How to Invest in Farming: 5 Powerful Strategies for 2025

Summary: Investing in Farming – A 2025 Guide to Growing Wealth in Agriculture

As global populations rise and climate change continues to shift agricultural patterns, farming remains a vital sector promising both economic returns and sustainability benefits. In 2025 and beyond, how to invest in farming is an increasingly relevant question for investors seeking resilient returns, portfolio diversification, and opportunities to contribute to food security on a global scale. This comprehensive guide explores five powerful strategies for investing in farming, including agricultural land, vertical farming, and farmland ETFs, highlighting the key benefits, risks, and approaches to consider to grow your wealth in agriculture.

“Global agricultural investments are projected to reach $4.8 trillion by 2025, largely driven by rising demand for food security.”

Table of Contents

- Introduction: Why Invest in Farming in 2025?

- 1. Investing in Agricultural Land

- 2. Investing in Farmland REITs

- 3. How to Invest in Farmland ETFs

- 4. Investing in Vertical Farming

- 5. Investing in Agritech Startups & Contract Farming

- Comparative Table: 2025 Farming Investment Strategies

- Key Considerations for 2025 Farming Investments

- How Farmonaut Empowers Agricultural Investments

- Frequently Asked Questions (FAQ) – How to Invest in Farming

- Conclusion

Introduction: Why Invest in Farming in 2025?

The agricultural sector is entering a transformative era. With global populations expected to reach 8.5 billion by 2030, the demand for reliable food production, efficient land use, and sustainable growth in agriculture is at an all-time high. Investors and institutions are increasingly seeking stable, inflation-resistant, and impactful opportunities—making how to invest in farming one of the compelling questions of our time.

Agricultural investments offer unique strategic advantages: resilience against economic downturns; alignment with sustainability goals; and the chance for both capital appreciation and steady income. As technology advances, especially in vertical farming, satellite-based monitoring, and blockchain traceability, 2025 promises an even broader and more accessible set of investment opportunities in the agricultural sector.

This article explores five powerful investment avenues in farming for 2025 and beyond:

- Purchasing Fertile Agricultural Land

- Farmland REITs

- Farmland ETFs

- Vertical Farming

- AgriTech Startups & Contract Farming

Each method blends financial returns with strategic benefits, offering investments tailored to different levels of capital, risk profiles, and long-term sustainability goals.

1. Investing in Agricultural Land: A Direct Approach to Farming Wealth

How to invest in agricultural land remains one of the oldest—and most resilient—strategies for tapping into the growth of agriculture. Owning farmland provides tangible assets, direct exposure to crop cycles, and the dual benefit of capital appreciation and operational income.

Key Considerations When Purchasing Farmland:

- Location & Soil Quality: Fertile soil in favorable regions increases crop yield potential and future land value. In 2025, emerging regions with advanced irrigation infrastructure and government incentives present high growth opportunities.

- Crop Diversity & Sustainability Focus: Integrating organic, regenerative, and rotation techniques can protect land value, anticipate regulatory shifts, and bolster returns even in challenging climates.

- Income Streams: Farmland can provide steady revenue through direct crop sales or by leasing the land—offering dual returns from both land appreciation and operational income.

However, purchasing agricultural land requires significant capital and due diligence regarding land rights, crop cycles, local market prices, and an understanding of related risks and regulations.

Advantages of Investing in Farmland:

- Resilience: Farmland has historically demonstrated stability during inflation and economic downturns due to the essential nature of food production.

- Appreciation: Rural land values in strategic regions have shown robust growth, especially with resource scarcity and increasing urbanization.

- Sustainable Returns: Integrating regenerative agriculture and climate-smart solutions can increase long-term value and appeal to eco-focused investors. To learn how carbon management tools help track sustainability, check our Carbon Footprinting product page.

Risks & Due Diligence:

- Market Volatility: Fluctuating crop prices and unpredictable climate conditions may affect annual income.

