What Percent of Fresh Flowers Are Imported from Colombia? A Deep Dive into the Global Cut Flower Trade

“Colombia supplies approximately 78% of all fresh cut flower imports to the United States each year.”

Colombian Flower Imports: A Market Overview

Colombia stands as the preeminent supplier of imported flowers to the United States. Every year, millions of stems traverse the skies and seas, leaving Colombia’s lush fields to reach florists, supermarkets, and vendors across the U.S. The imported flowers united states relies upon are not just decorative commodities; they are a linchpin of transnational trade, culture, and economics.

Understanding what percent of fresh flowers are imported from Colombia reveals fascinating patterns shaped by geography, policy, and international relationships. In 2022 alone, U.S. imports of cut flowers, plants, and nursery stock from 81 countries reached an astonishing $3.3 billion, with Colombia contributing about $1.2 billion—the largest share from any single country (drgnews.com).

U.S. Flower Market Suppliers & Global Import Landscape

The U.S. flower market suppliers form a diverse international group, but Colombia and Ecuador predominantly anchor the American fresh cut flower market. As reported by industry sources, close to 80% of flowers sold in the U.S. are imported, and of these, Colombia contributes approximately 74% by volume, with Ecuador closely following at 26%. This implies that nearly 68% of all cut flowers available for sale in the U.S. originate from Colombia (superfloral.com).

These numbers cement Colombia’s position as the dominant supplier—a reputation built on decades of investment, favorable climate, and evolving trade policies that facilitate bulk exports, particularly during high-demand seasons such as Valentine’s Day and Mother’s Day.

“During Valentine’s season, over 500 million stems of Colombian flowers are imported into the U.S. market.”

Fresh Cut Flowers Market: Key Statistics and Trends

The fresh cut flowers market has demonstrated continual growth thanks to streamlined supply chains and year-round demand. Here are the key statistics that underscore Colombia’s world-leading role:

- In 2022, the U.S. reported $3.3 billion in flower imports from 81 countries.

- Colombia supplied $1.2 billion— more than one-third of total flower import value.

- The U.S. imported over 500 million stems from Colombia each Valentine’s season.

- Colombia and Ecuador combined supply 85% by volume of U.S. cut flower imports, but Colombia alone contributes the bulk.

- Other leading exporters include the Netherlands, Mexico, and Canada—but none rival Colombia’s scale.

These figures highlight the reliance of American consumers and retailers on imported flowers from this South American nation, especially roses and other popular varieties, during high-volume holidays and year-round celebrations.

The Flower Industry in Colombia: Climate, Varieties, & Supply Chain

The flower industry in Colombia is a cornerstone of the country’s agricultural exports. Why is Colombia so successful in this field?

Ideal Growing Conditions

- Climate: Colombia’s equatorial location assures year-round mild temperatures.

- High Altitudes: Most flower farms are located at elevations of 2,000–2,600 meters above sea level, optimal for robust, long-stemmed flowers.

- Abundant Sunlight: Over 12 hours of daily sunlight fosters strong, healthy blooms.

- Soil and Water: Fertile volcanic soils and plentiful water support lush cultivation.

These factors lower production costs and enable Colombia to supply vast volumes of fresh flowers at competitive prices—making it the global supplier of choice for the American market.

Diverse Flower Varieties

Colombia’s flower exports are renowned for their quality and variety:

- Roses: The most popular import, particularly for Valentine’s Day flower imports

- Carnations

- Chrysanthemums

- Lilies

- Orchids

The country’s flower industry boasts over 1,600 varieties—catering to diverse consumer preferences across the United States and the globe.

