Agricultural Financing Solutions Texas: Top 2025 Options

Discover top agricultural financing solutions in Texas for 2025—featuring loans, credit, risk management, and strategies for resilient farm growth. Read on for a comprehensive guide to empower your farming business for a sustainable and prosperous future.

“Texas agricultural loans reached $3.5 billion in 2023, supporting resilient farm growth and new agribusiness ventures.”

Summary: Agricultural Financing Solutions in Texas — Empowering Farmers for a Sustainable Future

Texas, with its vast and diverse agricultural landscape, remains a cornerstone of the U.S. agricultural economy. As we approach 2025, agricultural financial solutions in Texas continue to evolve, fueled by technological advancements, digital platforms, and a growing focus on resilience and sustainability. Securing effective credit, loans, and risk management products is essential for Texas farmers and agribusinesses to scale, diversify, and adapt to a dynamic market driven by changing climate and consumer preferences.

The agricultural financing landscape has broadened, with traditional options from banks and the USDA being augmented by state-specific programs, digital lending solutions, and sustainability-linked financing. These diverse solutions help mitigate risk, provide access to capital, and empower Texas farmers for a sustainable future.

Current Agricultural Finance Landscape in Texas

Agricultural financing solutions Texas cover a broad spectrum of needs, supporting large-scale agribusinesses and family farms alike.

- Crop production loans help finance seeds, fertilizers, chemicals, and labor during critical growth periods.

- Equipment loans fund the acquisition or upgrade of tractors, harvesters, irrigation systems, and precision ag tech.

- Land acquisition loans enable farmers and ranchers to expand acreage or secure long-term land tenure.

- Lines of credit provide flexibility for working capital needs, especially during fluctuating market cycles or natural disasters.

Key players in the current agricultural financial solutions landscape:

- Farm Credit Banks and Commercial Banks: Many Texas-based lenders operate specialized agricultural divisions, offering dedicated loan products with competitive terms tailored to local crop and livestock cycles.

- USDA Farm Service Agency (FSA): A pivotal provider, especially for beginning and socially disadvantaged farmers, offering low-interest loans and flexible repayment schedules for farm startup, expansion, and operating expenses.

- Texas Agricultural Finance Authority (TAFA): A state agency offering targeted, low-interest loans supporting modernization, rural agribusiness projects, conservation, and property expansion.

In Texas, these programs remain popular due to flexible terms and accessibility. For farmers and producers aiming for stability, these traditional financial frameworks serve as a foundation for resilient farm growth.

Texas’s Broad Spectrum of Financing Solutions: Why They’re Essential for Farm Businesses

Texas agricultural producers operate in a region defined by diverse climate patterns, from semi-arid zones in West Texas to humid coastal prairies. As a result, financing solutions must be responsive to a broad spectrum of working capital needs, ranging from crop production and risk management to disaster relief and expansion support.

Key Benefits of Current Texas Financing Programs

- Competitive interest rates and longer repayment periods for farmers.

- Support for innovative projects in climate-smart agriculture and conservation.

- Programs targeted at beginning farmers, socially disadvantaged groups, and rural communities.

- Insurance-integrated loan products that manage risk from uncertain weather and volatile commodities.

In 2025, agricultural financing in Texas continues to be essential for scaling, diversifying, and modernizing farm operations. Access to capital is a key driver of innovation and rural prosperity state-wide.

Emerging Agricultural Financial Solutions & Technology Trends for 2025

The landscape of farming and agricultural finance across Texas is rapidly shifting. New technology-enabled solutions are driving this evolution:

-

Precision Agriculture Tech for Risk Assessment:

Modern precision ag techniques generate rich datasets around soil health, crop yields, and local weather patterns. Lenders can assess loan applications based on real, site-specific data—improving creditworthiness and tailoring financial products to each farm’s history and projected yields. -

Digital Platforms and Loan Automation:

Digital application platforms and automated underwriting reduce paperwork, accelerate loan approval timelines, and increase transparency, making financing more accessible for all Texas farmers. -

Sustainability-Linked and Green Loans:

Increasing environmental compliance and water conservation requirements are prompting Texas lenders to provide green loans—capital tied to measurable improvements in water use, soil health, or carbon capture. Meeting these criteria can lower interest rates. -

Personalized Credit Products:

Data-driven analytics allow lenders to personalize loan structures, payment schedules, and collateral requirements, helping farmers previously considered high-risk access essential capital.

How Data & Tech Are Shaping Agricultural Financing Solutions in Texas

Banks, the USDA, and government-backed programs increasingly leverage advanced analytics to evaluate soil data, management practices, and sustainability outcomes. Meanwhile, data-driven documentation allows for easier access to disaster relief or insurance-based loans during adverse climate conditions.

