Texas Farm Bureau Insurance: Smart Digital Ag Solutions 2026

“By 2025, over 60% of Texas farms will use digital analytics platforms for optimizing agricultural insurance coverage.”

- Introduction: Texas Agriculture in 2026

- The Role of Agricultural Insurance Companies in Risk Management

- Tailored Coverage: Specialized Insurance Products for Texas Farmers

- “My Texas Farm Bureau”: The Digital Platform Revolutionizing Insurance

- Digital Innovation: Technology’s Impact on Agricultural Insurance Company Operations

- Beyond Crop and Property: Health & Wellness in Rural Texas

- Synergies: Insurance & Rural Infrastructure Development

- Smart Ag Insurance Solutions: Comparative Features & Benefits Table (2025–2026)

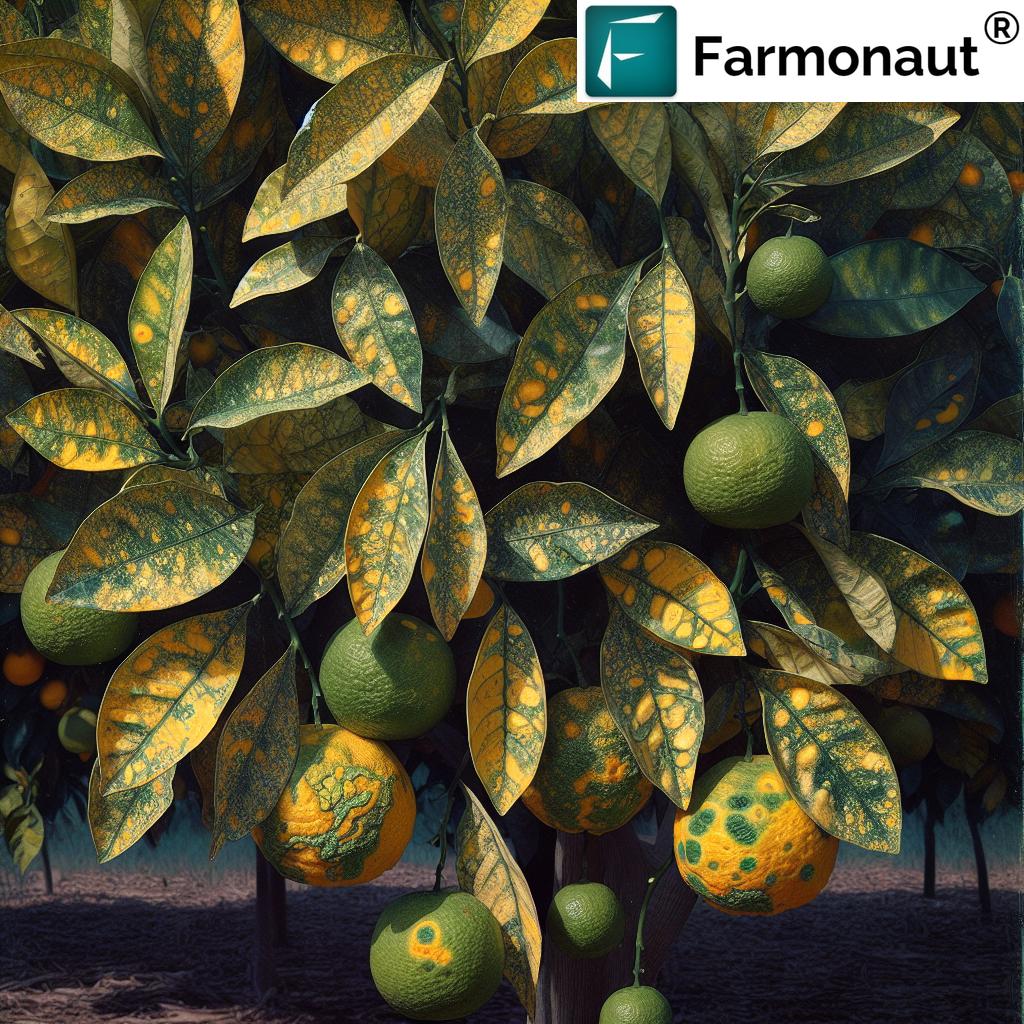

- How We at Farmonaut Leverage Satellite Tech for Insurance & Sustainability

- Smart Claim Processing in 2026: A Key Statistic

- 2026 & Beyond: Outlook for Texas Farm Bureau Insurance & Agricultural Risk Management

