Used Harvesting Equipment Prices: 7 Brazil Trends for Informed Buyers

“In Brazil, used harvesting equipment prices rose by 12% in 2023 due to increased demand and limited supply.”

Introduction

In the modern Brazilian agricultural and forestry sectors, efficiently managing and processing crops and timber is heavily reliant on robust harvesting equipment. Whether you’re a farmer, logging operator, or machinery dealer, the acquisition of such machinery—new or used—represents a significant investment. With the rapid evolution of technologies, shifting market dynamics, and new trends in precision farming, understanding the key factors influencing used harvesting equipment prices has never been more crucial.

Brazil, one of the world’s agricultural powerhouses, is witnessing distinct trends in the resale and purchasing of used harvesting machines. This blog delves deep into:

- What determines the price of used harvesters

- Typical price ranges for the most popular machines

- Brazilian market trends and forecasting for 2024-2025

- Best practices for evaluating and buying used agricultural machinery

- Financing and technology considerations

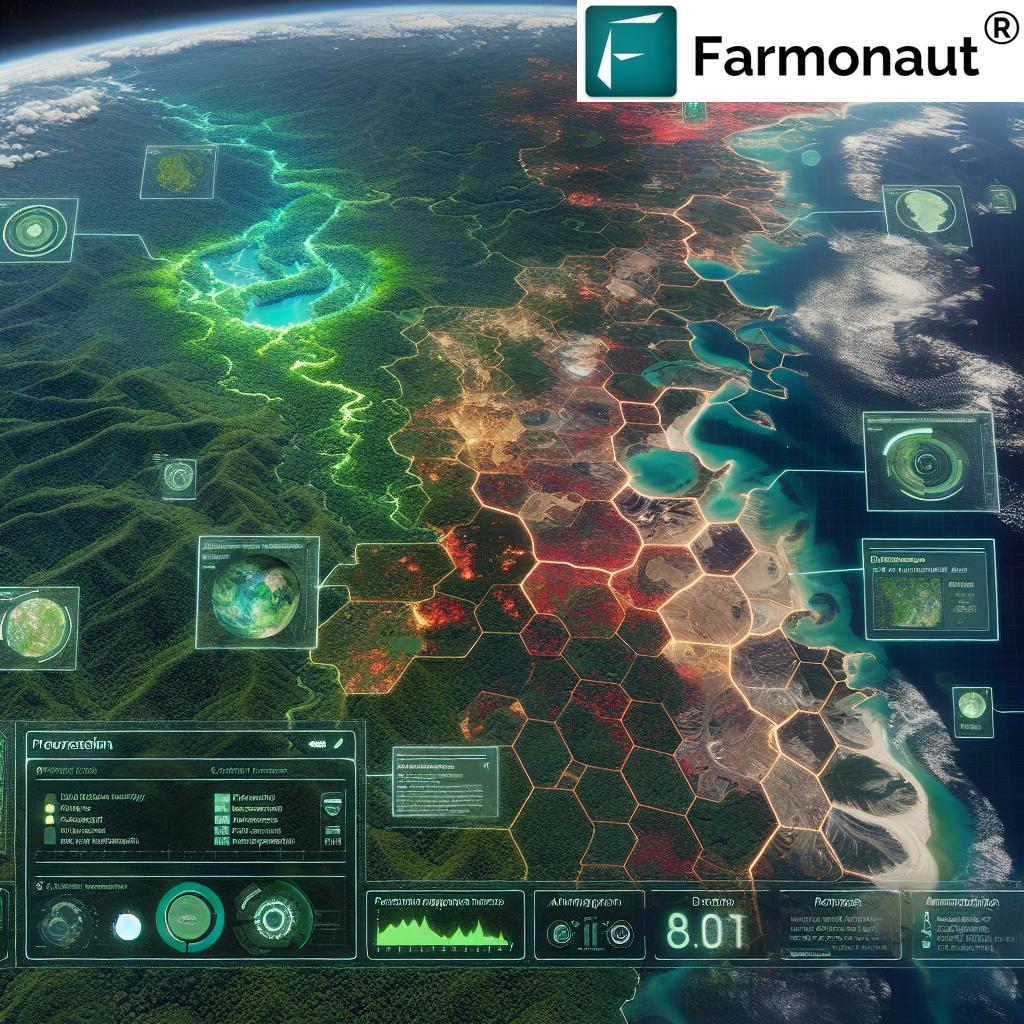

We’ll also highlight how precision agri-tech solutions from Farmonaut help buyers make more informed, data-driven decisions in the used equipment market, helping optimize returns on investment.

