Farm Bookkeeping and Accounting: 10 Key Practices for Profitable and Sustainable Agricultural Operations

Meta Description: Master farm bookkeeping and accounting with this expert guide on 10 key practices, from tracking expenses and income to compliance, reconciliation, and technology for sustainable agricultural management.

Table of Contents

- Trivia: Financial Accuracy in Farm Bookkeeping

- 1. Understanding Farm Bookkeeping and Accounting

- 2. Choosing the Right Accounting Method

- 3. Setting Up a Chart of Accounts

- 4. Implementing Consistent Record-Keeping Practices

- 5. Reconciling Accounts

- 6. Generating Essential Financial Reports

- 7. Utilizing Technology and Software

- 8. Best Practices for Farm Bookkeeping

- 9. Seeking Professional Assistance

- 10. Continuous Education and Improvement

- Comparison Table: Key Farm Bookkeeping Practices

- FAQ: Farm Bookkeeping and Accounting

- Conclusion

Effective farm bookkeeping and accounting are the backbone of thriving farm businesses. By systematically recording and analyzing financial transactions, tracking farm expenses, and maintaining compliant records, today’s farmers can boost profitability, ensure long-term sustainability, and plan for future growth. This comprehensive guide covers the foundations, strategies, and latest agricultural accounting methods to help farmers and agribusinesses master financial management.

Whether you operate in the heartland of America, Australia’s Outback, India’s Punjab, or Brazil’s Cerrado, adopting these 10 key farm bookkeeping best practices is essential for success. Let’s explore each in detail—from setting up core systems to leveraging the latest technology and seeking professional guidance.

1. Understanding Farm Bookkeeping and Accounting

Farm bookkeeping is the systematic process of recording, tracking, and organizing all financial transactions related to farm operations. This involves daily, weekly, or monthly tasks such as capturing income from crop or livestock sales, expenses for seeds, feed, labor, or fertilizer, and investments in new assets like machinery or buildings. Accounting extends this process by summarizing, analyzing, and reporting these transactions to derive insights into the farm’s financial position and performance.

Accurate farm bookkeeping empowers farmers to:

- Make better informed business decisions

- Track farm income and expenses precisely

- Monitor liabilities, loans, and equity

- Maintain regulatory compliance and meet tax obligations

- Increase transparency for financial institutions and partners

These are not optional administrative chores. They directly impact the profitability and sustainability of both smallholder and large-scale agricultural operations.

2. Choosing the Right Accounting Method for Your Farm

Selecting the appropriate accounting method is crucial for ensuring that farm financial records reflect true performance, support decision-making, and facilitate compliance with regulations.

Cash Basis Accounting

- Definition: Records income and expenses only when cash is received or paid.

- Simplicity: Ideal for small or less complex farms.

- Limitation: May miss outstanding invoices, liabilities, or unpaid bills.

Accrual Basis Accounting

- Definition: Recognizes revenue/expenses when earned or incurred, regardless of cash flow.

- Comprehensive Assessment: Provides a full picture of profitability and financial health.

- Recommended for: Larger or multi-enterprise operations needing accurate matching of income and expenses, asset depreciation, and long-term planning.

Pro Tip: Whichever method you use, document your choice and remain consistent year to year for tax compliance and comparability.

