Washington State Agriculture 2025: Must-Know Trends Shaping Water, Labor, Irrigation, and Sustainability

“2 forces drive Washington agriculture: climate variability and water availability shaping 2025 resilience planning, 3 tech pillars—automation plus efficient irrigation plus sustainability—target export growth; AI stands out in 2025 outlook”

Farming in Washington State is entering 2025 with a distinctive mix of high-value specialty crops, large-scale commodity production, and rapid technological adoption. The washington state agriculture profile remains diverse, spanning irrigated orchards and vineyards in the Yakima and Columbia valleys, wheat fields in the Palouse, and nurseries along the I‑5 corridor. This sector continues to power a strong export economy while adapting to climate change, water constraints, and labor shortages.

In 2025, agriculture in Washington state is shaped by warming temperatures, reduced mountain snowpack, earlier spring runoff, and shifting chill hours. Producers are investing in irrigation modernization, efficient sprinkler systems, drip systems, canal lining, and on-farm reservoirs, supported by state and federal grants. Meanwhile, automation—from robotic harvesters and optical sorters to drone-based scouting—is advancing across tree fruit, hops, vegetables, and large-scale row crops.

Explore tools that support 2025 readiness:

- Farmonaut API and Developer Docs for integrating satellite insights, weather, and AI advisory into on-farm and ag-supply systems.

Table of Contents

- 1) Washington State agriculture 2025: Overview and focus areas

- 2) Production profile: Apples, hops, cherries, pears, potatoes, wine grapes, and wheat

- 3) Climate and water: Irrigation modernization, snowpack, groundwater, and Yakima Basin

- 4) Technology and labor: Automation, drones, packing lines, and decision tools

- 5) Soil health and sustainability: Regenerative practices and carbon

- 6) Pests, diseases, and smoke: IPM and wildfire-season strategies

- 7) Markets and infrastructure: Exports, cold chain, and domestic demand

- 8) Policy, research, and resilience: Programs, funding, and access

- 9) 2025 Washington Ag Trends Impact Matrix (sortable)

- 10) Deep dives: Irrigation efficiency, AI scouting, robotics, varieties, and more

- 11) 2025 outlook: Integrated pathways for resilience

- 12) FAQ

Washington State agriculture 2025: Overview and focus areas

Washington State farming in 2025 reflects the confluence of water availability, climate variability, and the escalating cost and availability of labor. The state remains a nation-leading producer of apples and hops with a top-tier presence in cherries, pears, potatoes, wine grapes, and wheat. This mix of specialty and commodity crops supports a robust export orientation, with key markets in Asia, Mexico, and Canada.

Several themes define agriculture washington state in 2025:

- Climate and water: Warming temperatures, reduced mountain snowpack, earlier spring runoff, and shifting chill hours reshape management of summer irrigation.

- Technology adoption: Automation, robotic harvesters, optical sorters, automated packing lines, and precision sensing (soil moisture, canopy stress) move into mainstream use.

- Sustainability and soil stewardship: Reduced tillage, cover crops, compost amendments, and improved stewardship support long-term resilience goals.

- Export infrastructure: Cold chain reliability and inland distribution remain strategic levers for high-quality outputs.

These drivers are most visible in the Yakima Valley and Columbia Basin (irrigated orchards, vineyards), the Palouse (wheat), and nursery hubs along the I‑5 corridor. Producers are adapting to market realities while meeting higher consumer expectations for sustainable, locally traced food.

Production profile: Apples, hops, cherries, pears, potatoes, wine grapes, and wheat

Washington state agriculture remains a nation leading supplier of apples and hops, with robust volumes of cherries, pears, and potatoes. Wine grapes have earned global acclaim, and wheat from the Palouse continues to serve domestic and export markets.

- Tree fruit: The Yakima and Columbia valleys anchor irrigated orchards producing apples, pears, and cherries. Investments target improved canopy systems, automation, and packing upgrades.

- Wine grapes and vineyards: Heat management, trellis design, and smoke exposure monitoring are part of annual planning cycles in 2025.

- Hops: Trellis engineering, harvest logistics, and optical sortation support quality and consistency for the brewing supply chain.

- Potatoes and vegetables: Precision irrigation, soil moisture sensing, and automation in storage reduce loss and energy use.

- Wheat and forage: In the Palouse, conservation tillage and residue management strengthen soil resilience.

