Table of Contents

- Introduction: Corn Prices Rise Amid Strong Exports in 2025

- 2025 Corn Market Trivias – Quick Facts

- Key Drivers Behind the 2025 Surge in US Corn Prices & Exports

- Trade Dynamics, Major Export Markets & U.S. Trade Policy Shifts

- Climatic Challenges Influencing Corn Supply and Market Volatility

- Technological Advancements: Sustaining Corn Production Amid Volatility

- Year-over-Year US Corn Export & Price Trends Table (2023-2025)

- Economic Ripple Effects: Feed Costs, Inflation, and Beyond Corn

- How Farmonaut Powers Data-Driven Agriculture & Export Competitiveness

- 2025 and Beyond: What Lies Ahead for Corn, Agricultural Exports, and Global Food Security?

- Frequently Asked Questions (FAQ) on Corn Prices, US Exports, and Agricultural Market Trends

Corn Prices Rise: 2025 US Agricultural Exports Up

“In 2025, US corn exports surged by 15%, significantly boosting overall agricultural export values.”

The corn prices rise amid strong exports, farm exports, agricultural exports US is claiming headlines and analyst attention in 2025—and for good reason. Amid evolving trade policies, volatile climate patterns, sustained global demand, and remarkable technological advancements, corn—a critical staple commodity—has experienced a marked increase in export volumes and prices. The United States, as the world’s largest agricultural exporter, sits at the heart of this transformation.

This blog delivers an in-depth analysis of the dynamics shaping the 2025 global agricultural landscape. We’ll examine the drivers boosting corn prices, explore how robust US farm exports define the narrative, unravel the complex interactions between trade, climate, demand, and technology, and demonstrate how companies like Farmonaut provide critical support to the agricultural sector navigating these challenges.

If you’re an agribusiness leader, farmer, supply chain analyst, or tech innovator, understanding these trends will help you anticipate market volatility, respond to emerging opportunities, and build resilience for the future.

2025 Corn Market Trivias – Quick Facts

“Global corn demand reached a record high, pushing US corn prices up by nearly 20% compared to last year.”

- The United States remains the largest corn exporter in 2025, accounting for a significant share of global trade.

- Emerging economies in Southeast Asia & Africa are fueling demand, especially for animal feed and food security programs.

- Adoption of precision agriculture and digital monitoring tools have enabled producers to maintain strong export volumes.

- Trade policies continue to evolve, with new agreements boosting export competitiveness for US farm products.

- Climate variability remains a dominant force, amplifying volatility and underscoring need for adaptive, resilient agriculture systems.

Key Drivers Behind the 2025 Surge in US Corn Prices & Exports

Corn prices rise amid strong exports—this headline is not an isolated market blip in 2025 but a logical result of converging global forces. Let’s explore the key drivers:

1. Global Demand Fueled by Emerging Economies & Population Growth

- Emerging markets in Southeast Asia and Africa—such as Indonesia, Vietnam, Nigeria, and Egypt—are seeing rapid population and income growth in 2025. These nations are expanding their livestock and poultry sectors, drastically increasing corn’s role as the major animal feed.

- Global diets and feed consumption patterns are evolving. Rising prosperity means higher protein intake, with corn being fundamental to feed supply chains.

- Limitations in domestic production—driven by variable weather and resource constraints—push countries to seek imports to meet rising demand.

2. Tightening Global Supply and Climatic Challenges

- Disruptions in main producing regions—droughts in South America, sporadic flooding in the US Midwest, and heatwaves in parts of Europe—have reduced yields or delayed harvests.

- This has tightened global supply, amplifying market volatility and further fueling the climb in prices.

3. Technological Advancements in US Agriculture

- US farmers, empowered by advanced precision agriculture technologies, have maximized yield efficiency, resource management, and crop resilience.

- Innovations such as AI-driven crop monitoring, drought-tolerant seeds, and optimized fertilizer programs allow US producers to meet international demand, even under challenging conditions, thus supporting elevated export volumes.

4. Trade Policy Evolution & Improved Market Access

- New bilateral and multilateral agreements have reduced tariffs, removed previously restrictive quotas, and opened fresh markets in 2025.

- These policy frameworks boost US farm exports—including corn—by improving access and market stability.

