ESG Factors Influencing Mining: Top 2025 Trends

Meta Description: ESG factors influencing mining investments in 2025 are reshaping sustainability, risk management, and long-term value creation. Discover the top ESG trends driving mining investment decisions worldwide and how stakeholders can navigate this new landscape effectively.

- Introduction: Why ESG Factors Are Pivotal in Mining Investments in 2025

- Understanding ESG Factors Influencing Mining Investments

- Environmental Factors Shaping Mining in 2025

- Social Factors Influencing Mining Investment Decisions

- Governance Dimension: Robust Governance and Investor Confidence

- Table: Comparison of Top ESG Factors Impacting Mining Investments in 2025

- ESG Investment Trends in Mining: 2025 and Beyond

- The Future of ESG Integration in Mining

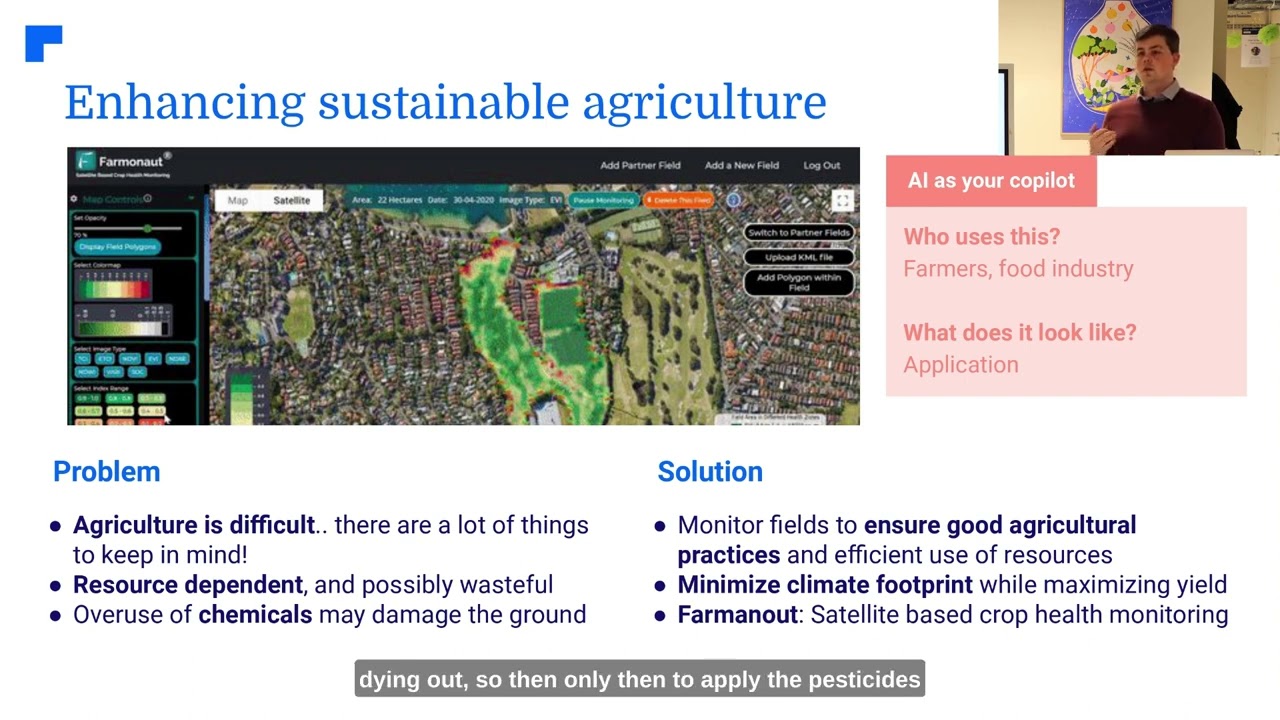

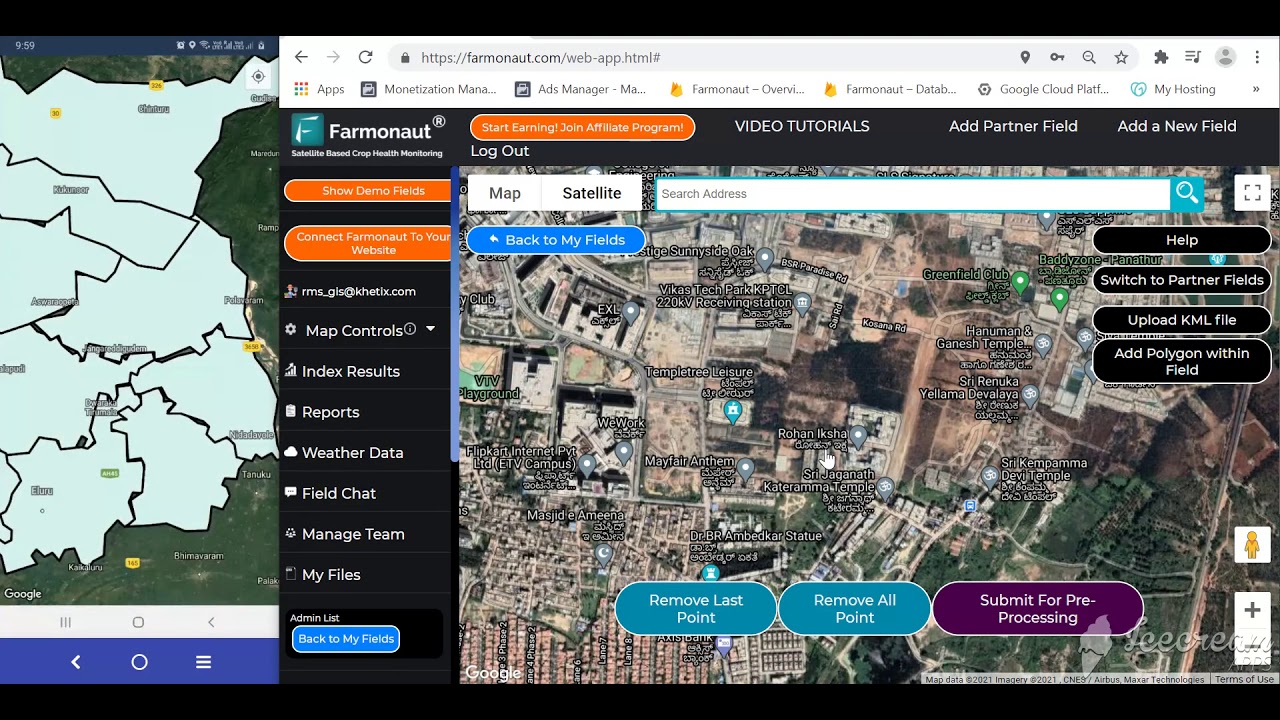

- Farmonaut: Satellite-Based Innovations for ESG in Mining

- FAQ: ESG Factors Influencing Mining Investments

- Conclusion: ESG as the New Gold in Mining Investment Decisions

Introduction: Why ESG Factors Are Pivotal in Mining Investments in 2025

The mining industry faces a paradigm shift as ESG factors influencing mining investments rise to the forefront of decision-making in 2025. Investors, companies, government stakeholders, and local communities alike are recognizing that ESG considerations are not merely regulatory hurdles or public relations gestures. They are critical drivers of value, risk management, and reputation in a fast-evolving, sustainability-oriented global landscape.

