Best Farmland Investment Trusts US & Canada 2025

Table of Contents

- Summary: Farmland Investment Trusts – A Strategic Approach to Agricultural Wealth in 2025

- Trivia: Land Value and Average Returns

- Understanding Farmland Investment Trusts: A Primer

- Best Farmland Investments in the US for 2025

- Top Farmland Investment Trusts in US & Canada (2025) [Comparison Table]

- Canadian Farmland Investment Trusts & Opportunities in 2025

- Market Videos: Farmland, Crop Yields, and Innovation in 2025

- SCS Farmland Investment: A Niche, Innovative Player

- Why Invest in Farmland Now?

- How Farmonaut Empowers Sustainable Farmland Investment

- Trivia: Canadian Land Value Surge

- FAQs: Farmland Investment Trusts in 2025

- Conclusion: Shaping the Future of Farmland Investment in North America

“U.S. farmland investment trusts delivered average annual returns of 11% from 1992 to 2022, outperforming many asset classes.”

Farmland Investment Trusts: A Strategic Approach to Agricultural Wealth in 2025

Within the rapidly evolving landscape of farmland investment trusts in the US & Canada, 2025 is shaping up to be an extraordinary year for investors seeking exposure to agriculture as a real asset class. As demand for food intensifies due to population growth, urbanization, and changing global consumption patterns, farmland investment trusts offer an accessible, efficient, and compelling vehicle to tap into the sustained value appreciation of North American agricultural land. These trusts not only facilitate strong returns and consistent income, but also provide essential portfolio diversification, support sustainable agricultural practices, and meet the rising call for ESG-focused investments.

In this comprehensive guide, we evaluate the best farmland investment trusts US & Canada 2025, presenting critical context, trends, and comparison data to empower informed business and entrepreneurship decisions.

Understanding Farmland Investment Trusts: A Primer

Farmland investment trusts are specialized entities designed to pool capital from investors seeking exposure to farm land and related agricultural assets. Unlike direct ownership, these trusts manage diverse portfolios by acquiring, developing, and leasing farmland properties—generating returns via land appreciation, crop yields, and lease income.

- Accessibility: Offers a low-barrier, structured, and regulated way for individuals and institutions to invest in agriculture.

- Diversification: Spreads risk across regions, crop types, and operational models—protecting against adverse weather, commodity price swings, or local disruptions.

- Sustainability: Modern trusts increasingly emphasize sustainable practices and ESG mandates, including organic crop production, regenerative farming, and environmental reporting.

- Income & Capital Growth: Combines steady cash flows from leases (with inflation-hedged contracts) and long-term land value appreciation.

As traditional investment vehicles face volatility and competition, farmland investment trusts have emerged as sturdy, profitable alternatives with growing momentum—especially across the United States and Canada.

Regenerative Agriculture 2025 ? Carbon Farming, Soil Health & Climate-Smart Solutions | Farmonaut

Best Farmland Investments US: Focus on Sustainability, Growth, & Diversification (2025)

The United States sits at the forefront of farmland investment, boasting:

- Extensive arable land: Fertile states like Iowa, Illinois, and Nebraska attract investors with consistent yields and robust agricultural infrastructure.

- Advanced farming technologies: Adoption of precision agriculture, data-driven practices, and satellite-driven monitoring (e.g., as supported by Farmonaut).

- Strong regulatory frameworks: Transparent and reliable property laws reduce legal and operational risk.

Leading Farmland Investment Trusts US: Top Picks for 2025

Two of the most popular choices among investors are Farmland Partners Inc. (NYSE: FPI) and Gladstone Land Corporation (NASDAQ: LAND). These entities pool substantial capital to acquire and manage diverse portfolios of high-quality farmland across the US, emphasizing:

- Diversified regional and crop exposure (row crops, permanent crops, specialty crops).

- Steady lease income + capital appreciation.

- Sustainable management practices—precision irrigation, conservation agriculture, ESG policies, and soil health enhancement.

Trend Spotlight: The best farmland investments US in 2025 reflect a shift towards organic crops and specialty production—mirroring consumer and commodity market trends (e.g., rising demand for organic produce and regenerative certification).

2025 Real-Estate Showdown: Canada vs Massachusetts ?️ Cash-Flow, Taxes & Market Crash Risks EXPOSED!

Many US farmland investment trusts now pursue climate-adaptive and sustainable farming initiatives, positioning their portfolios to meet both consumer demand and sustainability metrics—delivering an attractive mix of solid financial returns and environmental stewardship for investors and the broader agricultural sector.

- Consistent returns: Farmland Partners and Gladstone Land average annualized returns of 6–11% in the past decade.