- Greenhouse and nursery: Greenhouse and nursery production has grown, supplying domestic customers and exports, with organic acreage expanded as demand for sustainable, digitally traced products continues to rise.

In 2025, producers remain focused on strategic variety and rootstock selection to match changing chill hours and heat stress patterns, balancing production risk and quality outcomes in a shifting climate.

Climate and water: Irrigation modernization, snowpack, groundwater, and Yakima Basin

Across washington, warming temperatures, mountain snowpack declines, and earlier spring runoff are reshaping water management. Basin-level planning—notably in the Yakima Basin—is central to securing summer irrigation for orchards, vineyards, and vegetables. The 2025 focus includes:

- Irrigation efficiency: Conversion to efficient sprinkler systems and drip, lining canals, and building small on-farm reservoirs. Upgrades have accelerated, supported by grants and cost-share programs.

- Groundwater and compliance: Groundwater monitoring and metering improve allocation and recharge. Compliance technology supports accurate reporting and efficient planning.

- Deficit irrigation: Strategic water budgeting for quality in wine grapes, tree fruit, and potatoes under constraints.

- Varieties and rootstocks: Shifting toward heat- and drought-tolerant materials to match evolving chill hours and stress patterns.

Water, energy, and sustainability are linked. Pumping schedules, pressure regulation, and renewable-powered systems help reduce costs and emissions while maintaining yield stability in hot summers.

Technology and labor: Automation, drones, packing lines, and decision tools

Labor shortages, rising costs, and reliance on the H‑2A guest worker program are pushing mechanization and automation forward in 2025. In tree fruit, hops, potatoes, and vegetables, producers deploy:

- Robotic harvesters for targeted blocks and assistive platforms that handle steeper slopes or tall canopies.

- Optical sorters and automated packing lines to ensure throughput and consistent grades.

- Drone-based scouting with multispectral imaging to detect pest pressure, canopy stress, and soil moisture variability.

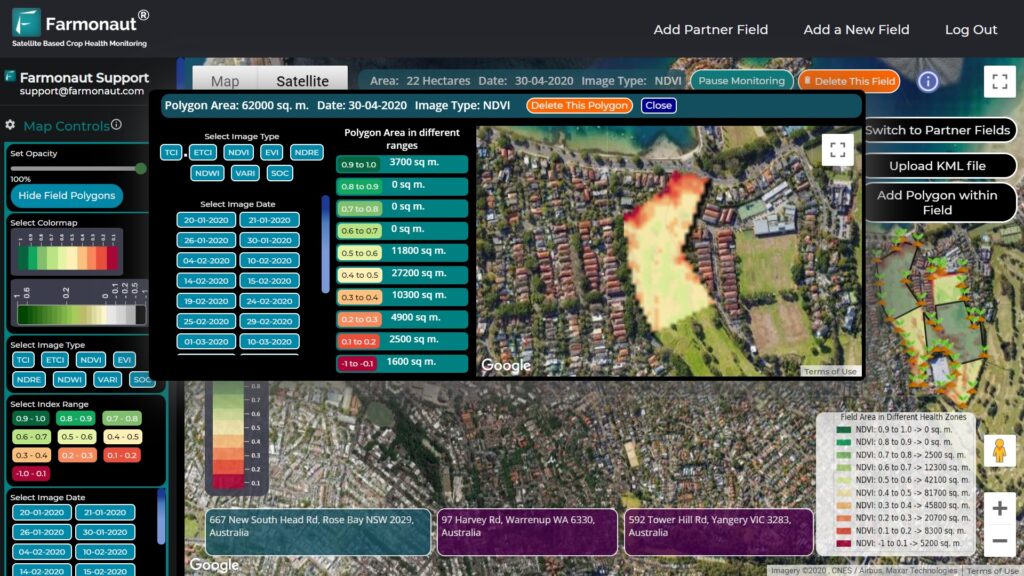

- AI-driven decision tools that integrate weather, NDVI/NDWI, and yield mapping for input optimization.

Precision agriculture tools enhance production efficiency and resilience under increasing pressure from water and labor constraints. Producers remain focused on ROI, payback periods, and risk reduction relative to climate variability.

Integrating satellite + AI into field decisions

We provide satellite monitoring, AI-based advisory, and resource management so producers can plan irrigation, monitor soil health, and scout pest hot spots with fewer passes.

- Farmonaut Large-Scale Farm Management: Coordinate multi-farm operations, assign tasks, and centralize management data to improve efficiency.

