American Farmland REIT: 2025 Stock Growth Insights

Table of Contents

- Introduction: 2025 and the Rise of American Farmland REITs

- Trivia: Farmland REIT Performance and Impact

- Understanding American Farmland and Its Importance

- How Farmland in America Offers Investment Benefits in 2025

- The Rise of American Farmland REITs

- Investment Dynamics: American Farmland REIT Stock Growth Insights 2025

- Farmland REIT Performance Overview (Estimated 2025)

- Challenges and Opportunities: Navigating American Farmland Investment

- Sustainable Farming Practices & Carbon Farming in Farmland Investments

- Transforming Farmlands with Agricultural Technologies

- How Farmonaut Empowers Sustainable Farmland Management

- Trivia: Farmland REITs and Sustainable Growth, 2025

- Income, Yields & Profitability: The Appeal of Farmland REIT Stocks

- FAQ: American Farmland REIT & Farmland Investment 2025

- Conclusion: The Future of Farmland in America & Investment in 2025

“***American farmland REITs saw an average annual return of 11% from 2010 to 2023, outperforming many traditional assets.***”

Introduction: 2025 and the Rise of American Farmland REITs

As 2025 unfolds, American farmland stands at the intersection of real estate investment, sustainable food production, and technology-driven agriculture. The American Farmland REIT sector continues to gain recognition for blending the stability of physical assets with the income potential and long-term growth opportunities demanded by today’s investors. With the global population rising and demands for sustainable food sources increasing, farmland in America remains a critical asset class, supporting both the economic and environmental wellbeing of the United States and beyond.

Whether for institutional investors seeking stable and inflation-resistant holdings, or individuals looking to diversify with farmland stocks, the American Farmland REIT offers unique appeal in 2025. This comprehensive guide will unpack the intertwined importance of American farmlands, agricultural REITs, and new technologies—helping you understand current trends, performance, and the forces shaping the market’s future.

