Current USDA Farm Loan Interest Rates 2025 & Ag Loan Trends

“USDA farm loan interest rates for 2025 start at approximately 4.5%, reflecting steady agricultural market trends.”

Introduction: The Financial Landscape for Agriculture Loans in 2025

As 2025 unfolds, the importance of understanding the current USDA farm loan interest rates 2025 and farm credit land loan interest rates becomes crystal clear for farmers, agribusiness owners, and stakeholders across the United States agricultural sector. With input costs continuing to fluctuate and commodity markets persistently volatile, access to affordable credit is not just desirable—it’s essential. Having reliable options for agriculture loan rate of interest allows thriving operations to make investments, weather uncertainties, and avoid the risk of struggling or ceasing operations entirely.

Throughout this comprehensive article, we’ll dive deep into the most current USDA farm loan rates, trends in broader agricultural lending, and explore new technologies—such as those provided by Farmonaut—that are shaping financing and risk management in agriculture. This guide is designed to provide valuable, actionable insights for those seeking financing solutions, whether you’re a new farmer starting your journey, an agribusiness owner seeking expansion, or a stakeholder navigating the complexities of 2025’s ag finance environment.

“Farm credit land loan rates in 2025 average between 5% and 6%, showing a slight uptick from 2024.”

USDA Farm Loan Interest Rates 2025: Overview

The United States Department of Agriculture (USDA) plays a vital role in supporting farming businesses by offering a variety of loan programs designed to enhance agricultural productivity and sustainability. In 2025, the focus remains on making credit accessible—especially for beginning farmers, small-scale operations, and socially disadvantaged applicants. This approach is crucial, as these groups are often the most sensitive to volatile input costs, lending rates, and market conditions.

- The current USDA farm loan interest rates 2025 for direct ownership loans often range between 4.5% and 5.0%—competitive by historical standards and uniquely tailored to borrower status, financial need, and repayment capability.

- Operating loans—used for seed, fertilizer, and seasonal expenses—typically carry rates from 4.25% to 4.75%, ensuring that short-term cash flow needs are met at an affordable interest.

- Microloans—ideal for small-scale and less complex farming enterprises—sometimes provide even lower interest rates (starting at 3.75%), making them attractive to first-time or underserved borrowers.

The USDA sets caps on its loan interest rates to keep borrowing affordable, and offers special reductions or subsidies for qualifying groups—such as veterans and new farmers—giving them the best shot at success in a turbulent agricultural economy.

With the Crop Loan and Insurance verification service from Farmonaut (see its

details here),

financial institutions can leverage satellite data for streamlined verification and reduced fraud—improving both access and confidence in credit provision for 2025 and beyond.

Types of USDA Farm Loan Programs in 2025

The USDA continues its mission in 2025 to enhance the sustainability and accessibility of farm financing across the United States. The core loan types offered and their applicability to borrowers’ needs are summarized below:

- Direct Farm Ownership Loans

- Purpose: Buying farmland, constructing buildings, improving structures, or refinancing debt.

- Estimated Interest Rate (2025): 4.5% to 5.0%.

- Guaranteed Farm Ownership Loans

- Issued by private lenders, guaranteed (up to 95%) by the USDA.

- Interest rates are negotiated—usually slightly higher than direct loans, but more accessible if you do not meet direct loan criteria.

- Direct Operating Loans

- Used for operating expenses: seeds, fertilizer, labor, equipment repair, etc.

- Estimated Interest Rate (2025): 4.25% to 4.75%.

- Microloans

- Purpose: Targeting small, beginning, and non-traditional farms.

- Lower paperwork, streamlined eligibility.

- Estimated Interest Rate (2025): as low as 3.75%.

- Youth Loans

- Provided to individuals (10–20 years old) for supervised agricultural projects.

- Estimated Interest Rate (2025): similar to microloans, making them highly accessible for youth in ag programs.

These USDA farm loan programs are specifically designed to foster growth, encourage diversity, and ensure that credit remains accessible even as the agricultural sector faces challenges in 2025.