- Low correlation: Farmland’s performance often moves independently of equities or bonds, providing crucial diversification.

- Inflation hedge: Land values, commodity pricing power, and lease contracts outpace inflation, in many cases.

For more on precision farming and digital innovation, see our insights on large-scale farm management tools.

Top Farmland Investment Trusts in US & Canada (2025)

| Trust Name | Country/Region | Estimated Annual Return (%) | Asset Under Management (Est., $M) | Minimum Investment (Est., $) | Key Crops/Properties | ESG/Sustainability Focus | Portfolio Diversification Score (1–5) |

|---|---|---|---|---|---|---|---|

| Farmland Partners Inc. | United States (Multi-State) | 7–11% | 1,300 | 5,000 | Corn, Soybeans, Wheat, Cotton Specialty: Almonds, Apples |

Yes | 5 |

| Gladstone Land Corporation | United States (California, Midwest, Southeast) | 6–10% | 900 | 3,000 | Strawberries, Blueberries, Lettuce, Almonds | Yes | 4 |

| SCS Farmland Investment | US Midwest & Canadian Prairies | 7–13% | 360 | 20,000 | Wheat, Barley, Lentils, Oilseeds Tech-Aided Diversification |

Yes | 4 |

| AgCapita Farmland Investment Partnership | Canada (Saskatchewan, Alberta) | 7–12% | 285 | 20,000 | Canola, Barley, Oats, Peas | Moderate | 3 |

| Bonnefield Canadian Farmland LPs | Canada (Ontario, Manitoba, Saskatchewan) | 6–10% | 1,000 | 25,000 | Grains, Soybeans, Corn, Mixed Row Crops | Yes | 5 |

See above for a streamlined comparison of the best farmland trusts in Canada and the US for 2025, covering annual returns, diversification of assets, minimum investment, ESG priorities, and portfolio diversification.

Want to manage or monitor your own farm investments more precisely? Try Farmonaut’s crop plantation & forest advisory platform – designed with satellite-based insights and AI advisory for effective agricultural asset management.

Farmland Investment Canada: Trusts, Trends & Innovative Opportunities (2025)