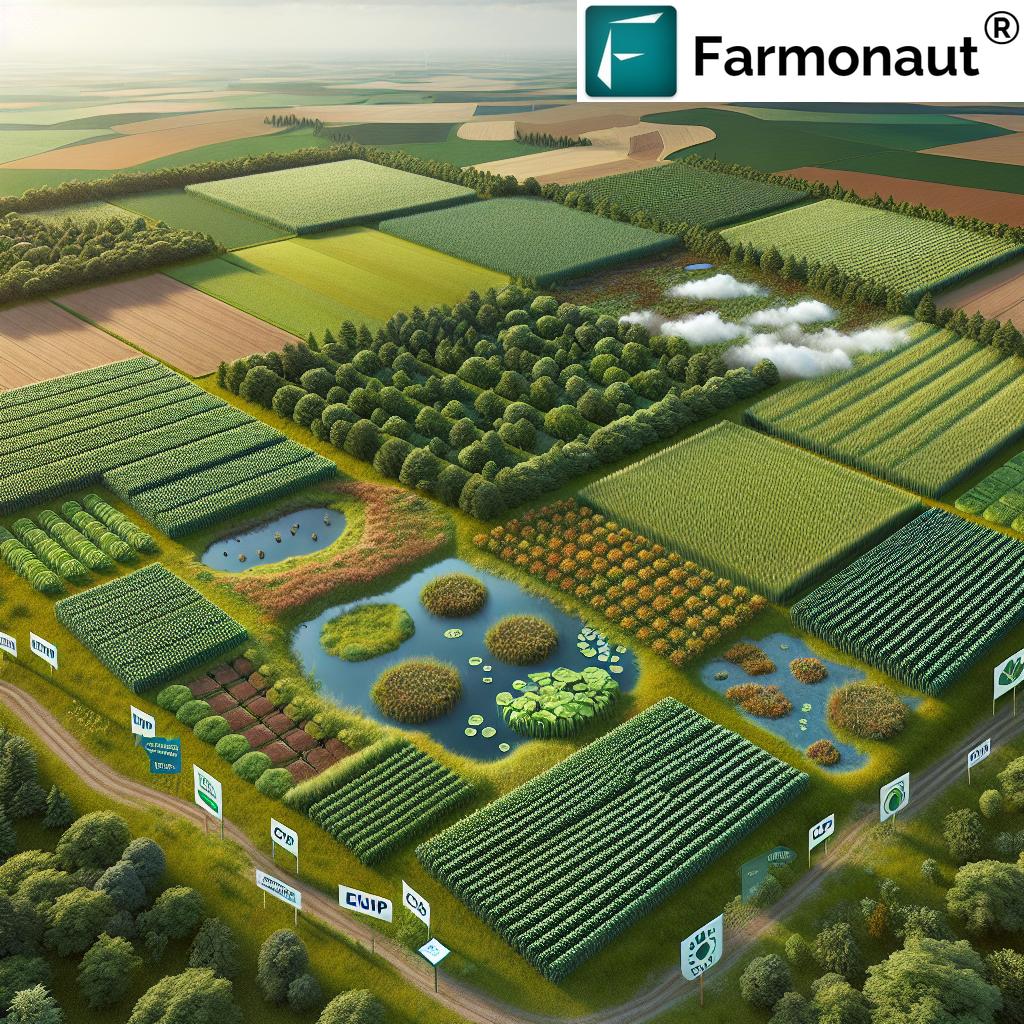

Understanding American Farmland and Its Importance

American farmland encompasses the vast expanses across the United States, ranging from the iconic Corn Belt stretching through the Midwest to the fertile valleys of California and beyond. This resource supports the production of essential crops like corn, soybeans, wheat, and cotton, as well as livestock rearing. American farmlands are not only foundational for providing food—they also play a vital role in:

- Supporting rural economies through job creation and infrastructure

- Maintaining ecological balance, including biodiversity and natural habitats

- Sequestration of atmospheric carbon dioxide, contributing to climate change mitigation

The importance of American farmland lies in more than just food—it is a critical economic and environmental resource. In 2025, as land values rise and technology improves productivity, farmland investment is increasingly recognized as a strategic decision for both security and growth.

Key characteristics that make farmland in America a vital part of the nation’s fabric include:

- Diversity of crop production: From the Midwest’s corn and soybeans to California’s valleys producing vegetables, fruits, and cotton

- Long-standing soil health and fertility: Achieved through centuries of sustainable management and gradual adaptation

- Role in rural and national economies: Farmlands underpin local businesses and national exports

- Environmental stewardship: American farmlands contribute to habitat preservation and carbon sequestration

Farmland in America: A Resource Beyond Food

The significance of American farmland today goes far beyond food production. As the population grows and global food demands increase, farmland also:

- Contributes to renewable energy production (e.g., biofuels from corn and soybeans)

- Helps balance ecological systems, maintaining clean water and air resources

- Offers recreational and conservation value, including for hunting, fishing, and heritage preservation

2025: Why American Farmlands Remain a Strategic Asset

In 2025, the American farmland sector remains recognized not merely as a farm resource but as a strategic investment asset. A combination of rising land values, increased adoption of sustainable practices, and technological advancements further enhances both productivity and profitability, aligning economic objectives with environmental impact and sustainability commitments.

How Farmland in America Offers Investment Benefits in 2025

Investing in American farmland REITs means engaging with a historically resilient asset class that offers unique benefits—notably, stability, tangible asset backing, and income potential. In a global climate of fluctuating equity markets and rising inflation, farmland stocks stand out for their ability to weather volatility and deliver consistent returns.

- Stable and tangible assets: Unlike paper assets, farmland is finite, providing a buffer against inflation and currency devaluation as land values typically trend higher over the long term.

- Inelastic food demand: Agriculture is considered an “essential service.” The world must eat, so demand for crops and livestock remains relatively stable, regardless of macroeconomic cycles.

- Income through leasing: Farmland owners, or REITs, lease land to reliable farmers and agricultural companies, generating rental income and often sharing in crop proceeds.

- Potential for appreciation and capital growth: Factors such as rising land scarcity near urban regions, improved yields due to smart farming technologies, and high global food prices support asset appreciation.

- ESG alignment: Farmland investment increasingly intersects with Environmental, Social, and Governance (ESG) goals, especially when supporting sustainable practices and carbon farming initiatives.

Investment Vehicles: What is an American Farmland REIT?

A Real Estate Investment Trust (REIT) is a publicly traded company that owns and operates income-producing real estate. Farmland REITs in America, such as Farmland Partners Inc. and Gladstone Land Corporation, specialize in acquiring, managing, and leasing agricultural land. These provide:

- Access for investors to benefit from large-scale agricultural operations, without directly managing farms

- Portfolio diversification, as farmland returns often move independently from equities and bonds

- Regular income in the form of dividends, sourced from lease agreements and crop revenue partnerships

- Liquidity; shares are traded like any public stock

The Rise of American Farmland REITs: 2025 and Beyond

In recent years, the rise of American farmland REITs has accelerated as more investors seek the stability, tangible value, and ESG-friendly attributes of agricultural land. American Farmland REITs are specialized investment vehicles that aggregate and professionally manage portfolios of quality farmland, leasing them to efficient, innovative farmers and agricultural companies.

