Ag Loan Jamestown: 7 Powerful Ways to Boost Farming in 2025

Agricultural Loans in Jamestown: Empowering Farmers for a Sustainable 2025

Table of Contents

- Introduction: The Pivot of Ag Loan Jamestown in 2025

- The Importance of Agricultural Loans in Jamestown

- Jamestown’s Current Ag Loan Landscape

- Comparison Table: Sustainable Ag Loan Options, Jamestown (2025)

- 7 Powerful Ways to Boost Farming with Ag Loan Jamestown in 2025

- How Farmonaut Technology Empowers Sustainable Financing

- Key Challenges and the Future of Agricultural Financing in Jamestown

- FAQs: Ag Loan Jamestown & Sustainable Farming Finance

- Conclusion

“In 2025, over 60% of Jamestown ag loans support climate-resilient farming projects, driving sustainable growth.”

Introduction: The Pivot of Ag Loan Jamestown in 2025

Agriculture continues to be the backbone of many regional economies, and in Jamestown, it truly stands as a pivotal hub for farming communities striving to enhance productivity and sustainability. In 2025, ag loan Jamestown options have become more critical than ever. These agricultural loans are vital tools for empowering local farmers, enabling them to adopt new technology, invest in infrastructure, and develop strategies for thriving in the face of climate change and volatile markets.

As the agricultural sector faces increasing challenges—from soil fertility dynamics and water management to shifting labor markets—having affordable, accessible, and supportive loans is essential for the success and resilience of the region. Let’s explore how Jamestown’s 2025 ag loan options are positioned to transform farming and usher in a new era of sustainable growth.

The Importance of Agricultural Loans in Jamestown

Agricultural loans in Jamestown are not just financial products—they are essential tools for driving change, fostering sustainability, and empowering farmers at all operational scales. Here’s why:

- Enable Growth Without Immediate Capital Burdens: Farming is capital intensive. From procuring seeds, fertilizers, and equipment to investing in modern practices like precision agriculture, drone surveillance, and irrigation system upgrades, there is a pressing need for upfront investment—something not possible for many without supportive loans.

- Allow Farmers to Invest and Innovate: With improved access to credit, farmers can adopt the latest technology, update infrastructure, and transition to climate-responsive crops, ultimately contributing to better yields and higher-quality produce.

