Farm Service Agency Loans: 2026 Guide & Management

“Farm Service Agency loans supported over $10 billion in sustainable agriculture technology advancements by 2025.”

Introduction to the Evolving Landscape of Farm Service Agency Loans (2026)

The agricultural sector of the United States stands at the intersection of innovation, risk, and sustainability in 2026. Farm Service Agency loans—offered through the U.S. Department of Agriculture—continue to be the backbone of farm financing, empowering farmers and ranchers to maintain, expand, and modernize their operations in a competitive, technology-driven landscape.

Amidst unpredictable markets, climate change, and technological advancements, access to the right financial tools and comprehensive management services is not just an advantage—it’s essential for the ongoing success of individual farmers, large-scale agriculture enterprises, and our nation’s food security as a whole.

The scope and benefits of farm service agency loans continue to grow and adapt, marrying traditional sources of credit with modern innovative technologies, sustainability measures, and insurance solutions. Understanding these evolving support programs is vital for stakeholders navigating today’s dynamic, data-powered farming landscape.

Farm Service Agency Loans: A Pillar of Agricultural Finance

The Farm Service Agency (FSA) is a specialized division of the U.S. Department of Agriculture (USDA), designed to provide flexible loans, credit access, and programs tailored to the diverse needs of American farmers and ranchers. In 2026, these farm services agency loans remain an essential source of financing for those aiming to:

- Purchase farmland or expand existing land holdings

- Acquire modern equipment, machinery, livestock, seed, and fertilizer

- Integrate innovative technologies such as precision agriculture, renewable energy, and soil improvements

- Support sustainable agricultural practices and environmental stewardship

- Access insurance that protects against risk factors (weather, disease, market, etc.)

The FSA offers a variety of direct and guaranteed loan programs, including microloans and disaster assistance. By addressing both ownership and operating needs, farmers can access funds directly from the agency or work through private lenders backed by the FSA’s guarantee, which reduces default risk for lenders and expands access to credit.

Access satellite-powered farm loan and management analysis – click to discover how our platform supports smart farming in 2026.

Key Features of Farm Service Agency Loan Programs

- Direct Farm Ownership Loans: For purchasing, improving, or expanding farmland.

- Direct Operating Loans: Cover annual crop expenses, livestock, equipment, and more.

- Guaranteed Loans: Enable access through commercial lenders, reducing lender risk via FSA guarantee.

- Microloans: Tailored for small farms or specialty/niche operations with simplified application processes.

- Youth Loans: Encourage agricultural involvement among young people (10-20 years), supporting educational projects.

- Disaster Assistance Loans: Support recovery after adverse events (natural disasters, disease, etc.).

Each loan type caters to specific needs and is designed to support the wide-ranging demands of U.S. agriculture, whether focused on growth, sustainability, or innovation.

Comparison Table: FSA Loan Types & Tech, Sustainability, Insurance (2025–2026)

To empower farmers, ranchers, and landowners with the most relevant financial options, understanding how each farm service agency loan supports technology integration, sustainability, and insurance is key for planning and efficiency. Below, we compare major FSA loan products for 2025–2026.

| FSA Loan Type | Estimated Maximum Loan Amount (USD) 2025–2026 | Typical Interest Rate (%) | Eligible Technological Uses | Sustainability Support | Insurance Bundling Available |

|---|---|---|---|---|---|

| Direct Operating Loan | $400,000 | 3.5–5% | Equipment, precision ag tools, yield mapping, soil monitoring, renewable energy upgrades | Yes (≈60% projects include sustainability terms) | Yes |

| Guaranteed Operating Loan | $2,230,000 | Market Rate* – agency guarantees loan, lowers risk for private lender | Same as above, with advanced tech via third-party funds | Yes (≈75% embrace eco practices) | Yes |

| Microloan | $50,000 | 2.5–5.5% | Starter tech, small-scale irrigation, soil testing kits, essential business software | Yes (emphasis on niche/sustainable small farming) | Optional |

| Youth Loan | $5,000 | 1.5–3.5% | Learning tech, small pilot ag projects, entry-level equipment | Moderate (encourages environmental education) | Optional, often not required |

(*) Determined by participating bank/credit institution rates as of 2025–2026.

