Farmland Return on Investment: High-Return Strategies 2025

“Farmland investments averaged a 10% annual return from 2020-2024, outperforming many traditional asset classes.”

Summary: Farmland Return on Investment – 2024-2025 Trends, Strategies & Outlook

Farmland return on investment is gaining unprecedented relevance among investors seeking stable income, capital appreciation, and climate-resilient portfolio growth. With global budgets shifting towards food security, population expansion, and commodity supply-demand imbalances, the 2024-2025 period is set to be transformative for agricultural land assets—especially in emerging markets like India. This article unpacks the mechanics behind farmland returns, evaluates global and Indian return trends, explores high-return farmland investment strategies, and delivers an actionable outlook for investors aiming to optimize this stable yet growth-oriented asset class.

Introduction: Why Farmland Remains a Compelling Proposition

Global and Indian investors are increasingly drawn towards farmland—not merely as agricultural or rural assets, but as integral pillars of resilient, inflation-proof investment portfolios. The reasons for this growing interest are clear:

- Stable, uncorrelated returns—key during economic instability

- Dual sources of value: recurring income (from leases or farming) plus long-term appreciation (as land values increase)

- Rising food demand and population pressures, especially in rapidly urbanizing nations like India

- Inflation protection, as agriculture commodity prices typically rise with inflation

- Technological advancements in agritech—precision farming, data analytics, and sustainable management—are ROI multipliers

- Global movement towards sustainability and ESG investing

Let’s explore how farmland return on investment works, current performance worldwide and in India, and what high-return farmland investment strategies are most effective for 2025 and beyond.

Understanding Farmland Return on Investment

Farmland ROI is typically generated via two main channels:

-

Income Yield:

Periodic returns derived from leasing land to farmers/operators, or by directly cultivating cash crops and selling the produce. Yield is impacted by:- Crop yields & type (commodities, horticulture, organic, specialty)

- Commodity prices (fluctuation, seasonality, inflation)

- Operational efficiency & cost management

-

Capital Appreciation:

Growth in the underlying agricultural land value due to market demand, scarcity (urbanization), infrastructure development, regulatory changes, and climate resilience considerations.

Compared with equity and bond markets, farmland investments typically offer:

- Lower volatility

- Strong resistance to inflationary pressures (as agriculture commodities often rise with inflation)

- Attractive, stable cashflows and capital appreciation, especially in globally growing markets

For detailed, real-time insights that boost farmland ROI, Farmonaut’s Large Scale Farm Management platform offers satellite-based crop health monitoring and field mapping. This drives smarter decision-making for income, appreciation, resource management, and operational efficiency.

Farmland Investment Returns 2024 & Agricultural Land Investment Returns India 2025

Understanding current trends and future outlook is fundamental for maximizing farmland return on investment. Here’s the landscape for 2024-2025, both globally and for India:

1. Global Farmland Investment Returns 2024

- Average annualized total returns hover between 8% to 12% worldwide, combining income and appreciation.

- Stable geographies (North America, select European and Oceanic markets) provide income yields of 3% to 5% per year via leasing.

- Capital appreciation is largely driven by:

- Agri-technology adoption

- Supply-demand imbalance in food markets

- Rising interest from institutional investors and funds

- Climate resilience and value of sustainable farmland

2. Agricultural Land Investment Returns India 2025

-

Return Estimates:

Indian farmland ROI is expected at 9% to 14% annually in 2025, slightly exceeding the global mean due to India’s untapped agricultural potential, infrastructural development, and growing agritech adoption. -

Capital Appreciation Drivers:

- Urbanization: Reduction in available arable land (almost 2% per year in some Indian states) drives up land value for scarce, high-quality parcels.

- Government Initiatives: Irrigation, sustainable agriculture, and farmer income support schemes (like PM-KISAN, crop insurance) strengthen the investment proposition.

- Market-Driven Growth: Growth of food processing, export-oriented crops (spices, organic), and climate-smart farming ecosystems.

-

Income Yields:

- Leasing to professional farm operators/corporate farmers offers recurring income streams of approximately 4% to 7%, depending on crop, region, and farm quality.

- High-value crops (spices, organic, horticulture) command premium lease rates and increased net income.

- Rising demand for food, specialty crops, and climate-resilient agriculture keeps upward pressure on farmland demand and prices.

- Technological efficiency, especially precision and satellite farming, is accelerating income and farm productivity.

