“Farms using detailed cash flow planning can increase profitability by up to 25% within two years.”

Farm Financial Planning: 7 Powerful Strategies for Growth

Farm financial planning is the cornerstone of any prosperous agricultural operation. In today’s rapidly changing agri-business landscape, effective financial management, strategic investment planning, and advanced risk strategies are more essential than ever. Our farms, whether small family plots or large, diversified agribusinesses, rely on precise cash flow management, robust budgeting, and the judicious use of innovative technology to ensure both profitability and sustainability.

In this blog, we’ll guide you through 7 powerful strategies every farmer should master for enhanced operational (and personal) financial health. These cover everything from detailed cash flow projections to advanced investment planning for farms, and best practices in tax planning for farmers. Along the way, we’ll showcase how integrating tools like farm management software elevates each strategy for modern farm management.

1. Cash Flow Management for Farmers: The Bedrock of Agricultural Success

At its core, cash flow management for farmers focuses on ensuring that farm income (inflows) aligns with expenses (outflows), maintaining adequate liquidity to meet day-to-day operational needs. Sound cash flow planning enables us to predict seasonal variations in revenues and expenses, anticipate low cash flow periods, and prevent unnecessary disruptions.

Neglecting cash flow is a common cause of financial stress among farmers—one that can endanger the long-term sustainability of our operations.

Key Steps in Cash Flow Projections and Management

- Create Monthly Cash Flow Projections:

- List all expected income streams (crop sales, livestock, subsidies, agritourism, etc.).

- Anticipate expenditure—from seeds, labor, fertilizer, and repairs to loan repayments and tax obligations.

- Identify months with high/low cash flow (e.g., high expenses during planting with income only at harvest).

- Align Cash Inflows & Outflows:

- Schedule major purchases or investments during periods of higher liquidity.

- Time loan repayments or tax-related payments after anticipated sales, when possible.

- Monitor & Adjust in Real-Time:

- Leverage tools like Farmonaut’s satellite-based farm management software for ongoing expense tracking and financial analysis.

- Use digital alerts to flag cash flow shortfalls and prompt timely adjustments.

Utilizing advanced solutions like satellite insights for crop health monitoring (available via Farmonaut’s platform) minimizes unnecessary resource wastage, optimizes input timing, and indirectly supports cash flow management for farmers by aligning agri-decisions with financial plans.

Benefits

- Ensures ongoing liquidity for seamless farm operations

- Reduces emergency borrowing and high-interest financial pressure

- Supports informed, data-driven decision-making for investments and expansion

“Over 60% of successful farms implement at least five financial management strategies for sustainable growth.”

2. Agricultural Budgeting Strategies & Financial Forecasting

A roadmap to enhancing farm profitability begins with agricultural budgeting strategies and solid financial forecasting. Rigorous budgeting enables us to evaluate all operational expenses and potential revenue streams on an annual and seasonal basis for our farm.

Steps to Creating Effective Farm Budgets & Forecasts

- Analyze historical data for expenses (seed, labor, fertilizer), income, and market fluctuations

- Project revenues based on realistic yield forecasts, market prices, and diversification

- Structure budgets to account for regular maintenance, planned investments, and unexpected events

- Incorporate expense reduction strategies, such as bulk purchasing or input optimization (using Farmonaut’s precision agriculture solutions for monitored resource usage)

- Review and update budgets quarterly—fostering responsiveness to external market fluctuations and internal performance metrics

By employing these financial planning tools, we open doors to greater cost reduction, improved resilience against shock events, and a more stable path to long-term growth.

3. Farm Risk Management: Safeguarding Profitability and Sustainability

Farming is exposed to numerous risks: unpredictable weather events, volatile markets, disease outbreaks, and more. Effective farm risk management requires a mix of proactive strategies to mitigate losses and maintain the financial health of our operation under all conditions.

Types of Agricultural Risks and Practical Management Strategies

- Production Risks: Crop failure from drought, pests, or floods.

