USDA Rural Map & Loans 2026: Unlock Sustainable Growth

“Over 50% of U.S. land qualifies for USDA rural loans, boosting sustainable housing and agriculture in 2026.”

Introduction: Why USDA Rural Maps and Loans Matter in 2026

As we approach 2026, rural America stands at a pivotal crossroads—balancing the deep-rooted traditions of agriculture, forestry, and close-knit communities with the demand for modern infrastructure, sustainable development, and climate-resilient economies. The United States Department of Agriculture (USDA) continues to play a pivotal role in this transformation through its innovative rural loan programs and rural area designations. These essential resources foster growth, support housing, enable modern infrastructure, and empower communities by making affordable credit and targeted support accessible for residents, farmers, foresters, and local businesses.

In this comprehensive guide, we explore:

- The definition and significance of USDA rural areas and their maps

- An in-depth look at USDA rural loans—including home, agriculture, business, and infrastructure loans—and their benefits in 2026

- The critical role of digital tools, like those offered by Farmonaut, in supporting loan access, project monitoring, and resource optimization for rural America

- Step-by-step processes for accessing USDA loans and maximizing sustainable impact, using GIS and satellite technologies

Let’s unlock the power of the USDA rural map, loans, and cutting-edge technology for a more sustainable and thriving rural future.

Defining USDA Rural Areas & Importance of the USDA Rural Map

What is a USDA Rural Area?

A USDA rural area is a specific geographic location designated by the USDA for eligibility under various support programs. These areas are defined based on criteria including population size, local infrastructure, and economic indicators. Typically, areas with a population under 35,000 that are not closely tied to metropolitan hubs qualify as USDA rural zones.

- Designated USDA rural areas are essential for targeting loan opportunities, financial programs, and development resources where they are most needed.

- Eligibility for rural loans USDA, grants, and other supports are determined by the current classification on the USDA rural map.

The USDA Rural Map: Key to Access and Opportunity

The USDA rural map is an online, GIS-driven tool that accurately delineates approved USDA rural areas for easy eligibility verification. By entering a property address or browsing the interactive map, prospective borrowers and local businesses can:

- Verify if a property is within an approved USDA rural zone

- Identify eligible locations for farms, homes, forestry operations, or community facilities

- Plan infrastructure projects for maximum support and community benefit

With advances in GIS and mapping technologies, the USDA rural map is now accessible online and updated regularly. This ensures applicants, homeowners, farmers, and businesses can make informed decisions in real time.

Example: A young couple interested in buying a home in a small Texas town can use the USDA rural map to see if they qualify for a USDA rural home loan—potentially saving thousands and making affordable, sustainable rural housing a reality.

Image ALT text for SEO: usda rural area map for texas showing eligible loan zones

“USDA programs funded $29 billion for rural infrastructure and green housing initiatives supporting eco-friendly communities in 2023.”

USDA Rural Loan Programs: Overview & Impact

From aspiring homebuyers to established foresters and business owners, the array of USDA rural loan programs provides tailored solutions for housing, agriculture, infrastructure, business expansion, and community facilities. Understanding these key programs is essential for accessing affordable credit and fostering sustainable growth in 2026 and beyond.

Major USDA Rural Loan Programs (2026 and Beyond)

-

Single Family Housing Guaranteed Loan Program

- Purpose: Help low-to-moderate income families purchase, build, improve, or refinance a rural home with guaranteed government support.

- Benefits: No down payment, competitive fixed rates, lenient credit requirements

- Usage: Rural homebuyers and residents within approved USDA rural areas

-

Single Family Housing Direct Home Loans

- Purpose: Provide affordable home financing (sometimes referred to as “Section 502 Direct Loan”) to very-low- and low-income applicants unable to obtain credit elsewhere.

- Benefits: Below-market interest rates, payment assistance, longer repayment terms

- Usage: Rural families, including farmers and foresters

-

Business & Industry Loan Guarantee Program

- Purpose: Encourage business growth and job creation by guaranteeing loans for agriculture, forestry, mining, manufacturing, and service industries in rural areas.

