Accurate Damage Assessment for Crop Insurance: Top Tech

“AI-powered crop damage assessment can improve insurance claim accuracy by up to 30% compared to traditional methods.”

Introduction: Ensuring Fair Compensation with Accurate Crop Damage Assessment

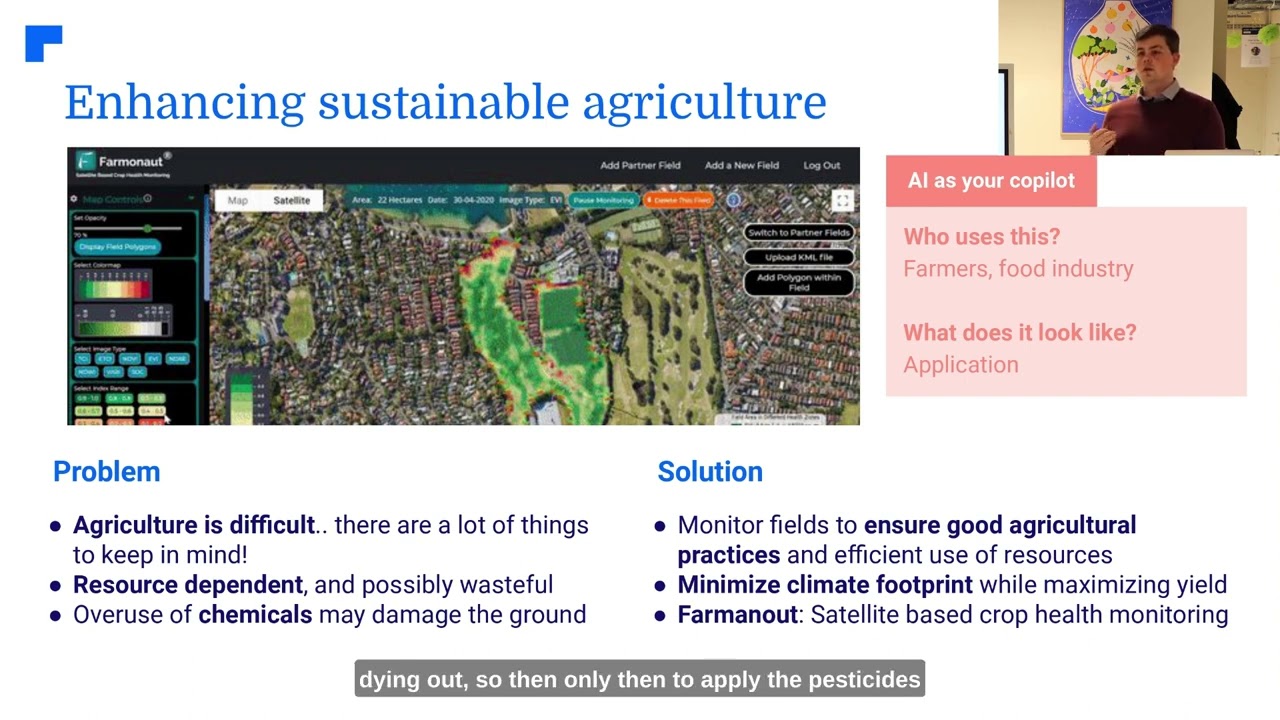

At the heart of every successful agricultural insurance policy lies a simple, yet crucial promise: that farmers will receive fair compensation for actual crop losses sustained through no fault of their own. Achieving this goal hinges on the accuracy, fairness, and efficiency of crop damage assessment. As the risk landscape for farmers evolves—marked by climate extremes, pests, and changing crop health patterns—a robust, tech-forward approach to assessment becomes non-negotiable.

In this comprehensive guide, we delve into why accurate crop damage assessment is essential to the insurance process, examine traditional methodologies, and explore the technological advancements—such as AI, remote sensing, index-based insurance, machine learning, and drone crop monitoring—that are setting new industry benchmarks. By centralizing the conversation around the latest tools, models, and regulatory developments, we aim to equip insurers, farmers, and the broader agricultural community with the knowledge and perspective needed for effective, fair, and transparent claims assessments in the 21st century.

