Agricultural Finance Review 2025: Top Software Reviews

” In 2025, over 60% of agri-finance reviews emphasized sustainability and digital innovations as key decision factors. ”

- Introduction: 2025 Agricultural Finance Landscape

- Key Trends in Agricultural Finance Reviews (2025)

- Agricultural Finance Review: Top Software & Tools Compared

- Digital Innovations & Their Impact on Agri-Finance

- Sustainability & Green Finance: Evaluating Environmental Impact

- Review Best Practices: Assessment Methods in Agri-Finance

- Financial Inclusion & Addressing the Agri-Finance Gap

- Farmonaut: Satellite-Powered Financial Innovation in Agriculture

- FAQ: Agricultural Finance Review 2025

- Conclusion: The Future of Agricultural Finance Reviews

Introduction: 2025 Agricultural Finance Landscape

2025 marks a turning point for the agricultural sector as finance, digital innovation, and sustainability converge to shape the future of farming worldwide. The agriculture sector continues to be a cornerstone of global food security and economic stability. Agricultural finance review processes have evolved into crucial reference points, helping farmers, institutions, policymakers, and agribusinesses evaluate impacts, suitability, and effectiveness of financial products and services tailored specifically to agriculture.

This comprehensive blog explores the current state and emerging trends in agri-finance reviews, with an emphasis on software platforms, sustainable finance programs, and the increased integration of digital tools. We will also examine best practices for reviews and highlight how top solutions—including Farmonaut—are setting new benchmarks for the sector.

From modern lending options and insurance products to advanced analytics, supply chain management, and environmental impact assessment, the 2025 agriculture review arena shows an impressive transformation. In this post, you’ll discover top agriculture software reviews, learn how financial decisions are now shaped by sustainability concerns, and access our high-value comparative table for quick reference.

Key Trends in Agricultural Finance Reviews (2025)

Agriculture reviews in 2025 revolve around three major axes: finance, sustainability, and digital innovations. These trends reflect both the sector’s historical context and its rapid modernization:

- Finance: Shifting focus from generic loans to tailored, risk-adjusted financial products designed for crop production, livestock, and equipment acquisition.

- Digital Innovations: The widespread digitization of rural finance—via mobile banking, cloud-based management, AI-powered credit scoring, and blockchain-driven traceability.

- Sustainability: Integration of green finance and carbon credit incentives to encourage adaptive, environmental practices in agriculture.

- Public and Private Roles: Governments are increasingly backing agri-finance with subsidies, guarantees, and direct lending to boost both sustainability and climate resilience. At the same time, private players offer flexible lending, microfinance, and impact investment funds to fill critical finance gaps.

- Software Integration: New-generation agriculture finance software platforms are streamlining loan applications, automating risk assessment, and helping farmers manage financial records alongside yield and market price tracking.

The agricultural finance review process now extends far beyond basic product outlines. Reviewers conduct much deeper analyses, examining user experience, data security, integration capabilities, and, notably, the sustainability impact and green credentials of every solution assessed.

Agricultural Finance Review: Top Software & Tools Compared

As agriculture software reviews have become a primary resource for making informed financial decisions, our comparative analysis lets you identify the top-performing tools in 2025. These reviews offer insights on:

- Agri-finance software usability and feature set

- Sustainability and digital innovation ratings

- User satisfaction and scalability

- Appropriate fit (smallholder, medium, or large farms)

- Price range and return on investment

| Software Name | Key Features | Sustainability Rating (out of 10) |

Digital Innovation Score | User Satisfaction (%) |

Price Range ($-$$$) |

Ideal Farm Size |

|---|---|---|---|---|---|---|

| Farmonaut | Satellite monitoring, AI-based advisory, blockchain traceability, real-time resource and crop management, API integration, carbon footprinting, farm loan and insurance support, fleet and product traceability, mobile/web/app support | 9.7 | High | 96% | $-$$ | Small/Medium/Large |

| AgriEdge | Farm finance planning, yield forecasting, digital lending module, mobile banking, basic crop insurance, integration with select supply chain tools | 8.5 | Medium – High | 91% | $$ | Small/Medium |

| AgriFinancePro | Multi-currency agri-lending, real-time credit scoring (AI), climate risk analytics, insurance integration, policy compliance checks, finance dashboards | 8.2 | High | 88% | $$-$$$ | Medium/Large |

| HarvestCloud | Marketplace management, simple loan calculators, crop health analytics, price tracking, manual data input, reporting tools | 7.9 | Medium | 85% | $-$$ | Small/Medium |

Key Takeaways from 2025 Agriculture Software Reviews:

- Top agri-finance software in 2025 provides all-in-one management—covering loan, insurance, traceability, and resource tracking—to maximize value for farmers across all scales.