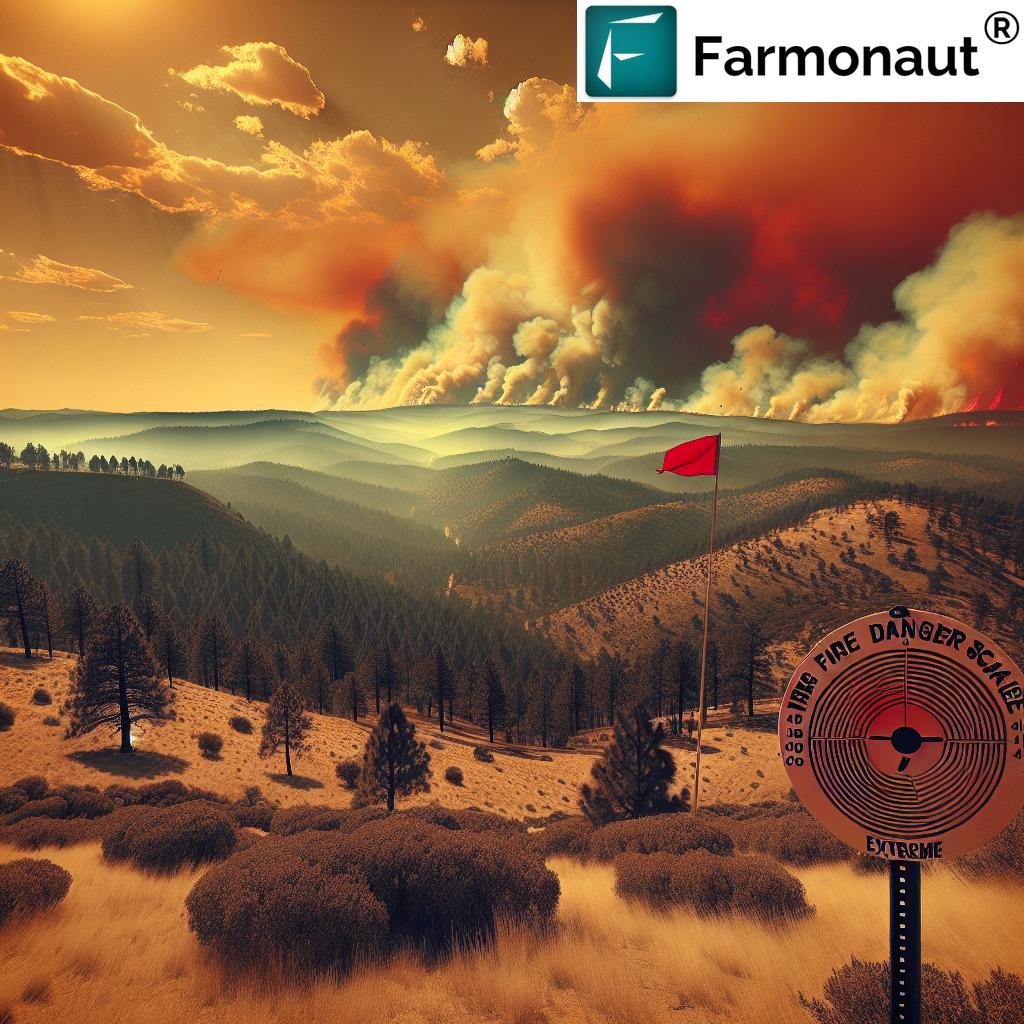

- Mitigate Risks Posed by Climate and Markets: Loans equipped with linked crop insurance or climate advisory help mitigate the risks associated with unpredictable weather patterns and volatile markets, offering a security net for farmers in Jamestown.

- Drive Adoption of Sustainable Practices: Many modern loans incentivize or require the adoption of sustainable farming techniques (e.g., carbon footprinting and traceability), supporting sustainability and long-term soil health.

Jamestown’s Current Ag Loan Landscape — What Makes It Unique?

Jamestown’s agricultural sector is marked by a diverse mix of grains, vegetables, and specialty produce designed for both local markets and exports. The soil fertility and water resources provide ample opportunities—yet, unpredictable weather patterns and labor shortages challenge farmers and financial institutions alike.

- Tailored Loan Products: Local banks, cooperative societies, and government agencies now offer options including microloans for smallholders, equipment financing, and working capital loans structured to align repayment with the cropping cycle.

- Flexible Collateral Alternatives: Recognizing that some farmers lack formal titles, lenders have shifted toward warehouse receipts, future crop contracts, and group guarantees to broaden access.

- Innovative Financial Support: Reduced interest rates, grace periods matched to harvest schedules, and bundled advisory services set Jamestown’s 2025 loan scene apart.

This innovative, adaptive loan landscape enables the region’s farms—from smallholders to commercial operations—to thrive in the face of challenges.

Comparison Table: Sustainable Ag Loan Options, Jamestown (2025)

| Loan Type | Estimated Interest Rate (%) | Funding Limit (USD) | Sustainability Focus | Technology Integration Support | Environmental Impact Score (1-10) |

|---|---|---|---|---|---|

| Microloan for Smallholders | 3.5 – 4.2 | $5,000 | Organic inputs, water conservation | Mobile advisory app, real-time soil data | 9 |

| Equipment Financing | 2.9 – 4.8 | $75,000 | Eco-machinery, renewable energy | Precision ag & IoT devices | 8 |

| Green Infrastructure Loan | 3.1 – 3.9 | $150,000 | Irrigation, renewables, resilience | Satellite monitoring; analytics dashboard | 9 |

| Seasonal Working Capital Loan | 4.0 – 5.5 | $25,000 | Sustainable input sourcing | Digital loan tracking; AI weather risk | 7 |

| Climate-Resilient Crop Loan | 3.7 – 4.3 | $40,000 | Drought, flood resistance, carbon cropping | Satellite-based monitoring | 10 |

| Export-Oriented Agri Loan | 3.8 – 4.9 | $100,000 | Organic, certified produce | Blockchain traceability (More info) | 8 |

| Group Loan with Risk Guarantees | 4.1 – 5.2 | $30,000 per group | Community sustainability projects | Mobile monitoring; group advisory | 8 |

“Modern financing in Jamestown boosts tech adoption—more than 45% of local farms invest in eco-friendly machinery with ag loans.”

