Table of Contents

- Introduction

- The Rationale for Public-Private Partnerships in Mining

- Types and Models of PPPs in Mining

- Comparative Table: Top 5 PPP Models for Mining in 2025

- Benefits of Public-Private Partnerships in Mining Projects

- Challenges Facing PPPs in Mining

- Emerging Trends & Strategic Outlook: Public-Private Partnerships in Mining 2025

- Enabling Technologies for Sustainable PPP Mining Ventures

- Farmonaut: Empowering Mining PPPs through Satellite Insight

- The Way Forward: Building Resilient PPP Frameworks for 2025 and Beyond

- Frequently Asked Questions (FAQ)

“In 2025, over 60% of new mining projects are expected to involve public-private partnership models worldwide.”

Public-Private Partnerships in Mining: 5 Top 2025 Models

The landscape of global mining is rapidly evolving as stakeholders combine public insight and private sector innovation in response to the world’s soaring demand for essential minerals and sustainable economic development. Public-private partnerships in mining projects have emerged as a pivotal mechanism to drive growth, optimize resource efficiency, and provide strategic frameworks to address environmental and social challenges. As 2025 approaches, ppps (Public-Private Partnerships) are expected to set the benchmark for success and sustainability in mining sectors worldwide.

The intersecting trends of green energy transition, technological advancements, and shifting global regulatory requirements have forced governments and companies to rethink how projects are designed, financed, operated, and managed. This comprehensive guide explores the top 5 PPP models shaping mining in 2025, the rationales behind them, their benefits, the critical challenges they face, key technological enablers, and the sector’s path toward future resilience and sustainability.

The Rationale for Public-Private Partnerships in Mining

Mining projects are capital-intensive, complex, and often operate under significant environmental and social scrutiny. With the global push toward green energy, the demand for minerals such as copper, lithium, and rare earth elements is escalating. These resources are fundamental for electric vehicles, renewable technologies, and digital infrastructure. However, governments—particularly in resource-rich developing countries—may lack the necessary capital, technological capabilities, and expertise to undertake such high-stakes ventures independently.

Private entities bring to the table:

- Access to investment funds and markets

- Operational efficiency and process innovation

- Advanced technological solutions for extraction and monitoring

Yet, private companies face hurdles, including regulatory uncertainty, community opposition, political risk, and complex environmental compliance requirements.

Public-private partnerships in mining projects offer an enabling framework where risks, rewards, and responsibilities are shared:

- Governments provide the license to operate, build infrastructure, guide community engagement, and enforce environmental oversight.

- Private partners contribute capital, expertise, and efficiency in project management and extraction technology.

This synergy helps bridge gaps—making large mining projects not only viable, but also more sustainable and socially responsible. The framework of PPPs enables sector-wide advancements and rapid adaptation to evolving global needs.

“Environmental compliance rates in PPP mining projects are projected to rise by 35% compared to traditional mining operations by 2025.”

Types and Models of PPPs in Mining for 2025

To structure public-private partnerships in mining projects, a variety of models have emerged and continue to evolve. Each model aligns with specific project requirements, regulatory frameworks, and sectoral challenges. The five PPP models poised to dominate 2025 include:

- Joint Ventures (JVs): The public sector and private entities co-invest to share capital, risks, rewards, and management responsibilities.

- Service Contracts: Private companies are contracted to manage or perform specific operational, environmental monitoring, or technological integration tasks, while ownership and resource rights remain public.

- Concessions: The government provides a license or right to operate a mine under strict regulatory and contract terms; the private partner oversees daily operations and investment.

- Strategic Alliances: Flexible partnerships formed to leverage expertise, technology, or market access across the mining value chain—sometimes without equity sharing.

- Lease Agreements: The government leases mining infrastructure or assets to a private entity; private partners take over extraction, operational efficiency, and environmental management for a specified period.

