Ukraine Agriculture Historical Data & Forecasts 2021–2024: Navigating Challenges, Adapting to Change, and Shaping Global Markets

“Ukraine’s grain exports dropped by over 30% between 2021 and 2023 due to ongoing conflict and market disruptions.”

- Ukraine Agricultural Sector: An Overview (2021-2024)

- Historical Data & Trends in Ukrainian Agriculture

- Impact of Conflict on Ukrainian Agriculture (2022 Onwards)

- Destruction of the Kakhovka Dam: Farmland & Irrigation Crisis

- Ukraine Land Reforms: From Moratorium to Market (2021 Onward)

- Ukraine Grain Exports: Global Market Dynamics & Challenges

- Oilseed Production in Ukraine: Sector Resilience & Growth

- Organic Product Exports Ukraine: Expanding Global Reach

- International Food Security Initiatives Ukraine

- Ukraine Agriculture Economic Challenges & Contributions

- Yearly Agricultural Production & Export Overview (2021–2024)

- Leveraging Technology: Farmonaut Solutions for Agriculture

- Ukraine Agricultural Sector Outlook for 2024 & Beyond

- FAQ: Ukraine Agriculture Sector Trends & Forecasts (2021–2024)

Ukraine Agricultural Sector: An Overview (2021-2024)

The ukraine agricultural sector has been a bedrock of its economy and a linchpin of global food security for decades. Between 2021 and 2024, our agricultural landscape experienced transformations fueled by major events, persistent challenges, and innovative adaptations.

As we analyze historical data and forecasts, it becomes clear how factors such as the impact of conflict on Ukrainian agriculture, land reforms, evolving global market dynamics, and international support programmes have reshaped crop production, export volumes, and regional sustainability.

- Ukraine stands as a top global grain and oilseed producer and exporter.

- The sector’s resilience was put to the test by the 2022 Russian invasion, the 2023 Kakhovka Dam destruction, and lengthy economic and policy reforms.

- Despite mounting obstacles, new strategies and technologies proved pivotal in our ability to adapt to new realities and strive for sector recovery.

Historical Data & Trends in Ukrainian Agriculture

To understand our current market position and sector outlook, let’s review Ukraine’s major agricultural trends and data-driven insights from 2021 through 2024:

- Pre-2022 Growth: Prior to the 2022 conflict escalation, Ukraine accounted for over 10% of global wheat exports, over 15% of corn exports, and was the largest sunflower seed and oil exporter worldwide.

- Exports accounted for more than 40% of Ukraine’s total exports by value—dominated by grains, oilseeds, and increasingly organic products.

- Land reforms implemented in 2021 heralded new opportunities and uncertainties for both farm ownership and investment across nearly 42 million hectares of arable land.

The next sections dissect the specific events and resulting trends that have defined our agricultural sector’s journey in this historic period.

Impact of Conflict on Ukrainian Agriculture (2022 Onwards)

The Russian invasion of Ukraine in February 2022 triggered the most significant disruptions to the ukraine agricultural sector in recent memory. Let’s break down the impact of conflict on Ukrainian agriculture, particularly during 2022 and 2023:

- Land Accessibility: Only 75% of our agricultural land—down from previous years—could be safely sown and harvested in 2022.

-

Production Reductions: Total agricultural output decreased 28.3% compared to 2021.

Crop production declined by 32.3%, while livestock production decreased by 11.1%. - Key Crops Hit Hard: Wheat, maize (corn), and sunflower seeds were the crops most severely affected, seen in sharp yield reductions and disrupted logistics.

- Export Hurdles: War-influenced export restrictions, port blockades, and elevated costs further hampered ukraine grain exports and global supply chains.

These challenges drove the need for faster adaptation, data-driven management, and strengthened regional and global alliances.

“Oilseed production in Ukraine is forecasted to rebound by 12% in 2024, signaling sector resilience amid reforms.”

Destruction of the Kakhovka Dam: Farmland & Irrigation Crisis

In June 2023, the destruction of the Kakhovka Dam unleashed a crisis with long-term implications for Ukrainian agriculture:

- Loss of irrigation on about 584,000 hectares of farmland—historically responsible for 4 million tons of grains and oilseeds annually.

- Loss of topsoil, increased land degradation, and diminished suitability of substantial farmland areas for cultivation for years to come.

- Immediate declines in yields and longer-term risks for both grain and oilseed crops across southern Ukraine.