Traditional Methods of Crop Damage Assessment

Historically, crop damage assessment has been rooted in traditional, manual and field-based approaches. Insurance adjusters or field officers would visit farms, conduct direct inspections, and assess the extent and nature of damage by:

- Visually evaluating crops on site

- Taking detailed photographs and notes

- Filling out rigorous reports documenting evidence of crop damage, pest infestations, or stress patterns

While this approach allowed for a firsthand, direct experience for assessors, it posed significant challenges in terms of:

- Time-consuming and labor-intensive processes—especially when dealing with large, remote, or inaccessible farming areas

- The potential for subjectivity, inconsistencies, or bias, as the accuracy of the assessment could be influenced by the experience and judgment of the adjuster

- Difficulty scaling up the process to cover thousands of hectares in a short time—especially critical after large-scale natural disasters

Ultimately, these limitations signaled the need for systematic, technological advancements in the insurance industry’s efforts to establish fairness and ensure effective indemnity payments for all farmers.

Remote Sensing Technologies for Agriculture: Transforming Crop Damage Assessment

The introduction and widespread adoption of remote sensing technologies for agriculture—such as satellites, drones, and UAVs—has dramatically improved the accuracy, efficiency, and reach of modern crop damage assessments.

Satellite Imagery: Wide-Area, Objective Crop Evaluation

Modern remote sensing leverages satellite-based crop health monitoring to scan vast agricultural areas, providing timely, detailed, and objective information about crop health, vegetation indices (like NDVI), soil moisture, and stress indicators. Companies like Farmonaut utilize multispectral satellite images to enable not just crop monitoring but also precision analysis for insurance or subsidy claims.

Farmonaut’s carbon footprinting solutions further add an environmental layer, crucial for sustainability-linked compensation.

Remote sensing analytics can:

- Show spatial patterns of crop stress, pest infestation, or drought impact

- Differentiate between healthy, moderately damaged, and severely affected zones within fields

- Provide data for accurate, large-scale claims assessments

Drones & UAVs: Detailed Aerial Crop Monitoring

Drone crop monitoring brings the ability to:

- Fly over crops and capture high-resolution imagery in visible, thermal, and multispectral bands

- Detect subtle symptoms of disease, pest infestations, water stress, or wind/hail damage at the leaf or plant level

These images are then processed by specialized software or AI models to determine the extent, severity, and nature of the crop damage. Drone crop monitoring particularly excels in:

- Timely response after a reported damage event

- Precise documentation for claims and insurance audits

- Reducing manual labor and the margin for error compared to field inspections

Remote sensing technology analyzes over 10,000 hectares daily for rapid, large-scale crop damage evaluation.