Key Characteristics of Leading Farmland REITs in America:

- Strategic Portfolio Management: Focused on high-value agricultural regions—such as the Corn Belt (Iowa, Illinois, Indiana, Minnesota, Nebraska) and California’s Central Valley.

- Diversification: Spanning a variety of crops (corn, soybeans, wheat, cotton, specialty vegetables, fruits, and nuts) and farm types.

- Sustainability Focus: Many American Farmland REITs emphasize long-term soil health, water conservation, and regenerative farming practices, supporting sustainable agricultural production.

- Income and Capital Growth: Tenants often sign long-term leases, ensuring consistent income, while rising land values create potential for capital appreciation.

- Accessibility: Lower investment minimums compared to directly buying farmland; available on major stock exchanges.

Notable American Farmland REITs: Building a Sustainable Sector

By 2025, U.S. farmland REITs collectively manage over 2 million acres—ranging from large-scale row crops in the Midwest to high-value specialty crops in the West. This professionalization brings expertise in leasing, sustainability, and maximizing both farmland value and income.

Some of the most visible and impactful names in the U.S. agricultural REIT space include:

- Farmland Partners Inc. (FPI)

- Gladstone Land Corporation (LAND)

- Agriculture REITs with a focus on carbon farming

- Other regionally specialized trusts

These REITs participate in the rise of American farmland stocks as a respected investment class, intertwining agricultural productivity with the traditional appeal of real estate investments.

Why Are Farmland REITs Gaining Traction?

Several factors contribute to the growing popularity of farmland REITs in 2025:

- Portfolio Diversification: Farmland returns have historically low correlation with major financial markets, providing a valuable diversification tool.

- Inflation Hedge: Land values and agricultural rents commonly rise with inflation, preserving purchasing power.

- Sustainable Impact: Investors increasingly seek assets that align with climate benefits and resilient food systems.

- Passive and Professional Management: Investors participate without the operational burden of running a farm.

Investment Dynamics: American Farmland REIT Stock Growth Insights 2025

By 2025, American farmland REIT stock performance is shaped by multiple economic, geographic, and technological factors. Understanding these investment dynamics is key for those evaluating farmland stocks as a core portfolio component.

1. Resilience Amid Market Volatility

Unlike many commercial or residential real estate sectors, American farmland stocks and REITs exhibit consistent resilience—even during equity market downturns. This is due to the inelastic nature of food demand and the safeguarding effect of land scarcity. Farmland continues to represent an essential resource with enduring value.

2. Rising Land Values & Technological Advancements

The convergence of rising values and technological advancements is a defining trait of farmland as a 2025 investment. Sophisticated farm management, AI-based precision agriculture, carbon farming, and yield optimization solutions increase both income potential and asset appreciation.

3. ESG Factors & Carbon Initiatives

ESG considerations now shape investment across all sectors. American farmland REITs increasingly incorporate sustainability commitments—promoting regenerative agriculture, soil health, and carbon sequestration (carbon farming). This enables:

- New income streams via carbon credits

- Reduced risk and stronger reputations in a climate-conscious world

- Improved long-term productivity due to healthy soils and ecosystem services

Learn about carbon footprinting for American farmland with Farmonaut’s Carbon Footprinting Solution. This service empowers land owners and managers to monitor and minimize their environmental impact with satellite-based real-time data on emissions—a crucial step for today’s ESG-driven agriculture investors.

Farmland REIT Performance Overview (Estimated 2025)

The table below compares leading American Farmland REITs in 2025—helping investors identify which trusts are demonstrating strong growth in stock price, income yield, sustainability, and overall return:

| REIT Name | Estimated 2025 Stock Price Growth (%) | Estimated Dividend Yield (%) | Portfolio Size (Acres) | Key States of Operation | Sustainability Initiatives | Estimated 2025 Total Return (%) |

|---|---|---|---|---|---|---|

| Farmland Partners Inc. (FPI) | 9.2 | 3.5 | 190,000 | Iowa, Illinois, Nebraska, Colorado, California | Regenerative agriculture, water conservation, carbon sequestration | 12.7 |

| Gladstone Land Corp. (LAND) | 7.8 | 3.0 | 117,000 | California, Florida, Texas, Oregon | Organic conversion, irrigation efficiency, sustainable certifications | 10.8 |

| American Agricultural REIT (Hypothetical) | 8.3 | 3.2 | 145,000 | Kansas, Minnesota, South Dakota | No-till farming, carbon credits, digital management systems | 11.5 |

| Harvest Land Equity Trust (Hypothetical) | 6.9 | 2.7 | 98,000 | Wisconsin, Indiana, Missouri | Cover cropping, pollinator programs, sustainable drainage | 9.6 |

