Farm Equipment Lease to Own: 5 Powerful Benefits for Farmers

Meta Description: Farm equipment leasing offers farmers financial flexibility, access to the latest machinery, and key tax benefits. Learn the 5 most powerful advantages of lease-to-own models, and compare leasing vs. purchasing for your agricultural needs.

“Over 60% of farmers improve cash flow by choosing lease-to-own equipment financing over outright purchases.”

Understanding Farm Equipment Leasing

For modern farmers facing rising costs and rapidly changing technology, choosing the right financial model for acquiring agricultural machinery is crucial. Farm equipment leasing is a flexible and potentially cost-effective arrangement that allows farmers to use the latest farm equipment without the substantial upfront costs associated with purchasing outright.

Farm equipment leasing involves entering into a contractual agreement with a lessor. The farmer pays periodic payments for the use of machinery during a specified period. At the end of the lease term, the lessee can opt to purchase, renew, or return the equipment.

This model has gained significant popularity, especially among farmers who wish to enhance cash flow, access the latest technology, or benefit from certain tax advantages. However, it’s essential to weigh these benefits against potential drawbacks, such as the lack of ownership and possible long-term expenses.

Key Focus: Farm equipment leasing is a finance model where the lessee pays for use over a specific term rather than investing entire capital for ownership at the onset.

Why Lease? Understanding the Agricultural Equipment Lease Landscape

- Cash Preservation & Predictable Payments: Leasing allows farmers to reserve working capital for urgent operational needs and enjoy steady, budget-friendly payments.

- Latest Technology Access: Upgrades and renewals mean access to newer, more efficient equipment without high upfront expenses.

- Tax Planning: Lease payments are often fully deductible, enabling better overall farm tax planning.

Types of Farm Machinery Lease Agreements

Understanding the different types of farm machinery lease agreements is essential for smart financial decisions. There are two primary agricultural equipment lease options:

1. Operating Lease for Farm Machinery

An operating lease (also called a true lease) typically allows the lessee to use the equipment over a set period without the intention of ownership. Here’s what to expect:

- Lower monthly payment vs. finance loan or purchase

- Payments recognized as operating expenses; usually tax deductible

- End-of-term options: renew the lease, purchase at market value, or return equipment

- Ideal for farmers who want new machinery every few years

2. Capital Lease for Farmers (Finance Lease)

A capital lease (or finance lease) is more like taking out a secure loan:

- Typically includes a nominal buyout amount at the end of the term

- Monthly payments are higher, but they contribute toward ownership

- The lessee claims equipment depreciation + interest deductions in tax filings

- Balances desire for equity building and lower initial costs

Summary Table:

- Operating Lease: Low risk, flexible, lower payments, no guarantee of ownership

- Capital Lease: Ownership possible, higher payment, builds equity, better for long-term usage

Choosing between operating and capital lease for farmers depends on operational needs, financial planning, and the desire for ownership at the end of the period.

Farm Equipment Lease to Own: 5 Powerful Benefits for Farmers

“Leasing farm equipment can reduce upfront costs by up to 30% compared to traditional purchasing methods.”

Farmers all over the world are discovering how using a farm equipment lease to own arrangement brings both immediate financial relief and strategic advantages. Let’s dive into the five most impactful benefits:

1. Preservation of Capital

- Leasing vs Buying Farm Equipment: Avoid heavy, upfront costs generally associated with purchasing outright.

- With minimal or no down payment, leasing allows you to keep working capital available for vital operational expenses—such as seeds, fertilizer, fuel, and labor.

- This is especially beneficial for farmers with limited funds or those seeking to expand their operations.

2. Improved Cash Flow and Predictable Expenses

- Regular, fixed payments simplify cash flow management, making monthly, quarterly, or seasonal budgeting much more manageable (vs unpredictable loan terms and interest rates).

- Leasing models can even be matched to harvest cycles or other unique agricultural cash flow needs.