Key Drivers & Trends Impacting Farmland Returns in 2025

The following factors are shaping high-return farmland investment strategies and overall farmland ROI as we approach 2025:

-

Food Security Demands:

With the global population to surpass 8 billion, there’s intense competition for quality agricultural land. Dietary shifts (towards protein, specialty, organic products) and biofuel mandates increase the pressure on farmland returns. -

Technological Advancements:

Precision agriculture, satellite imaging, AI analysis, and data-driven farm management boost yields while reducing costs.

Farmonaut’s large-scale management platform and satellite-based crop health monitoring are examples of technology propelling higher income, increased operational efficiency and value in farm investments.

-

ESG, Carbon Credits & Sustainability:

Sustainable farming, carbon footprint tracking, and organic transition command premium valuations and offer new value streams for farmland investors in 2025 and beyond.

-

Government Policies & Regulations:

Subsidies, crop insurance, infrastructure upgrades (irrigation, roads) and recent regulatory changes in India support investment liquidity and returns.

-

Institutionalization & Liquidity:

Farmland REITs, agri-focused funds, and fintech platforms enable diversified, liquid investment in land as an asset class.

“In 2025, high-return farmland strategies are projected to boost portfolio growth by up to 15%.”

Farmland ROI Strategy Comparison Table (2024-2025)

This comprehensive strategy table compares leading high-return farmland investment strategies as of 2024-2025. It delivers actionable insights into returns, risk, stability, and capital requirements for informed asset allocation and diversified portfolio growth.

| Investment Strategy | Estimated Annual Return (%) | Income Stability | Appreciation Potential (%/year) | Risk Level | Minimum Capital Required (USD) |

|---|---|---|---|---|---|

| Direct Farmland Purchase & Leasing | 8 – 14 | High | 3 – 7 | Medium | $25,000+ |

| Farmland REITs & Agri Funds | 7 – 12 | High | 2 – 5 | Low-Medium | $1,000+ |

| Specialty Crop Cultivation (Organic, Spices, Medicinal) | 10 – 15 | Medium | 5 – 10 | Medium-High | $15,000+ |

| Organic Transition | 9 – 14 | Medium | 4 – 8 | Medium | $10,000+ |

| Lease Agreements With Professional Operators | 6 – 10 | High | 2 – 6 | Low | $8,000+ |

| Agroforestry & Carbon Credit Monetization | 7 – 13 | Medium | 3 – 8 | Medium | $12,000+ |

| Value-Add Infrastructure (Irrigation, Cold Storage, Processing Units) | 8 – 15 | High | 5 – 10 | Medium-High | $35,000+ |

High-Return Farmland Investment Strategies for 2025

Investors aiming for farmland returns exceeding market averages should consider these actionable strategies for maximizing ROI and building a future-proof portfolio:

1. Direct Farmland Ownership and Leasing

-

Secure prime parcels in regions with robust irrigation, market access, and good soil health.

Farmonaut’s satellite-based crop health and field mapping can help identify high-quality parcels and support post-purchase management. - Lease land to professional operators, specialty crop farmers, or contract growers—this assures regular income while allowing for capital appreciation.

2. Agritech Integration & Farm Management Partnerships

- Integrate technologies like precision agriculture, drone monitoring, and real-time advisory (like Farmonaut’s Jeevn AI System) for higher yields and operational efficiency.

- Collaborate with agritech platforms for crop health monitoring, irrigation optimization, and predictive analytics to reduce input costs and drive consistent income returns.

- AI and satellite-based insights: Monitor weather and soil conditions dynamically to minimize yield losses and maximize profitability.

3. Specialty Crops, Organic Farming, and Spices

- Focus on high-value crops—organic produce, medicinal herbs, and spices (like cardamom, pepper, turmeric) command premium lease rates and higher margins.

- Example: Transitioning land over 2-4 years to organic certification status can significantly boost its market value and lease potential.

- Use platforms such as Farmonaut for traceability and certification, boosting supply chain transparency and earning premium prices.

4. Value-Add Farmland Investments

- Invest in irrigation infrastructure, cold storage, greenhouses, or food processing units linked to your land. These investments diversify income streams, support off-season farming, and can even attract institutional rent/leases.

- Farmonaut also supports fleet and resource management, allowing larger agribusinesses to streamline logistics, vehicle usage, and reduce operational costs—maximizing net ROI from value-add farming operations.

