Agricultural Land REIT: Top 7 Ways to Boost Income

“Over $30 billion is invested globally in agricultural REITs, offering stable returns and portfolio diversification.”

Organic farmland REITs have grown by 15% annually, outpacing traditional real estate investments.

Summary: Understanding Agricultural Land Real Estate Investment Trusts (REITs)

Agricultural land REITs (Real Estate Investment Trusts) are specialized vehicles created for investors to gain exposure to the farmland real estate sector. These investment trusts own, manage, and lease portfolios of productive agricultural properties while distributing income as dividends. By investing in farmland REITs, individuals can participate in the agricultural market without the complexities and capital requirements of direct land ownership. Such investments offer stable income streams, portfolio diversification, an inflation hedge, and potential for land appreciation—making them increasingly attractive in today’s dynamic investment landscape.

Let’s explore how we can leverage the key income-boosting strategies within agricultural land investment using REITs, with practical examples, technological insights, and current market trends.

Featured Video: How Farmonaut’s Satellite Technology is Revolutionizing Land Use in Agriculture

Unlocking Soil Organic Carbon: The Secret to Sustainable Farming with Farmonaut

Structure and Functioning of Agricultural Land REITs

Agricultural REITs operate by acquiring and managing portfolios of farmland properties across different states and crop categories. The typical structure includes the following key aspects:

- Ownership & Management: The REIT owns the real estate property (the farmland), handles administrative management, and oversees its productive use.

- Leasing to Operators: Farmland is leased to skilled farmers or agricultural operators, often under long-term lease agreements (including triple-net leases where operators cover most expenses).

- Income Generation: Rental income generated from leasing is distributed to investors as dividends, forming a stable income stream.

- Regulatory Structure: To qualify as a REIT, the company must adhere to strict regulations, including:

- At least 75% of assets invested in real estate

- At least 75% of gross income from real estate (rents, mortgage interest, or sales)

- Distributing at least 90% of taxable income to shareholders annually

This structure provides several benefits for investors, such as giving them a way to diversify their portfolios with a unique asset class and to gain returns from stable, income-generating properties in a sector less correlated with traditional financial markets.

Key Players in the Agricultural Land REIT Market

The United States has witnessed the growth of several prominent agricultural REITs. Two companies stand out for their market presence and distinct investment strategies:

-

Farmland Partners Inc. (FPI):

As of June 25, 2025, FPI’s stock price is $11.37. FPI operates with a diversified portfolio including row crops (corn, soybeans, wheat) and specialty crops such as citrus and other fruit trees. FPI also offers farm management services and has invested in renewable energy projects (solar and wind), enhancing land value and providing extra income streams.

Learn more about FPI -

Gladstone Land Corporation (LAND):

LAND, at $10.17 per share as of June 25, 2025, focuses mainly on fresh produce farms: berries, leafy greens, almonds, apples, olives, pistachios, grapes, and more. It emphasizes long-term, triple-net leases that provide stable cash flows and capital appreciation opportunities. LAND is also known for significant commitments to organic and sustainable farming investments.

Explore Gladstone Land

These players have established significant holdings across various agricultural states and sectors, offering investors a tested route to participate in the future of farming through REITs.

Comparative Benefit Table: Top 7 Ways Agricultural Land REITs Boost Income

| Method | Estimated Annual Yield/ROI (%) | Market Trend | Barrier to Entry | Brief Description |

|---|---|---|---|---|

| Rental Yield Optimization | 4-6% | Stable | Low | Enhance income by negotiating premium rents and using long-term, secure leases with top-tier farmers. |

| Crop Diversification | 5-8% | Growing | Medium | Invest in farms producing various crops (row & specialty) to spread risk and benefit from multiple agricultural cycles. |

| Eco-Tourism & Agri-Tourism | 2-5% | Emerging | High | Create extra value by inviting public or educational tourism to productive agricultural properties. |

| Organic Certification | 6-10% | Rapidly Growing | Medium | Transition to organic farming for higher crop prices, alignment with sustainability trends, and premium leases. |

| Carbon Credits & Environmental Services | 2-4% | Growing | Medium | Utilize carbon sequestration & environmental initiatives to generate credits, boosting overall return. |

| Land Appreciation | Varies (2-6%+) | Stable Growth | Low | Farmland values typically grow over the long-term, adding capital gains alongside annual income. |

| Alternative Investments (Platforms) | 4-9% | Expanding | Medium | Participate via fractional ownership through online platforms, accessing diverse farm types and markets. |

The Top 7 Ways Agricultural Land REITs Can Boost Income

1. Rental Yield Optimization

Rental yield forms the backbone of income from farmland investments. REITs maximize this by:

- Signing long-term leases with experienced farmers or operators for extra stability.