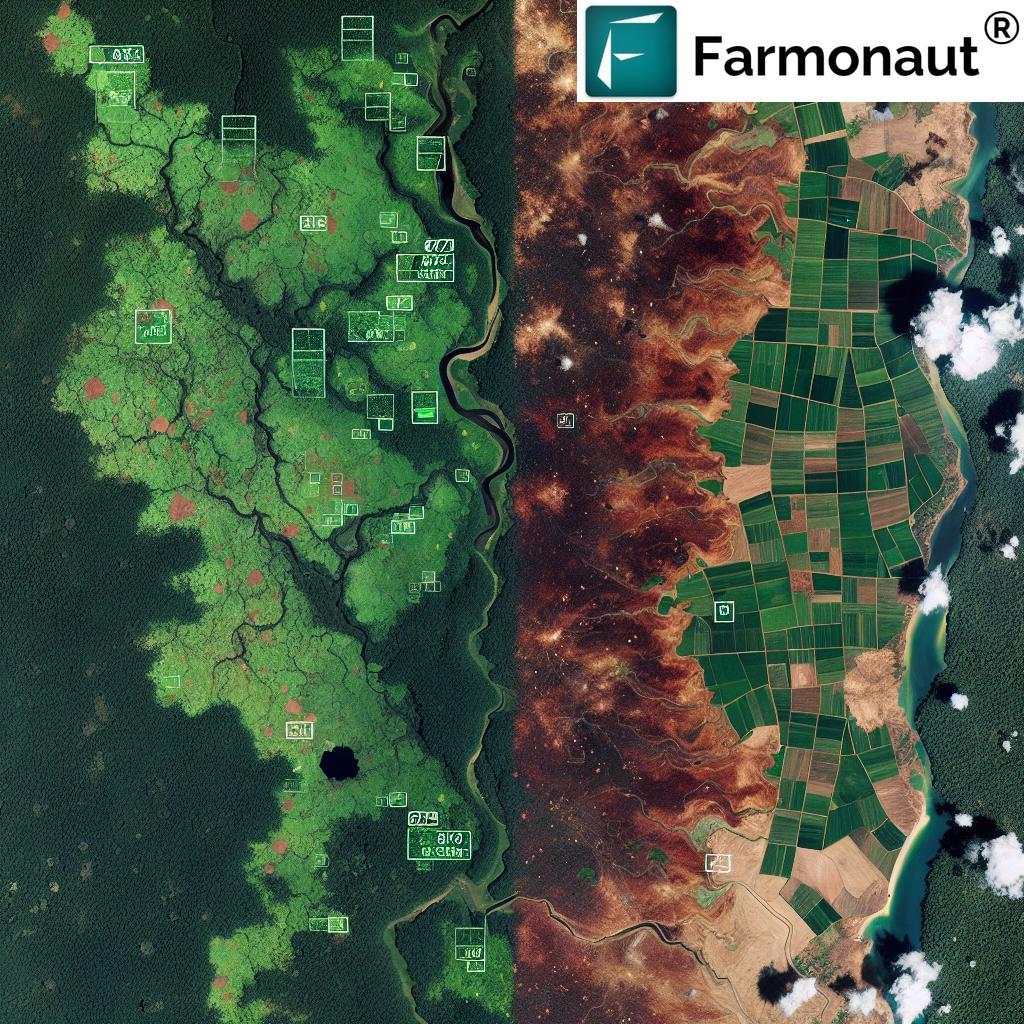

Sector Modernization and Traceability

Colombia’s flower sector has embraced technology for production, post-harvest handling, and logistics. Industry-wide adoption of advanced cooling, transportation, and quality systems has helped keep flowers fresh from farm to vase. For businesses prioritizing transparency, tools like Farmonaut’s Traceability solutions can play a crucial role by providing blockchain-backed documentation throughout the supply chain, ensuring authenticity and mitigating risks of fraud.