Tip: If your operation supports sustainability initiatives, consider exploring Farmonaut’s Carbon Footprinting tools for agriculture, which not only helps in sustainability certifications but also enhances eligibility for green financing in some USDA and private loan programs.

2025 USDA & Ag Loan Interest Rates Comparison Table

To help you quickly compare the most important features and estimated interest rates across different loan programs, here is a clean and concise table for 2025’s landscape:

| Loan Type | Estimated Interest Rate (2025) | Term Length | Min/Max Loan Amount | Key Features / Borrower Notes |

|---|---|---|---|---|

| Direct Farm Ownership | 4.50% – 5.00% | Up to 40 years | $50,000–$600,000 | Best for land purchase, improvement, and construction; lower down payment; subsidies possible for veterans and beginning farmers |

| Guaranteed Farm Ownership | 5.25% – 7.00% (negotiable) | Up to 40 years | Up to $2,037,000 (2025 cap) | Offered by approved lenders, up to 95% USDA guaranteed |

| Direct Operating | 4.25% – 4.75% | 1–7 years | $5,000–$400,000 | For seasonal & equipment expenses; eligibility for beginning, small, and disadvantaged farmers |

| Microloan (Direct) | 3.75% – 4.25% | 1–7 years (operating); up to 25 years (ownership) | Up to $50,000 | Simplified paperwork; for new, non-traditional, and limited-resource farmers |

| Farm Credit Land Loan | 6.00% – 7.25% | Up to 30 years | No set maximum (based on collateral and repayment ability) | Faster processing, larger loan amounts, flexible plans; slightly higher rates but essential for large land purchases |

Farm Credit Land Loan Interest Rates in 2025

Farm Credit System (FCS) institutions form a substantial portion of the ag lending network in the United States. Their land loan offerings are indispensable—especially for those looking for expansion, refinancing, or purchase of new farmland. In 2025, we observe some key characteristics:

- Interest Rates: The average farm credit land loan interest rates are running between 6.00% and 7.25%, depending on the creditworthiness of the borrower, size, and repayment term. This marks a moderate uptick compared to previous years, reflecting inflation and tightening monetary policy at the federal level.

- Loan Terms: Flexible repayment plans—some extending up to 30 years—help to spread financial burdens and improve cash flow.

- Processing & Loan Size: FCS loans are typically approved faster and for larger amounts compared to direct USDA loans, essential for time-sensitive land deals or large-scale operations.

- Eligibility: Requires strong credit, a good business plan, and demonstrable ability to repay. Interest rates can go higher for riskier enterprises or less robust financial profiles.

These rates, while somewhat higher than direct USDA offerings, often offer practical advantages when compared with commercial banks, especially on flexibility, expertise, and understanding of ag production cycles.

For users managing extensive operations, leveraging real-time satellite and AI-powered field tracking is crucial. Our Large Scale Farm Management Platform delivers a cohesive view of crop health, risk, and resource use—informing smarter borrowing decisions.

Agriculture Loan Rate of Interest: 2025 Trends & Forecasts

Interest rates for agriculture loans—across USDA, Farm Credit, and commercial lenders—are set not in isolation but as an outcome of broader market trends, risk perception, and federal monetary policy. Understanding these trends is crucial to making informed borrowing and investment choices. Here are the key factors that will shape agriculture loan rate of interest in 2025:

Main Influences on Agriculture Loan Interest Rates

- Federal Monetary Policy

- The Federal Reserve’s stance on inflation will continue to drive the base interest rate upwards, especially as inflationary pressures remain persistent in early 2025.

- Lending institutions—from commercial banks to FCS—adjust ag rates in response to changes in the Fed Funds Rate.

- Inflation

- Higher inflation means greater interest costs for both new loans and variable-rate products.

- Some borrowers, especially in high-risk or specialty crop sectors, may see rates approach or exceed 8%.

- Credit Risk Assessment

- Strong credit histories, established farming operations, and detailed business plans earn better rates—5.5% to 6.5% for top-tier borrowers.

