Billionaires Buying Farmland California: Stockpiling Food 2025 – The Industry-Shifting Trend Redefining Agriculture & Food Security

“In 2023, billionaires owned over 2 million acres of U.S. farmland, a 30% increase since 2018.”

Introduction – The Billionaire Farmland Frenzy

The year 2025 has brought one of the most significant shifts in the agriculture sector: an unprecedented wave of billionaires buying farmland, especially in California, tied to strategies of stockpiling food. This billionaires buying farmland hedge funds stockpiling food 2025 trend is transforming the way land, food, and agricultural production are controlled and perceived—not only within the United States but on a global scale.

The movement is not simply about asset accumulation or pursuit of profit. As climate change, geopolitical uncertainties, and commodity price fluctuations become more pronounced, farmland has become a strategic asset and critical component of broader food security, investment, and sustainability strategies.

In this comprehensive guide, we’ll break down:

- Why billionaires and large funds want control over vast tracts of agricultural land and food supply chains

- The impact on food prices, rural communities, and global food stability

- How California’s farmland remains at the epicenter of this transformation

- The role of technology and companies like Farmonaut in modern farmland management

- The social, economic, and environmental implications and future outlook

Why Farmland? Why Now? The 2025 Acquisition Backdrop

The surge in billionaires buying farmland is not a coincidence. Let’s unpack the multifaceted backdrop and chief concerns driving this 2025 trend:

- Climate Change & Environmental Risks: Droughts, water scarcity, and unpredictable weather patterns jeopardize global food production stability, making land ownership a food security safeguard.

- Asset Diversification: Amid fluctuating commodity prices and inflation, farmland is an inflation-resistant investment. For the ultra-wealthy, it’s a safe haven outperforming stocks and bonds in volatile times.

- Geopolitical Uncertainties: Tensions over food, land, and resources are intensifying. Direct control over farmland and food supplies mitigates risk during global disruptions or trade conflicts.

- Market Influence: Owning substantial hectares in key regions (like California) grants power to influence supply chains, prices, and even national policy—a potent lever for billionaires, hedge funds, and institutional investors.

Billionaires buying farmland stockpiling food 2025 is a strategic, long-term approach—not merely a fleeting trend or speculative play.

California: The Hotspot for Billionaires Buying Farmland

California’s agricultural sector is a global powerhouse—responsible for producing half the United States’ fruits, nuts, and vegetables. Its unique Mediterranean climate, fertile valleys, and established infrastructure make it a focal point for billionaire acquisitions. Yet, like everywhere, it is also facing critical challenges:

- Water Scarcity & Ongoing Droughts: California faces increasing water scarcity, exacerbated by years of low rainfall and over-extraction. Irrigation innovations are essential, but water access remains a key risk.

- Soil Degradation: Decades of intensive farming have depleted soil health. Regenerative practices are needed for long-term productivity.

- Regulatory Complexities: Land use laws, environmental controls, and labor regulations create high barriers to entry for all but the wealthiest investors.

- Rising Land Prices: Intense billionaires buying farmland in California competition significantly drives values higher, impacting smallholders and communities.

Billionaire buyers and large hedge funds are often equipped with capital and technology to invest in advanced irrigation systems, soil restoration, and infrastructure upgrades—potentially improving resilience and output, but also consolidating control.

“California farmland prices rose by 15% in 2024, driven by increased purchases from high-net-worth individuals.”