- Using triple-net lease models, where the operator pays property expenses, ensuring a predictable net stream.

- Re-assessing rents in line with land value & local trends, boosting returns while keeping vacancy rates low.

Example: Gladstone Land Corporation emphasizes triple-net leases, which produce steady, inflation-protected dividends.

Farmonaut also supports landowners and farmers by providing tools to manage large-scale farms efficiently, monitor asset performance, and optimize rental negotiations.

2. Crop Diversification (Row & Specialty Crops)

Diversifying crop production reduces risk and can increase annual ROI. Examples include:

- Balancing row crops (corn, soybeans, wheat) with specialty citrus and fruit tree operations.

- Adapting to market demand trends by quickly transitioning fields between high-value produce or permanent crops.

- Rotating crops to enhance soil health and meet organic certification standards (which further increases income).

Modern agricultural REITs like FPI and Gladstone Land Corporation select properties across various U.S. states and climate zones, maximizing diversification and minimizing weather or market shocks for their investors.

3. Eco-Tourism and Agri-Tourism Ventures

Some farmland REITs are exploring eco-tourism and agri-tourism as new sources of revenue. Methods include:

- Hosting tours, markets, and educational events on organic or specialty crop farms.

- Partnering with local businesses or schools for seasonal programs (harvest festivals, pick-your-own, farm stays).

- Leveraging unique farm features (orchards, vineyards) to attract tourism, especially in states like California and Oregon known for wine grapes and specialty fruit.

While still an emerging strategy, this can generate extra income, boost asset value, and build community support for sustainable farming.

4. Organic Certification & Premium Leases

The organic farming investment trend is growing rapidly, with REITs transitioning traditional land to organic to:

- Command higher lease rates from organic operators (producing berries, nuts, leafy greens, etc.)

- Meet rising consumer demand for sustainable, traceable food sources

- Qualify for sustainability and ESG-focused investment capital

Example: Gladstone Land is increasingly acquiring farms with a focus on organic and sustainable practices, responding to consumer and market trends.

For owners and large farms seeking organic certification, platforms like Farmonaut Traceability can assist in providing transparent, blockchain-based solutions that simplify certification and build trust in food supply chains.