- Frequently Asked Questions

- Conclusion

Introduction: Texas Agriculture in 2026

Texas remains at the forefront of American agriculture with a vast, evolving landscape encompassing conventional row crops, livestock, specialty farming, and emerging technologies. In 2025 and looking ahead to 2026, agricultural insurance companies such as the Texas Farm Bureau Insurance Company, Farm Bureau Mutual Insurance, and other providers continue to play a pivotal role in ensuring the sustainability and resilience of farms and rural communities. These entities offer the vital safety net required for agricultural and forestry enterprises, addressing the unique vulnerabilities of this sector, from unpredictable weather and fluctuating commodity prices to pests, risks, and increasing climate challenges.

Today, the fusion of insurance, digital platforms, and advanced data analytics is reshaping the future. As Texas farmers seek coverage and strategic protection for their livelihoods, state-of-the-art tools and tailored insurance policies are helping them stabilize income, invest confidently, and adapt to emerging business models. Let’s explore how this synergy is transforming the Texas rural landscape and the vital ecosystem that supports it.

The Role of Agricultural Insurance Companies in Risk Management

Agriculture is arguably one of the most risk-exposed industries anywhere. The inherent uncertainties stemming from natural, market, and operational factors mean that a single adverse event—be it a drought, hurricane, pest infestation, or unexpected machinery damage—can have catastrophic financial consequences for farms and related enterprises.

Agricultural insurance companies like Texas Farm Bureau Insurance Company, Farm Bureau Mutual Insurance, and other ag insurance company providers in Texas have stepped up by offering specialized, tailored risk management solutions:

- Crop loss from natural disasters, pests, or diseases

- Livestock mortality due to disease, extreme weather, or on-farm accidents

- Equipment damage and machinery breakdowns that can halt operational progress

- Liability exposures for on-site injuries or environmental impacts

- Farm & property coverage for barns, irrigation systems, fencing, and storage infrastructure

These policies are carefully aligned with the agricultural calendar and risk factors unique to Texas, enabling farmers to stabilize income streams, secure loans for operational investments, and plan for business continuity. As the sector evolves, these insurance organizations are adapting their products and risk models to address both traditional vulnerabilities and the new climate risks facing Texan agriculture in 2026.

Why the Texas Farm Bureau Insurance Company Is Vital

Since its founding, the Texas Farm Bureau Insurance Company has stood out for its commitment to protecting Texan rural livelihoods and advancing risk management. Through agents distributed across hundreds of rural counties, this organization is one of the leading facilitators of agricultural coverage, providing rapid disaster recovery, and contributing to market stability for the entire State.

Tailored Coverage: Specialized Insurance Products for Texas Farmers

- Texas-Specific Coverage: Insurance products offered by Texas Farm Bureau Insurance Company and similar organizations are tailored to the region’s unique risks—from hail and drought to hurricanes and flooding in the eastern counties.

-

Comprehensive Crop and Livestock Insurance: Crops, animals, and equipment are often the backbone of a Texan farm, so comprehensive coverage ensures financial recovery in case of:

- Crop loss—whether from weather events, disease, or commodity price collapse

- Livestock mortality from diseases or extreme temperatures

- Equipment/property damage—covering tractors, combines, irrigation pumps, and barns

- Liability and Property Protection: Third-party injury on a farm can expose the owner to substantial liability. Insurance shields farms from the legal and financial fallout of such events.

- Innovative Add-ons: Additional insurance policies now include climate risk modeling, cyber liability (for digital systems), and renewable energy asset insurance—reflecting the modern, evolving farm sector of Texas.

The net benefit is that farmers gain peace of mind, communities enjoy stability, and the greater Texas agricultural sector continues to thrive and innovate.

