Global Commodity Markets Tumble: How Trade Wars and Tariffs Are Shaping Economic Growth in 2023

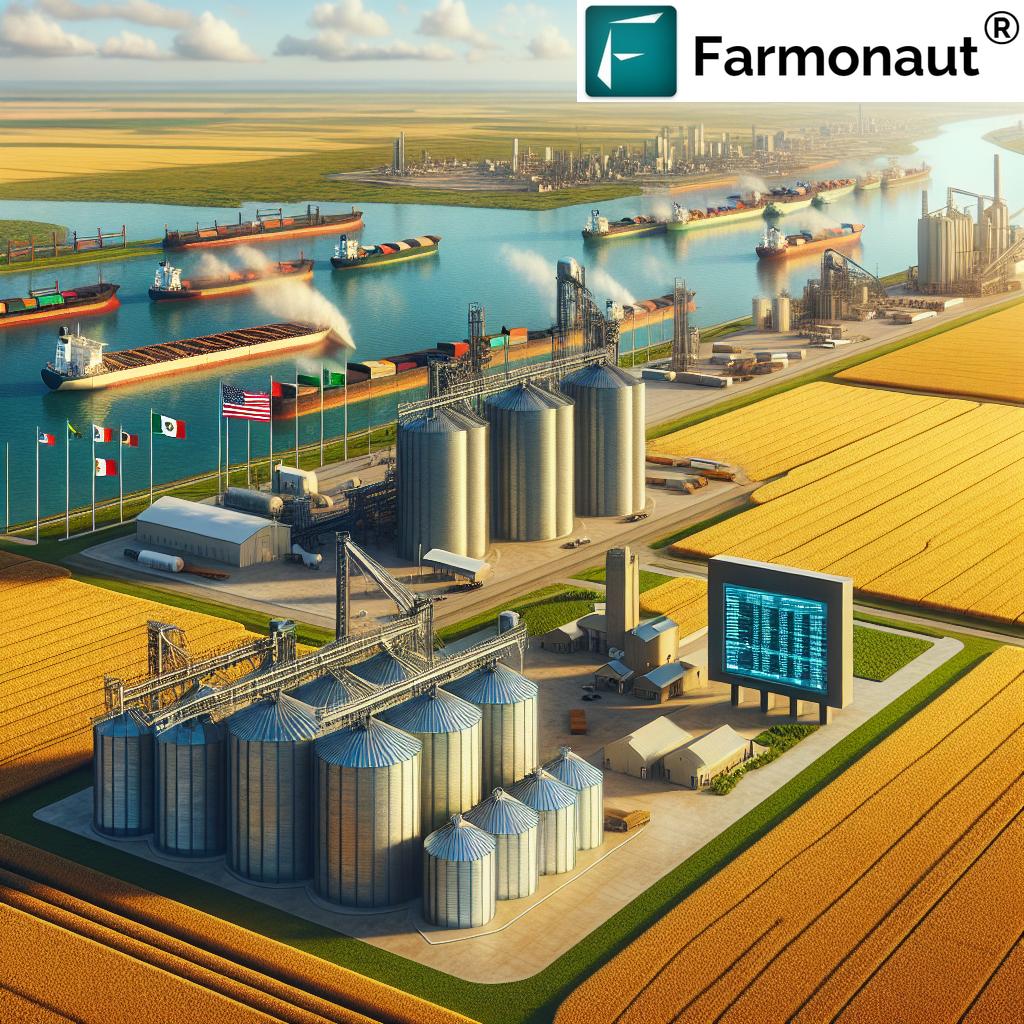

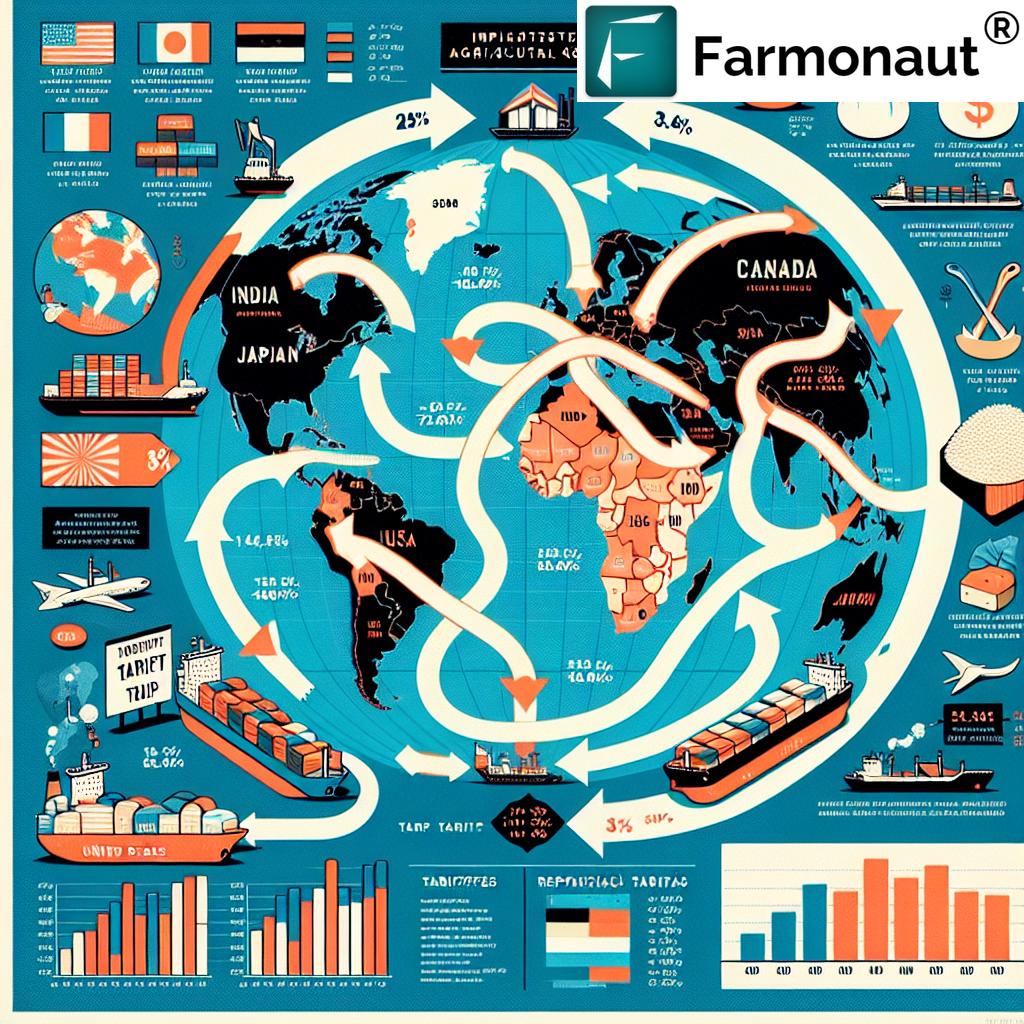

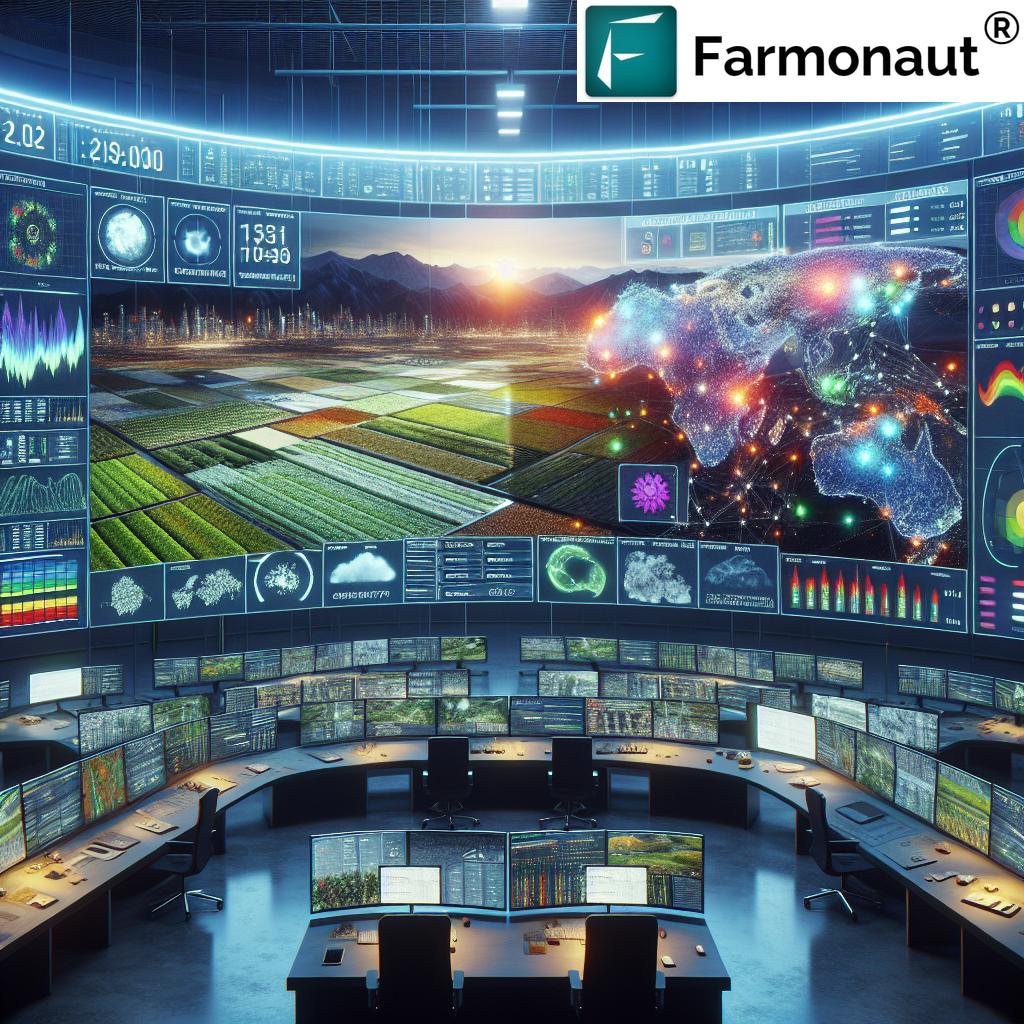

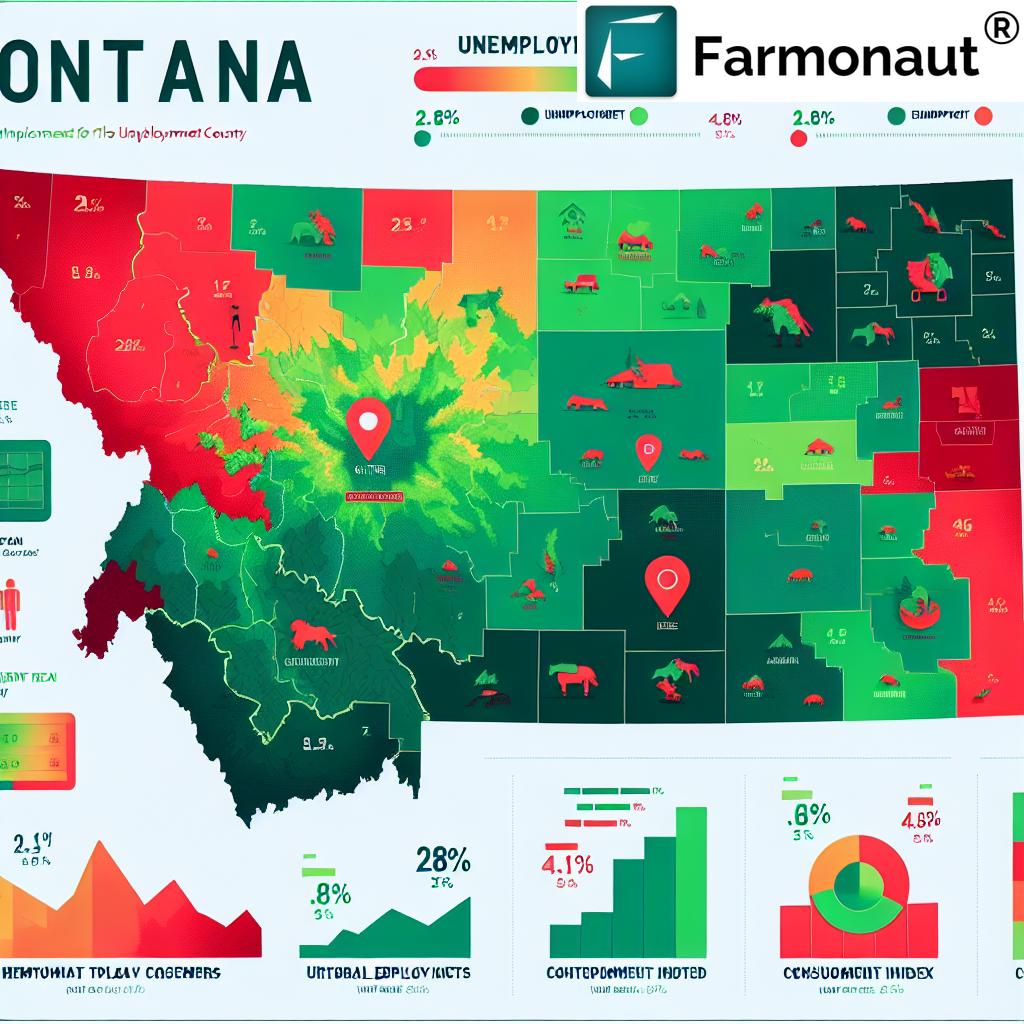

Global commodity markets face turbulence as oil prices and demand for goods plummet amid escalating trade tensions and fears of a global recession. The impact of aggressive tariffs on the global economy has sent shockwaves through various sectors, including agricultural exports and industrial commodities. Soybeans futures and other agricultural products are particularly vulnerable to potential retaliatory measures from major importers. Meanwhile, crude oil price fluctuations reflect concerns about weakening fuel demand in a slowing economic landscape. Investors are closely monitoring commodity market trends in 2023, with copper and aluminum markets feeling the pressure of reduced industrial activity. As economic uncertainty grows, gold prices have surged, highlighting its role as a safe-haven asset. This comprehensive analysis explores the intricate relationship between global economic growth, commodity demand, and the far-reaching effects of the ongoing trade war on markets worldwide.