Benefits Over Traditional Inspections

- Drastically increased area coverage in shorter timeframes

- Repeatable, consistent data for fair compensation decisions

- Objective, digital records to reduce disputes and boost transparency

- Digitally accessible records for insurers, regulators, and farmers alike

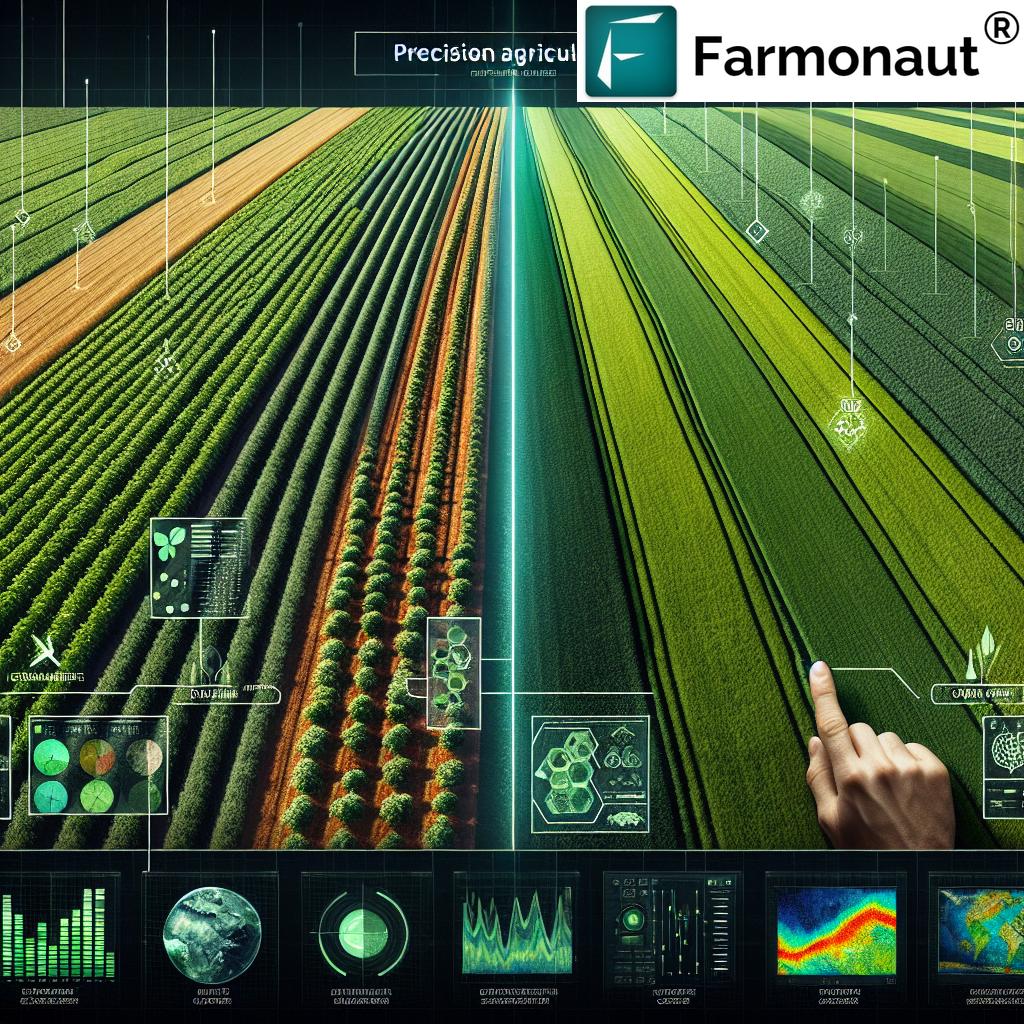

AI in Crop Insurance: Drone Monitoring, Image Analysis, and Data-Driven Assessments

The integration of artificial intelligence (AI) and machine learning in agriculture is radically transforming the way we approach both the collection and evaluation of crop damage data.

Artificial Intelligence in Crop Insurance

Modern AI models—from deep neural networks to ensemble learning—are now able to process exponentially more data from satellite, drone, and ground sources than a human ever could. The result is a leap forward in:

- Pattern recognition for specific crop stress signatures, pest or fungal infestations, drought, or hail damage

- Objectivity and repeatability in damage assessment processes, allowing for universal benchmarks and minimal subjective bias

- Speed: AI can evaluate thousands of images in real time, accelerating the claims and compensation process

For instance, mobile applications that utilize image processing and AI methods now allow both farmers and claim adjusters to quickly measure foliar damage and upload evidence to insurance systems in seconds.

Machine learning systems can be trained using historic crop loss data and visual imagery, continuously improving their accuracy over time. This technology not only benefits insurers by reducing fraudulent claims, but also empowers farmers through fairer, more predictable outcomes.

For developers or businesses seeking to integrate satellite-based and weather data in their own applications for accurate, systematic crop assessments, the Farmonaut API provides real-time access via developer documentation.

