Table of Contents

- Introduction

- Farmland REITs Trivia

- Understanding Farmland REITs

- Benefits of Investing in Farmland REITs

- 7 Ways to Boost Investment Diversification with Farmland REITs

- Comparative Analysis Table of Farmland REIT Diversification Strategies

- Risks of Farmland Investment and Farmland REITs

- Notable Farmland REITs

- Investment Considerations for Farmland REITs

- Farmonaut: Empowering Precision Agriculture

- Frequently Asked Questions (FAQ)

- Conclusion

REIT Farmland: 7 Ways to Boost Investment Diversification

Farmland investment through Real Estate Investment Trusts (REITs) presents a unique opportunity for investors seeking to diversify portfolios, secure potentially stable income streams, and hedge against risks—including inflation. As the global demand for food surges and sustainable agriculture becomes crucial, agricultural real estate—in the form of managed farms—is proving to be a resilient and attractive asset class.

In this comprehensive guide, we explore the mechanics of farmland REITs, the fundamental benefits and risks of farmland investment, the seven most effective ways to harness diversification through REITs, and how cutting-edge technology such as Farmonaut is shaping the landscape for both investors and farmers.

Understanding Farmland REITs: A Gateway into Agricultural Investment

Focus Keyword: farmland REITs

Farmland Real Estate Investment Trusts (REITs) are companies specializing in acquiring, owning, and managing vast swathes of agricultural land. Their core business model is straightforward yet powerful: These REITs lease agricultural properties to experienced farmers or agribusiness operators, generating income via rental payments and, in some cases, sharing revenue from crop production.

- Offering exposure to the agricultural sector—without the need to directly engage in farming or the complexities of land management.

- Providing potential income stability through long-term leasing arrangements.

- Offering investors access to a sector often not directly correlated with the traditional stocks, bonds, or real estate markets.

Instead of direct ownership and farm management, investors gain exposure to diversified agricultural real estate portfolios—ranging from row crops to permanent fruit and nut orchards and, increasingly, integrated with renewable energy projects and other agricultural productivity enhancements.

How Farmland REITs Work: The Structure Explained

- Acquisition: The REIT acquires agricultural properties in strategic locations, favoring regions and crop types with long-term production stability.

- Leasing: Properties are leased to tenants (farmers/agribusinesses) for fixed terms, often spanning several years.

- Income Streams: REITs generate income primarily through rental payments. In some cases, additional income is earned by sharing in the proceeds from successful crop production (revenue sharing).

- Capital Appreciation: Over time, property values may increase due to factors like land improvements, market demand, or regulatory changes.

This structure allows investors to participate in agricultural income and value appreciation, without directly owning or managing land.

Benefits of Investing in Farmland REITs

Before diving into the specifics of diversification, it’s crucial to understand the core benefits that make farmland investment through REITs so attractive in the modern financial landscape.

1. Stable Income from Farmland Through REITs

-

Steady cash flow is achieved via multi-year lease agreements with farmers.

Rental income is typically less volatile than direct equity or commodity investments because it is decoupled from short-term crop price fluctuations. - Example: Gladstone Land Corporation exemplifies this stability, maintaining a consistent track record of monthly dividend payments since IPO, with dozens of dividend increases over recent quarters.

- Farmonaut Crop Loan & Insurance Solutions can further help to stabilize farming operations, indirectly enhancing rental income reliability for REIT stakeholders by reducing default risks.

2. Diversifying Investment Portfolios: The Power of Farmland REITs

- Farmland investments are uncorrelated or weakly correlated with the broader equity and fixed-income markets, decreasing overall portfolio volatility.

- Exposure to agricultural real estate means adding a genuine alternative asset to your long-term holdings.

3. Hedge Against Inflation with Farmland

- Historically, farmland values and rents have increased alongside the prices of agricultural products during periods of inflation.

- Since people must always eat, the agricultural sector typically passes rising input costs on to end consumers, helping to maintain purchasing power and real returns.