How Insurance Products Are Aligned with Texas’ Unique Landscape

Insurance products are no longer “one size fits all.” For instance, companies often adapt their policies to the specific needs of dryland cotton regions, irrigated High Plains wheat, or East Texas forestry enterprises. Frequent weather volatility and pest patterns, commodity price fluctuations, and advancing technologies (including IoT-enabled equipment) all influence the structure and pricing of coverage plans.

“My Texas Farm Bureau”: The Digital Platform Revolutionizing Insurance

The My Texas Farm Bureau platform exemplifies how digital transformation is enhancing member experience and coverage services for 2026 and beyond. Policyholders in Texas can now:

- Manage all insurance policies digitally—Review details, monitor coverage, and analyze claim history through an online portal.

- File claims quickly and upload digital documentation, reducing paperwork and minimizing delays.

- Connect seamlessly with local agents—Access tailored guidance from insurance professionals in their region, right from the platform.

- Access educational resources & digital content to stay up-to-date with insurance programs, ag policy, and best practices in risk management.

This level of convenience and transparency fosters greater trust and empowers farmers to make more informed decisions about their insurance coverage—all while lowering operational burdens. With satellite imagery and data analytics increasingly integrated into digital platforms, insurance companies are now able to:

- Assess crop and property risks more accurately using real-time remote sensing and geospatial data.

- Expedite claim processing—receiving photographic evidence directly from smartphones, drones, or satellites for rapid storm/hail assessment.

- Utilize data-driven analysis to personalize coverage and price premiums dynamically based on verifiable risk factors.

Tip: Use Farmonaut’s Satellite Monitoring App for instant access to remote field status and guided insurance documentation in Texas and beyond.

Digital Innovation: Technology’s Impact on Agricultural Insurance Company Operations

-

Satellite Imagery & Remote Sensing:

Real-time field monitoring and NDVI (Normalized Difference Vegetation Index) images allow insurance companies to verify claims, assess pre- and post-damage conditions, and analyze vegetation health across a region. This enhanced visibility leads to fairer, faster payouts and prevents fraudulent claims. -

IoT Sensors & Telematics:

With more Texas farms deploying IoT sensors—from soil moisture probes to weather stations and GPS-enabled equipment—insurance can be matched with measured risk factors, benefiting both insurer and insured with lower premiums. -

Digital Claims Processing & Automation:

Automated claim intake, data analytics on historical claim rates, and intelligent document classification drastically shorten claims turnaround, particularly during peak weather hazards in Texas. -

Data-Driven Underwriting & Dynamic Premiums:

By incorporating data from climate models, past yield records, and remote sensing, modern ag insurance company platforms now customize pricing, providing more affordable and relevant coverage for every farm.

Overall, technology is helping insurance companies provide deeper risk insights, foster transparency, and encourage the adoption of sustainable, climate-smart practices in Texas agriculture.

Resource: Learn more about carbon footprinting for Texas farms—vital for sustainability-linked insurance incentives and compliance.

Beyond Crop and Property: Health & Wellness in Rural Texas

The physical and mental demands of farming are immense and, in many rural Texas communities, access to quality healthcare remains a challenge. Specialized health insurance provided by organizations like Indiana Farm Bureau Health Insurance addresses these challenges with:

- Affordable, accessible health coverage: Targeted specifically at rural workers and their families, filling insurance gaps in remote regions.

- Plans tailored to agricultural risk: Including catastrophic injury, preventive care, and wellness outreach tailored for hands-on agricultural laborers.

- Benefit alignment with rural realities: Many plans are designed to facilitate resilience in rural sectors, supporting return-to-work after injury and offering mental health assistance for stress management.

For 2026 and beyond, this comprehensive philosophy—insuring the whole farm operation, including its people—will set smart ag insurance companies apart in Texas and across the US.

Did you know? APIs like the Farmonaut Satellite API support real-time farm verification for crop loan and insurance qualifying checks, streamlining the application process for Texan farmers and their local agents. Explore our API Developer Documentation for more technical details.