Comparative Table: Top 5 PPP Models for Mining in 2025

| Model Name | Primary Objective | Public Role | Private Role | Estimated Adoption Rate (2025, %) | Typical Project Duration (Years) | Key Benefits |

|---|---|---|---|---|---|---|

| Joint Ventures | Shared risk, capital, and resource management for sustainability & growth | Regulatory oversight, resource access, community negotiation | Investment, technology, operational management | 28% | 10-30 | Risk-sharing, increased innovation, capital mobilization |

| Service Contracts | Operational efficiency and specialist expertise deployment | Project specification, performance monitoring | Service delivery, technical expertise, operational efficiency | 17% | 3-7 | Lower risk, access to expertise, flexibility |

| Concessions | Efficient extraction and transfer of mineral rights | Granting rights, compliance monitoring | Finance, extraction, environmental management | 25% | 8-20 | Long-term access, maximized resource use, steady revenue |

| Strategic Alliances | Leverage technology, market access, or sectoral expertise | Regulatory facilitation, strategic support | Joint strategic input, capacity building, R&D | 15% | 5-15 | Accelerated innovation, knowledge transfer, risk mitigation |

| Lease Agreements | Efficient asset utilization, short-to-medium term gains | Ownership retention, regulatory enforcement | Asset management, extraction operations, maintenance | 15% | 3-12 | Lower upfront investment, operational flexibility, revenue generation |

Key Benefits of Public-Private Partnerships in Mining Projects

- Resource Mobilization: PPPs attract private capital and reduce fiscal pressure on governments, enabling the launch of otherwise unviable projects.

- Technological Advancement: Access to advanced mining technologies enhances extraction efficiency, streamlines monitoring, and allows for greater innovation in environmental stewardship.

- Risk Sharing: Risks—such as commodity price volatility, regulatory challenges, or unforeseen environmental impact—are distributed between partners, stabilizing project viability.

- Social and Environmental Stewardship: Governments uphold community engagement and enforce compliance with environmental frameworks, prompting socially and environmentally responsible projects.

- Capacity Building: Collaborative partnerships enable skill and knowledge transfer to local workforces, boosting institutional growth and community resilience.

Challenges Facing Mining PPPs and How They’re Addressed in 2025

Although public-private partnerships in mining projects provide significant benefits, they also face challenges that can affect project sustainability and outcomes. As we approach 2025, understanding and navigating these obstacles is more critical than ever.

- Regulatory and Legal Complexities: Different countries and regions have various legal frameworks that can delay or complicate ppp arrangements. Best practices involve harmonizing contracts and ensuring clear roles for public and private entities.

- Transparency and Governance: Proper institutional governance and transparency frameworks must be established to avoid corruption and conflicts of interest. Integrating blockchain-based traceability solutions, such as those on platforms like Farmonaut’s Traceability Tools, enhances trust and supply chain transparency for both governments and companies.

- Community Engagement: Community acceptance is essential for securing the social license to operate. Active engagement with local and indigenous populations, alongside impact monitoring, is required throughout the project’s lifecycle.

- Environmental Impact and Sustainability: Mining inherently affects ecosystems. Stringent environmental monitoring and clear sustainability objectives are now contractually embedded in most modern ppps.

- Commodity Price Volatility: Fluctuating commodity prices demand adaptable financial and operational models for long-term project sustainability.

- Access to Financing: Upfront capital requirements can be daunting. Tools such as satellite-based loan and insurance verification increasingly support both lenders and mining project managers, reducing risk and accelerating access to funds.

Emerging Trends & Strategic Outlook: Public-Private Partnerships in Mining 2025

- Green Financing & ESG Integration: Capital for mining projects is increasingly tied to environmental, social, and governance (ESG) criteria—the norm for 2025. Green bonds and ESG-linked funds underpin new PPP arrangements, linking profitability with measurable sustainability benchmarks. Carbon footprint reporting tools, such as Farmonaut’s Carbon Footprinting Module, are critical for real-time environmental compliance.

- Advanced Technological Solutions: AI, remote sensing, blockchain, and digital twins are transforming how PPP mining projects are conducted, monitored, and governed. These technologies enhance transparency and allow faster, safer extraction and environmental oversight.

- Regulatory Convergence and Policy Support: Governments are moving toward harmonized, investment-friendly regulation, reducing legal barriers for private entities and clarifying responsibilities under PPP frameworks.

- Circular Economy & Resource Efficiency: Recycling and mineral reuse strategies are now embedded in PPP agreements, supporting a shift towards a circular minerals economy, and reducing extraction pressure on new resources.

- Community-First Approaches: Truly sustainable partnerships integrate community engagement and social development goals, promoting shared value creation for all stakeholders.

