Canada Tariffs on US Agricultural Products: 2025 Update

Introduction: Canada Tariffs on US Agricultural Products in 2025

The focus keyword Canada tariffs on US agricultural products is more than just a regulatory phrase; it’s the focal point of North American agriculture and trade policy in 2025. Changes in Canadian tariff regimes have a direct impact on US agricultural exports, shape bilateral economic relations, and redefine market competitiveness for both nations. As trade flows adjust to evolving policy shifts, understanding the forces at work is crucial for farmers, exporters, and agribusinesses on both sides of the border.

In this detailed update, we examine the 2025 landscape for Canada tariffs on agricultural products—exploring historic trends, evolving tariff structures, the interplay of policy, regulatory frameworks, and the broader economic context. We’ll discuss how tariffs serve as political instruments, economic shields, and levers in trade negotiations, all while reviewing their substantial implications for North American farmers, consumers, and global supply chain stability.

“Canada’s 2025 tariffs affect over $2.1 billion in US agricultural exports, reshaping North American trade flows.”

Historic Context & North American Trade Dynamics

The Canada-US agricultural trade relationship is among the world’s largest and most influential. Historically, this relationship has been deeply interconnected but often marked by disputes, negotiations, and periodic imposition of tariffs and non-tariff measures. These are commonly rooted in complex histories that span disagreements over subsidies, market access, and product standards.

Since the early days of the Canada-US Free Trade Agreement in 1989, and later NAFTA and the United States-Mexico-Canada Agreement (USMCA), agricultural trade has grown significantly, but not without challenges. The Canadian agriculture sector employs various protective measures—including import controls, supply management, and tariffs—to protect sensitive sectors like dairy, poultry, and eggs.

Disputes over Canada tariffs on US agricultural products are often triggered by sudden market disruptions or perceived unfair subsidies. Over the years, these disputes have shaped bilateral agreements such as the USMCA and World Trade Organization (WTO) framework, fostering new rules but leaving room for continued friction.

The intent behind Canada tariffs on US agriculture products—whether as a shield for local farmers or a lever in negotiations—remains a critical component of the Canada–US economic relationship. As we enter 2025, close scrutiny of these tariff policies is essential to understanding both market access opportunities and the ongoing risks faced by US exporters.

Key Drivers Behind Canada Tariffs on US Agricultural Products

In 2025, several key drivers underpin Canada’s determination to maintain and adapt tariff policies toward US agricultural imports:

- Protecting Sensitive Sectors: The Canadian supply management system for dairy, poultry, and eggs is at the core, designed to safeguard domestic producers against sudden influxes of cheaper imports.

- Stable Prices and Farm Incomes: Tariffs and import quotas work hand in hand to maintain stable market prices and ensure reliable incomes for Canadian farmers.

- Market Access Disputes: Disagreements about subsidies, production costs, and standards continuously trigger debates, negotiations, and occasional increases in Canada tariffs on US farm products.

- Community & Food Security: Policymakers aim to maintain rural livelihoods and national food security in an era of global supply chain uncertainties.

- Trade Leverage: Tariffs are also used as tools to influence ongoing trade discussions and renegotiate market access terms.

- Environmental Concerns: Recent trends in sustainability mean tariffs may adjust to support green practices among both imports and domestic production.

These drivers demonstrate that Canada tariffs on agriculture products are rarely just about economics—they’re the product of interconnected political, social, and global environmental pressures.

Comparative Tariff Impact Table (2025 vs 2024): Key US Agricultural Products Facing Canada Tariffs

One of the best ways to assess the significance and direction of Canada tariffs on US agricultural products in 2025 is to review comparative data—tracking year-on-year changes and their anticipated impact for each main product category.

| Product Category | Estimated Tariff 2024 (%) | Estimated Tariff 2025 (%) | Change (%) | Brief Trade Impact |

|---|---|---|---|---|

| Dairy Products | 220 | 225 | +2% | Marginal increase makes US dairy less competitive outside quota; favors Canadian supply management. |

| Poultry | 153 | 155 | +1.3% | Higher tariff discourages excess US poultry imports; supports domestic industry. |

| Eggs | 101 | 103 | +2% | Slight increase; strengthens protections for Canadian egg producers. |

| Wheat | 0 | 0 | 0% | Remains untariffed; enables balanced trade flow. |

| Corn | 0 | 0 | 0% | Stable; open market for US corn exports. |

| Soybeans | 0 | 0 | 0% | No change aids strong US-Canada agribusiness trade. |

| Fresh Fruits (e.g. apples, cherries) | 10 | 8 | -2% | Slightly lower tariffs boost US fruit exports. |