5. Market Volatility: 2025 Realities

- Unpredictable weather events and shifting trade relations have created significant price volatility in the corn market.

- However, this volatility has also underscored the importance of resilient production systems and adaptive farming practices.

6. Sustainability and Traceability Are Now Buyer Imperatives

- International buyers in 2025, particularly in Europe and Asia, demand proof of sustainable production and transparent supply chains for agricultural commodities such as corn.

- US exporters who meet these standards, including with help from satellite monitoring and blockchain-based traceability solutions, gain a competitive advantage.

Trade Dynamics, Major Export Markets & U.S. Trade Policy Shifts

Corn’s Central Role Among 2025 US Agricultural Exports

As corn prices rise amid strong exports, corn reaffirms its position as a critical staple among US agricultural commodities. In 2025, corn accounts for a substantial portion of total agricultural exports US—in both value and volume.

- Top export destinations: Mexico, China, Japan, South Korea, Southeast Asian countries (notably Vietnam, Indonesia, Philippines), and growing segments in North and West Africa.

- Policy frameworks: The US leverages recently signed trade agreements that reduce tariffs, harmonize standards for GMO crops, and recognize new biosafety and sustainability protocols.

- Result: Improved access and lower trade barriers, giving US corn a key advantage against South American and European suppliers.

Why Are US Corn Exports Gaining Share in 2025?

- Consistent High Yields: Thanks to technology-driven yield improvements and sound resource management.

- Reliability: US supply chains, supported by modernized fleet and logistics management solutions, have proven resilient, with faster transit and fewer disruptions.

- Compliance: US exporters meet increasingly demanding international buyer standards for traceability, carbon footprint, and sustainability through data-driven platforms.

2025 US Farm Export Highlights

- Most new trade protocols include “sustainability clauses”, which US exporters meet using satellite & blockchain-enabled platforms (such as Farmonaut’s traceability solution).

- Carbon footprinting reporting tools are increasingly integrated into export compliance, adding value for buyers and helping producers access climate-conscious markets.

- Infrastructure investments (port upgrades, rail modernizations) further reduced freight costs and time-to-market.