For example, Farmonaut’s crop loan & insurance solutions help farmers, lenders, and insurance providers access up-to-date satellite data for field verification, claim validation, and transparent reporting—eliminating fraud and minimizing delay.

Importance of Working Capital & Crop Insurance Financing

Texas agricultural operations must often contend with weather volatility, shifting commodity prices, pest outbreaks, and rising input costs. Thus, securing access to working capital and robust risk management products is crucial.

- Working Capital Loans: Used to cover operating costs such as seed, fertilizer, labor, and transportation. Offered by commercial banks, cooperatives, and state agencies.

- Crop Insurance Financing: Integrated with operating loans, crop insurance (federally subsidized or private) protects against yield losses from drought, flood, hail, pests, or disease. Lenders often lower collateral or offer better rates when coverage is in place.

In Texas, agricultural insurance products are especially valuable for cotton, corn, sorghum, and cattle producers facing unpredictable market and weather conditions.

Safety Nets for Financial Stability

These integrated loan and insurance bundles provide resilience against climate events and market shocks, helping Texas producers sustain operations during lean years.

According to a recent industry survey, more than 80% of Texas farmers utilize financial credit to protect against risk and drive innovation through the 2025 season.

“Over 80% of Texas farmers utilize financial credit, driving innovation and sustainability into the 2025 season.”

Comparative Table: Top Texas Agricultural Financing Solutions 2025

Below is a detailed comparison of the leading agricultural financial solutions available to Texas farmers in 2025. This table helps you compare estimated interest rates, loan amounts, terms, and unique application benefits across major programs.

| Financing Solution | Provider/Institution | Est. Interest Rate (%) | Max Loan Amount (USD) | Repayment Term (years) | Eligibility Criteria | Application Process | Key Benefits |

|---|---|---|---|---|---|---|---|

| USDA Farm Operating Loan | USDA Farm Service Agency (FSA) | 3.25–5.5 | $400,000 | 1–7 | U.S. citizen, farming experience or plan, credit history (less strict) | Online form + FSA consultation + supporting docs |

|

| Texas Ag Finance Authority (TAFA) Loan | Texas Agricultural Finance Authority | 3.1–4.8 | $500,000 | Up to 20 | Texas resident, rural/ag business or land expansion | Online pre-eligibility, submit docs to TAFA-lender, committee review |

|

| Farm Credit Ag Loan | Farm Credit Associations of Texas (FCAT) | 4.5–7.0 | $3,000,000+ | Flexible (3–30) | Creditworthy Texas producers | Application via local FCA + financials + on-farm visit |

|

| Microloan (USDA-FSA) | USDA Farm Service Agency | 2.85–4.5 | $50,000 | Up to 7 | New, small, or niche Texas farmers | Short form, minimal documents |

|

| Agricultural Equipment Loan | Commercial Banks / FCAT / Credit Unions | 6.0–8.5 | $500,000+ | 3–7 | Farm operations with equipment needs | Lender app + credit/asset check |

|

| Green & Sustainability Loans | Selected Commercial Banks, Credit Unions | 2.9–6.2 | $300,000+ | Up to 15 | Environmental targets (water, soil, carbon) | Proposal + monitoring plan + annual reporting |

|

| Disaster Relief Agricultural Loan | USDA/FEMA/State of Texas | 3.0–4.75 | $500,000 | 1–5 | Proof of disaster loss in eligible counties | Declaration, documentation, lender submission |

|

Risk Management & Climate-Resilient Financing for Texas Agriculture

Agriculture in Texas is subject to significant environmental risk, requiring continuous innovation in lending and insurance frameworks. The risk profile of Texas farmers is shaped by variable rainfall, drought, temperature spikes, hurricane threats along the Gulf Coast, and pest/disease outbreaks.

- Disaster-Responsive Lending: USDA and state agencies automatically activate low-interest disaster loans after federally declared events—streamlining access to capital for urgent recovery.

- Climate-Linked Insurance: Policies based on weather data and historical yield trends provide cash flow stability. Farmonaut’s crop loan and insurance monitoring helps validate weather-impacted claims seamlessly through satellite evidence.

- Water & Soil Conservation Incentives: Lenders offer rate reductions or grants for adoption of conservation tillage, improved irrigation, or carbon farming practices, protecting both farm productivity and lender portfolios over the long term.

Proactive Risk Analytics: The New Standard in 2025

With digitized weather records, soil surveys, and historical performance data, Texas lenders in 2025 continue to develop new analytics tools for issuing loans and insurance. Data integration ensures underwriting is both accurate and fair—empowering producers who invest in climate-smart or conservation practices.

Tip: Consider monitoring your farm’s water use and soil management practices with satellite-based analytics. This may help you qualify for sustainability-linked capital and major savings on interest rates through select 2025 loan programs.