- Higher-risk enterprises (e.g., highly leveraged, new, or specialty operations) receive higher margins over the base rate.

- Loan Purpose & Terms

- Operating loans may have slightly higher rates but shorter terms compared to ownership or infrastructure improvement loans.

- Long-term land/ownership loans receive more favorable fixed rates, especially when collateral is strong.

- Geographic & Enterprise Variability

- Rates differ by state, crop, and business model. Some regions/programs offer targeted rates to specialty crop or organic farms.

- Special environmental or sustainable ag loans can sometimes yield additional discounts.

To secure the best agriculture loan rates in 2025, farmers and agribusiness owners should prepare up-to-date financial records, detailed business plans, and leverage technology (like Farmonaut’s resource monitoring) to demonstrate risk reduction and operational efficiency.

Optimize your operations—and eligibility for the most favorable loan rates—by tracking environmental impact and sustainability outcomes. Learn about our cost-effective

Carbon Footprinting Solution for Agriculture!

Current Agricultural Loan Market Environment in the United States (2025)

The U.S. agricultural loan sector in 2025 is defined by both continuity and change. Farmers and agribusinesses face a financial landscape marked by:

- Continued Policy Support: USDA and federal agencies continue to strengthen safety nets, particularly for smallholders, socially disadvantaged applicants, and beginning farmers.