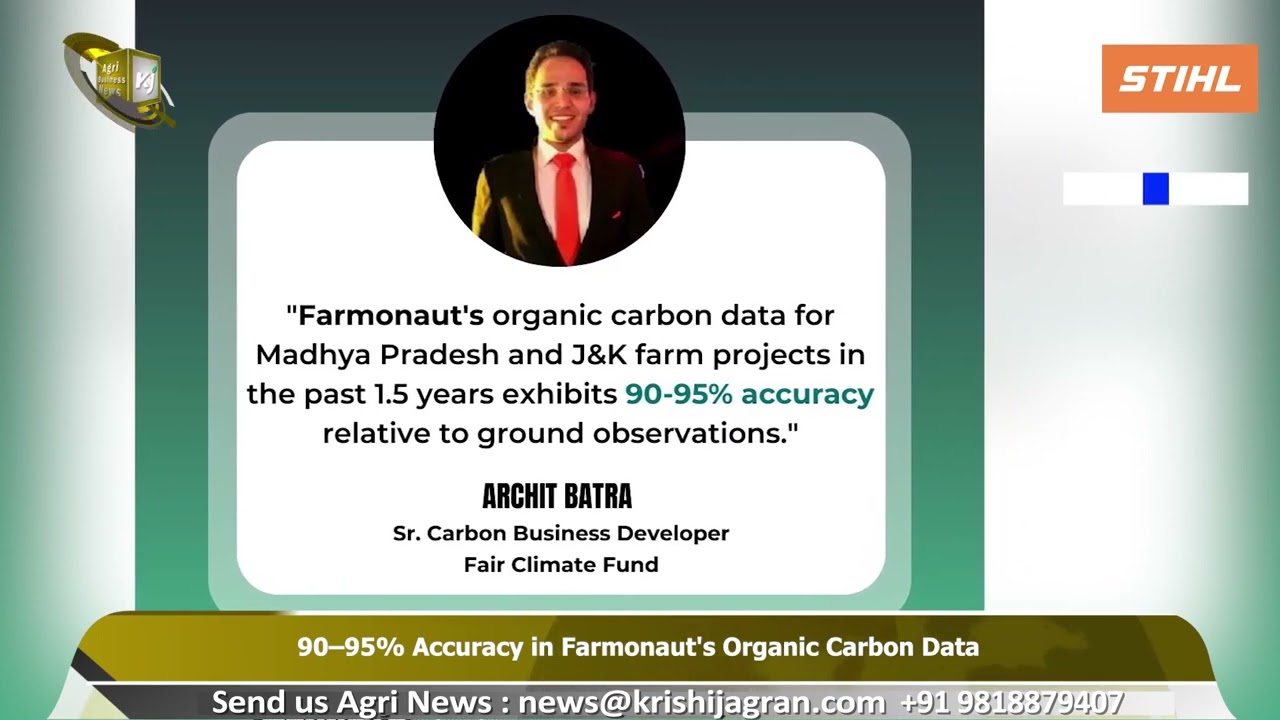

Farmonaut® | 90-95% Accuracy in Organic Carbon Data From Farmonaut

5. Carbon Credits & Environmental Services

Modern farmland management is increasingly linked to environmental performance. Agricultural REITs can boost overall income by:

- Enrolling farms in government or private carbon credit markets for carbon sequestration and sustainable land stewardship.

- Offering environmental services like conservation leases, pollinator habitats, and riparian restoration, which may attract public grants or compensation.

- Positioning portfolios for future sustainability requirements and green investment demand.

Tools like Farmonaut’s Carbon Footprinting Platform help farmers and agricultural asset managers track, verify, and monetize environmental improvements with real-time satellite data.

6. Land Appreciation

Besides cash flow, agricultural REIT investors profit from capital appreciation over time as land values rise due to:

- Conversion pressures (urban expansion, renewable projects like solar/wind farms)

- Market-driven scarcity of high-quality arable land

- General inflation, which agricultural land historically outpaces (70% correlation with U.S. CPI)

Leveraging this trend, investors benefit from both steady annual dividends and long-term growth in asset value.

Interested in measuring land improvements and asset growth? Farmonaut’s platform delivers precision data and crop advisory for both smallholders and large asset managers.

7. Alternative Investments Platforms for Farmland

Alternative investment platforms like AcreTrader and FarmTogether extend ownership opportunities beyond traditional REITs by:

- Allowing investors to buy fractional shares in specific, vetted farms (row, specialty, or organic).

- Reducing minimum capital requirements relative to buying land outright, making farmland investing more accessible to individuals.

- Distributing ongoing income and any appreciation directly, usually after management and platform fees.

These alternative models increase liquidity, provide greater choice in asset mix, and promote transparency in rural real estate investing.

Learn more about alternative agricultural platforms.

“Organic farmland REITs have grown by 15% annually, outpacing traditional real estate investments.”

Technological Advancements & Organic Farming Investment Trends

The Role of Technology in Boosting Agricultural REIT Performance

Advancements in agricultural technology are transforming how farmland is managed and how value is created for both REIT managers and investors:

- Satellite-Based Crop Monitoring: Remote real-time data helps optimize irrigation, fertilization, and yield forecasting, reducing risks and costs.

- AI-Driven Advisory Systems: Automated insights for crop rotation and precise farm management, supporting both traditional and organic farming.

- Blockchain-Based Traceability: Ensures food origin, building value for organic certification and specialty crop operations.

- Resource Optimization: Efficiently manage labor, fleets, and compliance with modern tools.

Welcome to the Future of Farming with JEEVN AI | AI Based Personalized Farm Advisory

At Farmonaut, we’re making these innovations accessible to all farms by offering satellite-based management and API platforms for integration with any real estate or agribusiness operation. Developers, agribusinesses, and even government institutions can access detailed developer documentation to build custom solutions for scalable, data-driven farm investments.

Organic Farming Investment Trends & ESG Appeal

The demand for organic farmland is at historic highs:

- More REITs are acquiring properties certified for organic produce (berries, nuts, vegetables), capitalizing on retail and export trends.

- Organic crops demand premium prices, with long-term leases to trusted operators further stabilizing returns.

- Meeting ESG (Environmental, Social, Governance) criteria draws in socially conscious capital and institutional investors.

REITs and investment managers can use solutions like Farmonaut’s traceability tools to simplify organic certification audits and improve stakeholder confidence in sustainable and responsible farm management.