Enabling Technologies for Next-Generation Mining Partnerships

State-of-the-art technological tools are central to the success of public-private partnerships in mining projects as 2025 approaches.

- Satellite-Based Monitoring: Real-time tracking of mine sites, infrastructure, and environmental impact ensures compliance, supports transparent reporting, and helps prevent risks and negative outcomes. Farmonaut’s Large Scale Field Mapping Solutions can help governments and companies monitor mining areas, optimize resource allocation, and plan strategically.

- Artificial Intelligence & Data Analytics: AI tools process complex data streams to provide predictive insights, optimize extraction, and improve operational management decisions for PPP mining ventures.

- Blockchain-Based Traceability: End-to-end traceability solutions increase governance transparency and reduce fraud across mining supply chains. This is increasingly embedded into new PPP contracts.

- Fleet Management Systems: Mining projects often require advanced fleet and equipment oversight. Platforms like Farmonaut Fleet Management give managers a live view of vehicles and machinery, reducing operational costs, improving safety, and supporting compliance goals.

- Environmental Impact Monitoring: Monitoring carbon footprints and ecosystem impact in real time helps reduce negative consequences and aligns with global sustainability objectives.

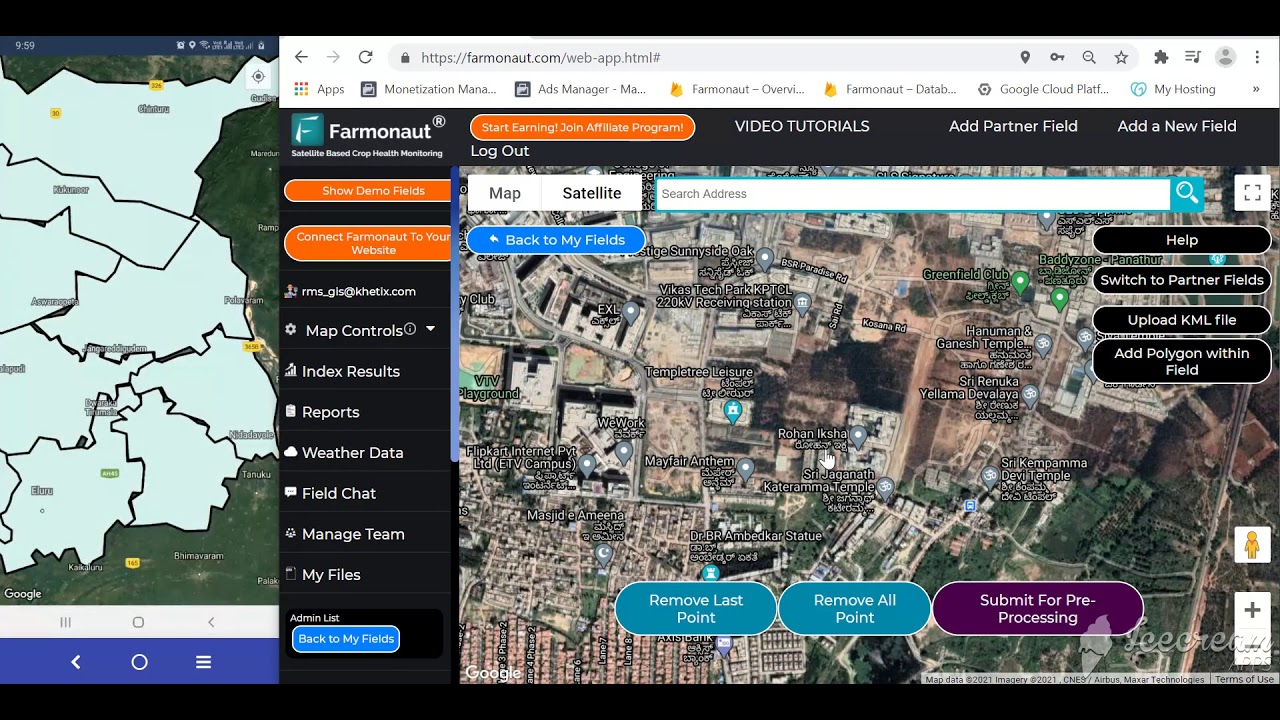

Farmonaut: Empowering Mining PPPs through Satellite & Data Insight

As 2025 unfolds, integrating real-time technology into PPP mining projects is not just an option—it’s a necessity. At Farmonaut, our mission is to make satellite-driven insights accessible and affordable for businesses, users, and governments worldwide. Here’s how our tools amplify the potential of public-private partnerships in mining projects:

- Real-Time Monitoring: We enable operational monitoring of mines and infrastructure, providing actionable insights into ground conditions, extraction sites, and fleet movements.