- Leased farm equipment doesn’t tie up credit lines, leaving your farm with more borrowing power for future opportunities or emergencies.

3. Access to the Latest Equipment and Technology

- Leasing allows you to utilize current models and cutting-edge machinery for optimal productivity and efficiency.

- Frequent upgrades with each new lease term help farmers stay ahead of rapidly advancing technology.

- Older equipment may not offer the same fuel efficiency, emissions compliance, or smart farming features as new models.

4. Tax Deductibility and Accounting Advantages

- Farm equipment tax deductions are available as most lease payments can be fully claimed as operational expenses, reducing your taxable income each year.

- This is often simpler and faster than depreciating purchased machinery on your books.

- Consult a tax advisor—leasing can sometimes produce bigger, up-front tax savings compared to equipment purchase depreciation.

5. Flexibility and Reduced Maintenance Burden

- Farm machinery lease agreements offer terms for upgrading, renewing, or changing equipment types to match seasonal or evolving operational needs.

- Depending on the agreement, some maintenance responsibilities may be included or shared with the lessor, helping conserve both time and money.

- Returning or upgrading to new machinery at lease-end avoids long-term aging equipment headaches.

When weighing lease or purchase farm equipment, these advantages can be financially transformative for both smallholder and commercial farms.

Financial Implications: Leasing vs Buying Farm Equipment

Selecting between agricultural equipment lease options and owning farm machinery outright is both a financial and operational decision. Here are core factors every farmer should consider to optimize their investments:

Cost Structure & Upfront Expenses

- Leasing minimizes or eliminates the need for a large upfront payment.

- Purchasing typically requires a significant down payment—sometimes as high as 20-30% of the equipment’s price.

- Preservation of capital is a major benefit for those with limited funds or competing working capital needs.

Payments, Maintenance, & Long-Term Cost

- Lease payments are stable and predictable.

- Loan repayments fluctuate with interest rates and can include future balloon payments.

- Maintenance responsibilities may differ: leases sometimes include basic servicing, while owners take on all costs post-warranty.

- Over an extended period, the total cost of leasing may surpass purchase. However, you also gain business flexibility and reduce exposure to aging equipment expenses.

Building Equity vs. Flexible Renewal/Return Options

- Purchasing builds equity and increases net worth.

- Leasing does not build equity, but at the end of the term you may have the option to buy for a nominal amount, renew, or return the equipment.

- For farmers who prefer to own assets outright and use equipment for an extended period, buying may make more sense.

Tax Benefits and Deductions

- Lease payments are generally 100% deductible as a business expense, directly reducing taxable income.

- Equipment purchase enables the owner to claim depreciation deductions—spread over several years for tax relief.

For the best strategy, consult a tax advisor who understands farm equipment tax deductions and local tax laws. See more on this under FAQ.

Lease vs Purchase: Cost and Benefit Analysis Table

To help you quickly compare the financial advantages of equipment leasing and purchasing, review this structured table outlining key criteria for a typical tractor or combine harvester (example values used, consult your dealer for specifics):

| Criteria | Lease (Estimated Value) | Purchase (Estimated Value) | Key Notes |

|---|---|---|---|

| Upfront Cost | $0 – $2,500 (first lease payment, low/no down payment) | $30,000 – $50,000 (20–30% down payment) | Leasing conserves cash, minimizes initial spend |

| Annual Payment / Installment | $8,000 – $18,000 (fixed; flexible options available) | $15,000 – $25,000 (loan repayment; variable interest) | Leasing offers lower, more predictable payments |

| Maintenance Expenses | Basic/partial coverage included in some leases | All costs on owner after warranty expires | Lease may reduce unexpected repair costs |

| Tax Benefits | Lease payments are fully deductible as business expense (consult tax advisor) | Depreciation and interest deductions over several years | Lease may provide larger, immediate tax deductions |

| Equipment Upgrade Frequency | Every 3–5 years (renew lease, access latest models) | Every 8–12 years (may hold equipment longer) | Leasing allows access to new technology more often |

| Impact on Cash Flow | Positive – cash preserved for other operational needs | Negative – large initial outlay, periodic higher payments | Leasing gives more financial flexibility |

Key Takeaway: Leasing is optimal for those seeking flexibility, lower upfront costs, and access to the latest farm equipment. Purchasing is beneficial for those who value ownership, equipment equity, and long-term use.