- Land Rights & Regulations: Thoroughly review legal documentation and government policies, as ownership laws and subsidies vary by region.

- Operational Complexity: Direct management or partnership with experienced farmers is critical to maximizing yield and sustainability.

In Summary:

Investing in agricultural land presents a stable path to agricultural wealth, combining both direct returns and appreciation potential for 2025 and beyond. With the added benefits of climate resilience and food production security, farmland investing remains a highly strategic cornerstone in any diversified portfolio focused on real assets.

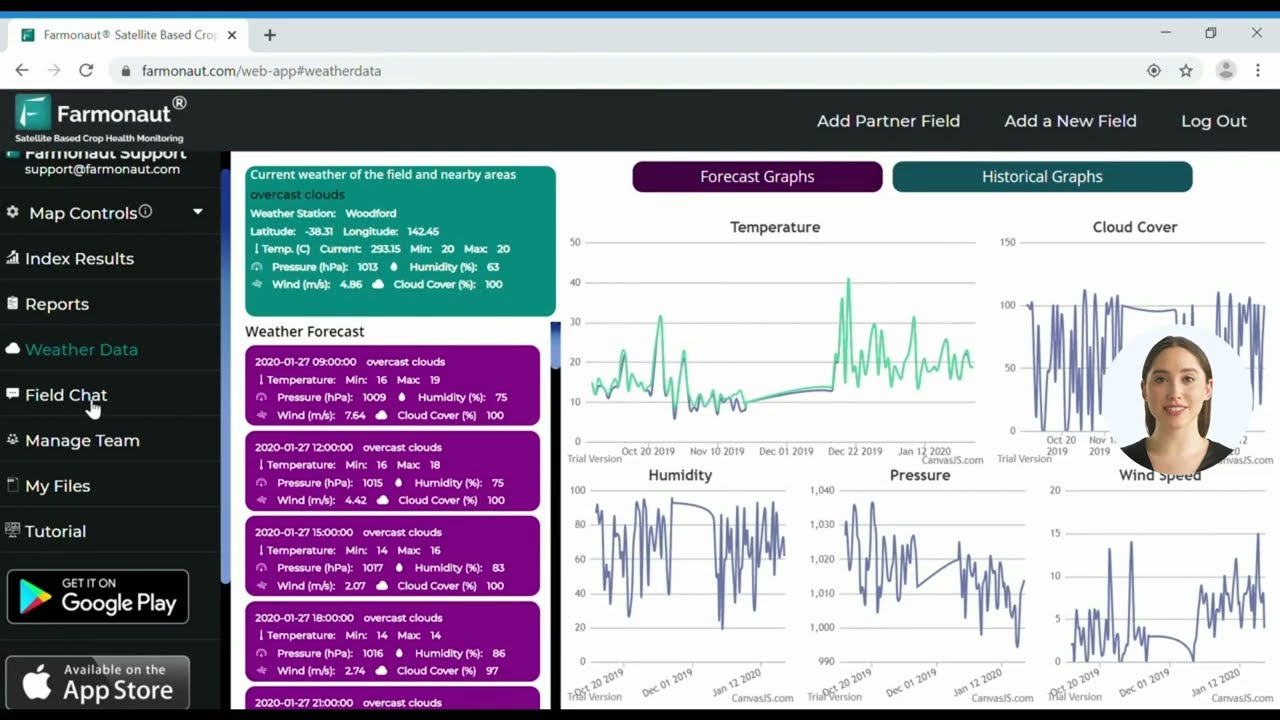

To support smarter land investment decisions, we at Farmonaut offer advanced satellite-based soil and crop health monitoring. Leveraging multispectral imaging and AI, our web and mobile apps empower both individual and institutional investors to analyze vegetation health, soil conditions, and environmental trends in real time, ensuring that due diligence is data-driven and comprehensive. Explore our Agro Admin app for large-scale farm management and decision support.