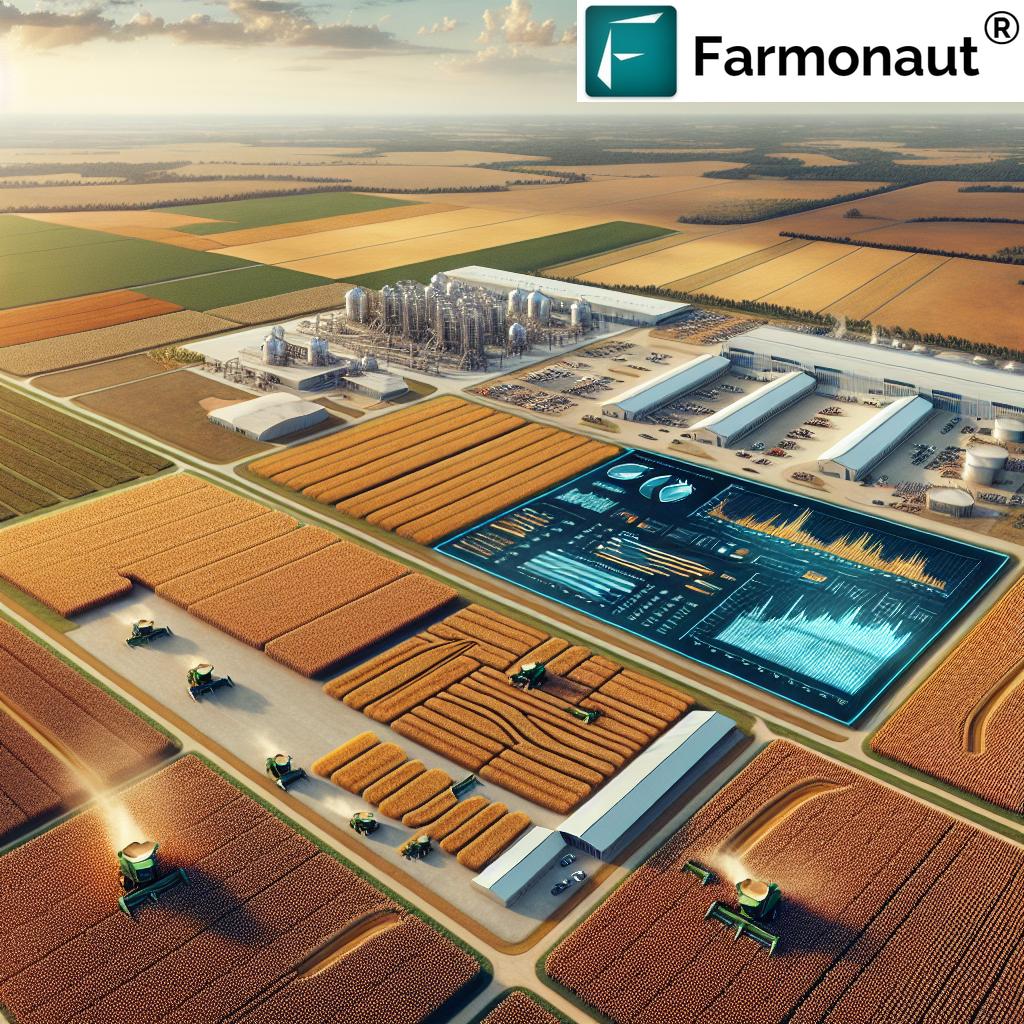

Hedge Funds Stockpiling Food & Farmland: 2025’s Dual Approach

An emerging dual approach goes beyond individual billionaire buyers: hedge funds and institutional investors are simultaneously acquiring farmland and stockpiling food commodities. This amplifies their influence over production and supply chains:

- Direct Farmland Control: Owning land grants direct say over production, crop selection, and supply chain logistics.

- Food Commodity Stockpiling: By holding physical stocks (e.g., grains, nuts, pulses), these entities can hedge against shortages or catastrophic market swings, potentially amplifying or dampening food price spikes.

- Vertical Integration & Market Power: The combination means controlling both the input (land/production) and output (market supply), allowing for remarkable price-setting leverage and risk management in volatile global markets.

