How to Invest in Lithium Mining: Australia Opportunities

“Australia produces over 50% of the world’s lithium, making it a global leader in lithium mining investment opportunities.”

Investing in Lithium Mining in Australia: Opportunities and Insights for 2025

Lithium mining investment in Australia is set to outpace other mining investment opportunities as the world accelerates toward renewable energy solutions and electrification. Driven by aggressive climate targets and the global adoption of electric vehicles (EVs) and energy storage systems, analysts project demand for lithium to grow at a CAGR exceeding 15% per year through the next decade. For investors seeking mining investment Australia, the sector remains a strategic hotspot for growth, returns, and value in 2025 and beyond.

Australia’s prolific lithium deposits in regions like Greenbushes, Western Australia, and Queensland position it as the largest producer of battery-grade lithium globally, with nearly 50% of world supply. The country’s robust mining infrastructure, emerging technologies, strong regulatory frameworks, and government support make mining investment opportunities in Australia especially attractive for investors globally.

In this guide, we’ll show you how to invest in lithium mining, explore sector trends, highlight key opportunities, analyze risk factors, and share essential insights for 2025 and beyond.

Why Invest in Lithium Mining?

Lithium is widely recognized as the critical component powering the new energy economy. The metal underpins the battery revolution—facilitating rechargeable batteries in electric vehicles, renewable energy storage, and a multitude of portable electronics and grid-scale systems.

- Soaring Lithium Demand: As governments worldwide commit to net-zero targets and carbon-neutral policies, the push for EVs, solar, and wind power solutions is intensifying. Global consumption is projected to experience a compound annual growth rate well above 15% over the next decade, making lithium mining investment opportunities particularly prominent.

- Automakers’ Commitments: Leading automakers are doubling down on electrifying fleets, further accelerating the need for lithium. Corporate ESG strategies and climate-focused funds continue to inject capital into mining investments that support sustainability.

- Australia’s Unique Role: With its abundant mineral resources, well-developed logistics, and progressive environmental policies, Australia remains the world’s lithium powerhouse. Its stable economy and strong legal frameworks further set the stage for safe and lucrative mining investment Australia.

- Attractive Financials: Established and emerging australian companies are offering high returns and competitive advantages in production, technological advancements, and downstream integration, attracting investors eyeing the 2025 market and beyond.

Mining Investment Opportunities in Australia: Key Entry Points

Australia offers diversified entry points for mining investment opportunities across the lithium value chain. Whether you’re considering junior exploration firms, major producers, or supporting infrastructure and services, the sector provides flexible options to suit varying risk tolerances and investment objectives.

1. Junior Lithium Miners and Exploration Companies

- What Are They? Junior lithium miners are emerging exploration companies focused on identifying new deposits and bringing new projects online—often in Western Australia, South Australia, and Queensland.

- Opportunity: Competitive share prices, potentially higher returns, and access to early-stage growth in the sector, albeit with higher risk and market volatility.

2. Established Producers

- Who Are They? Well-known names like Pilbara Minerals, Allkem (Galaxy Resources), and Liontown Resources are actively extracting and exporting lithium at scale.

- Opportunity: These established producers benefit from vast infrastructure, strong capital reserves, and efficient lithium processing—often offering more stable, albeit moderate, ROI.

3. Lithium Processing, Refining, and Battery Material Firms

- Trend: As downstream battery manufacturers covet consistency and quality, firms specializing in lithium processing and refining (e.g., Neometals, Tianqi Lithium) are increasingly critical to the sector.

- Opportunity: Investments in these companies often align with global battery material supply chains, increasing strategic value and margins.

4. Mining Infrastructure and Service Providers

- Examples: Equipment suppliers, logistics companies, and mining tech firms support the sector’s expansion—with returns linked less to lithium pricing and more to operational scale.

- Opportunity: Potential hedges against commodity price volatility, while benefiting from the sector’s overall growth.

Comparative Investment Opportunities Table: Key Australian Lithium Mining Projects (2025 Outlook)

| Company/Project Name | Location (State/Region) | Est. Annual Production (2025, Metric Tons) | Investment Type | Estimated ROI (2025, %) | Risk Level | Major Trends / Notes |

|---|---|---|---|---|---|---|

| Greenbushes Lithium (Talison Lithium / Albemarle) | Western Australia | ~1,400,000 | Stocks, Direct | 14–17% | Low | Largest global lithium mine; expanding processing for battery markets |

| Pilgangoora (Pilbara Minerals) | Pilbara, Western Australia | ~630,000 | Stocks, ETFs | 11–15% | Medium | Major spodumene producer; scaling hybrid extraction tech |

| Mount Cattlin (Allkem, ex Galaxy Resources) | Ravensthorpe, Western Australia | ~210,000 | Stocks, ETFs | 10–13% | Medium | Advanced recovery; merging into larger supply chain |

