Farming Partnership: 7 Essential Strategies for 2025

“2025 playbook: 7 strategies integrate governance, capital, technology, and risk-sharing to accelerate scaling and market access.”

Farming partnership models are reshaping agriculture in 2025. A farming partnership is a formal arrangement in which two parties (or more) share land, capital, labor, risk, and profit. This structure enables partners to reach scale, meet rising market demand, and implement technology-enabled management and agreements that drive results across agriculture value chains. The right partnership can unlock access to new buyers, reduce costs, and distribute financial risk more fairly—if it is built on clear decision rights, transparent accounting, and strong legal clauses.

Table of Contents

- Overview: What Is a Farming Partnership in 2025?

- Why Partnerships Are Reshaping Agriculture

- Farming Partnership: 7 Essential Strategies for 2025

- Comparison Matrix: Partnership Models and 2025 Metrics

- Step-by-Step Checklist and Governance Tools

- Legal Structures, Taxation, and Compliance

- KPIs, Dashboards, and Technology Implementation

- Frequently Asked Questions

- Final Thoughts and Next Actions

Overview: What Is a Farming Partnership in 2025?

In 2025, farming partnership models have evolved into a core model for competitive agriculture. A farming partner arrangement is a formal agreement in which two or more parties share land, capital, labor, operational risk, and financial profit. The intent is to blend roles and expertise—for example, one partner may supply local agronomic knowledge and acreage, while another provides machinery, marketing, or technology—so that all partners gain more together than they could alone.

Common varieties of a partnership include:

- General partnerships: All partners manage and share liabilities.

- Limited partnerships: At least one general partner manages operations; limited partners contribute capital with limited liability.

- Joint ventures: Project-specific ventures designed around a defined crop, season, or investment.

- Contract farming: Production under a buy-back or supply contract with set quality and delivery terms.

- Cooperatives (including Farmer Producer Organizations): Member-owned entities that pool purchasing, production, and market access.

Each model balances decision rights, sharing of returns, and exit conditions differently. What matters most is a clear written structure: governance, clauses for dispute resolution, allocation of costs and revenue, and defined roles for management. These are essential to avoid interpersonal and financial conflicts.

APIs for enterprise data integration: Farmonaut API | Developer documentation: API Docs

Why Partnerships Are Reshaping Agriculture

In 2025, the benefits are increasingly compelling for farming business partners. Partnerships enable scale economies, expand market access, and strengthen resilience to climate and input volatility.

Scale economies and cost reduction

- Pooled capital buys precision equipment, irrigation, and storage infrastructure that are unaffordable alone.

- Aggregated acreage supports better rotation, diversified crops, and biodiversity planning.

- Combined expertise improves yields and lowers per-unit costs.

Market access, traceability, and consistent volume

- Expand sales through shared networks and aggregation for buyers demanding consistent volume.

- Meet rising demand for traceability, sustainability certification, and quality compliance.

- Build bargaining power and better price realization in competitive markets.

Succession and continuity

- Facilitate succession planning—retiring producers can transfer management responsibilities to younger partners without selling assets outright.

- Shared management systems preserve institutional knowledge and reduce transition shocks.

Risk-sharing and resilience

- Spread weather, price, and input risks via insurance allocation and diversified rotations.

- Access institutional finance more easily with formal entities and performance data.

- Lower liability exposure using limited structures and robust legal clauses.

These advantages come with key challenges: climate extremes, regulatory complexity, and input volatility. Successful partnership farming must agree on climate-adaptive practices (cover crops, diversified rotations, efficient water-use), transparent accounting for inputs and machinery hours, and legal structures that affect taxation and liability.

Farming Partnership: 7 Essential Strategies for 2025

To turn a farming partnership into a durable competitive advantage, align governance, capital, technology, operations, and market strategy. Below are seven actionable strategies that top performers use.

1) Governance by Design: Write Clear Agreements, Rights, and Exit Clauses

Strong governance is the linchpin. Draft agreements that specify roles, decision rights, sharing rules, and exit options. Include clauses on dispute resolution, valuation methods for buy-outs, and triggers for restructuring. Define what each partner may approve unilaterally and what requires joint consent (e.g., new debt, investments, leasing machinery, changing crop plans). The goal is a transparent framework that prevents disputes and protects personal assets.

- Specify allocation of inputs, labor, equipment, and overheads.

- Set quarterly meeting cadence, agenda templates, and reporting packs.

- Use independent mediation/arbitration processes in case of conflicts.

2) Capital Architecture: Blend Equity, Revenue‑Share, and Insurance

Design a capital stack that balances flexibility and resilience. Beyond traditional loans, partners in 2025 are using:

- Revenue-sharing arrangements to align incentives and stabilize cash flow.

- Agri‑fintech instruments tied to verifiable production and monitoring data.