| Vegetables (selected) | 5 | 7 | +2% | Incremental rise could dampen exports of US vegetables. |

| Processed Foods | 6 | 7 | +1% | Costlier for US exporters; may support growth in Canadian processing sector. |

| Canola/Other Oilseeds | 0 | 0 | 0% | Remains open—crucial for integrated North American oilseed trade. |

| Beef (outside quota) | 26.5 | 27 | +0.5% | Minor rise; maintains high barriers to unregulated exports. |

| Pork | 0 | 0 | 0% | No tariffs, supports seamless cross-border pork trade. |

Note: These figures represent estimates based on prevailing tariff schedules and current trade legislation as of January 2025. Sub-quota rates (i.e., within TRQ—tariff-rate quotas) can be significantly lower, while above-quota imports face steep charges, especially in dairy, poultry, and eggs.

Implications of Canada Tariffs on US Agricultural Products: 2025 & Beyond

How Tariffs Impact US Exporters

Canadian tariffs on US agricultural products create both challenges and opportunities for US farmers and agribusiness:

- High tariff barriers—notably for dairy, poultry, and eggs—often reduce competitiveness for American producers, especially when export volumes exceed quotas negotiated under USMCA.

- For commodities like soybeans, corn, wheat, and pork, zero tariffs enable efficient market flows—though producers must still pay attention to evolving standards and border controls.

- Marginal increases in tariffs for processed foods and vegetables may encourage US exporters to explore value-added or niche products tailored to Canadian consumer preferences.

- US exporters are encouraged to adapt strategically, diversify markets, and invest in product innovation—especially in rising categories such as organics, non-GMO, and sustainable agriculture products.

For US businesses, understanding tariff developments is not optional—it’s essential for long-term market planning and export strategy in Canada.

How Tariffs Impact Canadian Farmers and Market Competitiveness

- Supply-managed sectors enjoy stable markets and predictable incomes. High tariffs act as a shield—limiting disruptions from volatile foreign imports.

- For field crops, open access supports plantings tailored to cross-border demand. Canadian farmers benefit from close ties with US input suppliers, especially in seed and equipment.

- There is a growing push to align domestic production standards with sustainability criteria, partially supported by tariff policy.

- Policy continuity around Canada tariffs on agriculture products helps maintain rural livelihoods and contributes to national food security.

- Trade with the US remains vital; but the tariff regime encourages investment in domestic processing, local value chains, and innovation in sensitive industries.

Policy Shifts, Regulatory Frameworks & Ongoing Trade Discussions in 2025

The 2025 landscape for Canada tariffs on US farm products is shaped by a matrix of policy, regulatory, and geopolitical dynamics:

-

USMCA (CUSMA): The trilateral USMCA agreement remains the foundational framework for treating agricultural imports.

- It establishes quotas for dairy, poultry, and eggs, with over-quota imports incurring steep tariffs.

- 2025 reviews include calls to modernize standards around sustainability, traceability, and transparency—especially in product labeling and safety.

- WTO Framework: Provides the global regulatory basis for dispute settlement and tariff reduction targets.

- Ongoing Bilateral Discussions: Since late 2023, regular trade discussions between Canada and the United States have focused on resolving disputes over market access and technical barriers to trade.

- Product Standards Evolution: Both nations have ramped up regulations around food safety, animal welfare, and environmental impact, creating new compliance requirements beyond simple tariffs.

- Supply Chain Resilience: Recent global chain uncertainties and climate risks have triggered a review of how trade policy can better «shield» national food systems.

For more detailed policy analyses and official statistics, stakeholders can consult:

“Tariff rate changes in 2025 impact more than 15 major US farm product categories entering Canada.”