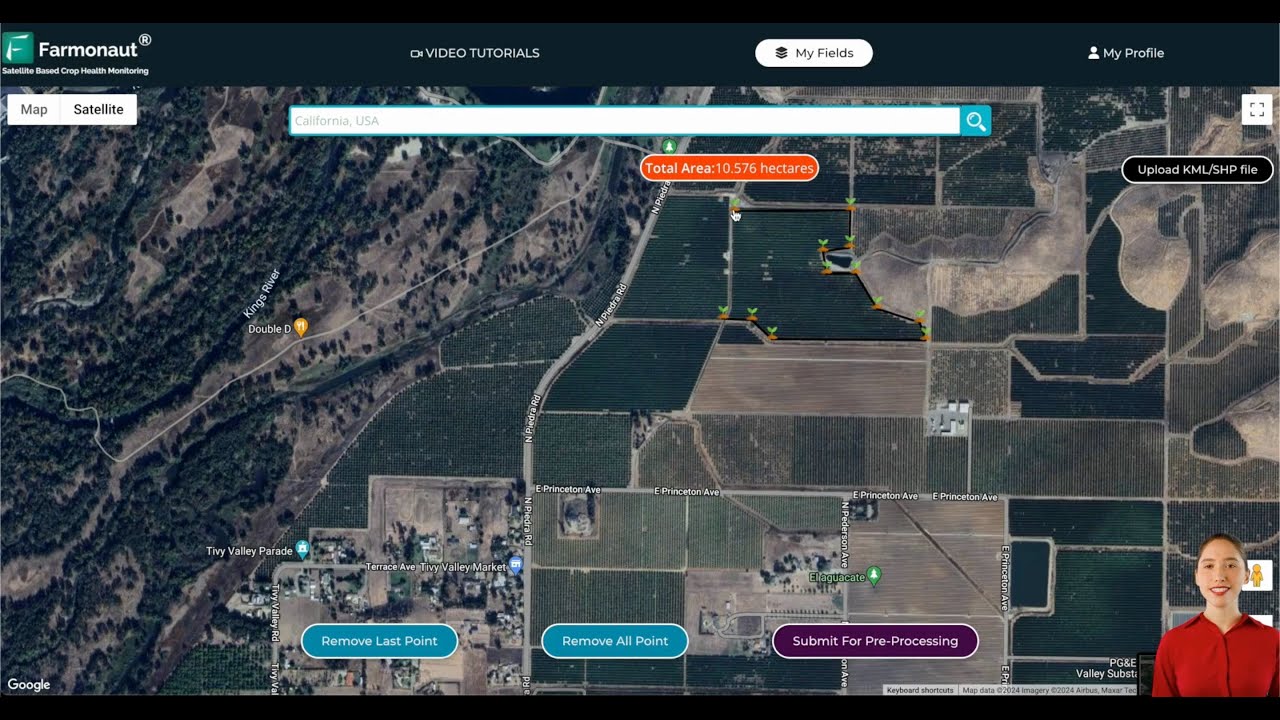

Did you know? Farmonaut’s satellite-based crop health monitoring can provide data that supports more accurate farm financial reporting by linking crop health to yield forecasts and input expenditure. This empowers precision agriculture and reduces unplanned costs. Explore more about large-scale farm management.

3. Setting Up a Chart of Accounts for Farm Bookkeeping

The chart of accounts serves as the backbone for organized farm bookkeeping. It is a structured list of each account used to classify every financial transaction your farm records. A logical chart allows efficient reporting, monitoring, and tax planning.

Key Components of a Farm Chart of Accounts

-

Revenue Accounts:

- Crop Sales (by product/crop type)

- Livestock Sales (by species or category)

- Other Income (rent, farm tours, government grants, subsidies)

-

Expense Accounts:

- Seeds, Feed, Fertilizers, Pesticides

- Labor, Contracted Services

- Fuel, Utilities, Repairs and Maintenance

- Insurance, Licenses, Regulatory Fees

-

Asset Accounts:

- Land, Buildings, Machinery, Vehicles

- Inventory (crops in storage, feed supplies, farm equipment parts)

- Livestock (by classification)

-

Liabilities and Loans:

- Banks Loans (operating, equipment, mortgages)

- Credit Accounts (supplier credits, credit cards)

- Other Obligations

-

Owner’s Equity/Capital:

- Initial Investments

- Retained Earnings

Tip for Implementation: Digital farm accounting software often includes customizable chart of accounts tailored to agricultural operations, streamlining set-up and reporting.

4. Implementing Consistent Record-Keeping Practices

Consistency is the cornerstone of trustworthy farm financial records. By systematically recording each transaction and organizing receipts, invoices, and supporting documents, farmers prevent errors, omissions, and confusion—especially at tax time or when seeking credit.

Core Record-Keeping Habits:

-

Regular Documentation:

- Capture income (from crop and livestock sales, government aid, side activities) immediately

- Log each expense (for inputs, labor, repairs, etc.) with supporting receipts

-

Organized Storage:

- Use folders or digital systems to separate by month, transaction type, or vendor

- Scan receipts to cloud or use mobile-friendly farm bookkeeping apps

-

Specialized Software:

- Leverage farm accounting software to automate entry, flag duplicates, and generate reminders for outstanding balances