All these farm service agency farm loans are evolving in 2026 to include robust adaptability to technology integration and incentivize sustainable agricultural practices through varying degrees of insurance bundling and collaboration with modern data-driven management services.

“In 2025, over 70% of new farm management services integrated data-driven tools for improved efficiency.”

Supporting Growth & Sustainability with Farm Service Agency Farm Loans

Whether you’re a beginning farmer, a socially disadvantaged producer, or an established landowner, FSA loan programs in 2026 provide essential opportunities for growth and sustainable operations. Its flexible terms, competitive rates, and tailored structures are key to modern agricultural success.

-

Lower Interest & Longer Repayment:

FSA loans often feature below-market interest rates and long repayment periods compared to commercial loans, allowing more manageable investments in equipment, land, and innovative technologies. -

Access for Underserved Groups:

Dedicated assistance programs for beginning and socially disadvantaged farmers enable new voices and ideas to thrive in the industry. -

Technological Upgrades:

Today’s loan types actively encourage purchases of precision agriculture systems, soil health monitoring, carbon accounting solutions, and renewable energy installations. -

Resilience & Climate Adaptation:

Loan structures reward climate-smart investments, enabling farmers to adapt to weather volatility while enhancing sustainability. -

Environmental Stewardship:

By supporting ecosystem restoration, conservation practices, and biodiversity enhancements, FSA loans help align financial support with ecological priorities.

Farmers who leverage these farm service agency farm loans gain both the credit to expand and the strategic foundation to maintain long-term sustainability.

Learn about Farmonaut’s Carbon Footprinting for Farms – Turn conservation into financial advantage

Farm Management Services: Enhancing Operational Efficiency in 2026

In an age when every acre must work harder, farm management service providers play a crucial role in bridging the gap between loans and operational productivity.

From crop planning to resource allocation, today’s services blend technology, analytics, and real-world farming expertise.

Core Areas of 2026’s Farm Management Services

-

Data-Driven Decision Making:

Using multi-source analytics—satellite, AI, IoT—management platforms help optimize planting, irrigation, and harvest timing. -

AI-Powered Risk Assessment:

Advanced modeling pinpoints risk exposures, supporting insurance planning and disaster response. -

Resource Optimization:

Services enhance input efficiency and environmental stewardship through yield-mapping, variable-rate application, and fleet management tech. -

Compliance Management:

Keeping operations in line with local, state, and federal regulations on labor, environmental impact, conservation, and carbon incentives.

Farm management in 2026 increasingly involves integrating new tech like blockchain traceability for transparent supply chains, and adopting advanced satellite-driven tools for real-time action.

Across the United States, over 70% of new farm management services now utilize data-driven tools for improved efficiency—a leap that empowers strategic decision-making at every level.

Discover how Farmonaut Fleet Management can streamline your agri-logistics in 2026

Strengthening Sustainability and Value

When loans, insurance, and expert management services are combined, modern farmers unlock operational efficiency, improve resource utilization, and strengthen stewardship of both land and financial assets.

Explore Farmonaut’s Traceability Solutions to assure product authenticity for every crop cycle

Farmers Insurance Agency: Protecting Agricultural Investments

Modern farming carries inherent risk. From volatile markets to extreme weather, countless factors can disrupt even the most well-planned operations. The farmers insurance agency model addresses these uncertainties by offering tailored insurance products that protect farmers‘ livelihoods.

-

Crop Insurance:

Shields against losses from drought, flood, disease, and pests—often mandatory for FSA loan eligibility. -

Livestock Insurance:

Safeguards investments in cattle, poultry, hogs, and specialty breeds. -

Equipment & Asset Protection:

Covers damage or loss of tractors, irrigation rigs, sensors, drones, and more. -

Farm Liability:

Protects the operation against accidents, injury, and market liability claims.