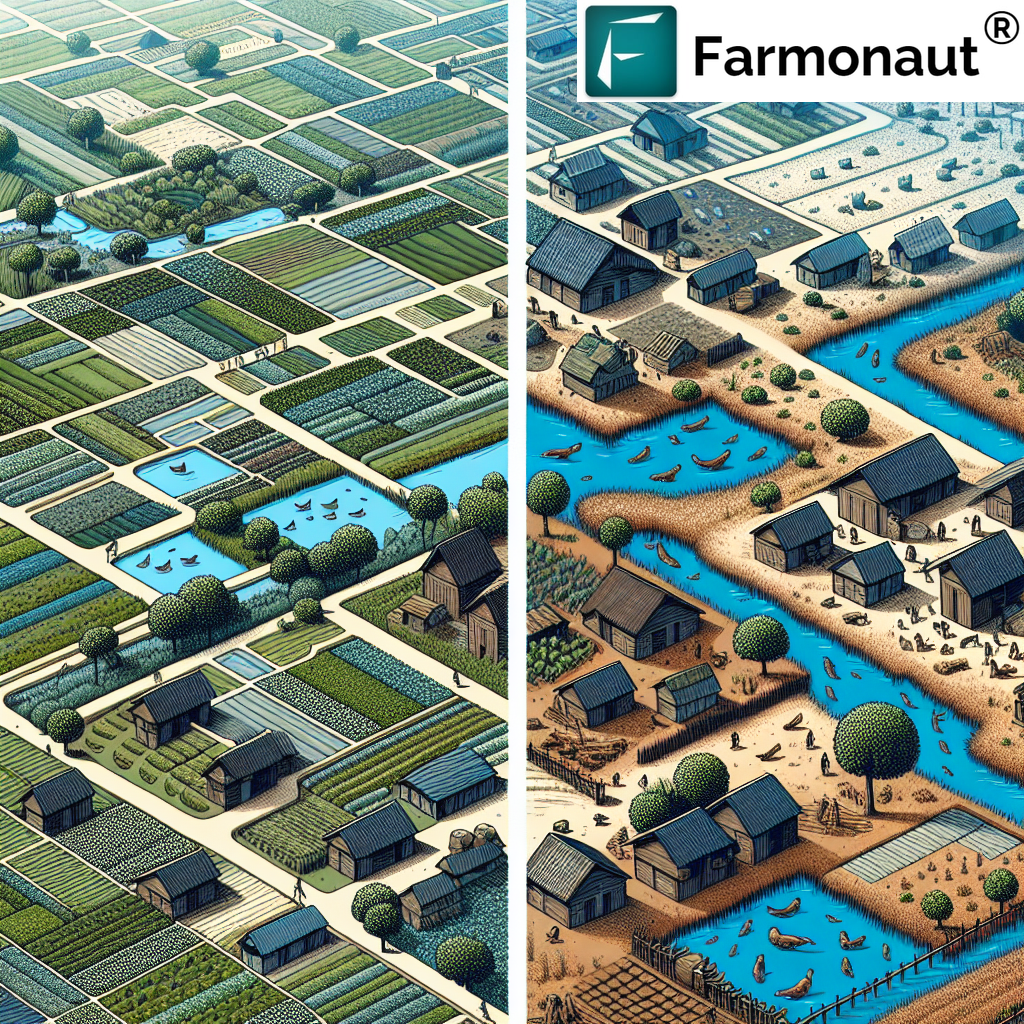

Index Based Crop Insurance: Streamlined Compensation Models

Recognizing the need to simplify and expedite indemnity payments, the industry has increasingly explored and adopted index-based crop insurance as an alternative to traditional claim assessment methods.

How Index-Based Crop Insurance Works

In index-based crop insurance, payouts are triggered automatically when a pre-determined threshold is breached. The indices typically include:

- Rainfall: Amount, timing, and distribution

- Temperature: Heat waves or unseasonal cold snaps

- Satellite vegetation indices: NDVI or other remote-sensed crop health data

When the index agrees with a significant loss scenario—for example, rainfall below 70% of a historical average or NDVI dropping below a danger threshold—farmers receive compensation, often without the need for detailed field inspections.