While some billionaire investment in agriculture brings needed capital and innovation, critics see new risks:

- Manipulation of prices and food access

- Reduction in market competition, exacerbating rural inequality

- Marginalization of local farmers and smallholder operations

Farmonaut’s Role in Modern Farmland Management

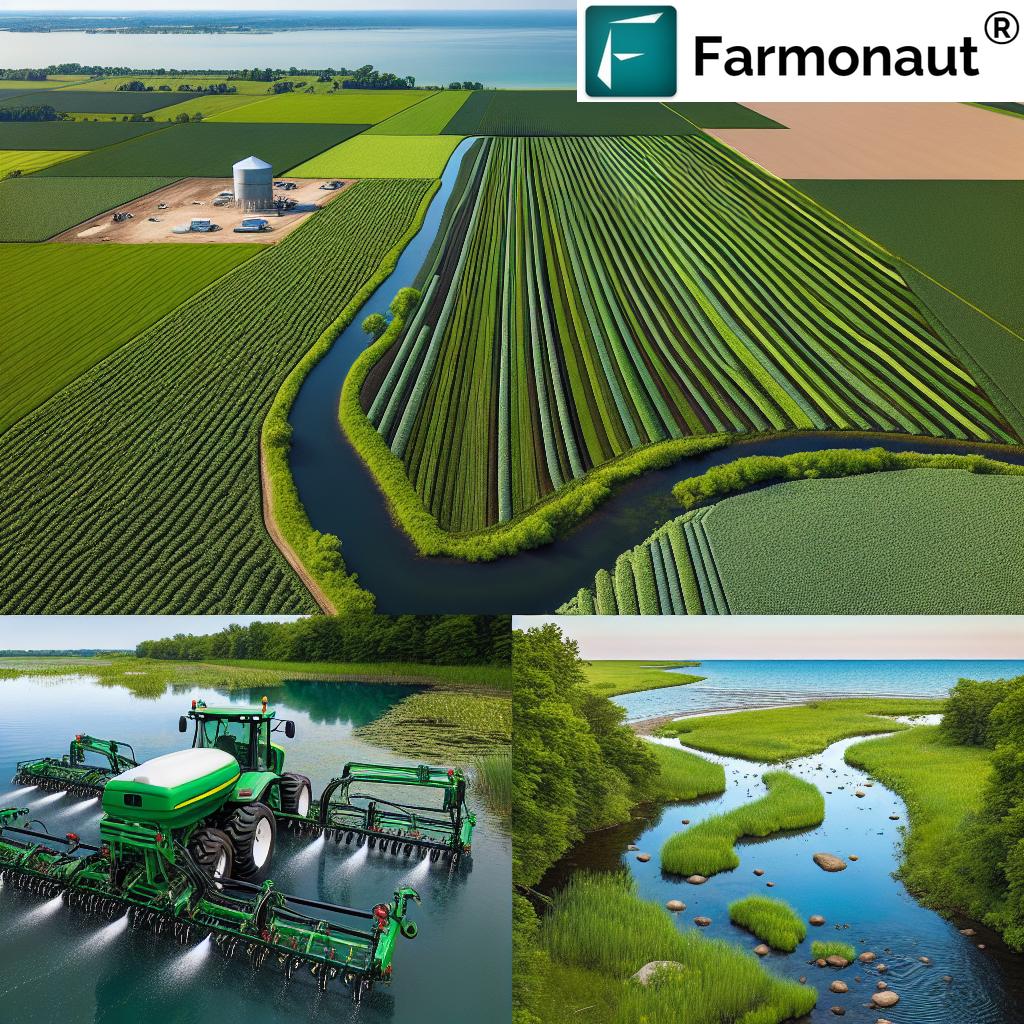

The scale, complexity, and risk profile of large-scale farmland ownership call for advanced monitoring and intelligence platforms. This is where we at Farmonaut step in. Our large scale farm management solution leverages satellite technology, AI-driven insights, and blockchain to deliver cost-effective and actionable intelligence for modern agriculture.

- Satellite-Based Monitoring: We use multispectral imagery to provide data on crop health (NDVI), soil conditions, and irrigation performance across expansive fields—supporting operational efficiency and risk reduction for both families and large investors.

- AI & Jeevn Advisory System: Our tailored real-time advisories enhance productivity, crop rotation strategies, and weather risk management.

- Blockchain-Based Traceability: With our traceability product, agri businesses and consumers can transparently track produce from field to shelf, reducing fraud and boosting trust.

- Resource & Fleet Management: Fleet management solutions optimize vehicles and equipment usage, lowering costs and emissions across rural supply chains.

