Crop Insurance Powered by Satellite Technology: Top 5 Benefits

“Over 80% of crop insurance claims can now be assessed remotely using satellite data, reducing manual field visits significantly.”

Introduction

In an era when climatic unpredictability, pest infestations, and extreme environmental conditions threaten global food security, crop insurance remains a vital tool for providing financial protection to farmers. For decades, the insurance claims process involved extensive manual field visits, subjective assessments, and delayed responses, often leaving farmers vulnerable during critical periods of loss. Today, advancements in satellite technology and remote sensing have revolutionized how we assess, manage, and respond to agricultural risk.

From India’s vast farmlands to digital management panels in urban centers, new precision tools now offer accurate, timely, and large-scale solutions for both insurers and farmers. In this comprehensive guide, we explore how satellite crop insurance works, its immense benefits, and why now is the right time to embrace this technology for effective agricultural risk management.

Focus Keyword: Crop insurance powered by satellite technology

The Role of Satellite Technology in Crop Insurance

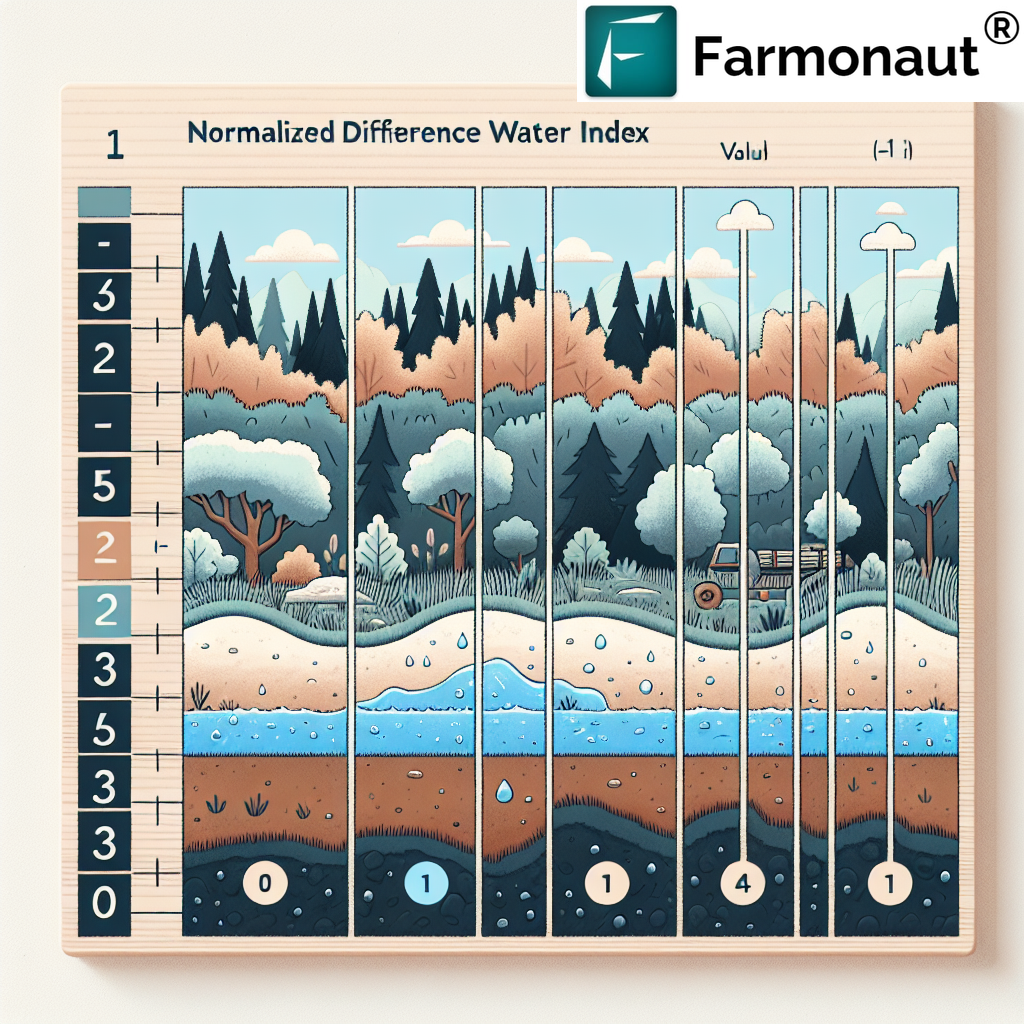

The integration of advanced satellite data and remote sensing in agriculture has dramatically enhanced both the accuracy and speed of crop damage assessments. Satellites equipped with multispectral and radar sensors can capture images at various spectral bands, monitoring extensive crop lands for health, disease, and environmental parameters in real-time. By analyzing this data, both insurance providers and farmers can achieve precise monitoring of crop growth, environmental stressors, and yield predictions.

This technological leap enables a streamlined insurance process, reducing operational costs for insurers while drastically improving the outcome for affected farmers. From real-time crop assessment technology to yield prediction using satellite data and flood and drought monitoring for farmers, this approach has reshaped the landscape of agricultural insurance.

Top 5 Benefits of Crop Insurance Powered by Satellite Technology

Let’s dive into the five most transformative benefits that satellite-powered crop insurance offers for modern risk management:

1. Real-Time Crop Health Monitoring with Satellite Imagery

Traditional crop insurance methods depend heavily on scheduled field visits and manual data collection. These approaches, while effective at small scales, rarely provide timely information for broad landscapes. Satellite technology revolutionizes this process by enabling constant monitoring of crop growth and health across vast areas, using high-resolution imagery and multispectral analysis.

- Instant Access to Crop Health Data: Remote sensing enables insurers and farmers to evaluate health indicators like chlorophyll concentration, leaf area index (NDVI), and water content, all crucial for understanding plant status.