Emerging Trends Shaping Canada Tariffs on US Agriculture Products (2025 and Beyond)

Canada tariffs on agricultural products are not static. In 2025, several major industry trends are reshaping how tariffs are used and what they’re designed to achieve:

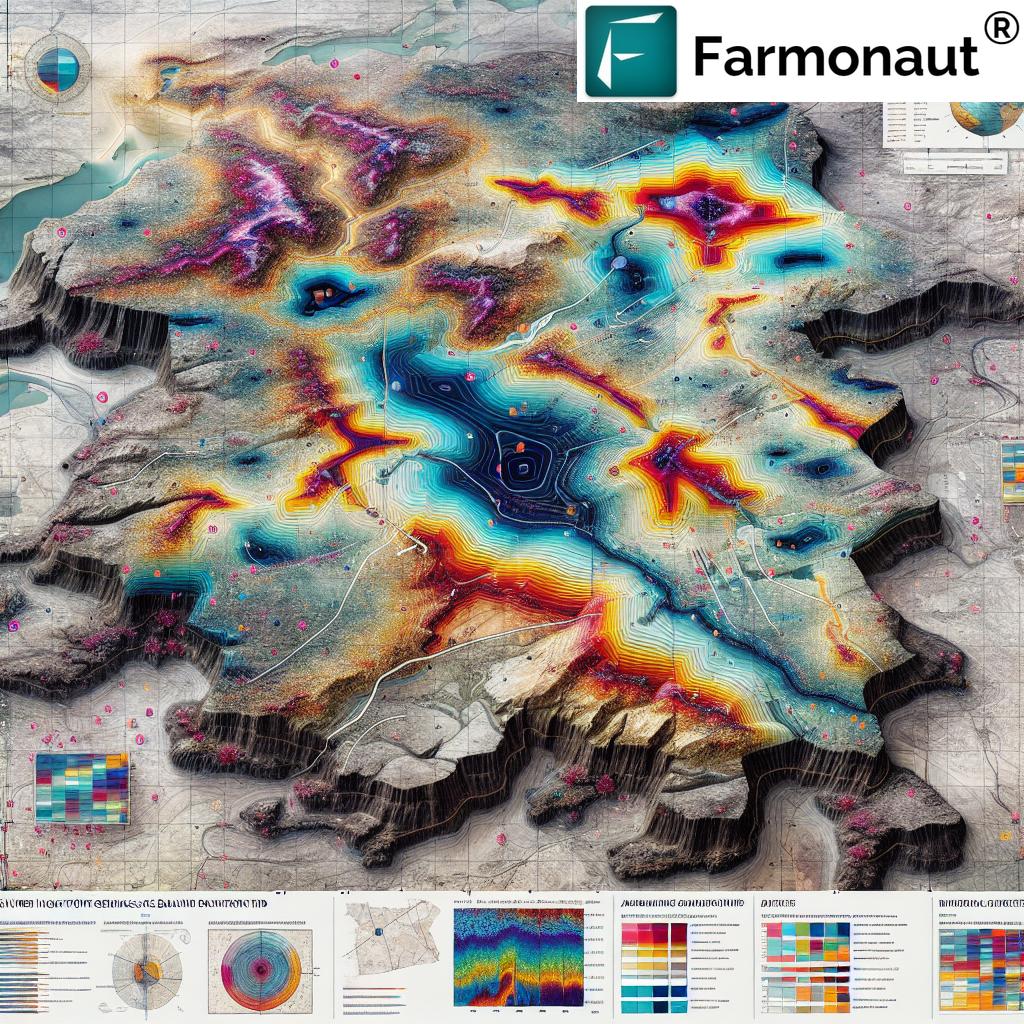

- Sustainability & Carbon Regulation: Canada is at the forefront of embedding sustainability standards within its tariff and trade policy. This means potential penalties for imports that do not meet certain sustainable production standards or carbon thresholds.

- Product Traceability: Increasing emphasis on product traceability—leveraging digital and blockchain solutions—ensures imported goods meet Canadian safety, origin, and quality standards. Properly implemented, this boosts transparency, builds consumer trust, and may lower barriers for compliant US producers.

- Technological Adoption: Rapid development of digital agriculture and biotech innovation influences tariff negotiations, as standards evolve to regulate gene-edited crops, AI-based systems, and smart farming solutions.

- Organic & Specialty Products: With increased demand for certified organic, local, and specialty foods, there is a trend toward tariff differentials or specific concessions for select categories.

- Zero-Waste & Circular Economy: Policies supporting a circular agri-food economy influence tariff strategies. For example, zero-waste farming initiatives powered by satellite data are incentivized with potential reduction in tariffs for qualifying products.

- Climate Change Adaptation: Tariffs may be adjusted to incentivize climate-resilient practices and investment in infrastructure that protects agriculture from floods, droughts, and irregular weather patterns.