- Structured insurance with parametric triggers to cushion climate shocks.

Set a reserve fund policy for emergencies and specify the allocation of payouts (risk-sharing ratio). Clarify tax treatment of distributions under chosen entities to avoid surprises in taxation.

Crop loan and insurance tools can speed up underwriting and reduce fraud by pairing field monitoring with claims verification. When partners implement transparent data flows, lenders offer better terms.

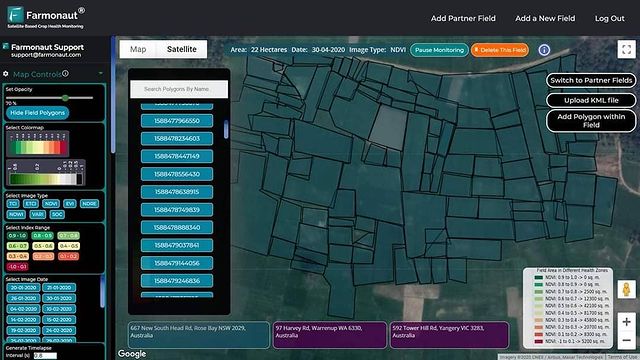

3) Technology First: Precision Platforms, Remote Sensing, and Shared Dashboards

Shared dashboards make management decisions faster. In 2025, precision platforms, remote sensing, and farm software allow partners to track crop health, inputs, and P&L in real time. Technology supports consistent standards across farms, especially when aggregated acreage spans regions.

- Use NDVI/NDRE indices to direct scouting, irrigation, and nutrient allocation.

- Capture machinery hours and fuel use to allocate costs fairly.

- Digitize approvals, contract renewals, and compliance logs with e‑signatures.

We provide satellite-based and AI-enabled tools that make this easy to run at scale. With Farmonaut, we offer real-time monitoring, AI advisory, blockchain-based traceability, fleet and resource management, and environmental impact tracking—accessible through Android, iOS, web apps, and APIs. These tools are designed to be accessible and cost-effective so that farming partners can implement data-driven practices without heavy hardware investments.

Traceability solutions help buyers verify origin, quality, and sustainability certification. Large-scale farm management tools centralize operations across multiple holdings. Fleet management cuts downtime and optimizes equipment use. Carbon footprinting supports ESG reporting that many buyers and financiers now expect.

4) Risk-Smart Agronomy: Diversified Rotations, Water Use, and Insurance Allocation

Proactive agronomy reduces risk. Partners should agree on core practices that stabilize output:

- Diversified rotations and cover crops to minimize pest pressure, improve soil health, and buffer revenue.

- Water planning: irrigation scheduling, shared reservoir rules, and drought escalation protocols.

- Insurance allocation and claims workflows defined in the base contract to avoid friction.

Align risk-sharing ratios with decision authority: if one partner controls nutrient inputs and equipment, ensure cost and outcome responsibilities match.

5) Market and Compliance: Certification, Consistency, and Price Realization

Price premiums in 2025 go to agriculture partner groups that prove traceability, sustainability, and consistent quality. Build a compliance calendar for audits, residue testing, and certification renewals. Use digital batch IDs and blockchain-backed records to satisfy buyer due diligence. Clear SOPs reduce variability across fields and ensure reliable delivery windows that buyers trust.

6) Operations at Scale: Shared Machinery, Scheduling, and Cost Allocation

Pooling machinery drives down unit costs, but only if scheduling and maintenance are tight. Use a shared booking tool with visibility of hours, downtime, and preventive maintenance windows. Allocate costs by data (fuel, hours, hectares covered), not by guesswork. Agree on replacement policies for critical equipment and who approves upgrades. The same logic applies to storage, drying, and transport.

7) People, Succession, and Social License

Sustained success depends on people. Define HR policies for labor hiring, wages, and safety. Train cross-functional teams so rotations, agrochemical use, and recordkeeping survive staff changes. Include succession rules—how responsibilities shift if a lead agronomist or principal retires. Commit to social stewardship: fair labor practices, community engagement, and shared environmental goals that earn the social license to operate.

Comparison Matrix: Partnership Models and 2025 Metrics

This directional matrix helps compare major partnership models. Figures are estimates for 2025 to support planning; actuals vary by region, crop, and market conditions.