- Early Detection of Issues: With indices like NDVI and SAVI, we can detect water stress, nutrient deficiencies, pest infestations, and diseases, facilitating timely interventions to mitigate risks.

- Wide Geographic Coverage: Satellites can monitor thousands of hectares simultaneously, eliminating dependence on manual sampling and fragmented on-ground observations.

These capabilities greatly improve yield prediction using satellite data and empower both farmers and insurers to take data-driven decisions for optimized results.

Satellite crop insurance platforms, like those powered by Farmonaut, integrate these insights directly into user-friendly mobile and web apps, democratizing advanced monitoring for farmers of all scales.

2. Rapid and Accurate Crop Damage Assessment Using Satellite Data

Perhaps the most significant leap in satellite data for crop damage assessment is the ability to assess extensive areas almost instantly after an event, such as droughts or floods.

- Immediate Damage Detection: Drought- or flood-affected areas can be flagged within 24–72 hours. Advanced radar and multispectral satellites penetrate clouds, making them reliable even in adverse conditions. (e.g., Sentinel-1, Sentinel-2)

- Objective Assessment: By eliminating subjective biases from manual field assessments, insurers gain a standardized, transparent process, boosting both fairness and trust in claim settlements.

- Granular Analysis at Scale: Field-level changes—such as sudden waterlogging, wilting, or pest damage—are detected using pixel-level analysis, improving the accuracy of insurance claims for crop damage.

Example: In India, radar-based satellite data speeds up assessment following monsoonal droughts or sudden floods, allowing for quick verification and prompt payouts, as seen in Tamil Nadu and other high-risk states.

For both insurers and farmers, real-time crop assessment technology translates to reduced uncertainty and enhanced protection when unpredictable events strike.

“Satellite imagery enables crop loss detection within 48 hours, compared to traditional methods taking up to two weeks.”

3. Enhanced Cost Efficiency & Area Coverage for Agricultural Insurance

One of the strongest arguments for satellite crop insurance is its powerful impact on efficiency and scale:

- Reduced Operational Costs: Fewer field visits and minimization of manual labor mean lower costs per assessment for insurers and affordable premiums for farmers.

- Large-Scale Monitoring: Satellite platforms capture images of large areas in a single pass, supporting risk assessments for crops spanning counties, districts, and entire regions.

- Quicker Policy Decisions: Efficient large-scale assessments ensure more farmers are covered, and policies can be tailored or renewed faster, without delays due to logistics.

