based diets is a critical driver of future lentil market growth, especially across Asia-Pacific and sub-Saharan Africa.

Key Takeaways: Lentil Consumption in India and Asia

- Culinary staple: India’s rich tapestry of regional cuisines (dal, sambhar, khichdi, etc.) ensures intense, year-round demand for lentils.

- Rising middle class: Countries like China are showing an upsurge in beans and lentils consumption as health and sustainability gain prominence.

- Diet diversification: Internationalization of Indian, Mediterranean, and Middle Eastern cuisines is bringing lentils to new markets and tables.

Lentil Trade Dynamics: Exports, Imports & Market Flows

The lentil trade dynamics are central to understanding market volatility, pricing, and supply chain reliability. Let’s explore who the leading exporters and importers are, and what drives their market decisions.

- Canada: The dominant global supplier, controlling much of the export flow into India, Turkey, the UAE, and many other importing countries.

- Australia: Second largest exporter, with increasing market share particularly in South Asian and Middle Eastern destinations.

- Russia: The surprise package of 2024, rapidly increasing exports to South Asia (up from 257,900 tonnes to 345,000 tonnes year-on-year).

- Turkey: A unique hub—acting as both importer and exporter. Notably, its 2024 imports dropped to 430,000 tonnes after 2023’s record 860,300 tonnes, due to both increased domestic production and diversified sourcing (Seedea).

- Kazakhstan: Emerging as a growing supplier to Turkey and other neighboring markets.

The interplay between production fluctuations, climatic disruptions, changing trade policies, and the need for sustainable sourcing is sharpening the edge of competition and spotlighting the strategic importance of reliable partners.

EXAMPLE:

- 2024-Dynamic: India, despite being a top producer, often imports massive volumes from Canada and Australia to offset shortfalls and price volatility caused by unpredictable monsoons or pest surges.

Key Focus: Lentil Exports and Imports

- Exports are driven by both quantity and quality—as buyers increasingly demand food safety, blockchain traceability (see below), and certifications.

- Importers are diversifying sources to reduce dependency and hedge against climatic or geopolitical risks.

- Countries like Turkey and UAE exemplify how a mix of domestic production and smart import policy helps manage market stability and price control.

How Lentil Trade Dynamics Are Evolving:

- Geopolitical changes and tariff adjustments influencing trade routes (e.g., Russia’s increased market presence in Asia).

- Technological innovations—like Farmonaut’s blockchain traceability—increasing confidence in food origins and since 2024, requested by top importers.

- Better inventory and supply chain management—empowered by satellite and AI-based monitoring—reducing post-harvest losses and improving fulfillment rates.

Shocking Trends Shaping the Lentil Market in 2024

Let us now explore the shocking trends and transformative factors shaping the global lentil market today:

- Rise of Plant-Based Diets: Consumer shift toward plant-based proteins—powered by health, ethical, and environmental considerations—fuels unprecedented growth in lentil demand, especially among Millennials and Gen Z.

- Ethnic and Fusion Cuisines: Globalization of culinary experiences has made South Asian, Middle Eastern, and Mediterranean lentil-based dishes mainstream worldwide. This trend is accelerating retail and food-service orders in Western markets.

- Eco-Conscious Consumers: Environmental awareness is driving demand for sustainable lentil farming methods. Lentils, known for fixing nitrogen and enriching soils, increasingly become the protein of choice for “green” consumers.

- Advancement in Technologies: Satellite-driven and AI-powered processing is enabling optimized yields, robust pest management, and targeted irrigation, minimizing waste and maximizing profits.

- Supply Chain Transparency: Growing emphasis on traceability and blockchain-backed supply validation, with software tools (like Farmonaut’s Product Traceability) ensuring food integrity and safety from farm to fork.

- Price Volatility: Lentil prices are highly susceptible to both climate shocks (droughts, floods) and market speculation, necessitating real-time market intelligence and risk mitigation strategies.

The synergy of these trends is transforming the dynamics of production, trade, and consumption, promising exciting opportunities—and challenges—in the years ahead.

For developers and businesses looking to integrate real-time satellite and weather data for smarter farm management, discover our Farmonaut Satellite Data API and check out the comprehensive API Developer Docs.