- Farmonaut stands out for its high innovation and sustainability scores, with unmatched API integration and scalability across farm sizes.

- Usability, data security, and compatibility with rural digital realities have become central review points, boosting confidence across user communities.

To further aid your evaluation, leading solutions now offer free trials, tiered subscriptions, and API access for seamless integration. Test your chosen platform to ensure it aligns with your farm’s needs and your region’s economic or climate challenges.

How to Choose the Right Agri-Finance Software in 2025

- Assess integration with existing farm management systems.

- Investigate user support and training programs, especially for rural or digitally inexperienced users.

- Review the sustainability impact and commitment to transparent, green lending.

- Consider cost versus functionality and projected ROI.

Many agricultural software tools also provide quick loan calculators, credit risk assessment, and direct access to insurance, making them invaluable for 2025’s complex agri-financing needs.

” 78% of finance-focused agri-tools reviewed in 2025 improved lending efficiency for surveyed agricultural businesses. ”

Digital Innovations & Their Impact on Agri-Finance

The digitization of agricultural finance in 2025 is a game-changer, enabling faster, fairer, and smarter lending decisions across the global agriculture sector. Let’s dissect how digital transformation is reshaping agricultural finance reviews today:

- Mobile Banking Solutions: With rural regions increasingly connected, mobile banking apps let farmers apply for loans, monitor accounts, and receive digital payments securely. This enhances accessibility and transactional speed, reducing dependence on traditional banks.

- Blockchain-Based Traceability: Platforms like those offered by Farmonaut use blockchain to ensure product traceability and secure every stage of the agriculture supply chain. This builds trust, mitigates fraud, and improves compliance—a key theme in 2025 reviews on o farming.

- AI-Driven Credit Scoring: Leveraging vast data (weather, satellite, historical yields), AI engines provide faster, more accurate credit scoring and risk assessment for farmers—critical for lenders seeking to mitigate agricultural variability.

- Digital Loan Processing: AI-backed software streamlines the borrower-lender process—no more mountains of paperwork. Quick, low-cost, and accessible lending models are now the norm, not the exception.

- APIs for Customization: Platforms offering easy API access allow rapid data integration into bank, insurance, and farm management systems. Developers can view documentation for seamless deployment.

In 2025, integration and interoperability have become central review factors. Stakeholders look for products that fit effortlessly into existing workflows. The focus keyword “agriculture software reviews” encompasses these strengths, guiding buyers toward tools that keep pace with rapid digital evolution.

Example: If you are prioritizing environmental impact or want to monetize climate-smart farming, consider software offering carbon footprinting features and real-time soil health tracking.

For large farm enterprises or agri-cooperatives, tools like the highly-rated Farmonaut Large Scale Farm Management platform provide custom dashboards for widespread operational oversight, resource management, and digital compliance.

- Resource and Fleet Management: Platforms provide fleet management modules—helping optimize logistics and cut costs across equipment and vehicle use.

- Crop Loan & Insurance Support: Modern agri-finance reviews highlight apps that bundle loan and insurance verification via satellite data, streamlining both approval and claims for maximum efficiency.

This new generation of digital finance solutions offers both cost savings and risk reduction compared to traditional approaches. Reviewers consistently rate high those platforms delivering regular updates, high uptime, and strong encryption for user data.

Sustainability & Green Finance: Evaluating Environmental Impact

In the 2025 agricultural finance review landscape, sustainability is no longer optional—it’s a leading decision factor in reviews, lending, and policy. The drive for sustainable farming and climate resilience is guided by innovative financial products and software features that incentivize verified environmental outcomes.

- Green Loans & Carbon Credits: Subsidized loans for regenerative agriculture, soil health, and biodiversity. Carbon farming modules (such as those from Farmonaut) help quantify emissions reductions and unlock extra revenue.

- Risk Mitigation Tools: Satellite-powered insurance review/assessment, climate risk modeling, and early warning systems lower risk and attract formal investment in climate-smart practices.

- Traceability (Transparent Supply Chains): Blockchain traceability modules ensure that products meet sustainability criteria—crucial for global market access and eco-labelling.

- Sustainability Ratings in Reviews: 2025’s agriculture software reviews now assign clear sustainability scores, reflecting a product’s actual impact—not just green marketing claims.

Review protocols have become much stricter: “greenwashing” is quickly flagged, and only solutions with measurable impact on everything from water conservation to soil regeneration receive top marks.