- AI Advisory & Decision Support: Our Jeevn AI delivers tailored insights and forecasts for optimal resource management, supporting both public and private stakeholders in 2025 mining ventures.

- Blockchain Traceability: By embedding blockchain, we enhance supply chain transparency, validate mineral origin, and foster trust in mining partnerships—supporting strong governance frameworks.

- Environmental Impact & Carbon Monitoring: Our satellite-based tracking services help mining projects achieve and demonstrate environmental compliance and carbon reduction, fueling sustainability.

- Scalable Platform Access: From individuals to corporate and government entities, our web, API, and mobile app ecosystem provides flexible, actionable data for every level of mining project oversight.

Developers and businesses looking to integrate advanced monitoring and data services can access our API or consult our comprehensive API Developer Documentation for seamless integration into existing systems.

The Way Forward: Building Resilient PPP Mining Frameworks for 2025 and Beyond

The future of public-private partnerships in mining projects is bright yet demands innovative thinking, harmonized frameworks, and agile adaptation to changing markets and societal concerns. As 2025 and beyond unfold, here are critical imperatives for mining sector success:

- Policy Innovation: Clear regulatory frameworks, incentives for private investment, and robust environmental and social compliance requirements are foundational for resilient PPPs in mining.

- Sustainability: Integrate carbon footprint monitoring, digital supply chain transparency, and circular economy practices into every level of mining project design and operation.

- Technological Integration: From satellite monitoring to AI-driven advisory systems, next-generation technologies must empower all stakeholders to make more informed, efficient, and sustainable decisions.

- Community and Stakeholder Engagement: A continuous process—not a one-time task. Embedding local perspectives and community benefit objectives strengthens the social contract of mining.

- Capacity Building: Strategic PPPs must foster local skills development, technology transfer, and good governance—creating lasting impacts long after projects end.

Public-private partnerships are setting the gold standard for mining project frameworks in 2025, aligning growth with environmental and social stewardship. Digital tools, strong policies, and collaborative engagement will drive the sector toward equity, efficiency, and resilience in an increasingly complex global landscape.

Explore Farmonaut Subscription Options for Business or Government:

Learn more about application areas such as large scale farm, infrastructure, and mining site monitoring and environmental impact tracking for PPP frameworks.

Frequently Asked Questions (FAQ) – Public-Private Partnerships in Mining Projects for 2025

-

What are public-private partnerships in mining projects?

These are structured collaborations where governments and private sector entities share investment, risks, responsibilities, and rewards to develop, operate, and monitor mining assets efficiently and sustainably.

-

Which PPP models are most relevant in 2025?

The top models are joint ventures, service contracts, concessions, strategic alliances, and lease agreements, each offering unique approaches to risk allocation, resource management, and technological integration.

-

How do PPPs help address environmental challenges?

They incentivize environmental compliance via contractual obligations, enable access to advanced monitoring/traceability technology, and promote shared stewardship of natural resources.

-

What role does Farmonaut play in mining PPPs?

We offer advanced satellite and AI solutions for real-time mining site monitoring, blockchain traceability, fleet/resource management, and carbon impact tracking—helping both public and private participants make data-driven, sustainable decisions.

-

How can businesses and governments get started with Farmonaut?

Start by exploring our web and mobile applications, leverage our APIs and developer tools, or contact us for custom solutions in mining and infrastructure monitoring.

-

What is the future outlook for PPPs in mining?

Public-private partnerships are set to dominate new mining projects globally, given their proven capacity to address funding, regulatory, technological, and sustainability challenges in an increasingly complex and resource-constrained world.

Ready to unlock sustainable mining partnership opportunities in 2025? Try our Farmonaut platform or consult our API documentation for seamless integration!