- Environmental Impact Monitoring: Our carbon footprint monitoring product helps agricultural investors comply with sustainability regulations and adopt greener practices.

- API & Integrations: Developers and businesses can directly integrate our data or leverage our developer documentation for custom applications.

Try the Farmonaut Web App

Try the Farmonaut Web App

Get the Android App

Get the Android App

Download on iOS

Download on iOS

By making these critical technologies accessible, we support a future where both small- and large-scale agricultural enterprises can thrive, adapt to environmental challenges, and contribute to food security.

Comparative Impact Table – Farmland Acquisition by Billionaires (California, 2025 Estimated Data)

| Year | Estimated Acreage Acquired by Billionaires (California, in thousands) |

Estimated Food Commodity Price Index Change (%) |

Estimated Small Farmer Land Loss (%) |

Estimated Rural Community Employment Change (%) |

Estimated Impact on National Food Security (Score/10) |

|---|---|---|---|---|---|

| 2022 | 320 | +4 | 2.5 | +0.5 | 7 |

| 2023 | 385 | +5.5 | 3.1 | +0.9 | 7 |

| 2024 | 440 | +6.7 | 4.2 | +1.8 | 6.5 |

| 2025 | 510 | +8.2 | 6 | +2.5 | 6 |

Interpretation: From 2022 to 2025, the estimated amount of California farmland acquired by billionaires rises by nearly 60%. This correlates with increased food commodity price indices, rising land loss among small farmers, and moderate job growth in rural areas, while the overall score for national food security dips slightly—illustrating the complex risks and benefits of this trend.

Implications: What This Means for Agricultural Markets & Food Security

Let’s dive into the billionaires buying farmland hedge funds stockpiling food 2025 phenomenon and its profound implications:

1. Food Prices & Commodity Market Volatility

As large-scale investors gain control over both farmland and food commodity stocks, their influence on market prices increases:

- Price Stabilization…Or Manipulation? Wealthy owners can use reserves to stabilize sharp price spikes (protecting their investments), but also to withhold supply, causing artificial scarcity and higher profits.

- International Ramifications: With California’s output being integral to global supply chains, these local dynamics have worldwide impacts, shifting import/export patterns and food prices abroad.

2. Consolidation and Decline of Smallholder Farmers

The acquisition spree is most often at the expense of family-run & smallholder farms. Surging land prices make it incredibly difficult for new or existing small farmers to compete:

- Land Loss: As shown in the impact table, small farmers could see a 6% loss of their land by 2025 alone, with ongoing threats to ownership & generational wealth.

- Food Sovereignty: When a few entities control agricultural assets, communities lose the right to shape their food systems and can be vulnerable to external market shocks.

3. Influence on Rural Communities & Labor

Despite the influx of capital, job growth can be uneven. Billionaire acquisitions may create new roles in management, technology, and logistics but also risk displacing traditional farmworkers or changing the social fabric of rural communities:

- Increased demand for skilled labor in agri-tech, data monitoring, and logistics

- Potential decline in jobs for local farmhands due to automation and advanced technologies

- Revitalization of neglected rural infrastructure if investments are made wisely

Social & Environmental Impacts: Rural America, Equity & Sustainability

A. Land Use Equity & Ownership Concentration

The move toward large-scale land consolidation could tip the balance of power even further away from family farmers and rural communities:

- Access to Land: New and minority farmers face higher barriers to entry.

- Community Structure: Social structures, support networks, and rural cultures could be eroded, with a risk of “ghost towns” where ownership is absentee.

- Historical Inequalities: Indigenous and marginalized groups have historically struggled to maintain land rights; further concentration threatens their livelihoods and heritage.

B. Environmental Risks & Sustainable Practices

Large capital inflows can support advanced sustainable agriculture, but not all billionaires prioritize the environment:

- Sustainable Practices: Where implemented, regenerative farming, precision agtech, and carbon footprint tracking can dramatically reduce environmental impact and enhance soil health.

- Resource Strain: Intensive production, if not managed sustainably, can exacerbate water scarcity, further degrade soil, and strain local ecosystems.