| Partnership Type | Governance Complexity (Low/Med/High) | Estimated Capital Outlay (USD range) | Operating Cost Share (% farmer vs partner) | Risk-Sharing Ratio (farmer:partner) | Estimated Payback Period (months) | Expected Yield Uplift (%) | Price Realization Gain (% vs baseline) | Market Access Score (1–5) | Technology Intensity (Low/Med/High) | Compliance Burden (Low/Med/High) | Suitable Farm Size (acres range) | Ideal Crop Categories | Scalability Potential (1–5) | Typical Contract Tenor (years) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Median Across Models | Med | $50k–$250k | 60:40 | 60:40 | 18–30 | 8–20% | 5–12% | 3–4 | Med | Med | 50–5,000 | Grains, oilseeds, horticulture | 4 | 3–7 |

| Contract Farming | Med | $20k–$150k | 70:30 | 70:30 | 12–24 | 5–12% | 3–8% | 3 | Med | Med | 25–1,000 | Vegetables, pulses, spices | 3 | 1–3 |

| Joint Venture | High | $250k–$2M+ | 50:50 | 50:50 | 24–48 | 10–25% | 6–15% | 4–5 | High | High | 500–10,000+ | Grains, oilseeds, cotton, tree crops | 5 | 5–10 |

| Farmer Producer Organization (FPO) | Med | $30k–$300k | 80:20 (pooled services) | 70:30 | 18–36 | 6–15% | 4–10% | 4 | Med | Med | 10–10,000 | Mixed crops, dairy-horti integration | 4 | 3–7 |

| Cooperative | Med–High | $100k–$1M+ | 70:30 (member:co-op) | 60:40 | 24–48 | 8–18% | 5–12% | 4–5 | Med–High | High | 100–50,000+ | Staples, dairy, sugarcane, perennials | 5 | 5–15 |

| Lease‑to‑Own | Low–Med | $10k–$200k (equipment/land options) | 80:20 | 80:20 | 24–60 | 5–10% | 2–6% | 3 | Low–Med | Low–Med | 25–2,000 | Mechanization-heavy row crops | 3 | 3–5 |

| Revenue‑Sharing Service Partnership | Med | $40k–$300k | 55:45 | 55:45 | 18–30 | 8–20% | 5–10% | 4 | High | Med | 100–5,000 | High‑value horticulture, seeds, niche grains | 4 | 2–5 |

| Technology Integration Alliance | Med | $60k–$400k (software/sensors) | 60:40 | 60:40 | 12–24 | 10–22% | 6–14% | 4–5 | High | Med–High | 100–10,000+ | All crops; precision-driven systems | 5 | 2–4 |

| Assumptions: 1–2 seasons/year; mixed commodity basket (grains, oilseeds, horticulture); moderate mechanization; baseline includes standard good-ag practices without advanced precision tech. Regional variance applies for labor costs, energy, logistics, and compliance regimes. | ||||||||||||||

Step-by-Step Checklist and Governance Tools

“Clear agreements reduce dispute resolution time by 30%, freeing capital to fund expansion and competitive market entry.”

Forming a successful farming partnership is easier with a clear checklist. The following steps operationalize best practices and reduce disputes.

Step 1: Define Complementary Roles and Skills

- Map each partner’s expertise (agronomy, marketing, finance, operations) and resource contributions (land, capital, machinery, labor).

- List decision domains and the person/entity with primary authority.

- Align risk responsibilities with control of inputs and activities.

Step 2: Draft the Partnership Agreement

- Cover capital contributions, ownership, profit distribution, and exit rules.

- Define insurance coverage, allocation of claims, and force majeure handling.

- Add audit rights, inspection windows, and performance monitoring clauses.

Step 3: Implement Transparent Bookkeeping and KPIs

- Standardize accounting for inputs, hours, and overheads; automate logs where possible.

- Agree on KPIs: yield per acre, cost per acre, water-use efficiency, and price realization.

- Set quarterly variance reviews with corrective action plans.

Step 4: Build Contingency Plans and Reserves

- Create playbooks for drought, flood, pest outbreaks, and supply disruptions.

- Define crop switching rules and diversified rotations thresholds.

- Maintain a cash reserve and line-of-credit hierarchy for shocks.

Risk Register Template (Starter)

- Climate event probability and expected loss; mitigation via cover crops and water plans.

- Input price swings; mitigation via forward buying or shared hedges.

- Compliance lapses; mitigation via SOPs, training, and internal audits.

Digital recordkeeping ties the whole checklist together. Traceability for batches and carbon-footprinting for ESG reporting both streamline audits and connect with buyers who require verifiable data.

Legal Structures, Taxation, and Compliance

The legal form you choose affects liability, taxation, and financing. In 2025, many partners prefer limited liability entities or formal cooperatives to protect personal assets and access institutional finance. Always consult qualified legal and tax advisors for jurisdiction-specific guidance.

Structuring Considerations

- Limited liability entities: Shield owners from certain debts and claims; may have pass-through or corporate taxation.

- Joint ventures: Define asset ownership, board composition, and deadlock resolution mechanisms.

- Cooperatives and FPOs: Member control, patronage dividends, and sector-specific regulatory oversight.

Contractual Clauses to Include

- Exit and buy–sell rules: Valuation formulas, lock-in periods, and transfer restrictions.

- Dispute resolution: Stepwise escalation—internal review, mediation, arbitration.