Solution: Leverage Farmonaut crop health monitoring to detect problems early, adopt resilient practices, and diversify crops. - Market Risks: Sudden price drops and demand shifts.

Solution: Lock-in prices using forward contracts and diversify income streams, such as value-added products or agritourism. - Financial Risks: Unsecured farm debt or unfavorable loan structure.

Solution: Optimize repayment plans, stay informed about rates, and work with experienced agricultural advisors. - Legal/Regulatory Risks: Changes in policies affecting subsidies or land use.

Solution: Stay educated via workshops and subscribe to alert systems.

Robust risk assessment helps us anticipate shocks and design strategies—like crop insurance (backed by verification through Farmonaut’s satellite-based validation)—that provide security for both us and our lenders.

4. Farm Debt Management: Structuring for Growth and Stability

Smart farm debt management is essential for supporting growth while preserving financial health. Farms must often borrow to invest in new equipment, upgrade infrastructure, or manage seasonal variations in cash requirements. The key is ensuring debt works for us—not against us.

Best Practices for Effective Farm Debt Management

- Regularly review debt structure: Assess your mix of short vs. long-term loans, interest rates, and collateral requirements

- Negotiate more favorable loan terms when rates fall or financial conditions improve

- Develop clear repayment plans that align with projected cash cycles and crop sales

- Avoid over-reliance on high-interest credit lines—opt for seasonal/ production loans that reflect agri-income cycles

- Use Farmonaut’s crop insurance verification to streamline access to lower-risk agricultural finance products

- Restructure and consolidate debts when possible to reduce servicing costs and financial strain

Clear, organized debt management fosters greater financial stability and supports strategic growth—giving us confidence in pursuing new opportunities even in uncertain markets.

5. Investment Planning for Farms: Growing Resilience and Profitability

Visionary investment planning for farms is about directing capital toward areas yielding the greatest long-term gains—be it infrastructure, updated equipment, or innovative technology.

We must always evaluate investments based on their expected returns, alignment with our business goals, and the impact on profitability and sustainability.

How to Evaluate and Plan Farm Investments

- Identify Investment Priorities:

- Modernize irrigation, equipment, or storage for enhanced efficiency

- Pilot digital farm management software such as Farmonaut’s satellite monitoring platform

- Explore value-adding infrastructure like on-farm processing or direct-to-market channels

- Adopt sustainability-forward solutions, such as carbon footprint tracking to qualify for green incentives

- Assess ROI and Payback Period:

- Calculate annual operational savings, yield improvements, or reduced input waste

- Estimate recovery period for each investment

- Utilize Professional Guidance:

- Work with agricultural financial advisors to verify projections and explore funding opportunities

- Continually monitor outcomes using real-time tracking tools

Smart investments put our agri-business on a growth trajectory, reducing costs, boosting productivity, and building the foundation for the next generation.

Comparison Table of Financial Planning Strategies

| Strategy Name | Description | Estimated Impact on Profitability (%) | Required Tools/Resources | Implementation Timeframe (Months) | Risk Level | Suitable Farm Size |

|---|---|---|---|---|---|---|

| Cash Flow Management | Project inflows/outflows; manage liquidity for operations | 15-25% | Cash flow software, historical records, bank statements | 1-3 | Low | All sizes |

| Budgeting & Forecasting | Set financial plans; monitor expenses & revenue | 10-20% | Budget templates, farm management software | 2-4 | Low | All sizes |

| Risk Management | Mitigate market, weather, & operational risks | 15-30% | Insurance, advisory systems, diversification | 3-6 | Medium | All sizes |

| Debt Management | Optimize loans; structure repayments for growth | 10-18% | Financial advisor, amortization tools | 2-5 | Medium | Small/Med/Large |

| Investment Planning | Fund infrastructure, technology, & expansion | 20-35% | Financial plans, ROI calculators | 6-12 | Medium | Med/Large |

| Tax Planning | Reduce liabilities; optimize deductions & timings | 8-15% | Tax software, accountant, tax calendars | 1-2 | Low | All sizes |

| Succession/Estate Planning | Plan for transfer of ownership & legacy | 10-25% | Legal/professional advisors, estate tools | 6-24 | Medium | Family/Medium/Large |

6. Tax Planning for Farmers: Deductions, Timing, and Compliance

Effective tax planning for farmers substantially impacts cash flow and operational stability. The agricultural sector is awarded several unique deductions and credits—knowing how, and when, to apply these can boost profitability and reduce financial stress.