- Benefits: Easier access to capital for rural businesses, including farm and forestry operations

- Usage: Farms expanding operations, new equipment purchases, value-added product facilities

-

Rural Business Development Loans/Grants

- Purpose: Support small and emerging businesses, technical assistance, and workforce development in underserved rural areas.

- Benefits: Flexible funding, support for innovation and job creation

- Usage: Cooperative startups, forestry-related businesses, sustainable agriculture projects

-

Community Facilities Direct Loan & Grant Program

- Purpose: Finance essential infrastructure and public services in rural communities—including schools, medical clinics, libraries, fire stations, and more.

- Benefits: Low fixed rates, flexible terms, direct federal support

- Usage: Rural municipalities, local governments, and public service providers

-

Water & Waste Disposal Loans and Grants

- Purpose: Fund modernization of water systems, sewer lines, and essential utilities for rural residents.

- Benefits: Healthier environments, reliable infrastructure, sustainable water management

- Usage: Local governments, water districts, agricultural communities, forestry areas

Advantages of USDA Rural Loan Programs (2026)

- Direct & Guaranteed Funding: USDA offers both direct loans (provided by USDA itself) and guaranteed loans (backed by USDA but issued by approved local lenders), multiplying access to credit.

- Low/No Down Payment Options: Many housing and facility loans require little or no upfront cash, making rural homeownership and community development more accessible.

- Lenient Credit Standards: Compared to traditional banks, USDA programs are designed for rural residents who may have limited access to local credit markets.

- Targeted for Sustainability: Grants and loans often incentivize sustainable agriculture, renewable energy adoption, and environmental improvements.

How USDA Rural Loans Foster Sustainable Growth

Sustainability is at the core of the USDA’s rural loan strategy for 2026. By focusing on the long-term resilience of rural economies, communities, and natural resources, the USDA aligns financing with the triple bottom line: economic growth, social well-being, and environmental responsibility.

Linking USDA Rural Maps & Loans to Broader Sustainable Development

-

Stabilizing Rural Population:

By enabling homeownership through rural loans, the USDA slows population decline and keeps families—especially farmers and foresters—living and working within their communities. -

Modernizing Farming & Forestry:

Loans support capital investments in equipment, sustainable farming systems, precision agriculture, and smart forestry operations, all while reducing resource waste. -

Boosting Infrastructure & Services:

Funding for clean water systems, broadband internet, health clinics, and schools helps bridge the infrastructure deficit, improving overall quality of life and business potential. -

Supporting Climate-Smart Practices:

Many programs incentivize renewable energy, efficient irrigation, and soil/water conservation for lower carbon footprints and better ecosystem outcomes.

Example Pathway: The Life Cycle of a USDA Rural Home Loan

- A prospective homebuyer uses the USDA rural map to verify their property as eligible.

- They apply to a local, approved lender, providing income, property, and credit information.

- Once approved, they access affordable financing to buy or build their rural dream home—often with competitive rates and no down payment.

- With a stable home, the family can remain near their farming or forestry operation, participate more in the community, and contribute to the local economy.

This process empowers residents, ensures sustainable livelihoods, and helps revitalize rural America.

USDA Rural Loans: Transforming Rural America for 2026

-

Forestry and Mining:

Special loan programs incentivize sustainable forestry operations, reforestation, and environmentally compliant mining practices, plus infrastructure improvements for safer, more sustainable resource management. -

Community Resilience:

Direct and guaranteed loans for water, waste, and healthcare infrastructure make rural communities more resilient to climate and economic shocks.

What Makes a Location “Rural” for USDA Lending?

The specific eligibility criteria for a USDA rural area are reviewed every five years, with boundaries updated based on census data and infrastructure improvements. For 2026, the USDA continues to expand digital mapping and public access resources to streamline the loan qualification process.

Key Terms for 2026 Applicants

- Geographic Designation: Only designated rural areas are eligible for most USDA loan programs.