4. Capital Appreciation

- Beyond income, well-managed farmland can rise in value over time, especially as global food demand increases and prime agricultural land becomes increasingly scarce.

- Improvements in irrigation, soil health, technology (e.g., precision agriculture solutions from Farmonaut), and sustainable management can all boost long-term appreciation.

5. Professional Agricultural Property Management

- Investors benefit from professional management teams with expertise in agricultural operations.

- This ensures the land is well-managed, compliant with regulatory guidelines, and operated in a way that preserves long-term soil and asset value.

- Farmonaut’s Large Scale Farm Management App supports efficient resource allocation, risk monitoring, and effective reporting, revolutionizing property oversight for agribusinesses and asset managers.

7 Ways to Boost Investment Diversification with Farmland REITs

Diversification is at the heart of robust investment strategy, and farmland REITs provide several levers for broadening exposure and managing risk. Here are seven proven ways to use farmland and agricultural real estate within REITs to increase diversification and maximize performance:

-

Geographic Diversification

- REITs often own land across different states and regions, reducing weather and climate risk. For instance, Farmland Partners Inc. (FPI) spans 17 states, while Gladstone Land covers 15.

- This approach buffers against localized events (droughts, floods, supply chain disruptions), ensuring more consistent income for investors.

-

Crop Type Diversification

- By leasing to farmers producing various crops—corn, soybeans, wheat, fruits, nuts, specialty crops—REITs reduce reliance on any single commodity price.

- Joins Farmonaut’s Crop Plantation/Farm Advisory for AI-powered crop planning across different land parcels.

-

Tenant Type Diversification

- REITs may lease their land to a mix of individual farmers, cooperatives, and corporate tenants—spreading credit risk and stabilizing lease income.

- Low tenant concentration means a single farm’s failure has limited impact on overall performance.

- Advanced background checks and satellite-based crop monitoring (from platforms like Farmonaut) support tenant risk mitigation.

-

Contract Structure Diversification

- Mixing fixed cash leases, variable cash leases, and crop share agreements helps balance income stability and upside.

- Fixed leases provide predictable payments; crop share structures participate in strong agricultural price cycles.

-

Integration of Renewable and Non-Agri Income Streams

- Some REITs add value by leasing land for solar and wind installations or even recreational use, broadening income generation beyond crops.

- Also, rural land value appreciation can be driven by non-farming factors.

-

Multi-Year Leasing and Long-Term Relationships

- Long-term leases provide cash flow visibility and income stability.

- Strong relationships with quality tenants enhance property performance and reduce tenant turnover risk.

