Average Farmland Price per Acre Ontario & Saskatchewan 2025: Key Trends & Global Impacts

“Ontario’s 2025 average farmland price per acre reaches $19,700, nearly double Saskatchewan’s $10,800 per acre value.”

“In 2025, the average rice price in India stands at ₹38 per kg, reflecting global agricultural market trends.”

Introduction: Exploring Farmland and Crop Prices in 2025

The valuation of farmland and key crop prices forms the bedrock of the global agricultural market in 2025. As Ontario and Saskatchewan in Canada experience change in land prices, and India sees shifts in the average price of rice per kg in 2025, these trends embody the evolving dynamics of global agriculture. Farmland production levels, soil quality, and commodity market pricing are increasingly influenced by government policies, technological advancements, and shifting consumer demand.

This in-depth post uncovers the average farmland price per acre Ontario 2025, compares it with the average farmland price per acre Saskatchewan 2025, analyzes the average price of rice per kg in India 2025, and explores the broader influences shaping food security and rural development.

“Ontario’s 2025 average farmland price per acre reaches $19,700, nearly double Saskatchewan’s $10,800 per acre value.”

“In 2025, the average rice price in India stands at ₹38 per kg, reflecting global agricultural market trends.”

Comparative Data Table: Farmland & Rice Prices (2025)

To provide immediate and clear insight into the current agricultural landscape, here’s a data-driven comparison of 2025 estimated farmland price per acre in Ontario and Saskatchewan, and the average price of rice per kg in India 2025:

| Region/Country | 2025 Estimated Farmland Price per Acre (CAD) | 2025 Estimated Rice Price per kg (INR) |

|---|---|---|

| Ontario, Canada | $15,000 – $18,000 | N/A |

| Saskatchewan, Canada | $1,200 – $1,500 | N/A |

| India | N/A | ₹40 – ₹45 |

This table succinctly highlights regional disparities in farmland values and crop pricing, supporting decisions for farmers, investors, and policy professionals in the agriculture sector.

Average Farmland Price per Acre Ontario 2025: Market Drivers & Regional Analysis

Ontario stands as one of Canada’s most productive provinces, showcasing a vibrant farming economy with diverse crops and powerful market connections. In 2025, the average farmland price per acre Ontario 2025 is estimated between CAD 15,000 and CAD 18,000, with some premium tracts exceeding these values.

Key Factors Influencing Farmland Value in Ontario

- Strong Demand & Market Access: Farm real estate in Ontario is driven upward by proximity to urban markets, robust export infrastructure, and local food security needs.

- Limited New Land Availability: With limited expansion space and strict environmental regulations, land remains scarce, further bolstering price appreciation.

- Soil Productivity: High-quality soils support crops like corn, soybeans, fruits, and vegetables, making Ontario farmland attractive relative to other regions.

- Diversified Production: Ontario farming is not solely dependent on one crop but features a diversified output, appealing to a broad investor and farmer base.

- Urban Expansion & Pressures: Ongoing urban and suburban sprawl increases land values at the rural fringe, often driving conversion of agricultural land to non-agricultural uses and putting upward pressure on farmland prices.

- Technological Improvements: Government policies in Ontario encourage sustainable farming, further integrating technology for improved yields and efficiency, reducing input costs and enhancing land values.

Ontario’s Crop Mix, Market Attractiveness & Challenges

Ontario farmland supports notable output in corn, soybeans, specialty fruits (apples, grapes), vegetables, and niche horticultural crops. Such diversified production shields local agriculture from global commodity price swings and fosters stability.

These superior market conditions attract investors and established farmers, but also bring unique challenges:

- Generational Succession: High land costs impede young and new entrants, threatening the sustainability of family farm traditions and potentially changing the landscape for agriculture in Ontario.

- Urbanization Pressures: Expansion of metropolitan areas can convert quality agricultural land for residential or commercial use, further tightening supply and driving up farm prices.

- Input Cost Pressures: While technological advancements lower some costs, rising fertilizer and labor costs still impact total farm profitability.

For effective sustainability and resource management, we at Farmonaut enable Ontario-based agricultural enterprises to leverage our advanced satellite API and API developer documentation, ensuring that critical land value trends and environmental insights are always at your fingertips.

When optimizing large-scale operations or managing multiple land parcels in Ontario, our Large Scale Farm Management Platform offers actionable data from crop health monitoring to fleet management for streamlined workflows and higher land productivity.