| Bald Hill (Alita Resources / Lithium miner restart) | Kambalda, Western Australia | ~60,000 | Direct, Private | 20–24% | High | Reopening mine, high-grade spodumene |

| Finniss Lithium (Core Lithium) | Northern Territory | ~191,000 | Stocks, ETFs | 12–16% | Medium | New mine, supply agreements with global OEMs |

| Mt. Marion (Mineral Resources / Ganfeng Lithium) | Goldfields, Western Australia | ~300,000 | Stocks, ETFs | 10–13% | Medium | Focus on sustainable production |

| Kathleen Valley (Liontown Resources) | Western Australia | ~300,000 (future, late 2020s) | Stocks, ETFs, Private | 16–19% | Medium | Construction; long mine life, major automaker offtakes |

Key Considerations and Trends for Mining Investment Australia (2025)

While mining investment opportunities in lithium are promising, investors must conduct thorough due diligence, consider regulatory and technological trends, and manage risks for optimal returns in 2025 and beyond.

Environmental and Regulatory Landscape

- Policies: Australia enforces rigorous environmental policies to regulate mining, water use, land rehabilitation, and biodiversity—especially in Western Australia and South Australia. Projects must gain a social license through community engagement and sustainability.

-

Sustainable Mining: Innovations in carbon footprinting and traceability—such as those supported by

Farmonaut’s Carbon Footprinting Solution—help companies monitor and reduce impacts across their projects.

Technological Innovations and Extraction

- Direct Lithium Extraction (DLE): New methods using solvents or ion exchange are revolutionizing lithium recovery from brine and hard-rock sources, offering higher yields and lower costs.