Alternative Investment Platforms for Farmland

Beyond listed agricultural REITs, a new generation of alternative investment platforms is making farmland ownership and exposure even more accessible:

- Online platforms select and manage agricultural properties, opening up fractional “crowdfunded” investment to accredited (and sometimes retail) investors.

- Examples include buying shares in Midwest row crop farms, California almond orchards, or Texas cattle pastures—each with their own risk/return profile.

- Ongoing costs and management fees are transparent, and regular income is distributed from crop/rent revenue (net of fees).

Investors benefit by diversifying their portfolios, participating in land appreciation and crop cycles, and accessing a sector traditionally out of reach without large capital investments.

Want to dig deeper? Read more about farmland REIT platforms and Farmonaut’s own management tools for asset tracking and portfolio optimization.

Farmonaut’s Flexible Subscription Options

At Farmonaut, we offer subscription packages tailored to the needs of individual farmers, agribusinesses, and large-scale asset managers. With scalable, affordable pricing, users can monitor thousands of hectares or just a single field—empowering smarter, more profitable, and sustainable farmland investing.

FAQs: Agricultural Land REITs & Farmland Investing

What is an agricultural land REIT?

An agricultural land REIT (Real Estate Investment Trust) is a company that owns, acquires, and manages agricultural farmland properties. It leases them out to farmers and distributes income, mainly as dividends, to shareholders. This allows investors to participate in the agricultural sector without directly buying or managing farms.

How does income from farmland investments differ from traditional real estate?

Agricultural REITs generate income through farm leases rather than apartment or office rentals. Their income streams tend to be more stable and less correlated with stock markets. Additionally, they offer exposure to commodity price trends, crop cycles, and inflation hedges.

Are agricultural REITs a good hedge against inflation?

Yes. Historical data shows farmland value moves with inflation; in the US, there’s a 70% correlation between farmland appreciation and CPI, providing an effective automatic hedge.

What risks should investors consider?

Risks include commodity price volatility, climate/weather effects, market or regulatory changes, and REIT management fees. Careful due diligence on each REIT’s portfolio, strategy, and fee schedule is essential before investing.

Can I invest in farmland if I have a small capital?

Yes. Alternative investment platforms for farmland such as AcreTrader or FarmTogether allow fractional investments, enabling exposure for as little as a few thousand dollars.

How can technology help me manage or monitor agricultural land investments?

Innovative solutions like Farmonaut offer satellite-based crop health monitoring, AI-driven advisory, and blockchain traceability, helping both owners and tenants optimize operations, track environmental performance, and increase returns.

What does it take for farmland to become certified organic?

Farmland must meet stringent standards for pesticide, fertilizer, and soil management. Certification typically takes 3 years and requires comprehensive documentation. Farmonaut’s Blockchain Traceability provides secure, transparent records—making the process smoother for both landowners and REITs.

Conclusion: Unlocking Value in Agricultural Land Investment

Agricultural Land REITs and farmland real estate investment trust vehicles offer a unique, attractive opportunity for both new and seasoned investors. By focusing on strategic rental agreements, crop diversification, organic farming shifts, carbon credits, land appreciation, and new alternative investment platforms, investors can unlock robust income and long-term growth in one of the world’s oldest industries.

Trends like organic certification, environmental services, and the integration of technology are redefining the possibilities for stable agricultural investment. With the right research and tools, such as Farmonaut’s AI-driven farm management platform and open API, every investor—from individuals to large institutions—can diversify their portfolio, improve returns, and positively impact global food systems.

Useful Links & Resources:

- Farmonaut Large Scale Farm Management App – Enhance farm productivity and streamline asset operations with real-time satellite insights for large holdings.

- Farmonaut Carbon Footprinting – Track, manage and reduce the environmental impact of agricultural lands. Ideal for ESG-focused farmland investing.

- Farmonaut Product Traceability – Ensure the origin and organic status of farm produce, supporting certification and brand value.

- Get Started with the Farmonaut Platform – Access crop health monitoring, advisory, and more for diversified real estate portfolios.

- Farmonaut Satellite & Weather API – Integrate field intelligence into any agri-finance, REIT, or management platform.

- Fleet Management for Agribusiness – Optimize agricultural logistics, lower operating costs, and improve land utilization.

- Crop Loan & Insurance Verification – Satellite-backed risk assessment for agri-finance and insurance providers.

Ready to invest smarter in agricultural land? Leverage technology-driven management, stay informed of market trends, and diversify your investments for greater growth, resilience, and sustainability in the world of agricultural land REITs.