Innovations in Lentil Processing, Packaging & Quality

The past few years have seen a leap in innovation across all points of the lentil value chain. Several disruptive changes are helping producers improve output, minimize losses, and expand export opportunities:

- Advanced Processing: Mechanized and AI-driven cleaning, sorting, and grading systems ensure lentils are free from contaminants and meet international trade requirements.

- Enhanced Packaging: Superior shelf-stable packaging technologies extend product life and improve international shipment capabilities. Modern packaging solutions also address sustainability concerns by reducing plastic and using biodegradable materials.

- Quality Assurance: Digital and blockchain-based traceability tools (like Farmonaut Product Traceability) validate origin, organic status, and handling conditions, keeping exporters compliant with stringent buyer demands.

With consumers increasingly associating quality with health and social responsibility, innovations in processing and packaging will remain vital cogs in the wheel of market growth.

-

Farmonaut Carbon Footprinting:

Essential for producers and exporters who wish to monitor and minimize their carbon emissions throughout the supply chain—strengthening both sustainability credentials and market access. -

Fleet Management Solutions:

Agribusinesses benefit from real-time tracking and efficiency improvements across harvest, processing, and export operations.

Challenges in Lentil Production: Water, Pest & Management

Despite the promise of surging demand and price incentives, persistent challenges in lentil production continue to burden farmers and disrupt supply chains. Understanding and mitigating these challenges is crucial to sustainable growth.

- Water Scarcity & Irrigation: Lentils require consistent moisture throughout their growth cycle. Water scarcity, droughts, and suboptimal irrigation practices can lower yields and result in economically unviable crops. Particularly in regions like South Asia and North Africa, changing climate patterns are aggravating these risks.