Sustainability & Financing Innovation for Texas Farms

Sustainability is a defining trend in agricultural financing solutions Texas in 2025. Many lenders now reward:

- Water-Saving Irrigation Projects: Loans with reduced rates for drip or precision irrigation projects saving water in drought-prone zones.

- Soil Health Improvements: Lending programs that require, or reward, tracking of soil organic matter, nutrient stewardship, and erosion prevention.

- Carbon Farming and Regenerative Agriculture: Producers implementing cover crops, conservation tillage, or on-farm renewable energy can access “green” loan products or grants tied to measurable impact. For verification and management insights, explore Farmonaut’s carbon footprinting tools.

Adopting these approaches can position your operation for higher creditworthiness as Texas’s finance sector combines economic and environmental metrics in 2025 and beyond.

Financial providers are increasingly tailoring products for Texas agribusinesses that demonstrate climate-smart management, blockchain-enabled traceability, and digital reporting.

For trusted produce supply chains and market access, see:

Farmonaut’s blockchain-based traceability solution.

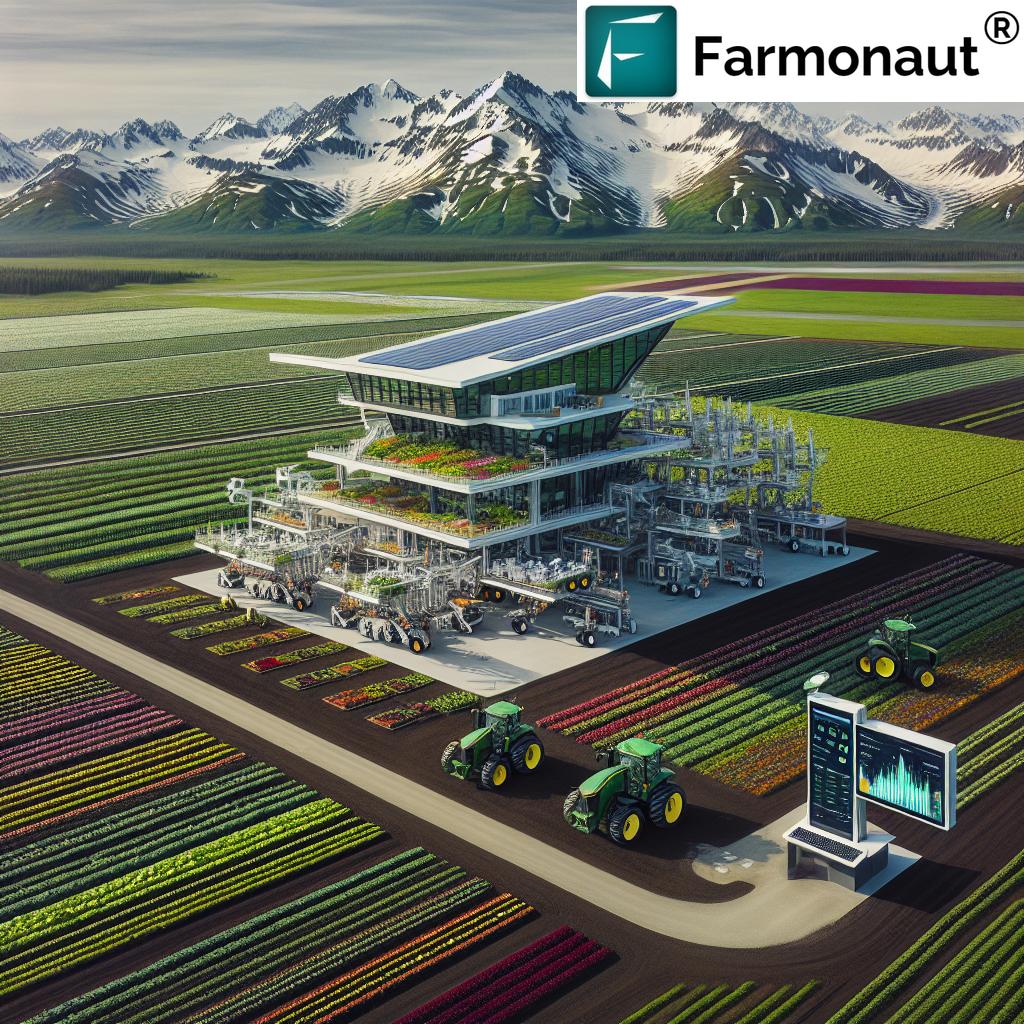

How Satellite Data and Farmonaut Support Agricultural Financial Solutions

As digital verification and analytics become more central to Texas’s financing landscape, many institutions are seeking reliable, real-time data to inform lending, insurance, and resource management decisions.