Comparison Table: Imported Flowers in the United States

This table highlights the major supplying countries, estimated shares, and seasonal peaks in the U.S. cut flower trade.

| Country | Estimated Import Percentage (%) | Estimated Volume (Million Stems) | Major Import Period(s) |

|---|---|---|---|

| Colombia | 74% | ~2,000 | Valentine’s Day, Mother’s Day |

| Ecuador | 26% | ~700 | Valentine’s Day, Mother’s Day |

| Netherlands | ~2% | ~30 | Easter, Spring |

| Other Countries | <1% | ~20 | Varied |

Source: Industry reports and U.S. Customs data

Trade Agreements, ATPA, and U.S.-Colombia Relationship

A pivotal element in the trade relationship between the United States and Colombia has been policy. The Andean Trade Preference Act (ATPA), enacted in 1991, eliminated tariffs on numerous goods—including flowers—from Colombia. This policy change dramatically boosted Colombian rose exports to the U.S., with a >30% increase in imports seen within two years of enactment (washingtonpost.com).

Key Points:

- ATPA (Andean Trade Preference Act flowers): Lower entry barriers for Colombian flowers to the U.S. market; increased competitiveness.

- Free Trade Agreements: Subsequent FTAs built on this foundation, locking in zero tariffs and preferential treatment for Colombian flowers.

- Policy Stability: Has allowed Colombian growers to invest in sustainable expansion.

Together, these agreements have ensured continuity and growth in the cut flower trade— making Colombia the largest and most reliable exporter to the U.S. The Farmonaut crop plantation & advisory platform can help growers in various regions take advantage of similar market opportunities through satellite-guided decisions and compliance insights.

Valentine’s Day Flower Imports: Peaks and Market Dynamics

No flower season is more crucial than Valentine’s Day. Each February, shelves across the U.S. are filled with fresh bouquets—most of which were cut, packed, and shipped from Colombian fields only days prior:

- Over 500 million stems are imported from Colombia for Valentine’s week alone.

- Roses make up the bulk, but carnations/chrysanthemums/lilies/orchids also surge.

- This period can account for up to 25% of annual flower sales in the U.S.