- Farmonaut Fleet Management: Track equipment and vehicles to reduce downtime, improve fuel use, and enhance logistics during harvest and packing.

Traceability and export compliance

As markets demand traced, sustainable food, digital records reduce manual reporting burdens and support buyers’ requirements.

- Farmonaut Traceability (Blockchain): Provide verifiable product journeys for exports and domestic buyers, with secure data access across the supply chain.

- Farmonaut Carbon Footprinting: Track emission baselines and practice impacts to align with buyer and retailer sustainability programs.

Access to finance and risk reduction

Satellite-based verification can streamline lending and risk assessment, improving access to capital for upgrades and technology adoption.

- Farmonaut Crop Loan & Insurance: Use satellite verification to support financing and insurance processes while reducing fraud.

- Farmonaut Crop & Plantation Advisory: Get AI-driven insights to improve management and outcomes across diverse crops.

Soil health and sustainability: Regenerative practices and carbon

Soil health underpins resilience across agriculture washington state. In 2025, interest in regenerative practices has expanded: cover cropping, reduced tillage, compost amendments, and integrated nutrient management. Growers are exploring revenue from voluntary carbon and ecosystem services markets while meeting retailer sustainability criteria.

- Cover crops: Improve infiltration and aggregate stability, buffer heat, and reduce erosion in the fields of the Palouse and irrigated row crops.

- Compost and organic matter: Increase water-holding capacity in the Yakima and Columbia valleys to handle summer heat.

- Integrated nutrient management: Balance N-P-K with soil biology for steady production and quality improvements.

- Certification readiness: Digital records demonstrate reduced pesticide load, improved water stewardship, and traceability.

Pests, diseases, and smoke: IPM and wildfire-season strategies

New pest pressures and shifting disease dynamics reflect changing microclimates and warmer winters. Integrated pest management remains a core strategy, supported by extension and surveillance. Wildfire seasons and resulting smoke now factor into harvest planning for tree fruit and wine grapes. 2025 playbooks include:

- Vigilant monitoring: Trap networks, scouting flights, and remote-sensing stress indicators.

- Timing adjustments: Harvest windows account for smoke risks and heat spells.

- Infrastructure: Improved air filtration in packing and cold rooms; on-farm protocols to protect workers and fruit.

- Varietal strategy: Adjusting clonal selections and trellis to reduce sunburn and improve airflow.

Markets and infrastructure: Exports, cold chain, and domestic demand

Export markets remain vital for washington state farming in 2025. Port capacity, cold storage reliability, and inland distribution across the state are critical bottlenecks. Policy focus has emphasized cold storage investment, transportation efficiency, and packing line modernization to preserve fruit quality from orchards and vineyards to end markets.

- Export outlook: Asia, Mexico, and Canada drive volumes for apples, cherries, and hops. Diversification helps offset regional slowdowns.

- Domestic demand: Purchasers seek sustainable, locally traced food, encouraging certification, traceability, and water stewardship verification.

- Cold chain upgrades: Energy-efficient systems, packhouse automation, and real-time monitoring protect quality in transit.

Digital recordkeeping supports buyer criteria and market access, particularly where provenance, chemical use, and water stewardship data are requested. We help producers organize and surface this data for compliance and marketing advantages.

Policy, research, and resilience: Programs, funding, and access

State programs, federal NRCS funding, and Washington State University research contribute to resilience in 2025, prioritizing water infrastructure, irrigation tech, and climate-focused agronomy. Persistent challenges include access to farmland for beginning growers, affordable housing for seasonal labor, and financing for technology adoption.

- Water projects: Canal lining, aquifer recharge, and small-scale storage to stabilize late-summer supply.

- Innovation funding: Incentives for precision systems, emissions reduction, and renewable-powered pumping.

- Education and extension: Decision tools, variety trials, and IPM updates for new pest pressures.

Digital infrastructure also matters. Reliable rural connectivity is essential for telemetry, cloud analytics, and coordinated operations across larger farms and co-ops.