-

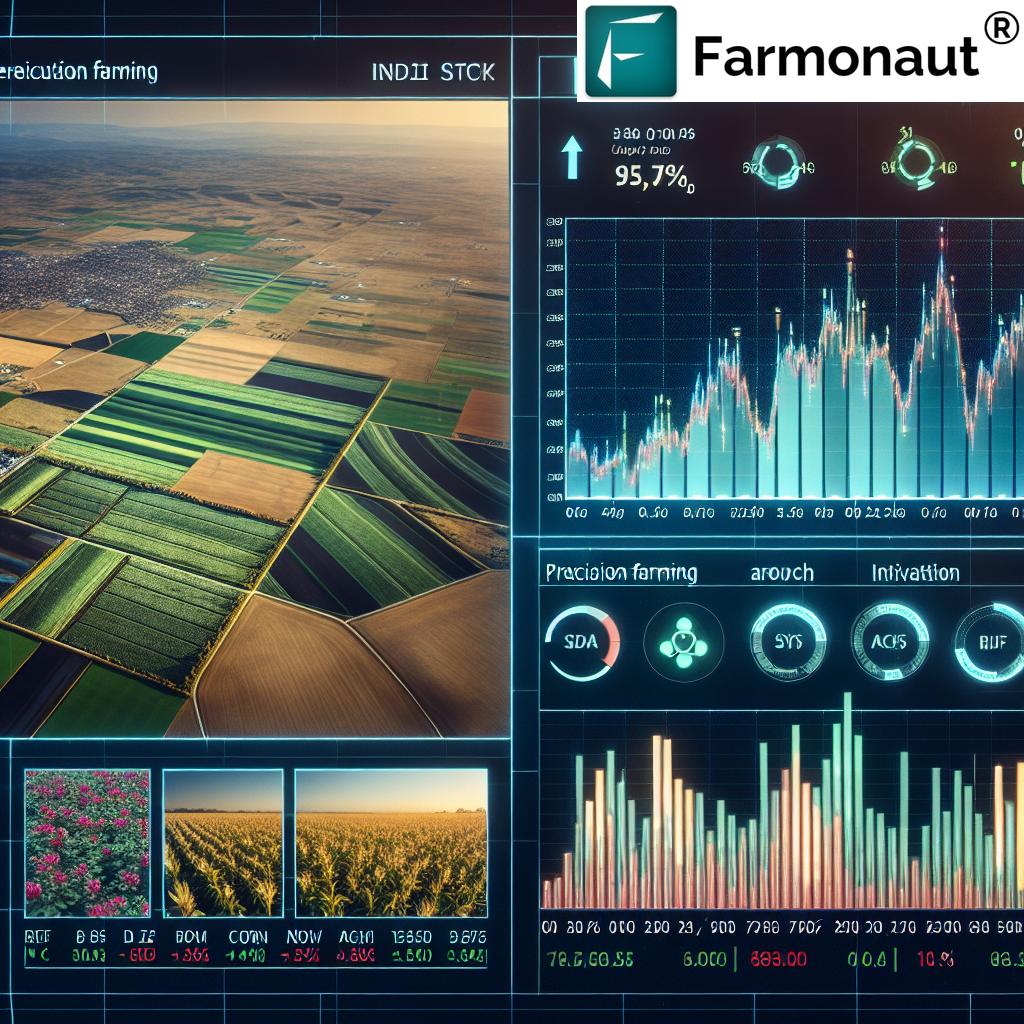

Active Portfolio Management and Technological Integration

- Continuous assessment and rebalancing of property portfolios allow REITs to capitalize on emerging markets and new crop opportunities.

- Farmonaut’s Fleet and Resource Management Tools enable operational efficiency for large land holdings, minimizing downtime and maximizing productivity.

- Use of carbon footprinting and sustainability tracking can enhance asset value for eco-conscious investors.

Comparative Analysis Table of Farmland REIT Diversification Strategies

| Diversification Method | Estimated Risk Reduction | Estimated Yield/Income Stability | Inflation Hedge Potential | Example REITs/Platforms | Potential Drawbacks |

|---|---|---|---|---|---|

| Geographic Diversification | High | 7-8% Avg. Annualized; Very Stable | Strong | Farmland Partners Inc., Gladstone Land | May introduce complex regulatory or logistical challenges |

| Crop Type Diversification | High | 6-9% (Dependent on Mix); Stable | Strong | Farmland Partners, Gladstone Land | Requires deep agronomic management and monitoring |

| Tenant Type Diversification | Medium-High | 6-8%; Steady if well managed | Moderate | Most Major U.S. Farmland REITs | Potential for credit/event risks if tenant concentration is high |

| Contract Structure Diversification | Medium | 6-8%; Moderately Stable | Strong (if leases are indexed) | Farmland Partners, Specialist REITs | Can create complexity for income prediction |

| Renewable/Non-Agri Income Streams | Low-Medium | 3-8% (depends on area leased to non-farm use) | Moderate | Farmland Partners Inc. | Regulatory issues, may dilute pure agricultural focus |

| Multi-Year Leases/Long-Term Tenants | High | 8-10%; Highly Stable | Strong | Gladstone Land, Farmland Partners | Reduced flexibility during sudden market shifts |

| Active Management & Tech Integration | High | Varies (can outperform averages) | Strong | REITs using platforms like Farmonaut | Requires continuous investment in data and resource management |

Risks of Farmland Investment and Farmland REITs

While farmland investment offers compelling benefits, it is essential for investors to understand the risks associated with farmland REITs and the broader agricultural sector:

1. Commodity Price Volatility

- Revenue from leased farmland can be impacted by fluctuating crop prices, driven by unpredictable supply, demand, and geopolitical events.