- Income Limits: Loans are typically reserved for those within specific income brackets, adjusted by location, household size, and cost-of-living factors.

- Intended Use: Funds must be used for housing, agriculture, business, or infrastructure projects that serve rural populations.

- Sustainability Incentives: Increased focus on environmental standards, climate adaptation, and resource efficiency in loan approvals.

Enhancing USDA Loan Impact: Farmonaut’s Satellite Technology

Category keywords: usda rural, agriculture, forestry, infrastructure, environmental, monitoring, resource, operations, technologies, sustainable, satellite, mapping, api, affordable, services, monitoring, platform, loan, credit

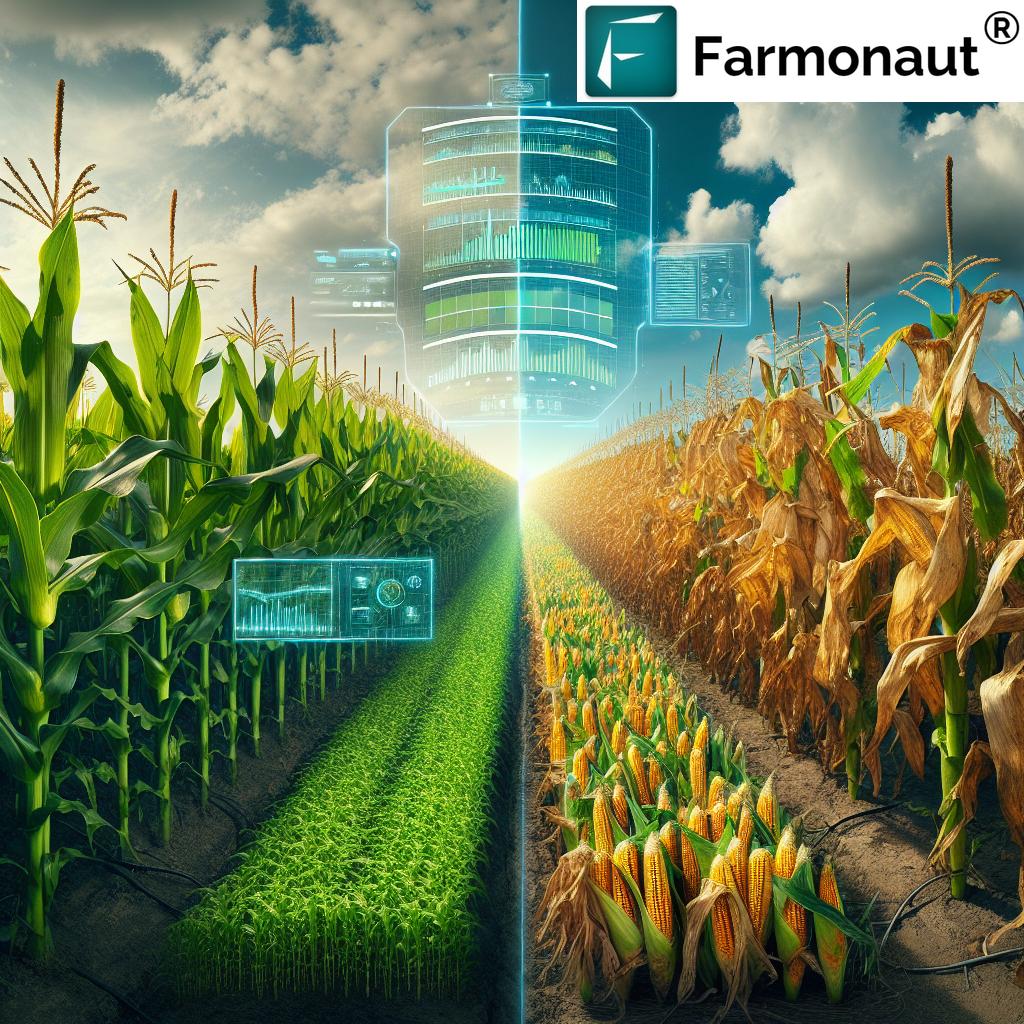

Access to affordable USDA rural loans is just the beginning. Maximizing their impact for sustainable growth—from field to infrastructure—requires robust data-driven approaches and technology. That’s where Farmonaut’s suite of satellite-based solutions makes a difference for:

- Farmers boosting yields and resource efficiency

- Foresters and miners seeking accurate environmental monitoring

- Local business leaders and governments ensuring project transparency for loan-backed initiatives

Farmonaut: Empowering Rural Operations with Advanced Monitoring

- Satellite Imagery & AI Advisory: We provide real-time insights on crop health, land condition, and potential risks—optimizing agricultural and forestry operations for maximum return on every dollar of loan funding.

- Blockchain Traceability: Blockchain-based traceability enables transparent supply chain validation, a crucial factor for USDA loan reporting and sustainable product certification in 2026.

- Fleet & Resource Management: Affordable tools for fleet and equipment management help reduce operational costs, improve efficiency, and ensure compliance with loan funding terms.

- Environmental Impact (Carbon Footprinting): Real-time carbon footprint monitoring supports applications for sustainable USDA loans with data on resource use and emission reductions.

- Insurance & Loan Verification: Satellite-based verification modules provide independent, scalable data to assist banks and rural lending institutions in risk reduction and faster credit approvals.

Why Satellite Technology Matters for USDA Rural Projects in 2026

- Affordable access to satellite monitoring increases transparency and project accountability—key requirements for USDA-backed funding.

- GIS & geospatial precision—essential for mapping rural loan eligibility zones and monitoring the compliance of funded projects.

- Al-based recommendations maximize crop, land, and resource utilization, which aligns with USDA’s push for innovation and efficiency.

Whether you’re a small farmer, local government, or large agribusiness in Texas, California, or anywhere across the heartland, Farmonaut’s tools put data-driven decision making in your hands for more effective investment of USDA funds.

Accessing USDA Rural Loans in 2026: Steps & Guidance

Access to affordable USDA loans is increasingly streamlined with digital, GIS, and satellite-enabled tools. Here’s how to proceed in 2026:

- Identify the Project or Property: Is it a home loan, agriculture, infrastructure, forestry, or community facility need?

- Use the USDA Rural Map: Confirm the property’s location within an approved USDA rural area using the latest GIS mapping tools (USDA website or Farmonaut’s satellite mapping platform).

- Check Eligibility: Review income, credit, and project-specific requirements and align with current USDA guidelines.

- Gather Documentation: This includes proof of income, property details, local permits, and sustainability plans for proposed projects.

- Engage an Approved Lender or Direct USDA Service Center: Apply for direct loans or find a lender for USDA-guaranteed loans.

- Leverage Technology: For streamlined monitoring and reporting, use Farmonaut’s API or platform for remote project management, regulatory compliance, and environmental reporting.

Pro Tip: Applicants for infrastructure projects—especially those with climate or resource management components—should include technology-based monitoring in their loan proposals. This showcases readiness and increases the likelihood of approval given USDA’s focus on sustainability.

USDA Rural Loan Types and Sustainable Impacts (Estimated Values, 2026)

| Loan Program | 2026 Estimated Funding (USD) | Eligible Uses | Average Loan Amount (USD) | Geographic Coverage | Projected Environmental Benefit |

|---|---|---|---|---|---|

| Single-Family Housing Guaranteed Loan | $14 Billion | Home purchase, construction, improvement, refinance | $220,000 | All designated USDA rural areas | 10% increase in energy efficiency for new homes; 8% reduction in urban sprawl |

| Single-Family Housing Direct Home Loan | $3.5 Billion | Home purchase, new home build, repairs | $170,000 | Low-income rural families | Improved housing quality, 7% lower household energy use |

| Business & Industry Loan Guarantee | $6 Billion | Agriculture, forestry, mining, business expansion, equipment | $550,000 | Rural businesses in designated areas | 12% increase in resource efficiency; expanded sustainable jobs |