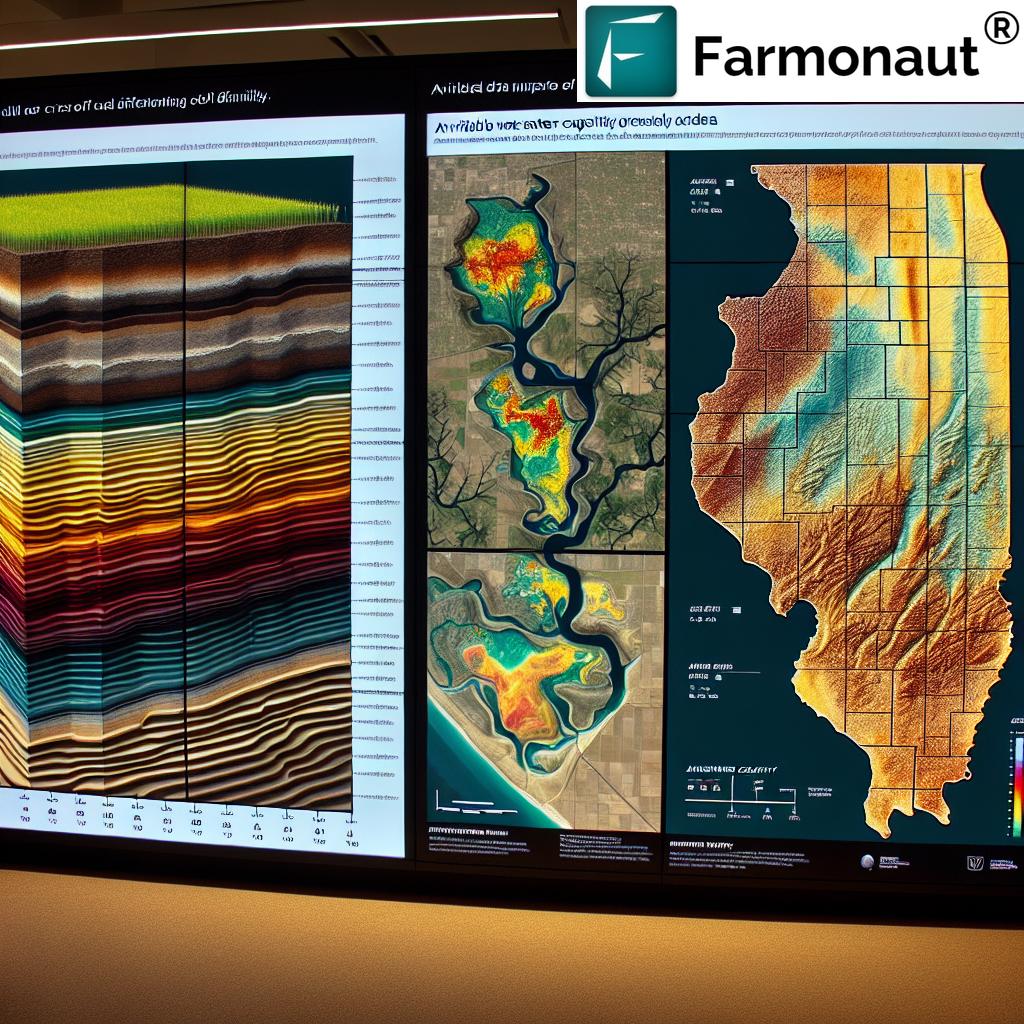

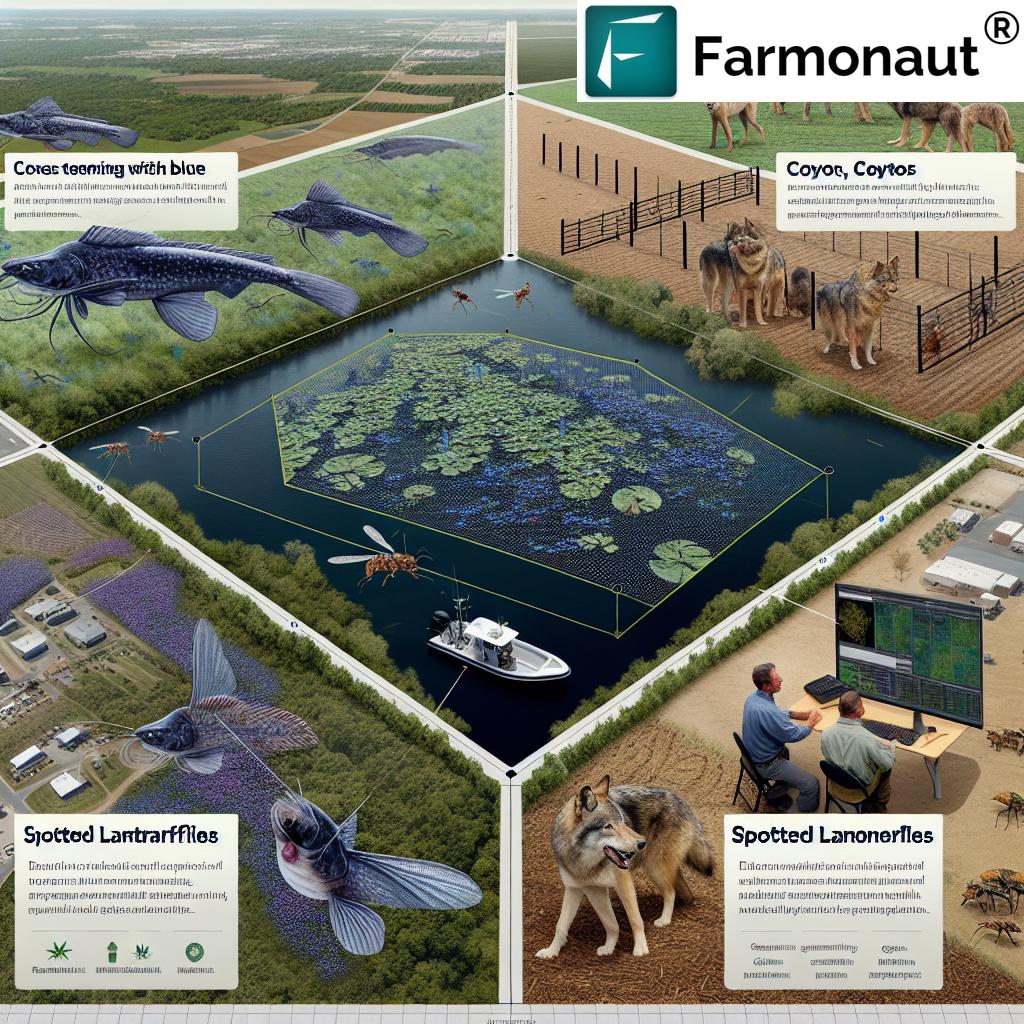

- Tech-Driven Assessment: Lenders increasingly turn to data-driven, tech-led assessment (including satellite and remote sensing) for more accurate loan decisions, minimizing risk for both sides.