Advantages of Index-Based Crop Insurance

- Faster payouts: Automated, rules-based triggers lead to prompt compensation

- Lower administrative costs: Reduces the need for manual, case-by-case inspections

- Objectivity: Less subject to interpretation or bias than direct field assessments

Challenges: Basis Risk

A key challenge is basis risk: the risk that the chosen index does not perfectly correlate with a farmer’s actual crop losses. Farmers may:

- Receive under-compensation when the index doesn’t fully reflect the extent of on-ground damage

- Receive over-compensation for areas unaffected by the risk event but falling within the triggered region

Research shows that basis risk can be compounded when using big data or imprecise statistical methods. Continuous refinement of both indices and data analytics models is necessary to bridge this gap and provide fair compensation for farmers.

To read more about satellite-based insurance and how Farmonaut is enabling transparent crop verification for insurance, visit the Farmonaut Crop Loan and Insurance page.

“Remote sensing technology analyzes over 10,000 hectares daily for rapid, large-scale crop damage evaluation.”

Comparative Table: Modern Tech in Crop Damage Assessment

Choosing the right damage assessment technology depends on factors like coverage area, cost, required accuracy, and farm size. Here is a direct comparison of the leading technologies shaping the future of crop loss evaluation and insurance compensation:

| Technology | How It Works | Accuracy (Est. %) | Speed of Assessment | Cost (Est.) | Suitability (Small/Large Farms) |

|---|---|---|---|---|---|

| AI Image Analysis | Automated detection and classification of crop damage using AI/ML models analyzing imagery data. | ~90-95% | Minutes to hours | Low-Medium | Both |

| Remote Sensing (Satellite) | Uses multispectral satellite imagery for monitoring vegetation health, moisture, and stress patterns. | 80-90% | Within 24 hours | Low | Large |

| Drone Monitoring | Captures high-resolution, low-altitude imagery for local, detailed damage detection. | 95%+ | Hours | Medium-High | Small/Medium |

| Index Based Assessment | Uses predefined environmental indices to trigger automatic payout events. | 70-85% (varies) | Immediate (if threshold met) | Very Low | Large, regional farms |

Each method comes with strategic tradeoffs, making it essential for insurers and farmers to select tools that align with their specific crop types, farming practices, and risk profiles.

Satellite Imagery for Crop Health: Precision Monitoring and Accurate Crop Loss Evaluation

The era of satellite imagery for crop health has unlocked a new dimension in monitoring, evaluation, and verification of crop losses at both the field and regional levels. Modern satellites enable:

- Regular, non-intrusive scanning of vast farming areas—even those that are remote or inaccessible

- Multispectral analysis to spot vegetative anomalies, water stress zones, pest or disease outbreaks at early stages

- Automated generation of field health reports, which can form the factual basis for insurance payouts

Farmers benefit from real-time insights and targeted advisories based on satellite data, while insurers leverage it for auditable, timestamped evidence of losses.

Learn how Farmonaut’s large-scale farm management tools utilize this data for enterprise and administrative insights, maximizing both accuracy and resource allocation.

Machine Learning in Agriculture: Optimizing Damage Assessment and Crop Insurance

Machine learning in agriculture is pivotal in moving the industry towards almost-real-time, predictive, and highly accurate damage assessment and fair compensation for farmers. Present across several workflows:

- Pest and Disease Recognition: Trained ML models can recognize and quantify pest damage, leaf discoloration, and infestation patterns on both drone and satellite images.

- Yield and Loss Prediction: AI can correlate environmental stressors with historical crop yield data to project loss severity and insurance payouts accordingly.

- Anomaly Detection: Identifies areas where crop health deviates from historical or regional trends, flagging possible claim events for further review.

- Bias and Risk Reduction: Minimizes subjective errors, aligning insurance claims closer to actual ground-truth crop losses.

Farmonaut’s Jeevn AI Advisory System exemplifies how AI-driven crop guidance—analyzing satellite data, weather, and local risk factors—empowers farmers to minimize loss and maximize compensation eligibility.

