West Africa Gold Mining Market 2025: Top Trends & Companies

“West Africa’s gold production is projected to grow by over 10% by 2025, outpacing most global mining regions.”

Overview of the West Africa Gold Mining Market

The west africa gold mining market remains one of the most significant regional gold production hubs globally, contributing substantially to Africa’s overall economic output. By 2025, West Africa’s gold sector continues to be a critical driver for jobs, infrastructure, and foreign investment. This region’s abundant gold resources and rapidly evolving mining technologies stimulate both local and multinational interest.

This in-depth article examines the market dynamics shaping West Africa’s gold mining industry, focusing on the latest trends, opportunities, regulatory environment, chemical processing, key challenges, technological innovation, and leading companies driving growth in 2025 and beyond. We also explore the emerging role of satellite technology, real-time data analytics, and new, more sustainable chemical reagents transforming gold extraction processes.

West Africa Gold Mining Market 2025: Key Trivia

“Over 60% of West African gold mines are expected to adopt new chemical processes for sustainability by 2025.”

Key Trends and Leading Companies: West Africa Gold Mining 2025

| Trend/Development | Estimated 2025 Impact | Top Companies Adopting | Quantitative Estimates |

|---|---|---|---|

| Production Volume Growth | High | AngloGold Ashanti, Newmont, Endeavour Mining | +7% (est.) |

| Sustainability Initiatives Adoption | High | Gold Fields, Resolute Mining | 5 major projects launched |

| Chemical Reagent Shift (Cyanide Alternatives) | Medium-High | Newmont, Barrick Gold | 60% mines with new chemicals |

| Investment Inflows/Foreign Direct Investments (FDI) | High | All major market entrants | +12% FDI (est.) |

| Regulatory Changes & Compliance Demands | Medium | Multinationals, Local mining authorities | 4 new regulations (est.) |

| Tech Integration: AI, Satellite, Blockchains | Medium-High | Regional & global leaders | 80% Tier-1 mines using satellite/AI by 2025 |

Focus Keyword Insight: The West Africa Gold Mining Chemical Market

The west africa gold mining chemical market is tightly linked to regional gold production volumes and advances. By 2025, extraction in West Africa relies heavily on chemical reagents—primarily cyanide—for efficient leaching and separation of gold from ores. The intense demand for gold output across Ghana, Mali, Burkina Faso, and Ivory Coast directly drives chemical consumption and technological innovation in this niche.

- Increasingly, chemical suppliers are focusing on biodegradable reagents, new compounds, and enhanced recovery systems to meet stricter environmental standards.

- Enhanced satellite and data technology are being integrated to monitor chemical usage, track compliance, and reduce risks of environmental degradation.

- Multinational chemical companies and local players are collaborating to develop supply chains that ensure high-quality, consistent, and safe reagents for the expansion of the mining sector.

Key Market Insight: The west africa gold mining chemical market is expected to experience significant regulatory-driven transformation, with over 60% of mines in the region moving towards sustainable chemical processes by 2025. This will create new business opportunities for leading chemical manufacturers and drive overall improvements in environmental performance and community relations.

The drive for sustainability, cost reduction, and carbon accountability is also drawing on new technologies, such as satellite-based carbon footprint monitoring and blockchain-enabled traceability platforms. These digital advances enable mining operators to monitor real-time chemical usage, comply with government regulations, and generate auditable environmental impact reports.

Chemical Regulations, Environmental Concerns, and Innovation

The west african mining market operates under increasingly stringent regulatory frameworks for chemical usage and environmental protection. As awareness grows about the impact of mining chemicals—especially cyanide and arsenic—on biodiversity, water sources, and local health, governments and international agencies are rolling out new rules aimed at:

- Reducing the volume of high-risk chemicals used in gold extraction

- Enforcing regular audits to track chemical storage, transport, and disposal

- Legal mandates for cyanide management plans and investment in sustainable alternatives

Companies are responding by:

- Investing in R&D: Global and regional players are test-piloting eco-friendly leachates and closed-loop chemical recovery systems.