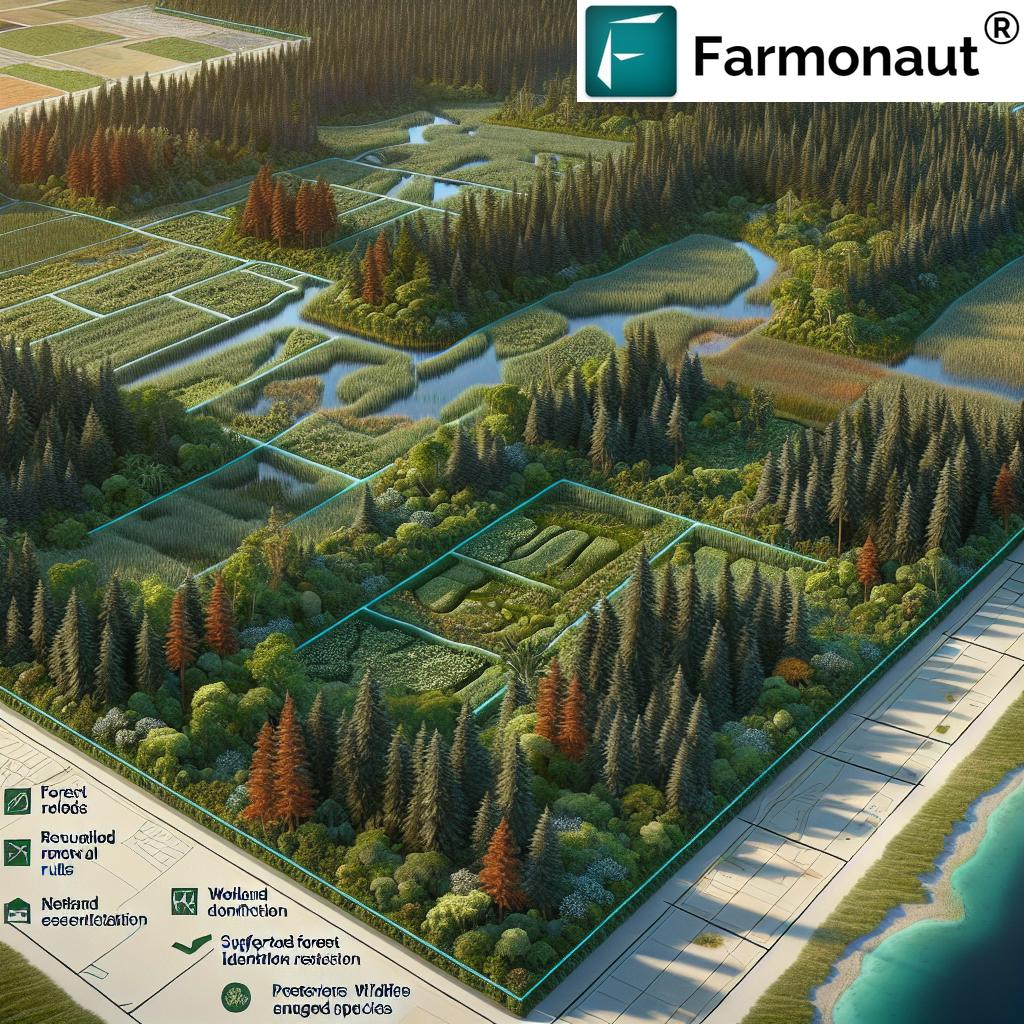

Canada is rapidly emerging as a prime destination for farmland investment trusts, especially in provinces like Saskatchewan, Manitoba, and Ontario. With fertile soils, extensive arable land, lower average acquisition costs per acre (compared to many US regions), and supportive regulatory frameworks, investors are increasingly allocating capital north of the border to diversify their agricultural exposure.

- Vast tracts of productive land sustain large-scale grain & oilseed production.

- Rising institutional participation and easier entry for international capital (changes in farmland ownership regulations).

- Innovative integration: Several Canadian farmland trusts blend traditional agriculture with forestry or agroforestry, supporting sustainable land management and climate resilience.

For ESG-impact investors, Canadian farmland trusts like Bonnefield and AgCapita have cultivated strong reputations for stewardship, community relations, and adherence to sustainable or regenerative best practices.

Ontario Farmers 2025 | 2.2 M kg Farm Plastic Recycling | Circular Economy & Sustainable Agriculture

Canada Fertilizer Boom 2025 | Green Ammonia, AI Precision & $2.3 B Granular Surge

Did you know you can track ESG and carbon impact across your land investments using digital platforms? Explore Farmonaut’s carbon footprinting tools for near real-time insights. This is crucial for trusts and individual farmland holders seeking transparency and environmental compliance.

Market Trends in Canada (2025):

- Organic and regenerative farming initiatives receive premium asset valuations.

- Gradually increasing capital flows from pension funds, family offices, and new asset management entrants.

- Trends toward blockchain-backed traceability and transparent reporting.

Leverage blockchain-based product traceability solutions on Farmonaut to enhance consumer trust in sustainable agricultural products and ensure authenticity—from the field to the shelf.

“Canadian farmland values have risen over 300% since 2000, making trusts a top choice for portfolio diversification.”

Canada Farm-Plastic Record 2025 | 2.2 M kg Recycled, Circular Economy & AI Precision Ag

Saskatchewan Runway Upgrade 2025 ✈️ $1.8M for Rural Aviation, Ag-Spraying & AI Precision Farming

SCS Farmland Investment: Niche Player in Technology-Driven, Sustainable Agriculture

Among emerging farmland investment trusts blending traditional agricultural assets and data analytics, SCS Farmland Investment stands out as a niche, innovative platform:

- Geographic reach: US Midwest and Canadian Prairies—regions prized for fertile soils and large-scale row cropping.

- Technological advantage: Integrates satellite imagery, data-driven agronomy, and precision resource management to enhance crop yields and reduce input waste.

- Sustainability focus: Strong alignment with ESG and carbon reduction targets; prioritizes climate-resilient crops and regenerative practices.

- Transparent investor reporting: Digital dashboards deliver real-time portfolio insights—covering land use, sustainability, and financial ROI.

SCS demonstrates how technology and stewardship combine to deliver profitable, future-proof farmland investments.

Farmonaut at 6 Years: How We’re Transforming Farming in 40+ Countries with Satellite Technology

Why Invest in Farmland Now? (2025 & Beyond)

Interest in farmland investment trusts is intensifying in 2025 and future years due to:

- Intrinsically limited supply: Urban sprawl and climate change constrain usable farmland—heightening scarcity and supporting rising land values (asset appreciation).

- Food security & demand: The world population is nearing 8.5 billion—placing long-term upward pressure on agricultural commodity prices, outputs, and margins.

- Stability & resilience: Farmland values have historically outperformed public equities and fixed income over multi-decade periods, offering distinct portfolio stability even during recessions.

- Inflation hedging: As physical, income-producing assets, farmland investments tend to retain real value as inflation rises—often indexed in lease and crop-sharing contracts.

- Tailwinds from technology: Advances in satellite monitoring, AI, remote sensing, and blockchain fuel both efficiency and transparency—reducing operational risk and unlocking new revenue streams.