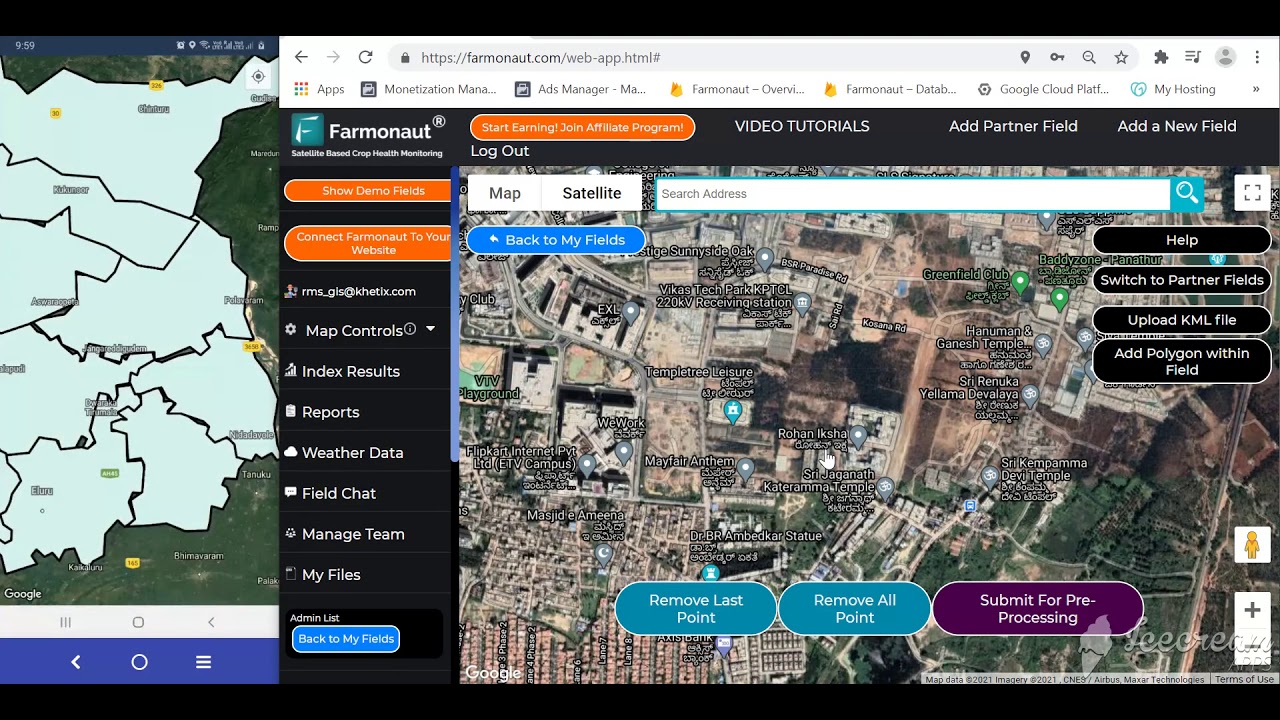

Efficiency Insight: Digital record-keeping, like that in the Farmonaut platform, eliminates manual data entry headaches and makes reporting to lenders or government agencies a breeze.

Explore our product traceability features to ensure transparency and compliance in your farm’s supply chain management, leveraging the power of blockchain for verifiable records.

5. Reconciling Accounts: Ensuring Accuracy and Integrity

Even with excellent recording practices, mistakes can creep in. Regular reconciliation of your bank, inventory, and loan accounts is essential to spot errors, fraud, or forgotten transactions.

How to Reconcile Accounts Effectively:

- Bank Reconciliation: Match entries from your farm’s bank statements with your internal records, noting any outstanding checks, missing deposits, or unrecorded fees.

- Inventory Reconciliation: Regularly audit both physical stocks and digital records of crops, feed, supplies, and harvested goods to avoid losses and support inventory-related banking or insurance claims.

- Loan & Credit Account Reconciliation: Track payments, interest, and outstanding balances on operating loans, equipment financing, and supplier credit lines.

Accuracy here directly influences your farm’s financial health and reputation with lenders or government bodies.

For truly streamlined audit and reconciliation, explore our crop loan and insurance services that leverage satellite-based field verification to support accurate record keeping for financial and insurance purposes.

6. Generating Essential Farm Financial Reports

Routine financial reports are vital for monitoring business performance, meeting tax regulations, and guiding operational decisions. Three reports are especially important:

-

Profit and Loss Statement (P&L):

- Summarizes revenue, costs, and expenses over a period to assess profitability

-

Balance Sheet:

- Shows the farm’s assets, liabilities, and owner’s equity at a point in time

-

Cash Flow Statement:

- Tracks real cash movement to assess if the farm can meet its short and long-term obligations

Compliance: These reports support not only internal management but also smooth bank loans or subsidy applications and are often mandatory for farm compliance and tax regulations.