Key Tax Planning Approaches for Agricultural Operations

- Track all tax-deductible expenses: such as inputs, vehicle mileage, maintenance, and depreciation (Section 179 allowances)

- Time tax payments to better match seasonal cash inflows (e.g., deferring income post-harvest)

- Utilize income averaging to smooth the impact of unpredictable earnings across multi-year periods

- Seek the help of agricultural accountants familiar with local/federal tax laws for accurate compliance and benefit maximization

Digital farm management software can simplify record-keeping by integrating purchase, sales, and investment tracking—creating an organized audit-friendly system. Staying informed about evolving risk strategies and legal landscapes is critical.

7. Succession and Estate Planning for Farms: Ensuring Legacy and Continuity

Robust succession and estate planning for farms is imperative for multi-generational sustainability—whether you’re passing the farm to family, business partners, or new operators.

Steps to Secure Effective Farm Succession

- Begin early: Establish successor(s) and involve them in management decisions

- Formalize plans: Utilize wills, trusts, and legal agreements for clarity and security

- Work with financial advisors and estate planning professionals to optimize tax positions and avoid conflicts

- Regularly review and adjust the plan to reflect changes in business health, family, and market conditions

Succession planning preserves the value of decades of hard work, protecting both our loved ones and the farm’s legacy.

Explore Farmonaut’s traceability solutions to streamline documentation for business transitions, especially for larger operations or those seeking to enhance transparency for future owners or stakeholders.

Monitor and reduce your farm’s carbon impact—enhance compliance and tap sustainable incentives.

Farmonaut Precision Farming Platform

Make informed decisions with real-time, satellite-based crop health analytics, optimize inputs, and boost profits.

Farmonaut Fleet Management

Track and manage all agricultural equipment—reduce downtime and operational costs at scale.

Satellite-based Crop Loan and Insurance Validation

Streamline access to risk-mitigated loans and efficient claims with transparent satellite data support.

Large Scale Farm Management App

Oversee and optimize thousands of hectares using Farmonaut’s scalable management solutions for enterprises and governments.

Utilizing Technology & Tools: Empowering Your Farm Financial Planning

In the era of digital transformation, leveraging farm management software, scenario planners, and resource tracking tools exponentially increases our farm’s efficiency, profitability, and resilience. Solutions like Farmonaut stand out in providing affordable, scalable, and intuitive technology for farms of all sizes.

Essential Digital Tools for Modern Farm Financial Planning

- Budgeting & Forecasting Software: Track performance against projections; quickly adjust as conditions change