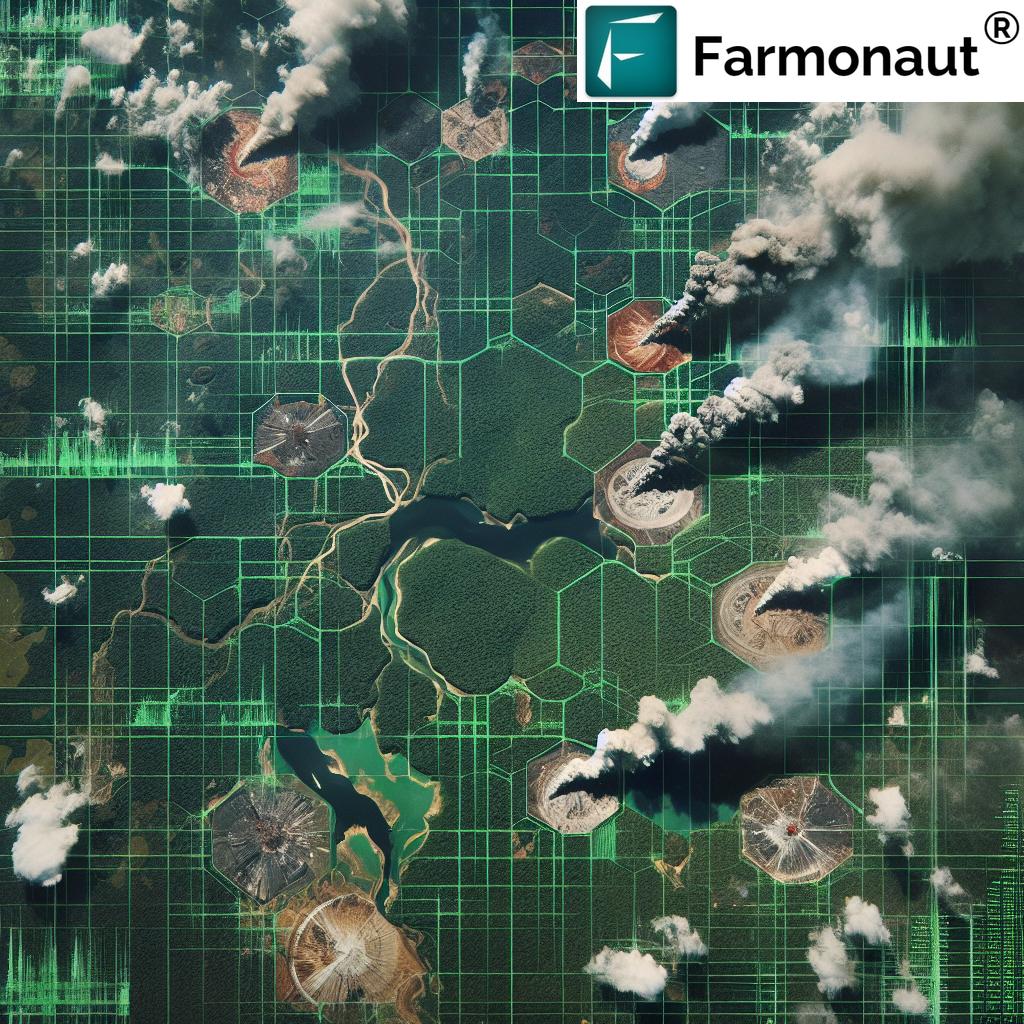

Efficient handling and logistics are essential. Transport must be swift and temperature-controlled, as the journey from Colombian farms to American retail outlets occurs within 2–4 days—ensuring maximum freshness and consumer satisfaction. Farmonaut users benefit from real-time monitoring tools that could easily integrate into such fast-paced supply chains to monitor crop health and optimize harvest scheduling.

Miami Airport: The Flower Import Hub

The Miami International Airport (MIA) operates as the chief hub for the entry and distribution of imported flowers into the United States, particularly from Latin America.

- ~70% of all imported flowers enter through MIA, emphasizing its role as North America’s floral gateway.

- Miami flower import hub processes up to 78,000 boxes of flowers per day during peak seasons.

- Advanced cold storage facilities and customs teams ensure rapid processing.

- The route from Colombian farm to American vase is among the most streamlined in global agriculture.

MIA’s infrastructure supports the speed and scale required by this transnational business—linking Colombian production directly to U.S. wholesale, retail, and event businesses with unparalleled efficiency.

Economic Impact of Colombian Flower Exports

The economic impact of Colombian flower exports is profound:

- $2 billion in flower export revenue (2022), a 19% increase year-on-year.

- The U.S. remains the largest recipient, accounting for 79% of Colombian flower exports—around $1.66 billion.

- Colombian flower exports support hundreds of thousands of jobs in rural communities, especially women.

- This trade finances innovation in cultivation, logistics, and environmental management.

Colombia’s rural workforce, national economy, and international reputation all benefit directly from this sector’s vitality. The Farmonaut carbon footprinting module could help major exporters track and report their sustainability efforts, meeting the growing demand from consumers and international buyers for environmentally responsible production.

Trade Disputes and Tariffs on Flower Imports

Despite the longstanding relationship, the trade in fresh flowers is not immune to diplomatic disputes or sudden tariffs on flower imports.

- In 2024, the U.S. threatened a 25% tariff on Colombian flower imports during Valentine’s season (apnews.com).

- The dispute was resolved via diplomatic negotiations, but it underscored the sector’s vulnerability to policy uncertainties.

- Any sustained price increase could shift buying patterns or create temporary shortages in the U.S. market.

Read more:

- Las flores colombianas coronan el Día de la Madre a pesar de la guerra arancelaria de Trump

- Just in time for Valentine’s Day, trade dispute with Colombia threatens flower imports

Strong supply chain intelligence and agile logistics—backed by platforms like Farmonaut’s fleet management tools—are essential in mitigating these risks for agribusinesses and importers.