Water scarcity, soil degradation, and the imperative to invest in alternative irrigation and land renewal emerged as urgent sector priorities.

Ukraine Land Reforms: From Moratorium to Market (2021 Onward)

The implementation of ukraine land reforms in July 2021 marked one of the most significant policy shifts since independence. Let’s explore key aspects and consequences:

- A 20-year moratorium on agricultural land sales was lifted, finally permitting private ownership and the creation of a functioning land market.

- Individuals could purchase up to 100 hectares in the first phase; companies were temporarily restricted from land ownership.

- Average land price reached 40,000 hryvnias (~USD $1,060) per hectare by 2023, reflecting demand, investment, and ongoing uncertainty.

- Land reform opened pathways for farmers to invest, innovate, or lease, but also raised issues of equity, imbalance, and rural livelihoods.

The pace and outcome of these reforms continue to shape sector competitiveness and market structure through 2024 and beyond.

Ukraine Grain Exports: Global Market Dynamics & Challenges

Despite adversity, Ukraine’s grain exports remain essential to global markets and food security initiatives across many countries.

- 2021: Ukraine was the world’s 5th-largest maize producer, 8th-largest wheat producer, and the largest sunflower seed producer.

- 2022–2023: Grain export volumes dropped by over 30%. The combination of the conflict, port closures (notably Odesa, Mykolaiv), and costly logistics led to a sharp decline.

- 2023 Harvest: Estimates suggested 35–40 million tons less grain production versus pre-conflict years.

Key export destinations include the EU, China, Egypt, Turkey, and, via international aid programs, many developing nations.

To address transparency demands in global food supply chains, Farmonaut’s blockchain-based traceability solution enables companies and regulatory bodies to verify the integrity and origin of grain and food products from Ukraine, increasing trust in exports and enhancing traceability for international buyers.

Oilseed Production in Ukraine: Sector Resilience & Growth

While the grain subsector grappled with immense challenges, oilseed production in Ukraine demonstrated remarkable resiliency:

- Sunflowers, soybeans, and rapeseed plantings surged over 30% in the past decade.

- 2022–2023: The sector weathered logistical, energy, and input disruptions better than grains, attributed to robust domestic processing, rising international demand, and strategic planting decisions.

- Forecast for 2024: Experts predict a 12% rebound in oilseed production, keeping Ukraine in the top tier of global suppliers.

- Sunflower oil and meal exports remain global market leaders, supporting sector recovery.

Large plantations and corporate farms benefit from Farmonaut’s large-scale farm management solutions, offering real-time satellite field monitoring, AI-driven crop advisory, and centralized resource control—especially valuable when adapting to volatile national and international oilseed markets.

Organic Product Exports Ukraine: Expanding Global Reach

The organic sector offers a promising diversification avenue for the ukraine agricultural sector:

- 2022: Despite the conflict, Ukraine exported 245,600 metric tons of organic products valued at $219 million to 36 countries.

- Top importers: Netherlands, Germany, Austria, Switzerland, Poland, Lithuania, USA, Italy, UK, Czech Republic.

- Main products: Corn, soybeans, and wheat led organic export volumes, demonstrating sector breadth and integrating Ukraine into global organic food supply chains.

Policy harmonization with the EU, traceability, and sustainable production practices underpin this market’s ongoing expansion.

With the growing international focus on sustainable and organic supply chains, Farmonaut’s carbon footprinting tools enable producers and exporters to track and reduce emissions associated with organic crop production. This data supports compliance with EU “Green Deal” requirements and boosts market access.

International Food Security Initiatives Ukraine

We have played a central role in global food security initiatives, especially since the onset of conflict:

-

“Grain from Ukraine” Project: Launched late 2022, this program coordinated the delivery of critically needed Ukrainian grain to nations such as Ethiopia, Kenya, Sudan, and Nigeria.

By 2024, millions of tons had been sent through this and parallel initiatives. - UN, EU, and World Food Programme partnerships furthered sector reach, providing both revenue and crucial humanitarian support for global food-insecure regions.

Moving millions of tons of agricultural goods under challenging conditions requires advanced logistics. Farmonaut’s fleet management solutions empower agribusinesses to optimize vehicle fleets, minimize fuel cost, and ensure timely logistics for both domestic market distributions and international aid shipments.