5. Farmland REITs and Diversified Agri Funds

- Gain exposure to diversified portfolios of farmland assets through REITs, agri-funds, and co-investment vehicles. These options suit investors seeking liquidity, lower minimums, and professional management.

- Many funds offer exposure to both income yields and capital appreciation across product types (grain, horticulture, specialty crops).

6. Agroforestry & Carbon Credit Monetization

- Agroforestry blends conventional cropping with tree plantations—boosting land resilience, biodiversity, and creating new revenue from carbon credits and emissions reduction.

- This strategy is well-aligned with ESG and climate-oriented asset classes expected to draw increased institutional interest for 2025 and beyond.

7. Lease Agreements With Professional Farm Operators

- Lease your land to expert, professional operators with proven experience in high-demand crops. This assures steady income, reduces operational risks, and often produces win-win structuring (income share, minimum guarantee, bonuses for performance/yields).

- Tracking lease performance and remote field conditions is easy via Farmonaut’s satellite-based management tools.

“Farmland investments averaged a 10% annual return from 2020-2024, outperforming many traditional asset classes.”

Risks and Considerations in Farmland Investing

Farmland investing remains a steady proposition, but investors should evaluate the following risk factors before allocating capital:

- Weather & Climate Risks: Drought, flooding, and climate change can negatively hit crop yields, soil health, and income projections.

- Commodity Price Volatility: Fluctuations in global and local market prices for crops can significantly affect income from produce and lease rates.

- Regulatory & Land Use Restrictions: Especially in India, land tenure laws and agricultural policies vary by state; local regulations may restrict ownership, transactions, or conversions of farm land.