Integrated Insurance Strategies & Lending

Most FSA loans now require evidence of adequate insurance coverage as a precondition to funding. This trend underscores how financial health, insurance protections, and risk management are now deeply intertwined.

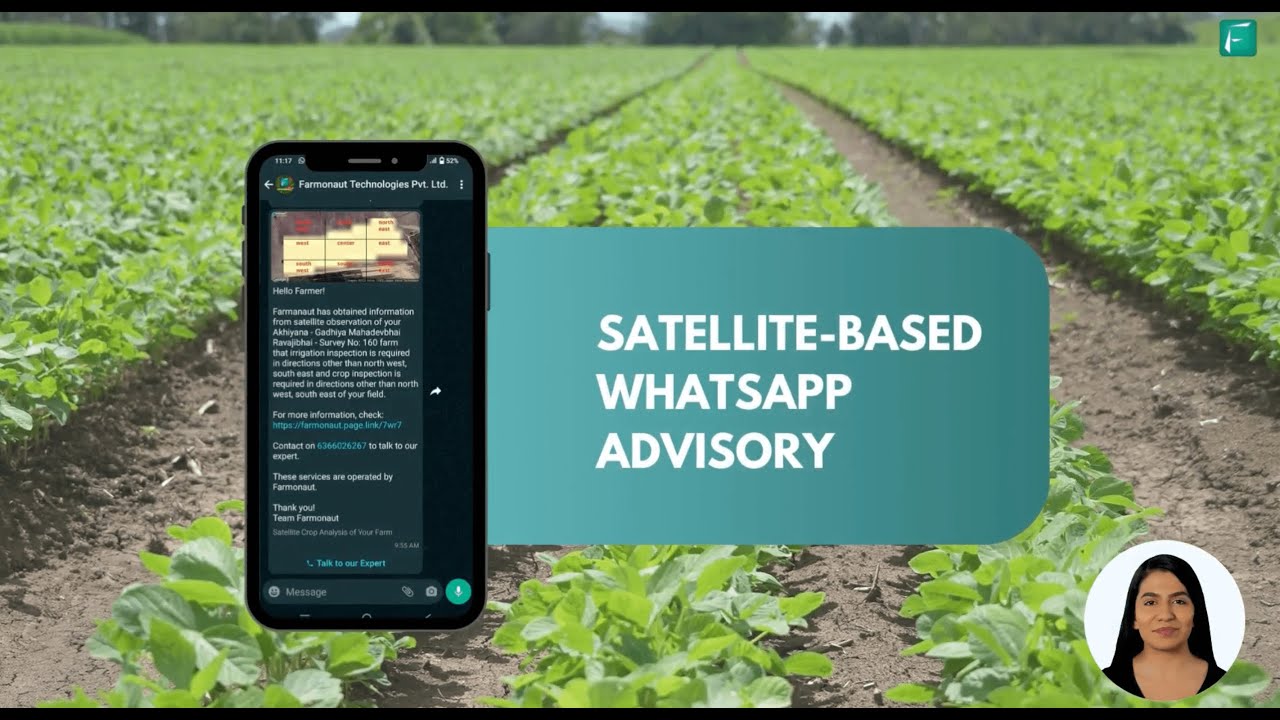

Digital insurance verification, often using satellite-based crop monitoring and blockchain signatures, increases both the speed and security of farm loan and insurance processes.

Farmland Management Services: Strategic Land Stewardship

Effective farmland management services go beyond the basics—they optimize land productivity while preserving its value for future generations. In 2026, these services blend strategic planning, sustainability metrics, and comprehensive resource oversight.

What Professional Farmland Management Involves

-

Strategic Land Use & Planning:

Analyze soil suitability, water rights, and revenue options via digital mapping. -

Soil & Water Conservation:

Implement erosion controls, drainage optimization, and carbon sequestration. -

Regulatory Compliance:

Navigate evolving environmental laws, labor rules, and subsidy programs. -

Succession & Estate Planning:

Facilitate smooth transfer, sale, or leasing of land assets across generations. -

Carbon Credit Trading:

Convert sustainable practices (cover cropping, reduced tillage) into real financial value.