These advantages are especially valuable in regions with extensive agricultural areas, like India, where monsoon-related risks are high and millions of farmers require timely, reliable coverage.

Cost efficiency also extends to compliance and auditing. All satellite-driven assessments are geo-referenced, timestamped, and easily retrievable.

4. Minimizing Fraud and Improving Transparency in Crop Insurance

Satellites provide objective, third-party data for each stage of the insurance lifecycle—policy issuance, damage assessment, and claim approval:

- Blockchain-Driven Traceability: Platforms like Farmonaut’s traceability solutions make it nearly impossible for claimants to misrepresent farm location, acreage, or crop health. This enhances both transparency and fraud reduction.

- Real-Time Verification: Whenever insurers review a claim, satellite imagery offers verifiable proof of disaster extent and timing, greatly reducing false or inflated claims.

- Policy Compliance: Policyholders themselves can check their eligibility against remotely sensed datasets, encouraging honest reporting and stronger stakeholder trust.

Through blockchain integration, these advancements solidify index-based agricultural insurance and support a fairer, more effective insurance system for all.

5. Advanced Risk Modeling and Tailored Policy Design

With years of historical satellite imagery available, insurers can analyze patterns, assess environmental factors, and proactively develop risk models reflective of actual regional threats.

- Dynamic Risk Assessment: Insurers analyze drought frequency, flood occurrence, temperature extremes, and pest outbreak hotspots using spatial and temporal datasets.

- Precision Policy Design: Policymakers and insurers can tailor premiums, deductibles, and payouts to localized risk—delivering fairer pricing and better coverage.

- Data-Driven Yield Prediction: When yield prediction using satellite data is combined with ground-truthing, both over- and under-compensation risks are minimized.

This robust, quantified approach is the foundation of index-based agricultural insurance, ensuring sustainability and long-term affordability for everyone involved.