- Cash Flow Apps: Automated alerts for low liquidity or overspending

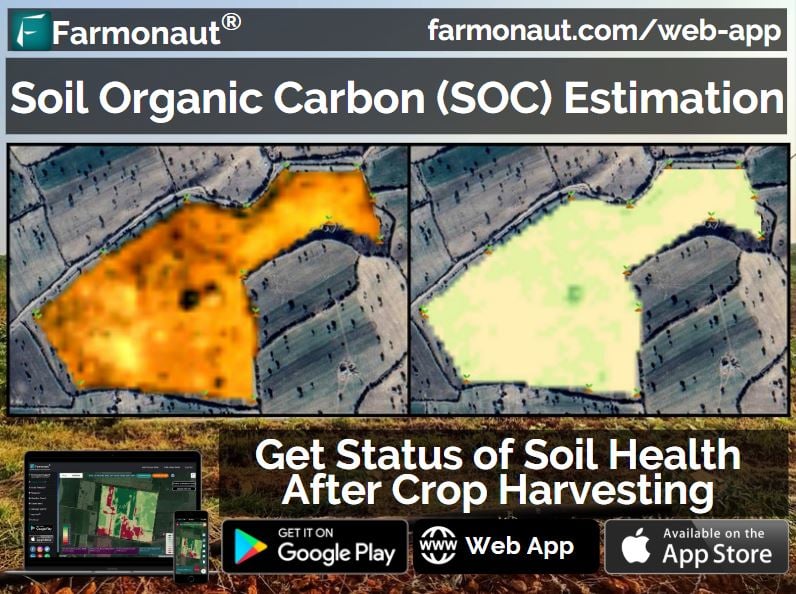

- Satellite Monitoring & AI Insights: Reduce risk via real-time crop health monitoring—react faster to threats and optimize resource allocation (Farmonaut Jeevn AI Explanation)

- Blockchain Traceability: Enhance transparency for compliance, loans, and stakeholder trust with Farmonaut traceability

- Resource & Fleet Management: Minimize downtime and input waste via fleet management features

- Digital Carbon Footprinting: Quantify, report, and reduce farm carbon output for green markets or compliance (see details)

Our platform, Farmonaut, integrates all these capabilities in a single, easy-to-access system. Use our app or web interface for data-driven decision making, whether on Android, iOS, or browser. Developers and agribusinesses can access our satellite and weather data via API (developer docs here).

Continuous Education, Professional Guidance, and Ongoing Best Practices

No single financial plan is static—agriculture is ever evolving. That’s why ongoing education, consistent access to the latest financial management insights, and professional guidance are non-negotiable for every farm.

We must stay abreast of changes in regulations, tax policy, market trends, and the emergence of disruptive technologies, leveraging:

- Regular participation in farm business management education workshops

- Consulting with specialized agricultural advisors and financial planners

- Engaging with online knowledge hubs and agricultural newsletters

- Testing and implementing new farm management software and AI-driven analytics as they emerge

By fostering a culture of continuous learning, we’re better positioned to adapt our financial planning and optimize our operational strategies for superior long-term farm profitability.

Frequently Asked Questions (FAQs) on Farm Financial Planning

What is farm financial planning and why is it essential?

Farm financial planning is the structured process of managing, projecting, and optimizing all financial aspects of a farm. This includes budgeting, risk assessment, investment, debt structure, and tax planning. Its aim is to ensure profitability, business sustainability, and resilience against risks for all farm sizes.

How often should farm budgets and financial forecasts be updated?

We recommend updating budgets and forecasts at least quarterly, or whenever significant changes in market, weather, or production conditions arise. Regular updates allow your financial roadmap to stay closely aligned with real-world circumstances.

Which digital tools are most valuable for farm financial management?

Leading solutions include farm management software like Farmonaut’s app for real-time monitoring, budgeting tools, expense tracking solutions, and AI-driven crop advisory systems. Integration with data sources (e.g., satellite imagery) further enhances precision.

What are the main risks facing my farm—and how can I manage them?

Main risks are production (weather, diseases), market volatility, financial/debt structure, and regulatory change. Risk management includes insurance, diversification, forward contracts, and leveraging satellite-based monitoring (e.g., for claims and crop health).

How can I use Farmonaut to optimize my farm’s financial planning?

Farmonaut delivers real-time crop, weather, and resource data through a single digital interface, supporting better budgeting, expense tracking, and investment decisions. Its carbon tracking and blockchain-based traceability features provide transparency and compliance for larger operations as well.

Conclusion: Shaping the Future of Your Farm with Strategic Financial Planning

To secure lasting, profitable growth in agriculture, we must master each component of farm financial planning—from cash flow management and budgeting to advanced investment and risk assessment strategies. By embracing precision tools, leveraging digital platforms like Farmonaut, and continuously educating ourselves, we are well-equipped to face uncertainties, enhance farm profitability, and ensure the sustainability of our land and legacy.

Let’s plan boldly, manage wisely, and invest in a future where our farm operations thrive—no matter what lies ahead.