“Over 40% of agricultural ETFs saw double-digit growth in 2023, highlighting agriculture as a strong diversification strategy.”

2. Investing in Farmland REITs: Accessing Agricultural Wealth Through Real Estate Markets

For those seeking exposure to farmland without the demands of direct ownership, Farmland Real Estate Investment Trusts (REITs) offer a streamlined alternative. REITs specialize in acquiring, managing, and leasing agricultural properties—bundling their earnings for shareholder return.

Benefits of Farmland REITs:

- Liquidity: REIT shares are traded on major stock exchanges, allowing for ease of entry and exit compared to illiquid physical land holdings.

- Diversification: Investors gain access to a basket of agricultural properties and lease types, reducing risk tied to any single region or crop cycle.

- Income: Farmland REITs pay regular dividends sourced from land leasing income, offering a steady return profile.

- Professional Management: Agricultural practices and property management are handled by institutions, lowering individual oversight requirements.

Key Considerations:

- Market Sensitivity: Although less volatile than equities, REITs can experience downturns due to broader real estate or financial market shocks.

- Fee Structures: Management and performance fees can affect net returns—always review terms closely.

- Environmental Focus: Many 2025 REITs integrate ESG (Environmental, Social, and Governance) screening, appealing to investors focused on sustainability.

Investing in farmland through REITs is ideal for individuals and institutions seeking a hands-off approach, blending asset-backed security with liquidity.

3. How to Invest in Farmland ETFs: Agricultural Diversification for 2025

One of the fastest growing avenues for agricultural exposure is via Farmland Exchange Traded Funds (ETFs). For investors evaluating how to invest in farmland ETF options, ETFs combine the advantages of a diversified portfolio, liquidity, and ease of access—making them essential for the modern portfolio.

What Are Farmland ETFs?

Farmland ETFs typically hold shares in:

- Publicly traded agricultural landowners

- Farmland-focused REITs

- Agri-businesses & supply chain companies

This provides investors with instant exposure to a wide range of agricultural market segments, from crop production and land leasing to food processing and distribution.

Advantages for 2025 Investors

- High Liquidity: ETFs can be traded on exchanges—enabling real-time buy/sell with low transaction costs.

- Diversification: Gain exposure across multiple regions, crops, and agricultural business models.

- Income and Growth: Many ETFs distribute dividends from lease income and benefit from underlying land appreciation.

- Accessibility: Lower minimum investment compared to direct land purchase, opening agricultural investment to a broader audience.

Risks and Critical Evaluation

- Market Volatility: Prices of agriculture ETFs can fluctuate in tandem with markets and commodity cycles.

- Lack of Direct Ownership: No direct control over land management or specific operational strategies.

- Performance Variability: Success depends on the ETF’s underlying composition and asset manager’s strategies.

For those seeking to diversify portfolios and invest in farming without operational complexity, farmland ETFs make it possible to participate in the anticipated growth of the agricultural sector in 2025.

4. Investing in Vertical Farming: Urban Solutions for Agricultural Growth

The future of urban agriculture and sustainable food systems is being reshaped by vertical farming. For those exploring how to invest in vertical farming, this technology-driven approach delivers high yields on minimal footprint, making it a compelling asset class as cities and populations expand in 2025.

What is Vertical Farming?

Vertical farming is the practice of growing crops in vertically stacked layers, often within controlled-environment buildings. The technology maximizes yield per square foot, reduces water use by up to 90%, and lessens dependence on traditional arable land.

Why Vertical Farming is Attracting Investors:

- Technology-Driven Yield: Use of LED lighting, hydroponics, and AI climate controls achieves year-round, high-volume crop cycles.

- Urban Market Access: Grows produce closer to consumers, reducing logistics costs, food spoilage, and carbon emissions.

- Impact Investment: Attractive to sustainability-focused portfolios due to water and resource efficiency, reduced pesticide use, and adaptability to climate change.