Farmland investment trusts are thus uniquely positioned for sustainable growth, income generation, and risk-adjusted returns in the next investment decade.

Monitor your own agricultural assets, improve efficiency, or request crop health insights via Farmonaut’s developer API (see API Documentation for integration). This is ideal for institutions and investors seeking customized analytics and farm monitoring at scale.

How Farmonaut Empowers Sustainable Farmland Investment in North America

At Farmonaut, we recognize the essential role of data and technology in sustaining farmland investment trusts and maximizing agricultural returns. Our advanced, satellite-based farm management platform delivers cutting-edge functionality via App (Web, Android, iOS) and API access, serving a global user base—including North American trust managers, individual investors, cooperatives, and corporate clients.

Key Capabilities and Benefits

- Satellite-Based Crop Health Monitoring: Real-time NDVI, soil moisture, and crop condition analytics enable proactive management and optimal yield decisions.

- AI Advisory & Optimization: Our Jeevn AI provides hyper-local weather, pest, and irrigation advisories—driving efficient input use and sustainable practices.

- Blockchain-Based Product Traceability: Ensure transparency in sustainable/organic agricultural supply chains—strengthening investor trust and compliance.

Discover more: Learn about Blockchain Traceability - Carbon Footprinting & ESG Tracking: Quantify, report, and strategize around carbon impact—meeting the rising demand for ESG-verified farmland investments.

Start Tracking: Monitor your Carbon Impact - Fleet & Resource Management: Optimize agricultural logistics and reduce costs with live fleet management. Fleet Management Details

- Insurance & Crop Loan Support: Satellite-verified reports for insurance claims and loan applications help mitigate borrower risk and improve financing access.

Protect Your Assets: Satellite-Based Crop Loan Verification

Our modular, scalable subscription platform adapts to the needs of small producers, large agribusinesses, and institutional farmland managers alike. Test the platform for free, or subscribe per hectare—making digital precision agriculture and sustainable management affordable to all.

Farmonaut Precision Agriculture Subscription

Unlock innovative solutions to optimize yields, manage risk, and reduce your environmental footprint. Flexible pricing for all scales.

Explore Farmonaut API |

API Developer Docs

Frequently Asked Questions: Farmland Investment Trusts US & Canada 2025

What are farmland investment trusts?

Farmland investment trusts are specialized entities that pool capital from investors to acquire and professionally manage diversified portfolios of agricultural land, typically generating income through leases and crop production, while aiming for long-term capital appreciation.

Why invest in US & Canadian farmland trusts in 2025?

The US and Canadian farmland markets offer robust regulatory protection, fertile land, sustainable practices adoption, and attractive risk-adjusted returns—making them ideal for portfolio diversification, inflation hedging, and income generation in 2025 and beyond.

What is the difference between direct farmland ownership and investing via trusts?

Direct ownership involves acquiring and managing agricultural land yourself, with all associated risks and responsibilities. Farmland investment trusts enable passive, diversified investment across various properties and crop types, managed by experienced professionals, often with lower capital requirements.

Which are the best farmland investment trusts for 2025?

Among the leading options for 2025: Farmland Partners Inc. and Gladstone Land Corporation (US); SCS Farmland Investment (US/Canada); AgCapita and Bonnefield (Canada). See the comparison table above for details.

How does technology play a role in modern farmland management?

Digital tools, like Farmonaut’s satellite analytics and AI advisory, enhance productivity, risk reduction, compliance, and sustainability reporting—key to efficient investment management in contemporary farmland portfolios.

How can I start monitoring my farmland investment with Farmonaut?

Access the Farmonaut platform on web or mobile app, or integrate with your asset management systems via API. Subscription models are available for all scales and needs.

Conclusion: Shaping the Future of Farmland Investment in North America

In summary, farmland investment trusts US & Canada 2025 stand at the nexus of sustainable agriculture, financial growth, and technological innovation. With proven performance, compelling global food demand drivers, and strong ESG credentials, they offer multiple opportunities for investors to participate in the next decade of agricultural wealth creation.

From Iowa and Illinois to Saskatchewan and Ontario, fertile land, advanced farming technologies, and robust management frameworks create a resilient foundation for portfolio diversification, inflation protection, and solid returns. As the sector intensifies and market dynamics evolve in 2025 and beyond, digital platforms like Farmonaut further empower investors with transparent, data-driven insights to capitalize on the best investment opportunities in North America and beyond.

For further exploration—and to unlock the benefits of next-generation farm management, crop monitoring, and impact reporting—try our app:

Invest in the future of agriculture—make smarter, more sustainable farmland investment decisions in 2025 and beyond.