Financing Models for Large-Scale Mining: 2025 Trends

Financing models for large-scale mining operations are evolving rapidly. This article explores the entire landscape, offering deep insight into the financial mechanisms, trends, and innovations set to redefine mining in 2025 and beyond.

“Over 60% of large-scale mining projects in 2025 are expected to use hybrid debt-equity financing models.”

Table of Contents

- Summary: 2025 Mining Finance Models

- Mining Sector: The Cornerstone of the Global Economy

- Traditional Financing Models in Mining

- Project Finance: Risk Sharing and Off-Balance Sheet Solutions

- Private Equity, Infrastructure Funds & Their Role in Mining Finance

- Hybrid & Alternative Financing Models for Mining in 2025

- ESG-Linked Financing: Sustainability Meets Mining Investment

- Digital and Blockchain-Enabled Financing Trends

- [Video Showcase: Mining Finance & Satellite Tech in Action]

- Analytical Comparison Table: Mining Financing Models 2025

- Farmonaut Satellite Technology: Enabling Transparency, Risk Mitigation & Sustainable Finance

- Frequently Asked Questions

- Conclusion: Creative Financial Solutions for 2025 Mining

Summary: Financing Models for Large-Scale Mining Operations in 2025

The mining sector continues its role as a cornerstone of the global economy, supplying essential raw materials for sectors across technology, infrastructure, manufacturing, and beyond. As large-scale mining operations grow in complexity and scale, the need for securing appropriate financing becomes even more critical—a true determinant of project success. In 2025, the financing models for large-scale mining operations are being transformed by:

- Evolving market dynamics and commodity price cycles

- Innovative technologies—AI, blockchain, digital platforms

- Increasing environmental, social, and governance (ESG) demands

- Diversification of funding sources and hybrid models

This article explores the predominant models deployed, highlighting trends, practical considerations, and how new approaches are being adopted to drive capital flows and operational stability.

“ESG-linked financing in mining is projected to grow by 35% in 2025, reflecting rising investor demand for sustainability.”

Mining Sector: The Cornerstone of the Global Economy

The mining sector is foundational to the world’s economy, supplying essential raw materials required across diverse industries. From copper for advanced electronics to rare earths powering the green energy transition, mining continues as a vital economic driver. As new ventures grow in scale and complexity, financing models for large-scale mining operations become increasingly significant—not just for project launch, but for ongoing operational success, risk management, and market resilience.

Traditional Financing Models in Mining

Large-scale mining traditionally relied heavily on a combination of corporate equity, debt financing, and internal cash flows. These standard approaches remain relevant, especially for established miners and proven projects:

Equity Financing: Shares, Placements & Public Markets

- Equity financing involves raising capital through the issuance of shares to public or private investors.

- It provides long-term capital, without direct burden of repayments, and is used to fund exploration, equipment, expansion, and upgrades.

- However, it can dilute ownership and lower shareholder value, especially when large amounts are raised repeatedly.

- Major corporations often use placements or rights issues for specific project or operational needs.

Debt Financing: Bank Loans, Credit Facilities & Bond Markets

- Debt financing is typically accessed via bank loans, syndicated credit facilities, or bonds.

- It offers fixed repayment schedules (principal plus interest), minimizing equity dilution for profitable companies.

- Strong balance sheets, proven operational history, and favorable project economics help companies negotiate lower cost of capital and better terms.

- Still, debt increases financial risk, especially when cash flows are volatile and commodity prices decrease.

To maximize the success of traditional models, mining companies must maintain robust financials, transparent data for due diligence, and mitigate operational risks—especially in fluctuating markets.

Project Finance: Risk Sharing and Off-Balance Sheet Solutions

A major trend in 2025 is the rising adoption of project finance as the go-to for new mines, expansions, and infrastructure-heavy mining projects.

- Project finance isolates financial risk via a special purpose vehicle (SPV), keeping liabilities off the parent company’s balance sheet.