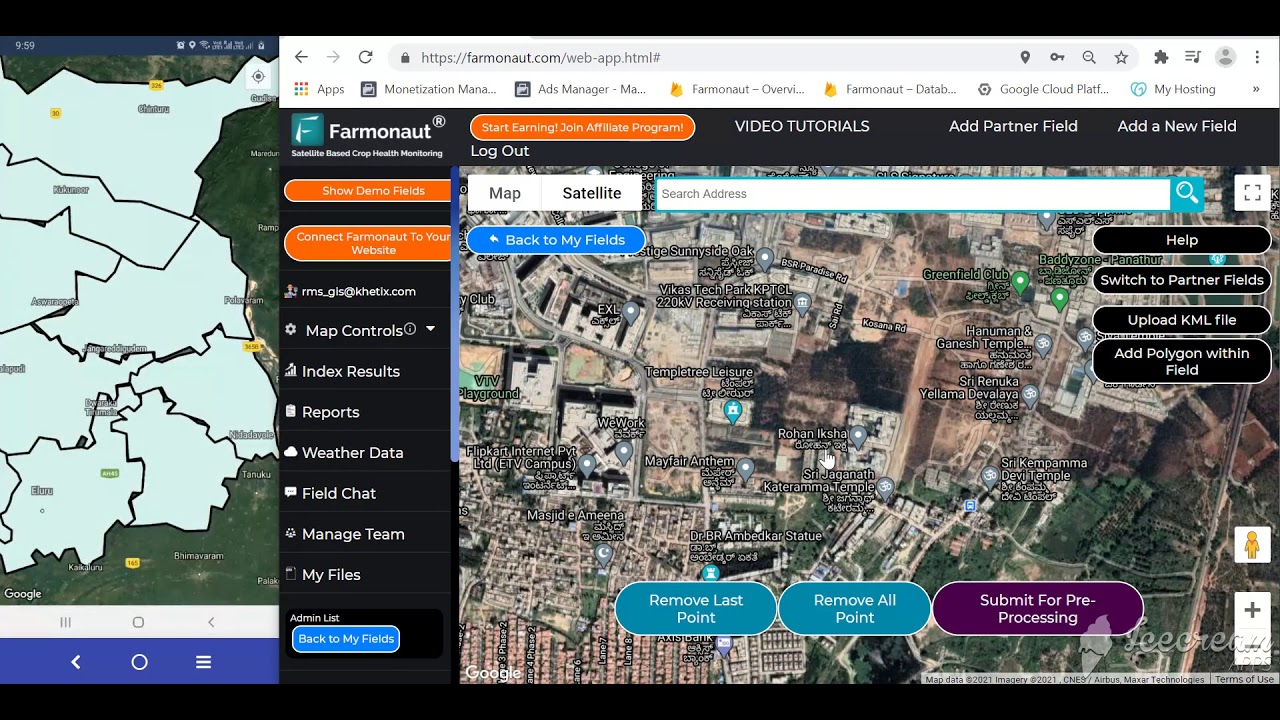

- Integrating satellite monitoring: Monitoring geospatial impacts, tailings, and chemical dispersion via real-time remote sensing (for example, the Farmonaut platform).

- Enhancing reporting: Leveraging blockchain to certify origin and responsible processing for ethical gold exports (see more on traceability).

These trends position the west africa gold mining chemical market as a test bed for environmental best practices among emerging global mining regions in 2025.

Production Output and Leading West African Gold Mining Companies

West Africa accounts for nearly 20% of global gold output, due to the combination of abundant natural resources, progressive government policies, and a rising number of mining operations. Ghana, Mali, Burkina Faso, and Ivory Coast form the backbone of the region’s mining power.

By 2025, production is projected to grow by over 10%, making the west african mining sector one of the fastest-growing globally. Multinational corporations such as:

- Newmont Corporation (Ahafo, Ghana; Merian, Suriname)

- AngloGold Ashanti (Obuasi and Iduapriem in Ghana; Siguiri in Guinea)

- Endeavour Mining (Houndé, Ity, Sabodala-Massawa, Boungou, Mana mines)

- Barrick Gold

- Gold Fields (Damang, Tarkwa in Ghana)

- Resolute Mining (Syama, Mako)

…lead large-scale production and set standards for operational excellence. These top west african gold mining companies are:

- Leveraging advanced extraction and processing technologies

- Investing in workforce training and local supplier networks

- Partnering with local mining entities under favorable government frameworks

- Adopting innovative solutions—like AI-based resource management, fleet logistics, and real-time environmental tracking

Emerging local mining companies have become vital regional players, contributing to national development, technology transfer, and capitalizing on growing gold demand.

