Impact of Electric Vehicle Adoption on Mineral Demand 2025: Mining, Technologies & Challenges Redefining the Future

“By 2025, electric vehicles could drive lithium demand up by 300%, reshaping global mining priorities.”

Introduction: The Global Shift Towards EVs

The year 2025 stands out as a pivotal point in our journey towards sustainable transportation, as the adoption of electric vehicles (EVs) accelerates at an unprecedented pace. This evolution is driven by stringent emission regulations, breakthroughs in battery technology, and an increasingly growing consumer awareness regarding environmental challenges. As these vehicles become more prevalent, the implications for mineral demand—especially for lithium, cobalt, nickel, and graphite—have never been more pronounced.

In this comprehensive exploration, we’ll dissect the impact of electric vehicle adoption on mineral demand, analyze the latest mining technologies and innovations, and discuss the evolving challenges in sourcing the critical minerals that are essential to the future of EVs.

The Impact of Electric Vehicle Adoption on Mineral Demand in 2025

As EV adoption accelerates, it is catalyzing significant transformations across the mining and energy sectors. Batteries, the heart of every electric vehicle, rely heavily on a range of advanced components—primarily lithium, cobalt, nickel, manganese, and graphite. These critical minerals serve as key cathode and anode materials, enabling greater energy density, safety, and performance.

The implications of this shift are sweeping. According to current industry forecasts, global demand for these minerals will triple or more compared to figures from just a decade ago. Mining companies are ramping up exploration and production efforts, while governments and businesses worldwide face new challenges in managing sustainable practices and securing vital supply chains.

Key Factors Driving the Surge in Mineral Demand

- Stringent emission regulations worldwide promote a rapid shift towards EVs, increasing mineral requirements.

- Growing consumer awareness and environmental concerns motivate the transition to electric vehicles.

- Constantly improving battery technology demands higher purity and larger volumes of key minerals.

- Geopolitical priorities pressure nations to secure and localize critical mineral supply chains.

However, this surge in mineral demand also introduces new challenges—from resource scarcity to environmental sustainability and supply chain ethics.

EV Battery Chemistry: Why These Minerals Matter

The current generation of lithium-ion batteries predominantly relies on four critical minerals:

- Lithium (Cathodes & Electrolytes)

- Cobalt (Stabilizes Cathodes, Improves Safety)

- Nickel (Increases Energy Density, Especially in Class 1 High-Purity Form)

- Graphite (Primary Anode Material)

Lithium: The Cornerstone of EV Batteries

The role of lithium as the cornerstone of battery technology cannot be overstated. As Li-ion batteries are the primary storage mechanism for electric vehicles, the metal’s importance to the global energy transition is fundamental. Demand for lithium is expected to triple by 2025 compared to a decade ago, triggered by the surge in EV production and the proliferation of “clean” transportation.

A lithium brine extraction site in South America’s Lithium Triangle

The “Lithium Triangle”—Argentina, Bolivia, and Chile—along with Australia and emerging producers like Zimbabwe, stand as key regions where exploration and ramped-up efforts are reshaping the industry’s priorities and geographies.

Environmental and Social Challenges

- Water-Use Concerns: Lithium extraction, especially from brine, is resource-intensive and often faces environmental scrutiny for excessive water consumption—a pressing issue in arid regions.

- Socioeconomic Impacts: Operations in areas like South America impact local communities, requiring sensitive social practices.

- Geopolitical Risks: Heavily concentrated supply increases supply chain vulnerabilities.

Innovation is key. The industry is actively pursuing more sustainable methods, such as direct lithium extraction (DLE), which promises to reduce water usage, speed up production, and improve yields. Recycling initiatives are increasingly important to supplement primary extraction and reduce reliance on mining.

Key Takeaways:

- By 2025, lithium demand is expected to rise up to 300%.

- Technology trends include DLE, closed-loop water systems, and battery recycling operations.

Cobalt & Nickel: Managing Supply, Ethics, and Innovation

Cobalt and nickel remain essential components of EV batteries, particularly for cathodes with higher energy density (NMC and NCA chemistries). The increased volume of EVs on roads is driven by the need for high-performance batteries, triggering a skyrocketing interest in production.

Cobalt: Ethical and Supply Chain Concerns

- The Democratic Republic of Congo (DRC) predominantly dominates the world’s cobalt supply, accounting for about 70% of global output.

- Human rights and supply chain ethics are critical concerns. There are well-publicized issues around safety, labor (including child labor), and environmental regulation in the DRC.