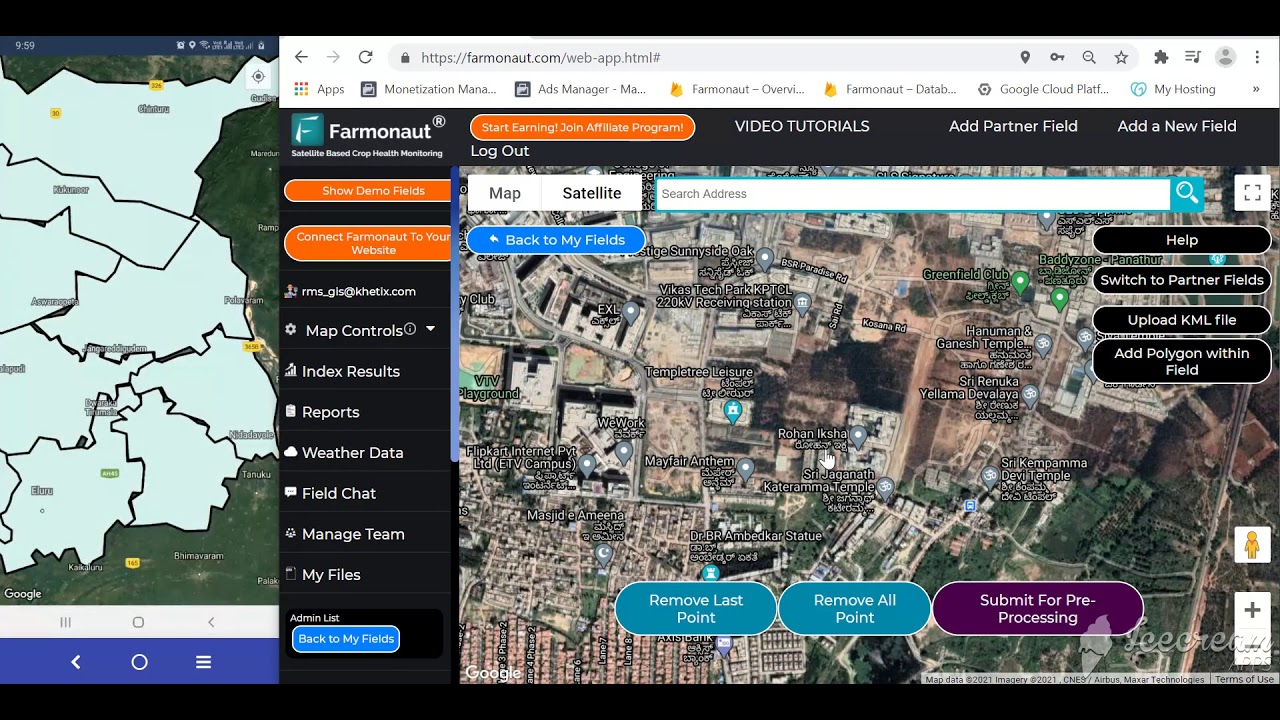

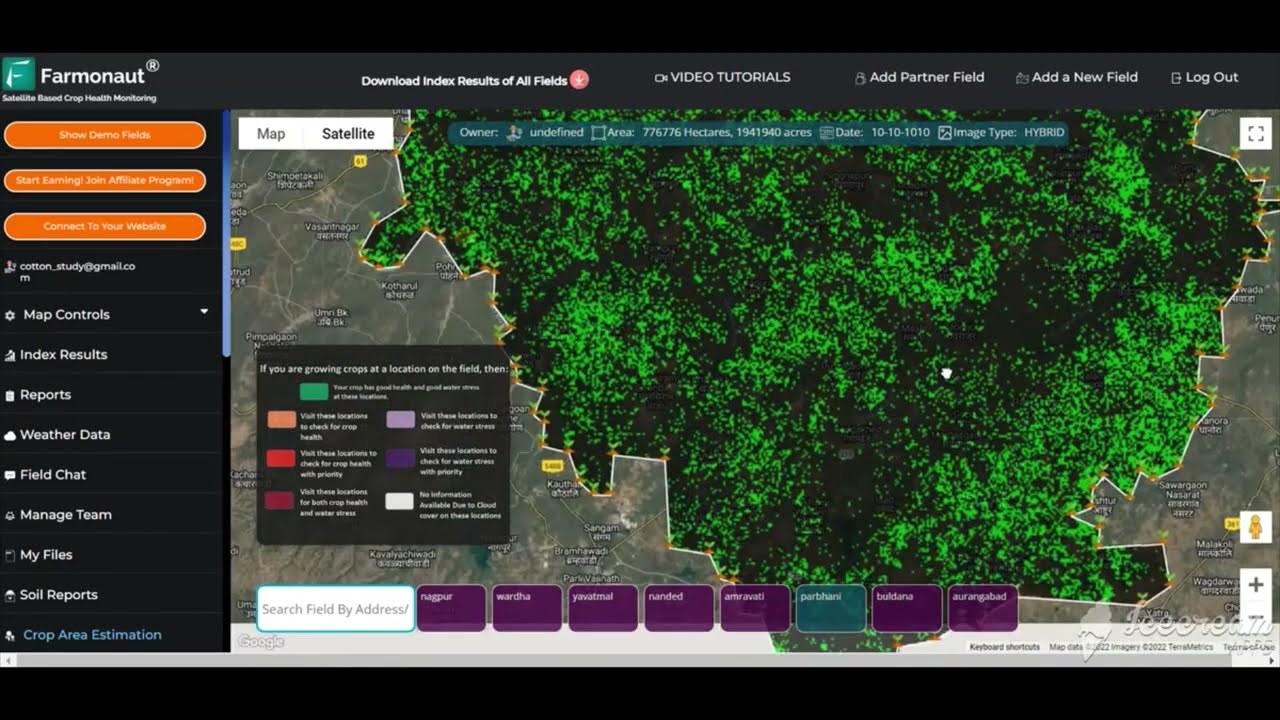

- Advanced Satellite, AI & Blockchain: Satellite-driven platforms like Farmonaut’s Traceability Technology enable real-time environmental impact monitoring and support compliance—boosting transparency and streamlining resource flows across the supply chain.

Global Supply Chain Dynamics

- Geopolitics: Lithium supply faces headwinds due to trade policies and global uncertainties—particularly in South America and China. Australia’s stable government and robust export networks position it as a strategic partner in the global energy transition.

- Clean Energy Focus: World governments and automakers are securing long-term offtakes with Australian mines, reinforcing project viability and returns.

Market Volatility and Pricing

- Dynamics: Lithium prices, though currently strong, can fluctuate due to rapid expansions, new projects, and global demand shifts. Portfolio diversification, hedging strategies, and in-depth sector analysis are key for minimizing risk.

How to Invest in Lithium Mining: Pathways for Investors

Investors have a variety of ways to access mining investment Australia, either through equities, funds, or private capital, depending on their knowledge, risk tolerance, and financial goals.

-

Direct Share Purchases

The Australian Securities Exchange (ASX) features dozens of lithium mining and processing companies. Investors can invest direct in shares using online brokerages. This offers high liquidity, instant exposure, and control over asset selection—especially for those interested in both junior and established mining firms.

-

Exchange-Traded Funds (ETFs)

Lithium-focused ETFs offer diversified portfolios spanning multiple operators (e.g. Global X Lithium & Battery Tech ETF, BetaShares Electric Vehicles and Future Mobility ETF), reducing single-project risk.

-

Private Equity, Direct, and Venture Capital Investments

Qualified investors can access private placements in new projects and joint ventures—often with higher potential returns, but also requiring extensive sector due diligence and a higher risk threshold.

-

Indirect Investments via Battery & Tech Firms

Exposure to the lithium value chain is possible through upstream and downstream investments in battery manufacturing, EV, and technology developers (e.g., Tesla, Panasonic), which are tightly linked to demand for raw materials.