As markets worldwide increasingly prioritize sustainability and responsible practices, mining must contend with stricter regulations, higher stakeholder expectations, and a broader understanding of long-term value creation. In 2025, environmental, social, and governance factors are shaping not only the availability of capital for mining projects but also their operational viability and continued societal license to operate. Understanding these trends and their influence is essential for anyone aiming to navigate mining investments effectively.

Understanding ESG Factors Influencing Mining Investments

ESG stands for Environmental, Social, and Governance – a trio of critical domains that frame sustainability and ethical performance for organizations. Let’s break down these dimensions:

- Environmental: How mining activities impact air, water, land, ecosystems, and climate through emissions, usage, footprints, pollution, and reclamation.

- Social: The company’s effect on local communities, labor conditions, indigenous rights, diversity, safety, stakeholder engagement, and community relations.

- Governance: Practices concerning board oversight, transparency, anti-corruption, ethical management, regulatory compliance, risk disclosure, and inclusive leadership.

For mining companies and investors in 2025, ESG factors influencing mining investments span all three pillars, shaping how risks are assessed, how capital is allocated, and how reputations are built or lost.

Environmental Factors Shaping Mining in 2025

The environmental dimension of ESG, in the context of mining, is now more scrutinized than ever. With heightened climate change awareness, stricter regulations, and widespread acknowledgment of the mining sector’s significant environmental footprints, investors in 2025 prioritize operations that demonstrate environmental stewardship and sustainability.