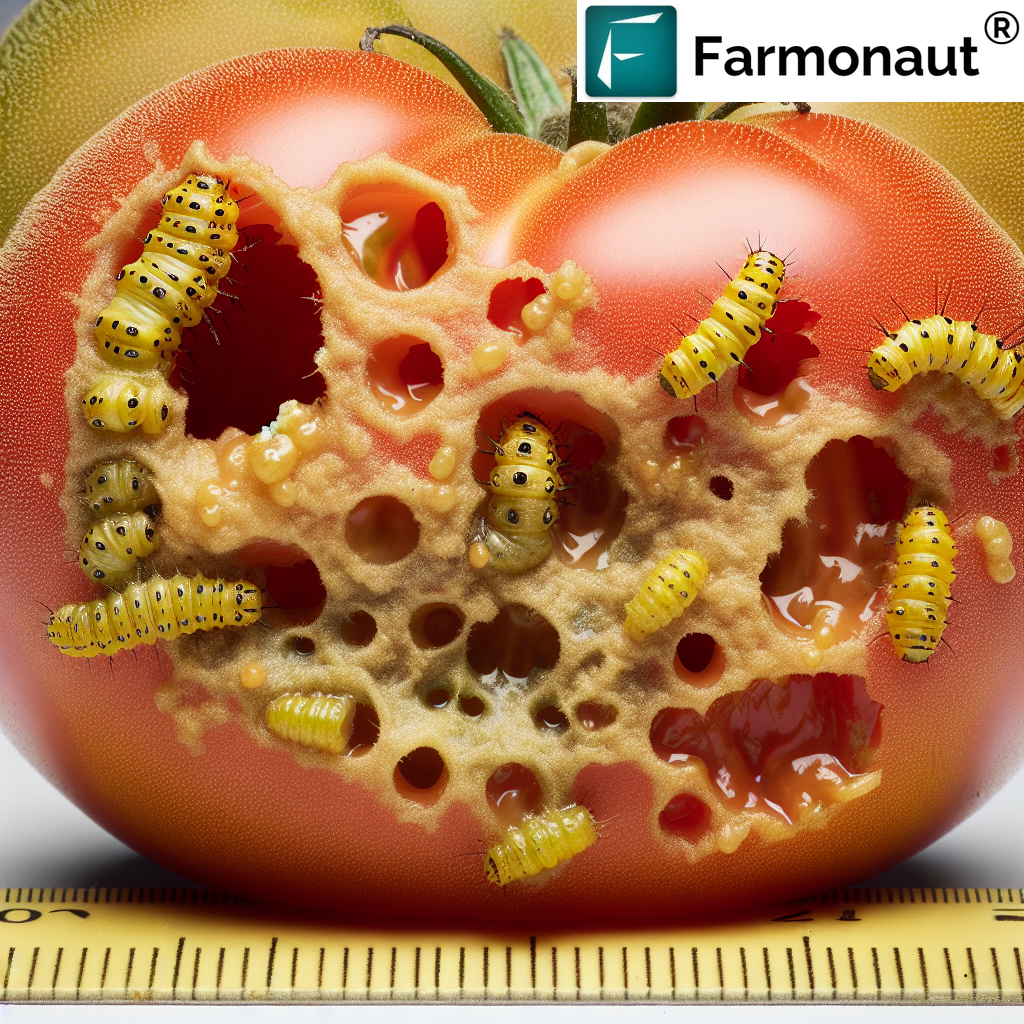

- Pest & Disease Threats: Neglecting regular pest and disease management threatens food safety and farm profitability. Root rot, rust, blight, and insect infestations (e.g., aphids, weevils) cut productivity—demanding timely monitoring and control.

- Price Volatility: Market prices are sensitive to global disruptions (adverse weather, pandemic-led logistics delays, export bans). This unpredictability requires farmers and suppliers to implement responsive planning and risk mitigation tools.

For stakeholders seeking more precise, data-driven farming—Farmonaut’s satellite crop health monitoring and AI-based Jeevn Advisory equip growers with actionable field-level insights to optimize irrigation, fertilization, and pest control.

For financial stability, tools for crop loan and insurance validation support both farmers and lenders—making agricultural finance more accessible and less risky.

Sustainability in Lentil Agriculture & Eco-Friendly Practices

The push for sustainability is more than a buzzword—it’s a necessity for the future of global lentil market stability. Lentils, as legumes, naturally enrich soils through nitrogen fixation, reducing the need for synthetic fertilizers and supporting regenerative agriculture. This inherent attribute is making them increasingly central to climate-resilient cropping systems globally.

- Rotations: Producers are integrating lentils into crop rotations to maintain soil fertility, manage pests, and break disease cycles.

- Carbon Tracking: Companies use solutions like Farmonaut Carbon Footprinting for data-backed sustainability reporting and compliance with global standards.

- Smart Resource Management: Precision management of water, nutrients, and agrochemicals—supported by satellite imaging and AI—reduces environmental impact and input costs while maximizing yields.

Such sustainable lentil farming practices are being adopted by progressive producers worldwide—helping set new benchmarks for environmental stewardship while meeting the rising expectations of conscious consumers and regulators.

For government agencies and NGOs focused on food security, climate adaptation, and sustainable rural development, advanced farm monitoring platforms (like Farmonaut’s Large-Scale Farm Management) offer powerful planning and policy support.

Farmonaut: Driving Precision & Sustainability in Lentil Farming

As climate uncertainties and global competition intensify, integrating technology becomes indispensable for lentil producers, exporters, and policymakers. This is where Farmonaut brings transformative change:

- Satellite-Based Crop Health Monitoring: Multi-spectral imaging provides farmers with NDVI (Normalized Difference Vegetation Index), soil moisture, and other metrics—enabling real-time crop surveillance for optimal resource allocation.

- Farmonaut Jeevn AI: AI-driven personalized advisory, offering dynamic recommendations on irrigation, fertilizer usage, and pest/disease control—significantly increasing productivity and resource efficiency.

- Blockchain Product Traceability: Lentil exporters can secure trust and food safety compliance across international supply chains with blockchain-backed traceability from farm to market.

- Fleet and Resource Management: Large farms and agri-exporters can manage harvesting fleets, monitor fuel usage, and optimize logistics for more sustainable and cost-efficient operations.

- Carbon Footprint Tracking: Producers can measure and reduce GHG emissions, reporting accurately to regulators and climate-conscious buyers.

Farmonaut’s app, web platform, and APIs make these tools accessible, scalable, and affordable. Smallholder farmers, large agribusinesses, government agencies, and NGOs can all benefit from these innovations, helping elevate lentil production worldwide.

🎯 Farmonaut Subscription Plans: Make Precision Farming Affordable

The Future of Lentil Market: Growth, Outlook, and Opportunities

The future of the lentil market is exceptionally bright. The market size is projected to hit USD 5.76 billion in 2025, with a forecasted CAGR of 2.8% through 2030, reaching USD 6.61 billion (Mordor Intelligence).