“2 forces drive Washington agriculture: climate variability and water availability shaping 2025 resilience planning, 3 tech pillars—automation plus efficient irrigation plus sustainability—target export growth; AI stands out in 2025 outlook”

2025 Washington Ag Trends Impact Matrix: Irrigation Efficiency, Automation, Sustainability

| Trend | Short rationale | Estimated 2025 adoption in WA farms (%) | Estimated water-use change (%) | Estimated yield change (%) | Estimated capex ($/acre) | Estimated payback (years) | Emissions change (%) | Primary crops | Regions most impacted | Export outlook impact (YoY %) | Policy sensitivity | Risk level | Data confidence |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Precision/variable-rate irrigation | Targeted water to match canopy and soil variability | 35–55% | -10% to -30% | +2% to +10% | $450–$1,200 | 2–5 | -3% to -12% | Apples, cherries, hops, potatoes | Yakima Valley, Columbia Basin | +1% to +3% | Med | Med | Med |

| AI imagery and scouting | Rapid pest detection and stress mapping | 40–60% | -2% to -8% | +1% to +6% | $15–$40 (SaaS/acre/yr) | 1–2 | -1% to -5% | Tree fruit, hops, grapes, potatoes | Yakima Valley, Columbia Basin, Skagit | +0.5% to +2% | Low | Low | Med |

| Orchard robotics and automation | Mitigate labor shortages, boost pack-out | 15–30% | -1% to -5% | +2% to +8% | $2,000–$6,000 | 3–7 | -2% to -6% | Apples, cherries, pears | Yakima Valley, Columbia Basin | +1% to +4% | Med | Med | Low–Med |

| Drought-tolerant varieties/rootstocks | Adapt to heat and chill hours shifts | 20–40% | -3% to -12% | +0% to +7% | $1,500–$5,000 | 5–10 | -1% to -4% | Apples, grapes, cherries, hops | Yakima Valley, Columbia Basin | +0% to +2% | Med | Med | Low |

| Deficit irrigation and water banking | Quality targeting + seasonal security | 10–25% | -8% to -25% | -1% to +4% | $200–$800 | 2–4 | -2% to -7% | Grapes, apples, potatoes | Yakima Basin, Columbia Basin | +0% to +2% | High | Med | Low–Med |

| Renewable-powered pumping | Reduce energy costs and emissions | 8–20% | -0% to -3% | 0% to +2% | $1,200–$3,500 | 4–8 | -5% to -20% | All irrigated crops | Yakima Valley, Columbia Basin | Neutral to +1% | Med | Low | Low |

| Regenerative soil practices | Water retention, erosion control, resilience | 30–50% | -2% to -10% | 0% to +5% | $50–$300 | 2–6 | -2% to -10% | Wheat, apples, potatoes | Palouse, Yakima, Skagit | +0% to +1% | Low | Low | Med |

| Export diversification and cold-chain upgrades | Quality protection and market access | 25–45% | Neutral | +1% to +6% | $800–$2,500 | 3–6 | -1% to -4% | Apples, cherries, pears | Yakima, Columbia Basin, Skagit | +1% to +5% | Med | Med | Med |

| Water-rights compliance tech | Metering, reporting, and planning | 15–35% | -1% to -6% | 0% to +2% | $20–$150 | 1–3 | -0% to -2% | All irrigated crops | Yakima Basin, Columbia Basin | Neutral | High | Low | Low–Med |

All values are directional 2025 estimates for planning. Outcomes vary by block, system design, and season. Use local trials and advisors for final decisions.

Deep dives: From precision irrigation to compliance tech

Below are short deep dives on each trend in the Impact Matrix with Washington-local context. Use these notes to calibrate timing, capital, and expected results across irrigated orchards, vineyards, potatoes, and wheat in the Yakima Valley, Columbia Basin, Palouse, and Skagit.

Precision/variable-rate irrigation

- What changes: Pivot or drip zones adjust by soil texture, slope, canopy vigor, and phenology.

- Why now: Water scarcity and energy costs in summers; pressure to document stewardship.

- WA fit: Yakima and Columbia systems already upgrading with sprinkler systems, drip, and lining canals to cut losses.

- Tip: Pair with soil moisture sensors and NDWI to avoid over-irrigation during heat waves.

AI imagery and scouting

- What changes: Aerial and satellite analyses flag pest and stress signals before visual symptoms.

- Why now: Larger footprints and labor constraints demand remote monitoring.

- Use case: Tree fruit, hops, and wine grapes integrate alerts into spray and irrigation plans.

We offer real-time monitoring, AI advisory, and blockchain-based traceability to support these workflows end-to-end—accessible via Android, iOS, web, and API.

Orchard robotics and automation

- What changes: Assistive platforms, robotic pickers, and robotic bin handling reduce labor bottlenecks.