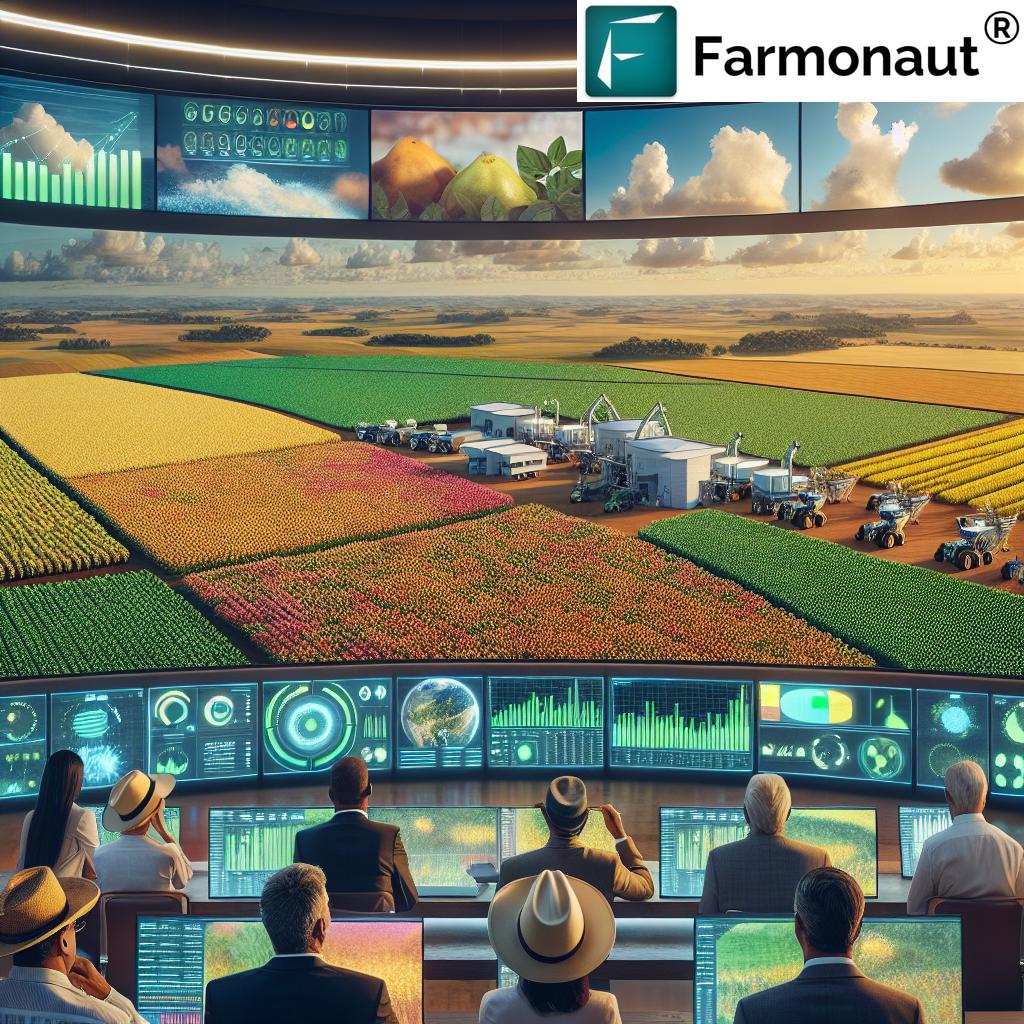

How Farmonaut Supports Modern Flower Supply Chains

Advanced agricultural technologies are increasingly vital for all players in the global fresh cut flowers market. At Farmonaut, we provide innovative solutions that enhance transparency, traceability, sustainability, and productivity at every step:

- Satellite-Based Crop Health Monitoring: Stay informed about field health, making production more reliable and minimizing the risk of crop failure or spoilage.