- Funding often involves a blend of debt and equity from multiple investors, sometimes including off-take agreements that guarantee future sales at pre-agreed prices.

- This approach is favored by investors and banks for its clear risk-sharing mechanism, as repayments are sourced only from the project’s cash flows.

- Due diligence is particularly rigorous, with geological data, environmental permits, social license, and market viability under close scrutiny.

- Increasingly, project finance in mining integrates sustainability-linked loan covenants, where interest rates vary based on ESG performance metrics (such as emissions, water use, or community outcomes).

This trend reflects the dynamic risk-sharing needs and desire for operational independence in large mining projects.

Private Equity, Infrastructure Funds & Their Role in Mining Finance

The 2025 landscape sees private equity (PE) and infrastructure funds playing a growing role, especially as traditional banks become more risk-averse or restrain lending for greenfield projects.

- PE funds and infrastructure investors offer capital for mid- to late-stage projects, focusing on operational improvements, expansion and modernization.

- They bring strong governance, cost optimization expertise, and are drawn by stable, utilitarian cash flows akin to classic infrastructure investments.

- Transparency, access to accurate data, digital platforms, and robust risk assessments are critical for enabling such investments and streamlining due diligence.

- This influx offsets reduced bank appetite, ensuring projects with strong fundamentals are not starved of funds.

Hybrid & Alternative Financing Models for Mining in 2025

With commodity markets and ESG demands growing in complexity, hybrid financing models are gaining traction:

- Hybrid models can combine equity, debt, royalty, and streaming agreements.

- Streaming contracts allow miners to receive upfront funds in exchange for agreeing to sell a portion of future production at pre-set (usually discounted) prices, transferring part of the operational risk to financiers.

- Royalties offer investors a portion of revenue/profit from mineral sales, with less direct operational exposure.

-

Green bonds and sustainability-linked bonds are now mainstream for financing low-emission, renewable mining infrastructure or water recycling facilities.

- These instruments often involve favorable terms or reduced rates if sustainability performance indicators (e.g., carbon footprint, water use) meet or exceed targets.

- Government and multilateral development banks increasingly provide concessional finance—reduced interest rates, guarantees, or risk insurance for projects aligned with development or climate goals.

Hybrid financing solutions are especially suited to large, capital-intensive mining projects in 2025, where risk, stakeholder demands, and capital requirements are high.

ESG-Linked Financing: Sustainability Meets Mining Investment

Environmental, Social, and Governance (ESG) financing has rapidly become a leading model for both attracting capital and ensuring operational social license in mining.

- ESG-linked loans and bonds (where interest rates or loan covenants are tied to key performance indicators, such as emissions or community engagement) are on track to grow by 35% in 2025.

- Investors and funds consider ESG credentials as non-negotiable criteria; poor ESG ratings can sharply reduce access to global capital markets.

- Tools for transparent, real-time reporting (such as satellite-based carbon footprinting or blockchain traceability) are increasingly influential in securing ESG-linked financing.

For those seeking bonds, loans, or equity placements in 2025, demonstrating measurable ESG improvements is essential for both accessing capital and minimizing funding costs.

Access actionable, real-time environmental impact data for mining finance and ESG: Carbon Footprinting with Farmonaut.

Digital and Blockchain-Enabled Financing Trends

In 2025, the rise of digital platforms and blockchain is redefining transparency, risk management, and investment access in mining.

- Blockchain platforms facilitate secure, real-time trade finance and supply chain traceability, reducing risk of fraud and enhancing trust between partners, investors, and end-users.

- Tokenization of mineral rights, future revenues, or cash flows is emerging, broadening investment opportunities beyond institutional investors to smaller, global participants.

- Digital data platforms also improve due diligence, monitoring, risk assessment, and ongoing compliance—becoming an expectation in any major financing deal.

- Use of AI-driven predictive analytics and satellite monitoring reduces risk and builds investor confidence in both operational performance and ESG management.