- Asia Pacific: Poised for maximum growth thanks to population expansion, rising incomes, and an evolving middle class hungry for healthy protein choices. India, China, and Australia lead the transformation.

- Emerging Demand: Urbanization, shifting dietary preferences, and inclusion of lentils in government nutrition programs are set to sustain boom times.

- Technological Acceleration: Farm-level adoption of apps, satellite monitoring, and AI will define the winners of tomorrow’s competitive landscape.

With the right investments in sustainable agriculture, data-driven decision-making, and supply chain transparency, the coming years could see lentils further shine as a nutritious, eco-friendly, and high-demand staple for billions.

Top Global Lentil Producers in 2024: Estimated Production & Market Share

| Country | Estimated Production (Metric Tons) | Global Market Share (%) | Year-on-Year Growth Rate (%) | Export Volume (Metric Tons) | Notable Trends or Insights |

|---|---|---|---|---|---|

| Canada | 2,200,000 | ~34% | +2.5% | 1,800,000 | Leader in exports, advanced technology adoption, stable infrastructure |

| India | 1,800,000 | ~27% | +3.0% | 300,000 | Largest consumer, high domestic demand, growth in Madhya & Uttar Pradesh |

| Australia | 720,000 | ~11% | +4.0% | 600,000 | Major exporter, innovation leader in sustainable practices |

| Russia | 490,000 | ~7% | +24% | 345,000 | Rapid export growth, strong focus on South Asia trade |

| Turkey | 410,000 | ~6% | +2.0% | 110,000 | Plays dual role as producer & importer, diversified sourcing |

| USA | 320,000 | ~5% | +1.8% | 195,000 | Stable output, focus on quality assurance and niche markets |

| Kazakhstan | 180,000 | ~3% | +14% | 120,000 | Emerging supplier to Turkey & regional markets |

| Bangladesh | 110,000 | ~2% | +2.2% | 25,000 | Growth in consumption; net importer |

| Others | 470,000 | ~7% | ~ | ~ | Smaller but growing contributors worldwide |

FAQ: Lentil Market & Sustainable Agriculture

Q1: Who are the top global lentil producers in 2024?

Canada and India lead the world in lentil production, contributing around 34% and 27% of total global output, respectively. Australia, Russia, Turkey, and the USA are also major producers.

Q2: Why is India the largest consumer of lentils?

Lentils are a dietary staple in India, integral to various traditional dishes and a key protein source for its predominantly vegetarian population.

Q3: What are the main challenges in lentil production globally?

Water scarcity, increasingly erratic climate conditions, pests, disease outbreaks, and price volatility are the key challenges. Access to real-time advisory and technology (like satellite-based monitoring) helps mitigate these risks.

Q4: How do innovations in processing and packaging impact the market?

Enhanced processing ensures food safety and higher quality, while advanced packaging prolongs shelf-life and improves export logistics. Both areas are crucial for maintaining international competitiveness.

Q5: What is the outlook for lentil market growth?

The global lentil market is set to grow by a projected 2.8% CAGR from 2025 to 2030, supported by rising demand in Asia-Pacific, Africa, and new health-conscious consumer segments globally.

Q6: How can platforms like Farmonaut support the lentil value chain?

Farmonaut provides affordable, scalable tools for real-time crop health monitoring, AI-driven advisory, blockchain-based product traceability, and resource management—empowering farmers, agribusinesses, and policymakers toward higher productivity, sustainability, and transparency.

Conclusion: Towards a Sustainable, Nutritious Future

In conclusion, lentils symbolize much more than a dietary staple—they’re at the crossroads of nutrition, sustainability, and global trade. As we’ve explored, the global lentil market is buoyed by rising demand for plant-based proteins, technological innovation, and diligent adaptation to sustainability imperatives. The next decade will see the convergence of advanced farm management technologies, evolved trade dynamics, and responsive policy frameworks.

Whether you are a grower striving for higher productivity, an exporter seeking traceability, a policymaker prioritizing food security, or a technology enthusiast, leveraging tools like Farmonaut’s precision agriculture platform will be key to remaining competitive and sustainable in the evolving lentil market.

Together, let’s shape a future where lentil farming is not just profitable, but profoundly sustainable, nutritious, and accessible—for producers and consumers worldwide.