- Exposure to multiple crops, tenants, and markets can help mitigate this risk, but it remains inherent to the agricultural sector.

2. Weather and Climate Risks

- Weather events (drought, flood, storm) and broader climate changes can lead to lower yields and property damage.

- Farmonaut’s real-time crop health monitoring using satellite data offers actionable insights for risk management.

3. Tenant Risk

- Financial stress or default by tenants (farmers or agribusinesses) can disrupt rental income and property stability.

- Diversifying the tenant base and using AI/tools for tenant evaluation helps reduce income shocks.

4. Regulatory and Policy Changes

- Changes in agricultural subsidies, tariffs, environmental standards, or land use policies can affect profitability and asset values.

- Monitoring policy developments in key states/regions is an active component of REIT management strategy.

5. Asset Liquidity

- Although REITs themselves are typically liquid (exchange-traded), farmland as an asset class can be relatively illiquid versus stocks or urban real estate, depending on market conditions.

6. Biological and Operational Risks

- Crop diseases, pest outbreaks, and input (seed/fertilizer) price spikes can negatively affect yields and income.

- Leveraging technology—like satellite-based field monitoring from Farmonaut—helps mitigate some operational risks.

Summary Table: Main Risks of Farmland Investment

- Commodity Price Volatility: Fluctuations impact income stability.

- Weather/Climate Impact: Catastrophic weather may hurt yields.

- Tenant Default Risk: Loss of lease income.

- Regulatory Changes: May alter profitability or land usage.

- Operational/Management Issues: Inefficient farm management can erode value.

Notable Farmland REITs

-

Farmland Partners Inc. (FPI):

- Owns/operates 180,000 acres across 17 U.S. states.

- Leases land to over 100 tenants, offering exposure to 26 crop types—both commodity and specialty crops.

- Also generates income from renewable energy projects (solar, wind) and offers professional farm management services.

-

Gladstone Land Corporation (LAND):

- Owned 164 farms with 113,000 acres (as of Q1 2022) in 15 states.

- Focuses on fruit, vegetable, and permanent crop farms (e.g., almonds, blueberries, cherries, wine grapes), enhancing crop and tenant diversification.

- Has a proven track record of monthly dividends with consistent increases, highlighting income reliability.

Many other REITs and private investment vehicles also offer tailored exposure to farmland and related infrastructure assets.

Investment Considerations for Farmland REITs

- Diversification Fit: Assess how the REIT contributes to your existing portfolio’s diversification goals.

- Management Quality: Review the REIT’s management, track record, and approach to risk, crop/tenant selection, and compliance.

- Financial Performance: Examine financials (e.g., dividend history, income streams, debt profile) for stability and growth.

- Market Conditions: Monitor commodity prices, weather events, and regulatory changes impacting agriculture at large.

- Product Traceability & Transparency: With tools like Farmonaut’s Blockchain-Based Traceability Solutions, REITs and investors can ensure market confidence and regulatory compliance along the supply chain.

Farmonaut Subscription Options (For Investors and Land Managers)

Farmonaut: Empowering Precision Agriculture for Farmers and Investors

At Farmonaut, our mission is to make precision agriculture accessible, affordable, and transparent for farmers, agribusinesses, asset managers, and investors globally. We are not an online marketplace, equipment manufacturer, or regulatory authority; instead, we offer world-leading agricultural technology designed to reduce risks and maximize the value of land investments.