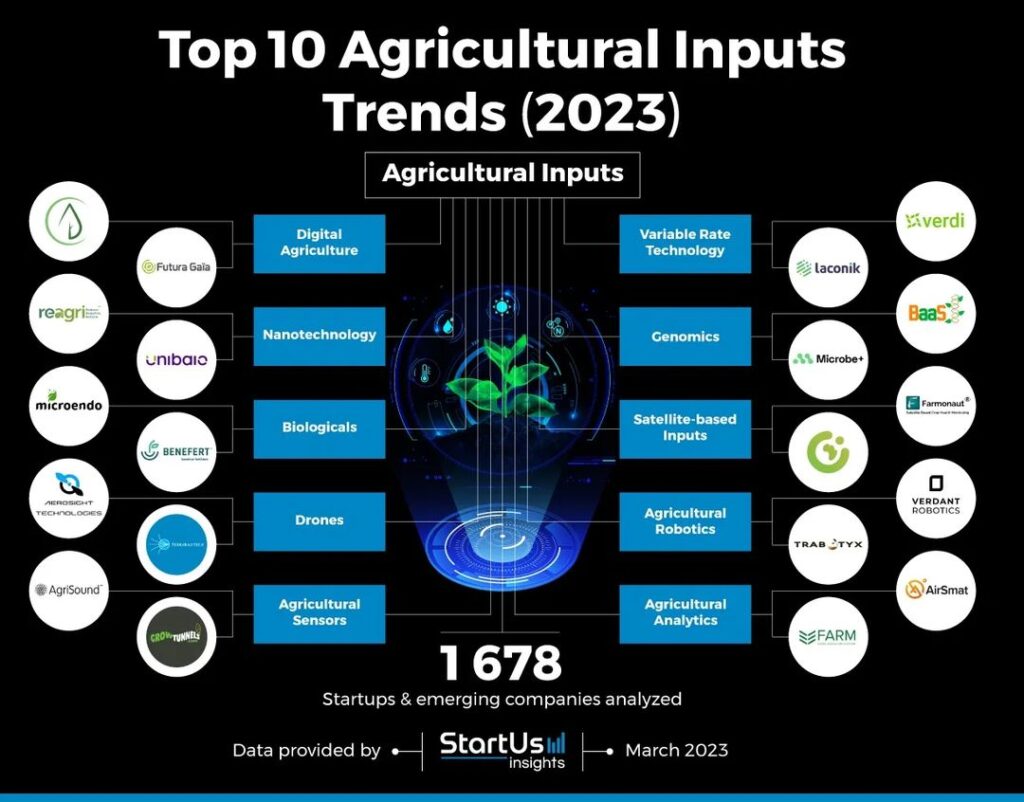

Farmonaut’s Satellite-Powered Crop Insurance Solutions

At Farmonaut, our mission is to make precision agriculture and satellite-driven insurance affordable and accessible to all stakeholders in the food and farming ecosystem. Our solutions are designed to empower:

- Individual Farmers: Receive instant updates on crop health, early warnings for droughts or diseases, and actionable recommendations via Android, iOS, or browser apps. We reduce manual effort, improve claim timeliness, and foster resilience to unpredictable events.

- Agribusinesses and Cooperatives: Manage crop insurance verification, resource allocation, and disaster response on a single platform for large-scale operations. Our large-scale farm management toolkit enhances efficiency at plantation and administrative levels.

- Governments and Institutions: Enable targeted subsidy, disaster relief, and regional crop health monitoring—essential for policy planning and food security assurance.

- Insurers and Financial Institutions: Leverage Farmonaut’s API and developer documentation to automate claims assessment, policy validation, and fraud detection using near-real-time satellite data.

- Corporate Clients: Use our traceability module and carbon footprinting system for supply chain transparency, ESG reporting, and sustainability initiatives.

Through AI-driven advisory, blockchain for traceability, and scalable satellite-powered modules, Farmonaut makes satellite crop insurance truly inclusive, efficient, and impactful.

Challenges and Considerations in Satellite Crop Insurance Integration

While the advantages of satellite technology are revolutionary, a few critical challenges remain when integrating these solutions into the traditional insurance process:

- Data Quality & Resolution: High-resolution imagery is crucial. Persistent cloud cover, sensor downtime, or insufficient revisit frequency can sometimes impede clear data capture, especially during peak seasons in monsoonal regions. Solutions like radar-based satellites partially address this, but gaps can persist.

- Interpretation Requires Expertise: Remote sensing in agriculture involves complex indices and models. Accurate assessments necessitate skilled data scientists, agronomists, and robust analytics infrastructure within insurance ecosystems.

- Compatibility with Existing Systems: Seamless integration of satellite-based insights with legacy claims systems, actuarial workflows, and regional policy frameworks demands careful planning and agile development.

- Local Conditions: Satellite data provides valuable, area-wide perspectives but may not detect micro-variations, such as isolated disease outbreaks or localized pest infestations at very early stages.

Nevertheless, as satellite constellations expand and data-processing algorithms mature, these limitations continually diminish. Farmonaut’s ongoing R&D addresses these areas to maintain cutting-edge performance in our offerings.

Explore Farmonaut’s solutions for seamless satellite-driven crop insurance and loan management.

Benefits Comparison Table: Traditional vs. Satellite-Powered Crop Insurance

| Benefit | Description | Traditional Crop Insurance (Estimated Data) |

Satellite-Powered Crop Insurance (Estimated Data) |

|---|---|---|---|

| Claim Assessment Speed | Average time taken for insurers to assess crop damage after an event | 10–14 days (manual field visits required) | 1–3 days (satellite data processed remotely) |

| Accuracy of Damage Detection | Precision in identifying loss area and type (drought, pest, flood) | ~70% (subjective and variable) | >90% (objective, quantified with indices and historical benchmarks) |

| Area Coverage | Size of agricultural land that can be monitored and assessed | ~200–400 hectares/day/team | 10,000+ hectares/day (satellite imagery) |

| Cost Efficiency | Average operational cost per assessment/claim | $100–$150 USD/claim (labor, travel, administration) | $20–$35 USD/claim (platform subscription model) |

| Fraud Reduction | Ability to detect and prevent fraudulent insurance claims | Low (manual records, easy to manipulate) | High (blockchain traceability & remote verification) |

The Future of Satellite Crop Insurance & Technology Integration

As satellite sensing, AI, and cloud-based analytics continue to evolve, the future promises:

- Higher Resolution, More Frequent Data: Smaller satellites (“smallsats” and CubeSats) ensure that data gaps due to weather or revisit times shrink rapidly.