7 Powerful Ways to Boost Farming with Ag Loan Jamestown in 2025

Ag loan Jamestown solutions are not static. By 2025, they are designed for maximum impact, focusing on innovation, sustainability, and risk management. Here are seven practical, impactful ways today’s farmers in Jamestown can harness these loans:

1. Investing in Sustainable & Resilient Infrastructure

- Loans now enable farmers to upgrade their infrastructure—drip irrigation systems, solar-powered pumps, weather-proof storage—fostering resource conservation and reducing operational expenses.

- Green infrastructure loans support renewable energy adoption—lowering both costs and carbon footprints. Explore carbon tracking solutions here.

2. Precision Farming Tools & Advanced Equipment

Modern ag loan Jamestown programs provide financial support for:

- Investing in drones, smart sprayers, automated tractors, and IoT-enabled machinery.

- Enabling farmers to adopt precision practices that boost yield, cut wastage, and support sustainable agriculture.

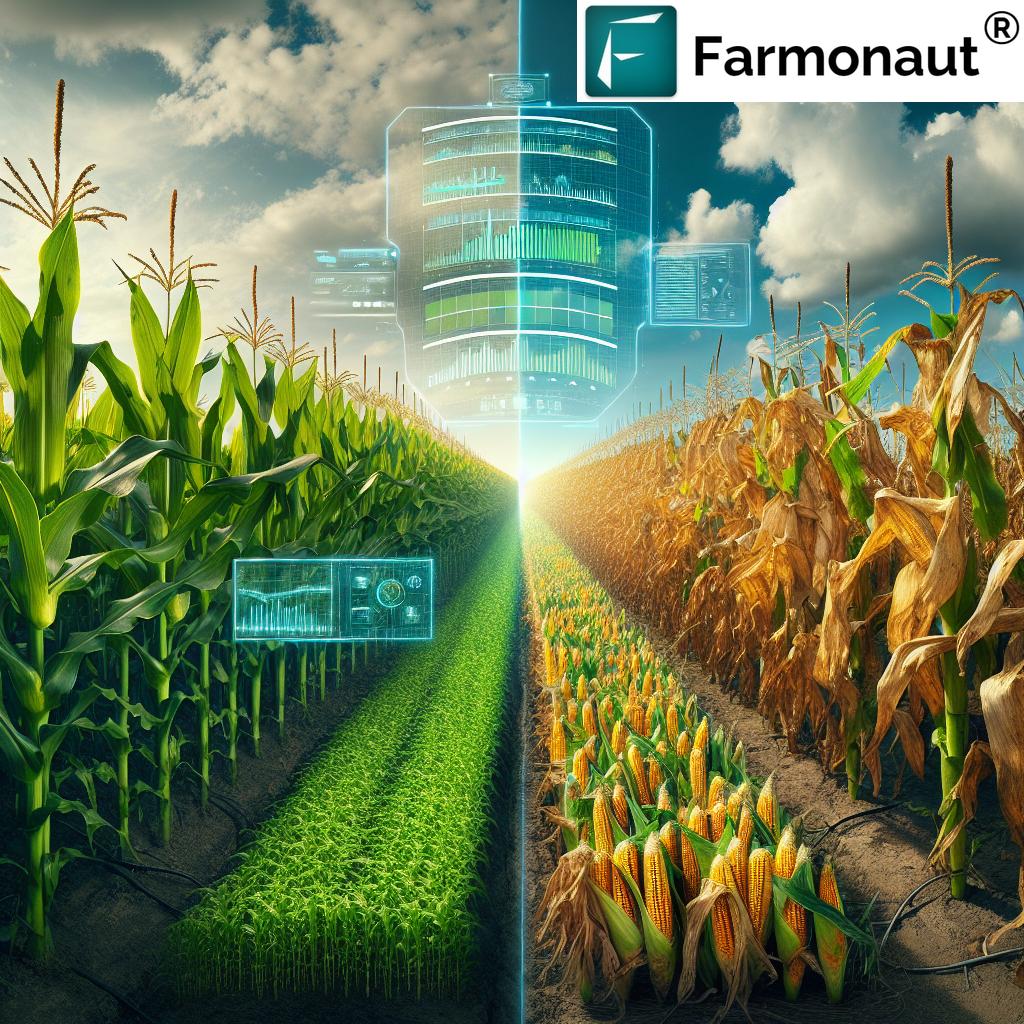

By upgrading equipment, local farms both reduce labor dependency and mitigate weather risks. These tools can be the difference between thriving farms and failed harvests.

3. Data-Driven Decision-Making & Satellite Integration

- Jamestown loans in 2025 often come paired with technology integration—like access to satellite monitoring systems for tracking crop growth, soil health, and resource management.

- Solutions such as Farmonaut’s satellite platform provide real-time insights to optimize inputs, detect risks early, and maximize efficiency. See how digital fleet/resource management supports smart farming.

- Data analytics from these platforms guide loan utilization and reporting, empowering complex decision-making for both farmers and lenders.

4. Climate-Responsive Financing & Risk Management

-

Climate-responsive loans are fast becoming the standard, with added benefits such as:

- Crop insurance linked directly to loan disbursement or renewal.

- Advisory services for weather-risk reduction: drought-resistant varieties, soil moisture forecasting, water management.

- This structure reduces default rates, builds resilience into farmer operations, and supports sustainability efforts across Jamestown.

5. Supporting Sustainable Input Procurement & Crop Traceability

- Agricultural loans increasingly offer terms or benefits favoring certified/organic seeds, eco-friendly fertilizers, and traceability tools.