- To reduce ethical risks, manufacturers are exploring alternative chemistries with lower cobalt content and strengthening the traceability of their supply chains.

Though some new production initiatives are emerging in Australia, Canada, and Indonesia, the global supply remains concentrated and vulnerable, underscoring the importance of ethical tracing and new mining technologies.

Nickel: A Pivot to High Energy Density

- Nickel is vital to EV batteries as higher energy density allows for extended range and performance (Class 1 nickel preferred).

- Supply expansion is underway in regions such as Indonesia, Australia, Russia, and Canada.

- Laterite ore processing in Southeast Asia presents environmental challenges but is essential for meeting the growing global demand.

Nickel use in EV batteries is projected to rise by 50% by 2025, spurring rapid mining innovation.

“Nickel use in EV batteries is projected to rise by 50% by 2025, spurring rapid mining innovation.”

Managing the Shift: Innovation in Sourcing and Sustainability

- Hydrometallurgical extraction is reducing environmental impact for nickel and cobalt mines.

- Cobalt-free or low-cobalt battery chemistries (such as LFP and NCM-811) are being tested to reduce demand pressure and mitigate ethical risks.

Graphite & Manganese: Critical Components in Battery Chemistries

While lithium, cobalt, and nickel receive much attention, graphite and manganese are equally essential for battery anodes and cathodes, respectively. Graphite—both natural and synthetic—remains the primary anode material for nearly all lithium-ion batteries, supporting the surge in EV adoption.

Graphite: The Anode Powerhouse

- Natural graphite mining is concentrated in China, Mozambique, and Brazil, while synthetic graphite (though energy-intensive) is used to supplement supply.

- Environmental issues arise from high energy use in synthetic graphite production and pollution at some major production hubs.

Manganese: Battery Safety and Power

- Manganese is used in certain cathode chemistries (e.g., NMC) to improve stability, power, and safety.

- Manganese mining is concentrated in South Africa, Australia, and increasingly, new African producers.

- While less headline-grabbing than other minerals, manganese’s role in next-gen battery technologies is significant and growing.

Resource Scarcity and Challenges

- Limited reserves, geopolitical instability, and high energy costs complicate graphite and manganese extraction.

- Reliance on a few major suppliers increases the vulnerability of the global supply chain to disruption.

Comparative Demand Forecast for Key EV Minerals in 2025

| Mineral | Main Use in EVs | Estimated Global Demand 2025 (Metric Tons) | % Change from 2022 | Major Source Countries | Innovation / Mining Technology Notes |

|---|---|---|---|---|---|

| Lithium | Battery Cathodes, Electrolytes | 1.2 – 1.5 million | +300% | Australia, Chile, Argentina, China, Zimbabwe | Direct Lithium Extraction (DLE), water recycling, battery recycling |

| Cobalt | Battery Cathodes, Stability, Energy Density | 220,000 – 250,000 | +85% | DRC, Indonesia, Australia, Russia, Canada | Ethical sourcing, AI-driven tracing, cobalt-reduced chemistries |

| Nickel | High-Energy Battery Cathodes | 650,000 – 740,000 | +50% | Indonesia, Australia, Russia, Canada | Hydrometallurgical extraction, low-impact laterite processing |

| Graphite | Battery Anodes | 3.8 – 4.2 million | +125% | China, Mozambique, Brazil | Low-emission synthetic graphite, recycling, process electrification |

Mining Industry Response: Innovations & Sustainability Practices

In response to the impact of electric vehicle adoption on mineral demand, the mining sector is investing in technologies to improve yield, reduce the environmental footprint, and integrate sustainable practices across the value chain.