- AI-Powered Farm Advisory: Use Jeevn AI to optimize growing strategies, resource allocation, and harvest timing—especially useful for time-sensitive crops like flowers.

- Blockchain-Based Traceability: Leverage Farmonaut’s traceability platform to guarantee authenticity in transnational supply chains, combating fraud and assuring buyers.

- Fleet Management Tools: Streamline import/export logistics and cold chain stewardship (learn more).

- Carbon Footprinting and Sustainability: Track, report, and reduce your flower operation’s environmental impact using carbon footprinting analytics.

- Scalable APIs: Integrate satellite and weather data into your business systems via Farmonaut API and developer documentation.

Farmonaut’s suite of digital tools and analytics empowers producers, exporters, importers, and distributors to thrive in the rapidly evolving global flower trade.

Want to experience these innovations? Get started with the Farmonaut app for web, Android, or iOS.

Ready to Transform Your Agribusiness?

Explore Farmonaut subscriptions for individual farmers, agribusinesses, and government agencies. Choose scalable solutions—subscribe via the secure portal below and empower your operations today!

FAQ: Imported Flower Market & Colombia’s Role

Q1: What percent of fresh flowers are imported from Colombia?

Approximately 74% by volume of all imported cut flowers in the United States are sourced from Colombia, making it the top supplier to the U.S.

Q2: Which flowers does Colombia mainly export to the United States?

Colombia’s main exports include roses (particularly for Valentine’s Day), carnations, chrysanthemums, lilies, and orchids.

Q3: What is the Andean Trade Preference Act and how has it affected flower imports?

The Andean Trade Preference Act (ATPA) of 1991 eliminated tariffs on certain goods, including flowers, from Colombia. This made Colombian flowers more competitive in the U.S. market and spurred a sharp increase in rose imports and overall flower trade.

Q4: How does Miami International Airport facilitate flower imports?

MIA is the main hub, handling about 70% of all flower imports into the U.S., thanks to its advanced cold storage and logistics facilities.

Q5: How significant are Valentine’s Day flower imports?

Valentine’s Day flower imports account for up to a quarter of annual flower sales in the U.S. The vast majority of these—over 500 million stems—originate from Colombia, underscoring its leading position in the market.

Q6: What technology solutions can help flower exporters?

Flower exporters can use advanced solutions like Farmonaut’s platform for real-time monitoring, product traceability, and carbon footprint tracking to ensure efficient, transparent, and sustainable supply chains.

Conclusion: Colombia’s Pivotal Place in U.S. Flower Imports

Colombia has carved out an unmatched global position in the cut flower trade—with a robust industry structured around unique climatic advantages, an extensive variety of blooms, and sophisticated logistics.

In 2022, Colombian flower exports to the United States not only dominated industry statistics but also underpinned a vast network of growers, logistics providers, and retailers. Despite occasional trade disputes and the looming threat of tariffs, the U.S.-Colombia trade relationship remains vital for both economies. The prominence of valentine’s day flower imports highlights how critical Colombian supply is during peak seasons when market reliance is at its highest.

As the flower market continues to evolve, driven by consumer preferences and a globalized economy, intelligent digital platforms, like those we offer at Farmonaut, will remain central to ensuring the industry’s transparency, sustainability, and resilience—benefiting all constituents, from rural Colombian farmers to end consumers enjoying a bouquet in an American city.

Grow Smarter, Track Better—Choose Farmonaut

-

Farmonaut for Large-Scale Farm Management:

Manage vast operations efficiently with multispectral satellite imagery, fleet tracking, and team collaboration features. -

Crop Loan & Insurance Validation:

Simplify loan approvals and insurance claims with satellite-based verification. -

Fleet Management:

Logistically optimize vehicle and machinery use for flower farms and exporters.

Discover the future of farm management & sustainable trade with Farmonaut—empowering agri-businesses globally.