Advanced farm accounting software can generate these reports at the click of a button, ensuring data integrity and saving countless hours during financial reviews.

7. Utilizing Technology and Software for Efficient Farm Bookkeeping

Modern farm bookkeeping is rapidly being transformed by technology. Specialized farm accounting software brings automation, accuracy, and accessibility, whether you’re in the field or at the office. Here are several ways technology is elevating farm financial management:

- Automated Data Entry: Import bank transactions, receipts, and invoices directly, reducing manual entry and minimizing errors.

- Real-Time Inventory Management: Track inventory levels (crops, seeds, feed, fuel, inputs) linked to both purchasing and usage cycles.

- Remote and Mobile Access: Enter data or view reports from anywhere, enabling decisions upfront and on-the-go.

- Integrated Compliance Reminders: Automated reminders for regulatory deadlines or loan payments.

Farmonaut’s platform takes this a step further, combining core farm management tools with real-time satellite crop health monitoring, carbon footprint tracking, fleet and machinery management, advisory systems, and blockchain-powered traceability. This integration enables smart, data-driven decisions and streamlined compliance.

For developers and agri-tech partners: Our API enables satellite and weather data integration for any system. Learn more about Farmonaut’s API or read our developer documentation.

Curious about sustainability? Our carbon footprinting tools help you monitor and reduce your farm’s environmental impact in line with compliance goals.

8. Farm Bookkeeping Best Practices for Accuracy and Efficiency

To ensure your farm bookkeeping system delivers maximum value, adopt these industry-vetted farm bookkeeping best practices:

- Separate Business and Personal Finances: Use dedicated bank accounts and cards for the farm, never mixing transactions with household spending. This is crucial for tax efficiency and audit readiness.

- Consistent Coding and Categorization: Assign every transaction to the most appropriate account in your chart of accounts. This ensures meaningful reports and easier data analysis.

- Regular Reconciliation: Bank and inventory reconciliation should be conducted monthly or quarterly—don’t let small discrepancies snowball!

- Scheduled Backups and Security: Protect digital financial data with secure, cloud-based backups and access controls.

- Staff Training: If you have employees or trusted helpers, ensure they are familiar with standard recording and reconciliation practices.

Long-Term Advantage: Consistent best practices will streamline your tax filings, facilitate loans, and equip you with actionable insights for next season’s business plan.

9. Seeking Professional Assistance: When and Why to Consult Experts

As farm operations increase in scale and complexity, professional bookkeepers and accountants play a critical role in guiding agricultural financial management decisions. Their expertise offers:

- Tax Planning and Compliance: Navigating detailed tax regulations, maximizing eligible deductions, and ensuring timely, proper filings.

- Advanced Financial Analysis: Interpreting financial reports for future growth, investments, and risk management.

- System Optimization: Setting up or streamlining bookkeeping systems, including integrating advanced farm accounting software.

Remember: The peace of mind and cost savings from error-free, optimized farm bookkeeping often far outweigh the investment in professional support.

For fleet and equipment management, explore Farmonaut’s tools designed for efficient resource allocation and tracking: Farmonaut Fleet Management.

10. Continuous Education and Improvement in Farm Bookkeeping

The world of agricultural accounting continually evolves with technology, regulations, and new management approaches. To stay competitive:

- Attend Workshops and Seminars: Look for programs by local agricultural colleges, government bodies, or industry groups.

- Peer Learning: Share knowledge and solutions with neighboring farmers or through online forums.

- Utilize Online Resources: Take advantage of online tutorials, webinars, articles, and user communities dedicated to farm bookkeeping and financial management.

Tip: Whenever new accounting software, record keeping system, or regulatory change arises, plan educational sessions for you and your team.

Interested in agricultural advisory powered by AI and satellite insights? Our Jeevn AI Advisory delivers the latest on crop management, weather forecasts, and resource optimization. Start your journey at Farmonaut’s App.