Technological Advancements Shaping Mining Operations

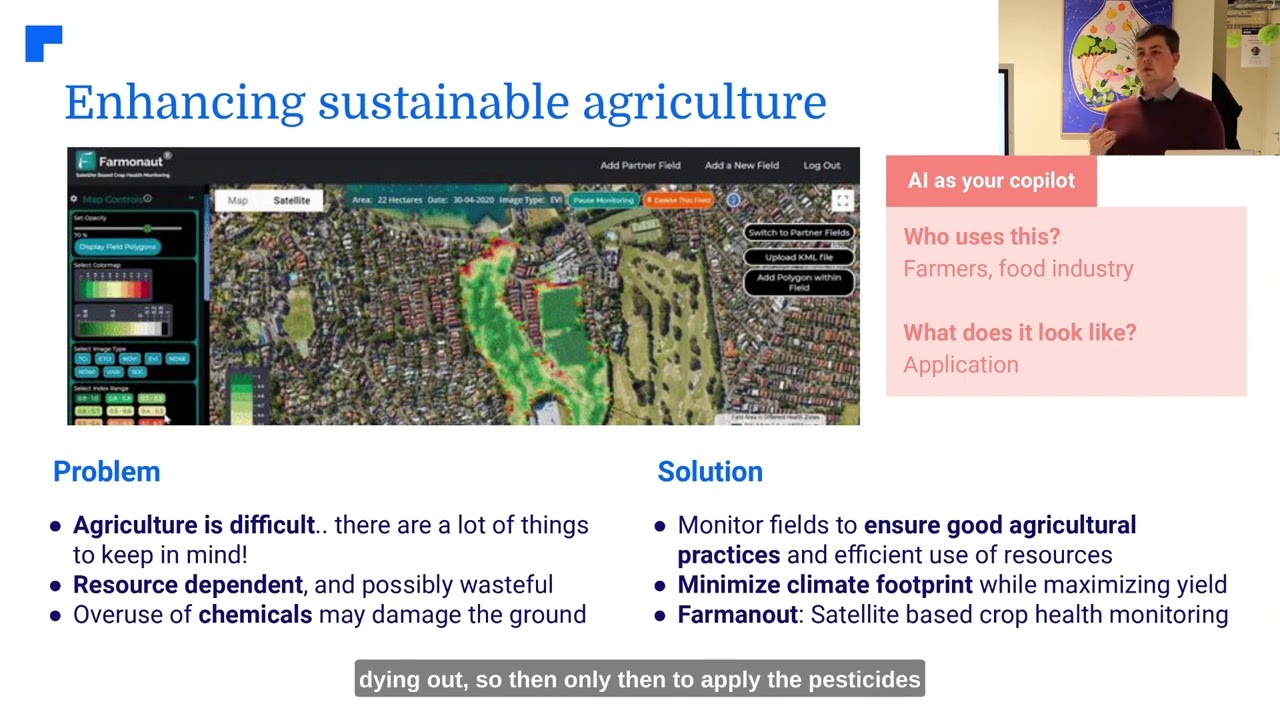

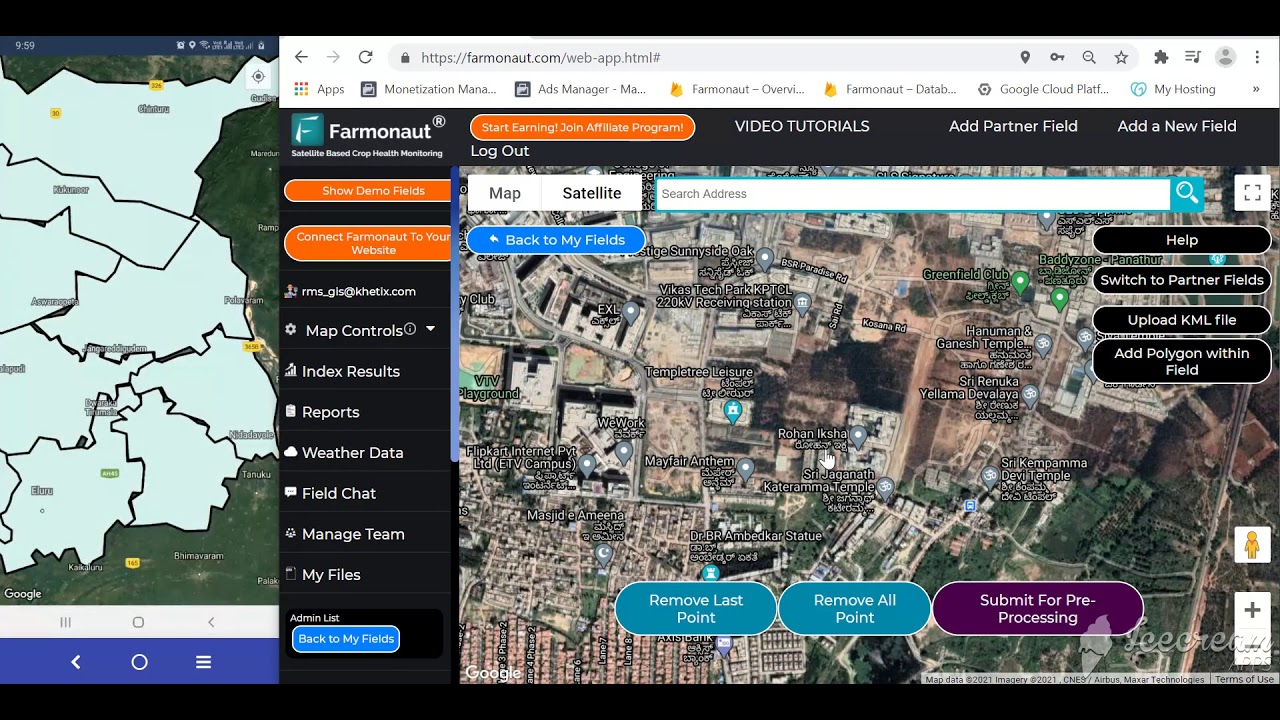

-

Satellite monitoring for real-time extraction site updates and resource management.

Farmonaut’s large scale management platform empowers companies to oversee vast mine areas remotely and optimize fleet operations efficiently. - Artificial intelligence (AI) and machine learning in mineral exploration, dynamic planning, and predictive maintenance of critical equipment.

-

Blockchain-based traceability ensures transparency in raw material sourcing, crucial for ethically sensitive minerals like cobalt.

See more: How Farmonaut’s traceability solutions work - Water recycling systems and advanced tailings management reduce environmental impact.

-

Renewable energy integration at mining sites to limit carbon footprint.

Explore Farmonaut’s Carbon Footprinting solutions for real-time environmental monitoring.

Environmental and Social Responsibilities

- Resource efficiency: Using less energy and water per ton of mineral extracted.

- Emissions management: Monitoring air, soil, and water pollution is essential to comply with region-specific standards.

- Community engagement: Transparent communication with local communities is key in social license to operate.

Challenges for the Mining Sector:

- Geological limitations: Not all reserves are economically viable or environmentally friendly to exploit.

- Political risk: Instability in mineral-rich nations (e.g., DRC, certain South American countries) can disrupt supply chains.

- Regulatory compliance: Navigating diverse national and international regulations.

- Technology adaptation: Integrating new methods while maintaining profitability and resource security.

Global Geographies: Where Critical EV Minerals Are Sourced

The shift toward EVs is reshaping the geographical priorities of the global mining industry. Here’s how global supply is distributed:

- Lithium Triangle (Argentina, Bolivia, Chile): Major brine-based lithium reserves, focus of intense extraction innovation and geopolitics.

- Australia: Leads spodumene-based lithium mining and has robust nickel and manganese operations.

- Democratic Republic of Congo: The world’s cobalt hub but faces pressing ethical and social concerns.