- Why now: H‑2A program reliance and rising costs have pushed mechanization forward.

- Consider: Interoperability with grading, optical sorters, and automated packing lines for end-to-end efficiency.

Drought-tolerant varieties and rootstocks

- What changes: Scaffold design and canopy density tuned for sunburn risk and airflow.

- Why now: Changing chill hours, heat stress, and seasonal unpredictability.

- WA fit: Apples, cherries, hops, and grapes pursue material shifts block by block during replants.

Deficit irrigation and water banking

- What changes: Budgeted deficits outside critical growth windows; banking to secure late-season volumes.

- Why now: Summer allocations and constraints under environmental and hydrological change.

- WA fit: Yakima Basin planning and groundwater coordination support long-term stability.

Renewable-powered pumping

- What changes: On-site solar and pump controls manage peak loads and reduce operating costs.

- Why now: Energy-price volatility and emissions goals.

- Stack: Precision irrigation + telemetry + demand management increases ROI.

Regenerative soil practices

- What changes: Reduced tillage, cover, compost, and buffer strips to improve soil function and reduce erosion.

- Why now: Carbon markets, retailer requirements, and resilience against heavy rain and heat spells.

- WA fit: The Palouse integrates practices to cut erosion; irrigated valleys build organic matter for water retention.

We help quantify and report environmental impact through satellite-based monitoring and Farmonaut Carbon Footprinting, supporting both internal goals and buyer programs.

Export diversification and cold-chain upgrades

- What changes: Airflow optimization, high-efficiency compressors, and real-time telemetry for cold rooms and containers.

- Why now: Export quality protection and market flexibility.

- WA fit: Yakima and Columbia Basin packers upgrading to maintain tree fruit quality.

We support traceability documentation and quality data capture end-to-end via **Farmonaut Traceability (Blockchain)** for buyer transparency: learn more.

Water-rights compliance tech

- What changes: Metering, analytics, and audit-ready reports that align with basin plans.

- Why now: Allocation scrutiny and drought-season checks.

- WA fit: Yakima Basin and Columbia Basin blocks lean on accurate logs to demonstrate stewardship.

We enable integrated, digital records through our platform and **Farmonaut API** for system-to-system data flows.

2025 outlook: Integrated pathways for resilience

By 2025, agriculture in washington is more tech-enabled and sustainability-focused, but faces real limits from water availability, labor, and climate extremes. Integrated approaches—combining irrigation efficiency, improved varieties, automation, soil stewardship, and smart policy—determine whether the state can remain productive and competitive while meeting environmental goals.

- For orchards and vineyards (Yakima, Columbia Basin): Precision water, canopy cooling, smoke monitoring, and harvest automation.

- For the Palouse and wheat systems: Conservation tillage, cover, and diversified rotations for erosion control and water retention.

- For nurseries and greenhouse producers along I‑5: Energy-efficient climate control and traceability to match buyer expectations.

Export markets will reward quality, consistency, and documented stewardship. Domestic demand for sustainable, locally traced food continues to grow, supporting programs that verify reduced inputs, improved water use, and resilient production.

Get started with decision-grade insights:

- Farmonaut Large-Scale Farm Management centralizes field monitoring, tasks, and reporting for multi-block operations.

- Farmonaut Traceability secures supply chain data with blockchain to support export and retailer requirements.

- Farmonaut Carbon Footprinting quantifies emissions for certifications and buyer programs.

- Farmonaut Fleet Management optimizes harvest and packing logistics to reduce fuel and idle time.

- Farmonaut API and Developer Docs bring satellite and weather intelligence into your tools.

FAQ: Washington State agriculture 2025

What are the biggest 2025 challenges for farming in Washington State?

Top challenges include water availability, climate variability (warming temperatures, reduced snowpack, and earlier runoff), and labor shortages with rising costs. Smoke and heat events also impact tree fruit and wine grapes.

Which crops define the state’s 2025 production profile?

Apples and hops remain leading. Cherries, pears, potatoes, wine grapes, and wheat are important pillars. Greenhouse and nursery outputs are grown, and organic acreage has expanded.

Where are irrigation upgrades most common?

Upgrades are concentrated in the Yakima Valley and Columbia Basin, where irrigated orchards and vineyards rely on efficient sprinkler systems, drip, and lining canals. Basin-level planning and groundwater coordination are supported by grants and programs.

How is technology easing labor pressure?