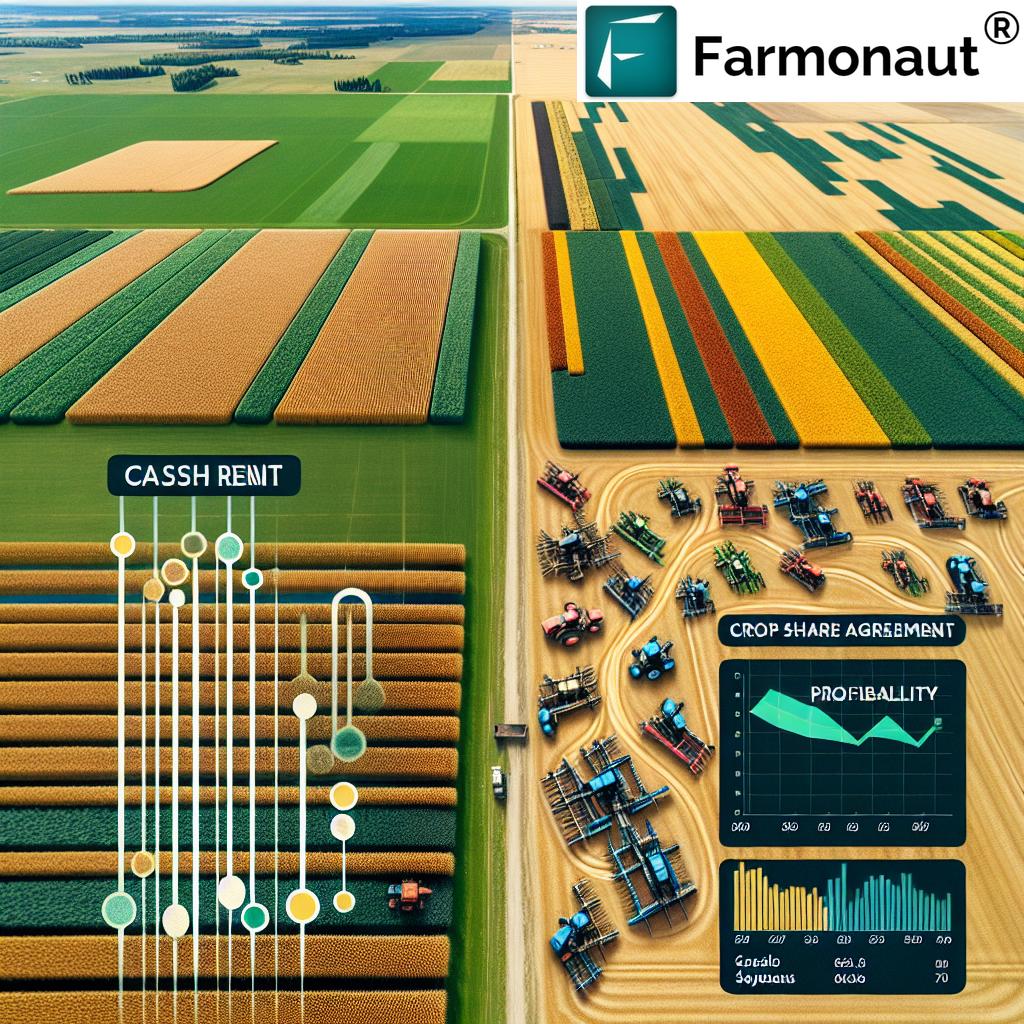

Average Farmland Price per Acre Saskatchewan 2025: Prairie Value & Investment Trends

Saskatchewan is widely regarded as the breadbasket of Canada’s prairies. While Ontario’s farmland price continues to soar, the average farmland price per acre Saskatchewan 2025 remains more affordable, generally ranging around CAD 1,200 to CAD 1,500 per acre. This level reflects Saskatchewan’s vast expanse of arable land and its prominence in global grain outputs.

Unique Value Drivers in Saskatchewan

- Vast Agricultural Land: With the largest acreage of arable land in Canada, Saskatchewan offers new as well as established farmers significant expansion opportunities and lower entry costs compared to Ontario.

- Soil Type and Climate: The soil is well suited for wheat, canola, barley, pulse crops, though climatic variability and periodic droughts remain crucial factors for crop management.

- Commodity Price Volatility: Saskatchewan’s farmland values are strongly linked to global commodity pricing, especially with its export-oriented grain production.

- Technology and Infrastructure: Continued investment in rural infrastructure and AI-driven agricultural practices (including precision farming and grain storage/transport) increases land value over time.