Carbon Emissions Management

Greenhouse gas emissions and carbon intensity remain hot-button issues worldwide. Mining’s energy-intensive processes, reliance on diesel-powered equipment, and legacy carbon footprints drive environmental risk. Investors and regulatory frameworks are increasingly demanding proactive reduction plans.

- Adopting renewable energy (solar, wind, hydro) to power operations and limit emissions.

- Leveraging advanced technologies (AI-driven monitoring, smart grids) to track and optimize energy usage.

- Transparency in reporting (aligned with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD)).

Example: Mining companies reporting their carbon footprint and publishing reduction targets enhance investor confidence and attract ESG-aligned capital flows. See more on Farmonaut’s Carbon Footprinting capabilities for real-time emissions tracking using satellite technology.

Water Management and Pollution Controls

Water has become a central issue for mining sustainability. Water is essential for mineral processing, dust suppression, and more — but mismanagement can mean contamination, depletion, and regulatory penalties.

- Advanced water treatment methods and closed-loop recycling systems are increasingly required.

- Investors are assessing how companies manage water usage, pollution, and local ecosystem impacts.

- AI-driven and satellite-based monitoring systems (like those operated by us at Farmonaut) dramatically increase oversight and compliance.

Wastewater discharge permits, river contamination controls, and transparent reporting are now non-negotiable, especially in regions where water scarcity affects both operations and communities.

Waste Reduction and Recycling Initiatives

Mining generates vast amounts of waste — from tailings and overburden to used industrial materials. Responsible waste management and recycling are critical to ESG compliance.

- Implementation of innovative waste recycling (e.g., reprocessing tailings for rare minerals).

- Safe long-term waste storage and engineering controls to prevent hazardous leaks.

- Transparency in tracking and disclosing waste volumes, recovery rates, and management strategies.

ESG-savvy investors value firms adopting advanced technologies for waste reduction and those integrating circular economy models — further highlighted in Farmonaut’s Fleet and Resource Management solutions which help optimize on-site logistics to minimize operational waste.

Biodiversity and Land Stewardship

Biodiversity loss and land degradation are significant concerns associated with mining’s extensive footprints. ESG-focused companies must:

- Conduct ecological impact assessments pre- and post-mining, openly sharing results.

- Commit to post-mining land reclamation plans and reforestation where possible.

- Promote natural landscape regeneration and minimize long-term damage to habitats.

The application of satellite-based monitoring and AI technology is enhancing ongoing biodiversity assessments, as firms are required to comply with evolving regulatory expectations. Learn more about sustainable restoration planning on the Farmonaut platform.

Climate Change: Adaptation, Resilience, and Reporting

The climate change imperative is transforming how mining companies conduct operations and reporting. Investors demand:

- TCFD-aligned climate risk disclosures (physical and transition risks).

- Scenario analysis that covers extreme weather events, asset risks, and commodity demand shifts due to global climate policies.

- Development of resilience strategies — integrating climate adaptation into project planning.

In 2025, non-disclosure or poor transparency on climate impacts is increasingly a disqualifier for institutional investment.

Social Factors Influencing Mining Investment Decisions

The social component of ESG places a spotlight on the impact of mining activities on human communities, labor conditions, stakeholder relationships, and societal expectations. 2025 brings unprecedented scrutiny, with stakeholders and investors alike demanding responsible business practices far beyond the minimum regulatory requirements.

Indigenous Rights and Community Consent

Indigenous rights and community consent are now considered non-negotiable. Investors increasingly reject projects failing to secure free, prior, and informed consent (FPIC) from local or indigenous populations.

Effective community engagement processes are essential, sometimes requiring multi-year dialogue and co-management arrangements.

- Mining companies must establish robust stakeholder engagement procedures, aligned with global standards like the ICMM or UNDRIP.

- Companies investing in local community development (healthcare, education, infrastructure) are viewed favorably and experience fewer project risks.

- Transparency, respect, and accountability are critical for reputation and access to capital.

Labor Conditions and Inclusion

Mining is labor-intensive and often situated in remote or developing regions — making fair labor practices and inclusion all the more vital.

- Investors assess whether companies ensure safe working conditions, fair wages, and uphold human rights.

- Emphasis on gender equity, diversity, and upskilling programs signals a progressive, risk-mitigated workforce.

- Failure to meet these standards can lead to strikes, reputational damage, or legal liabilities, all of which reduce investment attractiveness.

These priority areas are supported by transparent tracking, automated using AI and satellite inputs to verify field-level labor practices — central to traceability solutions.