Climatic Challenges Influencing Corn Supply and Market Volatility in 2025

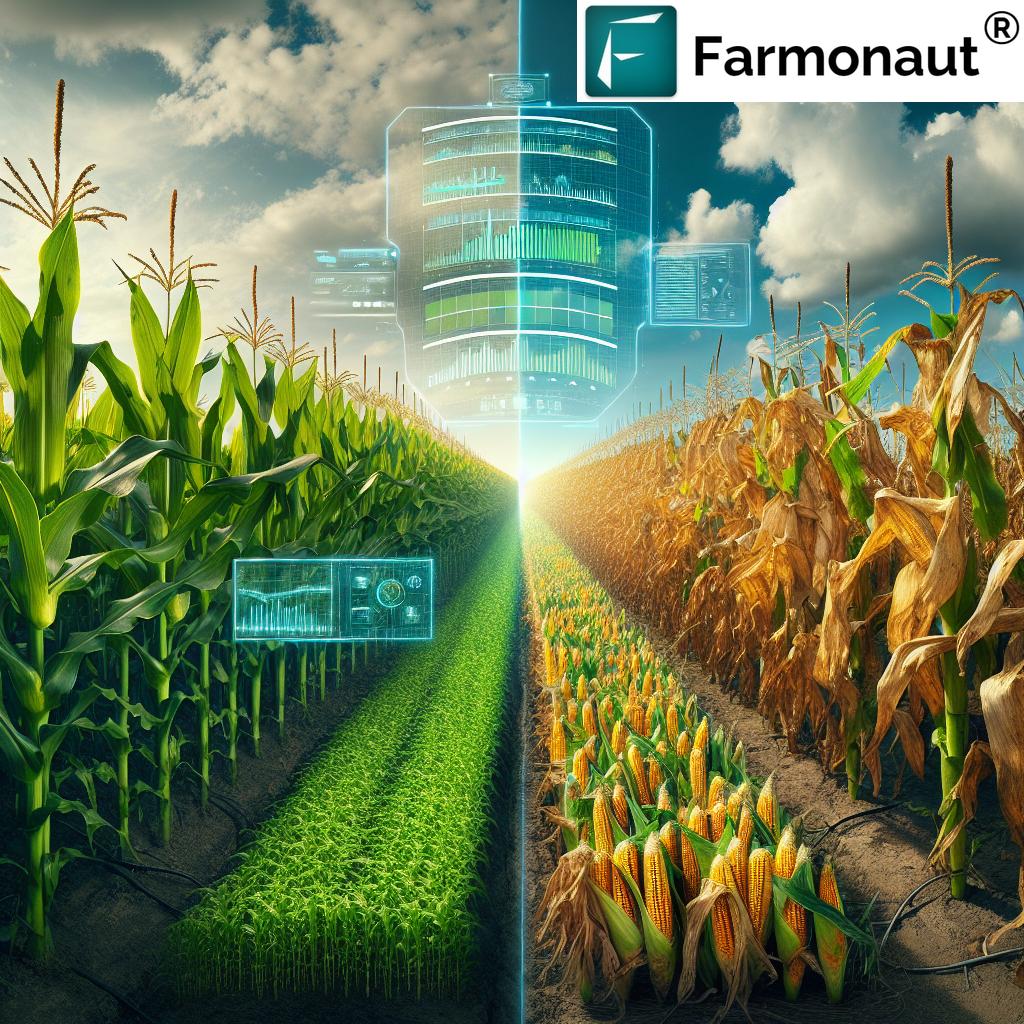

Despite technological progress and market access gains, the biggest wildcard in the corn prices rise amid strong exports narrative remains climate variability.

1. Droughts in South America & Midwest Floods Disrupt Supply

- South America, especially Brazil and Argentina, faced intense droughts in 2024 and early 2025, sharply reducing regional corn output.

- US Midwest experienced sporadic flooding in parts of Iowa, Missouri, and Illinois, impacting planting, delaying harvesting cycles, and slightly constraining national supply.

Satellite-based crop health and weather monitoring systems—like those provided by Farmonaut—are now vital tools for forecasting and adaptation in this unpredictable environment.

2. Variable Weather Patterns and Harvest Cycles

- More frequent and severe weather events have disrupted traditional planting and harvesting schedules.

- Variable rainfall, temperature anomalies, and late frosts demand adaptive management and real-time monitoring.

3. Impact on Other Producing Regions and Global Supply

- Ukraine’s output remains below pre-2022-23 levels due to war-related production bottlenecks.

- China’s corn imports for food security and feed continue at high levels, influenced by erratic domestic weather and feed grain needs.

4. Climate Change Influences Long-Term Supply & Market Volatility

- New climate realities mean long-term production risks remain elevated—amplifying volatility in the corn market and increasing the value of predictive analytics, insurance, and adaptive risk management tools and insurance access.

- Resilient supply chains and diversified sourcing strategies are now cornerstones for exporters and buyers alike.

Technological Advancements: Sustaining Corn Production Amid Volatility

American agriculture’s resilience in 2025 is defined by the rapid adoption of precision agriculture, satellite monitoring, and AI-powered analytics. This technology ecosystem is strengthening the ability of US farmers and exporters to maintain high yields despite climatic uncertainties, optimize input usage, and comply with strict export protocols.

1. AI-based Satellite Monitoring & Decision Support

- Platforms like Farmonaut deliver real-time imagery and AI-based agronomic advice to farmers, agronomists, and exporters across the United States and global agriculture markets.

- This not only maximizes yield but also ensures environmental compliance and farm sustainability—essential for accessing international buyers.

2. Drought-Resistant Seeds and Optimized Input Management

- The rise in seed technologies—developed for drought and pest tolerance—plays a pivotal role in maintaining production even in challenging conditions, directly supporting robust export flows.

- Platforms that monitor and advise on optimized fertilizer and irrigation schedules, such as those built on Farmonaut’s Jeevn AI advisory system, help enhance both productivity and sustainability.

3. Blockchain for Traceability and Authenticity

- The integration of blockchain ensures that exports meet EU and Asian importers’ traceability requirements, boosting trust and opening new premium markets.