How Farmonaut Empowers Stakeholders in a Dynamic Tariff Environment

As Canada tariffs on agriculture products continue to evolve, it becomes critical for businesses, farmers, and even government bodies to access, analyze, and act on market intelligence quickly. We at Farmonaut provide precisely these tools and insights, leveraging:

- Real-Time Monitoring: Our satellite-based monitoring delivers near real-time visibility on crop conditions, resource use, and supply disruptions—empowering farmers and agribusinesses to respond effectively to rapid market shifts or regulatory changes.

- AI & Jeevn Advisory: Our AI-driven platforms, like Jeevn, analyze satellite data to provide strategic recommendations in light of tariff shocks (e.g., weather disruptions, unexpected trade restrictions).

- Blockchain Traceability: By integrating blockchain-based traceability into our agricultural solutions, we assist exporters and importers in verifying their product origins, meeting international standards, and potentially negotiating lower tariffs on qualifying shipments.

- Environmental Impact Tracking: Our carbon footprinting solutions help Canadian and US producers measure emissions and demonstrate compliance with environmental criteria, a critical factor as tariffs increasingly favor “greener” supply chains.

- Large-Scale Farm Management: Using large-scale farm management tools, major agri-enterprises can manage compliance, audit crop health, and optimize resources across multiple regions impacted by shifting trade rules.

- Fleet Management for Efficient Supply Chains: We provide fleet management solutions to reduce costs and optimize delivery in the face of tariff-induced supply chain bottlenecks between the US and Canada.

- Support for Crop Loan & Insurance: Satellite-based verification enables faster loan and insurance claim validation — mitigating risk for both lenders and producers in a volatile trade and tariff environment.

- API & Developer Tools: We offer a robust API platform and developer documentation for seamless integration of our insights into third-party agricultural and trade software.

Our mission is to democratize agricultural intelligence and empower decision-makers at all levels to thrive—even as tariffs and supply chain risks continue to shift year after year.

Start exploring Farmonaut’s subscription packages, tailored to individual users, businesses, and government stakeholders:

FAQ: Canada Tariffs on US Agricultural Products – 2025

Q1: What are the 2025 highlights in Canada tariffs on US agricultural products?

A: In 2025, most tariffs on sensitive goods such as dairy, poultry, and eggs have increased slightly, with above-quota imports facing the highest rates (e.g., >220% for dairy). Tariffs on major row crops such as wheat, corn, soybeans, and pork remain at 0%, reflecting stable cross-border commodity flows.

Q2: Why does Canada keep high tariffs on certain agricultural products?

A: The primary reasons are to protect domestic supply management systems, maintain stable prices, ensure food security, and preserve rural livelihoods. Policy is shaped by both economic priorities and national debates about food sovereignty.

Q3: Are there any sectors where tariffs have decreased in 2025?

A: Minor reductions are seen in some fresh fruits, signaling targeted opportunities for US growers. However, overall, most of the biggest changes involve incremental increases.

Q4: How do environmental standards interact with tariff policy?

A: Increasingly, tariffs are used to incentivize or enforce higher sustainability standards. For example, “green” or low-carbon products may access lower tariffs if they meet set benchmarks.

Q5: Where can I access up-to-date policy and tariff rate information?

A: The Canada Border Services Agency (CBSA) Tariff Database and the Automated Tariff Lookup Tool provide real-time updates.

Q6: How can agri-businesses futureproof themselves against changing tariffs?

A: By adopting technology-driven monitoring, implementing traceability, and investing in sustainable production—as well as staying engaged in cross-border trade discussions—businesses can better navigate risks and leverage opportunities.

Conclusion: The Continuing Evolution of Canada Tariffs on US Agricultural Products

In 2025, Canada tariffs on US agricultural products retain their role as critical levers in the North American agri-food trade equation. These tariffs are not merely barriers—they are instruments for protecting domestic sectors, driving policy innovation, and reflecting the fast-changing realities of global supply chains. Canadian policymakers continue to balance national interests—food security, rural viability, and sustainable agriculture—against the backdrop of growing pressure for open, competitive cross-border trade.

For US exporters and Canadian farmers alike, the year ahead will call for agility, data-driven decision making, and strategic adaptation. While friction between trading partners occasionally flares, ongoing cooperation and robust dialogue remain essential to cultivating a balanced, resilient, and prosperous North American agriculture market.

Technology, compliance, and sustainability will all play larger roles as tariff policy continues to evolve. We at Farmonaut will be there—offering satellite-powered insights, AI-driven advice, and actionable analytics—to help you thrive, no matter the trade environment.