Supply chain transparency bolsters both transparency and risk mitigation. Farmonaut Product Traceability guarantees secure, blockchain-powered records of origin, processing, and transit—a valuable layer for specialty or high-value perennial crops.

Case in Point: Perennial Crops

While machine learning excels in annual crop cycles, assessing long-term damage in perennial crops (e.g., orchards, vineyards) is more complex. Damage can unfold over multiple years and entail:

- Monitoring the enduring effects of drought, disease, or adverse weather

- Factoring in lost future productivity in addition to immediate crop losses

- The need for sophisticated algorithmic models and field surveys to track plant health across seasons

Agricultural Insurance Challenges: Ensuring Accuracy and Fairness

Despite its many technological advancements, the agricultural insurance industry still faces several significant challenges in providing accurate crop loss assessment and ensuring fair compensation for farmers:

- Basis Risk (again): When the chosen index or remote sensing method doesn’t perfectly align with actual farmer experiences, compensation can be unfair—either overpaying or underpaying for real losses.

- Data Bias: Large datasets with more variables than true in-field observations can introduce bias, leading to inaccurate risk and loss models.

- Complex Farming Practices: Insurance policies often require proof of “good farming practices”—but what happens when a farmer employs innovative or sustainable methods outside traditional norms? This can complicate claims, especially when regulations are slow to adapt.

- Perennial Crops: As discussed earlier, these require multi-year tracking and more sophisticated, ongoing assessments, which not all insurers are equipped to handle.

- Regulatory Evolution: Regulations must keep pace with advances in technology to ensure transparency, fairness, and that all farmers—regardless of their chosen practices—are treated equitably.

As a result, innovation in data-driven tools, regulatory frameworks, and risk modeling is as essential as the adoption of new imaging and assessment technologies.

Farmonaut: Driving Accuracy and Efficiency in Crop Damage Assessment

At Farmonaut, we understand that the future of accurate crop damage assessment depends on integrated, accessible, and cost-effective technology. Our solutions are purpose-built for farmers, agribusinesses, insurers, and regulatory bodies who demand more from their damage assessment models and compensation systems.

- Satellite-Based Crop Health Monitoring: Leveraging multispectral satellite data, we deliver near-real-time insights on vegetation health, soil moisture, and pest/disease indicators, directly influencing timely, fair insurance payouts.

- AI & Machine Learning Systems: Our Jeevn AI Advisory engine analyzes vast pools of data—enabling precise, farm-level recommendations and supporting claims with digital evidence.

- Blockchain-Enabled Traceability: We offer secure, transparent records of crop origin and handling, valuable in insurance for specialty crops or food safety compliance.

- Fleet & Resource Management: Fleet management tools help optimize operational efficiency, indirectly improving farm resilience and risk management.

- Carbon Footprint Tracking: We monitor and manage agricultural emissions, supporting both sustainability incentives and insurance-linked climate risk products.

Our subscription-based model ensures these advanced solutions are affordable and scalable—from smallholder farmers up to large government monitoring programs. Access our platform through versatile Android, iOS, or web applications, and for agribusiness integration, explore our API.

Ready to transform your farm assessment process? Start with Farmonaut Apps and benefit from real-time, data-driven insights that drive fairer, more transparent insurance systems for all.

Managing logistics and farm machinery efficiently has a direct impact on risk and damage prevention. Discover how Farmonaut’s fleet management solution can help large agribusinesses minimize downtime and enhance operational efficiency.

Regulatory and Policy Considerations in Damage Assessment

Technology alone isn’t enough; effective crop insurance compensation also requires:

- Adaptive regulatory frameworks that recognize innovative and non-conventional farming practices

- Clear, transparent policies that spell out evidence requirements, qualifying conditions, and standards for both traditional and alternative agricultural systems

- Cooperation between insurers, farmers, and policy makers to create responsive, fair compensation models

As agriculture evolves, so must insurance products and the rules that underpin them, ensuring no farmer is disadvantaged for adapting to climate change or sustainable practices.

Aligned with this mission, Farmonaut is committed to making precision agriculture, carbon reporting, and traceability accessible and auditable for everyone.