Making the Best Equipment Decision for Your Farm

Every farm has unique operational needs—from cash flow cycles to technology requirements and long-term goals. To make the right decision between lease or purchase farm equipment:

Key Factors to Weigh:

- Financial position (cash reserves, borrowing needs, tax planning)

- Farm size & operational intensity (large farms may benefit more from frequent upgrades; smallholders may want asset building)

- Desire for ownership vs flexibility (is building equity important or is adaptability more valuable?)

- Expected usage period (short-term needs = lease; long-term = purchase)

- Tax goals (immediate deduction vs. multi-year depreciation)

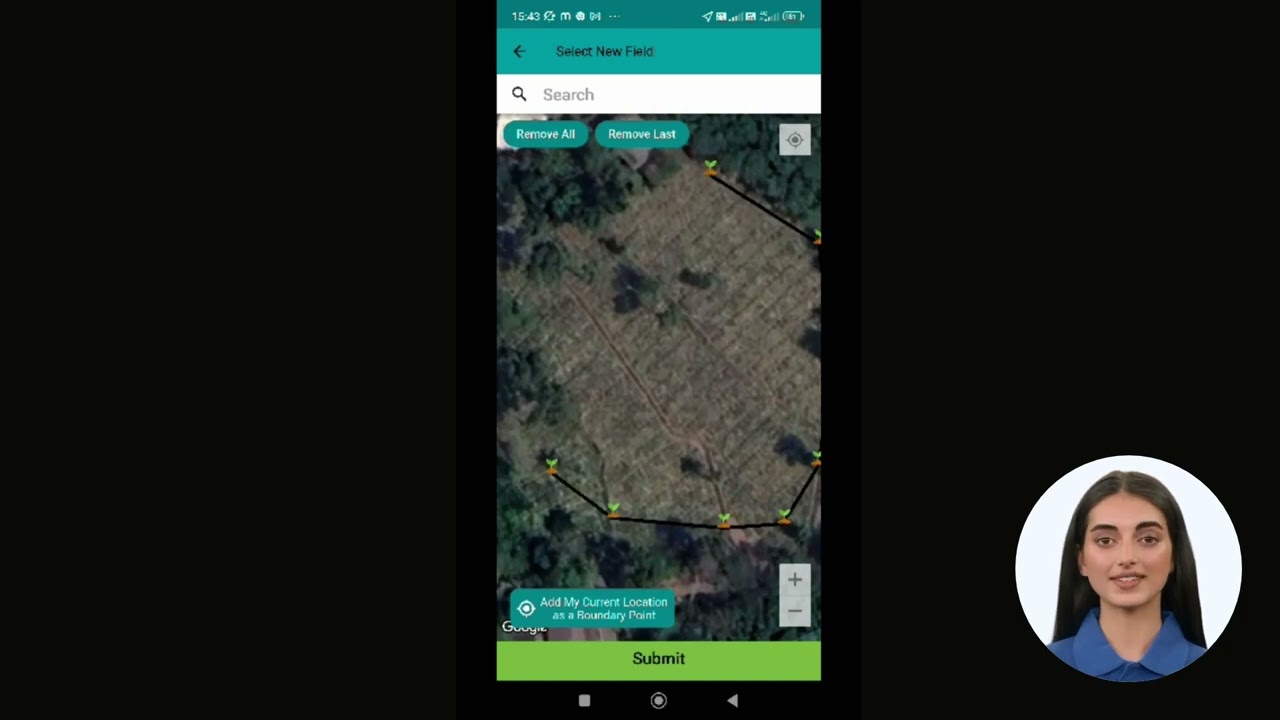

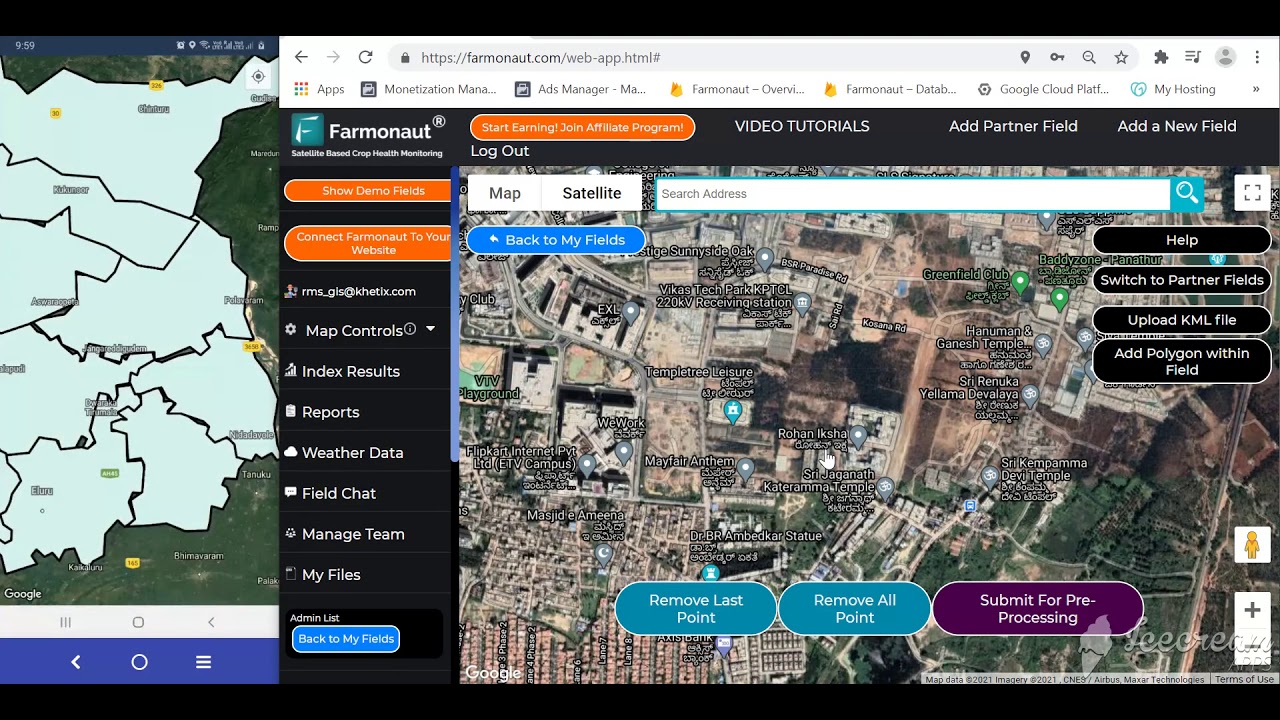

How Farmonaut Empowers Modern Agriculture

At Farmonaut, we understand that precision farming, sustainability, and cost-effectiveness are central to modern agricultural success. While we do not manufacture or sell farm equipment, our mission is to help farmers maximize the value of their assets by integrating satellite-based insights, AI-powered advisory, and efficient farm management tools.

Here’s how Farmonaut adds value, especially when you need to manage leased or owned machinery efficiently:

-

Fleet Management:

Our fleet management platform (Fleet Management) leverages satellite tracking and analytics to help you optimize equipment scheduling and reduce unnecessary fuel costs. This tool is valuable for both owned and leased machinery, enhancing operational efficiency and safety.