-

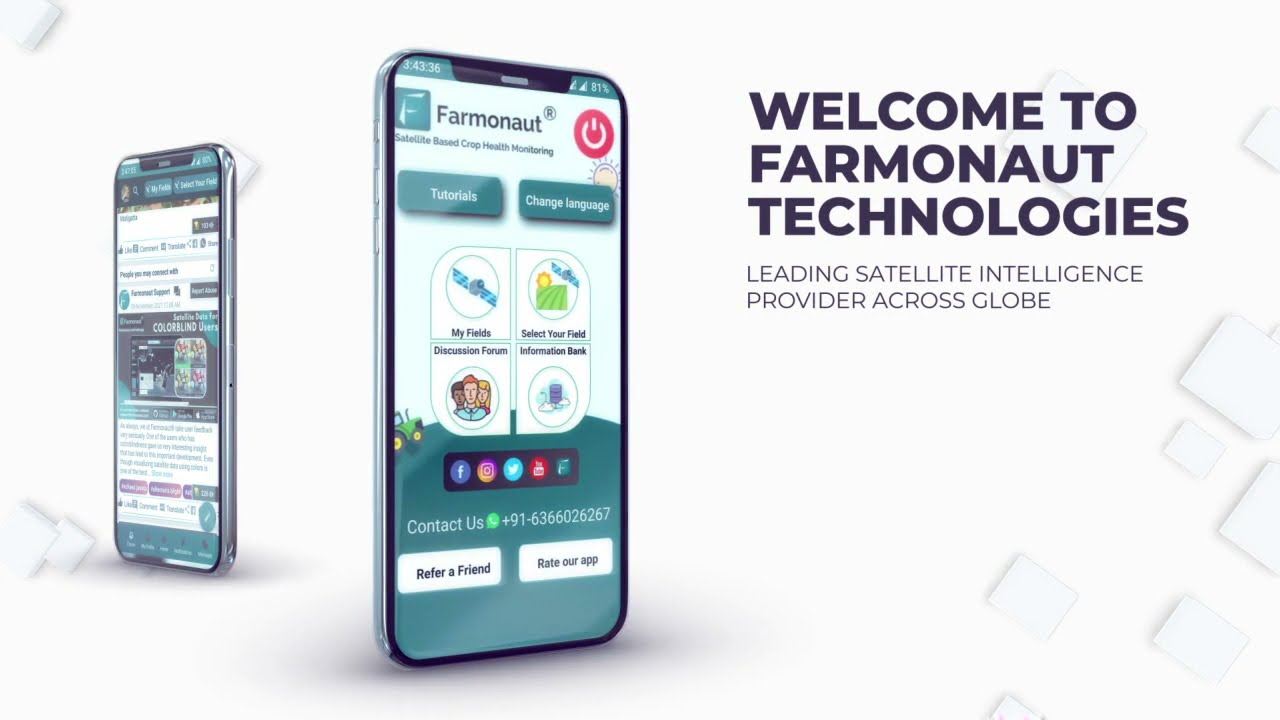

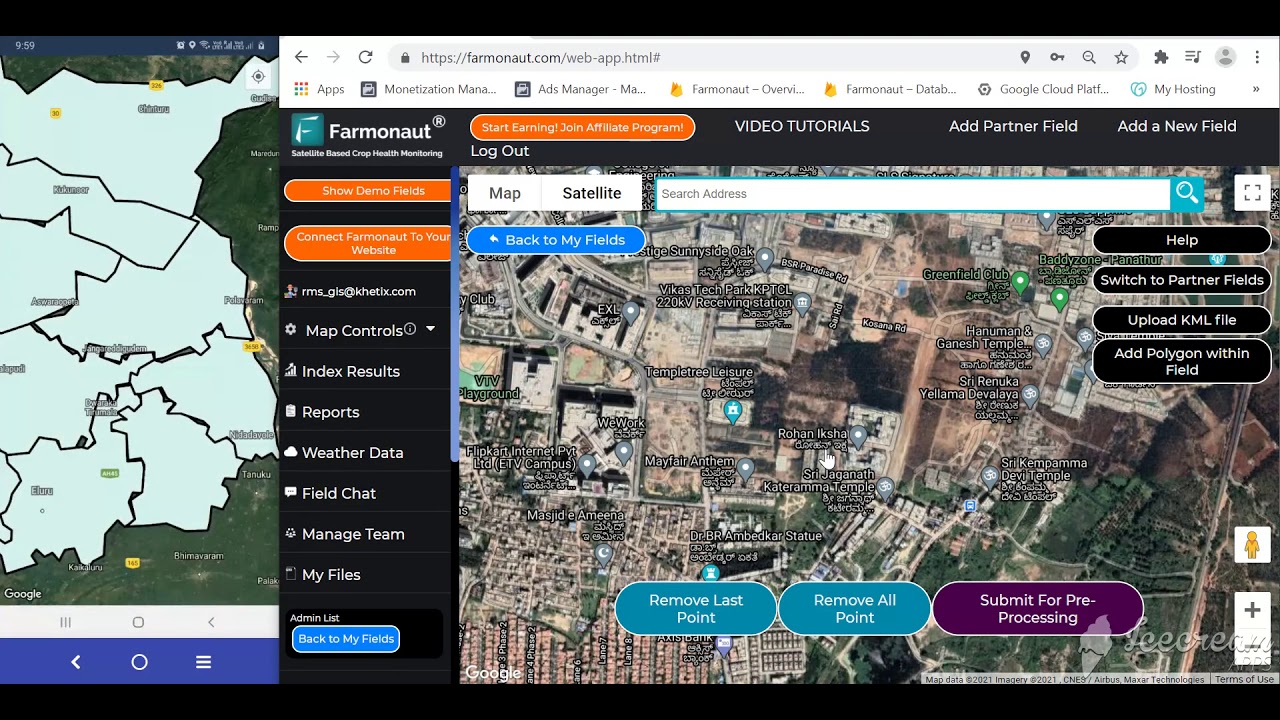

Satellite-Based Farm Monitoring:

Our platform delivers real-time crop health analysis using satellite imagery, enhancing decision-making and resource allocation. -

Jeevn AI Advisory:

Personalized, AI-driven farm management strategies to guide both smallholders and large landowners. -

Blockchain Traceability:

Ensure trust, differentiation, and transparency from farm to market for both investors and consumers. -

Fleet & Resource Management:

Optimize operational expenses and reduce downtime on large holdings through intelligent machinery and labor management. -

Carbon Footprinting:

Real-time emissions data—crucial for investors and companies pursuing sustainable agricultural investment opportunities. Learn more here. - API Access: Integrate Farmonaut’s advanced data into your own dashboards and analytics platforms. Access the API or read the developer docs.

Our solutions are accessible via web, Android, and iOS, with a range of subscription packages and API integration points for custom needs. Agribusinesses and financial providers can leverage satellite-based verification to streamline loans and insurance for farmers, reducing default and fraud.

Frequently Asked Questions (FAQ) about Farmland REITs & Diversified Agricultural Investment

- Stable income streams from leases.

- Diversification away from traditional stocks and bonds.

- Potential for capital appreciation as land values increase.

- Hedge against inflation, as agricultural goods and rents often rise with inflation.

Conclusion

Farmland REITs represent a compelling opportunity for those seeking agricultural investment with reduced complexities and enhanced diversification. By delivering stable income streams, portfolio diversification, and a proven hedge against inflation, farmland REITs enable investors to access an essential global sector, potentially with less volatility than equity-dominated portfolios.

Yet, as with any investment, attention to risks—such as commodity price swings, weather, tenant, and regulatory uncertainties—is crucial. Diligent research, informed selection, and leveraging modern management platforms such as Farmonaut can help mitigate these risks, optimize productivity, improve transparency, and drive both sustainability and returns from agricultural land.

As the world faces rising demand for food, water, and sustainable land use, agricultural real estate and farmland REITs will likely remain central to forward-thinking investment strategies. Stay informed, embrace diversification, and explore the latest technology-driven agricultural investment opportunities for a resilient, profitable future.