| Rural Business Development Loan/Grant | $900 Million | Startups, technical assistance, innovation in agriculture, energy | $65,000 | Priority rural zones; high need regions | 10–15% decrease in resource waste; support for green startups |

| Community Facilities Direct Loan & Grant | $4 Billion | Schools, clinics, public safety, civic infrastructure | $775,000 | Municipal governments, unincorporated communities | Improved health and education outcomes; green energy investments |

| Water & Waste Disposal Loan and Grant | $5.1 Billion | Water system upgrades, waste management, sewer infrastructure | $320,000 | Rural water districts, underserved regions | Up to 30% reduction in water loss; cleaner water, improved health |

Farmonaut Apps & API: Digital Solutions for Rural Stakeholders

We, at Farmonaut, offer flexible access for stakeholders seeking to amplify the ROI of their USDA rural loans, infrastructure investments, and agriculture projects:

-

Web & Mobile Apps – Monitor crops, infrastructure, and compliance directly from desktops or smartphones.

Explore our platform through Web App, Android, and iOS tools. - API Integration – For businesses and developers, the Farmonaut API and developer docs enable custom integration of satellite and weather data for large-scale monitoring of agri-loan and infrastructure projects.

- Large-Scale Farm Admin – Governments and large farm businesses can deploy scalable field management systems to oversee implementation and sustainability of USDA-funded operations.

Our mission is to promote affordable, accessible satellite-driven solutions for all, enabling sustainable rural growth and higher loan utilization efficiency—whether for agriculture, forestry, mining, infrastructure, or rural community facilities.

FAQ: USDA Rural Map & Loans 2026

1. What qualifies as a USDA rural area in 2026?

A USDA rural area is typically a specific geographic zone—with a population under 35,000—not closely linked to urban or metropolitan centers. The USDA rural map is updated with each census and adjusted for growth, enabling prospective borrowers to verify project or property eligibility in real time.

2. Which programs and loans are available by using the USDA rural map?

The USDA rural map identifies eligibility for a wide range of rural loans USDA, including Single Family Housing Guaranteed Loans, Direct Home Loans, Community Facilities Loans, Water & Waste Disposal Loans, and Rural Business Development Loans, among others.

3. Are USDA rural loans only for farmers?

No. While farmers and foresters are major beneficiaries, USDA rural loans also support homebuyers, local government projects, businesses, and rural residents seeking to improve housing, infrastructure, and economic opportunities.

4. How does the USDA ensure these loans support sustainable growth?

The USDA increasingly integrates sustainability requirements—such as energy efficiency, resource conservation, and environmental standards—into both application review and project monitoring, aligning with climate and economic resilience goals for 2026 and beyond.

5. Is it possible to monitor, manage, or report on USDA-funded projects digitally?

Yes. By leveraging satellite-based services like Farmonaut’s platform, APIs, and apps, rural stakeholders can monitor progress, demonstrate compliance, and optimize investments. This is especially valuable for loan-backed farm, infrastructure, and sustainability projects.

Conclusion: Building Sustainable Rural Communities for the Future

Looking toward 2026 and beyond, USDA rural loan programs—empowered by precise USDA rural maps—remain the cornerstone for revitalizing rural America. With an expanded focus on sustainability, equity, digital access, and climate resilience, these loans and services offer affordable, modern solutions for:

- Housing the next generation of farmers, foresters, and rural families

- Modernizing agriculture, forestry, and mining operations for global competitiveness

- Investing in community facilities, health, water, and education infrastructure that improves lives

- Fostering climate-smart agriculture, green energy, and resource conservation

- Keeping local economies strong, innovative, and future-ready

By integrating USDA resources with advanced digital tools from Farmonaut, every stakeholder—from small farmers in Nebraska to large agribusinesses in California—can access, monitor, and maximize the sustainable impact of investments. Together, we can unlock a vibrant and resilient future for all of rural America.

Start your journey: Use the USDA rural map to check eligibility, explore modern satellite tools for project management, and access world-class data for smarter, faster, and more sustainable growth.