- Farmonaut’s blockchain-based traceability solution is helping companies and export managers meet stringent regulatory and buyer norms, building higher market share and premium value.

4. Carbon Footprint Monitoring and Sustainability Credentials

- With carbon emissions and sustainable practices now factored into many bilateral trade agreements, exporters benefit from carbon footprint monitoring tools that validate eco-friendly production across the supply chain.

5. Remote Farm and Large-Scale Operations Management

- Large farms, as well as co-ops and agribusinesses, benefit from large scale farm management solutions—centralizing monitoring across wide geographic areas and multiple crops.

- This approach is foundational for keeping US export pipelines steady, efficient, and compliant.

Year-over-Year US Corn Export & Price Trends Table (2023-2025)

| Year | Estimated Export Volume (Million Metric Tons) |

Estimated Avg Corn Price (USD/ton) |

Key Export Destinations | Notable Global Demand Factors | Technology & Climate Impacts |

|---|---|---|---|---|---|

| 2023 | 45.0 | $240 | Mexico, Japan, China, South Korea | Moderate growth in Asia & Latin America, steady livestock production | Adoption of basic precision ag; normal Midwest weather |

| 2024 | 47.2 | $255 | China, Vietnam, Mexico, South Korea | Stronger Asian demand, early droughts in Brazil cutting competition | More advanced AI crop monitoring, Midwest flooding begins |

| 2025 (Est.) | 54.3 | $305 | China, Mexico, Indonesia, Vietnam, Egypt | Major surge in animal feed demand, premium for traceable/sustainable corn, tight global supply | AI-driven precision ag, satellite monitoring, blockchain, adaptive schemes for drought/flood |

Economic Ripple Effects: Feed Costs, Inflation, and Beyond Corn

While corn prices rise amid strong exports benefits US producers, the effects spread throughout the US and global food sector—and not always positively for every stakeholder.

1. Impact on US Livestock Producers and Domestic Food Prices

- Feed costs for cattle, pork, poultry, and dairy operations have climbed in 2025, reducing profit margins for ranchers and potentially leading to higher consumer prices for meat and dairy.

- Policymakers are challenged to balance export growth with food inflation, considering interventions or support to mitigate impacts on domestic food affordability.

2. Grain Elevators & Supply Chain Surge

- Grain elevators and processing plants are witnessing increased throughput, spurring investments in additional capacity and logistics automation.

- Transportation infrastructure and fleet upgrades—from rail lines to river barges—improve handling of surging export volumes.

3. Rural and National Economic Benefits

- Rural economies experience a positive uptick in 2025, with higher farm incomes, greater employment, and associated service sector growth.

- At the national level, rising agricultural trade surpluses help stabilize the balance of payments and support the US dollar.

4. Heightened Focus on Farm Risk Management and Insurance

-

In the face of volatility and unpredictable weather, farmers and lenders are increasingly leveraging

satellite-verified insurance and crop loan platforms to guard against losses and smooth out income volatility.

“In 2025, US corn exports surged by 15%, significantly boosting overall agricultural export values.”

How Farmonaut Powers Data-Driven Agriculture & Export Competitiveness

At Farmonaut, we recognize that export and supply chain competitiveness in 2025 hinges on turning real-time data, remote monitoring, and analytics into actionable insights for the entire agriculture sector. Our satellite-powered platform is built for this new era, supporting US producers, exporters, and agri-businesses to:

-

Monitor vegetation health, soil moisture, and carbon impacts in real time,

ensuring optimal yield and sustainability for global buyers. -

Integrate blockchain for traceable, secure, and transparent export documentation,

meeting the highest international standards. - Leverage Jeevn AI Advisory for hyper-local, adaptive crop management—minimizing yield risk amid climate volatility and optimizing input use for profitability and compliance.

-

Enhance transportation and fleet efficiency with our

fleet management tools,

lowering shipment costs and boosting responsiveness across the US grain corridor. - Support financial access for farmers and lenders through satellite-verified insurance and loan documents, reducing risk and increasing lending efficiency.

For developers or businesses seeking to integrate real-time satellite or weather data into their own platforms or apps, our Farmonaut Satellite API and Developer Documentation make streamlined integration simple and robust.

2025 and Beyond: What Lies Ahead for Corn, Agricultural Exports, and Global Food Security?