- Increasing Input Costs: Fertilizer, seed, and machinery remain volatile, directly impacting loan demand and repayment capacity.

- Volatile Global Markets: Exports and commodity pricing are unpredictable, prompting farms to maintain cash buffers and seek flexible loan terms.

- Flexible Repayment Options: Repayment schedules tied to expected cash inflows from harvest or livestock production are increasingly common, reflecting the seasonal realities of farming.

- Sustainability Incentives: Farmers who integrate climate-smart practices (carbon tracking, traceability, reduced input use) sometimes qualify for special loan programs and lower rates.

For farmers interested in smarter resource management, our Fleet Management Platform empowers you to track, optimize, and extend the useful life of your equipment and logistics vehicles—an essential step for operational efficiency in 2025.

Why Understanding Loan Interest Rates Remain Crucial in 2025

Interest rates are the single most important factor in the real cost of capital for farmers and agribusinesses. Even seemingly small differences—say, between 4.5% and 5.5% on a land purchase—can mean thousands of dollars saved or lost over the life of a loan.

- Affordability: Lower rates result in lower total repayment, enabling more working capital for vital investments (technology, sustainability, land expansion, new equipment).

- Competitiveness: Farmers with better access to affordable credit can react swiftly to input price changes, temporary setbacks, or new market opportunities.

- Resilience: Operations carrying high-interest debt are more at risk if market prices fall, input costs spike, or yields underwhelm.

Practical Steps: Always compare current USDA farm loan interest rates 2025 against commercial and Farm Credit options. Consider both

fixed and variable rates, term length, and the overall loan structure, including possible prepayment penalties.

Pro Tip: Stay up-to-date with USDA announcements and lender communications to catch limited-time rate reductions or special programs for beginning farmers, veterans, or climate-smart initiatives.

How Farmonaut Empowers Modern Agriculture with Satellite Insights

As we navigate 2025’s changing agricultural finance environment, leveraging technology is more critical than ever for maximizing the value of every dollar borrowed.

- Farmonaut’s satellite-based resource monitoring allows real-time, field-level insight into crop health, input use (via NDVI), and risk.

- AI-driven advisory (Jeevn AI) enables smarter, more precise farm management based on data—not just intuition—helping users get more from every hectare, minimize losses, and plan loan repayment with confidence.

- Blockchain-based traceability ensures transparency in agricultural and supply chain processes, which may improve your eligibility for preferred rates and specialized lending products.

- Fleet management & environmental impact monitoring through Farmonaut’s platform optimizes equipment usage and tracks carbon footprint, supporting both operational efficiency and green financing agendas.

Ready to integrate satellite monitoring, AI-driven insights, and sustainability tracking into your agricultural enterprise?

Download our applications or use our APIs for seamless integration with your existing workflow.

Top Educational Videos on Ag Finance & Technology

Explore these trending videos for actionable insights—from low-investment agribusiness ideas to scalable farm automation via satellite and AI in 2025:

Farmonaut Subscription Pricing Table

Explore affordable plans for satellite-based agricultural solutions—tailored for farmers, agribusinesses, and institutions seeking real-time data to support loan verification, resource management, and sustainability.

Frequently Asked Questions (FAQ) – Current USDA Farm Loan Interest Rates 2025 & Ag Loan Trends

-

What are the current USDA farm loan interest rates for 2025?

Direct farm ownership loans typically range from 4.5%–5.0%; direct operating loans range from 4.25%–4.75%; and microloans start as low as 3.75%. Actual rates depend on borrower status and the loan type.

-

How do farm credit land loan interest rates compare to USDA loan rates?