Explore Farmonaut’s API for integrating real-time satellite monitoring and mining data:

Farmonaut API.

Access documentation to build custom mining monitoring solutions in your firm’s workflow:

API Developer Docs.

How Farmonaut Satellite Technology Empowers Lithium Mining & Investment

As mining investment Australia becomes more reliant on technology and efficiency, advanced geospatial solutions are transforming how companies monitor projects, benchmark performance, and ensure sustainable operations. At Farmonaut, we provide affordable and scalable, satellite-based insights for mining sector stakeholders—delivering actionable data across exploration, production, and environmental monitoring.

- Site Monitoring & Resource Management: Our multispectral imaging and real-time monitoring allow investors and companies to track the progress of lithium projects across Australia, evaluate vegetation changes, and detect anomalies before they impact production or compliance.

- Supporting ESG & Regulatory Compliance: With robust carbon footprinting services, we enable clients to transparently report on sustainability, meeting both investor demands and government policy requirements.

- End-to-End Traceability: Blockchain-based traceability solutions help mining firms ensure the provenance and transparency of lithium, building trust with global battery manufacturers and end users.

- Fleet & Logistics Management: Our fleet management tools optimize haulage operations—reducing costs, enhancing safety, and supporting efficient extraction-to-port workflows.

- Financing and Risk Management: Our satellite-based verification streamlines loan and insurance applications for miners by providing third-party authentication of operations and assets.

Looking to scale up your lithium mine’s monitoring or streamline ESG processes? See our Large Scale Mine Management Portal for hands-on administration at scale.

2025 Growth Trends: What to Watch in Lithium Mining Australia

Key Sector Trends Shaping Mining Investment Opportunities for 2025

- Ongoing Investment in New Deposits: Recent discoveries and the expansion of brownfield projects—especially in Western Australia and Queensland—have paved the way for robust supply increases, higher production, and job creation.

- Technologies Transforming Extraction & Processing: Artificial intelligence (AI), machine learning, and blockchain enhance operational efficiency, environmental monitoring, and traceability throughout the lithium supply chain.

- Government Incentives & Policy Support: Australia actively supports responsible resource development through funding programs, tax incentives, and research partnerships—favorable dynamics for new mining investment.

- Booming Battery Markets: Surging EV adoption, national grid storage initiatives, and portable electronics markets continue to pull demand, keeping lithium a strategic and lucrative focus for investors eyeing 2025.

- Increased Focus on Sustainability: Projects are increasingly required to incorporate environmental, social, and governance (ESG) best practices, helping to unlock significant institutional capital and brand value.

- Global Trade & Security of Supply: As trade frictions increase, major battery OEMs and governments are forming new supply agreements directly with Australian mines, prioritizing security and transparency.

FAQ: Investing in Lithium Mining in Australia

What is driving demand for Australian lithium mining investment opportunities?

Rapid expansion in electric vehicle production, grid-scale energy storage, and growing portable electronics consumption are pushing global lithium demand higher. Australia’s abundant resources and established export networks make it the keystone of global supply.

What types of lithium mining companies can I invest in for 2025?

Investors can choose among junior exploration firms, established producers, and companies specializing in lithium processing, battery refining, and supporting services. ETFs and direct equities are common investment routes.

How can I minimize risk in a volatile market?

Diversify across project stages, leverage ETFs, invest in both mining and processing companies, and use third-party insights or satellite monitoring (such as those delivered by Farmonaut) for operational transparency and trend analysis.

What technologies are influencing the lithium sector most?

Direct lithium extraction (DLE), AI-driven resource mapping, advanced environmental monitoring, and blockchain traceability are propelling the sector toward higher yields and greater sustainability.

Are there regulatory or sustainability issues to watch?

Yes. Australia’s environmental and land use regulations are among the world’s strictest, demanding clear ESG planning and compliance. Innovative carbon management and traceability ensure ongoing project viability and support strong international partnerships.

Conclusion: Charting a Profitable Course in Australian Lithium Mining 2025+

As global efforts toward clean energy and vehicle electrification accelerate, lithium remains the critical component—powering batteries that underpin the energy transition. For investors seeking robust, future-proof growth, mining investment opportunities in Australia offer a compelling risk/reward profile in 2025 and beyond.

The country’s strong government support, favorable regulatory landscape, abundant mineral deposits, and advancing technology trends position it as the undisputed global leader in lithium production and export. By carefully analyzing project options, monitoring market dynamics, staying ahead with technological innovations, and leveraging real-time data and satellite-based solutions, investors can seize attractive investment opportunities—balancing growth with sustainability.

As we move into 2025 and beyond, lithium mining in Australia is not just an investment in commodities—it’s an investment in the future of mobility, energy storage, and global technological advancement.