Taxation and Royalty Regimes in Mining: 2025 Trends

Summary: Taxation and Royalty Regimes in Mining: Navigating the Future in 2025

“Over 60% of mining countries plan to revise royalty rates by 2025 to boost sustainability and government revenue.”

Mining Sector Overview: Economic Relevance & Demand Trends (2025)

The mining sector remains a cornerstone of economic development globally, providing essential raw materials for industries ranging from construction and infrastructure to defense and technology in 2025. The strategic significance of minerals—from base metals like copper and nickel to critical minerals such as lithium and rare earth elements—continues to rise as demand grows in response to:

- Green transition and clean energy adoption (solar, wind, batteries)

- Rapid urbanization—growth in construction and infrastructure development

- Technological advancements requiring specialty and critical minerals

- Global rise in foreign and domestic investments in mining ventures

As resource-rich countries seek to capitalize on rising demand, the design and adaptation of taxation and royalty regimes in mining becomes increasingly critical for governments to ensure adequate revenue generation, support sustainable mining operations, and attract investments.

Understanding Taxation and Royalty Regimes in Mining

To fully grasp the future of mining fiscal frameworks, it’s important to understand the core elements of taxation and royalty in mining:

- Taxation typically refers to the broad spectrum of fiscal policies imposed on mining companies, including corporate income tax, capital gains tax, and import duties on equipment.

- Royalties are payments made to the government based on the volume or value of minerals extracted and sold.

- While taxation ensures that governments receive a fair share of profits, royalties provide a direct link to resource extraction—enabling the state to benefit even when mining operations show low profitability or delayed cash-flow generation.

The interplay of taxation and royalty regimes in mining helps balance revenue, investment incentives, and the overarching necessity for sustainable development.

Types of Royalties and Taxation Applied Globally

- Ad valorem royalties – calculated as a percentage of the mineral’s sales value

- Specific (unit-based) royalties – a fixed charge per tonne of mineral extracted

- Profit-based royalties – based on the net profits from mining activities

- Corporate income tax – imposed on the taxable income of mining companies

- Withholding taxes, capital gains taxes, and import duties – may also apply

Country-specific regimes often combine several of the above, striving to attain an effective, fair, and investment-friendly mix that aligns with national development priorities.

Current Trends, Challenges & Evolving Approaches in Taxation and Royalty Regimes in Mining (2025)

As of 2025, taxation and royalty regimes in mining are undergoing dynamic transformation, influenced by technological, economic, and environmental factors. Let’s explore critical trends and persistent challenges:

-

Balancing Revenue Generation and Investment Incentives

- Governments face the challenging task of setting rates high enough to generate adequate revenues without deterring investments.

- Overly burdensome tax or royalty frameworks may lead to reduced exploration and production activities, while lenient regimes may deprive countries of critical funds for development.

Key point: Many resource-rich countries are reviewing fiscal policies to find a sustainable balance for 2025 and beyond.

-

Sustainability and Environmental Considerations

- 2025 is witnessing environmental sustainability become integral to taxation and royalty regimes in mining.

- Green taxes, environmental levies, and resource-use tariffs are being introduced or considered to incentivize the adoption of cleaner technologies and reduce externalities like carbon emissions and water pollution.

Example: Carbon taxes and water-use royalties are gaining ground in jurisdictions from Australia to Canada.

-

Transparency and Compliance: Tackling Illicit Financial Flows

- Adopting internationally recognized transparency standards—such as the Extractive Industries Transparency Initiative (EITI)—is becoming mainstream.

- Digitalization is transforming compliance, with automated royalty collection systems and blockchain-based reporting (like those enabled by Farmonaut’s traceability products) providing new tools to prevent revenue leakage.

In fact: Blockchain ensures transparency, security, and auditability at every stage of a mineral’s journey.

-

Community Participation and Benefit Sharing

- Modern taxation and royalty frameworks increasingly include community development royalties or mandates for profit-sharing with local stakeholders.

- This approach aims to reduce social conflict, support local infrastructure growth, and benefit directly impacted communities.

Impact: Community focus helps sustain mining operations’ “social license to operate.”

“In 2025, 40+ nations will introduce new tax incentives to attract mining investment amid evolving global regulations.”

Key Elements of Effective Taxation and Royalty Regimes in Mining

A successful taxation and royalty regime in mining is neither static nor one-size-fits-all. The future points toward adaptive, sustainable, and fair frameworks focused on:

- Progressivity: Implementing sliding-scale royalties (e.g., rates move alongside mineral prices or company profitability) to stabilize government revenues throughout commodity cycles.

- Stability Clauses: Fiscal stability agreements protect investments against abrupt political, legal, or taxation regime changes—critical in fostering long-term investments and planning.

- Clarity on Cost Recovery: Clear provisions on deductible costs for taxable income calculations prevent base erosion and aggressive tax planning.