- Indonesia: Rapidly ramping up nickel output for the Asian and global EV supply chain.

- China: Dominates graphite production and battery manufacturing; also a top lithium refiner.

Latin America’s lithium, Australia’s nickel and manganese, Africa’s cobalt, and China’s graphite are at the core of the EV revolution.

The Role of Recycling & the Circular Economy in EV Mineral Supply

Recycling is emerging as a key method to supplement primary extraction and reduce environmental impact. With battery recycling technology advancing, it is increasingly possible to recover lithium, nickel, cobalt, and graphite from spent batteries for reuse. Although global recycling capacity currently falls short of the anticipated need by 2025, ongoing initiatives signal a promising future.

- Closed-loop recycling: Reduces demand on virgin resources, shortens supply chains, and supports sustainability.

- Second-life applications: Old EV batteries are reused in stationary energy storage, extending utility and delaying waste.

- Battery design innovation: Modular designs and standardized cells enable easier recycling.

- Policy incentives: Several nations now mandate recycled content or “producer responsibility” for end-of-life batteries.

Recycling Challenges:

- Technological limitations: Chemistries and battery formats complicate automated disassembly and material recovery.

- Economic scale: Many recycling plants are still too small to meet future demand.

- Collection infrastructure: Efficient systems for collecting used batteries remain underdeveloped in many regions.

How Farmonaut Enhances Mining Monitoring and Resource Management

As the mining industry evolves to meet the impact of electric vehicle adoption on mineral demand, leveraging advanced technology for sustainable operations becomes crucial.

We at Farmonaut offer satellite monitoring and AI-driven insights tailored for both resource mapping and environmental impact monitoring. Our platform provides:

- Real-time satellite-based monitoring: Our tools allow mining operators and governments to track site activity, assess vegetation health, analyze soil conditions, and oversee extraction progress globally. This supports sustainable and compliant operations.

- AI-based advisory systems: Our Jeevn AI delivers actionable strategies for efficient resource allocation and productivity improvements across the industry.