Mining Technology & Innovation in Gold Extraction

A core trend in the west african mining sector for 2025 is the rapid adoption of AI, satellite imagery, machine learning, and blockchain to maximize efficiency and sustainability. Advanced technology solutions allow mining companies to:

- Remotely monitor gold mining sites, including production output, chemical usage, and environmental parameters.

- Optimize fleet and resource management, minimizing downtime and reducing fuel/emissions (satellite-powered fleet management can cut logistics costs by up to 25%).

- Access real-time geological data and predictive analytics to identify high-potential zones, evaluate soil and rock properties, and reduce the likelihood of failed exploration campaigns.

- Implement blockchain traceability tools for ethical gold sourcing (read more about traceability here).

- Meet regulatory compliance for carbon footprinting and environmental impact (carbon footprinting in mining).

If we examine farmonaut’s technologies specifically, we see how satellite-driven insights foster precise, cost-effective, and scalable mining site monitoring—helping target underexplored areas, ensure chemical safety, and track regulatory compliance without expensive on-ground surveys.

For mining businesses, Farmonaut’s subscription-based API and end-user app (get started  ) enable:

) enable:

- Daily to weekly satellite updates

- AI-based advisories on mine planning and environmental impact mitigation

- Fleet tracking and field resource optimization

- Secure integration with supply chain systems via APIs (see API documentation or developer docs)

Key Regional Markets: Ghana, Mali, Burkina Faso, Ivory Coast

Let us review the top countries driving west africa gold mining market growth:

- Ghana: Africa’s top producer with nearly 130 metric tonnes annually, Ghana’s gold market is driven by robust government incentives, an established mining infrastructure, and advanced chemical processing facilities. Leading mines include Newmont’s Ahafo and AngloGold’s Obuasi.

- Mali: A key west african gold mining region, Mali has ramped up both large-scale extraction and artisanal mining output. Major mines like Loulo-Gounkoto (Barrick) and Syama (Resolute) set production standards.

- Burkina Faso: Known for its resource-rich geology, Burkina Faso’s output has surged with investments from Endeavour, Nordgold, and other players. Despite security and infrastructure challenges, government reforms are incentivizing further exploration and formalization of artisanal production.

- Ivory Coast (Côte d’Ivoire): Fastest-growing gold sector in West Africa, attracting foreign investors and multinationals. Mines such as Ity and Agbaou (Endeavour) are at the forefront of sustainable extraction and environmental accountability.

Collectively, these countries represent nearly all of West Africa’s 20% share of global gold production, underscoring their importance for the region’s economic growth, job creation, and foreign currency earnings.

Major Challenges and Future Trends in West African Gold Mining

The west africa gold mining market faces a multifaceted challenge landscape, which is steadily being addressed through technology, investment, and policy innovation:

- Illegal Mining (Galamsey): Informal extraction remains prevalent, especially in rural Ghana and Mali. It undermines formal sector growth, causes environmental damage, and costs governments substantial tax revenue. Moves to integrate artisanal miners into the formal economy via registration, training, and support are underway.

- Infrastructure Constraints: Unreliable road networks, insufficient power supply, and limited communications hinder efficient mine operations and gold logistics.

- Environmental Degradation: Historical inefficiencies in leaching, chemical disposal, and mine tailings management have led to water contamination and land loss—prompting regulatory reforms, new standards enforcement, and advanced monitoring solutions.

- Socio-political Instability: Some regions are exposed to periodic unrest or security challenges, influencing investment flows.

Despite these challenges, opportunities abound in the west african gold mining market for 2025 and beyond:

- Production expansion in underexplored and remote areas, powered by satellite imaging and ground-penetrating radar.

- Integration of small-scale miners into the formal economy through government support, licensing, and technology access.

- ESG (Environmental, Social, Governance) leadership: Multinationals and regional players must align with new sustainability standards to attract foreign investment, improve community relations, and drive operational excellence.

- Digital transformation: Blockchain, machine learning, and IoT devices now allow for super-efficient operations, from carbon emissions monitoring to real-time fleet tracking.

- Rising gold demand: West African mines supply both global jewelry markets and growing demand for electronics and as a safe-haven asset.