- Exploration Incentives: Tax credits and upfront deductions spur new resource discovery—foundational for industry sustainability.

- Environmental & Social Incentives: Reduced taxes or royalties for companies adopting sustainable practices and investing in local infrastructure or community projects.

Modern regimes are thus striving to fulfill the dual objectives of securing public revenues and driving responsible industry growth.

2025 Mining Taxation and Royalty Regime Comparison Table

To provide a clear, comparative snapshot, here is a data-driven overview of mining fiscal regimes across key regions for 2025. This table includes taxation rates, royalty types and averages, notable trends, and projected impacts on industry investment:

| Country/Region | Corporate Income Tax Rate (%) | Royalty Rate Type | Avg. Royalty Rate | 2025 Trend/Change | Industry Investment Impact |

|---|---|---|---|---|---|

| Australia | 30 | Ad valorem (sales value) | 2.5%–7.5% | Introduction of carbon royalties and community agreements | Medium |

| Canada | 15–27 | Profit-based, Ad valorem | 1%–5% (provincial variance) | Resource tax incentives for critical minerals | High |

| Chile | 27 | Progressive (price-based) | 3%–14% | Sliding-scale model based on copper/lithium prices | Medium |

| African Union (select states) | 25–35 | Ad valorem, Unit-based | 3%–10% | Upward revision of royalties; focus on community benefit sharing | Medium–Low |

| India | 25 | Ad valorem | 2%–8% | Royalty rationalization, digital payments, traceability tech adoption | Medium |

| Brazil | 34 | Ad valorem (gross revenue) | 1.5%–4% | Stronger ESG-linked fiscal incentives | High |

| South Africa | 28 | Profit-based, Ad valorem | 0.5%–7% | Mandated social investments and job quotas | Medium–Low |

| Russia | 20 | Ad valorem, profit-based | 4%–8% | Industry restructuring, extended digital audit | Low |

*All values are modelled or estimated averages as of 2025 and subject to legislative updates.

This at-a-glance table offers sector participants and observers essential clarity on the evolving landscape of mining taxation and royalty frameworks worldwide.

Global Outlook & Trends Shaping Mining Fiscal Regimes into 2025 & Beyond

As we move deeper into the 2025 decade, taxation and royalty regimes in mining face new priorities driven by shifting economic, environmental, and technological drivers. Let’s summarize the transformational trends:

- Resource Nationalism—Governments are increasingly seeking greater economic participation, introducing windfall taxes and local content requirements.

- Critical Minerals Race—Global focus on lithium, cobalt, rare earths, and copper is intensifying as nations vie for supply chain security and defense applications.

- Green Fiscal Reforms—ESG (Environmental, Social, Governance) standards are spurring targeted incentives—like carbon credits and emissions-based tax breaks—pushing mining firms toward sustainable practices.

- Digital Transformation—Digital tax administration, blockchain traceability, and automated royalty collection are mainstreaming, boosting compliance and transparency.

- Global Coordination—More countries are coordinating tax base and reporting standards to curb tax avoidance and enhance multinational compliance.

Technological Innovation, Sustainability, and Transparency in Taxation and Royalty Regimes in Mining

Modern technologies such as satellite monitoring, advanced data analytics, automation, and blockchain are revolutionizing how companies and governments monitor mining operations, ensure compliance, and optimize taxation and royalty outcomes.

Key Innovations Impacting Mining Fiscal Regimes:

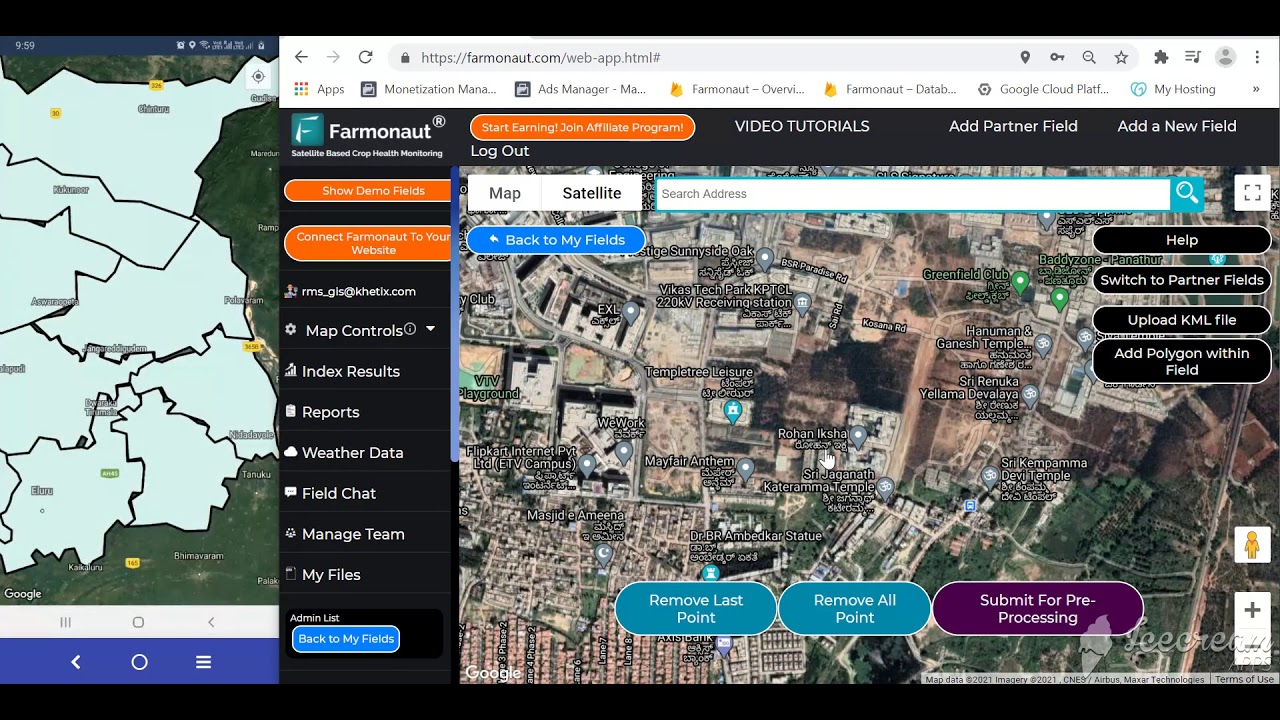

- Satellite-Based Monitoring: Enables real-time tracking of extraction activities, accurate volume/value reporting, and environmental inspections—essential for revenue estimation and regulatory oversight.

- AI and Data Analytics: Support predictive modeling for production, tax forecasting, and identifying fiscal risks, optimizing royalty revenue streams.

- Blockchain Traceability: Ensures end-to-end transparency in mineral extraction and trade, reducing risk of underreporting, fraud, or illicit flows.

- Environmental Impact Tools: Platforms such as Farmonaut support carbon footprinting (learn more about Farmonaut’s carbon footprinting), water-use analytics, and ecosystem monitoring to help mining companies align with new environmental tax policies.

By embracing these technological advances, both governments and companies are better positioned to meet 2025 compliance standards and sustainability targets while maximizing sectoral revenues and stakeholder trust.

See Developer API Docs for details on retrieving mining and environmental data via Farmonaut’s API.

Explore Farmonaut’s blockchain-powered product traceability for mining supply chains.

Farmonaut Insights: Supporting Mining, Sustainability, and Compliance

At Farmonaut, we empower businesses, governments, and users across the mining industry with scalable, satellite-driven solutions that address the full spectrum of 2025 taxation and royalty regime challenges. Here’s how our platform aligns with the sector’s evolving needs:

-

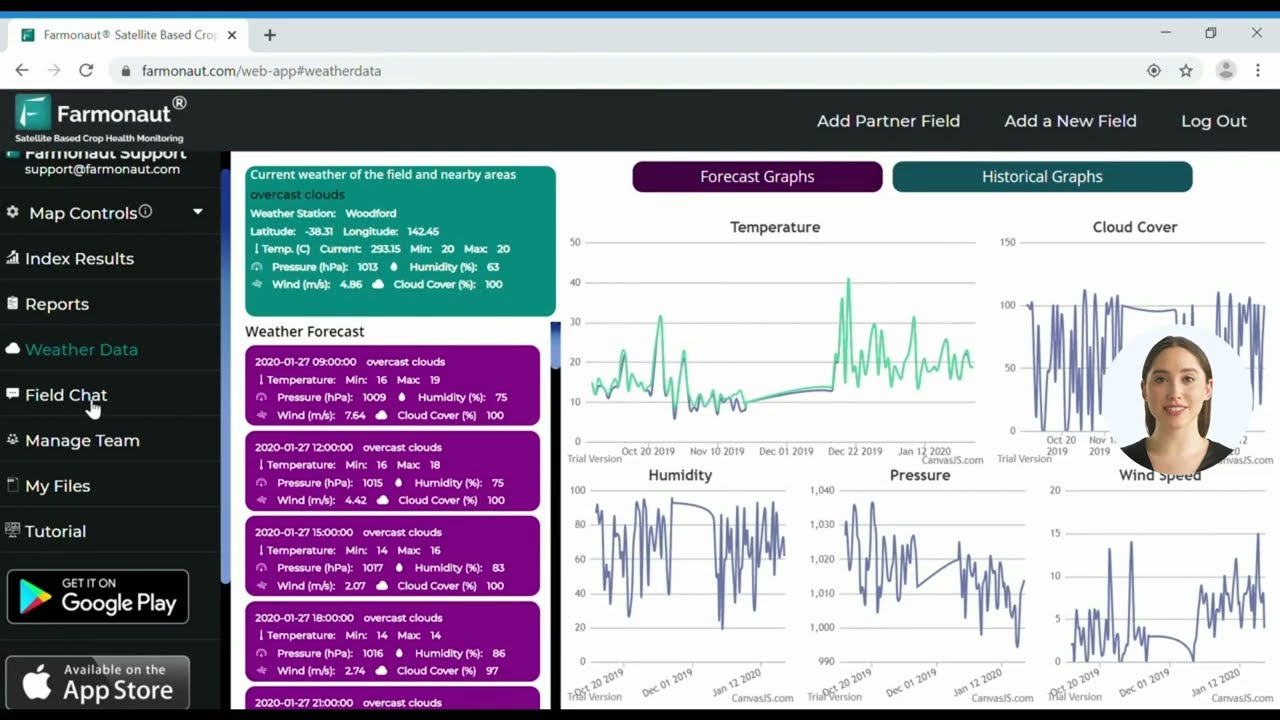

Satellite Monitoring & Compliance:

- Our platform supplies real-time, multispectral satellite imagery for accurate tracking of mineral extraction activities.

- This is invaluable for transparent royalty calculations and regulatory reporting, helping governments and companies meet compliance requirements.

-

AI Driven Mining Advisory:

- Our Jeevn AI Advisory System analyzes field conditions and mining operations, delivering customized guidance to support both sustainability and fiscal optimization.

- This helps mining operators understand the tax implications of new extraction methods, environmental levies, and regional policy shifts.

-

Blockchain Traceability:

- Our traceability solution assures authorities of full digital transparency, supporting anti-fraud, auditing, and compliance with global ESG standards.

-

Environmental Impact Tracking:

- Our environmental monitoring tools provide actionable insights on carbon emissions and water usage, helping mining companies adjust to new environmental taxation and royalty policies.

-

Fleet and Resource Management:

- Optimize asset utilization and logistics, ensuring more accurate operating cost reporting for tax purposes by leveraging Farmonaut’s fleet management tools.

Farmonaut’s commitment is to provide robust, cost-effective, and accessible technologies to all sector participants seeking to thrive under evolving taxation and royalty frameworks in mining, driving greater transparency, sustainability, and operational resilience.

To help scale your mining and resource management operations with advanced satellite technology, visit our

Large-scale field mapping and management portal.

FAQ: Taxation and Royalty Regimes in Mining (2025)

What is the difference between mining taxation and royalties?

Taxation refers to taxes imposed on mining company profits or activities, such as corporate income tax, capital gains tax, or import duties. Royalties are payments made based directly on the volume or value of minerals extracted and sold. While taxes are linked to profitability, royalties ensure governments benefit regardless of profits.

Why are countries revising taxation and royalty regimes in mining in 2025?

Most nations are revising these regimes to boost government revenues, align with emerging environmental priorities, attract sustainable investment, and promote community benefit sharing. Modern digital and technological trends drive this evolution.

How does technology enhance compliance and transparency in mining?

Technologies such as satellite monitoring, blockchain, and AI enable real-time visibility of mining activities, automated royalty calculations, and tamper-proof reporting, greatly reducing the risk of underreporting and corruption.

What incentives are offered for sustainable mining practices under new regimes?

Countries are increasingly offering tax breaks, royalty reductions, or exploration credits to companies adopting low-carbon technologies, reducing emissions, or investing in community infrastructure.

How can miners prepare for compliance with evolving 2025 fiscal policies?

By investing in modern monitoring systems (like those available via Farmonaut), improving internal data analytics, staying informed on regional reforms, and actively engaging in transparent reporting to regulators and communities.

Conclusion: Navigating the Future of Mining Taxation and Royalty Regimes

In 2025, taxation and royalty regimes in mining represent a critical pivot point for the sector and governments globally. The landscape is evolving—driven by rising demand for critical minerals, the necessity for sustainable practices, and the progress of technologies supporting transparency and compliance.

Well-designed mining fiscal frameworks will strike a balance: securing adequate government revenues, attracting responsible investments, and advancing both environmental and community benefit objectives. As new challenges arise in an increasingly complex global market, embracing innovation and collaborative problem-solving remains essential.

At Farmonaut, we support policy-makers, industry leaders, and communities in navigating these transitions by providing affordable, scalable, and actionable satellite-driven solutions for real-time monitoring, environmental compliance, and digital traceability. Visit our crop loan & insurance verification portal to learn how satellite insights can support fair access to mining sector financing.

As the sector continues to transform, staying ahead of regulatory and fiscal trends is not just a compliance goal—but a strategic imperative for economic growth, sustainability, and the shared benefit of mineral wealth.