Review Best Practices: Assessment Methods in Agri-Finance

What makes an effective agricultural finance review in 2025? Rigorous, transparent, and inclusive best practices underpin the top reviews on o farming, ensuring every assessment is actionable for farmers, institutions, and decision-makers.

Core Review Criteria

- Accessibility: Is the product usable by rural and smallholder communities (including language, device, and connectivity constraints)?

- Integration: Does it sync easily with other platforms and farm management tools?

- Effectiveness: What real-world impact does the solution have on loan approval speed, risk reduction, and yield/profit improvements?

- Sustainability: Are there clear, verifiable metrics for environmental outcomes and incentives for sustainable practices?

- Data Security: Is information securely managed—vital in an era of frequent digital risks?

Recommended Review Approach

- Perform a side-by-side comparison of products (see our table above).

- Use focus keywords like agriculture review nc if evaluating region-specific solutions (ex: North Carolina, USA).

- Seek user-generated reviews from both smallholder and large-scale operators to balance perspectives.

- Apply checklists or templates that score each tool on innovation, user experience, security, and sustainability.

- Prioritize reviews that disclose both strengths and potential drawbacks.

This structured process, reflected in all leading 2025 agricultural finance review publications, ensures you make smart, risk-aware finance decisions aligned with your operational needs.

Financial Inclusion & Addressing the Agri-Finance Gap

Despite major advancements, access to agricultural finance remains uneven—especially for women, young people, and rural marginalized communities.

Modern reviews and software address this gap directly, focusing on tailored loan products, microfinance outreach, and inclusive user interfaces.

- Targeted Credit Programs: Custom loans aimed at smallholder and underbanked farmers.

- Digital Literacy Campaigns: 2025’s best tools embed video tutorials, local language support, and easy onboarding. (See Farmonaut’s Android/iOS applications.)

- Insurance Innovations: Automatic payout triggers using satellite-based crop loss verification for rapid disaster relief and productive risk sharing.

- Gender-Sensitive Solutions: Credit scoring and outreach tools that counteract traditional bias, ensuring all groups can secure the funding needed for decent livelihoods and food security.

The impact of these inclusive finance innovations is clear: in 2025, more agriculture communities are receiving timely, affordable funding to adopt new technologies, deal with climate shocks, and drive rural prosperity worldwide.