By leveraging these professional services, landowners can maximize both tangible returns and long-term stewardship for their farmland.

The Role of Technology & Innovation in 2026 Agriculture

As the farm service agency loans landscape rapidly adapts, successful agriculture in the United States now hinges as much on technology and management as on soil and weather.

Applications driven by satellite data, AI, and blockchain empower farmers and ranchers to gain instant, validated insights into everything from crop health and soil status to fleet usage and insurance verification.

- Precision Agriculture: Site-specific application of water, fertilizers, and pesticides decreases costs and increases sustainability.

- Yield Mapping: Remote monitoring and predictive analytics for harvest forecasting.

- Blockchain Traceability: Ensures product authenticity, prevents fraud, and boosts consumer confidence.

- Real-Time Environmental Tracking: Monitors carbon footprint, helping meet regulatory and market expectations.

-

API-Based Integration: Connects farm data directly with financial institutions, expediting loan and insurance decisions.

Explore Farmonaut’s API |

API Developer Docs

Why Use Farmonaut for Agriculture in 2026?

At Farmonaut, we believe satellite-based intelligence and AI-driven advisory are essential resources for stakeholders determined to thrive in modern agriculture. Our platform brings these benefits:

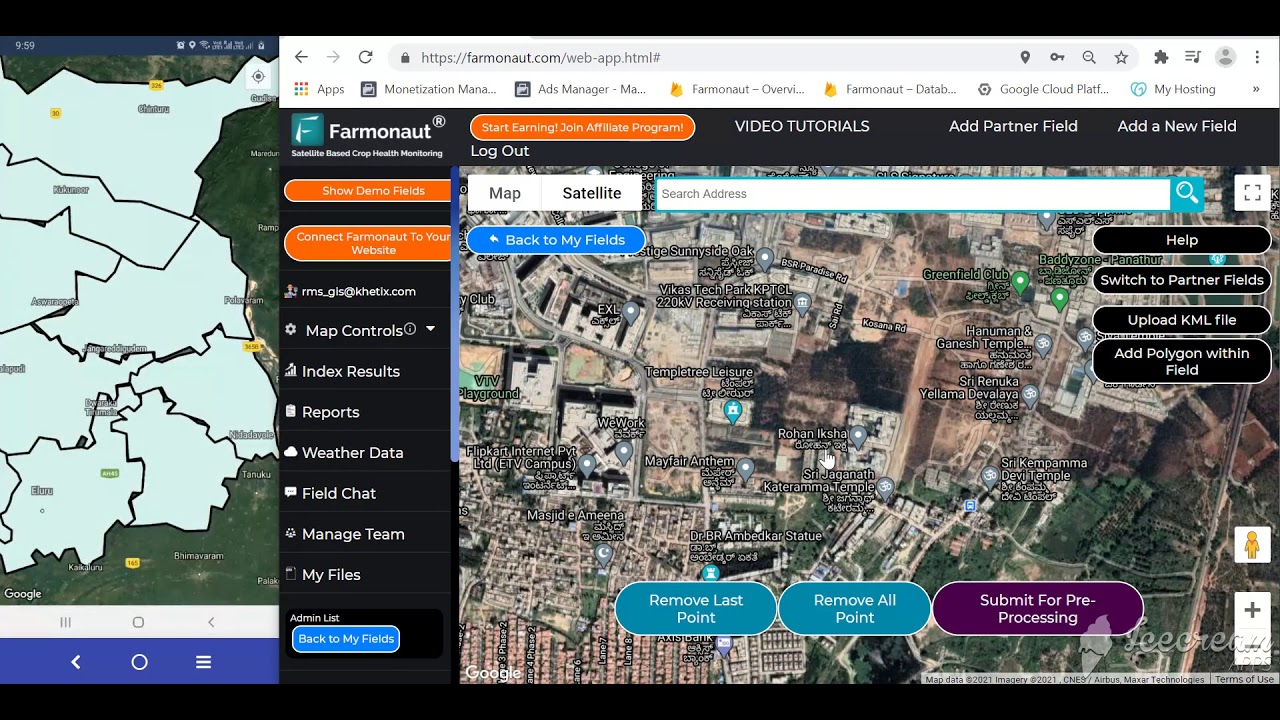

- Real-time Crop & Soil Monitoring: Our advanced satellite imagery updates reveal up-to-date NDVI, EVI, soil moisture, and stress indicators, essential for both management and loan applications.

- AI Analytical Tools: Jeevn AI system translates satellite data into actionable advice and resource schedules—making planning efficient and transparent.

- Blockchain Traceability: Secure your crop and asset provenance with immutable blockchain records, a powerful advantage for insurance verification and loan approval.

- Fleet & Resource Management: Monitor tractors, harvesters, and logistics for cost-saving efficiency.

- Environmental Compliance & Reporting: Quantify carbon impacts and sustainability gains for both financial incentives and regulatory alignment.

- Affordable, Accessible Subscriptions: Choose a plan that matches your operation scale and get started instantly via web, iOS, Android, or API.

With Farmonaut, future-ready farmers and landowners can harmonize financial, operational, and sustainability priorities, ensuring robust growth and resiliency in every season of 2026 and beyond.

Frequently Asked Questions (FAQ): Farm Service Agency Loans & Management (2026)

-

What are the main types of farm service agency loans for 2026?