Comparison Table of Key Farm Bookkeeping Practices

| Practice Name | Description | Estimated Implementation Time | Estimated Annual Cost | Compliance Benefit | Profitability Impact |

|---|---|---|---|---|---|

| Understanding Farm Bookkeeping and Accounting | Setting up foundational systems for systematic financial recording and reporting | 4-6 hours (setup), 1-2 hrs/week maintenance | $0-$200 (self-managed) | High | 5-10% increase via reduced errors |

| Choosing the Right Accounting Method | Selection and documentation of cash or accrual accounting according to farm scale | 2-4 hours (consultation/setup) | $0-$500 (if advisor used) | High | 3-7% increase via improved accuracy |

| Setting Up a Chart of Accounts | Customizing accounts to properly classify farm income, expenses, and assets | 4-8 hours setup, 1hr/month review | $0-$300 (software/templates) | High | 6-10% via smarter reporting |

| Consistent Record-Keeping Practices | Regular documentation and organized storage (paper/digital) | 2-3 hrs/week | $100-$400 (systems/software) | High | 7-12% via reduced loss/overlooked claims |

| Reconciling Accounts | Regular review and balancing of bank, inventory, and loan/credit accounts | 2-4 hrs/month | $0-$150 (if self-managed) | High | 5-8% via fraud/error prevention |

| Generating Financial Reports | Routine profit/loss, balance sheet, and cash flow statement preparation | 1-4 hrs/month | $50-$400 (software or advisor) | Medium | 6-15% via decision-making support |

| Utilizing Technology and Software | Adoption of farm-specific accounting and management tools | 8-12 hrs (learning/setup), 1hr/week maintenance | $100-$600 (subscription/software) | High | 8-16% via efficiency/time saved |

| Bookkeeping Best Practices | Separation of accounts, coding consistency, and regular training | 2-6 hrs/month | $0-$250 (training, resources) | High | 7-12% via smoother audits/compliance |

| Seeking Professional Assistance | Leverage accountants/bookkeepers for optimization and compliance | Depends on engagement (8-40 hrs/year) | $200-$2,000+ (fees) | High | 10-25%* (for large, complex ops) |

| Continuous Education & Improvement | Ongoing learning via seminars, online resources, and peer-learning | 2-4 hrs/month | $0-$350 (events/online) | Medium | 5-11% via innovation/adaptation |

Farmonaut Precision Agriculture Subscriptions

FAQ: Farm Bookkeeping and Accounting

What is the main purpose of farm bookkeeping?

The main goal is to systematically record, classify, and analyze all financial transactions to manage farm income, expenses, compliance, and long-term profitability.

Should I use cash or accrual basis accounting?

It depends on farm size and complexity. Small farms may start with cash basis for simplicity, while larger farms should use accrual basis for a more accurate reflection of financial health.

How often should I reconcile accounts?

Bank accounts should be reconciled at least monthly. Inventory and loan account reconciliation is recommended quarterly, or after major transactions.

What financial reports are most important for farms?

The Profit and Loss Statement, Balance Sheet, and Cash Flow Statement are critical. They provide insights into profitability, liquidity, and overall financial position.

How does technology benefit farm bookkeeping?

Technology automates data entry, speeds up reporting, supports compliance, reduces error rates, and makes bookkeeping accessible from anywhere.

What are some best practices for managing farm finances?

Key practices include separating business and personal finances, organizing and coding all transactions, regular reconciliation, periodic training, and leveraging technology.

Is it necessary to hire a professional accountant?

For complex or growing operations, a professional is invaluable for compliance, strategy, and audit preparedness. Even small to medium farms benefit from periodic consulting.

How can I improve the sustainability and transparency of my farm’s finances?

Utilize technologies like Farmonaut’s carbon footprinting and blockchain traceability tools, attend industry education sessions, and keep up with regulatory requirements.

Where can I find digital tools to help with farm bookkeeping?

Consider specialized farm accounting software or integrated technology platforms such as Farmonaut; see links above for web and mobile apps.

Conclusion: Powering Your Farm’s Success With Smart Bookkeeping

Sustained profitability and sustainability in farming depend on mastering farm bookkeeping and accounting. From the very first transaction to advanced financial reports and compliance checks, these 10 practices form a cycle of continuous improvement for any agricultural operation.

Leveraging tools like those provided by Farmonaut—AI-driven analysis, satellite-based crop health data, blockchain traceability, and seamless integration with existing financial systems—farmers can stay ahead in a data-driven, transparent, and increasingly sustainable industry.

Start small, get organized, use the right software, and—when needed—turn to professionals for advice. With diligence, regular review, and a willingness to adapt, farm bookkeeping becomes the engine of better decisions, solid compliance, and growing profitability.

Ready to transform your farm’s financial health? Download our app now, or explore advanced solutions for product traceability, carbon footprinting, and large-scale farm management.