We recommend Farmonaut’s blockchain traceability for mining to enhance transparency and support digital financing compliance in complex, multi-phase operations.

API: https://sat.farmonaut.com/api

Developer Docs: Farmonaut Satellite & Weather API Docs

Boost transparency, prove compliance, and attract digital-first investors with Farmonaut’s traceability platform.

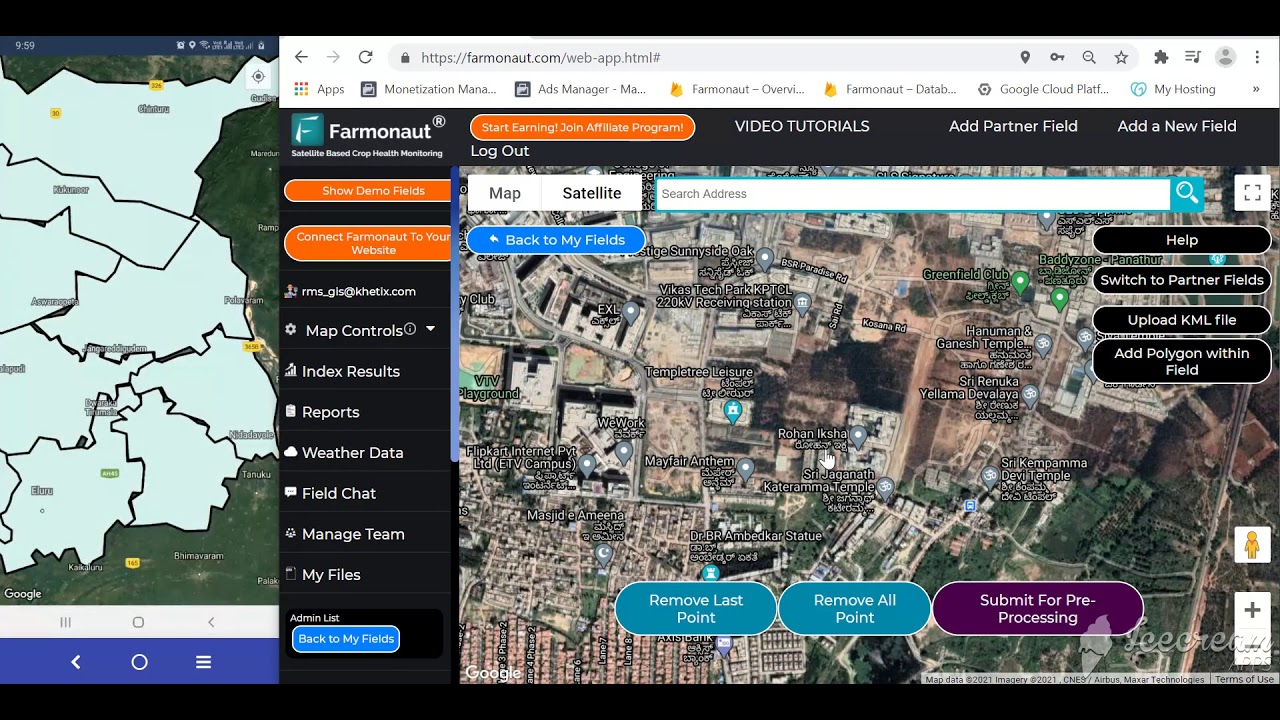

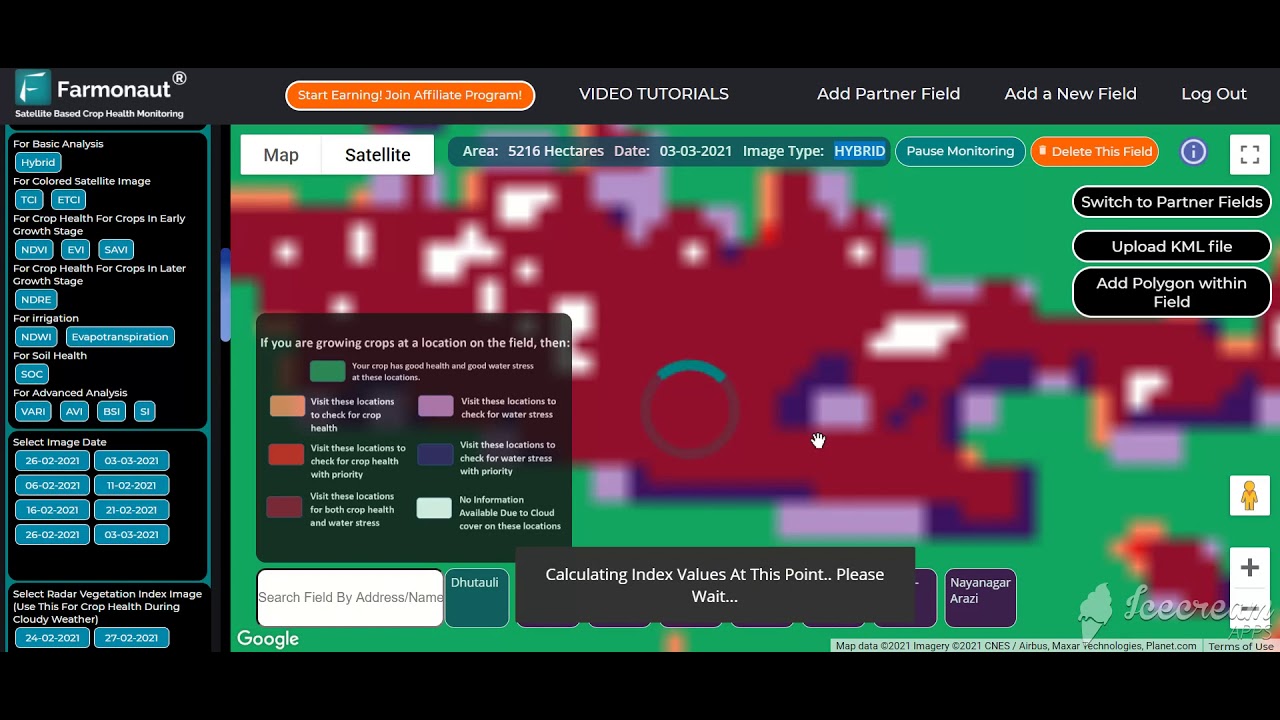

Video Showcase: Mining Finance & Satellite Tech in Action

- Explore how AI-driven satellites, geochemistry & ESG tech are transforming large-scale mining finance:

Analytical Comparison Table: Mining Financing Models 2025

| Financing Model | Est. 2025 Market Share (%) | Typical Cost of Capital (%) | Implementation Complexity | Key Advantages | Potential Risks | 2025 Trend Forecast |

|---|---|---|---|---|---|---|

| Debt Financing | 28 | 6–9% | Medium | Lower equity dilution, relatively favorable for strong balance sheets, predictable terms | Higher financial risk in volatile commodity markets, cash flow pressure during downturns | Stable, but increased scrutiny; digital data required |

| Equity Financing | 22 | 9–14% | Low–Medium | No direct repayments, suitable for high-growth or greenfield projects, easier access | Ownership dilution, potential undervaluation in bearish markets, market sentiment driven | Steady, but hybrid use is rising |

| Project Finance | 17 | 7–11% | High | Off-balance sheet, improved risk sharing, attracts multiparty investment | Rigorous due diligence, complexity, dependence on SPV success | Growth in SPV/ESG-linked structures |

| ESG-Linked Financing | 13 | 7–10% | Medium–High | Attracts ESG-focused investors, potential for lower rates with ESG compliance, opens green bonds | ESG metric compliance, reporting challenges, possible KPI underperformance increases cost | Fastest growth segment (35% YoY rise projected) |

| Digital/Blockchain Financing | 7 | Varies (4–9%) | Medium | Enhanced transparency, broadens investor base, democratizes asset exposure | Regulatory uncertainty, adoption curve, cybersecurity risks | Accelerating adoption; expected to triple by 2028 |

| Hybrid Models | 13 | 6–10% | High | Combines best features, risk mitigation, aligns with cash flow variation | Structuring complexity, stakeholder interest alignment needed | Increasingly dominant for large projects |