Synergies: Insurance & Rural Infrastructure Development

The scope of agricultural insurance company offerings is expanding “beyond the field.” Investment in rural infrastructure is a critical enabler of sustainability and resilience for Texas communities, encompassing:

- Buildings, barns, and storage facilities: Coverage protects investments in farm property against wildfire, hurricane, or unexpected repair needs.

- Irrigation systems, pumps, and water infrastructure: With drought becoming more prevalent in some Texas regions, insuring water delivery is essential.

- Rural roadways and logistics networks: Transportation infrastructure coverage ensures continuity and quick restoration after disaster strikes.

- Emerging infrastructure needs: Renewable energy installations (like on-farm solar and wind), smart farming equipment with IoT connectivity, and digital field monitoring tools are now eligible for protection.

Robust rural insurance programs often intersect with public programs, risk mitigation initiatives, and incentives for technology adoption—accelerating the uptake of innovative, sustainable practices throughout the region.

Pro tip: Discover satellite-based monitoring for crop insurance claims and loan support in Texas—minimizing manual verification and maximizing efficiency for agricultural insurance company processes.

Smart Ag Insurance Solutions: Comparative Features & Benefits Table (2025–2026)

As Texas agriculture modernizes, both insurers and producers must compare and selectively adopt the right digital solutions. The table below summarizes leading digital ag tools and their direct impact on insurance risk assessment, premium pricing, and sustainability outcomes for Texan farmers in 2026.

| Tool Name | Adoption Rate in Texas (%) 2025–26 | Core Functionality | Data Analytics Level | Impact on Risk Assessment | Enhanced Coverage (%) | Sustainability Contribution (1–10) | Estimated Premium Discount (%) |

|---|---|---|---|---|---|---|---|

| IoT Sensors & Telematics | 48% | Real-time soil, moisture, weather, asset status | Advanced | Moderate–High | 30–45 | 7 | 5–20 |

| Satellite Analytics (Farmonaut) | 61% | Remote crop/field monitoring (NDVI, health check) | Advanced | High | 40–60 | 9 | 10–25 |

| Mobile Insurance Apps (e.g., My Texas Farm Bureau) | 63% | Policy management, claims, agent access | Basic–Advanced | Moderate | 20–30 | 5 | 3–12 |

| Insurance Claim Automation Platforms | 35% | Auto claims filing/processing, digital documentation | Advanced | High | 45–55 | 8 | 10–18 |

| Climate Risk Modeling Platforms | 22% | Forecasting weather/pest risks, premium optimization | Advanced | High | 25–35 | 7 | 5–15 |

| Blockchain Traceability Platforms (Farmonaut) | 13% | Supply chain verification, anti-fraud, compliance | Advanced | Moderate | 10–20 | 8 | 2–10 |

Note: Interested in blockchain-based traceability for insurance compliance? Explore Farmonaut’s traceability platform for agricultural and forestry supply chains in Texas.

How We at Farmonaut Leverage Satellite Tech for Insurance & Sustainability

At Farmonaut, we empower the next generation of ag insurance company solutions across Texas and beyond with a comprehensive suite of satellite-powered tools.

- Real-time satellite imagery & analytics: We use multispectral satellite images to monitor crop health, detect anomalies, and verify claim events for insurance processes—achieving faster, more accurate payouts and eliminating unnecessary site visits.

- AI-Driven Advisory with JEEVN: Our AI-powered advisory system delivers actionable insights for risk reduction, crop productivity, and weather adaptation, directly benefiting insurance modeling.

- Blockchain traceability: We secure the entire agricultural and forestry supply chain, establishing trust, compliance, and transparency—critical for both regulatory insurance programs and premium discounts.

- Environmental impact tracking: With satellite data, Texas agricultural producers can measure carbon, water, and energy metrics, qualifying for sustainability-focused insurance incentives.

- Fleet & Resource Management: Insurance companies and large agribusinesses can reduce costs, meet operational targets, and minimize equipment risks through our fleet management module.

Our platform offers companies, governments, and financial institutions affordable access to these technologies through subscription or API integration, scaling from family operations to complex, multi-property management. We are deeply invested in driving transparency, resilience, and sustainability for insurance and rural infrastructure programs statewide.