Stakeholder Engagement and Societal Expectations

Regular, transparent stakeholder engagement is recognized as a strategic necessity. In 2025:

- Mining firms are expected to demonstrate commitment by responding to societal pressure, adjusting to evolving community priorities, and fostering positive relations.

- The ability to prevent or quickly address protests, social unrest, or legal disputes directly impacts the robustness of an investment.

- Digital portals and real-time disclosure platforms, supported by satellite, AI, or blockchain, set new standards for engagement and responsibility.

Governance Dimension: Robust Governance and Investor Confidence

Governance within ESG covers the management, structure, policies, and accountability processes of mining firms. In 2025, responsible governance isn’t a checkbox — it’s a screening threshold for sustainable investments.

Investors look for evidence of ethical decision-making, clear executive compensation alignment with ESG, anti-corruption, regulatory compliance, and diversity of thought in leadership.

Transparency and Regulatory Compliance

- Transparency in reporting (public disclosures, alignment with leading frameworks like GRI, SASB, TCFD).

- Full and timely regulatory compliance worldwide, no matter the jurisdiction, is expected — and increasingly monitored by both industry and financial regulators.

- Blockchain and digital traceability (as enabled by Farmonaut’s blockchain product traceability) improve auditability, enabling real-time oversight of operations and supply chains.

Diversity in Leadership and Board Accountability

- Diversity in the C-suite and board is a proxy for innovation, inclusive perspectives, and effective stakeholder representation.

- Companies with high leadership diversity report better ESG integration and company resilience, enhancing investor confidence.

- Clear separation of powers, independent committees, and systematic risk review processes further differentiate governance leaders.

Risk Management, Anti-corruption, and Financial Disclosures

- Robust risk management frameworks anticipate geopolitical, regulatory, and operational risks — becoming decisive in project evaluations.

- Strict anti-corruption practices, frequent audits, and robust internal controls reduce uncertainties for investors.

- Detailed financial disclosures on ESG-aligned expenditures, carbon offset purchases, or community investments are expected for capital access.

These practices not only demonstrate sound governance but create long-term value while protecting reputation for both companies and stakeholders.

Table: Comparison of Top ESG Factors Impacting Mining Investments in 2025

| ESG Factor | Estimated Influence Level | 2025 Investor Priority Score (1-10) | Example Impact on Mining | Brief Description |

|---|---|---|---|---|

| Water Management | High | 10 | Projects employing advanced water recycling get faster approvals. | Sustainable source, usage, recycling, and pollution prevention. |

| Carbon Emissions | High | 9 | Operations with net-zero goals attract ESG capital. | Emissions reduction, renewable energy adoption, transparent TCFD reporting. |

| Community Relations | High | 10 | Securing FPIC prevents delays and protests. | Indigenous engagement, local consent, shared benefits, social license. |

| Workforce Diversity | Medium | 8 | Firms with diverse boards report better shareholder returns. | Gender, race, skills diversity in management & labor. |

| Regulatory Compliance | High | 9 | Proactive compliance wins expedient capital allocation. | Adherence to global ESG laws and standards. |

ESG Investment Trends in Mining: 2025 and Beyond

In 2025, ESG factors influencing mining investments have transitioned from trend to necessity. The global financial community is leading this shift:

- More than 70% of mining investors now use ESG ratings or criteria as a critical filter in investment decisions.

- Sustainable mining projects are projected to attract 40% more capital than non-ESG-compliant ones.

- Financial instruments like green bonds, sustainability-linked loans, and ESG-themed equity are incentivizing companies to hit ambitious targets.

- Regulatory frameworks (EU Taxonomy, US SEC climate rules, TCFD) continuously raise the baseline for disclosures and compliance.

- AI, big data, satellites, and blockchain are making ESG reporting and monitoring increasingly real-time and data driven.

This “ESG premium” is acutely visible in valuations, project approval speeds, and even insurance rates. ESG integration is not optional; it is now critical for access to global investment and future-proofed operations.

The Future of ESG Integration in Mining

Strong ESG performance is no longer a “nice to have.” It is, instead, the new gold standard. Here are the future trends for how ESG will increasingly influence mining investments:

- Standardization – Widespread adoption of global frameworks (GRI, SASB, TCFD) will harmonize expectations and raise the bar for all industry participants.

- Digitalization – Satellite monitoring, AI analytics, blockchain traceability, and open API architectures (like Farmonaut’s API with full developer documentation) will ensure seamless, automated compliance and reporting.