Farmonaut Satellite Technology: Enabling Transparency, Risk Mitigation & Sustainable Finance

Satellite technology is integral to modern mining finance, risk management, and sustainable operations. At Farmonaut, our affordable, scalable, and data-driven satellite platforms support mining, infrastructure, and industry users with:

- Real-time monitoring: For accurate operational and compliance reporting

- Blockchain traceability: To enhance lender and investor confidence through transparent, immutable supply chain data

- ESG impact tracking (e.g., Carbon Footprinting): For sustainable mining investments

- AI-based advisory: Custom action plans for operational productivity, fleet management, and risk minimization

- Accessible APIs: For seamless, secure integration of satellite and operational data into your mining finance workflows (find API docs above)

Robust, digital-ready data solutions significantly reduce due diligence costs, streamline lending, and maximise investment outcomes for mining in 2025.

Improve mining loan access, reduce fraud risk and accelerate insurance with Farmonaut’s remote data verification—ideal for institutional lenders and mining operators.

Minimize operational costs by optimizing mining equipment logistics with Farmonaut’s real-time satellite fleet tracking solution.

Oversee vast mining concessions, expansion projects, and infrastructure works efficiently with Farmonaut’s multiuser satellite platform.

Farmonaut Plans: Satellite Monitoring Subscriptions

Frequently Asked Questions (FAQs)

1. What are the main financing models for large-scale mining operations in 2025?

The primary models include debt financing (bank loans, bonds), equity financing (share issues, placements), project finance (SPVs, off-balance sheet), ESG-linked finance (sustainability bonds/loans), hybrid combinations (royalties, streaming), and digital/blockchain-based financing. These are often blended to balance risk, capital needs, and investor requirements.

2. Why is hybrid financing becoming so prevalent in mining?

Hybrid models combine the benefits of multiple sources, improve risk-sharing, match cash flows to operational realities, and address increasing ESG and stakeholder demands. They’re especially suited for large, complex projects where no single model is sufficient.

3. How do ESG-linked financing trends influence mining operations?

ESG-linked models tie financing terms directly to environmental or social outcomes, incentivizing sustainable practices, and making access to capital dependent on ESG performance. In 2025, nearly all global funds prioritize ESG in mining finance decisions.

4. What role does satellite technology play in mining finance and risk mitigation?

Satellite analytics deliver transparent, high-frequency data on site operations, environmental impact, resource flows, and risk factors—boosting lender confidence, accelerating due diligence, and supporting loan covenants (e.g., for carbon footprinting or water use compliance).

5. How can mining companies access the latest digital and data-driven financing tools?

Mining companies and investors can integrate digital satellite tools, blockchain traceability, and real-time environmental analytics using platforms like Farmonaut. These tools improve data-driven reporting, access to green finance, and overall project bankability.

Conclusion: Creative Financial Solutions for 2025 Mining

The financing models for large-scale mining operations in 2025 reflect a sector at the forefront of innovation. Traditional debt and equity structures remain vital, but are now complemented by project finance, hybrid solutions, digital transparency, and ESG-linked investment models—each designed to meet the demands of today’s market, investor base, and regulatory climate.

Success depends on a balanced approach: combining resilient capital structures, technology-driven operational oversight (such as Farmonaut’s satellite monitoring), and measurable sustainability. As mining projects become more capital-intensive and complex, adaptive funding and risk management strategies are indispensable to driving global growth and sustainable resource supply.

For those seeking to navigate the evolving financing landscape in mining, adopting innovative digital platforms, transparent reporting, and hybrid funding solutions will be critical for unlocking value and ensuring long-term success in 2025 and beyond.