Key Factors Influencing Used Harvesting Equipment Prices

The pricing of used harvesting equipment is rarely arbitrary. Multiple intricate factors play into how machines are valued and what you’ll pay or receive in the resale market. Let’s explore the most important indicators:

- Age and Usage (Operational Hours)

- Newer machines with fewer operating hours typically command higher prices.

- For example, a 2021 John Deere S790 Combine Harvester with 1,964 hours is offered at $254,000, while a 2013 model with 2,316 hours sells for $109,000.

- The difference in price reflects not only the expected useful life remaining but also possible technological features.

- Condition and Maintenance History for Farm Machinery

- Well-serviced, regularly maintained equipment with clear records (documented service history) attracts higher values.

- Buyers should prioritize inspection for wear or signs of neglect—lack of maintenance can drastically reduce value and reliability.

- machines with minimal visible damage and proven service history remain valuable even as they age.

- Brand and Models

- Brand reputation is a major influencer—John Deere, Case IH, and New Holland are especially popular in Brazil’s used equipment landscape, known for durability, performance, and higher resale values.

- Certain models become preferred for their proven features or reliability within specific sectors like forestry and large-scale grain harvesting.

- Technological Features and Capabilities

- Modern precision farming equipment—those equipped with GPS autosteer, yield mapping, or IoT connectivity—fetch up to 12% higher prices at auction in Brazil.

- These advanced technologies increase efficiency and reduce operational costs, making such features a premium factor.

- Market Demand and Supply Dynamics

- Macro trends and demand–supply balance—the used machinery market in Brazil recently saw upward price trends from low stock and increased demand for harvesting machines in the 2023-2024 season.

- Surpluses, such as the 2024 U.S. spike in unsold tractors and combines, contributed to a downward impact on prices in some cases, emphasizing volatility in the marketplace (read market report).

For advanced monitoring and fleet optimization, see our Fleet Management tools—manage machinery, reduce costs, track fuel and improve safety.

To ensure transparent supply chains in Brazilian agriculture and forestry, learn about our Blockchain Product Traceability Solutions.

Price Ranges for Used Harvesting Equipment: Brazil Focus

Understanding typical price ranges helps farmers and dealers establish realistic budgets and negotiate effectively. Prices vary widely based on age, condition, technological features, brand, and model, but the following estimates reflect the current Brazilian market:

-

Used Combines for Sale: $50,000–$200,000 USD

- Newer, low-hour models like a 2019 Case IH 8250 (1,080 hrs) appear at the high range (find current listings).

- Mid-2010s models typically offer the best balance for buyers.

-

Forage Harvesters: $4,000–$9,000 USD

- Used options suitable for silage—price swings by usage and wear (see forage harvester price guide).

-

Feller Bunchers (Forestry): $55,000–$120,000 USD (used)/$180,000+ USD (new)

- Known for high operational efficiency in heavy timber harvests.

- Cost-effective for bigger operations despite higher maintenance costs (learn about forestry equipment price trends).

-

Other Machinery (Headers, Planters, Balers): $3,000–$45,000 USD

- Ranges depend on needs, especially condition, age and precision options.

The increased adoption of advanced technologies and precision farming equipment can further influence these ranges in the coming years as market trends show growing demand for digitalized, efficiently managed operations.