- Customized, Farmer-Centric Policies: Dynamic, location-specific risk models mean insurance coverage and premium structures can be continuously optimized for each field and season.

- Integration with Advisory Systems: Tools like Farmonaut’s Jeevn AI automatically convert raw satellite imagery and weather forecasts into actionable advice—not just for insurance, but for water management, pest control, and nutrient applications.

- Sustainability Impact: With modules like carbon footprinting, agricultural practices can be monitored for GHG emissions, enabling insurers and policymakers to tie insurance pricing incentives to sustainable farming practices.

- Scalable Traceability: Blockchain integration will soon power transparent, fraud-resistant insurance processes at every stage, from seed-to-sale.

Ultimately, these advancements will serve to empower farmers further, enhance food security, and safeguard against the unpredictable nature of agriculture.

Frequently Asked Questions:

-

Q1: What is satellite crop insurance?

Satellite crop insurance leverages satellite data and remote sensing technology to monitor crop health, assess environmental damage, and process insurance claims efficiently. This approach removes the need for frequent manual field assessments, provides accurate, objective data, and enables rapid payouts to farmers following events like droughts, floods, or pest infestations. -

Q2: How does satellite data for crop damage assessment work?

Satellites capture multispectral images of agricultural fields before and after a damaging event. By comparing vegetation indices, water content, or changes in canopy cover, insurers can quantify the area and severity of damage. These assessments are processed rapidly, facilitating timely and evidence-based insurance claims. -

Q3: Is satellite insurance more expensive for farmers?

No. In fact, satellite-powered insurance tends to be more cost-efficient as it reduces manual workload, speeds up claim settlements, and eliminates unnecessary overhead. Subscription-based models (like Farmonaut) lower the barrier to entry even for small and medium-sized farms. -

Q4: How accurate are these assessments?

With modern satellites, damage detection accuracy can exceed 90%, far surpassing traditional manual methods, which are often subjective and vary across different assessors. -

Q5: Can smallholder farmers access these solutions?

Yes. Platforms like Farmonaut are designed to be accessible via smartphone apps or web browsers and operate on affordable subscription models. This ensures inclusivity regardless of farm size or technology familiarity. -

Q6: Do I need special equipment to use satellite crop insurance?

No specialized equipment is needed. A smartphone or web browser is enough to access your satellite data and manage insurance processes on platforms like Farmonaut. -

Q7: How do I get started with Farmonaut’s satellite insurance services?

Simply download the Farmonaut app or visit our web platform, select your crop details and location, and begin monitoring your fields. For insurers, our API allows seamless integration with your existing business systems.

Get Started with Precision Crop Insurance from Farmonaut

The era of satellite crop insurance and real-time agricultural risk management is already here. With Farmonaut, you receive:

- Affordable subscription models—choose the service level and hectare coverage that fits your needs, from single plots to vast estates.

- Comprehensive insurance support—rapid claim processing, accurate risk assessment, and robust fraud prevention via technology.

- AI-driven advisory—personalized recommendations for crop, water, and resource management, making your farming operation more resilient and productive.

- Transparency at all stages—blockchain-backed traceability and data-driven insights build confidence for both farmers and insurers.

Embrace precision farming and protect your agri-investments in the face of unpredictable weather, disease, and global risks!

Learn about Farmonaut’s crop loan and insurance solutions to experience instant, satellite-powered insurance verification.

Conclusion

Crop insurance powered by satellite technology brings efficiency, objectivity, and scale to the field of agricultural insurance. By eliminating guesswork and manual bottlenecks, this digital transformation empowers farmers and insurers alike to face environmental uncertainties with data, speed, and confidence.

Platforms such as Farmonaut make these advances accessible and actionable across India and the world, breaking barriers for smallholder farmers, cooperatives, corporates, and governments. Join us as we redefine the future of agricultural risk management—one satellite image at a time.