-

Crop Health Monitoring:

Our satellite-based solutions give you current crop health data, soil moisture, and pest detection so you can allocate leased or owned machinery more efficiently—boosting productivity and returns.

-

Blockchain Traceability:

For those growing high-value or export crops, our blockchain-based traceability (Product Traceability) guarantees proof of origin and authenticity, which is essential in competitive markets.

-

Environmental Sustainability:

Use Farmonaut’s carbon foot printing tools to monitor and reduce your farm’s carbon output—especially relevant when upgrading to newer, eco-friendly leased machinery.

-

Crop Loan & Insurance Facilitation:

Our satellite verification for crop loans and insurance (Crop Loan & Insurance) ensures seamless access to financing—crucial for those leveraging leasing as part of a comprehensive farm finance strategy.

Through our easy-to-use web & mobile apps, millions of data points help farmers, agribusinesses, and institutions make more data-driven leasing and purchasing decisions worldwide.

For developers and agri-tech integrators, our powerful API and developer docs provide seamless integration for custom analytics, machinery monitoring, weather insights, and more.

Cover your end-to-end farm management and resource allocation needs—no matter which machinery ownership model you choose—with Farmonaut at your side!

Farmonaut Subscriptions

Discover flexible subscription plans for solo farmers, cooperatives, and agribusinesses to maximize efficiency with our satellite and AI-powered farm management tools:

FAQ: Farm Equipment Leasing

Q1: What are the main benefits of leasing farm equipment?

Leasing farm equipment enables farmers to conserve capital, access the latest machinery, structure predictable payments, and often receive full tax deductions on lease payments. Leasing may also reduce the maintenance burden and allow frequent upgrades to newer technology.

Q2: What are typical disadvantages of farm equipment leasing arrangements?

Potential drawbacks include the lack of ownership (no equity built), long-term cumulative cost, possible usage restrictions imposed by the lessor (e.g., hours of operation), and in some agreements, ongoing maintenance responsibilities for the lessee.

Q3: Which lease type is best—operating or capital lease—for my farm?

An operating lease for farm machinery is ideal if you want the latest equipment and maximum flexibility with minimal ownership obligations. A capital lease for farmers works best if you intend to own the equipment eventually and want depreciation deductions.

Q4: Are lease payments for farm equipment tax-deductible?

Most lease payments are 100% deductible as a business expense, immediately reducing taxable income. Always check with your accountant or tax advisor for farm-specific rules and compliance.

Q5: When does buying farm equipment make more sense than leasing?

Buying is generally more suitable when the equipment will be used heavily, is expected to serve for a long period, and ownership (and the equity it brings) is a priority. Consider purchase if you wish to avoid future renewal or return processes.

Q6: Can Farmonaut help maximize the value of my leased or purchased equipment?

Absolutely! While we don’t lease or sell equipment directly, our solutions optimize machinery usage, maintenance, and logistics through real-time satellite insights for the entire farm ecosystem.

Conclusion

Farm equipment leasing provides modern farmers with a strategic model for acquiring essential machinery without the burden of heavy upfront costs or restrictive loans. This approach can enhance cash flow, improve access to the latest technology, and deliver substantial tax advantages—while maintaining flexibility and reducing some aspects of the maintenance burden.

However, every financial arrangement carries trade-offs. Leasing lacks long-term ownership, may involve contractual restrictions, and could incur higher total expenses over time if not carefully managed. Purchasing, by contrast, is beneficial for those who wish to build equity, own assets outright, and utilize equipment for an extended period.

With careful planning on agreement details, lease term lengths, payment schedules, and tax strategy, farmers can realize the powerful benefits of leasing farm equipment. Consider your operational needs, risk appetite, and long-term financial goals—then choose the equipment acquisition model that sets your farm up for lasting success.

Combine data-driven farm management solutions from Farmonaut with your equipment leasing or purchasing strategy, and stay ahead in the ever-evolving world of agriculture.