Tip: When evaluating farmland REIT stocks, look for a blend of stock price appreciation, reliable dividend yields, a strong sustainability mandate, and regional diversification.

Challenges and Opportunities: Navigating American Farmland Investment

Like any investment, acquiring exposure to American farmland REITs and stocks comes with risks. However, 2025 offers unique upside as technology and sustainability trends reshape the landscape.

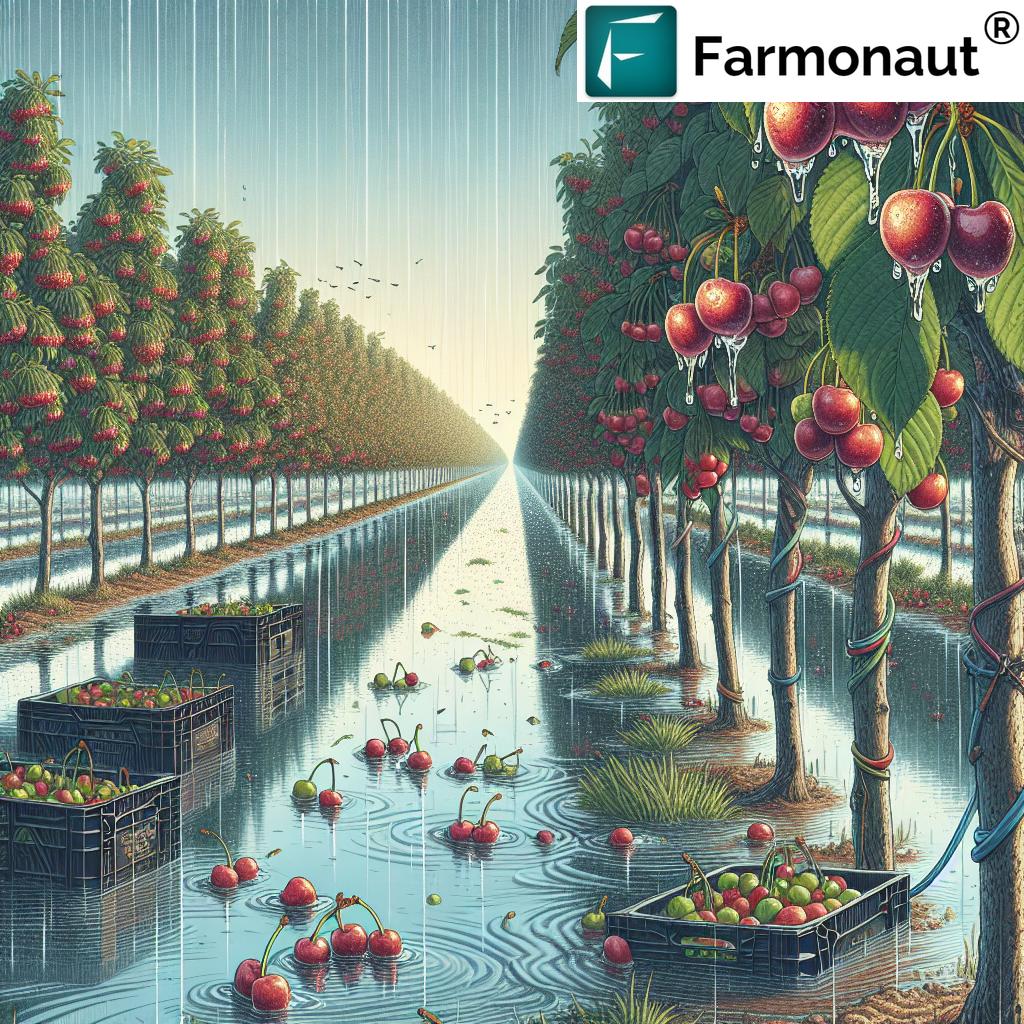

Primary Challenges

- Climate Change: Farmlands are vulnerable to extreme weather, shifting rainfall patterns, and long-term drought—especially impactful in states like California, Texas, and the Midwest.