Comparative Price & Feature Trend Table: Used Harvesting Equipment in Brazil

| Equipment Type | Average Price Range (USD) | Year of Manufacture | Condition | Main Price Influencer | Market Trend (2024-2025) |

|---|---|---|---|---|---|

| Combine Harvester | $50,000 – $200,000 | 2013 – 2023 | Good–Excellent | Technological Upgrades, Brand | Rising |

| Forage Harvester | $4,000 – $9,000 | 2012 – 2020 | Fair–Good | Maintenance history, Usage | Stable |

| Feller Buncher (Forestry) | $55,000 – $120,000 | 2010 – 2022 | Good | Brand, Operational Costs | Rising |

| Planter (Row Crop) | $7,000 – $45,000 | 2010 – 2021 | Fair–Good | Availability, Demand | Stable/Decreasing |

| Baler | $3,000 – $32,000 | 2010 – 2020 | Fair | Condition, Age | Stable |

| Header (Grain/Forage) | $2,000 – $14,000 | 2011 – 2020 | Good–Very Good | Model, Compatibility | Stable |

*Estimated averages for Brazilian market, 2024. Factors may shift due to regional and global market fluctuations.

“Over 60% of Brazilian farmers consider financing options crucial when purchasing used agricultural machinery.”

Harvesting Equipment Market Trends: Brazil’s Dynamic Landscape

Brazil’s harvesting equipment market trends echo global shifts yet reflect unique local demand cycles, regulatory changes, and evolving production priorities.

Key trends and recent market insights include:

-

Used Equipment Prices Increased Significantly in 2023

Continued strong demand for used combines and feller bunchers pushed prices up by about 12%—more than the global average. -

Inventory Swings Lead to Bargain Windows

After several years of tight supply, dealerships in early 2024 report larger stocks of used machinery—pressuring prices down and improving buyer choice. -

Precision Agricultural Machinery Now Favored

Equipment equipped with yield monitors, auto-steering or advanced technologies saw the sharpest price gains and remain in high demand. -

Financing Program Availability Drives Sales

Financing flexibility and OEM “certified pre-owned” programs are now decisive—over 60% of local farmers cite financing options for farm equipment as essential. -

Environmental and Traceability Requirements Rise

Machines that are eligible for emissions upgrades or blockchain-based traceability see increased interest (explore sustainability and carbon footprint tracking with Farmonaut). -

Buyers Seek to Maximize Operational Uptime

In the wake of labor shortages and rising costs, buyers are prioritizing dependable machinery to avoid lost harvest days in the country’s tight seasonal windows.

Staying informed about these trends helps farmers and dealers determine the best times to buy or sell, as well as what features attract higher values in rural Brazil’s specialized market.

Looking to launch environmentally responsible operations? See our Carbon Footprinting platform for actionable emissions data and sustainable practice planning.

How to Evaluate Used Harvesters: A Step-by-Step Guide for Buyers

“How to evaluate used harvesters” is a common question among Brazilian farmers and dealers—and for good reason! Skipping a methodical assessment can lead to unforeseen costs and poor operational performance.

A Smart Inspection Checklist

-

Conduct a Thorough Physical Inspection

- Evaluate chassis, cutter bars, chains, tires, and engine for wear or excessive repairs.

- Check for signs of recent repainting (may mask prior damage).

- For forestry equipment, closely inspect hydraulic systems on feller bunchers for leaks or sluggish operation.

-

Review Maintenance Records and Service History

- Prioritize machines with thorough records of servicing and parts replacement.

- Lack of documentation is a risk factor—well-maintained equipment has higher resale values.

-

Verify Age and Operating Hours

- Odometers and hour meters should match visual condition.

- Remember: high-hour units (over 4000-5000 hrs for combines) often have limited useful life left without major refurbishment.

-

Assess Technological Compatibility

- Can the machine integrate with your planned or existing precision farming systems (yield monitors, satellite receivers, remote fleet tools)?

-

Run the Engine and Functional Test

- Where possible, request a test harvest—listen for abnormal sounds, vibration, and performance lags.

-

Check for Aftermarket Programs/Upgrades

- Some certified pre-owned options from major brands include emissions upgrades or new GPS capabilities for enhanced value.

Pro Tip:

- Use digital farm management platforms (e.g., Farmonaut App) for organizing equipment records, monitoring fleet status, and scheduling maintenance.

- Integrate large-scale farm management features to keep all operational data and season plans in one secure location.

Precision Farming Equipment: Technology’s Big Impact on Value

Upgrading to precision farming equipment can transform your bottom line and land value—especially in Brazil’s competitive cash crop sector. Machines with these advanced technologies now typically:

- Sell faster and at higher prices on the used market, especially during auction cycles or periods of peak demand.