- Multiple Investment Channels: Participate via equity in established companies, venture capital in start-ups, or investment in real estate developed for controlled-environment agriculture.

Risks & Challenges:

- Capital Intensive: Requires significant upfront investment in infrastructure and technology.

- Operational Complexity: Managing artificial environments and large-scale systems demands technical expertise.

- Market Maturity: Vertical farming is still emerging; not all innovations are commercially proven.

Investing in vertical farming in 2025 delivers diversified growth potential and aligns with the shift towards urban agriculture and sustainability. For serious investors seeking innovation-led exposure within agriculture, this is a path to watch.

As new technologies power the vertical farming sector, we at Farmonaut provide real-time crop monitoring and AI-based advisory services, ensuring operational efficiency and optimizing yield remotely. For agritech businesses and investors, our crop plantation and forest advisory solutions help minimize resource waste and environmental impact using actionable satellite-driven intelligence.

5. Investing in Agritech Startups & Contract Farming: Innovation at the Roots

The synergy of technology and agriculture is fostering a wave of AgriTech startups and scalable contract farming. This avenue offers direct participation in the transformation shaping how we grow and supply food on a global scale.

Why Consider AgriTech Startups?

- Disruptive Solutions: Startups deploy AI, IoT, satellite data, robotics, and blockchain to solve yield, resource, logistics, and traceability challenges—from farm to fork.

- High-Growth Potential: Early-stage investments can deliver exponential returns—especially when targeting climate-smart food tech and precision agriculture companies.

- Diversification: Backing a range of AgriTech innovations enables risk sharing and exposure to rapidly growing market segments.

For investors seeking direct impact, product traceability tools powered by blockchain are transforming agricultural value chains, reducing fraud, and enhancing transparency from farm to shelf.

Contract Farming as an Investment Model

- Partnerships: Investors provide capital or guarantees to farmers; in return, they receive a share of crops or agreed profits as per contract terms.

- Supply Security: Contract farming secures steady produce flows for food companies, processors, and exporters, ensuring predictable returns for investors.

- Risk Mitigation: Well-crafted contracts share operational risks and offer mutual assurances.

As regulatory, technology, and financial ecosystems mature, agritech startups and contract farming present dynamic opportunities for portfolio diversification, innovation, and sustainability-focused investing.

To support both agritech investments and financial security, we at Farmonaut offer blockchain-based product traceability and satellite-based API verification for loans and crop insurance. These services enhance transparency and reduce risk for all stakeholders in modern agricultural finance. Developers can access our robust APIs and integration tools using our developer documentation.

Comparative Table: 2025 Farming Investment Strategies

The following table compares the five main investment approaches for farming in 2025. It highlights estimated annual returns, capital requirements, liquidity, risk, and sustainability impact, helping investors align decisions with their financial and environmental goals.

| Investment Type | Estimated Annual Return (%) | Initial Investment Required (USD) | Liquidity Level | Risk Level | Sustainability Impact |

|---|---|---|---|---|---|

| Agricultural Land (Direct Purchase) | 5-8% | $50,000+ | Low | Medium | High |

| Farmland REITs | 4-7% | $1,000+ | High | Low-Medium | Medium |

| Farmland ETFs | 3-6% | $100+ | High | Medium | Medium |

| Vertical Farming (Startups/Facilities) | 8-15% (potential, higher risk) | $10,000+ | Low-Medium | Medium-High | High |

| Agritech Startups & Contract Farming | 10-20% (potential, highest risk) | $5,000+ | Low | High | High |

Key Considerations for 2025 Farming Investors

-

Climate Change: Risks and Opportunities

- Volatile weather increases agricultural risks, but also creates chances to deploy resilient technologies like drought-resistant crops and precision agriculture.

- Solutions like carbon footprint monitoring support climate-smart farming and sustainability compliance.