Automation via robotic harvesters, optical sorters, and automated packing lines helps offset shortages. AI-based scouting and remote sensing improve management efficiency across large footprints.

What practices strengthen soil resilience?

Reduced tillage, cover cropping, compost use, and integrated nutrient plans enhance soil structure and water-holding capacity, supporting production under heat and drought pressure.

How important are export markets in 2025?

Exports remain vital, especially to Asia, Mexico, and Canada. Cold chain reliability, infrastructure investment, and documentation (traceability, stewardship) safeguard access and pricing.

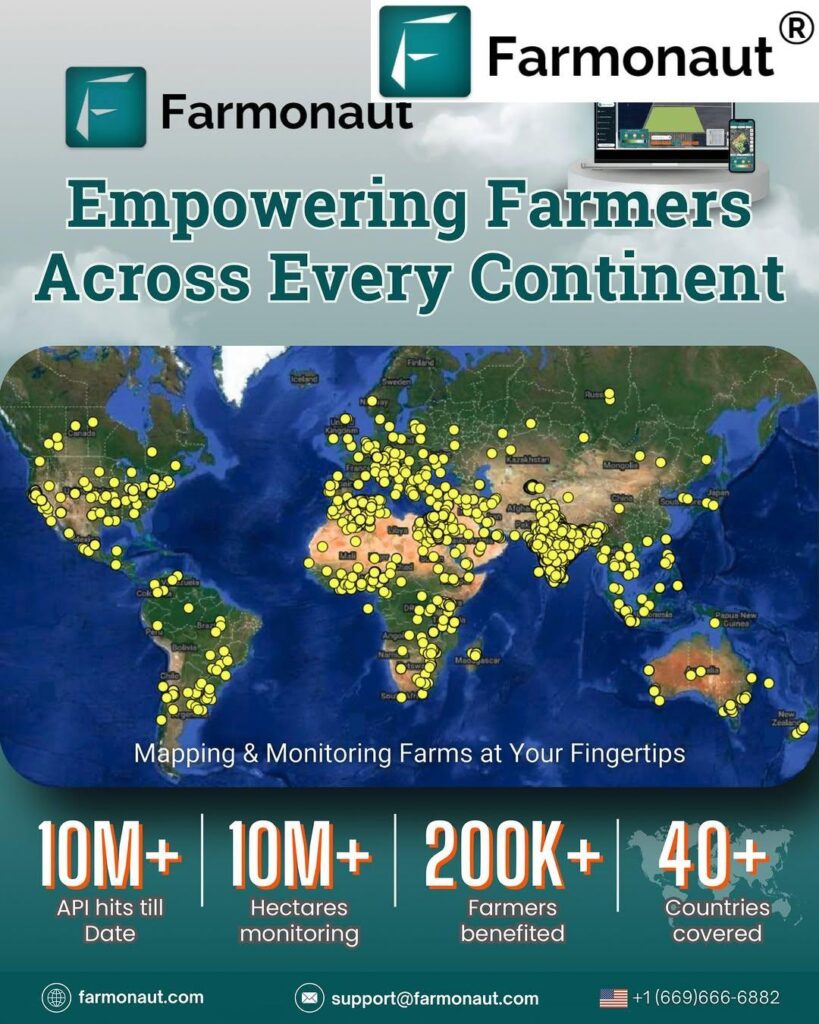

What role does Farmonaut play in Washington State agriculture?

We deliver satellite-based monitoring, AI advisory (Jeevn AI), blockchain-based traceability, and resource management tools through mobile, web, and API. Our mission is to make satellite-driven insights affordable and accessible, supporting irrigation, soil monitoring, risk reduction, and documentation needs across the state.

Is Farmonaut a marketplace or a regulatory body?

No. We are a satellite technology platform offering monitoring, analytics, and traceability—not an online marketplace, input manufacturer, or regulator.

How can teams get started?

Download our apps, access the web portal, or integrate via the Farmonaut API. See the pricing table above for subscription options and the Developer Docs for technical details.

Summary for 2025 and beyond: Washington state agriculture balances high-value specialty crops and key commodity outputs with rapid technological adoption. Under increasing pressure from water constraints, labor dynamics, and climate volatility, integrated strategies—efficient irrigation, canopy and variety management, automation, soil stewardship, and data-backed traceability—support a resilient, export-driven economy. We provide satellite and AI tools to help producers plan, document, and thrive in this evolving landscape.