- Blockchain traceability: Our traceability solutions ensure transparency and ethical tracking in supply chains, vital for minerals like cobalt and lithium.

-

Fleet and resource management tools: Our platform helps optimize vehicle usage, enhance logistical efficiency, and manage equipment lifecycle.

Discover more:

Farmonaut’s Fleet Management -

Environmental impact and carbon footprint monitoring: Receive real-time insights for emissions and resource usage to guide best practices.

Learn more about Carbon Footprinting solutions. -

API for integration: Seamlessly incorporate mining and environmental insights into business workflows.

Learn more about the Farmonaut API and Developer Documentation.

Future Outlook: The Road Ahead for EV Mineral Demand and Mining

Moving beyond 2025, the intertwined futures of electric vehicles and mineral mining reveal a landscape defined by innovation, adaptation, and growing complexity. EV adoption will continue to place enormous pressure on critical minerals such as lithium, cobalt, nickel, and graphite.

- Mining industry response: Adapting to volatility in mineral prices, integrating sustainability, expanding recycling, and embracing technology convergence will be central to supporting the transition to cleaner transportation.

- Sustainable practices and resource diversification: The pursuit of greener battery technologies may gradually modify the mineral mix—for example, solid-state and sodium-ion batteries—potentially reducing reliance on the most constrained resources.

- Circular economy: Recycling and second-life battery initiatives, while still expanding, are expected to account for a rising share of total mineral supply, especially beyond 2025.

- Policy and social impact: Governments, industry, and communities must collaborate to ensure supply security, ethical practices, and a just transition.

In conclusion: The impact of electric vehicle adoption on mineral demand is reshaping mining and energy sectors. The ability of both industry giants and emerging leaders to innovate, practice environmental stewardship, and ensure equitable supply chains will define the sustainable future of global transportation.

Frequently Asked Questions (FAQ): Impact of Electric Vehicle Adoption on Mineral Demand

1. What is the main driver behind the rising demand for minerals like lithium, cobalt, nickel, and graphite?

The main driver is the global shift toward electric vehicle adoption. As automakers scale up EV production to meet emission regulations and consumer demand, the need for batteries—and thus for essential battery minerals—is soaring.

2. Why are lithium and nickel so critical for EV batteries?

Lithium is the key element for battery cathodes and electrolytes, while nickel (especially high-purity Class 1) boosts energy density and range. Both are vital for next-gen battery performance.

3. What are the main environmental challenges associated with mineral extraction for EVs?

Environmental challenges include water use (especially in lithium brine operations), carbon emissions, tailings waste, and land disturbance. Ethics and local social impacts are also major concerns—especially for minerals sourced from high-risk regions.

4. How is the mining industry addressing sustainability?

The industry is integrating advanced technologies (AI, satellite monitoring), innovating mining methods (e.g., DLE for lithium), adopting renewable energy, and participating in recycling and traceability initiatives to reduce environmental footprint and ensure ethical sourcing.

5. Can recycling and second-life applications for batteries reduce the demand for new mineral extraction?

Yes, but current recycling capacity is still ramping up. Over the next decade, recycling and reuse will play a major role in supplementing primary mineral sources for the EV supply chain.

6. How does Farmonaut’s technology help mining companies?

We at Farmonaut deliver actionable satellite and AI-based monitoring, advisory, and traceability that empower mining operators to oversee extraction, manage resources efficiently, and ensure both environmental and social compliance.

Related Farmonaut Solutions

- Blockchain-based traceability: Ensure transparency in mining supply chains and reduce fraud.

- Carbon footprint monitoring: Track and manage the environmental impact of mining operations.

- Fleet and resource management: Optimize machinery and vehicle operations on mining sites.

- API Developer Docs: Find detailed integration info at Farmonaut API Documentation.

Summary: The Impact of Electric Vehicle Adoption on Mineral Demand

The exponential adoption of EVs by 2025 is reshaping the mining industry, redefining global mineral demand patterns, especially for lithium, cobalt, nickel, and graphite. Fueled by advanced technologies, changing regulations, and consumer pressures, this surge triggers both unprecedented challenges and opportunities.

The future of energy and transportation sectors depends on sustainable mining, innovative practices, and a focus on circular economy strategies.

Satellite technology leaders like Farmonaut will continue to play a crucial role in making the transition to sustainable, data-driven mineral supply chains possible, supporting governments, businesses, and communities in the green revolution.

For detailed queries or integration support, visit the Farmonaut official website.