-

Satellite-Based Monitoring:

We at Farmonaut provide real-time crop and soil monitoring solutions through user-friendly Android, iOS, and web apps, delivering essential insights for Texas producers of any scale. -

AI-Based Advisory & Custom Insights:

Our Jeevn AI system empowers Texas farmers with tailored recommendations, weather forecasts, and risk alerts, enhancing financial decision-making throughout each crop season. -

Resource Management:

For efficient logistics, Farmonaut’s fleet management tools help you track equipment, manage vehicle deployment, and optimize costs—supporting streamlined loan applications and profitability. -

Satellite Verification for Financing:

We support financial institutions by providing API-based access to field data, enabling satellite-driven verification of loan or insurance claims—improving transparency, reducing fraud, and accelerating credit disbursement.

Developers can explore technical integration via our developer docs. -

Environmental Impact Tracking:

We offer affordable carbon footprinting solutions to help Texas farming businesses comply with sustainability-linked lending and emissions reporting.

Our modular platform is designed for everyone: smallholder ranchers, row crop producers, agri-cooperatives, and large-scale agribusinesses operating within Texas’s diverse sector.

Farmonaut Solutions & Product Links

To help you navigate the future of agricultural financial solutions in Texas, explore Farmonaut’s digital products and value-added options:

-

Crop Loan & Insurance Monitoring: Satellite-based verification and claim validation for lenders and insurers. Reduces fraud, fast-tracks claims, and provides digital field history for credit analysis. -

Carbon Footprinting Tool: Track your operation’s real-time carbon output for access to green financing, regulatory compliance, and environmental certification. -

Product Traceability Platform: Blockchain-based authenticity for supply chains, supporting food safety, market access, and premium branding for Texas products. -

Fleet & Resource Management: Streamline logistics, reduce operating costs, and demonstrate management efficiency in loan/insurance applications. -

Large-Scale Farm Management: Platform for operators managing multiple properties, diversified crops, or extensive fleets—ideal for commercial and cooperative Texas ventures.

Get Started: Farmonaut Apps & Resources

Monitoring and analytics are central to unlocking new financing opportunities across Texas. Farmonaut’s platforms are accessible via web app, Android, and iOS—designed for both independent producers and established agribusinesses.

For enterprise or development integration (e.g., direct bank or insurance platform connectivity), utilize our API and Developer Docs.

Farmonaut Subscription Packages for Agricultural Monitoring

We offer flexible, affordable packages for Texas producers and agribusinesses who need continuous, satellite-driven monitoring and advanced analytics. These help you build a better business case for agricultural financing, risk management, and sustainability-linked loans.

Frequently Asked Questions

What are the main types of agricultural financing solutions available to Texas farmers in 2025?

Texas farmers have access to operating loans, equipment financing, land acquisition loans, working capital lines, disaster relief loans, and green/sustainability credit products. Major providers include USDA FSA, Texas Agricultural Finance Authority, commercial banks, and specialized farm credit associations.

How have technology and data analytics changed the farm lending process in Texas?

Advanced analytics using precision ag data and digital platforms have streamlined application processes, improved risk assessment, and enabled personalized loan offers. Satellite verification simplifies field documentation and fraud prevention, boosting lender confidence.

What types of risk management products are essential for Texas agriculture?

Crop insurance, disaster response loans, and bundled loan-insurance solutions are crucial for protecting farm income from weather events, market swings, or pest outbreaks. Integration of risk management products with operating credit is now standard among top Texas lenders.

How does Farmonaut support agricultural finances and insurance applications?

We at Farmonaut offer affordable, satellite-driven monitoring and verification for lenders, insurers, and producers, including real-time crop health, soil insights, and automated reporting. Our API and app-based platform facilitate fast, transparent applications and assist in eligibility proof.

Can Texas farmers access financing for sustainability or carbon reduction projects?

Absolutely. Many state and commercial lenders now offer green loans or interest rate reductions tied to measurable climate or environmental targets. Satellite tracking—like our carbon footprinting tool—helps verify projects and access these funds effectively.

What documents are required for agricultural loan applications?

Typical documentation includes financial statements, production records, credit history, farm management plans, and, increasingly, digital evidence (e.g., satellite imagery or yield analytics). Requirements can be lighter for microloans and certain beginning farmer programs.

Conclusion

The evolution of agricultural financing solutions Texas in 2025 offers Texas producers an unprecedented combination of traditional credit, innovative digital platforms, and sustainability-driven lending. By accessing the right mix of capital, risk management products, and technology support, Texas farming operations can scale, diversify, and thrive amid changing climate and market dynamics.

Ensuring fair access across all producer groups, supporting environmental stewardship, and leveraging data for smarter lending will cement Texas’s status as a global agricultural cornerstone. To further support this future, Farmonaut remains committed to empowering farmers, agribusinesses, and lenders with affordable, satellite-based insights and seamless digital tools.

Take the next step into resilient farming—explore Texas’s many financing options, adopt smart monitoring solutions, and lay the groundwork for sustainable growth for generations to come.