Market Outlook & Volatility in 2025-2026

- Analysts project continued price volatility for corn, influenced by ongoing climate tumult, geopolitical maneuvering, and rapid demand evolution.

- US farm exports are expected to remain strong, with further room for premium growth in traceable, sustainably certified, and value-added segments.

- Supply chain resilience—underpinned by digital platforms & smart logistics—will remain a key factor in sustaining export volumes.

Role of Technology & Sustainability

- Farmonaut foresight: As technology leaders, we are committed to empowering resilient, data-driven agriculture from planting to export, ensuring that US and global agri-ecosystems thrive in uncertainty.

- Adoption of satellite, AI, and blockchain tools will only deepen, becoming an integral part of how crops like corn are monitored, certified, and exported worldwide.

Balancing Trade, Domestic Needs & Food Security

- Export policy makers will need to continue balancing global market opportunities with domestic food system stability—especially regarding inflation, feed costs, and nutritional access.

- Rural economic investment and support for adaptive farming remain crucial, ensuring prosperity and food security from the Midwest to emerging markets.

Emerging Opportunities

- Premium corn markets—those offering sustainability, traceability, or unique seed genetics—will continue commanding higher prices and export volumes.

- AI-powered farm management and blockchain traceability will become differentiators for buyers seeking quality and compliance.

FAQ: Corn Prices, US Exports, and the 2025 Agricultural Market

Why did corn prices rise so sharply in the US export market in 2025?

Corn prices climbed in 2025 due to a combination of surging global demand—especially from rapidly growing Southeast Asian and African economies—supply disruptions from climate volatility in key regions (US Midwest floods, South American droughts), and advances in US export competitiveness through technology and trade policy improvements.

Which countries are the biggest buyers of US corn in 2025?

Top buyers in 2025 include China, Mexico, Indonesia, Vietnam, and Egypt, along with stable demand from Japan and South Korea. Demand is strongest in countries with large livestock sectors and limited domestic production capacity.

How has technology influenced US corn production and exports?

US farmers have adopted precision agriculture, satellite monitoring, and AI-based advisory systems to maximize yield, optimize resource use, and meet strict international export standards. Blockchain and carbon footprinting also boost sustainability and traceability, opening premium markets worldwide.

What are the main risks for US agricultural exports in 2025 and beyond?

Key risks include:

- Climate volatility (droughts, floods, heatwaves disrupt yields and supply chains)

- Export policy shifts or tariff changes by importing countries

- Rising domestic feed and food costs impacting consumer prices

Effective risk management, diversification, and adoption of technology are essential for sustained success.

What role does Farmonaut play in supporting US farm exports and the corn supply chain?

At Farmonaut, we provide satellite-driven real-time monitoring, AI-powered advisory systems, and blockchain-based traceability for US and global farmers, agribusinesses, and export managers. These tools reduce risk, boost productivity, ensure compliance, and open access to high-value, traceable markets, directly strengthening the export competitiveness of US agricultural producers.

Are there specific tools for large-scale farm or plantation management?

Yes. Our large-scale farm management solutions allow operators of extensive agricultural holdings to centralize and streamline all operations—boosting efficiency and compliance for large-volume exports.

How can developers or data scientists access satellite or weather data from Farmonaut?

Developers and analysts can utilize the Farmonaut API and reference our comprehensive developer docs to integrate satellite, weather, and crop health insights directly into their platforms, mobile apps, or custom analytics tools.

Conclusion: Corn Prices Rise and US Agricultural Export Strength in a 2025 World

The rise in corn prices amid strong US farm exports in 2025 illustrates the powerful forces shaping today’s agricultural markets: evolving global demand, relentless climate challenges, cutting-edge technology, and forward-looking trade policies. The United States remains pivotal as a supplier—thanks to resilient farmers and a supply chain now supercharged by digital and AI-driven solutions.

At Farmonaut, we are dedicated to providing the satellite-powered insights, AI advisory, and transparent systems that help ensure America’s agricultural exports not only survive—but thrive—in a rapidly transforming world. From the fields of Iowa to ports in Asia and Africa, corn and technology will continue to play a central role in feeding the globe and powering rural economies for years to come.