Farm Credit System land loans are generally higher (6.0%–7.25% in 2025), but offer greater flexibility, larger loan sizes, and quicker processing—ideal for sizable expansion or time-sensitive transactions.

-

What affects agriculture loan rate of interest in 2025?

Rates are influenced by inflation, monetary policy, loan term, borrower risk, region, market trends, and sustainability initiatives. Lower rates are often awarded to well-established, low-risk borrowers with documented operational efficiency.

-

Can technology help improve my chances of getting a better loan rate?

Yes! Using data-driven tools like Farmonaut’s real-time satellite monitoring, AI-based advisories, and environmental tracking can demonstrate effective risk management and sustainability, potentially qualifying you for better rates or unique loan programs.

-

What are some strategies to secure the best agriculture loan rate of interest?

- Maintain strong, up-to-date financials and clear business plans;

- Leverage crop monitoring and resource management platforms;

- Apply for the most favorable programs (new farmer, sustainable ag, veteran, socially disadvantaged);

- Stay informed about market trends and lender offers.

-

Where can I use Farmonaut’s solutions to support my agricultural loan applications?

Use Farmonaut’s crop loan and insurance verification tools, blockchain-based traceability platform, and carbon footprint monitoring to provide evidence of good stewardship and operational efficiency, strengthening your case for favorable loan terms.

-

How can I get started with Farmonaut technology for my ag borrowing needs?

Download our Android or iOS app, use our API, or explore subscriptions above. These tools are optimized for businesses, smallholders, and institutions alike.

Conclusion & Next Steps: Informed Financing for Thriving 2025 Farming Operations

As 2025’s agricultural financial landscape continues to evolve, the USDA farm loan interest rates remain a critical driver of affordable access to capital for qualifying farmers—especially beginning and small-scale operations. Meanwhile, farm credit land loan interest rates balance speed, scale, and flexibility, even as the sector adapts to inflation and tighter monetary policy.

Smartly navigating this environment means:

- Staying updated on the latest loan rates, terms, and eligibility criteria

- Comparing all available options—USDA, Farm Credit, private lenders and new satellite verification solutions

- Embracing resource optimization and sustainability tools to potentially qualify for better rates while supporting long-term operational success

At Farmonaut, we are committed to democratizing access to affordable, real-time agricultural insights—empowering farmers, agribusinesses, banks, and stakeholders. By leveraging the latest advancements in satellite monitoring, AI analysis, and blockchain traceability, we aim to strengthen your financial standing and position your operations for resilience and growth in a dynamic marketplace.

Ready to make financing smarter for your operation? Download Farmonaut’s app or use our APIs & management platforms today:

Keywords used in this post: current usda farm loan interest rates 2025, farm credit land loan interest rates, agriculture loan rate of interest, rates, farm, loan, interest, credit, loans, 2025, farmers, usda, agricultural, land, agriculture, rate, financial, understanding, remain, offers, lending, current, sector, affordable, trends, financing, direct, ownership, operating, repayment, typically, offer, lower, institutions, provide, terms, plans, higher, risk, options, crucial, across, make, operations, farming, designed, low, reflecting, federal, especially, beginning, several, including, microloans, generally, borrower, expenses, enterprises, needs, slightly, sometimes, borrowers, lenders, expansion, often, somewhat, influenced, years, monetary, policy, environment, flexible, may, essential, inflation, qualifying, borrowing, unfolds, landscape, agribusiness, owners, stakeholders, access, difference, thriving, struggling, particularly, input, costs, fluctuate, markets, volatile, article, look, general, providing, valuable, insights, seeking, solutions, industry, overview, united, states, department, continues, play, vital, role, supporting, variety, programs, enhance, productivity, sustainability, competitively, government, commitment, making, accessible, socially, disadvantaged, applicants, types, youth, range, depending, status, capability, aimed, covering, seeds, fertilizers, machinery, repairs, carry, around, support, small, less, complex, tend, importantly, caps, subsidies, reductions, eligible, veterans, contrast, system, substantial, portion, network.