- Lenders and markets alike prioritize farms that can document their supply chains—using Farmonaut’s blockchain traceability, for instance, to prove authenticity or low-carbon practices.

This not only boosts market access but gives Jamestown’s producers a unique value proposition for premium and export markets.

6. Digital Apps, Remote Monitoring, and API Access

-

Loan application, status-check, and reporting are now easier than ever thanks to digital banking & agri apps.

Download Farmonaut’s web or mobile app for real-time crop and resource tracking: - Businesses or developers? Integrate the API into your systems for streamlined reporting and satellite verification: See Farmonaut’s API, Developer Documentation.

-

Video guide: How to use satellites on WhatsApp for farm monitoring:

7. Flexible Credit With Outcome-Linked Incentives

- Loan repayment terms are increasingly tied to crop cycle outcomes or verified sustainability gains (for example: lower carbon footprint, use of climate-resilient crops).

- Jamestown lenders offer interest rate reductions or rate resets for farms that prove they are adopting sustainable, modern practices.

- Some schemes offer group guarantees and reward timely repayments with higher future credit limits, enhancing community trust and operational growth.

How Farmonaut Technology Empowers Sustainable Financing

At Farmonaut, we are committed to making satellite-driven insights and AI-powered resource management accessible and affordable for the entire spectrum of agriculture. Through our platform, users—including farmers, financial institutions, and government agencies—can leverage:

- Multispectral satellite-based monitoring for tracking vegetation health (NDVI), soil moisture, and infrastructure integrity.

- AI & Jeevn AI Advisory for data-driven, real-time agricultural strategies and weather-risk mitigation.

- Blockchain-based traceability for authenticity in produce, bolstering compliance for loan and export requirements. Read more about traceability.

- Fleet and Resource Management tools for optimizing all aspects of farm operations (Learn about digital fleet management).

- Environmental impact monitoring—including carbon footprint tracking—for regulatory compliance and sustainability reporting. Find out about carbon footprinting.

Our subscription-based platform is flexible—catering to individual users, growing businesses, and government organizations. It includes web, mobile, and API access, so you can connect all your systems seamlessly for loan monitoring, reporting, and operational intelligence.