- Regulatory Environment: Changes to water rights, pesticide rules, and land-use regulations may affect profitability and management.

- Soil Health: Decades of conventional farming can degrade soil. Transitioning to sustainable practices may require up-front investment.

- Market Volatility: While food demand is inelastic, crop prices and land values can be influenced by global markets and geopolitical factors.

Major Opportunities

- Technology Adoption: AI, drones, satellite crop monitoring, and blockchain traceability create new potential for enhancing yields and transparency.

- Carbon Markets: Farms implementing regenerative agriculture can sequester carbon—earning income from carbon credits and appealing to ESG investors.

- Consumer Trends: Demand for organic, local, and sustainable foods is driving investment in eco-conscious farmland operations.

- Professional Management: REITs mitigate operational risks, leveraging expertise to maximize both income and resource stewardship.

Learn how Farmonaut’s Blockchain-Based Product Traceability empowers farm businesses to ensure full transparency and trust in the journey of their crops and livestock products—from field to consumer, contributing to premium pricing and reduced fraud.

Sustainable Farming Practices & Carbon Farming in Farmland Investments

Sustainability has become a cornerstone of American farmland management in 2025. Both direct farmland owners and REITs are embracing regenerative agriculture practices to restore soil health and maximize long-term value:

- No-till and reduced tillage: Minimizing soil disturbance, which builds organic matter and sequesters carbon.

- Cover cropping: Growing plants during the off-season to enrich soils, reduce erosion, and support pollinator habitats.

- Water conservation: Precision irrigation, leak detection, and drought-resilient crops for regions like California and Texas.

- Integrated pest management (IPM): Using biological control and targeted pesticide use.

- Carbon farming: Proactively sequestering atmospheric CO2 in soils and plant biomass—creating carbon credits for additional revenue.

Discover more about digital solutions for carbon management by exploring Farmonaut’s Carbon Footprinting Platform, enabling real-time tracking of emissions for ESG-aligned farm management and carbon revenue opportunities.

Carbon Footprinting, Traceability & Compliance

Carbon footprint tracking and transparent supply chains are must-haves for U.S. agricultural stakeholders in 2025. Investors, banks, and customers all demand clear evidence of sustainable practices. Farmonaut’s digital tools support farmers, REIT operators and corporations by providing integrated Traceability and Carbon Footprinting solutions, reducing administrative burdens while enhancing trust and market access.

Access up-to-date Satellite and Weather Data for Farmland Management via Farmonaut APIs

(View API Developer Documentation)

Transforming Farmlands with Agricultural Technologies

The integration of technology in American farmlands is rapidly evolving—notably through satellite data, AI-powered farm advisory, and environmental monitoring. These innovations help overcome major challenges while driving long-term productivity increases:

- Satellite-based crop health monitoring: Enables real-time, field-level decisions about irrigation, fertilization, and pest/disease control—cutting waste and boosting yields.

- AI Advisory and forecasting: Data-driven insights (like those from Farmonaut’s Jeevn AI) provide actionable management advice to farmers and REIT operators.

- Blockchain-based traceability: Verifies every product’s journey—restoring consumer trust and qualifying for sustainable branding or premium pricing.

- Resource management tools: Fleet and input tracking for larger agricultural enterprises, ensuring operational efficiency.

To experience advanced large-scale farm management with real-time data, discover Farmonaut’s Agro Admin App—tailored for both professional farmland owners and REITs.

Accessible and Embedded Solutions: The Role of APIs in Farmland Management

APIs, such as those offered by Farmonaut, empower software developers and agribusinesses to incorporate advanced satellite imagery and weather data directly into proprietary management systems—enhancing the agility and operational intelligence of farm portfolios. Visit the Farmonaut API page for access and connection details.

How Farmonaut Empowers Sustainable Farmland Management

We at Farmonaut are dedicated to democratizing precision agriculture globally by delivering cost-effective, satellite-driven farm management technology to every stakeholder—whether you’re an individual farmer, agribusiness, corporate client, or American farmland REIT operator.

- Satellite-Based Crop Health Monitoring: With multispectral satellite images, we empower rigorous monitoring of crop vegetation, soil moisture, and threats—optimizing yields and minimizing resource waste.

- AI-Powered Jeevn Advisory System: Real-time, field-level recommendations improve farm management, productivity, and resilience—crucial for large-scale REIT portfolios in America and globally.