The core products include direct operating loans, guaranteed operating loans, microloans, youth loans, and disaster assistance loans. Each caters to specific needs from purchasing land to upgrading technology and equipment.

-

How do FSA loans support sustainable agriculture?

Many FSA loans offer lower rates and longer terms for projects that emphasize environmental stewardship, carbon footprint reductions, and adoption of climate-smart tech.

-

Can satellite and AI tools help with FSA loan applications?

Absolutely. With platforms like ours at Farmonaut, you can gather validated data on crop performance, soil health, and resource use, streamlining both loan documentation and insurance proof.

-

What insurance coverage is required for FSA loans?

Most FSA loans mandate crop insurance, with others requiring asset and liability protection. Digital verification (satellite/blockchain) is increasingly standard.

-

How can I integrate precision agriculture tools with farm loan support?

Precision tools for planting, irrigation, yield-mapping, and environmental monitoring are eligible uses for most FSA loan funds—especially direct and guaranteed loans.

-

Are farmland management services necessary for small operations?

Increasingly, yes. Even small farms benefit from expert management, compliance assistance, and sustainability planning, which all improve eligibility for loans and insurance.

-

Where can I access Farmonaut’s solutions for crop, insurance, and traceability?

Visit our main app here, explore crop loan and insurance integration, and see our traceability tools. For developers, check our API page.

Conclusion: Building Agricultural Resilience for 2026 & Beyond

Farm service agency loans are more than financial lifelines—they’re an adaptive, forward-thinking pillar of the United States’ agricultural sector. By integrating insurance, farm management service solutions, and sustainable practices, these programs empower farmers, landowners, and ranchers to navigate today’s complex landscape with confidence.

As we move deeper into 2026, embracing innovative tools—like those we offer at Farmonaut—including satellite analytics, AI advisory, and blockchain-enabled traceability, will prove vital for anyone aiming to sustain and grow their agricultural ventures. The results? Increased operational efficiency, greater financial stability, and more resilient, climate-smart agriculture ready to meet the challenges and opportunities of tomorrow.

- Modern lending programs offer adaptive, tech-friendly, and sustainable financial support

- Farm management and insurance strategies work hand-in-hand to reduce risk

- Professional farmland management services optimize both productivity and long-term stewardship

- Farmonaut subscription plans, analytics, and blockchain traceability redefine data-driven agriculture

Start optimizing your farm finance and management for future-ready agriculture!