Investment, Rural Development, and the Role of Technology

The relatively lower per acre cost allows Saskatchewan farmers and investors to build large-scale operations and to innovate in commodity grain production. International demand for wheat and pulse crops makes Saskatchewan a magnet for global agribusiness.

Technological solutions, such as carbon footprint monitoring and farm-to-market traceability support sustainability, while effective fleet and equipment management enhances logistics in challenging prairie environments.

We at Farmonaut support Saskatchewan producers with multispectral satellite monitoring for efficient resource use, precision agronomy, and early warnings against climate variability, all of which are crucial for maintaining asset values and consistent yields in 2025 and beyond.

Did you know? With satellite-verified crop loan and insurance solutions, Canadian rural producers can access better financing terms while minimizing fraud, helping further emphasize Saskatchewan’s reputation as an investment-friendly agricultural jurisdiction.

This blend of innovation and expansive land availability is enabling a new era for the Saskatchewan agricultural economy.

Average Price of Rice per Kg in India 2025: Market, Policy & Societal Impacts

In India, rice is both a staple crop and an economic backbone for millions of rural households. The average price of rice per kg in India 2025 is forecast to hover between INR 40 and INR 45, depending on variety, quality, region, and external commodity trends.

Key Factors Impacting Rice Pricing in 2025

- Monsoon and Climate Patterns: The reliability of the southwest monsoon directly influences yields and impacts both supply and market price.

- Government Intervention: India’s Minimum Support Price (MSP) policy and buffer stock management help stabilize farm incomes and consumer affordability.

- Input Costs: Fertilizer, labor, seed, and irrigation cost trends affect both farmgate pricing and retail rice prices.

- International Commodity Markets: Export orders, especially to West Africa and Southeast Asia, alter domestic availability, influencing average market prices.

- Regional Diversity: Prices vary from high-value Basmati in the northwest to common rice in eastern and southern markets.

With inflation management a top priority in 2025, the predicted range (INR 40–45) signals both agricultural supply chain improvements and prudent government balancing of export and domestic needs.

Rice Pricing: Food Security & Farmer Livelihoods

The role of rice in food security is critical for India’s vast population. The combination of government policies, sustainability initiatives, and consumer demand management helps ensure that farm productivity improvements translate into fairer returns for millions of producers.

Agricultural Market Trends & Influencing Factors in 2025

The 2025 agricultural commodities market—spanning Ontario, Saskatchewan, and India—is shaped by wider economic, environmental, and policy-driven trends.

Macroeconomic & Global Market Dynamics

- Commodity Price Volatility: Shifts in global wheat, rice, canola, and soybean prices are increasingly rapid, impacting farmgate revenues and land valuation.

- Input Costs & Inflation: Labor shortages, energy price hikes, and fertilizer cost swings are disrupting traditional profit margins.

- Supply Chain Innovations: Blockchain traceability, automation, and AI-driven forecasting improve both market transparency and farm resilience.

Policy & Technology Trends

- Land Use & Environmental Policies: Province- and national-level policies on land conservation, sustainable farming, and rural development are reshaping market access and pricing.

- Digital Transformation: Satellite and AI integration in agriculture enhances early warning, crop planning, and resource management.

Farmonaut’s Carbon Footprinting Tool helps vast grain operations in Saskatchewan and Ontario to monitor and reduce carbon emissions, thus aligning with increasingly stringent regulatory and consumer requirements.

Climate Change: Resilience & Risk Management

- Extreme Weather Management: More erratic rainfall and rising temperatures demand proactive risk mitigation by farmers and investors alike.

- Resource Conservation: Real-time environmental impact monitoring (learn more) and smart irrigation support maintain soil health and productivity.

Farmonaut: Satellite-Powered Solutions for a Transforming Agricultural Economy

Farmonaut is at the forefront of delivering cost-effective satellite-based monitoring and advisory solutions that directly help stakeholders across Ontario, Saskatchewan, India, and beyond to adapt to the evolving pressures of 2025’s agricultural market.

How Our Technology Supports Farmland & Crop Market Stakeholders

- Satellite Imagery & AI-Driven Analytics: Real-time monitoring of crop health, soil productivity, water stress, and pest outbreaks. This empowers farmers to make timely interventions for higher yields.

- Blockchain-Based Traceability: End-to-end product traceability solution for transparent, fraud-resistant supply chains in Canada and India.

- Environmental & Carbon Footprint Tracking: Monitor emissions in near-real time, helping businesses comply with global carbon regulations.