Smart Claim Processing in 2026: A Key Statistic

“Smart ag insurance solutions are expected to reduce farm claim processing times by up to 40% by 2026 in Texas.”

2026 & Beyond: Outlook for Texas Farm Bureau Insurance & Agricultural Risk Management

The future of Texas farm insurance is rooted in digital transformation, climate adaptation, and holistic risk management.

- Climate risk modeling: Insurers are increasingly integrating climate data, pest trends, and sustainability metrics in their underwriting, customizing coverage for every region and operation.

- Technology-based protections: As Texan farms deploy more IoT devices and satellite analytics, insurance programs are expanding to encompass renewable assets, automated machinery, and even marketplace fraud risks.

- Non-traditional assets: Rainwater harvesting, solar fields, and smart irrigation systems are now eligible for bespoke insurance coverage, giving farm owners the confidence to invest and innovate.

- Emphasis on sustainability: Premium incentives, transparent reporting, and eco-compliance will increasingly reward Texas operations that combine productivity with environmental care.

All these trends point to one thing: The strategic advantage of aligning with the most innovative agricultural insurance companies—whether the Texas Farm Bureau Insurance Company, Farm Bureau Mutual Insurance, Indiana Farm Bureau Health Insurance, or other future-centric organizations—is greater than ever before for the state’s resilient rural backbone.

Interested in managing vast Texan properties or multiple cropping cycles? Explore Farmonaut’s large-scale farm management platform for advanced oversight, insurance compliance support, and sustainability metrics all in one place.

Frequently Asked Questions

-

How does the Texas Farm Bureau Insurance Company leverage digital analytics for farmer coverage in 2026?

Modern platforms incorporate satellite imagery, IoT data, and real-time weather analytics to assess risks, validate claims, and offer dynamic pricing—raising transparency and accelerating farm recovery after disasters. -

What are the main benefits of using My Texas Farm Bureau as a digital portal?

My Texas Farm Bureau empowers policyholders with seamless access to manage insurance, file claims, connect with local agents, and access educational resources—all from their smartphone or computer. -

Will specialized health insurance continue to be offered in rural Texas?

Yes. Providers like Indiana Farm Bureau Health Insurance deliver plans tailored for agricultural workers’ risks, including coverage for injury, preventive care, and expedited return-to-work after accidents. -

Are premium discounts given for adopting digital and sustainability solutions in 2026?

Absolutely! Adoption of IoT sensors, satellite field monitoring, climate modeling, and blockchain traceability—all lead to lower insurance premiums and better coverage. -

How do platforms like Farmonaut help with insurance in Texas?

We at Farmonaut support insurance companies with satellite verification, blockchain compliance, real-time crop analytics, and APIs—reducing fraud, expediting processing, and enabling smarter insurance products for Texas farms. -

What role do digital apps and APIs play in rural insurance programs?

Digital solutions streamline every insurance process—from verifying field status, documenting claims, and tracking resource usage—to fully automating insurance eligibility for rural communities. -

Can smart insurance help with climate resilience and sustainability?

Yes, by rewarding conservation practices and enabling rapid adaptation to changing environmental threats through data-driven insights and targeted insurance incentives.

Conclusion

In 2026, agricultural insurance companies including the Texas Farm Bureau Insurance Company, Farm Bureau Mutual Insurance, Indiana Farm Bureau Health Insurance and others continue to anchor the success, stability, and resilience of Texas’s rural landscape. With the digital transformation led by platforms like My Texas Farm Bureau and the integration of advanced analytics, satellite monitoring, and smart infrastructure coverage, the future for Texas agriculture looks bright, innovative, and secure.

For ranchers, crop producers, and forestry operators, the choice of a forward-thinking insurance provider is no longer just about financial protection—it’s about securing access to vital data, maximizing policy benefits, and navigating the complexities of modern, evolving agriculture.

We at Farmonaut remain dedicated to supporting the Texas agricultural sector and its insurance providers, offering affordable, scalable, and advanced digital tools that foster resilience, sustainability, and transparency for all stakeholders.

Take the next step. Explore the tools, coverage, and resources that will power the future of Texas farming and rural insurance, today and tomorrow.