- Compliance warranties: Adherence to pesticide MRLs, labor laws, and environmental permits.

- Data rights and privacy: Ownership and use of agronomic data, logs, and imagery.

Large-scale farm management software helps maintain audit-ready documentation for agreements, SOPs, inputs, and hours—reducing compliance costs.

KPIs, Dashboards, and Technology Implementation

Performance monitoring is the backbone of modern partnership management. Track leading indicators and share them on a common dashboard to keep partners aligned and transparent.

Core KPI Set for Partnership Farming

- Yield per acre and variance across fields.

- Input efficiency: kg nutrient per ton produced; irrigation water per acre.

- Operational metrics: machine hours per acre; downtime; fuel per acre.

- Financials: cost/acre, contribution margin, price realization vs index.

- Compliance/ESG: pesticide compliance rate, soil health score, emissions intensity.

We built Farmonaut to make high-quality data accessible to every farming partner. We combine satellite imagery, AI, and blockchain so partners can implement precision decisions and verifiable reporting at scale:

- Satellite-based monitoring for vegetation indices (e.g., NDVI) and soil conditions.

- AI advisory (Jeevn) to turn signals into actionable tasks and planning.

- Blockchain traceability for batch-level proof of origin and certification-ready logs.

- Fleet and resource management to optimize machinery use.

- Environmental impact tracking to quantify emissions and support sustainability investments.

Enterprise teams can integrate via APIs and manage programs on mobile or web. For tailored monitoring and finance workflows, see crop loan and insurance, traceability, and carbon-footprinting.

Subscription options can scale with your operation:

Frequently Asked Questions

What is the difference between a general partnership and a limited partnership in farming?

A general partnership shares management and liabilities among all partners. A limited partnership has at least one general partner (operational control and full liability) and one or more limited partners who provide capital with limited liability and do not manage day-to-day operations.

How do partners allocate insurance and risk fairly?

Match risk to control. If one partner manages irrigation and nutrient inputs, that party should assume more responsibility for related outcomes. Document the allocation of insurance premiums and claims in the base agreement to reduce disputes.

Which partnership model best suits smallholders?

Contract farming, FPOs, and cooperatives often fit smallholders because they pool purchasing, provide extension support, and improve market access without high upfront capital outlay. A technology integration approach can then layer on precision tools as costs decline.

What KPIs should be in a partnership dashboard?

Start with yield per acre, cost per acre, input efficiency, water-use efficiency, machine hours per acre, downtime, and price realization vs benchmark. Add soil health scores and emissions intensity for ESG reporting.

How can technology reduce disputes among farming business partners?

By making data transparent and shared. Remote sensing, precision platforms, and farm software provide time-stamped logs for inputs, hours, and field operations. Clear numbers enable fair cost splits and faster dispute resolution.

Do limited liability entities help with institutional finance?

Yes. Formal entities with limited liability, audited accounts, and performance data are increasingly preferred by lenders, which can improve access to finance and better rates.

Where do sustainability and certification fit in 2025?

They are front and center. Many buyers require documented practices (residue limits, soil health, labor standards) and production monitoring to approve suppliers. Plan budgets for investments in monitoring equipment and audit fees.

Final Thoughts and Next Actions

Well-crafted partnerships—from joint ventures to cooperatives—give farming groups a pathway to scale, cost efficiency, and reliable market access in 2025. They balance roles and expertise, distribute risk, and open doors to technology that lifts yields while lowering costs. Success rests on clear agreements, strong governance, and transparent operations backed by shared data.

When you are ready to digitize planning, monitoring, and compliance, we at Farmonaut make satellite-driven insights and AI advisory accessible across Android, iOS, web, and API. We focus on delivering cost-effective tools for precision decision-making, traceability, fleet management, and environmental tracking—so partners can implement best practices and demonstrate performance at scale without overhauling their entire stack.

Explore solutions:

- Large-scale farm management – centralize tasks, fields, teams, and reports.

- Traceability – deliver buyer-ready transparency and certification data.

- Carbon footprinting – quantify emissions and support sustainability claims.

- Fleet management – reduce fuel spend and optimize machinery use.

- Crop loan & insurance – use verifiable production data to streamline finance.

Quick Recap

- Design governance with precise clauses to avoid conflicts.

- Blend capital, revenue-sharing, and insurance to stabilize cash flow.

- Digitize operations with precision platforms, shared dashboards, and traceability.

- Diversify rotations and formalize water and risk protocols.

- Align with buyers on sustainability and certification to lift market access.

- Pool machinery and allocate costs by data, not estimates.

- Invest in people, succession, and social stewardship to sustain momentum.

With these strategies, farming partners can navigate climate shifts, volatility, and regulatory complexity—and capture the opportunities that are defining agriculture in 2025 and beyond.