- Enable data-driven decisions—integration with satellite monitoring, yield mapping, and GPS guidance systems allows for optimized planting, reduced overlap, real-time adjustments and input savings.

- Qualify for certain financing or green investment programs aimed at sustainable agricultural production.

In Brazil, equipment with such features saw a 12% price premium in 2022-2023 compared to basic models (source).

At Farmonaut, we empower farmers and dealers with affordable ways to manage precision farming data—with essential tools like:

- Satellite crop health monitoring & yield prediction

- Carbon footprint tracking for better environmental compliance

- AI-driven advisories for efficient resource allocation

Accessible via App, API or browser.

Financing Options for Farm Equipment Buyers in Brazil

For most farmers, financing options for farm equipment can be the difference between accessing a new harvester or sticking with outdated machinery. Here’s what to consider in the Brazilian marketplace:

-

Loans and Leasing Programs

- Traditional bank loans for used machinery with variable term lengths

- Manufacturer programs for certified used equipment sometimes offer discounted rates

-

Certified Pre-Owned Programs

- Some OEMs provide warranty, maintenance, and emissions compliance as part of the deal

- Financing availability is often tied to equipment having advanced technological features

-

Digital & Remote Verification

- Farmonaut’s satellite-data-backed verification helps financial institutions reduce fraud risk—unlocking access to faster crop loans and insurance programs. (explore options)

The verdict? Shop around, read the fine print, and, where possible, use data-driven platforms to track equipment value, usage, and available tax or carbon incentive programs.

Farmonaut: Enhancing Decision-Making in Used Harvesting Equipment Acquisition

At Farmonaut, our mission is to make precision agriculture accessible and actionable for farmers, dealers, and agribusinesses. By leveraging satellite-based farm management solutions, AI advisories, and blockchain-powered data, we help you:

- Monitor crop health/soil moisture from your phone, tablet, or PC—before, during and after harvest.

- Analyze the ROI of precision technology investments on a field-by-field basis.

- Plan equipment purchases and maintenance schedules based on real-time operational data.

- Fulfill carbon, traceability, and sustainability goals with minimal extra costs.

Our technology is modular—scale up as your fleet grows without replacing existing systems. Use our app or API, and integrate with your preferred dealer or bank to streamline asset management and financing applications.

FAQ: Used Harvesting Equipment Prices & Trends in Brazil

1. What are the most important factors influencing used harvesting equipment prices?

- Age and usage (operating hours), condition, maintenance history, brand, technological features, and current supply and demand trends.

2. How can I verify the maintenance history for farm machinery?

- Request service records. Where possible, use digital record-keeping platforms such as Farmonaut’s fleet management solutions for ongoing data tracking.

3. Why are precision farming equipment and technology upgrades so valuable?

- They increase yields and efficiency, lower input waste, and raise resale values. Machines with these features often match to higher price points and qualify for certain financing options for farm equipment.

4. What is the typical price range for used combines for sale in Brazil?

- The range is roughly $50,000–$200,000 USD depending on age, hours, brand, condition, and features.

5. How do market trends impact my used equipment purchasing decision?

- Buying during periods of oversupply can mean bargains, while low inventory can drive prices up. Stay informed on local conditions!

6. What is the best way to assess the real value of a machine before buying?

- Combine an in-person inspection, review of records, and use of digital farm management systems for informed decision-making.

Conclusion

Understanding used harvesting equipment prices in Brazil—and the many factors influencing equipment prices—prepares you for smarter purchasing in today’s changing market. Whether you’re investing in the latest precision farming equipment or optimizing your mixed fleet with high-value used combines for sale, careful evaluation and awareness of market trends are crucial.

At Farmonaut, we’re committed to making the power of big data, precision ag, and advanced digital oversight accessible for Brazilian farmers—helping you increase productivity, ensure asset transparency, and reduce risk in every phase of machinery life.

Ready to take your farm or dealership to the next level? Explore Farmonaut’s full digital ag suite or connect with our teams.

With data, technology, and industry insights at your side, your next used harvesting equipment purchase will be your smartest investment yet.