- Blockchain-Based Traceability: Our platform provides seamless traceability for crops and agricultural products, rebuilding supply chain trust and enabling true transparency for REIT stakeholders.

- Fleet and Resource Management: Designed for agribusiness and institutional farm operators managing expansive acreages—supporting operational efficiency and reducing costs.

- Carbon Footprinting: Our real-time carbon tracking tools allow for accurate measurement and reduction planning, aligning directly with evolving regulatory and investor sustainability requirements.

Start optimizing your farm management and sustainability compliance by joining Farmonaut today:

“***In 2025, U.S. farmland REITs manage over 2 million acres, supporting both sustainable agriculture and investor income growth.***”

Income, Yields & Profitability: The Appeal of Farmland REIT Stocks

The appeal of American farmland REIT stocks rests on several profit and return drivers in 2025:

- Consistent Cash Flow: Lease payments from farmers and sharecropping arrangements provide steady income.

- Dividend Potential: U.S. farmland REITs offer attractive dividend yields—often exceeding those of commercial office or residential REITs.

- Land and Crop Appreciation: Especially in high-demand regions (e.g., California, the Midwest Corn Belt), land values continue to climb over the long run.

- Operational Efficiency and Technological Improvements: Focused management enables higher productivity, better yields, and expense reduction.

For institutional investors, pension funds, and individuals alike, exposure to American farmland stock means accessing returns fueled by food security, sustainability, and the competitive advantages of well-managed agricultural land.

Curious about optimizing returns through better risk management and compliance? Explore Farmonaut’s Crop Loan & Insurance Satellite Verification Solution, ideal for financial institutions and large farm managers to reduce fraud, improve access to financing, and provide greater certainty in income streams.

FAQ: American Farmland REIT & Farmland Investment 2025

What is an American Farmland REIT?

It’s a Real Estate Investment Trust specializing in the acquisition, management, and leasing of income-producing agricultural land. These REITs trade on public exchanges, offering investors exposure to farmland as an asset class—combining both income (from farm leases) and appreciation (as land and food values grow).

How do farmland investments differ from traditional REITs?

Traditional REITs center on commercial (offices, warehouses) or residential (apartment complexes) real estate. American Farmland REITs focus on productive farmland, aligning with inelastic food demand and directly supporting agricultural production and rural economies.

Why is farmland considered a strong hedge against inflation and volatility?

Land is a finite, tangible asset. Its value generally rises with inflation (especially food prices) while food demand remains constant—helping stabilize returns during market instability.

Are American Farmland REIT stocks suitable for ESG investment strategies?

Yes, particularly when the REIT places a strong focus on sustainable management, regenerative agriculture, and carbon farming. Modern investors increasingly prioritize farmland REITs that integrate ESG principles.

What are the main risks in farmland investment in 2025?

Core risks include climate change, extreme weather, regulatory changes, water rights disputes, and agricultural commodity price fluctuations. However, technological advances and professional REIT management can mitigate many of these risks.

How can technology platforms like Farmonaut help maximize the value of farmland investments?

By leveraging satellite imagery, AI-based precision advisory, blockchain traceability, and real-time carbon footprinting, Farmonaut allows both farm managers and investors to optimize productivity, ensure regulatory compliance, and substantiate sustainability claims.

Can I integrate Farmonaut data into my business or investment platform?

Absolutely. We offer robust APIs (see here) and developer documentation (view docs) for seamless integration of agricultural intelligence into your proprietary systems or investment dashboards.

Conclusion: The Future of Farmland in America & Investment in 2025

In 2025, American farmland continues to represent a critical asset class, intertwining the stability of agriculture with the enduring appeal of real estate investment vehicles like the American Farmland REIT. Farmland stocks distinguish themselves by providing investors with inflation resilience, steady income, and the fulfillment of ESG mandates—all while supporting national and global food security.

Professional REIT management, technology adoption, and sustainability integration are transforming America’s rural landscape—ensuring that farmlands remain economically viable and environmentally sustainable into the future. The sector’s impact extends far beyond food—it touches carbon sequestration, rural economies, biodiversity, and the evolving demands of a growing, increasingly responsible global population.

For those seeking a blend of stability, income, and positive environmental impact, American farmland REITs and stocks in 2025 offer one of the most compelling, future-facing opportunities in the investment landscape.

Ready to elevate your farm’s management and transparency? Discover advanced solutions by Farmonaut for large-scale farm management and traceability—ideal for REITs, agribusinesses, and progressive farm investors worldwide.