Future Directions: Technology, Practice, and Policy in Crop Insurance

Looking forward, accurate crop damage assessment for insurance will be defined by:

- Seamless integration of high-frequency satellite data, AI, and ground truth: Continual data streams will further minimize human bias and maximize assessment speed and accuracy.

- Quantitative, farm-level risk modeling: Bringing actuarial accuracy to smallholder and marginal farms, traditionally underserved by current insurance models.

- Flexible compensation frameworks: Adapting insurance triggers and documentation to new forms of sustainable, climate-adapted farming.

- User empowerment through transparent digital platforms: Farmers and insurers accessing the same datasets in real time for dispute-free, trust-driven claims processes.

- Open APIs and data sharing: Fostering a data-driven ecosystem where products like Farmonaut’s API allow seamless, cross-platform insight and workflow automation.

- Focus on environmental compliance: Carbon footprinting and traceability becoming integral to both compensation and sustainability-linked funding.

Ultimately, we envision a global agricultural insurance system that’s efficient, responsive, and equitable—delivering value not only to insurers, but empowering farmers to mitigate risk, increase yields, and build a sustainable future.

Farmonaut: Affordable Crop Monitoring Subscriptions

Precision agriculture, real-time crop damage assessment, and risk analytics are now within reach for every farmer and insurer. Our simple subscription plans scale with your needs—whether you operate a single field or manage large regional programs.

Frequently Asked Questions (FAQ)

1. What is crop damage assessment, and why is it important for insurance?

Crop damage assessment is the process of systematically evaluating the extent and nature of sustained crop losses due to factors such as weather, pests, or disease. It’s critical for insurance because accurate assessments ensure that indemnity payments are fair and correspond to true farmer losses.

2. How do remote sensing and satellite imagery improve assessment accuracy?

Remote sensing and satellite imagery provide objective, wide-area evaluation of crop health, enabling insurers and farmers to quickly recognize patterns of damage over extensive fields—far more than manual inspection can achieve. They also create an auditable digital record for all stakeholders.

3. What role does AI play in crop insurance?

AI analyzes vast datasets, such as satellite/drone images, to detect and quantify crop damage with high accuracy and speed. AI-powered models reduce human error, standardize assessments, and help minimize fraud—resulting in fairer, more efficient insurance payouts.

4. What is index-based crop insurance, and how does it differ?

In index-based insurance, payouts are linked to objective indices (rainfall, temperature, NDVI) rather than individual field assessments. This speeds up compensation but can introduce basis risk if the index doesn’t perfectly match on-farm crop losses.

5. How does Farmonaut support advanced crop damage assessments?

Farmonaut combines satellite imagery, AI-driven analysis, and blockchain-powered traceability in a scalable, affordable platform. This empowers both small and large farms, as well as insurers, to conduct accurate crop loss evaluation and streamline claims with transparency and efficiency.

6. Where can developers access Farmonaut’s satellite and weather API?

Developers and IT teams can integrate real-time satellite and weather data for agricultural applications through Farmonaut’s Crop Assessment API and API documentation.

Conclusion: Unlocking the Future of Crop Damage Assessment for Fair Compensation

In a world of ever-increasing climate volatility and agricultural risk, the accuracy, efficiency, and fairness of crop loss assessments has never been more critical. By systematically integrating remote sensing, AI, machine learning, drone crop monitoring, and index-based insurance models, the industry is moving steadily towards a future where every farmer is assured of fair compensation for real, sustained losses.

At Farmonaut, our mission is to make precision agriculture affordable, accessible, and data-driven—empowering both farmers and insurers to adapt, thrive, and uphold the integrity of the global food and agricultural system. Our platform, built on satellite technology, AI, and blockchain, stands as a beacon for those seeking a robust, scalable, and trustworthy solution for all facets of crop damage assessment and insurance.

Join us in reimagining the future of agriculture—where technology meets trust, and where every harvest is protected by transparency, innovation, and a commitment to fairness for all farmers.