-

Government Policy & Subsidies

- Policies, subsidies, and trade agreements directly influence farm profitability and land valuation. Stay informed on local and global regulatory shifts that can affect cash flows and strategic decisions.

-

Technology & Data

- Embracing satellite monitoring, AI advisory, and digital resource management increases productivity and optimizes investment returns in farming.

-

Risk Diversification

- Combine various agricultural assets (land, REITs, ETFs, vertical farming, startups) to balance risks across operational, geospatial, and market factors.

How Farmonaut Empowers Agricultural Investments

Maximizing your agricultural investment in 2025 requires advanced tools for risk evaluation, operational efficiency, and sustainability tracking.

Here’s how we at Farmonaut support investors and businesses across all major farming investment avenues:

- Satellite-Based Monitoring: Assess soil fertility, crop growth, and infrastructure from anywhere via our Android, iOS, and web apps.

- AI Advisory: Access real-time insights, yield forecasts, and farming strategies through Jeevn AI, ensuring better decisions and increased income.

- Blockchain Traceability: Authenticate crop origin and enable transparent supply chains—essential for contract farming and ESG-focused investing.

- Resource Management: Optimize fleets and inputs to reduce costs and increase returns, supported by our fleet management system.

- Environmental Compliance: Monitor carbon footprints and environmental impacts for regulatory compliance and sustainability benchmarking.

- APIs for Integration: Easily integrate our satellite intelligence into your business tools or digital platforms. Visit our API gateway and use our developer documentation for seamless integration.

Our scalable subscription packages meet the needs of individual farmers, enterprises, and government organizations across the globe, ensuring that everyone can access actionable, affordable, and accurate agricultural intelligence.

Frequently Asked Questions (FAQ): How to Invest in Farming in 2025

Q1. What is the safest way to invest in farming?

Direct farmland ownership is known for its resilience, but may require significant capital and due diligence. For lower risk and high liquidity, consider agricultural REITs and ETFs. Diversification across methods also minimizes risk.

Q2. Can I invest in vertical farming as an individual?

Yes. You can participate by purchasing equity in public vertical farming companies, joining crowdfunding campaigns, or backing startups within controlled-environment agriculture.

Q3. How do Farmland ETFs work?

Farmland ETFs pool capital to invest in agricultural landowners, REITs, suppliers, and processors. Investors buy shares on major exchanges, receiving both capital appreciation and potential dividends.

Q4. What are the key risks in farming investments?

Risks include weather and climate variability, regulatory changes, crop price fluctuation, land rights issues, and operational complexities of managing farmland. Using advanced technologies, such as satellite monitoring and AI, can help mitigate some of these risks.

Q5. How does technology improve agricultural investment returns?

Technologies like AI, satellite imaging, and blockchain boost productivity, manage resources efficiently, enhance traceability, and ensure compliance—directly increasing yields and reducing operational losses.

Q6. What makes Farmonaut unique?

We at Farmonaut stand out by making satellite-driven agricultural monitoring, advisory, and traceability tools affordable, scalable, and data-rich—serving individuals, businesses, financial institutions, and governments globally via app and API.

Conclusion: Strategic Farming Investments for 2025 and Beyond

In 2025, investing in farming is more dynamic, diversified, and accessible than ever before. From acquiring fertile agricultural land, harnessing the innovation of vertical farming, to participating in farmland ETFs and AgriTech startups, investors can tailor their exposure to capital, risk, and sustainability objectives.

With global populations on the rise and food security a pressing concern, agricultural investments remain vital for both wealth generation and societal well-being. As technology and data-empowered platforms like ours at Farmonaut continue to advance, investors gain the edge in due diligence, operational management, and environmental compliance.

Whether you are an individual investor or institution, the route to farm wealth can deliver stable returns, portfolio diversification, and lasting impact in a world where food is essential and sustainability essential.

Ready to make informed decisions and maximize returns in agriculture? Begin your journey with powerful, real-time satellite and AI-driven tools—the future of farming investment is here.