- Compliance & Ethics: Our carbon footprinting tool helps landowners comply with environmental regulations and demonstrate sustainability—a growing necessity for both market and public approval.

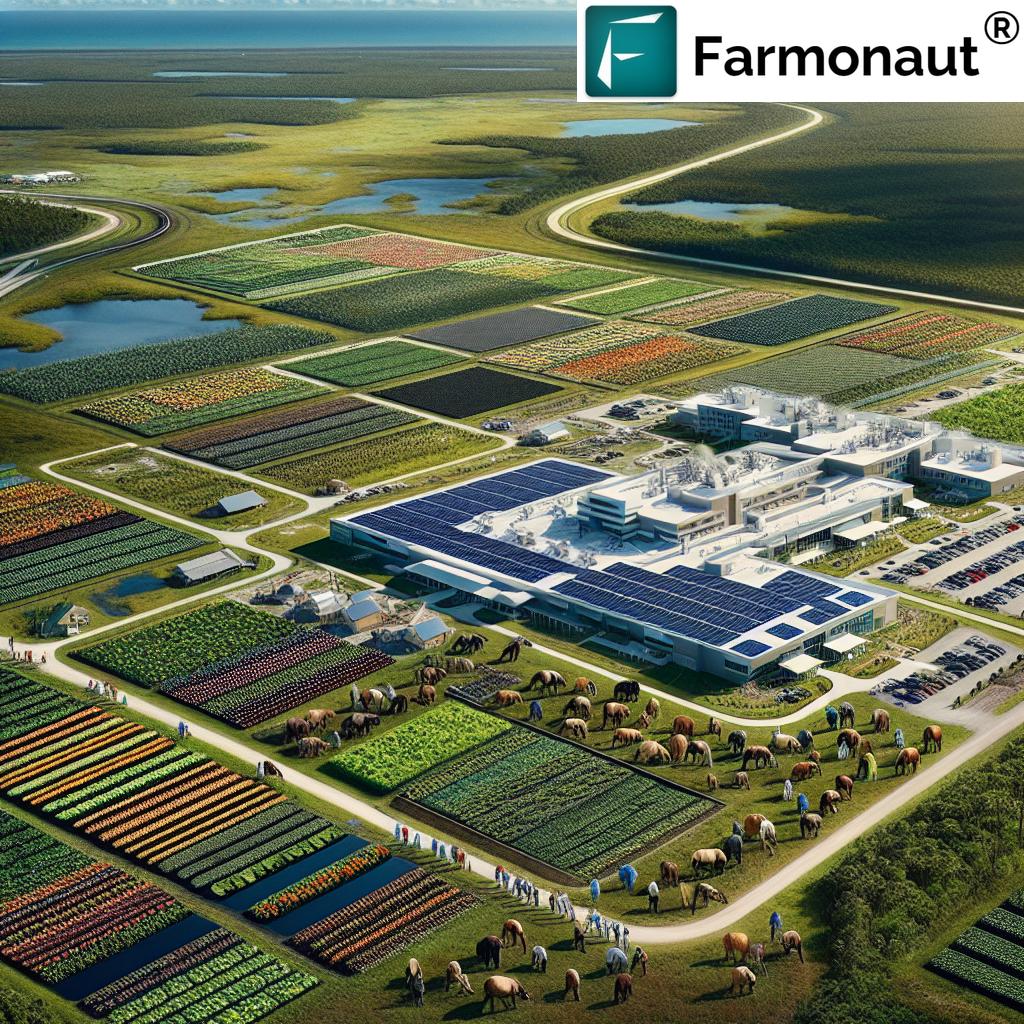

Innovation & Sustainable Practices in Billionaire-Owned Agriculture

Many billionaire buyers have invested heavily in advanced irrigation, soil management, and infrastructure upgrades on their California farms. The effect is twofold:

- Technology Adoption: Satellites, AI, and precision farming constitute the backbone of modern, large-scale agriculture. Tools that we offer at Farmonaut are central to this revolution—enabling both environmental stewardship and financial performance.

- Blockchain Traceability: Blockchain solutions such as our traceability product boost transparency, authenticity, and accountability throughout agricultural supply chains.