Ukraine Agriculture Economic Challenges & Contributions

On the eve of war, the ukraine agricultural sector:

- Accounted for over 20% of GDP

- Provided 18% of total employment

- Represented more than 40% of total export value

The last three years have tested the sector’s abilities to manage economic shocks, loss of land, infrastructural damages, and external trade volatility.

- Employment and rural livelihoods have been particularly stressed, as many regions faced physical, financial, and logistical obstacles to continued farming.

- Yet, agriculture continues to anchor the national economy, with sector recovery central to long-term growth and redevelopment planning.

For both farmers and lenders, Farmonaut’s crop loan and insurance verification tools ensure that loan applications and insurance claims are supported by reliable, satellite-based crop health and area data—critical for mitigating risk, reducing fraud, and improving funding flows in a turbulent economic landscape.

Yearly Agricultural Production & Export Overview (2021–2024)

A comparative table summarizing grain production, oilseed output, export volumes, major destinations, and notable factors allows us to see at a glance how industry trends evolved across four years of intense change.

| Year | Grain Production (million tons) |

Oilseed Production (million tons) |

Grain Export Volume (million tons) |

Major Export Destinations | Notable External Factors |

|---|---|---|---|---|---|

| 2021 | 84 | 22 | 55 | EU, China, Egypt, Turkey | Stable; Land reforms enacted |

| 2022 | 60 | 18 | 38 | Reduced: EU, China, Middle East | Russian invasion, export disruptions |

| 2023 | 48 | 19 | 37 | EU, humanitarian programs, Asia | Dam destruction, infrastructure loss |

| 2024 (forecast) |

51 | 21.5 | 39 | EU, Africa (via aid), Middle East | Recovery, oilseed rebound, ongoing conflict |

Note: Figures represent approximate aggregates and forecasts, spotlighting sector adaptation to conflict, reforms, and global market shocks.

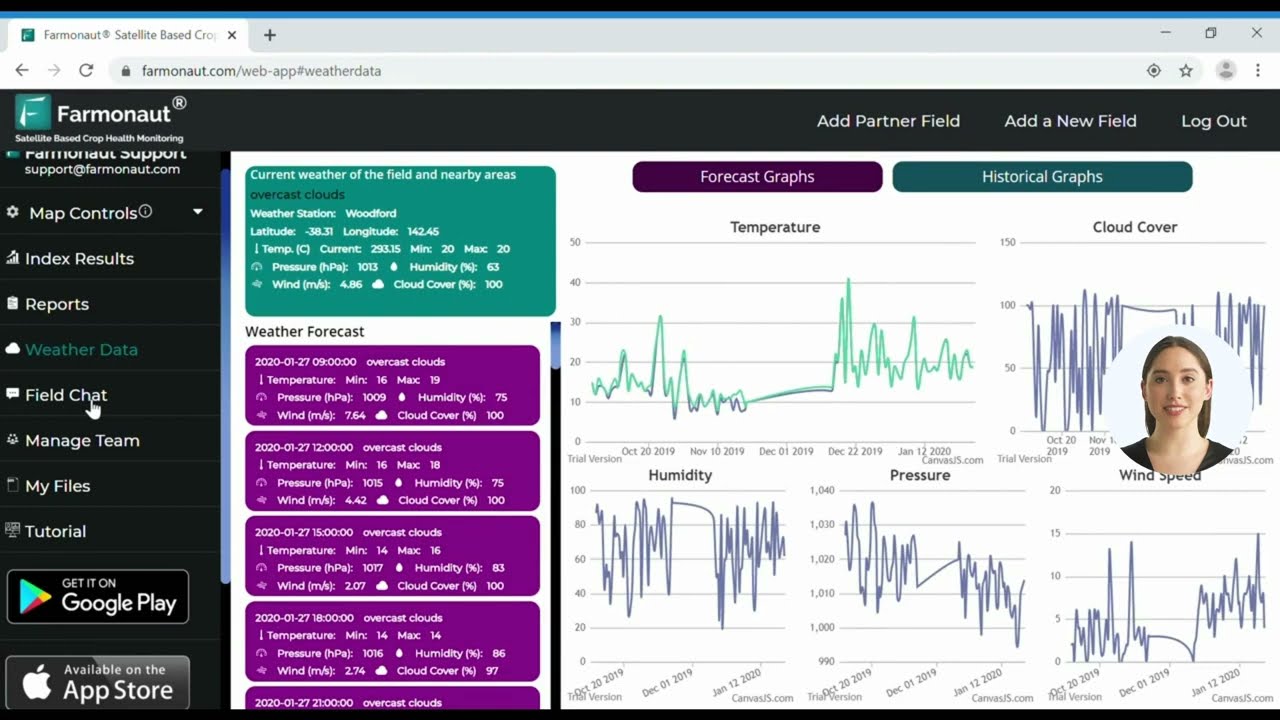

Leveraging Technology: Farmonaut Solutions for Agriculture

Modern ukraine agriculture increasingly depends on advanced technologies for efficiency, resilience, and transparency. Farmonaut is at the forefront, making precision solutions accessible and affordable:

- Satellite-Based Crop Health Monitoring: Enables farmers to monitor crop health, soil moisture, and yields in real-time—crucial for optimizing resource use and counteracting conflict-related losses.

- Jeevn AI Advisory System & Custom Advisory: Delivers actionable crop management strategies, weather forecasts, and pest alerts.

- Blockchain-Based Traceability: Provides complete transparency for food products “from field to fork”, meeting the growing requirements of export markets and international buyers.

- Fleet & Resource Management: Improves logistics for large and small-scale farms—essential when supply chains are under stress from war or infrastructure loss.

- Carbon Footprinting: Supports sustainable production by quantifying and reducing the carbon impact associated with crop and livestock operations.

Our platform is available via web, Android, and iOS apps, as well as through flexible APIs and Developer Documentation, catering to diverse user needs—from individual farmers to government agencies, agribusinesses, and enterprise clients.

Ukraine Agricultural Sector Outlook for 2024 & Beyond

Looking forward, the ukraine agricultural sector stands at a crossroads. Key challenges and opportunities will define our source of resilience and growth trajectory:

- Ongoing conflict and infrastructure loss demand adaptation in logistics, planted area, and resource allocation.

- Continued focus on oilseed and organic markets may safeguard against volatility in global grain dynamics.

- International support, reform adherence, and investment in modern technology are paramount for productivity boosts and export competitiveness.

- Farmonaut and digital solutions will continue to democratize access to precision agriculture data and advisory capabilities, helping both smallholders and enterprises recover and thrive.

The next chapter in Ukraine’s agriculture will be written by our collective drive for innovation, sustainability, and market adaptation.

FAQ: Ukraine Agriculture Sector Trends & Forecasts (2021–2024)

1. How has the Ukrainian agricultural sector changed since 2021?

Our sector has undergone major transformations due to conflict escalation, economic reforms, infrastructure loss, and evolving global market conditions. We have adapted by shifting exports, investing in oilseeds and organics, and leveraging new technology.

2. What was the impact of conflict on Ukrainian agriculture?

Since 2022, the conflict has led to decreased arable area, major reductions in grain and livestock production, export disruptions, and the loss of vital irrigation infrastructure—resulting in harvest declines and economic loss.

3. How have land reforms impacted agricultural production and exports?

Land reforms (2021) allowed private ownership for the first time in decades, boosting market investment and flexibility but also provoking concerns about land concentration and equitable access.

4. Why is oilseed production important for Ukraine?

Oilseed production in Ukraine—particularly sunflowers, rapeseed, and soybeans—enables continued export growth and adaptation to shifting global demands, compensating for grain sector volatility and supporting domestic processing industries.

5. What role do innovations like satellite crop monitoring play?

Digital and satellite technology is vital for precision farming, yield optimization, sustainability, fraud prevention, and maintaining competitiveness in fluctuating environmental and political contexts.

6. How can stakeholders access advanced agricultural management in Ukraine?

We provide robust solutions via the Farmonaut web, Android, and iOS apps, as well as through API access and developer documentation.

Conclusion: Ukraine’s Agricultural Sector—Resilience, Adaptation, and the Road Ahead

Between 2021 and 2024, the ukraine agricultural sector weathered an unprecedented mix of conflict, disasters, and policy change. Despite large-scale losses in grain production and harvest declines, oilseed production in Ukraine has shown impressive resilience, while global and organic markets offer new growth frontiers. Through effective reforms, international food security programs, and the adoption of innovative technology—including Farmonaut’s affordable, data-driven solutions—we continue to adapt, support our communities, and fuel the global food supply chain.

The future of Ukraine’s agriculture will be defined by our ability to learn from historic disruptions, leverage our natural and human capital, and embrace technologies that secure both sustainability and prosperity for generations to come.