How Satellite Technology (Farmonaut) Empowers Mining in Africa

We at Farmonaut empower businesses, governments, and individuals in the mining sector with cost-effective, real-time, and scalable satellite monitoring and AI-based advisory technology. Here is how our solutions benefit the west africa gold mining market:

- Real-time mining site monitoring: Our satellite imaging allows mining companies to observe and analyze mine status, vegetation cover, water sources, and possible illegal mining activities even in the most remote locations of West Africa.

- AI-Powered Decision Support (Jeevn AI): By analyzing satellite and weather data, our Jeevn AI system offers tailored advice on mining operations optimization, environmental risk mitigation, and safety planning.

- Blockchain-Based Traceability: We offer blockchain integration for mining supply chains, ensuring tamper-proof documentation and enhancing export market confidence—learn more about traceability benefits.

- Fleet and Resource Management: With our fleet management tools, mining enterprises optimize machinery usage, safeguard remote workers, and reduce operational expenses.

- Environmental Impact Reporting: We provide ongoing carbon and pollution tracking reports for regulatory compliance (carbon footprinting), fostering greater sustainability.

- API Integration: Developers can tap directly into our API or review our developer docs to bring satellite-driven data and advisory features to bespoke industry systems.

These capabilities support the full spectrum of the mining operations value chain—exploration, extraction, processing, and regulatory reporting. For West African markets, this means more reliable outputs, reduced environmental impact, and improved operational transparency.

Get Started with Farmonaut: Satellite Solutions for Mining

- Large Scale Mining or Farm Management? Our platform enables comprehensive large area monitoring for top-down mine management and site planning.

- Track Your Carbon Footprint: Minimize regulatory risks and align with global mining standards via carbon emissions monitoring.

- Streamline Drill Fleet Logistics: Optimize your equipment usage, cut out unnecessary expense, and keep transport compliant with AI-based fleet management.

FAQs: West Africa Gold Mining Market 2025

What drives growth in the west africa gold mining market?

The market is driven by abundant regional gold resources, technological innovation (especially in ore processing and environmental management), strong foreign investment, and supportive government policies. Digital technologies (satellite monitoring, AI, blockchain) and evolving chemical use also spur production increases and attract multinationals.

What are the key challenges faced by west african gold mining companies?

- Inefficient infrastructure in remote areas (roads, energy networks)

- Environmental compliance with stricter chemical regulations

- Illegal artisanal and small-scale mining activities

- Socio-political risks in certain locations

- Talent gaps and skill shortages for advanced mining operations

How do chemical reagents and technologies impact gold extraction?

Chemical reagents such as cyanide remain essential for gold leaching and refining, but regulatory and environmental pressures are prompting the adoption of biodegradable alternatives and improved chemical recovery systems. Technological advances enable more precise reagent usage, reduced waste, and lower emissions.

Which countries lead the west africa gold mining market?

Ghana, Mali, Burkina Faso, Ivory Coast (Côte d’Ivoire) are the top west african producers, jointly accounting for almost all of the region’s 20% share of global gold output.

What are the opportunities for the west african mining sector between 2025 and 2030?

- Expansion into underexplored geographical areas

- Increased adoption of satellite- and AI-driven remote monitoring and planning

- Enhanced compliance with global ESG standards—opening up premium export markets

- Formalizing and integrating artisanal miners into the economic mainstream

Conclusion: West Africa’s Mining Future

In 2025 and heading into the next decade, the west africa gold mining market remains robust, resilient, and innovative. High production growth, shifting chemical processing methods, and a mix of dynamic global and local companies anchor the sector’s contribution to Africa’s economy.

While persistent challenges—including illegal mining, environmental regulation compliance, and infrastructure bottlenecks—require strategic solutions, ongoing investments in digital, satellite, and AI-based technologies are fundamentally reshaping the mining landscape. Companies adopting sustainable production methods, efficient resource management, and new transparency standards are best placed to thrive.

As the region attracts increasing foreign investment and integrates advanced data-driven technologies, west african mining stands as a focal point for efficiency, sustainability, opportunity, and economic development on the African continent for years to come.

For mining operators, businesses, and governments looking to modernize and ensure competitiveness in 2025 and beyond, satellite platforms like Farmonaut offer a powerful pathway to smarter, more transparent mining futures.

Explore how Farmonaut’s satellite and AI-powered solutions can support your mining operations, resource management, and ESG compliance across West Africa:

Add digital intelligence to your mining strategy. Harness Farmonaut’s API and developer tools to tap into actionable satellite data.