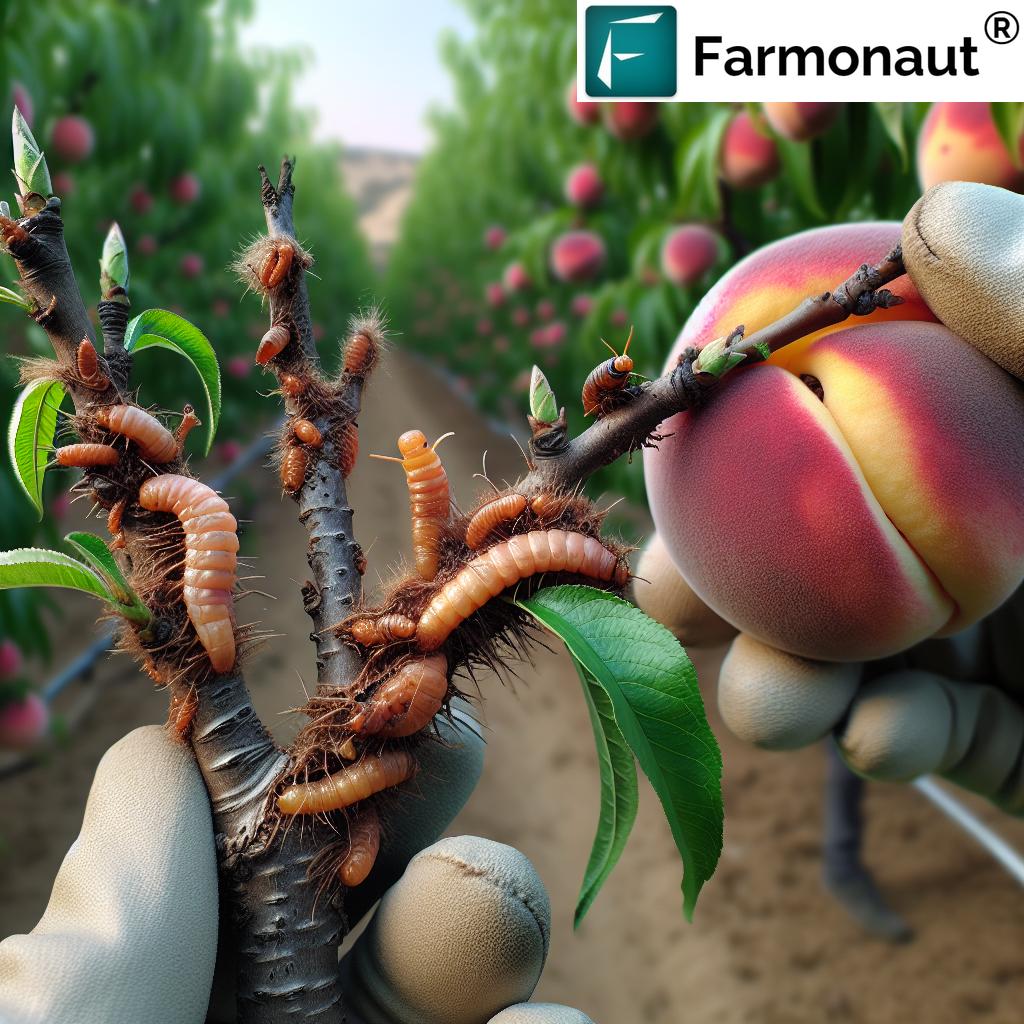

- Operational Risks: Dependence on tenant operators, management efficiency, and potential for soil depletion or misuse.

- Liquidity Risks: Direct land investments may have lower liquidity than funds or REITs.

Mitigate many of these risks with precision monitoring, remote management, real-time data, and professional advisory support—such as those provided by Farmonaut.

Leveraging Farmonaut Technology for Higher Farmland ROI

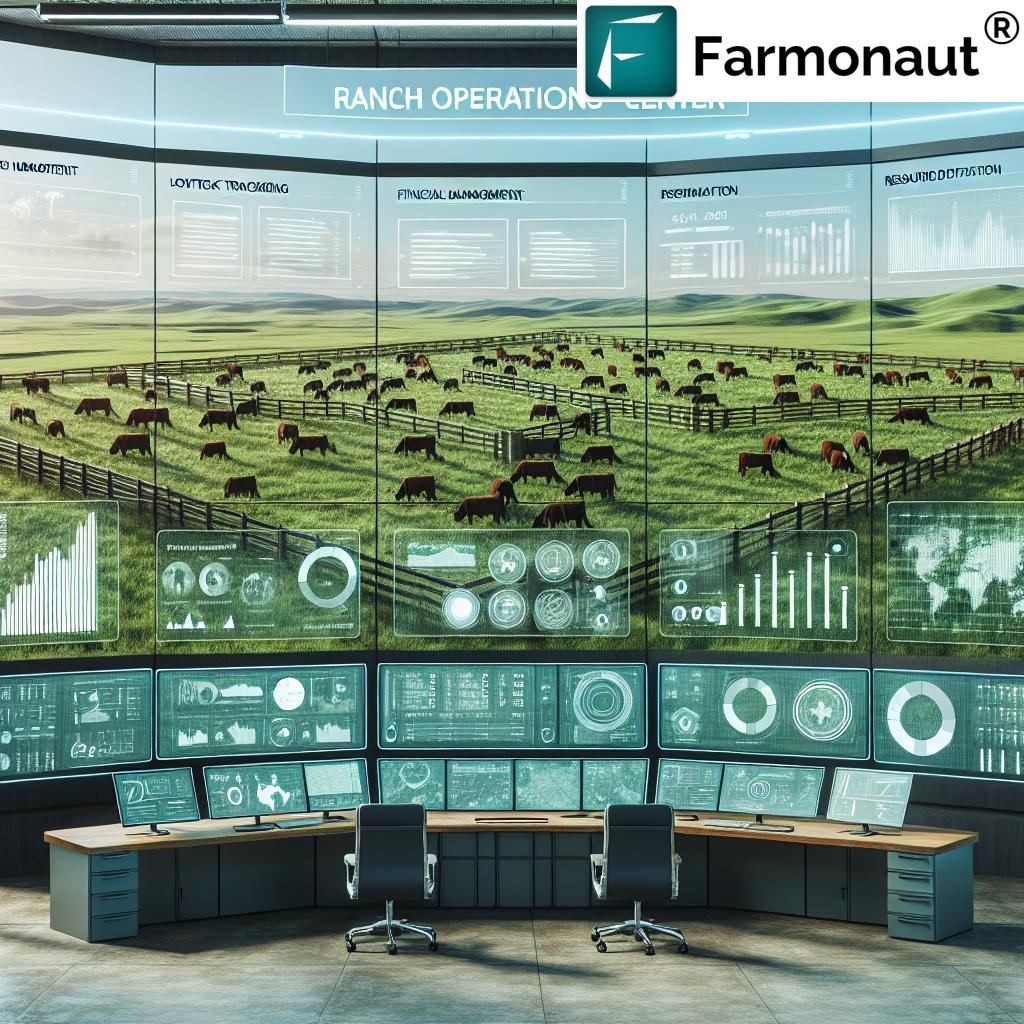

Farmonaut’s satellite-based, AI-enabled management platform empowers investors and operators to:

- Monitor crop health, soil moisture, and vegetation indices in real time across wide land areas

- Optimize irrigation, input use, and pest/fungal management for higher yields and reduced costs

- Automate and verify farm operations using fleet and resource management for streamlined logistics and input allocation

- Utilize blockchain-based traceability for premium market access, quality assurance, and consumer trust in specialty/organic crops

- Track carbon emissions and maximize carbon credit value via climate-smart initiatives — a new, profitable revenue stream for ESG-focused investors

Our Farmonaut platform is available as an App for Android, iOS and through Web platform. For developers or large institutional asset managers, our API and API Docs integrate advanced Agri-data into proprietary management systems.

To further enhance farm-level outcomes—especially for corporates or plantations—explore our crop plantation & forest advisory solutions, which combine AI insights with operational guidelines tailored to your crop profile and regional climate.

Farmland Return on Investment Outlook for 2025

The outlook for farmland investments remains distinctly positive, both globally and for India, in 2025 and beyond. Key highlights include:

-

Average annualized returns: 8%–12% globally, 9%–14% in India (with specialty and value-added land offering even higher upside).

-

Compound drivers: Food security & climate pressures, technological adoption, urbanization, and regulatory reforms continue to boost land value, yields, and income stability.

-

Best-positioned strategies: Direct land ownership (with agritech integration), specialty crops, organic transition, value-add infrastructure, and carbon credit monetization offer highest risk-adjusted rewards.

-

ESG, Regulatory & Digital Innovations: Investors leveraging carbon tracking, blockchain traceability, and data-centric management will command a growing share of farmland ROI.

In summary, farmland investing is now a strategic, future-proof class for income-seeking, risk-averse, and growth-oriented portfolios alike. As emerging markets like India continue to evolve, asset managers, agribusinesses, and even small-scale investors can unlock competitive, sustainable returns.

With Farmonaut’s cost-effective platform, investors at any scale can monitor and optimize every aspect of their farmland ROI journey.

FAQ: Farmland Investment Returns, Strategies & Risks

What is the average farmland return on investment in 2025?

In 2025, global farmland investments deliver average annual returns of 8%–12% (including income and capital appreciation), while Indian agricultural land investment returns are expected between 9%–14% per year, owing to untapped potential and technology adoption.

Which farmland investment strategy offers the highest returns?

Direct ownership with precision management and specialty crop cultivation delivers the best long-term returns (10–15%), especially when coupled with value-add (irrigation, cold storage, carbon credits) and sustainable transitions (organic, agroforestry).

How can technology increase agricultural land ROI?

Tech innovations—like satellite crop monitoring, AI-driven decision support, fleet/resource management, and blockchain traceability—enhance yields, reduce costs, boost soil and resource efficiency, and add new income streams (carbon credits, premium certifications).

Are there barriers for international investors in Indian farmland?

Indian agricultural land is largely restricted to resident citizens and certain institutional entities by regulation. Investing requires meticulous due diligence on local land use, tenure rights, and policy shifts.

What are the key risks in farmland investing?

Primary risks include weather/climate, commodity price volatility, regulatory and operational uncertainty, and liquidity. Using modern monitoring and risk management tools (like Farmonaut’s platform) can mitigate many of these issues.

How do I track carbon credits or emissions from my farmland?

Adopt a carbon accounting platform (like Farmonaut Carbon Footprinting) to monitor emissions, optimize ESG practices, and monetize carbon credits in voluntary markets.

Farmonaut Subscription: Make Precision Farm Investing Smart & Scalable

Ready to empower your farmland investments with real-time, satellite-powered management and unlock the next era of agricultural returns? Browse our flexible, scalable Farmonaut subscription options and transform your farmland strategy for 2025 and beyond:

Conclusion: Farmland ROI, Stability & Innovation in 2025

The age of farmland investing has arrived. As food security, climate variability, and global demand trends converge, agricultural land is repositioned as an essential asset for the next decade. By embracing technological integration, sustainability, diversified strategies, and data-driven asset management (including powerful platforms like Farmonaut), investors can enjoy superior, stable farmland returns—while supporting a resilient agricultural future for India and the world.