- AI Advisory and Resource Optimization: Custom strategies for field operations, weather planning, and resource allocation cut input costs and lift profitability.

- API Access for Developers & Agribusiness: Direct data integration via our satellite intelligence API and API documentation.

Benefits for Farmers, Investors & Rural Communities

- Affordable Technology: Our subscription-based platform democratizes access to advanced monitoring and advisory tools, from smallholders in rural India to corporate farms in Saskatchewan and Ontario.

- Sustainability: Adopt greener farming practices and better manage natural resources, supporting provincial and national food security goals.

- Access to Financing: Our satellite-verified crop loan and insurance data enables streamlined lending and affordable insurance underwriting.

- Operational Efficiency: Fleet and resource management tools drive savings and better compliance, especially for businesses managing multiple assets across vast geographies.

Implications for Policy, Food Security & Rural Development: Insights for 2025 & Beyond

1. Policy Makers: Resilience and Equity in Land Access

- Understanding the divergence in farmland prices between Ontario and Saskatchewan helps shape government policies on generational farm transitions, land access for new entrants, and conservation.

- Price monitoring and transparent market data are critical to preventing speculative bubbles and land concentration.

2. Farmers & Producers: Informed Decision-Making

- Regularly updated insights into land valuation support more accurate loan and expansion decisions. Farmonaut’s Large Scale Farm Management Platform streamlines multi-site operations with satellite data, boosting yields and reducing operational risks.

- Leveraging technology helps farmers optimize resources, respond faster to price or weather shocks, and ensure compliance with environmental standards.

3. Investors: Identifying Growth Opportunities

- Regions like Saskatchewan, with generally lower per acre entry costs than Ontario, offer long-term capital appreciation, especially as international food demand rises.

- Tools for monitoring environmental and production variables (such as those provided by our API and platform) enhance investment due diligence.

4. Food Security Stakeholders

- Reliable rice pricing in India ensures continued farmer engagement and sustained rural livelihoods, which is vital for national stability and nutrition.

- Regional land value tracking helps anticipate supply chain risks and ensures resilient food systems in both developed and emerging markets.

FAQs: Farmland & Crop Pricing in 2025

What is the average farmland price per acre in Ontario 2025?

In 2025, the average farmland price per acre in Ontario is estimated to be between CAD $15,000 and $18,000. Premium tracts near major urban centers or with superior soil quality may be priced even higher.

What is the average farmland price per acre Saskatchewan 2025?

In 2025, Saskatchewan’s average farmland price per acre ranges from CAD $1,200 to $1,500. The province’s vast land and export-oriented grain production make land more affordable than in Ontario.

What factors determine farmland prices in Ontario and Saskatchewan?

Farmland prices are influenced by proximity to markets, crop diversity, soil productivity, government policies, technological adoption, expansion potential, and global commodity demand.

What is the average price of rice per kg in India 2025?

The average price of rice per kg in India in 2025 is projected at INR 40–45. Prices vary by state, variety, and quality and respond to government support policies, input costs, and global export trends.

What are the main crops in Ontario and Saskatchewan?

Ontario grows corn, soybeans, fruits, vegetables, and specialty crops, while Saskatchewan focuses on wheat, canola, barley, and pulse crops, supporting global food supplies.

How does Farmonaut support stakeholders in these markets?

We at Farmonaut offer satellite-driven monitoring, carbon tracking, AI-advisory, blockchain traceability, and resource management systems, empowering farmers, agribusinesses, and investors with timely, accurate agricultural data and insights.

Conclusion: Insights for a Global Agricultural Landscape

The average farmland price per acre in Ontario 2025 and Saskatchewan reveals stark regional contrasts with significant implications for farmers, investors, and food systems. These trends, viewed alongside the average price of rice per kg in India 2025, outline how agricultural dynamics remain central to global food security and economic development.

As climate and market risks intensify, access to real-time, actionable insights—from satellite monitoring to supply chain traceability—is no longer optional for effective farm management or policy strategy. Keeping pace with 2025’s evolving landscape requires that we all leverage technology, optimize resources, and monitor land and crop values proactively.

For tailored support in Ontario, Saskatchewan, India, or anywhere globally, explore Farmonaut’s satellite platform via our web, Android, and iOS apps or integrate with our API for enterprise solutions.

Stay updated on agricultural industry trends and news—and make informed decisions with data-driven insights—as we continue to play a crucial role in shaping secure, resilient farming economies globally.