- Regenerative Agriculture & Soil Health: The trend toward carbon farming, cover cropping, and reduced chemical inputs is on the rise—necessary to sustain productivity under climatic duress.

This influx of financial and technological capital could enhance resilience and long-term output—but only if equitable, community-focused, and environmentally sustainable policies are enforced.

The Future: Resilience, Risk, and Food Sovereignty

How will this trend play out beyond 2025?

- Balance of Power: The continuing billionaires buying farmland stockpiling food 2025 movement may further centralize agricultural control, making policies on equity and fair access more critical than ever.

- Need for Innovation: The supply, security, and sustainability of food depends on rapid evolution of agricultural technologies and responsible corporate practices.

- Market & Regulatory Response: Policy makers may need to re-evaluate land ownership laws, support smallholder resilience, and promote sustainable practices nationwide.

- Global Impact: As more countries feel the ripple effects of food commodity hoarding or land acquisition, international cooperation and new regulatory frameworks could emerge.

What remains clear is the pivotal role of technology in bridging gaps—making data, traceability, and resource intelligence accessible for all stakeholders in the agricultural sector.

Explore Farmonaut Solutions for Farmland Intelligence

As agriculture heads into a new era marked by large-scale investment and rapid land acquisition, technological enablement is non-negotiable. Our satellite-based, AI-driven, and blockchain-integrated platform brings accessibility, cost-effectiveness, and transparency for all players—from family farms to large corporate entities.

- Large Scale Farm Management App: Enables centralized, spatial tracking of vast farmlands, supporting health monitoring, emergency response, and data-backed decisions.

- Crop Loan & Insurance: Offers satellite verification for loan/insurance applications, mitigating lender risk, improving access for growers, and reducing fraud.

- Carbon Footprinting: Facilitates compliance with ever-tightening environmental regulations, carbon trading, and ESG reporting.

- Traceability: Ensures blockchain-secured transparency from farm to consumer—building brand value and trust in today’s hyper-competitive food markets.

- Fleet Management: Designed for large operations, empowers efficient logistics, resource use, and timely delivery of perishable goods.

- API integration for custom applications: API Access | Developer Docs

Frequently Asked Questions

Q1. Why are billionaires so interested in buying farmland, especially in California?

Farmland in California is uniquely valuable—thanks to its climate, established infrastructure, and productivity. Farmland is a stable, inflation-resistant asset. The combination of land and food commodity stockpiling offers wealthy individuals and hedge funds strategic control over food supply and prices, as well as a buffer against economic and geopolitical risks.

Q2. What are the main risks of this trend for rural communities and small farmers?

The primary risks include land loss among smallholders, rising barriers for new farmers, increased rural inequality, and greater market manipulation by large owners. Community culture and agricultural diversity may suffer as corporate consolidation increases.

Q3. How does technology (like Farmonaut) fit into large-scale farm management?

Satellite technology, AI monitoring, and blockchain traceability are essential for managing vast acreages, optimizing resources, maintaining sustainability, and ensuring compliance with regulatory requirements—empowering both independent and institutional landowners.

Q4. Does billionaire investment in farmland always lead to negative outcomes?

Not always. Large investors can introduce much-needed capital, innovation, and sustainable practices. However, without careful governance and equity-focused policies, the risks of market manipulation, environmental degradation, and loss of local autonomy remain high.

Q5. How might this trend affect global food prices and supply security in the future?

As US regions like California are integral to global food chains, concentration of ownership means decisions by a few entities have clear international ramifications—affecting prices, availability, and the resilience of food systems worldwide. Regulatory frameworks, transparency, and technological monitoring will be crucial to mitigating risks.

Conclusion:

The 2025 trend of billionaires buying farmland in California and stockpiling food is reshaping the landscape of agriculture, rural communities, and global food security. While technological advances—such as those we deliver at Farmonaut—can empower smarter, sustainable, and more resilient production, society must address the equity, social, and environmental risks that come with large-scale investment and consolidation. The future of food depends on how we steward land, capital, and innovation for the benefit of all.