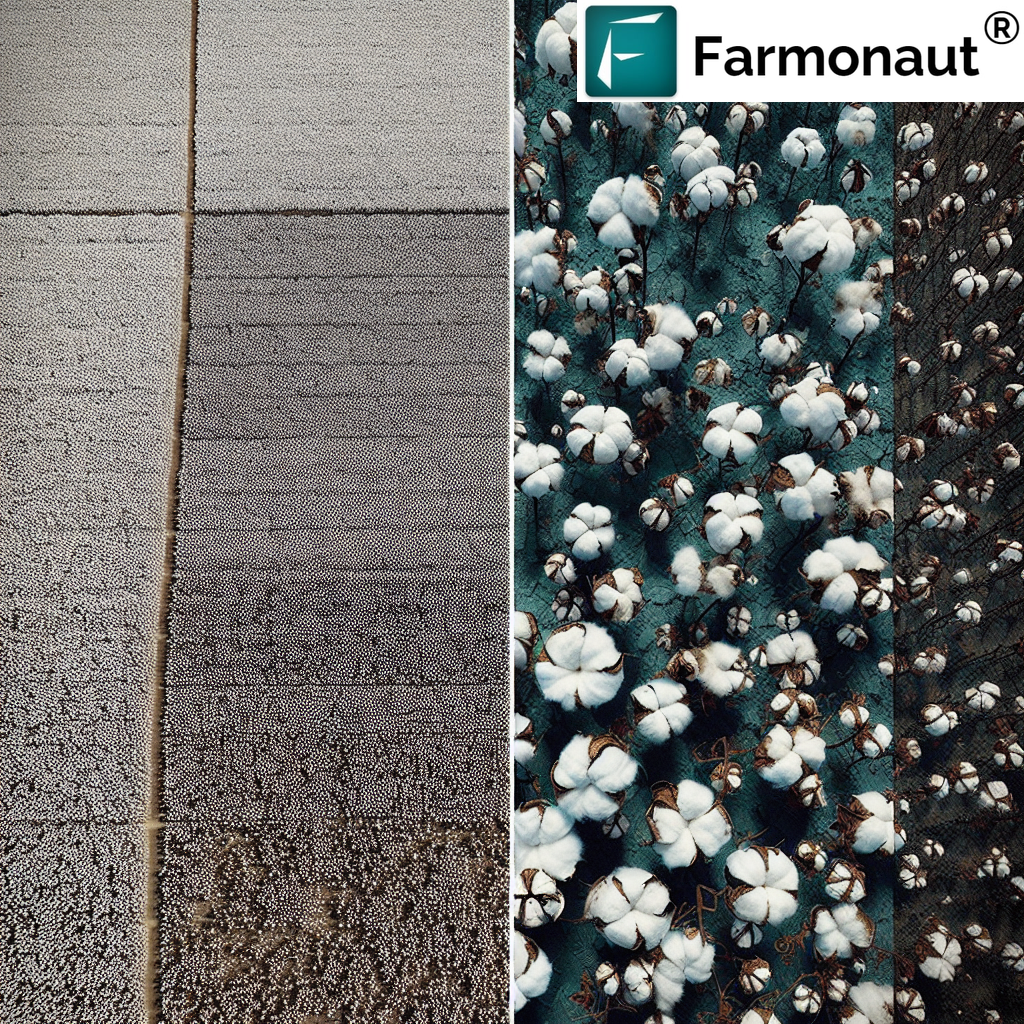

Farmonaut: Satellite-Powered Financial Innovation in Agriculture

We at Farmonaut are proud to advance agriculture review standards with our affordable, accessible, and scientifically robust satellite technology:

- Real-Time Monitoring: Multispectral satellite imagery for crop, soil, mining, and infrastructure health assessment. This enables precise, risk-adjusted lending and insurance decisions.

- AI Advisory: Our AI-powered Jeevn platform delivers tailored insights for improved yield, operational efficiency, and climate response.

- Blockchain Traceability: Our transparent traceability solutions help secure supply chains, protect brands, and ensure compliance with global standards.

- Fleet & Resource Management: Fleet management tools enable seamless logistics and optimized equipment use for large farming or agri-logistics operators.

- Environmental Impact Monitoring: Carbon footprint tracking and other sustainability modules help businesses comply with new regulations and unlock green finance.

- Accessible Platform: Our platform is available via web, Android, and iOS apps, and through API for integration, making it scalable from small farms to governments.

- Cost-effective subscriptions—no capital barriers, affordable even for small farms

- All-in-one satellite, AI, and blockchain suite—manage loan, insurance, resource, and sustainability all in one place

- Robust data privacy and security standards

- Non-disruptive to your daily workflow—deploy and scale as needed

Discover the perfect plan for your needs—explore Farmonaut’s convenient subscription options below:

FAQ: Agricultural Finance Review 2025

What is an agricultural finance review?

An agricultural finance review is an in-depth analysis of the financial products, services, software, and policy frameworks available to support farmers and agribusinesses. It examines accessibility, effectiveness, innovation, and sustainability, helping stakeholders make smarter investment and operational decisions.

What makes the 2025 agricultural finance reviews different from previous years?

2025 reviews now focus on digital innovations, sustainability credentials, fast lending processes, and inclusive finance. They typically provide more comprehensive comparative tables, transparent assessment methods, and real-world performance scores.

How important is sustainability in choosing agri-finance tools/software?

Very important. Over 60% of reviews and finance providers now list sustainability, environmental impact, and compliance with climate-smart criteria as top requirements for positive ratings or eligibility for green loans and subsidies.

How do I know which agri-finance platform is best for my farm size?

Use comparative feature tables (like above), focusing on “Ideal Farm Size,” key features, and user satisfaction scores. Most top-rated platforms, such as Farmonaut, cater to all scales through modular, customizable offerings.

Where can I get started with satellite-based farm management and finance tools?

You can launch the Farmonaut Web App or download their Android/iOS apps using the buttons above. Developers and business users may access the full API via the links shared in this review.

What is the agriculture review nc?

This refers to agriculture reviews specific to North Carolina (NC), where localized finance products can be compared for relevance and impact. Reviewers often include geographic tags for region-specific assessments worldwide.

Conclusion: The Future of Agricultural Finance Reviews

The agricultural finance review landscape in 2025 is defined by digital transformation, robust sustainability metrics, and a commitment to inclusive finance—all critical as agricultural practices evolve and climate challenges intensify.

By rigorously assessing finance products, innovations, and software solutions, these reviews empower farmers, institutions, and policymakers to make informed decisions, bridging financial gaps and accelerating the shift to resilient, sustainable, and productive agriculture worldwide.

Whether you’re a smallholder seeking your first digital loan or a large enterprise needing comprehensive resource and supply chain management, reviewing the top agri-finance platforms in 2025 will help you secure your place in a new era of smart, climate-ready farming.

Explore the latest Agricultural Finance Review tools and software for 2025—empower your farm, community, and business for a future of resilient growth.