- Investor Activism – Both retail and institutional investors are shifting toward thematic portfolios and ETFs focused on ESG performance, exerting influence on mining strategies.

- Stakeholder Inclusion – Ongoing, transparent engagement will be expected via digital portals, not occasional consultation.

- Responsible Financing – Insurers and lenders are tightening requirements and favouring operations with demonstrable ESG compliance to mitigate risk.

These trends predict that the winners in 2025 and beyond will be companies able to pioneer, adopt, and transparently communicate advanced ESG strategies. ESG leaders gain not only capital, but also resilience, better risk-adjusted return, and sustained reputation.

Farmonaut: Satellite-Based Innovations for ESG in Mining

How does Farmonaut enable ESG compliance and value creation in mining?

- Satellite Monitoring: We offer advanced multispectral satellite image monitoring of mining sites, tracking land usage, ecological change, vegetation health, and infrastructure. This data empowers responsible resource management and supports regulatory compliance.

- Jeevn AI Advisory System: Our AI-driven system delivers real-time ESG insights, environmental impact notifications, and customized improvement strategies for mining operations, accessible through web, mobile, and API integration.

- Blockchain Traceability: We enable blockchain-based traceability to audit and verify the sustainability of mineral supply chains, ensuring transparency from pit to market and reducing the risk of regulatory or stakeholder backlash. Read more on Farmonaut’s Product Traceability page.

- Resource and Fleet Management: Our tools allow mining operations to optimize everything from heavy machinery deployment to fleet logistics, resulting in lower emissions, efficient fuel usage, and minimized waste. Discover more at Farmonaut Fleet Management.

- Environmental Impact and Carbon Footprint: We provide real-time tracking of emissions and help mines plan for carbon neutrality. This supports projects applying for green financing or addressing regulatory requirements. Learn about Farmonaut’s Carbon Footprinting service.

Our platform is designed for ease of scaling — from single-site operators to global mining conglomerates. This makes advanced ESG data accessible and affordable, supporting a new era of responsible mining investments.

FAQ: ESG Factors Influencing Mining Investments

What are ESG factors influencing mining investments?

ESG factors include Environmental, Social, and Governance considerations that impact how mining projects are evaluated for investment. These factors encompass everything from carbon emissions and water management to labor practices and transparency in financial and corporate governance reporting.

Why is ESG so important for mining investors in 2025?

By 2025, ESG factors are pivotal for investment decisions, shaping risk-adjusted returns and company reputation. Investors are prioritizing ESG to reduce exposure to regulatory sanctions, supply chain disruptions, and community opposition, while maximizing long-term value.

How can mining companies demonstrate ESG compliance?

By adopting advanced monitoring technologies (like satellites and AI), disclosing transparent reports aligned to global standards (e.g., TCFD, GRI), engaging stakeholders proactively, and implementing effective risk management frameworks.

What is the impact of ESG on mining project financing?

Projects with high ESG scores attract more capital and can access preferential financing through green bonds, sustainability-linked loans, and ESG-focused equity, resulting in competitive advantages and long-term viability.

What tools can help with ESG integration in mining?

Tools include satellite-based monitoring, AI-driven analytics, blockchain traceability platforms, and digital engagement portals. Solutions like those provided by us at Farmonaut allow mining companies to automate compliance reporting, optimize resources, and strengthen stakeholder trust.

Conclusion: ESG as the New Gold in Mining Investment Decisions

As we enter 2025, ESG factors influencing mining investments are redefining what success means for mining companies globally. Environmental, social, and governance considerations are no longer regulatory afterthoughts but are central to business value, access to capital, reputation, and social license to operate.

Investors, miners, and other stakeholders who understand and proactively integrate ESG considerations will not only reduce risk and enhance sustainability but will capture a growing share of value in a markets landscape that increasingly prioritizes responsible business. The future of mining belongs to those who can navigate this evolving landscape effectively — leveraging transparency, stakeholder engagement, advanced technologies, and a commitment to sustainability.

For mining companies, it’s time to move beyond compliance and embrace ESG integration as a core strategy — a strategy that unlocks operational resilience, financial success, and the trust of stakeholders worldwide.

Systematic Large-Scale Field and Resource Management |

Satellite-based Crop Loan and Insurance Verification for Mining Operations

For advanced satellite-based ESG monitoring and analytics solutions, download the Farmonaut app for Android or iOS or access our robust web platform and APIs for scalable, real-time mining insights.