Want to learn more? Get the complete guide to crop loan and insurance verification through satellite and AI: Crop Loan & Insurance Verification.

Key Challenges and the Future of Agricultural Financing in Jamestown

Despite these advances, several challenges remain in accessing and utilizing ag loan Jamestown options to their fullest:

- Limited Financial Literacy: Many farmers in Jamestown face hurdles with documentation, digital applications, and understanding financial products. Continuous education and expanded advisory support are critical.

- Infrastructure Deficits: Gaps in rural banking connectivity, network coverage, and road logistics can delay loan disbursement and monitoring.

- Risk Management: Extreme weather events and market volatility still threaten timely repayment. Integrating crop insurance with loans remains vital.

- Uptake of Technological Tools: Ongoing support is needed for farmers transitioning to AI/IoT integration in their management and loan utilization.

- Access to Collateral: Evolving collateral models (like group guarantees or warehouse receipts) broaden inclusion, but require careful risk pricing by institutions.

The Future: Integrating Fintech, Data Analytics & AI in Jamestown’s Ag Loans (2025 and Beyond)

- Personalized, AI-Assessed Lending: Automated data analysis and satellite verification will enable precise risk mapping and tailored loan offers.

- Seamless Reporting and Compliance: Digital platforms will let farmers and lenders monitor sustainability compliance, automate paperwork, and support quick disbursements.

- Increased Role for APIs: More APIs and data links (such as Farmonaut’s API) will help governments, institutions, and businesses embed satellite-based validation in every part of the agri-loan process.

- Focus on Long-Term Environmental Impact: Lenders will increasingly require proof of sustainable soil, water, and input management—a process streamlined through digital reports and traceable data.

The next decade will see ag loan Jamestown products and processes merging sustainability, technology, and financial inclusion like never before. Adaptation and education are key.

FAQs: Ag Loan Jamestown & Sustainable Farming Finance

What kinds of agricultural loan options are available for farmers in Jamestown in 2025?

In Jamestown, farmers can access a diverse mix of microloans, equipment financing, green infrastructure loans, climate-resilient crop loans, and working capital lines. Loan options often come with sustainability incentives and are adapted to local operational needs—empowering both smallholders and large commercial enterprises.

How do agricultural lenders in Jamestown approach credit for farmers without formal land titles?

Many institutions accept alternative collateral such as warehouse receipts, future crop contracts, or group guarantees. This enables wider loan access, especially for smallholders or tenant farmers.

What support is available for farmers adopting precision agriculture or climate-smart technology in Jamestown?

Numerous ag loan products are tailored for technology integration, offering support for drones, satellite monitoring, IoT-enabled machinery, and AI-driven advisory platforms. These help farmers boost yields and minimize risk while fulfilling loan requirements for sustainable and efficient practices.

How does Farmonaut help financial institutions and farmers in the loan process?

We provide satellite-based verification, real-time crop monitoring, and AI-powered insights, enabling lenders to assess risk efficiently and farmers to optimize their operations. Our platform also streamlines the loan reporting process, making it easier to comply with both financial and sustainability criteria.

Is it possible for businesses or developers to integrate Farmonaut’s solutions into their agri-finance products?

Absolutely. Our API (see Farmonaut API) and developer docs make it easy to embed satellite and AI data processes into custom financial, insurance, or farm management apps.

How can a Jamestown farmer get started with digital crop & resource monitoring?

Simply sign up for Farmonaut’s platform, available as a web app (web version), Android app (Android), or iOS app (iOS).

Conclusion

Agricultural loans in Jamestown are much more than just financial aids—they are the catalysts for growth, sustainability, and food security in this vital region. With robust support from financial institutions, government agencies, and technology platforms such as Farmonaut, the agricultural sector in Jamestown is poised to secure a sustainable and bountiful future.

By enabling farmers to invest in modern practices, innovative inputs, climate resilience, and digital adoption, ag loan Jamestown options drive productivity while honoring environmental responsibilities. 2025 marks a critical juncture—farming in Jamestown is adapting, integrating, and thriving for the challenges and opportunities ahead.